|

市场调查报告书

商品编码

1833651

自动驾驶列车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Autonomous Train Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

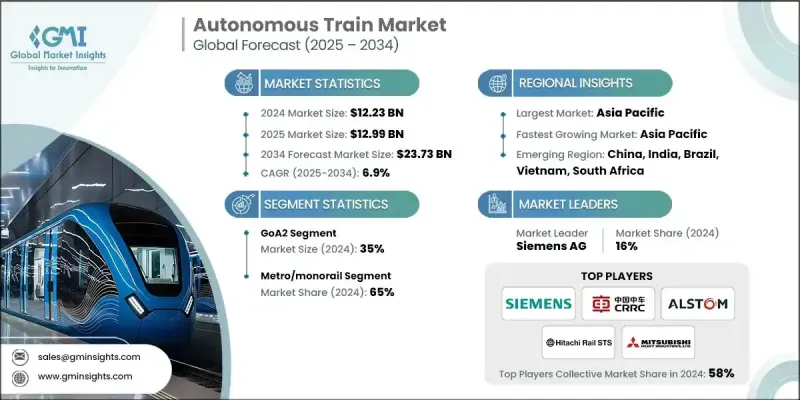

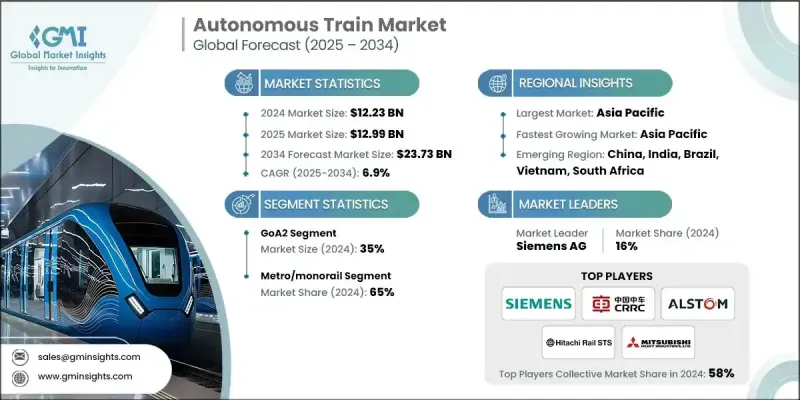

2024 年全球自动驾驶列车市场价值为 122.3 亿美元,预计到 2034 年将以 6.9% 的复合年增长率增长至 237.3 亿美元。

铁路营运商越来越多地采用自动驾驶技术来提高营运效率、减少人为错误并实现精准调度。这种日益增长的需求加速了对感测器、控制系统和车载诊断系统等关键部件的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 122.3亿美元 |

| 预测值 | 237.3亿美元 |

| 复合年增长率 | 6.9% |

地铁采用率不断提高

受城市交通网络快速扩张和拥塞城市无人驾驶出行需求的推动,地铁市场在2024年将保持可持续的份额。由于地铁采用固定轨道和时刻表运行,因此是实现全自动化的理想选择,需要配备列车自动运行 (ATO)、车载感测器和即时控制单元等先进系统。为了抓住这一机会,各大公司正专注于开发紧凑、节能的组件,这些组件既可以整合到新建项目中,也可以改装到现有列车上。与地铁部门和交钥匙专案供应商建立策略合作伙伴关係也有助于製造商巩固其市场地位。

光达模组将获得发展

2024年,雷射雷达模组市场占据强劲份额,提供高解析度3D地图绘製和物体侦测功能,对安全且高效的导航至关重要。这些感测器能够即时识别障碍物、计算距离并调节速度,尤其是在混合使用环境中或在隧道和开放轨道之间转换时。日益严格的安全要求以及自动驾驶系统对冗余的需求推动了市场的成长。主要参与者正在投资轻量化、针对铁路优化的光达技术,这些技术能够承受恶劣环境并提供高精度测量。

亚太地区将崛起成为推动力地区

受大规模基础设施投资、快速城镇化以及政府大力推动智慧轨道交通的推动,亚太地区自动驾驶列车零件市场预计将在2024年实现可观的收入。中国、日本、韩国和印度等国家正在大力投资无人驾驶地铁系统和高铁项目,这为感测器、控制单元和通讯模组等自动化零件带来了强劲的需求。在该地区营运的公司正在采取在地化策略,建立区域研发和製造中心,并使其产品与国家技术标准保持一致。

自动驾驶列车零件市场的主要参与者包括高通技术公司、日立有限公司、西门子股份公司、西屋煞车公司、罗克韦尔自动化公司、三菱电机、泰雷兹集团、施耐德电气、阿尔斯通公司和中国中车股份有限公司。

