|

市场调查报告书

商品编码

1801939

固氮菌生物肥料市场机会、成长动力、产业趋势分析及2025-2034年预测Azotobacter-based Biofertilizer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

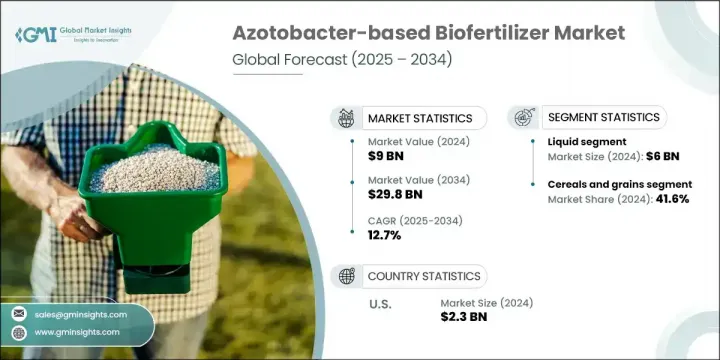

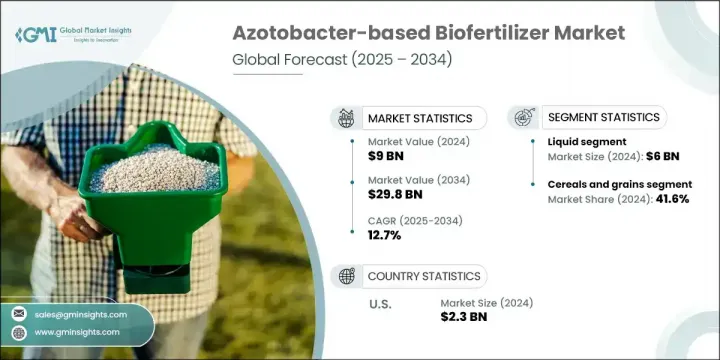

2024年,全球固氮菌生物肥料市场规模达90亿美元,预计到2034年将以12.7%的复合年增长率成长,达到298亿美元。这一快速增长的动力源于全球人口增长、对永续农业的日益重视以及向有机农业实践的转变。随着人们对合成肥料有害影响的担忧日益加深,农民正稳步转向更环保的替代方案。消费者对无化学成分农产品的需求进一步推动了生物肥料的普及。各国政府也纷纷透过激励计划,积极推广永续农业实践,为生物肥料产业注入了新的动力。固氮菌产品尤其受到青睐,因为它们能够自然地固定大气中的氮,改善土壤质量,并促进植物生长——同时,它们还能最大限度地减少环境负担,并且与传统解决方案相比,是一种经济高效的解决方案。

由于环境变化,基于固氮菌的生物肥料在性能一致性方面面临挑战。土壤pH值、温度和水分含量等因素都会影响产量,当不同地区的产量波动时,农民可能会感到沮丧。保质期短是另一个障碍,因为任何产品功效的损失都可能导致用户体验不佳,并在某些地区限制其采用,从而可能减缓其广泛应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 90亿美元 |

| 预测值 | 298亿美元 |

| 复合年增长率 | 12.7% |

2024年,液体製剂市场规模达60亿美元,凭藉其高效能施用、均匀覆盖和易于操作的优势占据领先地位。这些特性使其成为首选,尤其适用于大规模农业经营。液体製剂与农业施用系统的兼容性进一步支持了其在多种农业环境中的广泛应用。

2024年,谷物占比41.6%,继续保持作物类型中的最大份额。这一主导地位得益于全球对粮食安全日益增长的需求、政府支持的有机农业计划,以及基于固氮菌的生物肥料在提高谷物和谷类作物产量方面的成熟功效。随着人们对土壤健康的认识不断提高,许多农民正在采用这些生物肥料,以实现永续发展目标,同时保持生产力。

2024年,美国固氮菌生物肥料市场规模达23亿美元,这得益于现代农业技术、大力推广有机农业以及成熟的农业部门。支持性监管框架和土壤保护意识的提升,持续推动美国固氮菌生物肥料的普及率。在加拿大,随着越来越多人遵守环保实践并重视永续农业,生物肥料市场正在快速成长。研究机构与关键参与者之间的合作正在推动新型高效产品品种的开发,并扩大固氮菌解决方案的使用范围。

固氮菌生物肥料市场的主要参与者包括 Growtech Agri Science、Biotech International、KN BIO SCIENCES、Unisun Agro、IFFCO、Rizobacter、FARMADIL INDIA LLP、Green Vision Life Sciences、Gujarat State Fertilizers & Chemicals 和 Jaipur Bio Fertilizers。全球固氮菌生物肥料市场的公司正透过专注于产品创新、有针对性的合作和配方多样化来扩大其市场份额。领先的公司正在投资研发,以开发适用于不同土壤和气候条件的稳定、持久的生物肥料。与研究机构和大学的策略合作伙伴关係提高了产品性能和区域适应性。一些公司正在强调针对不同作物的客製化解决方案,并扩大其分销网络以涵盖服务不足的农业地区。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 液体

