|

市场调查报告书

商品编码

1801877

能源密集材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Energy Dense Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

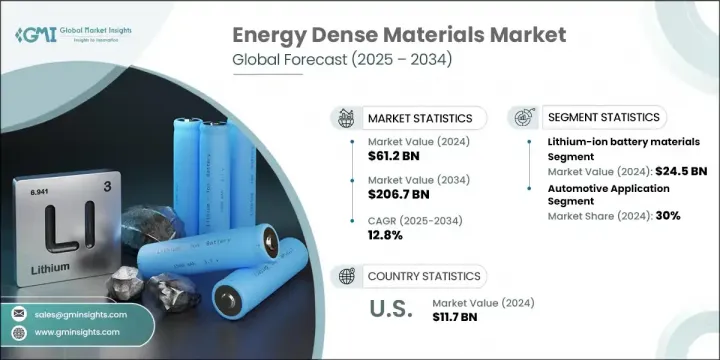

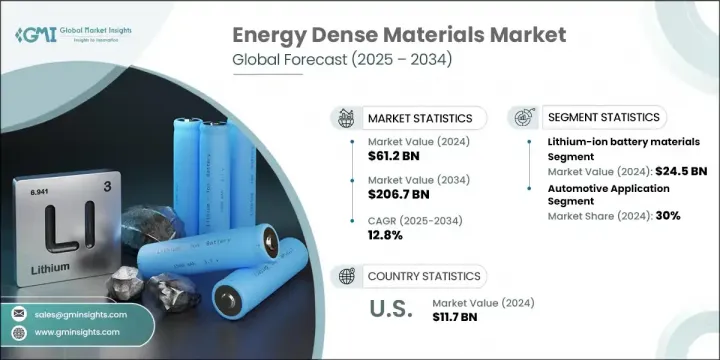

2024年,全球高能源效率材料市场规模达612亿美元,预计到2034年将以12.8%的复合年增长率成长,达到2067亿美元。由于碳减排的紧迫性日益增强,以及向更永续的电气化能源系统转型,该市场正经历强劲发展势头。随着再生能源在发电领域持续成长,对紧凑高效的储能解决方案的需求也日益凸显。高能源效率材料透过确保电网稳定性、在高峰需求期间平衡供电以及提高间歇性电源供电的一致性来支持这一转变。随着全球对高效能、轻量化和高容量储能的需求持续成长,高能源效率材料在各个领域的重要性日益凸显。

电动车的兴起是市场成长的主要动力之一。随着电动车在全球市场的快速扩张,对续航里程更长、充电速度更快、重量更轻的电池的需求变得至关重要。高能量密度材料在电动飞机和无人机的航太推进系统中也发挥着重要作用,最大限度地提高单位质量的能量可以延长飞行时间并提高有效载荷能力,最终推动航空运输技术的创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 612亿美元 |

| 预测值 | 2067亿美元 |

| 复合年增长率 | 12.8% |

2024年,锂离子电池材料市场规模达245亿美元。其广泛应用得益于其相对于燃料电池材料、超级电容器和固态电池等其他材料更高的能量密度。锂离子电池以紧凑轻巧的形式储存大量能量,使其成为便携式电子设备、电动车和大型储能係统的首选解决方案。其强大的功率输出、更长的循环寿命和稳定的性能使其成为现代储能的基础技术,并支援从消费性电子产品到公用事业规模电网储能等行业的快速应用。

汽车应用领域在2024年占最大份额,达30%。这些应用是高能量密度材料创新的核心,其驱动力来自于人们对续航里程、充电速度和性能与传统引擎相当的汽车日益增长的需求。电池技术能够提供更高的单位空间和重量能量密度,有助于解决消费者对续航里程的担忧,并支持电动车的广泛普及。随着汽车产业的持续扩张,它仍然是市场成长的关键力量。

美国能源密集型材料市场规模在2024年达到117亿美元,预计2034年将以13%的复合年增长率成长。随着经济稳定扩张、能源需求成长以及工业成长,美国对高效能电池、磁铁和燃料电池组件的需求不断增长。能源密集型材料正在帮助各行各业优化能源利用、降低成本并提升整体系统性能。它们在各行各业的能源储存和转换中发挥着重要作用,这对于建立更具弹性和更有效率的能源基础设施至关重要。

全球高能源效率材料市场的主要公司包括LG能源解决方案、松下公司、三星SDI有限公司、特斯拉公司和宁德时代新能源科技股份有限公司(CATL)。为了巩固其在全球高能源效率材料领域的立足点,领先公司正专注于几个策略重点。这些包括积极投资先进化学技术的研发,以提高能量密度、安全性和生命週期。各公司也在扩大产能,以满足日益增长的电动车和电网需求,尤其是在关键成长地区。与汽车製造商和能源供应商的策略联盟有助于确保长期合约的签订。此外,各公司正在实现产品组合多元化,以涵盖固态和锂硫技术等下一代材料,同时优化其全球供应链,以提高成本效益和稳定性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场规模及预测:依材料类型,2021-2034

