|

市场调查报告书

商品编码

1822617

生物肥料市场机会、成长动力、产业趋势分析及2025-2034年预测Biofertilizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

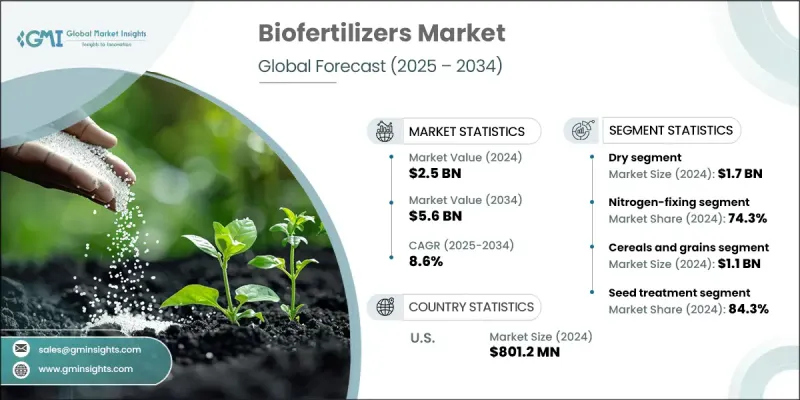

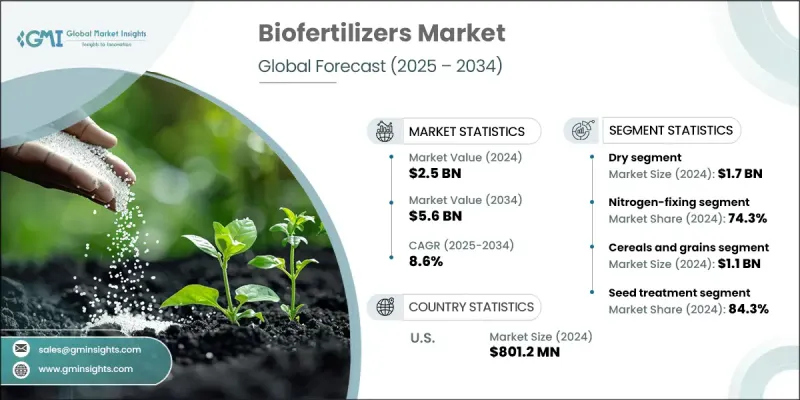

2024 年全球生物肥料市场价值为 25 亿美元,预计到 2034 年将以 8.6% 的复合年增长率增长,达到 56 亿美元,这得益于人们对永续农业实践的认识不断提高。生物肥料具有减少土壤退化和减少化学物质径流等好处。农民转向有机和环保农业的动力是消费者对有机农产品的偏好以及促进永续农业的更严格的监管框架。根据有机贸易协会的报告,2023 年美国有机食品销售额达 630 亿美元。生物技术和微生物研究的进步也为市场收入做出了贡献。微生物菌株和配方技术的创新提高了生物肥料的功效和应用,使其在各种农业应用中更具吸引力。

例如,2023年发表在《应用微生物学杂誌》上的一项研究强调,新的微生物配方使作物产量提高了15%。这项技术进步正在推动新型改良生物肥料产品的开发,这些产品具有更高的养分效率,并与各种作物具有更好的兼容性。寻求提高土壤肥力和作物产量的可行解决方案正在推动该行业的发展。整个生物肥料产业根据产品、作物、形态、应用和地区进行分类。钾肥活化领域因其能够提高土壤肥力和优化养分利用效率而日益受到关注。这些生物肥料旨在释放土壤中的钾,使其更容易被植物吸收,这对于促进植物的旺盛生长和提高作物产量至关重要。透过利用钾溶解细菌和真菌等专门的微生物,这些生物肥料可以有效地将钾从不溶性形式转化为可利用的养分。随着农业实践转向可持续和高效的养分管理解决方案,钾肥活化领域的应用预计将得到更广泛的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 56亿美元 |

| 复合年增长率 | 8.6% |

随着农民寻求更有效的方法来提高土壤健康和肥力,到2032年,土壤处理应用领域将占据显着的市场份额。透过利用有益微生物(例如细菌和真菌)来丰富土壤,土壤处理生物肥料有助于分解有机物、抑制土传病害,并增强土壤通气性和保水性。对永续农业和土壤保护实践的日益重视推动了对这些生物肥料的需求,因为它们提供了一种天然环保的化学土壤改良剂替代品,从而提高作物产量并长期保持土壤健康。亚太地区生物肥料市场正经历快速成长,这得益于农业部门的蓬勃发展和永续农业实践的广泛采用。在人口压力日益增大的背景下,解决土壤退化、减少对化学肥料的依赖以及加强粮食安全的需求推动了产品应用的不断增长。政府推动有机农业发展的措施和补贴,加上生物肥料技术的进步,正在进一步加速亚太地区生物肥料市场的成长。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计资料(HS 编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 干燥

