|

市场调查报告书

商品编码

1833449

能量收集感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Energy Harvesting Transducer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

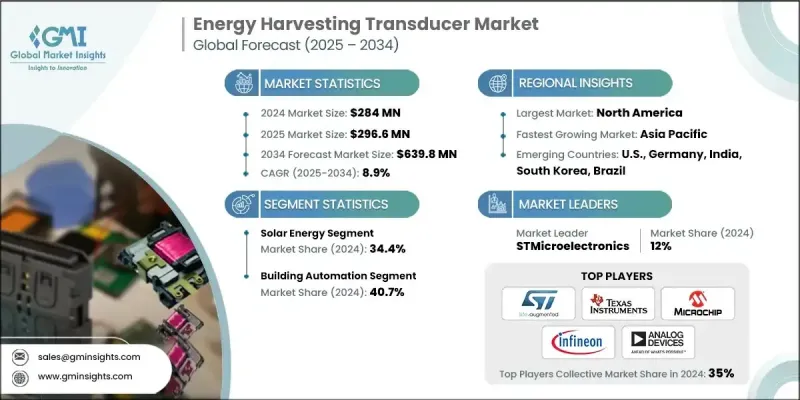

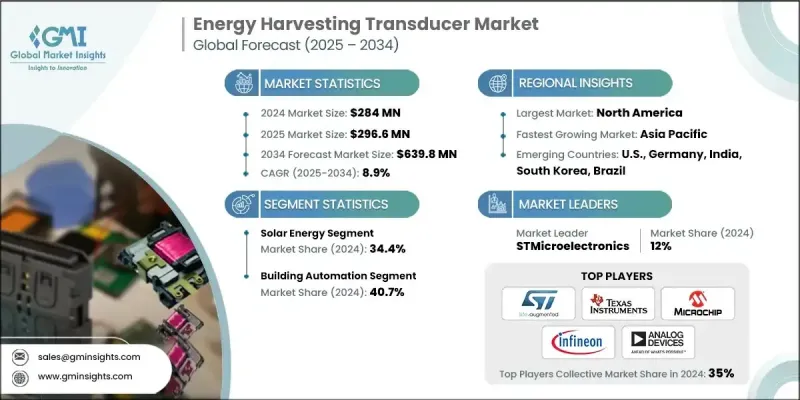

2024 年全球能量收集感测器市场价值为 2.84 亿美元,预计到 2034 年将以 8.9% 的复合年增长率增长至 6.398 亿美元。

对永续能源和绿色技术的日益关注是能量收集感测器市场的主要驱动力之一。随着各行各业、政府和消费者都在寻求减少碳足迹的方法,对再生能源和自供电设备的需求也日益增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.84亿美元 |

| 预测值 | 6.398亿美元 |

| 复合年增长率 | 8.9% |

太阳能利用率不断上升

太阳能领域在2024年占据了相当大的份额,因为太阳能仍然是最容易取得且应用最广泛的可再生能源之一。太阳能收集换能器(例如光伏电池)正越来越多地被整合到各种设备和应用中,从穿戴式电子设备到智慧城市。这些换能器将阳光转化为电能,提供可持续、低成本的能源解决方案,满足日益增长的离网和自主电源需求。

楼宇自动化需求不断成长

受能源效率和营运成本降低的推动,楼宇自动化领域在2024年创造了可观的收入。这些系统整合到无线感测器、灯光控制系统和运动感测器中,利用振动、温度和光照等环境能源供电,无需依赖传统电源。透过利用周围环境中的少量能量,这些系统无需更换电池或连接有线电源,从而提高了建筑的可持续性和效率。

北美将成为推动力地区

2024年,北美能量收集换能器市场占据了可持续的市场份额,这得益于该地区大力推动永续能源解决方案,以及各行各业对自主低功耗系统日益增长的需求。随着智慧型装置、穿戴式装置和物联网技术的日益普及,对能量收集解决方案的需求也正在加速成长。各公司正在抓住汽车、消费性电子、工业自动化和医疗保健等行业的机会,这些行业可以使用小型低能耗换能器为设备供电,而无需依赖传统的电池供电。

能量收集换能器市场的主要参与者包括霍尼韦尔国际公司、VTT 技术研究中心、E-peas、Nowi Energy、ADI 公司、EnOcean GmbH、Qorvo 公司、Powercast 公司、Microchip Technology 公司、瑞萨电子公司、GreenTEG AG、意法半导体、村田製作所、Silcian Power、ABB、Mr. Corp.、WePower 和 Zarlink Semiconductor。

为了巩固其在能量收集换能器市场的地位,各公司正在采取几项关键策略。首先,他们大力投入研发,以提高转换效率、降低製造成本并提升换能器的整体效能。意法半导体和德州仪器等公司正在不断创新,以提高能量收集系统的效率,并使其能够在多种应用中扩展。另一个重要策略是与其他技术供应商(例如物联网设备製造商和智慧城市开发商)建立策略合作伙伴关係,以建立整合解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

- 新兴机会和趋势

- 数位化和物联网集成

- 新兴市场渗透

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依来源,2021 - 2034

- 主要趋势

- 太阳能

- 振动与动能

- 热能

- 射频(RF)

- 其他的

第六章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 无线感测器网路

- 消费性电子产品

- 楼宇自动化

- 汽车

- 其他的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABB

- Analog Devices, Inc.