- 主要趋势

- 锂离子电池材料

- 正极材料(LFP、NMC、NCA、LCO)

- 负极材料(石墨、硅、锂金属)

- 电解质材料

- 隔膜材料

- 固态电池材料

- 固态电解质(氧化物、硫化物、聚合物)

- 介面材料

- 先进电极材料

- 超级电容器材料

- 电极材料(碳基、金属氧化物)

- 电解质溶液

- 隔膜材料

- 先进碳材料

- 石墨烯及其衍生物

- 碳奈米管

- 碳纤维复合材料

- 含能材料

- 高能量密度化合物

- 推进剂材料

- 霹雳

- 燃料电池材料

- 催化剂材料

- 膜材料

- 电极材料

第六章:市场规模及预测:依应用,2021-2034

- 主要趋势

- 汽车应用

- 电动车(BEV、PHEV、HEV)

- 汽车电子

- 启动停止系统

- 消费性电子产品

- 智慧型手机和平板电脑

- 笔记型电脑和穿戴式装置

- 行动电源和可携式设备

- 储能係统

- 电网规模存储

- 住宅储能

- 商业和工业存储

- 航太和国防

- 飞机和太空船应用

- 军事和国防系统

- 无人驾驶汽车和无人机

- 工业应用

- 物料搬运设备

- 备用电源系统

- 电信基础设施

- 医疗保健

- 植入式装置

- 便携式医疗设备

- 紧急医疗系统

第七章:市场规模及预测:依技术,2021-2034

- 主要趋势

- 电池技术

- 锂离子电池

- 固态电池

- 钠离子电池

- 金属空气电池

- 电容器技术

- 超级电容器

- 混合电容器

- 陶瓷电容器

- 燃料电池技术

- 质子交换膜(PEM)

- 固态氧化物燃料电池(SOFC)

- 碱性燃料电池

- 能量收集技术

- 热电材料

- 压电材料

- 光电材料

第 8 章:市场规模与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 汽车产业

- 电子和半导体

- 能源和公用事业

- 航太和国防

- 医疗保健和医疗器械

- 工业製造

- 电信

- 海洋和运输

第九章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Tesla

- Panasonic Corporation

- Samsung SDI

- LG Energy Solution

- Contemporary Amperex Technology

- BYD Company Limited

- QuantumScape Corporation

- Solid Power

- Sila Nanotechnologies

- Group14 Technologies

- Wildcat Discovery Technologies

- Amprius Technologies

- Enovix Corporation

- Ion Storage Systems

- Ampcera

- Sion Power Corporation

- Oxis Energy

The Global Energy Dense Materials Market was valued at USD 61.2 billion in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 206.7 billion by 2034. This market is experiencing strong momentum due to the increasing urgency around carbon reduction and the shift toward more sustainable, electrified energy systems. As renewable energy continues to gain traction in power generation, the demand for compact and highly efficient energy storage solutions is becoming more critical. Energy dense materials support this transition by ensuring grid stability, balancing supply during peak demand, and improving the consistency of power delivery from intermittent sources. Their importance is rising across various sectors as the global appetite for efficient, lightweight, and high-capacity energy storage continues to grow.

The rise of electric mobility is one of the primary contributors to market growth. As electric vehicles scale quickly across global markets, the need for batteries that deliver longer range, faster charging, and reduced weight becomes vital. Energy dense materials also serve an important role in aerospace propulsion systems for electric aircraft and drones, where maximizing energy per unit of mass results in longer flight duration and greater payload capabilities, ultimately driving innovation across air transport technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $61.2 Billion |

| Forecast Value | $206.7 Billion |

| CAGR | 12.8% |

In 2024, the lithium-ion battery materials segment generated USD 24.5 billion. Their widespread use is driven by their superior energy density relative to other options such as fuel cell materials, supercapacitors, and solid-state batteries. Lithium-ion batteries store significant energy in compact, lightweight formats, making them the go-to solution for portable electronics, electric vehicles, and large-scale energy storage systems. Their strong power output, extended cycle life, and stable performance have made them a foundational technology in modern energy storage and have supported fast adoption across industries ranging from consumer electronics to utility-scale grid storage.

The automotive applications segment held the largest share in 2024, accounting for 30% share. These applications are at the heart of energy dense material innovation, driven by the rising need for vehicles that can travel further, charge quicker, and match traditional engine performance. Battery technologies delivering greater energy density per unit of space and weight help address consumer range concerns and support widespread EV adoption. As the automotive industry continues to expand, it remains a key force behind the market's growth.

U.S. Energy Dense Materials Market reached USD 11.7 billion in 2024 and is forecasted to grow at a CAGR of 13% through 2034. With steady economic expansion, increased energy needs, and industrial growth, the U.S. has seen rising demand for efficient batteries, magnets, and fuel cell components. Energy dense materials are helping industries optimize energy use, reduce costs, and improve overall system performance. Their role in energy storage and conversion across sectors continues to make them essential for building a more resilient and efficient energy infrastructure.

