|

市场调查报告书

商品编码

1822638

太阳眼镜市场机会、成长动力、产业趋势分析及2025-2034年预测Sunglasses Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

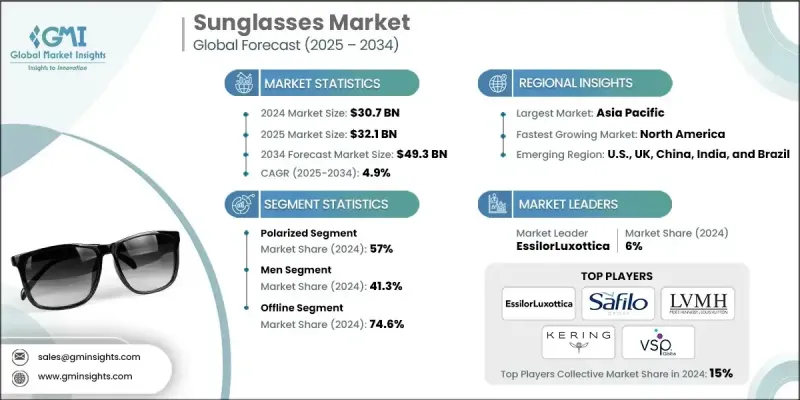

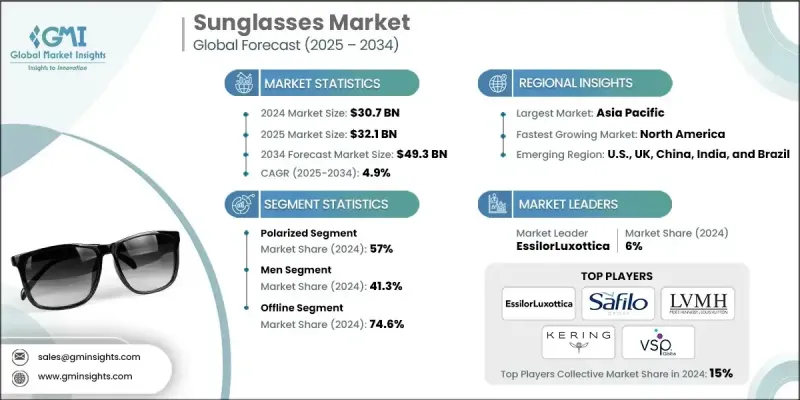

根据 Global Market Insights Inc. 发布的报告,2024 年全球太阳眼镜市场规模估计为 307 亿美元,预计将从 2025 年的 321 亿美元增长到 2034 年的 493 亿美元,复合年增长率为 4.9%。

消费者越来越意识到紫外线 (UV) 对眼睛健康的危害,这推动了对经认证的紫外线防护太阳眼镜的需求。这种转变使太阳眼镜不再只是时尚配件,更是不可或缺的健康保健产品。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 307亿美元 |

| 预测值 | 493亿美元 |

| 复合年增长率 | 4.9% |

偏光镜片的普及率不断上升

2024年,偏光镜片市场占据了显着份额,因为消费者越来越重视护眼和视觉清晰度,尤其是在户外活动时。偏光镜片有助于减少水面、路面和雪地等反射表面的眩光,使其成为驾驶、运动和旅行的理想选择。随着人们对紫外线伤害和数位眼睛疲劳的认识不断提高,越来越多的消费者开始转向高性能眼镜,即使在休閒场合也是如此。

男性需求不断成长

2024年,受功能性需求和不断升级的时尚意识的共同推动,男士太阳眼镜市场收入可观。越来越多的男士将太阳眼镜视为一种时尚宣言,同时也注重耐用的设计和镜片技术,以支持通勤、运动和旅行等日常活动。领先品牌正积极响应这一趋势,推出客製化系列,将阳刚之气与UV400防护、防刮涂层和偏光镜片等技术特性结合。

线下消费偏好上升

2025-2034年,线下零售市场将维持可观的复合年增长率。包括眼镜连锁店、时尚精品店和百货公司在内的实体店,将继续吸引那些寻求亲身体验和个人化服务的顾客。对于首次购买或购买高阶产品的消费者来说,能够试穿不同风格并获得专家推荐尤其重要。旅游零售和季节性快闪店也为线下零售提供了助力。

区域洞察

亚太地区将成为利润丰厚的地区

2024年,亚太地区太阳眼镜市场占据了相当大的份额,这得益于可支配收入的提高、中产阶级人口的扩大以及人们对眼部健康的意识的增强。中国、印度和韩国等国家凭藉其蓬勃发展的时尚产业和年轻的消费族群,正在刺激太阳眼镜的需求。此外,该地区较高的日照强度和城市污染水平也促使消费者寻求具有功能性防护功效的眼镜。国际和本土品牌都在大力投资产品在地化、网红行销和店内扩张,以抢占市场份额。

