|

市场调查报告书

商品编码

1833628

助听器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hearing Amplifiers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

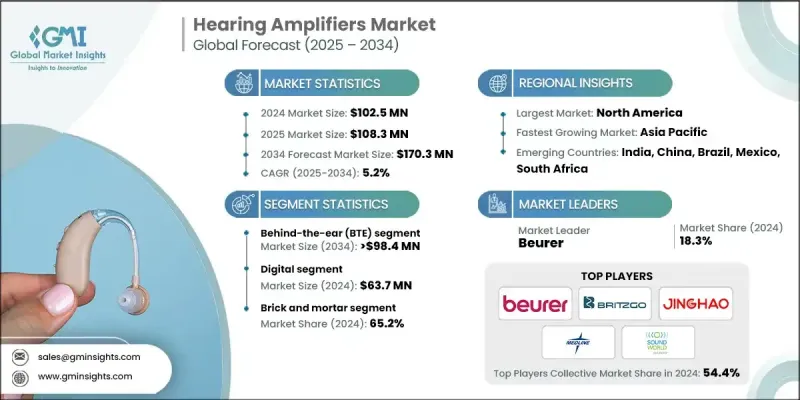

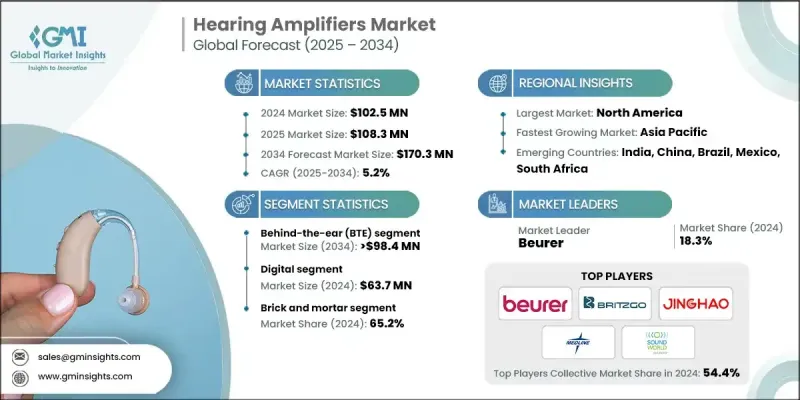

2024 年全球助听器市场价值为 1.025 亿美元,预计将以 5.2% 的复合年增长率成长,到 2034 年达到 1.703 亿美元。

这一增长受到多种关键因素的推动,包括听力损失人数的增加、全球人口的快速老化、声音放大技术的持续创新以及意识和消费者接受度的提高。助听器,通常被称为个人声音放大产品 (PSAP),旨在为轻度至中度听力障碍人士提高环境声音的音量。与传统助听器不同,PSAP 不属于医疗器械,因此无需听力学家即可轻鬆在柜檯购买。这些设备价格实惠、使用方便,对许多人来说是一个有吸引力的选择,尤其是那些不愿投资更昂贵助听器的老年人。领先的公司透过策略性地理定位、高度重视产品创新以及大量投资研发以改善其助听器产品来保持竞争优势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.025亿美元 |

| 预测值 | 1.703亿美元 |

| 复合年增长率 | 5.2% |

2024年,耳背式助听器 (BTE) 占了59%的市场。该细分市场因其用户友好的功能、强大的放大能力以及与不同程度听力障碍的兼容性而广受欢迎。耳背式助听器因其易于调节、佩戴舒适且与入耳式助听器相比更符合人体工学的优势,尤其受到老年消费者的青睐,尤其是手部灵活性有限的老年消费者。这些特性使耳背式助听器成为广泛人群的首选解决方案,进一步巩固了其在市场上的主导地位。

预计到2034年,类比音讯市场的复合年增长率将达到5.5%。注重性价比的消费者将继续青睐类比音讯产品。它们的吸引力不仅在于价格实惠,还在于其简单易用、可自订音效设定的操控方式。这些特质吸引了已开发地区和发展中地区的买家,他们希望获得兼具功能性和经济实惠的个人扩音设备。

2024年,北美助听器市场占38.5%的市占率。不断变化的监管环境,尤其是非处方助听器(OTC)的授权,是推动该地区成长的重要因素。这些政策转变消除了传统的进入门槛,拓展了零售管道,并赋予消费者无需就医即可探索便捷听力解决方案的权利,从而创造了新的成长机会。这些变化显着提升了该地区助听器市场的知名度和兴趣。

积极影响助听器产业的关键参与者包括 MEDCA HEARING、JINGHAO、Sound World Solutions、Diglo、NUHEARA、Beurer、Alango、Medline、Britzgo、Kinetik Medical、Innerscope Hearing Technologies、Conversor 和佛山沃鸿科技。为了巩固其在助听器市场的立足点,各公司都强调产品创新,专注于针对老年消费者量身定制的人体工学和高性能设计。许多公司正在大力投资研发,以增强功能、音质和用户控制。透过利用无线技术和小型化的进步,各公司旨在提供易于使用的精巧、功能强大且易于携带的设备。透过非处方药和线上零售管道扩大分销有助于提高可及性。此外,与医疗保健提供者的合作以及旨在提高知名度的促销活动使公司能够接触到更广泛的人群,并巩固其在成熟市场和新兴市场的品牌影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 与年龄相关的听力损失盛行率不断上升

