|

市场调查报告书

商品编码

1833677

建筑设备市场机会、成长动力、产业趋势分析及2025-2034年预测Construction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

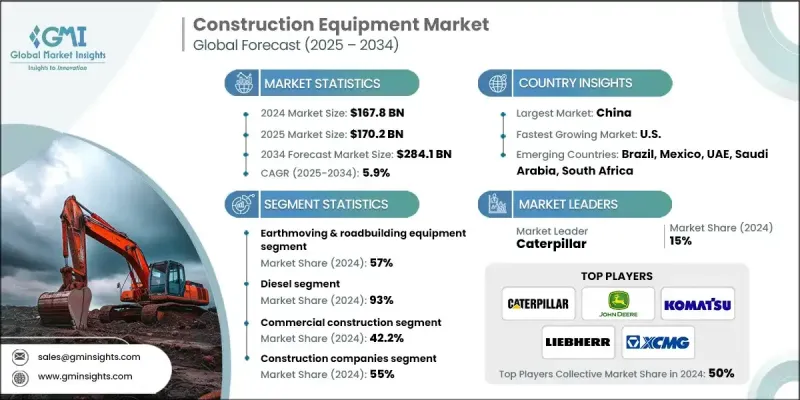

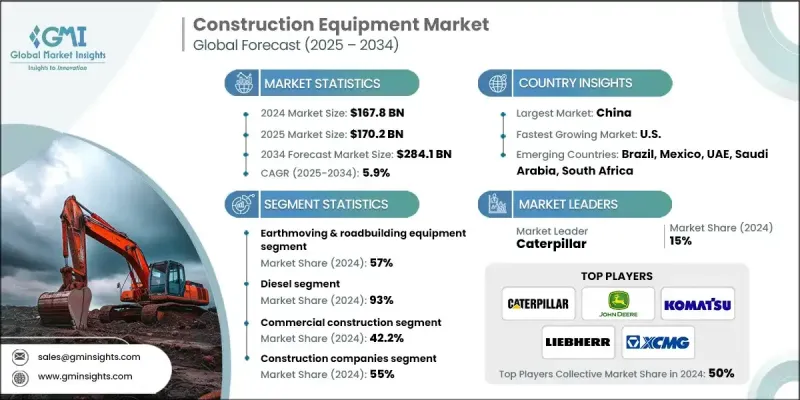

2024 年全球建筑设备市场价值为 1,678 亿美元,预计到 2034 年将以 5.9% 的复合年增长率增长至 2,841 亿美元。

基础设施建设和城镇化进程的加速推动了这一成长。各国政府正大力投资道路、桥樑、机场和铁路等基础设施,以促进经济成长并改善互联互通。建筑业的蓬勃发展需要先进的机械设备,从而增加了对建筑设备的需求。人工智慧和物联网等先进技术与製造设备的整合正在提高生产力和安全性,使这些设备对製造企业更具吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1678亿美元 |

| 预测值 | 2841亿美元 |

| 复合年增长率 | 5.9% |

私部门投资和房地产开发的成长也将影响市场成长。随着工业扩张和新兴产业的兴起,零售、工业和建筑工程的需求不断增长。这增加了对建筑设备的需求,从挖土机、堆高机到起重机和推土机。农业和采矿业向工业化转型至关重要,因为这些行业需要专用设备来提高效率。

土方和道路施工设备领域在2024年占据57%的市场份额,预计在2025年至2034年期间的复合年增长率将达到5%。该领域包括反铲、挖土机、装载机和压实机等机械,由于世界各国政府加大对公共基础设施的投资力度以及快速实施道路建设项目,有望加速成长。对高效道路运输系统的需求激增,以及与农村和欠发达地区更紧密的连接性,巩固了土方和道路施工机械在整个建筑设备领域的主导地位。

就燃料类型而言,柴油动力设备市场在2024年占据了93%的份额,预计在2025-2034年期间的复合年增长率将达到5%。领先的製造商正在为其柴油车队配备智慧技术,以提高性能、减少停机时间并提升燃油效率。先进的远端资讯处理解决方案,包括GPS整合、诊断和基于感测器的监控,正在部署,以透过行动网路即时收集和传输营运资料。这些创新技术能够洞察设备使用情况、进行预测性维护和效能最佳化,帮助操作员延长机器寿命,同时最大限度地提高现场生产力。

2024年,亚太地区建筑设备市场占45.7%的市占率。电信和基础设施领域的持续升级推动了该地区建筑设备市场的扩张。电信塔建设和光纤铺设的成长推动了对起重机和其他起重设备的需求。此外,租赁模式在该地区越来越受欢迎,尤其是对于高性能、低维护的设备。承包商越来越多地选择租赁现代化设备,而不是购买老旧机械,从而最大限度地降低营运成本,并确保更高的施工效率。