太阳眼镜市场的主要参与者有 Michael Kors Holdings、Fielmann、Oakley、Zenni Optical、Marchon Eyewear、Warby Parker、EssilorLuxottica、Quay Australia、VSP Global、Marcolin、LVMH Moet Hennessy Louis Vuitton、Safilo Group、Johnson & Johnson Vision Care、LVMH Moet Hennessy Louis Vuitton、Safilo Group、Johnson & Johnson Vision Care、Luxottica Group Kering、Luxov。

为了巩固在全球太阳眼镜市场的份额,各大公司正在实施一系列产品创新、全通路扩张和品牌合作的措施。许多公司正在推出采用可回收或可生物降解材料的环保系列,以顺应永续发展趋势。时尚前卫的设计,加上偏光、光致变色和蓝光过滤等先进的镜片技术,帮助品牌兼顾风格和功能。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 消费者越来越重视眼睛健康和紫外线防护

- 时尚和生活方式的吸引力日益增强

- 电子商务与全通路零售的扩张

- 产业陷阱与挑战

- 竞争激烈,市场饱和

- 经济敏感度和波动的可支配收入

- 机会

- 人们越来越关注眼睛健康和紫外线防护。

- 对环保太阳眼镜的需求

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监理框架

- 标准和合规要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码:9004100000)

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:太阳眼镜市场估计与预测:按类型,2021-2034

- 主要趋势

- 偏振

- 非极化

第六章:太阳眼镜市场估计与预测:按镜框材质,2021-2034

- 主要趋势

- 塑胶

- 金属

- 其他的

第七章:太阳眼镜市场估计与预测:按镜片材料,2021-2034

- 主要趋势

- CR-39(烯丙基二甘醇碳酸酯)

- 聚碳酸酯

- 聚氨酯

- 其他(玻璃等)

第八章:太阳眼镜市场估计与预测:按涂层,2021-2034

- 主要趋势

- 抗反射涂层

- 防刮涂层

- 防紫外线

- 蓝光滤镜

- 其他的

第九章:太阳眼镜市场估计与预测:依设计风格,2021-2034

- 主要趋势

- 全框

- 半框

- 无框

第 10 章:太阳眼镜市场估计与预测:按价格,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 11 章:太阳眼镜市场估计与预测:按应用,2021-2034 年

- 主要趋势

- 运动的

- 时尚

- 安全/防护(如工业、实验室)

- 处方眼镜

- 老花眼镜

- 驾驶眼镜

第 12 章:太阳眼镜市场估计与预测:按最终用途,2021-2034 年

- 主要趋势

- 男士

- 女性

- 男女通用的

- 孩子们

第 13 章:太阳眼镜市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 专卖店

- 大卖场/超市

- 零售商

第 14 章:太阳眼镜市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 15 章:公司简介

- EssilorLuxottica

- Fielmann

- Johnson & Johnson Vision Care

- Luxottica Group

- Kering SA

- LVMH Moet Hennessy Louis Vuitton

- Marchon Eyewear

- Marcolin

- Michael Kors Holdings

- Oakley

- Quay Australia

- Safilo Group

- VSP Global

- Warby Parker

- Zenni Optical

The global sunglasses market was estimated at USD 30.7 billion in 2024 and is expected to grow from USD 32.1 billion in 2025 to USD 49.3 billion by 2034, at a CAGR of 4.9%, according to the report published by Global Market Insights Inc.

Consumers are becoming increasingly aware of the harmful effects of ultraviolet (UV) rays on eye health, driving demand for sunglasses that offer certified UV protection. This shift is positioning sunglasses not just as fashion accessories but also as essential health and wellness products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.7 Billion |

| Forecast Value | $49.3 Billion |

| CAGR | 4.9% |

Rising Adoption of Polarized Lenses

The polarized segment held a notable share in 2024 as consumers increasingly prioritize eye protection and visual clarity, especially during outdoor activities. Polarized lenses help reduce glare from reflective surfaces like water, roads, and snow, making them highly desirable for driving, sports, and travel. As awareness around UV damage and digital eye strain continues to rise, more consumers are shifting toward high-performance eyewear, even in casual settings.

Increasing Demand Among Men

The men segment generated notable revenues in 2024, fueled by a blend of functional needs and evolving fashion consciousness. Men increasingly view sunglasses as a style statement, while also valuing durable designs and lens technology that supports everyday activities like commuting, sports, and travel. Leading brands are responding with tailored collections that combine masculine aesthetics with technical features such as UV400 protection, anti-scratch coatings, and polarized lenses.

