|

市场调查报告书

商品编码

1822579

萃取设备市场机会、成长动力、产业趋势分析及2025-2034年预测Extraction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

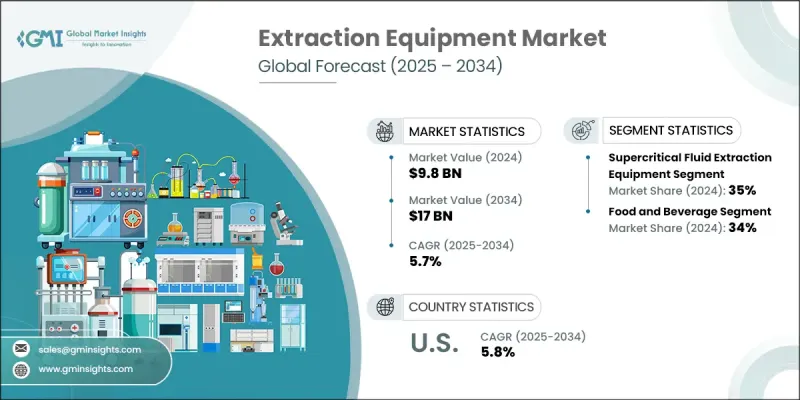

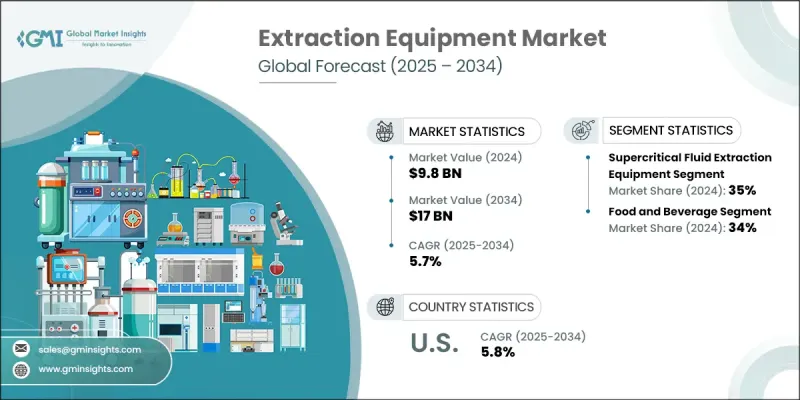

2024 年全球提取设备市场价值为 98 亿美元,预计将以 5.7% 的复合年增长率成长,到 2034 年达到 170 亿美元。

稳定的市场成长反映出各行各业日益重视高效且可持续地获取高纯度化合物。製药、营养保健品、化学品以及食品饮料行业的企业正在持续采用创新的提取技术,以提高产品品质、提升加工能力并满足严格的监管基准。对清洁标籤产品、功能性化合物和永续生产实践日益增长的需求也推动了高性能设备的采用。同时,各行各业(尤其是製药和营养保健品产业)的投资趋势正在加速提取系统的创新步伐。先进萃取技术的广泛应用凸显了向精准度、环境责任和生产优化的更广泛转变。随着各行各业不断推动提取流程的自动化和标准化,设备供应商正在根据不断变化的客户需求调整其产品。这使得提取技术对于在保持营运效率的同时实现稳定的产品性能至关重要,从而增强了其在新兴市场和成熟市场中的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 98亿美元 |

| 预测值 | 170亿美元 |

| 复合年增长率 | 5.7% |

超音波萃取设备凭藉其在更快处理时间和更佳化合物保存方面的操作优势,持续保持领先地位。此方法在较低温度下也能有效运行,非常适合萃取对热敏感的精细成分。此外,它还能减少所需溶剂的用量,符合永续和绿色加工的原则。这些优势使超音波系统成为追求更清洁、更经济高效的生产的製造商的首选。其高效性和适应性使其成为注重性能和可持续性的行业中的关键技术。