- 液体

第六章:市场估计与预测:按产品,2021-2034

- 主要趋势

- 固氮

- 磷酸盐溶解剂

- 钾肥调动

- 其他的

第七章:市场估计与预测:依作物,2021-2034

- 主要趋势

- 谷物和谷类

- 豆类和油籽

- 水果和蔬菜

- 其他的

第 8 章:市场估计与预测:按应用,2021-2034 年

- 主要趋势

- 种子处理

- 土壤处理

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Agri Life

- Ajay Bio-Tech

- Cairochem

- Chema Industries

- CBF China Bio-Fertilizer AG

- Gujarat State Fertilizers & Chemicals

- Jay Enterprises

- Koppert

- Lallemand

- Madras Fertilizers

- Peptech Biosciences

- Symborg

- Rizobacter Argentina SA

The Global Biofertilizers Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 5.6 billion by 2034 owing to a wider awareness of sustainable agricultural practices. Biofertilizers offer benefits such as reduced soil degradation and minimized chemical runoff. The shift among farmers toward organic and eco-friendly farming is motivated by consumer preference for organic produce and stricter regulatory frameworks promoting sustainable agriculture. According to a report by the Organic Trade Association, organic food sales in the United States reached $63 billion in 2023. Advancements in biotechnology and microbial research also contribute to the market revenues. Innovations in microbial strains and formulation techniques have enhanced the efficacy and application of biofertilizers, making them more appealing across various agricultural applications.

For instance, a study published in the Journal of Applied Microbiology in 2023 highlighted that new microbial formulations improved crop yields by 15%. This technological progress is leading to the development of new and improved biofertilizer products that offer better nutrient efficiency and compatibility with various crops. The search for a viable solution for enhancing soil fertility and crop productivity is pushing the industry growth. The overall biofertilizers industry is classified based on product, crop, form, application, and region. The potash-mobilizing segment is gaining traction due to its ability to enhance soil fertility and optimize nutrient use efficiency. These biofertilizers are designed to unlock potassium in the soil, making it more available to plants, which is crucial for promoting robust plant growth and improving crop yields. By leveraging specialized microorganisms, such as potassium-solubilizing bacteria and fungi, these biofertilizers effectively convert potassium from insoluble forms into accessible nutrients. As agricultural practices shift towards sustainable and efficient nutrient management solutions, the potash-mobilizing segment is expected to see increased adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $5.6 Billion |

| CAGR | 8.6% |

The soil treatment application segment will hold a notable market share by 2032, as farmers seek more effective ways to enhance soil health and fertility. By enriching the soil with beneficial microorganisms, such as bacteria and fungi, soil treatment biofertilizers help in the degradation of organic matter, suppression of soil-borne diseases, and enhancement of soil aeration and water retention. The increasing emphasis on sustainable agriculture and soil conservation practices is driving the demand for these biofertilizers, as they offer a natural and eco-friendly alternative to chemical soil amendments, leading to improved crop productivity and long-term soil health. Asia Pacific biofertilizers market is experiencing rapid growth, driven by the thriving agriculture sector and wider adoption of sustainable farming practices. The increasing product adoption is fueled by the need to address soil degradation, reduce dependency on chemical fertilizers, and enhance food security amidst rising population pressures. Government initiatives and subsidies promoting organic farming, coupled with advancements in biofertilizer technologies, are further accelerating the market growth in Asia Pacific.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Form

- 2.2.3 Product

- 2.2.4 Crop

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trend

- 5.2 Dry

- 5.3 Liquid

Chapter 6 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trend

- 6.2 Nitrogen-fixing

- 6.3 Phosphate-solubilizing

- 6.4 Potash-mobilizing

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Crop, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cereals & grains

- 7.3 Pulses & oil seeds

- 7.4 Fruits & vegetables

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trend

- 8.2 Seed treatment

- 8.3 Soil treatment

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Agri Life

- 10.2 Ajay Bio-Tech

- 10.3 Cairochem

- 10.4 Chema Industries

- 10.5 CBF China Bio-Fertilizer AG

- 10.6 Gujarat State Fertilizers & Chemicals

- 10.7 Jay Enterprises

- 10.8 Koppert

- 10.9 Lallemand

- 10.10 Madras Fertilizers

- 10.11 Peptech Biosciences

- 10.12 Symborg

- 10.13 Rizobacter Argentina SA