- 老年人口基数不断上升

- 放大和降噪技术改进

- 产业陷阱与挑战

- 来自处方助听器和人工耳蜗的竞争

- 报销/保险范围有限

- 市场机会

- 网路销售和远距听力学平台的成长

- 产品小型化和人体工学改进

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前的技术趋势

- 新兴技术

- 消费者途径

- 2024年定价分析

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲和中东地区

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 耳背式(BTE)

- 耳内式 (ITE)

- 其他产品

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 数位的

- 模拟

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 实体店面

- 电子商务

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Alango

- Beurer

- Britzgo

- Conversor

- Diglo

- Foshan Vohom Technology

- Innerscope Hearing Technologies

- JINGHAO

- Kinetik Medical

- MEDCA HEARING

- Medline

- NUHEARA

- Sound World Solutions

The Global Hearing Amplifiers Market was valued at USD 102.5 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 170.3 million by 2034.

This growth is fueled by several key factors, including the rising number of individuals experiencing hearing loss, a rapidly aging global population, continued innovation in sound amplification technologies, and increasing awareness and consumer acceptance. Hearing amplifiers, often referred to as personal sound amplification products (PSAPs), are designed to boost the volume of ambient sounds for people with mild to moderate hearing difficulties. Unlike traditional hearing aids, PSAPs are not classified as medical devices, making them easily accessible over the counter without the need for an audiologist. The affordability and convenience of these devices make them an appealing choice for many, especially older adults who are hesitant to invest in more expensive hearing aids. Leading companies are maintaining their competitive edge through strategic geographic positioning, a strong focus on product innovation, and significant investment in research and development to refine their hearing amplifier offerings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $102.5 Million |

| Forecast Value | $170.3 Million |

| CAGR | 5.2% |

In 2024, the behind-the-ear (BTE) segment held 59% share. This segment has gained popularity because of its user-friendly features, strong amplification capabilities, and compatibility with various degrees of hearing impairment. BTE models are favored by older consumers, especially those with limited hand dexterity, due to their ease of adjustment, comfort, and ergonomic benefits compared to in-ear devices. These qualities make BTE hearing amplifiers a preferred solution across a wide demographic, further solidifying their dominance in the market.

The analog segment is forecasted to grow at a CAGR of 5.5% through 2034. Consumers who prioritize cost-effectiveness continue to gravitate toward analog models. Their appeal lies not only in affordability but also in their simple, user-friendly controls that offer customizable sound settings. These features attract buyers in both developed and developing regions who want functional and budget-conscious options for personal sound amplification.

North America Hearing Amplifiers Market held 38.5% share in 2024. A significant driver of regional growth is the evolving regulatory landscape, particularly the authorization of over-the-counter (OTC) hearing devices. Such policy shifts have created new growth opportunities by removing traditional barriers to entry, expanding retail channels, and empowering consumers to explore accessible hearing solutions without medical consultations. These changes have significantly increased visibility and interest in hearing amplifiers across the region.

Key players actively shaping the Hearing Amplifiers Industry include MEDCA HEARING, JINGHAO, Sound World Solutions, Diglo, NUHEARA, Beurer, Alango, Medline, Britzgo, Kinetik Medical, Innerscope Hearing Technologies, Conversor, and Foshan Vohom Technology. To strengthen their foothold in the hearing amplifiers market, companies are emphasizing product innovation, focusing on ergonomic and high-performance designs tailored to older consumers. Many firms are investing heavily in R&D to enhance functionality, sound quality, and user control. By leveraging advances in wireless technology and miniaturization, companies aim to deliver discreet, powerful devices that are easy to use. Expanding distribution through OTC and online retail channels helps boost accessibility. In addition, partnerships with healthcare providers and promotional efforts aimed at raising awareness are enabling firms to tap into wider demographics and solidify brand presence in both mature and emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of age-related hearing loss

- 3.2.1.2 Rising geriatric population base

- 3.2.1.3 Technological improvements in amplification and noise reduction

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from prescription hearing aids and cochlear implants

- 3.2.2.2 Limited reimbursement/insurance coverage

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of online sales and tele-audiology platforms

- 3.2.3.2 Product miniaturization and improved ergonomics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Consumer pathway

- 3.7 Pricing analysis, 2024

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Behind-the-ear (BTE)

- 5.3 In-the-ear (ITE)

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Digital

- 6.3 Analog

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alango

- 9.2 Beurer

- 9.3 Britzgo

- 9.4 Conversor

- 9.5 Diglo

- 9.6 Foshan Vohom Technology

- 9.7 Innerscope Hearing Technologies

- 9.8 JINGHAO

- 9.9 Kinetik Medical

- 9.10 MEDCA HEARING

- 9.11 Medline

- 9.12 NUHEARA

- 9.13 Sound World Solutions