超临界流体萃取设备市场在2024年占据35%的市场份额,预计到2034年将以5.9%的复合年增长率成长。该领域的成长源于其能够生产高纯度萃取物,同时提供卓越的环境效益。该技术在高温高压下使用超临界流体(通常为二氧化碳),在化合物萃取过程中实现深度渗透和高选择性。这些特性非常适合注重维持生物活性成分完整性的产业,包括食品、营养保健品和製药业。其能够提供清洁、无残留的提取物,这增强了其对在受监管且注重品质的市场中运营的公司的吸引力。

食品饮料产业在2024年占据了34%的市场份额,预计到2034年将以6%的复合年增长率成长。对天然调味剂、功能性食品添加剂和有机成分的需求不断增长,促使製造商整合先进的萃取解决方案。消费者越来越青睐标籤透明、化学添加剂含量极低的产品,激发了人们对无残留、环保萃取方法的兴趣。企业正在采用新一代系统来应对这项挑战,该系统能够从植物来源中分离出高品质的化合物,同时又符合环境和安全标准。

2024年,德国萃取设备市场占18%,贡献了6.956亿美元的市场规模。该国的工业和技术格局正在推动对先进萃取解决方案的强劲需求。合规驱动的创新、工业现代化以及对製造业永续性的持续推动,进一步推动了德国和整个欧洲的成长。与法国等邻近市场一起,该地区正逐渐成为下一代萃取技术的关键枢纽。对精度、可靠性和高通量性能的需求正鼓励欧洲企业投资可扩展的先进萃取系统。

全球萃取设备市场的领导公司包括岛津公司、阿法拉伐、沃特世公司、苏尔寿有限公司和步琪实验室技术有限公司。这些关键参与者不断影响技术进步,并树立着业界新标准。顶级萃取设备製造商正透过专注于研发来推出效率更高、支持环保加工的系统,从而巩固其市场地位。许多公司正在投资自动化技术和模组化设备设计,以满足不同规模的生产需求,同时优化能源使用和原材料消耗。各公司也透过策略合作伙伴关係、收购和在地化生产能力来扩大其全球影响力。对法规遵循和品质保证的关注正在推动清洁萃取方法和无溶剂技术的创新。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对天然和植物产品的需求不断增长

- 提取效率的技术进步

- 跨多个行业的应用日益增加。

- 人们越来越关注可持续的提取方法。

- 产业陷阱与挑战

- 初期投资成本高

- 技术复杂性与营运挑战

- 某些应用中的监管障碍

- 市场机会

- 新兴市场和应用

- 自动化与物联网技术的融合

- 混合提取系统的开发

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按提取方法,2021 - 2034 年

- 主要趋势

- 超音波萃取设备

- 聚焦超音波系统

- 传统超音波系统

- 化学萃取设备

- 溶剂型体系

- 酸碱萃取系统

- 高压萃取设备

- 液压系统

- 机械压力机系统

- 超临界流体萃取设备

- CO2萃取系统

- 其他超临界流体系统

- 微波辅助萃取设备

- 水蒸馏设备

- 其他提取方法

第六章:市场估计与预测:依设备类型,2021 - 2034 年

- 实验室规模的设备

- 中试设备

- 工业规模设备

- 手动提取系统

- 半自动提取系统

- 全自动提取系统

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 食品和饮料

- 精油

- 香精和香料

- 食用油

- 茶和咖啡萃取物

- 水果和蔬菜萃取物

- 製药和生物技术

- API撷取

- 植物药物

- 营养保健品

- 细胞萃取

- 粒线体撷取

- DNA/RNA萃取

- 化妆品和个人护理

- 活性成分

- 天然萃取物

- 化学加工

- 精细化学品

- 特种化学品

- 大麻和麻类加工

- CBD萃取

- THC萃取

- 环境应用

- 污染物去除

- 废水处理

- 其他的

第 8 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 韩国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 阿根廷

- 多边环境协定

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Alfa Laval

- Sulzer Ltd

- Waters Corporation

- BUCHI Labortechnik

- Shimadzu Corporation

- Hielscher Ultrasonics

- Sonomechanics

- Sonics & Materials

- Qsonica

- FUST Lab

- Accudyne Systems

- Separeco

- SFE Process

- Apeks Supercritical

- Eden Labs

- Vitalis Extraction

- Pure Extraction

- Isolate Extraction

- Joda Technology

- De Dietrich Process Systems

- Koch Modular Process Systems

- Flottweg SE

- French Oil Mill Machinery

- CPM Holdings

- Anderson International

- Harburg-Freudenberger

- Allgaier Process Technology

The Global Extraction Equipment Market was valued at USD 9.8 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 17 billion by 2034.

