|

市场调查报告书

商品编码

1645059

亚太地区滚筒烘干机市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia-Pacific Tumble Dryers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

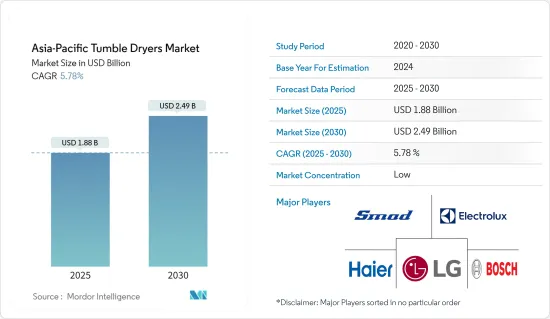

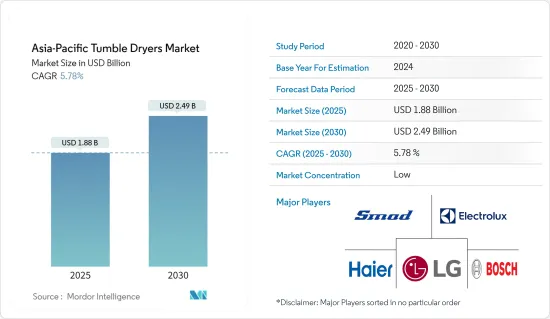

预计 2025 年亚太地区滚筒式干衣机市场规模为 18.8 亿美元,到 2030 年将达到 24.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.78%。

亚太国家是世界上最大的经济体之一,因此已成为家用电器的主要市场,为洗衣设备和滚筒式烘干机的销售带来了积极的外部因素。滚筒烘干机的主要需求群体是年龄在 30 至 50 岁之间的就业人口,他们增加了在半自动和全自动滚筒烘干机上的支出,因为它们节省时间并且高效。亚太地区对节能滚筒烘干机的需求日益增加,这促使製造商在其产品上配备热泵和自动干燥功能,一旦衣物干燥即可自动关闭洗衣机。

随着亚太地区都市化进程不断加快,越来越多的人喜欢快速洗涤和烘干衣物。日本、印度和中国已成为城市人口最多的国家,导致製造商加强对滚筒烘干机零售单位销售、广告和服务中心的投资。

自疫情爆发以来,亚太国家滚筒烘干机的线上市场占有率有所提升,海尔、小天鹅、西门子、米迪亚、博世、Panasonic等新兴企业的大部分销售额都来自线上通路。卫生干燥、自动化功能、防振设计、Wifi 连接和其他技术创新使产品更易于使用,从而导致住宅和商业环境中滚筒式烘干机的采用率不断提高。

亚太地区滚筒烘干机市场趋势

市场领先的通风滚筒烘干机

在亚太地区,由于洗衣机消费量的上升和滚筒烘干机支出的增加,通风式滚筒烘干机已成为买家更青睐的滚筒烘干机选择。通风式滚筒烘干机专注于快速烘干衣物,但能源效率较低。而且使用起来也很方便,无需清空水箱,并且具有将水分直接排放到外部的功能。 Bosch、伊莱克斯、LG 电子和 Asco 已成为该地区通风式滚筒烘干机的供应商之一。技术和产品创新使得通风滚筒烘干机融入了感测器干燥、反向滚筒和智慧技术等功能,这些功能有助于增加销售量并使滚筒烘干机与市场上现有的烘干机区分开来。

中国引领亚太市场

中国滚筒烘干机市场规模逐年成长,去年已达7.8亿美元以上。中国滚筒烘干机製造商正专注于线上和线下销售管道,以扩大其市场销售额和收益,海尔、西门子和米迪亚等公司不仅在国内扩大其滚筒烘干机市场,而且由于出口增加,还在海外扩大其市场。目前,中国织物烘干机的普及率约为10%,家电支出不断增加,家庭可支配收入不断提高,为全球滚筒烘干机製造商在中国扩大产品提供了新的机会。由于这些趋势,中国已成为亚太地区滚筒烘干机製造商的关键市场。

亚太地区滚筒烘干机产业概况

亚太地区的滚筒烘干机市场较为分散,该地区有许多参与者,并占据每个国家的市场占有率。技术和产品创新使得製造商能够在市场上提供各种各样的滚筒烘干机。亚太地区滚筒式烘干机市场的现有参与者包括 Smad、伊莱克斯、海尔、LG 电子和博世。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 都市化和家庭收入提高

- 市场限制

- 地缘政治问题导致滚筒烘干机成本增加

- 旋转式烘干机和其他洗衣干燥替代品的竞争

- 市场机会

- 对具有智慧功能的滚筒烘干机的需求不断增加

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 亚太地区滚筒烘干机市场的技术创新

- COVID-19 市场影响

第五章 市场区隔

- 按产品

- 热泵滚筒烘干机

- 冷凝式滚筒烘干机

- 通风式滚筒烘干机

- 瓦斯加热滚筒烘干机

- 按销售管道

- 在线的

- 离线

- 按最终用户

- 住宅

- 商业的

- 按国家

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Smad

- Electrolux

- Haier

- LG Electronics

- Bosch

- Haier

- Midea

- Panasonic

- Little Swan

- Siemens*

第七章 市场未来趋势

第八章 免责声明及发布者

The Asia-Pacific Tumble Dryers Market size is estimated at USD 1.88 billion in 2025, and is expected to reach USD 2.49 billion by 2030, at a CAGR of 5.78% during the forecast period (2025-2030).