- Cymbet Corporation

- EnOcean GmbH

- E-peas

- GreenTEG AG

- Honeywell International Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- Murata Manufacturing Co., Ltd.

- Nowi Energy

- Powercast Corporation

- Qorvo, Inc.

- Renesas Electronics Corporation

- Silicon Labs

- STMicroelectronics

- Texas Instruments

- Thermo Life Energy Corp.

- Voltree Power

- VTT Technical Research Centre

- WePower

- Zarlink Semiconductor

The Global Energy Harvesting Transducer Market was valued at USD 284 million in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 639.8 million by 2034.

The increasing focus on sustainable energy and green technologies is one of the primary drivers of the energy harvesting transducer market. As industries, governments, and consumers look for ways to reduce their carbon footprint, the need for renewable energy sources and self-powered devices is rising.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $284 Million |

| Forecast Value | $639.8 million |

| CAGR | 8.9% |

Rising Adoption of Solar Energy

The solar energy segment held a significant share in 2024 as solar power remains one of the most accessible and widely utilized renewable energy sources. Solar energy harvesting transducers, such as photovoltaic cells, are increasingly being integrated into various devices and applications, from wearable electronics to smart cities. These transducers convert sunlight into electrical power, providing a sustainable, low-cost energy solution that supports the growing need for off-grid and autonomous power sources.

Increasing Demand in Building Automation

The building automation segment generated sizeable revenues in 2024, driven by energy efficiency and reduced operational costs. These systems are integrated into wireless sensors, light control systems, and motion sensors, providing power from ambient sources like vibration, temperature, and light without relying on traditional power sources. By harnessing small amounts of energy from the surrounding environment, these systems eliminate the need for battery replacements or wired power connections, thus enhancing the sustainability and efficiency of buildings.

North America to Emerge as a Propelling Region

North America energy harvesting transducer market held a sustainable share in 2024, driven by the region's strong push toward sustainable energy solutions and the growing demand for autonomous, low-power systems across industries. With the increasing adoption of smart devices, wearables, and IoT technologies, the demand for energy harvesting solutions is accelerating. Companies are capitalizing on opportunities in industries like automotive, consumer electronics, industrial automation, and healthcare, where small, low-energy transducers can be used to power devices without relying on conventional battery sources.

Major players in the energy harvesting transducer market are Honeywell International Inc., VTT Technical Research Centre, E-peas, Nowi Energy, Analog Devices, Inc., EnOcean GmbH, Qorvo, Inc., Powercast Corporation, Microchip Technology Inc., Renesas Electronics Corporation, GreenTEG AG, STMicroelectronics, Murata Manufacturing Co., Ltd., Silicon Labs, ABB, Voltree Power, Infineon Technologies AG, Cymbet Corporation, Thermo Life Energy Corp., WePower, Zarlink Semiconductor.

To strengthen their market position in the energy harvesting transducer market, companies are adopting several key strategies. First, they are focusing heavily on research and development to improve conversion efficiency, reduce manufacturing costs, and enhance the overall performance of transducers. Companies like STMicroelectronics and Texas Instruments are continually innovating to make energy harvesting systems more efficient and scalable across multiple applications. Another important strategy is forming strategic partnerships with other technology providers, like IoT device manufacturers and smart city developers, to create integrated solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Source, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Solar energy

- 5.3 Vibration & kinetic energy

- 5.4 Thermal energy

- 5.5 Radio frequency (RF)

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Wireless sensor networks

- 6.3 Consumer electronics

- 6.4 Building automation

- 6.5 Automotive

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Analog Devices, Inc.

- 8.3 Cymbet Corporation

- 8.4 EnOcean GmbH

- 8.5 E-peas

- 8.6 GreenTEG AG

- 8.7 Honeywell International Inc.

- 8.8 Infineon Technologies AG

- 8.9 Microchip Technology Inc.

- 8.10 Murata Manufacturing Co., Ltd.

- 8.11 Nowi Energy

- 8.12 Powercast Corporation

- 8.13 Qorvo, Inc.

- 8.14 Renesas Electronics Corporation

- 8.15 Silicon Labs

- 8.16 STMicroelectronics

- 8.17 Texas Instruments

- 8.18 Thermo Life Energy Corp.

- 8.19 Voltree Power

- 8.20 VTT Technical Research Centre

- 8.21 WePower

- 8.22 Zarlink Semiconductor