This steady market growth reflects the increasing emphasis across industries on obtaining high-purity compounds efficiently and sustainably. Businesses operating in pharmaceuticals, nutraceuticals, chemicals, and food and beverage are consistently adopting innovative extraction technologies to boost output quality, improve processing capabilities, and meet strict regulatory benchmarks. The rising demand for clean-label products, functional compounds, and sustainable manufacturing practices is also encouraging the implementation of high-performance equipment. At the same time, investment trends across sectors-particularly in pharmaceutical and nutraceutical operations-are accelerating the pace of innovation in extraction systems. This widespread adoption of advanced extraction technologies underlines a broader shift toward precision, environmental responsibility, and production optimization. With industries pushing for greater automation and standardization in extraction processes, equipment providers are aligning their offerings with evolving customer needs. This has made extraction technologies essential for achieving consistent product performance while maintaining operational efficiency, thereby reinforcing their importance across both emerging and mature markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 Billion |

| Forecast Value | $17 Billion |

| CAGR | 5.7% |

Ultrasonic extraction equipment continues to lead due to its operational edge in terms of faster processing times and improved compound preservation. This method operates effectively at lower temperatures, making it suitable for extracting delicate ingredients that are sensitive to heat. Moreover, it reduces the volume of solvents required, aligning well with the principles of sustainable and green processing. These advantages make ultrasonic systems a preferred choice among manufacturers striving for cleaner and more cost-efficient production. Their efficiency and adaptability have positioned them as crucial technologies across industries that value both performance and sustainability.

The supercritical fluid extraction equipment segment accounted for a 35% share in 2024 and is expected to grow at a CAGR of 5.9% through 2034. This segment's growth is anchored in its ability to produce high-purity extracts while offering superior environmental benefits. Using supercritical fluids-typically carbon dioxide-at elevated pressure and temperature, the technology achieves deep penetration and high selectivity during compound extraction. These properties are ideal for industries focused on preserving the integrity of bioactive ingredients, including those in the food, nutraceutical, and pharmaceutical sectors. Its capability to deliver clean, residue-free extracts enhances its appeal among companies operating in regulated, quality-sensitive markets.

The food & beverage sector held a 34% share in 2024 and is projected to grow at a 6% CAGR through 2034. Increased demand for natural flavoring agents, functional food additives, and organic ingredients is driving manufacturers to integrate advanced extraction solutions. Consumers are increasingly favoring products with transparent labeling and minimal chemical additives, which is fueling interest in residue-free, eco-friendly extraction methods. Companies are responding by adopting next-generation systems capable of isolating high-quality compounds from plant-based sources while adhering to environmental and safety standards.

Germany Extraction Equipment Market held an 18% share in 2024, contributing USD 695.6 million. The country's industrial and technological landscape is fostering strong demand for advanced extraction solutions. Growth in Germany and across Europe is further supported by compliance-driven innovation, industrial modernization, and a consistent push for sustainability in manufacturing. Together with neighboring markets such as France, the region is shaping up to be a key hub for next-generation extraction technologies. Demand for precision, reliability, and high-throughput performance is encouraging European businesses to invest in scalable, state-of-the-art extraction systems.