Key companies operating in the Global Energy Dense Materials Market include LG Energy Solution, Panasonic Corporation, Samsung SDI Co., Ltd., Tesla, Inc., and Contemporary Amperex Technology Co. Limited (CATL). To strengthen their foothold in the global energy dense materials landscape, leading companies are focusing on several strategic priorities. These include aggressive investment in R&D for advanced chemistries that improve energy density, safety, and lifecycle. Companies are also scaling up production capacities to meet rising EV and grid demand, particularly in key growth regions. Strategic alliances with automakers and energy providers are helping secure long-term contracts. Additionally, firms are diversifying product portfolios to include next-gen materials like solid-state and lithium-sulfur technologies, while optimizing their global supply chains for cost efficiency and stability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Application

- 2.2.4 End Use Industry

- 2.2.5 Technology

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Lithium-ion battery materials

- 5.2.1 Cathode materials (LFP, NMC, NCA, LCO)

- 5.2.2 Anode materials (graphite, silicon, lithium metal)

- 5.2.3 Electrolyte materials

- 5.2.4 Separator materials

- 5.3 Solid-state battery materials

- 5.3.1 Solid electrolytes (oxide, sulfide, polymer)

- 5.3.2 Interface materials

- 5.3.3 Advanced electrode materials

- 5.4 Supercapacitor materials

- 5.4.1 Electrode materials (carbon-based, metal oxides)

- 5.4.2 Electrolyte solutions

- 5.4.3 Separator materials

- 5.5 Advanced carbon materials

- 5.5.1 Graphene and derivatives

- 5.5.2 Carbon nanotubes

- 5.5.3 Carbon fiber composites

- 5.6 Energetic materials

- 5.6.1 High energy density compounds

- 5.6.2 Propellant materials

- 5.6.3 Explosive materials

- 5.7 Fuel cell materials

- 5.7.1 Catalyst materials

- 5.7.2 Membrane materials

- 5.7.3 Electrode materials

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Automotive applications

- 6.2.1 Electric vehicles (BEV, PHEV, HEV)

- 6.2.2 Automotive electronics

- 6.2.3 Start-stop systems

- 6.3 Consumer electronics

- 6.3.1 Smartphones and tablets

- 6.3.2 Laptops and wearables

- 6.3.3 Power banks and portable devices

- 6.4 Energy storage systems

- 6.4.1 Grid-scale storage

- 6.4.2 Residential energy storage

- 6.4.3 Commercial and industrial storage

- 6.5 Aerospace and defense

- 6.5.1 Aircraft and spacecraft applications

- 6.5.2 Military and defense systems

- 6.5.3 Unmanned vehicles and drones

- 6.6 Industrial applications

- 6.6.1 Material handling equipment

- 6.6.2 Backup power systems

- 6.6.3 Telecommunications infrastructure

- 6.7 Medical and healthcare

- 6.7.1 Implantable devices

- 6.7.2 Portable medical equipment

- 6.7.3 Emergency medical systems

Chapter 7 Market Size and Forecast, By Technology, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Battery technologies

- 7.2.1 Lithium-ion batteries

- 7.2.2 Solid-state batteries

- 7.2.3 Sodium-ion batteries

- 7.2.4 Metal-air batteries

- 7.3 Capacitor technologies

- 7.3.1 Supercapacitors/ultracapacitors

- 7.3.2 Hybrid capacitors

- 7.3.3 Ceramic capacitors

- 7.4 Fuel cell technologies

- 7.4.1 Proton exchange membrane (PEM)

- 7.4.2 Solid oxide fuel cells (SOFC)

- 7.4.3 Alkaline fuel cells

- 7.5 Energy harvesting technologies

- 7.5.1 Thermoelectric materials

- 7.5.2 Piezoelectric materials

- 7.5.3 Photovoltaic materials

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Automotive industry

- 8.3 Electronics and semiconductors

- 8.4 Energy and utilities

- 8.5 Aerospace and defense

- 8.6 Healthcare and medical devices

- 8.7 Industrial manufacturing

- 8.8 Telecommunications

- 8.9 Marine and transportation

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Tesla

- 10.2 Panasonic Corporation

- 10.3 Samsung SDI

- 10.4 LG Energy Solution

- 10.5 Contemporary Amperex Technology

- 10.6 BYD Company Limited

- 10.7 QuantumScape Corporation

- 10.8 Solid Power

- 10.9 Sila Nanotechnologies

- 10.10 Group14 Technologies

- 10.11 Wildcat Discovery Technologies

- 10.12 Amprius Technologies

- 10.13 Enovix Corporation

- 10.14 Ion Storage Systems

- 10.15 Ampcera

- 10.16 Sion Power Corporation

- 10.17 Oxis Energy