The Asia-Pacific countries are among the leading global economies as a result of which they are emerging as a major market for home appliances and developing a positive externality for the sales of laundry appliances and tumble dryers. The major segment of tumble dryer demand emerges from the employed age group between 30 and 50 years who are increasing their spending on time-saving and efficient semi-automatic and automatic tumble dryers. Over the period, the Asia-Pacific had observed an increasing demand for energy-efficient tumble dryers, as a result of which manufacturers are equipping their products with heat pumps and Autodry features with which the machine automatically stops functioning as the laundry becomes dry.

The rising level of urbanization in the Asia-Pacific is acting as a catalyst for the sales of tumble dryers with people preferring quick wash and drying of their laundry. Japan, India, and China have emerged as countries with the largest share of the urban population, leading to increased investment in retail unit sales, advertisement, and service centers for tumble dryers by manufacturers.

Post-COVID-19, Asia-Pacific countries observed a rising online market share of tumble dryers, with Haier, Little Swan, Siemens, Midea, Bosh, and Panasonic emerging as firms with a major portion of their sales through online channels. Hygienic drying, automatic features, anti-vibration design, Wifi connectivity, and other technology innovations are making the product more user-friendly, resulting in increased adoption of tumble dryers by residential and commercial units.

Asia-Pacific Tumble Dryers Market Trends

Vented Tumble Dryer Leading the Market

Rising energy consumption by laundry appliances and increasing spending on tumble dryers in the Asia-Pacific region are leading to vented tumble dryers emerging as more preferable tumble dryer products among buyers. Vented tumble dryers' are majorly focused on the speed of drying laundry and stand low in energy efficiency. Comparatively lower cost of vented tumble dryers than other segments of tumble dryers make them more affordable among the large share of the population in Asia-Pacific, and they exist with features of directly venting moisture outside without any need to empty the water reservoir, making it more user-friendly. Bosh, Electrolux, LG Electronics, and Asko have emerged as some of the manufacturers supplying vented tumble dryers in the region. Technology and product innovation are leading to embedded features of sensor drying, reverse tumble, and smart technology in vented tumble dryers, which are increasing their sales and differentiating them from the existing tumble dryers in the market.

China Leading the Asia-Pacific Market

The size of the tumble dryer market in China has observed a continuous increase over the years, existing at a value of more than USD 780 million last year, leading to an increasing number of manufacturers entering the market with a wide range of products. Tumble dryer manufacturers in China are focusing on both online as well as offline sales channels to increase their market sales and revenue with firms such as Haier, Siemens, and Midea increasing their domestic as well as international tumble dryers market with a rising export. China, with its cloth dryer penetration rate of around 10%, provides an emerging opportunity for global tumble dryer manufacturers to expand their products in the country with rising expenditure on home appliances and increasing disposable income of households. These trends are leading to China emerging as a major market for tumble dryer manufacturers in the Asia-Pacific region.

Asia-Pacific Tumble Dryers Industry Overview

The Asia-Pacific tumble dryers market is fragmented, with many players existing in the region and having their market share in different countries. Technological and product innovations are leading to manufacturers making available a wide range of tumble dryer segments in the market. Some of the existing players in the Asia-Pacific tumble dryers market are Smad, Electrolux, Haier, LG Electronics and Bosch.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Urbanization Rate and Household Income.

- 4.3 Market Restraints

- 4.3.1 Rising Cost-Push Inflation of Tumble Dryers with Geopolitical Issues.

- 4.3.2 Existing Competition from Spin Dryers and Other Laundry Drying Substitutes.

- 4.4 Market Opportunities

- 4.4.1 Increasing Demand for Tumble Dryers Equipped with Smart Features

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in Asia-Pacific Tumble Dryers Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Heat Pump Tumble Dryer

- 5.1.2 Condenser Tumble Dryer

- 5.1.3 Vented Tumble Dryer

- 5.1.4 Gas Heated Tumble Dryer

- 5.2 By Distribution Channel

- 5.2.1 Online

- 5.2.2 Offline

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Country

- 5.4.1 China

- 5.4.2 Japan

- 5.4.3 India

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profile

- 6.2.1 Smad

- 6.2.2 Electrolux

- 6.2.3 Haier

- 6.2.4 LG Electronics

- 6.2.5 Bosch

- 6.2.6 Haier

- 6.2.7 Midea

- 6.2.8 Panasonic

- 6.2.9 Little Swan

- 6.2.10 Siemens*