- 载体型(粉末或颗粒)

第六章:市场估计与预测:依作物类型,2021-2034

- 主要趋势

- 谷物和谷类

- 油籽和豆类

- 水果和蔬菜

- 其他(包括经济作物、纤维作物等)

第七章:市场估计与预测:按应用方法,2021-2034 年

- 主要趋势

- 土壤处理

- 种子处理

- 叶面施肥

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 农民/耕种者

- 研究机构

- 农业合作社

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Biotech International

- FARMADIL INDIA LLP

- Green Vision Life Sciences

- Growtech Agri Science

- Gujarat State Fertilizers & Chemicals

- IFFCO

- Jaipur Bio Fertilizers

- KN BIO SCIENCES

- Rizobacter

- Unisun Agro

The Global Azotobacter-based Biofertilizer Market was valued at USD 9 billion in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 29.8 billion by 2034. This rapid growth is being driven by the rising global population, increasing focus on sustainable farming, and a shift toward organic agricultural practices. As concerns around the harmful effects of synthetic fertilizers grow, farmers are steadily moving toward more eco-friendly alternatives. Consumers' demand for chemical-free produce is further encouraging the switch to biofertilizers. Governments are also stepping in to promote sustainable practices through incentive-based programs, creating momentum in the biofertilizer industry. Azotobacter-based products are particularly gaining traction as they naturally fix atmospheric nitrogen, enrich soil quality, and support plant development-all while minimizing the environmental burden and offering a cost-effective solution compared to conventional options.

Azotobacter-based biofertilizers face challenges around consistency in performance due to environmental variability. Factors such as soil pH, temperature, and moisture content influence outcomes and may discourage farmers when results fluctuate across different regions. Limited shelf life is another hurdle, as any loss in product efficacy can lead to poor user experience and restrained adoption in some areas, potentially slowing down widespread use.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9 Billion |

| Forecast Value | $29.8 Billion |

| CAGR | 12.7% |

The liquid formulations segment generated USD 6 billion in 2024, holding a leading position due to their application efficiency, uniform coverage, and ease of handling. These attributes make them a preferred option, particularly for large-scale farming operations. Their compatibility with agricultural application systems further supports their widespread use across multiple farming environments.

The cereals and grains accounted for 41.6% share in 2024, maintaining the largest share by crop type. This dominance is supported by rising global demand for food security, government-backed organic farming initiatives, and the proven ability of azotobacter-based biofertilizers to improve grain and cereal crop yields. With growing awareness around soil health, many farmers are adopting these biofertilizers to meet sustainability goals while maintaining productivity.

U.S. Azotobacter-based Biofertilizer Market was valued at USD 2.3 billion in 2024, driven by modern agricultural techniques, a strong push toward organic farming, and a well-established farming sector. Supportive regulatory frameworks and heightened awareness around soil conservation continue to boost adoption rates across the country. In Canada, the market is growing rapidly with increasing adherence to environmentally responsible practices and an emphasis on sustainable agriculture. Collaboration between research organizations and key players is helping bring out new, efficient product variants and expanding the usage scope of azotobacter-based solutions.

Key participants in the Azotobacter-based Biofertilizer Market include Growtech Agri Science, Biotech International, K. N. BIO SCIENCES, Unisun Agro, IFFCO, Rizobacter, FARMADIL INDIA LLP, Green Vision Life Sciences, Gujarat State Fertilizers & Chemicals, and Jaipur Bio Fertilizers. Companies in the global azotobacter-based biofertilizer market are expanding their market presence by focusing on product innovation, targeted collaborations, and diversification of formulations. Leading players are investing in R&D to develop stable, long-lasting biofertilizers suitable for diverse soil and climate conditions. Strategic partnerships with research institutions and universities enhance product performance and regional adaptability. Several firms are emphasizing tailored solutions for different crops and expanding their distribution networks to reach under-served agricultural regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Crop type trends

- 2.2.3 Application method trends

- 2.2.4 End user trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Liquid

- 5.3 Carrier-based (powder or granules)

Chapter 6 Market Estimates and Forecast, By Crop Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cereals and grains

- 6.3 Oilseeds and pulses

- 6.4 Fruits and vegetables

- 6.5 Others (including cash crops, fiber crops, etc.)

Chapter 7 Market Estimates and Forecast, By Application Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Soil treatment

- 7.3 Seed treatment

- 7.4 Foliar application

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Farmers/cultivators

- 8.3 Research institutions

- 8.4 Agricultural cooperatives

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Biotech International

- 10.2 FARMADIL INDIA LLP

- 10.3 Green Vision Life Sciences

- 10.4 Growtech Agri Science

- 10.5 Gujarat State Fertilizers & Chemicals

- 10.6 IFFCO

- 10.7 Jaipur Bio Fertilizers

- 10.8 K. N. BIO SCIENCES

- 10.9 Rizobacter

- 10.10 Unisun Agro