Rising preference for Offline

The offline segment will grow at a decent CAGR during 2025-2034. Brick-and-mortar outlets, including optical chains, fashion boutiques, and department stores, continue to attract customers seeking hands-on product experience and personalized service. The ability to try on different styles and receive expert recommendations is particularly important for first-time buyers or premium product purchases. Offline retail is also bolstered by travel retail and seasonal pop-up stores.

Regional Insights

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific sunglasses market held a sizeable share in 2024, driven by rising disposable incomes, expanding middle-class populations, and increased awareness of eye health. Countries like China, India, and South Korea are fueling demand with their growing fashion industries and youthful consumer bases. Additionally, the region's high levels of sun exposure and urban pollution are pushing consumers toward protective eyewear with functional benefits. Both international and local brands are investing heavily in product localization, influencer marketing, and in-store expansion to capture market share.

Major players in the sunglasses market are Michael Kors Holdings, Fielmann, Oakley, Zenni Optical, Marchon Eyewear, Warby Parker, EssilorLuxottica, Quay Australia, VSP Global, Marcolin, LVMH Moet Hennessy Louis Vuitton, Safilo Group, Johnson & Johnson Vision Care, Luxottica Group, and Kering SA.

To strengthen their presence in the global sunglasses market, companies are implementing a mix of product innovation, omnichannel expansion, and brand collaborations. Many are launching eco-friendly collections using recycled or biodegradable materials to align with sustainability trends. Fashion-forward designs, coupled with advanced lens technologies like polarization, photochromic adaptation, and blue light filtering, help brands meet both style and function expectations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Frame material

- 2.2.4 Lens material

- 2.2.5 Coating

- 2.2.6 Design style

- 2.2.7 Price

- 2.2.8 Application

- 2.2.9 End use

- 2.2.10 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer focus on eye health and UV protection

- 3.2.1.2 Growing fashion and lifestyle appeal

- 3.2.1.3 Expansion of e-commerce and omnichannel retailing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition and market saturation

- 3.2.2.2 Economic sensitivity and fluctuating disposable income

- 3.2.3 Opportunities

- 3.2.3.1 Rising focus on eye health and UV protection.

- 3.2.3.2 Demand for eco-friendly sunglasses

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code: 9004100000)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Sunglasses Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Polarized

- 5.3 Non-polarized

Chapter 6 Sunglasses Market Estimates & Forecast, By Frame Material, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Others

Chapter 7 Sunglasses Market Estimates & Forecast, By Lens Material, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 CR-39 (allyl diglycol carbonate)

- 7.3 Polycarbonate

- 7.4 Polyurethane

- 7.5 Others (glass, etc.)

Chapter 8 Sunglasses Market Estimates & Forecast, By Coating, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Anti-reflective coating

- 8.3 Scratch-resistant coating

- 8.4 UV protection

- 8.5 Blue light filtering

- 8.6 Others

Chapter 9 Sunglasses Market Estimates & Forecast, By Design Style, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Full rim

- 9.3 Half rim

- 9.4 Rimless

Chapter 10 Sunglasses Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Sunglasses Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Sports

- 11.3 Fashion

- 11.4 Safety/protective (e.g., industrial, lab)

- 11.5 Prescription eyewear

- 11.6 Reading glasses

- 11.7 Driving glasses

Chapter 12 Sunglasses Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Men

- 12.3 Women

- 12.4 Unisex

- 12.5 Children

Chapter 13 Sunglasses Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Online

- 13.2.1 E-commerce

- 13.2.2 Company websites

- 13.3 Offline

- 13.3.1 Specialty store

- 13.3.2 Hypermarket/supermarket

- 13.3.3 Retailers

Chapter 14 Sunglasses Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 UK

- 14.3.3 France

- 14.3.4 Italy

- 14.3.5 Spain

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 India

- 14.4.3 Japan

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.5.3 Argentina

- 14.6 MEA

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles

- 15.1 EssilorLuxottica

- 15.2 Fielmann

- 15.3 Johnson & Johnson Vision Care

- 15.4 Luxottica Group

- 15.5 Kering SA

- 15.6 LVMH Moet Hennessy Louis Vuitton

- 15.7 Marchon Eyewear

- 15.8 Marcolin

- 15.9 Michael Kors Holdings

- 15.10 Oakley

- 15.11 Quay Australia

- 15.12 Safilo Group

- 15.13 VSP Global

- 15.14 Warby Parker

- 15.15 Zenni Optical