为了保持竞争力并扩大其在自动驾驶列车零件市场的影响力,领先企业正优先考虑技术创新、策略合作伙伴关係和区域扩张。其中,重点是开发支援人工智慧的感测器整合解决方案,例如光达模组、即时控制系统和预测性维护平台,以提升性能和安全性。企业也与铁路营运商、交通运输机构和城市交通管理部门合作,以达成长期合同,尤其是在地铁和高铁项目方面。这些策略不仅有助于企业满足不断变化的监管和营运需求,还能在竞争日益激烈的市场中确立其端到端解决方案提供者的地位。在地化仍然是一项关键策略,许多企业在亚太等高成长地区建立製造和研发中心,以降低成本并遵守区域标准。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 城市轨道运输需求不断成长

- 讯号与通讯技术的进步

- 全球推动永续发展

- 智慧基础设施投资不断成长

- 增强乘客安全和服务可靠性

- 长期营运的成本效益

- 产业陷阱与挑战

- 高资本支出要求

- 与遗留系统的整合挑战

- 市场机会

- 智慧货运走廊的出现

- 半自动驾驶区域列车的发展

- 政府主导的大型基础建设项目

- 人工智慧和数位孪生的采用

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 技术和创新格局

- 现有技术趋势

- 即将推出的技术

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 定价模型与总拥有成本 (TCO) 分析

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本分解分析

- 专利分析

- 投资与融资趋势分析

- 网路安全威胁情势

- 5G/6G对铁路自动化的影响

- 商业案例分析

- 投资报酬率计算模型与投资回收期分析

- 风险评估和缓解策略

- 性能指标

- 变革管理与组织准备

- 实施策略

- 实施时间表基准

- 分阶段部署策略

- 风险评估与缓解框架

- 供应商选择和采购指南

- 品质保证和测试协议

- 劳动力影响与变革管理

- 工作类别影响分析

- 再培训和再技能培训要求

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 市场进入策略

- 客户满意度基准测试

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依级别,2021 - 2034

- 主要趋势

- GoA1

- GoA2

- GoA3

- 第四政府军

第六章:市场估计与预测:火车,2021 - 2034

- 主要趋势

- 捷运/单轨列车

- 轻轨

- 高速/子弹列车

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 中央商务区

- 紧急交通管理系统

- PTC

- 空中交通管制

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 乘客

- 货运

第九章:市场估计与预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 印尼

- 菲律宾

- 泰国

- 韩国

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- 全球参与者

- Siemens Mobility

- Alstom

- Hitachi Rail

- CRRC Corporation

- Thales

- Wabtec

- Kawasaki Heavy Industries

- CAF

- 区域参与者

- Stadler Rail

- Progress Rail

- Mitsubishi Electric

- Ansaldo

- Knorr-Bremse

- Huawei Technologies

- Bombardier

- Toshiba

- 新兴参与者/颠覆者

- ADLINK Technology

- Cylus

- OTIV

- Parallel Systems

- Cisco Systems

The Global Autonomous Train Market was valued at USD 12.23 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 23.73 billion by 2034.

Rail operators are increasingly adopting autonomous technologies to improve operational efficiency, reduce human error, and enable precise scheduling. This rising demand is accelerating the need for critical components such as sensors, control systems, and onboard diagnostics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.23 Billion |

| Forecast Value | $23.73 Billion |

| CAGR | 6.9% |

Increasing Adoption in Metro

The metro segment held a sustainable share in 2024, driven by the rapid expansion of urban transit networks and the push for driverless mobility in congested cities. With metros running on fixed tracks and schedules, they are ideal candidates for full automation, requiring advanced systems like automatic train operation (ATO), onboard sensors, and real-time control units. To capitalize on this opportunity, companies are focusing on developing compact, energy-efficient components that can be integrated into new builds as well as retrofitted onto existing fleets. Strategic partnerships with metro rail authorities and turnkey project providers are also helping manufacturers solidify their market foothold.

LIDAR Module to Gain Traction

The LIDAR modules segment held a robust share in 2024, offering high-resolution 3D mapping and object detection capabilities essential for safe and efficient navigation. These sensors enable real-time obstacle recognition, distance calculation, and speed regulation-especially in mixed-use environments or when transitioning between tunnels and open tracks. Market growth is supported by increasing safety mandates and the need for redundancy in autonomous systems. Key players are investing in lightweight, rail-optimized LIDAR technologies that can withstand harsh environments while delivering high precision.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific autonomous train components market is expected to reach decent revenues in 2024, driven by major infrastructure investments, rapid urbanization, and a strong government push for smart rail transport. Countries like China, Japan, South Korea, and India are heavily investing in driverless metro systems and high-speed rail projects, creating robust demand for automation components such as sensors, control units, and communication modules. Companies operating in this region are adopting localization strategies, setting up regional R&D and manufacturing hubs, and aligning their offerings with national technology standards.