建筑设备产业的主要参与者包括特雷克斯、小松、凯斯纽荷兰工业、卡特彼勒、徐工集团、日立建机、利勃海尔、沃尔沃、斗山、迪尔公司和三一重工。领先的建筑设备製造商正专注于创新、永续发展和数位转型,以加强其全球影响力。许多製造商正在整合远端资讯处理、物联网和自动化技术,以提高设备效能、安全性和远端操作能力。各公司正在扩展其混合动力和纯电动产品线,以符合日益严格的排放法规并满足绿色建筑需求。与科技公司的策略合作伙伴关係正在推动支持智慧建筑实践的下一代机械。此外,各公司正在加强其售后服务、零件供应链和全球经销商网络,以改善客户体验和支援。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 都市化和基础设施发展

- 政府对智慧城市和公共工程的投资不断增加

- 技术进步(自动化、远端资讯处理、物联网)

- 转向电动和混合动力建筑设备

- 租赁业繁荣

- 产业陷阱与挑战

- 资本和维护成本高

- 原物料价格波动

- 熟练操作员短缺

- 监管和排放合规要求

- 租赁和二手设备的激烈竞争

- 市场机会

- 电动和混合动力设备采用加速

- 自主施工运作与人工智慧集成

- 精密施工技术与GPS导航

- 设备即服务(EaaS)商业模式

- 旧设备改造与升级市场

- 成长动力

- 成长潜力分析

- 主要市场趋势和中断

- 未来市场趋势

- 监管格局

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利分析

- 价格趋势

- 按地区

- 按产品

- 成本分解分析

- 生产统计

- 生产中心

- 进出口

- 主要进口国家

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依产品,2021 - 2034

- 主要趋势

- 土方和道路建设设备

- 反铲

- 挖土机

- 装载机

- 压实设备

- 其他的

- 物料搬运和起重机

- 储存和搬运设备

- 工程系统

- 工业卡车

- 散装物料处理设备

- 混凝土设备

- 混凝土泵

- 破碎机

- 混凝土搅拌车

- 沥青摊舖机

- 配料厂

第六章:市场估计与预测:以推进方式,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 压缩天然气/液化天然气

- 电的

第七章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 住宅建筑

- 商业建筑

- 工业建筑

- 采矿和采石

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 建筑公司

- 采矿业者

- 租赁公司

- 政府和市政当局

- 工业用户

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- Caterpillar

- Komatsu

- John Deere

- Volvo

- Liebherr

- Hitachi

- JCB

- Sany

- Regional Champions

- Case

- New Holland

- Doosan

- Hyundai

- XCMG

- Zoomlion

- Terex

- Manitou

- Wacker Neuson

- 新兴企业和服务提供者

- United Rentals

- Ashtead Group / Sunbelt Rentals

- H&E Equipment Services

- Home Depot Tool Rental

- Built Robotics

- SafeAI

- Trimble

- Topcon

The Global Construction Equipment Market was valued at USD 167.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 284.1 billion by 2034.

The growth is driven by the rising infrastructure development and urbanization. Governments are investing heavily in infrastructure such as roads, bridges, airports, and railways to boost economic growth and improve connectivity. This increase in construction demands advanced machinery, increasing the demand for construction equipment. The integration of technological advancements such as AI and IoT into manufacturing devices is increasing productivity and safety, making these devices more attractive to manufacturing companies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $167.8 Billion |

| Forecast Value | $284.1 Billion |

| CAGR | 5.9% |

The rise in private sector investments and real estate development will also influence market growth. As industry expands and new industries emerge, the need for retail, industrial, and construction work increases. This increases the demand for construction equipment, ranging from excavators and forklifts to cranes and bulldozers. The shift towards industrialization in agriculture and mining is important, as these industries require specialized equipment to be efficient.

The earthmoving and road-building equipment segment held a 57% share in 2024 and is forecasted to grow at a CAGR of 5% between 2025 and 2034. This segment, which includes machinery such as backhoes, excavators, loaders, and compactors, is poised for accelerated growth due to increasing investments in public infrastructure and the rapid execution of road development projects by governments worldwide. The surge in demand for efficient road transportation systems and better connectivity to rural and underdeveloped regions has solidified the dominance of earthmoving and road construction machinery in the overall construction equipment sector.