Leading companies in the Global Extraction Equipment Market include Shimadzu Corporation, Alfa Laval, Waters Corporation, Sulzer Ltd, and BUCHI Labortechnik. These key players are consistently influencing technological advancements and setting new standards in the industry. Top extraction equipment manufacturers are strengthening their market foothold by focusing on R&D to introduce systems that deliver higher efficiency and support eco-friendly processing. Many are investing in automation technologies and modular equipment design to cater to different scales of production while optimizing energy use and raw material consumption. Companies are also expanding their global footprint through strategic partnerships, acquisitions, and localized production capabilities. A focus on regulatory compliance and quality assurance is driving innovations in clean extraction methods and solvent-free technologies.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Extraction method

- 2.2.3 Equipment type

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Executive decision points

- 2.3.2 Critical success factors

- 2.4 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for natural and plant-based products

- 3.2.1.2 Technological advancements in extraction efficiency

- 3.2.1.3 Increasing applications across multiple industries.

- 3.2.1.4 Rising focus on sustainable extraction methods.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Technical complexity and operational challenges

- 3.2.2.3 Regulatory hurdles in certain applications

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets and applications

- 3.2.3.2 Integration of automation and IoT technologies

- 3.2.3.3 Development of hybrid extraction systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Extraction Method, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Key trends

- 5.2 Ultrasonic Extraction Equipment

- 5.2.1 Focused Ultrasonic Systems

- 5.2.2 Conventional Ultrasonic Systems

- 5.3 Chemical Extraction Equipment

- 5.3.1 Solvent-Based Systems

- 5.3.2 Acid-Base Extraction Systems

- 5.4 High Pressure Extraction Equipment

- 5.4.1 Hydraulic Press Systems

- 5.4.2 Mechanical Press Systems

- 5.5 Supercritical Fluid Extraction Equipment

- 5.5.1 CO2 Extraction Systems

- 5.5.2 Other Supercritical Fluid Systems

- 5.6 Microwave-Assisted Extraction Equipment

- 5.7 Hydrodistillation Equipment

- 5.8 Other Extraction Methods

Chapter 6 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Laboratory-scale equipment

- 6.2 Pilot-scale equipment

- 6.3 Industrial-scale equipment

- 6.4 Manual extraction systems

- 6.5 Semi-automated extraction systems

- 6.6 Fully automated extraction systems

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Key trends

- 7.2 Food and Beverage

- 7.2.1 Essential Oils

- 7.2.2 Flavors & Fragrances

- 7.2.3 Edible Oils

- 7.2.4 Tea and Coffee Extracts

- 7.2.5 Fruit and Vegetable Extracts

- 7.3 Pharmaceutical and Biotechnology

- 7.3.1 API Extraction

- 7.3.2 Phytopharmaceuticals

- 7.3.3 Nutraceuticals

- 7.3.4 Cell Extraction

- 7.3.5 Mitochondria Extraction

- 7.3.6 DNA/RNA Extraction

- 7.4 Cosmetics and Personal Care

- 7.4.1 Active Ingredients

- 7.4.2 Natural Extracts

- 7.5 Chemical Processing

- 7.5.1 Fine chemicals

- 7.5.2 Specialty Chemicals

- 7.6 Cannabis and Hemp Processing

- 7.6.1 CBD Extraction

- 7.6.2 THC Extraction

- 7.7 Environmental Applications

- 7.7.1 Pollutant Removal

- 7.7.2 Wastewater Treatment

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 South Korea

- 9.4.3 Japan

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Alfa Laval

- 10.2 Sulzer Ltd

- 10.3 Waters Corporation

- 10.4 BUCHI Labortechnik

- 10.5 Shimadzu Corporation

- 10.6 Hielscher Ultrasonics

- 10.7 Sonomechanics

- 10.8 Sonics & Materials

- 10.9 Qsonica

- 10.10 FUST Lab

- 10.11 Accudyne Systems

- 10.12 Separeco

- 10.13 SFE Process

- 10.14 Apeks Supercritical

- 10.15 Eden Labs

- 10.16 Vitalis Extraction

- 10.17 Pure Extraction

- 10.18 Isolate Extraction

- 10.19 Joda Technology

- 10.20 De Dietrich Process Systems

- 10.21 Koch Modular Process Systems

- 10.22 Flottweg SE

- 10.23 French Oil Mill Machinery

- 10.24 CPM Holdings

- 10.25 Anderson International

- 10.26 Harburg-Freudenberger

- 10.27 Allgaier Process Technology