Key players in the autonomous train components market are Qualcomm Technologies, Inc., Hitachi Ltd., Siemens AG, Wabtec Corporation, Rockwell Automation Inc., Mitsubishi Electric, Thales Group, Schneider Electric, Alstom SA, and CRRC Corporation Limited.

To stay competitive and expand their footprint in the autonomous train components market, leading companies are prioritizing technology innovation, strategic partnerships, and regional expansion. A major focus is on developing AI-enabled, sensor-integrated solutions such as LIDAR modules, real-time control systems, and predictive maintenance platforms that enhance both performance and safety. Companies are also collaborating with rail operators, transit agencies, and urban transport authorities to secure long-term contracts, especially in metro and high-speed rail projects. These strategies are helping companies not only meet evolving regulatory and operational demands but also establish themselves as end-to-end solution providers in an increasingly competitive landscape. Localization remains a key tactic, with many players establishing manufacturing and R&D hubs in high-growth regions like Asia Pacific to reduce costs and comply with regional standards.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Level

- 2.2.3 Train

- 2.2.4 Technology

- 2.2.5 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Demand for Urban Mass Transit

- 3.2.1.2 Advancements in Signaling & Communication Technologies

- 3.2.1.3 Global Push Toward Sustainability

- 3.2.1.4 Growing Investments in Smart Infrastructure

- 3.2.1.5 Enhanced Passenger Safety & Service Reliability

- 3.2.1.6 Cost Efficiency in Long-Term Operations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Capital Expenditure Requirements

- 3.2.2.2 Integration Challenges with Legacy Systems

- 3.2.3 Market opportunities

- 3.2.3.1 Emergence of Smart Freight Corridors

- 3.2.3.2 Development of Semi-Autonomous Regional Trains

- 3.2.3.3 Government-Led Infrastructure Mega Projects

- 3.2.3.4 Adoption of AI and Digital Twins

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LATAM

- 3.4.5 MEA

- 3.5 Technology and innovation landscape

- 3.5.1 Existing Technological trends

- 3.5.2 Upcoming Technologies

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.8.3 Pricing models & total cost of ownership (TCO) analysis

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Investment & funding trends analysis

- 3.13 Cybersecurity Threat Landscape

- 3.14 5G/6G Impact on Rail Automation

- 3.15 Business case analysis

- 3.15.1 ROI calculation models & payback period analysis

- 3.15.2 Risk assessment & mitigation strategies

- 3.15.3 Performance metrics

- 3.15.4 Change management & organizational readiness

- 3.16 Implementation Strategy

- 3.16.1 Implementation Timeline Benchmarks

- 3.16.2 Phased Deployment Strategies

- 3.16.3 Risk Assessment & Mitigation Framework

- 3.16.4 Vendor Selection & Procurement Guidelines

- 3.16.5 Quality Assurance & Testing Protocols

- 3.17 Workforce Impact & Change Management

- 3.17.1 Job Category Impact Analysis

- 3.17.2 Retraining & Reskilling Requirements

- 3.18 Sustainability and environmental aspects

- 3.18.1 Sustainable practices

- 3.18.2 Waste reduction strategies

- 3.18.3 Energy efficiency in production

- 3.18.4 Eco-friendly initiatives

- 3.18.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Go-to-market strategies

- 4.7 Customer satisfaction benchmarking

- 4.8 Key developments

- 4.8.1 Mergers & acquisitions

- 4.8.2 Partnerships & collaborations

- 4.8.3 New product launches

- 4.8.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Level, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 GoA1

- 5.3 GoA2

- 5.4 GoA3

- 5.5 GoA4

Chapter 6 Market Estimates & Forecast, By Train, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Metro/Monorail

- 6.3 Light Rail

- 6.4 High-speed/Bullet Train

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 CBTC

- 7.3 ERTMS

- 7.4 PTC

- 7.5 ATC

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger

- 8.3 Freight

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Siemens Mobility

- 10.1.2 Alstom

- 10.1.3 Hitachi Rail

- 10.1.4 CRRC Corporation

- 10.1.5 Thales

- 10.1.6 Wabtec

- 10.1.7 Kawasaki Heavy Industries

- 10.1.8 CAF

- 10.2 Regional Players

- 10.2.1 Stadler Rail

- 10.2.2 Progress Rail

- 10.2.3 Mitsubishi Electric

- 10.2.4 Ansaldo

- 10.2.5 Knorr-Bremse

- 10.2.6 Huawei Technologies

- 10.2.7 Bombardier

- 10.2.8 Toshiba

- 10.3 Emerging Players / Disruptors

- 10.3.1 ADLINK Technology

- 10.3.2 Cylus

- 10.3.3 OTIV

- 10.3.4 Parallel Systems

- 10.3.5 Cisco Systems