In terms of fuel type, the diesel-powered equipment segment held a 93% share in 2024 and is anticipated to grow at a CAGR of 5% during 2025-2034. Leading manufacturers are equipping their diesel fleets with smart technologies to enhance performance, reduce downtime, and improve fuel efficiency. Advanced telematics solutions featuring GPS integration, diagnostics, and sensor-based monitoring are being deployed to collect and transmit operational data in real time via mobile networks. These innovations provide insights into equipment usage, predictive maintenance, and performance optimization, helping operators extend machine life while maximizing job site productivity.

Asia Pacific Construction Equipment Market held a 45.7% share in 2024. The regional expansion is underpinned by consistent upgrades in telecommunications and infrastructure sectors. Growth in telecommunication tower construction and fiber-optic rollout is propelling demand for cranes and other lifting equipment. Additionally, rental models are gaining popularity across the region, especially for high-performance, low-maintenance machines. Contractors are increasingly opting to rent modern equipment rather than purchasing older machinery, minimizing operational costs and ensuring better efficiency on construction sites.

Major players operating in the construction equipment industry include Terex, Komatsu, CNH Industrial, Caterpillar, XCMG, Hitachi Construction Machinery, Liebherr, Volvo, Doosan, Deere & Co., and Sany. Leading construction equipment manufacturers are focusing on innovation, sustainability, and digital transformation to strengthen their global footprint. Many are integrating telematics, IoT, and automation technologies to enhance equipment performance, safety, and remote operability. Companies are expanding their hybrid and electric product lines to comply with tightening emission regulations and meet green construction demands. Strategic partnerships with technology firms are enabling next-gen machinery that supports smart construction practices. Additionally, firms are strengthening their aftermarket services, parts supply chains, and global dealer networks to improve customer experience and support.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and infrastructure development

- 3.2.1.2 Rising government investments in smart cities & public works

- 3.2.1.3 Technological advancements (automation, telematics, IoT)

- 3.2.1.4 Shift toward electric and hybrid construction equipment

- 3.2.1.5 Rental and leasing boom

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and maintenance costs

- 3.2.2.2 Volatility in raw material prices

- 3.2.2.3 Shortage of skilled operators

- 3.2.2.4 Regulatory and emission compliance requirements

- 3.2.2.5 Intense competition from rental and used equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Electric & Hybrid Equipment Adoption Acceleration

- 3.2.3.2 Autonomous Construction Operations & AI Integration

- 3.2.3.3 Precision Construction Technology & GPS Guidance

- 3.2.3.4 Equipment-as-a-Service (EaaS) Business Models

- 3.2.3.5 Retrofit & Upgrade Market for Legacy Equipment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent analysis

- 3.11 Price trends

- 3.11.1 By region

- 3.11.2 By product

- 3.12 Cost breakdown analysis

- 3.13 Production statistics

- 3.13.1 Production hubs

- 3.13.2 Import and export

- 3.13.3 Major import countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Earthmoving & roadbuilding equipment

- 5.2.1 Backhoe

- 5.2.2 Excavator

- 5.2.3 Loader

- 5.2.4 Compaction equipment

- 5.2.5 Others

- 5.3 Material handling and cranes

- 5.3.1 Storage and handling equipment

- 5.3.2 Engineered systems

- 5.3.3 Industrial trucks

- 5.3.4 Bulk material handling equipment

- 5.4 Concrete equipment

- 5.4.1 Concrete pumps

- 5.4.2 Crusher

- 5.4.3 Transit mixers

- 5.4.4 Asphalt pavers

- 5.4.5 Batching plants

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 CNG/LNG

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Residential construction

- 7.3 Commercial construction

- 7.4 Industrial construction

- 7.5 Mining & quarrying

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Construction companies

- 8.3 Mining operators

- 8.4 Rental companies

- 8.5 Government & municipalities

- 8.6 Industrial users

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Caterpillar

- 10.1.2 Komatsu

- 10.1.3 John Deere

- 10.1.4 Volvo

- 10.1.5 Liebherr

- 10.1.6 Hitachi

- 10.1.7 JCB

- 10.1.8 Sany

- 10.2 Regional Champions

- 10.2.1 Case

- 10.2.2 New Holland

- 10.2.3 Doosan

- 10.2.4 Hyundai

- 10.2.5 XCMG

- 10.2.6 Zoomlion

- 10.2.7 Terex

- 10.2.8 Manitou

- 10.2.9 Wacker Neuson

- 10.3 Emerging Players & Service Providers

- 10.3.1 United Rentals

- 10.3.2 Ashtead Group / Sunbelt Rentals

- 10.3.3 H&E Equipment Services

- 10.3.4 Home Depot Tool Rental

- 10.3.5 Built Robotics

- 10.3.6 SafeAI

- 10.3.7 Trimble

- 10.3.8 Topcon