|

市场调查报告书

商品编码

1844364

紧凑型建筑设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Compact Construction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

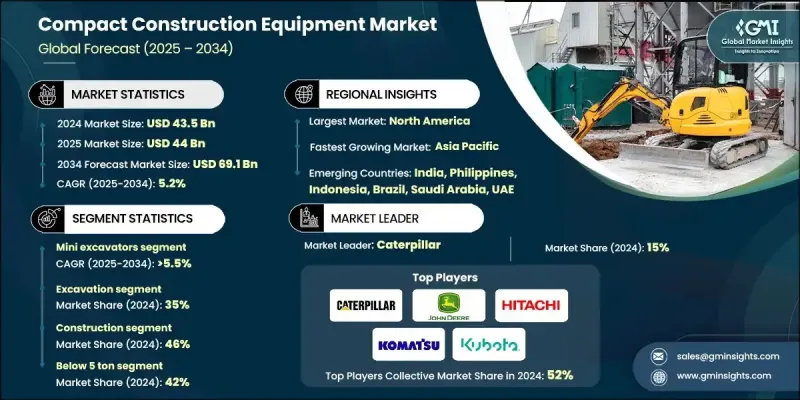

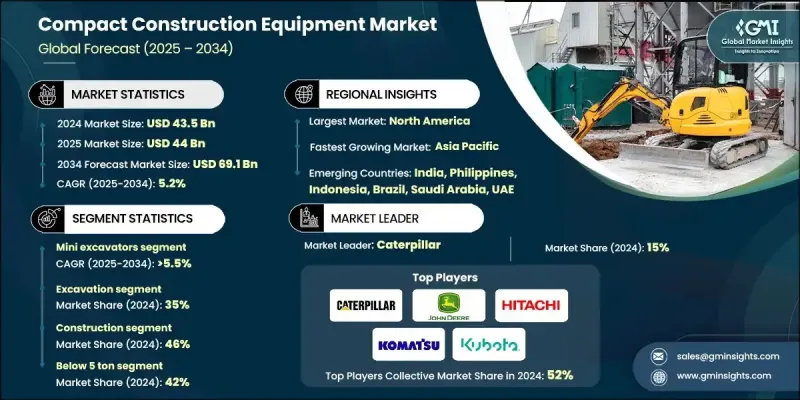

2024 年全球紧凑型建筑设备市场价值为 435 亿美元,预计到 2034 年将以 5.2% 的复合年增长率增长至 691 亿美元。

城市发展项目、智慧城市计划和住宅建设的激增正在重塑市场成长。对于希望透过节能引擎和嵌入式远端资讯处理来提高工地效率、减少对劳动力的依赖并降低营运成本的承包商来说,紧凑型设备至关重要。清洁能源和减排的日益普及推动了对电动和混合动力机型的需求,包括小型装载机、小型挖土机和伸缩臂叉装机。基于机器学习的预测性维护、虚拟化和远端资讯处理等技术正在提供即时洞察,从而减少停机时间并延长机器使用寿命。随着对更智慧、低排放设备的需求不断增长,对车队智慧和紧凑型自动化的投资持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 435亿美元 |

| 预测值 | 691亿美元 |

| 复合年增长率 | 5.2% |

大规模基础设施扩建、清洁能源部署和农业升级推动了小型履带式装载机、小型挖土机和反铲装载机的日益普及。电动机械、基于物联网的车队系统和半自动化设备仍然是创新和资本部署的关键领域。在北美和欧洲等已开发地区,道路升级、房屋建设和永续发展驱动的建筑实践的持续投资推动了市场整合。

小型挖土机市场在2024年占据38%的市场份额,预计到2034年将以5.5%的复合年增长率成长。其主导地位源自于其多功能性、运输便利性和成本效益。小型挖土机设计紧凑,但操作性能强大,广泛应用于城市发展、园艺、公共事业以及中小型住宅和商业建筑。它们能够灵活地适应不同的属具,这使其在各种工地应用中更加实用,对承包商和租赁企业都极具价值。

2024年,挖土机市场占比35%,预计2025年至2034年的复合年增长率为4.8%。挖土机仍然是现代建筑活动的重要组成部分,包括地基挖掘、沟槽开挖、道路施工和公用设施安装。小型挖土机在空间受限的环境和人口密集的城市中提供所需的精确度和多功能性。它们能够在多个属具之间切换,从而节省成本并提高效率,使其成为各种专案中不可或缺的辅助设备。

美国小型建筑设备市场占85%的市场份额,2024年市场规模达145亿美元。该地区的成长主要得益于大规模基础设施重建、交通投资和住房需求。联邦政府和地方政府大力推行智慧建筑倡议,加之人们对电动和自动驾驶机械的日益青睐,正在改变全国的设备使用方式。劳动力短缺和日益严格的排放法规也促使承包商和市政当局在建筑和公用事业领域部署更智慧、更有效率的紧凑型机械。

影响全球紧凑型建筑设备市场的关键製造商包括日立建机、沃尔沃建筑设备、迪尔公司、小松、卡特彼勒、徐工集团、久保田、JCB、洋马和三一重工。紧凑型建筑设备市场的公司正专注于创新、数位整合和减排,以巩固其市场地位。策略重点包括扩大电动和混合动力产品组合,以满足不断变化的环境法规。领先的企业正在投资先进的远端资讯处理和基于人工智慧的预测分析,以提高设备效率和生命週期价值。与租赁机构和智慧城市开发商的合作正在帮助原始设备製造商获得更广泛的客户群。向新兴市场扩张和提高本地製造能力也是旨在优化成本和提升区域竞争力的关键策略。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 都市化和基础设施项目不断增长

- 租赁车队采用率的上升提高了设备的经济利用率。

- 远端资讯处理、自动化和人工智慧等技术进步激增。

- 小型建筑设备电气化浪潮。

- 产业陷阱与挑战

- 日益严格的排放法规

- 来自大型设备的激烈竞争

- 市场机会

- 电池、混合动力和氢动力设备的电气化趋势日益增长。

- 智慧和自主紧凑型建筑解决方案的采用率不断上升。

- 售后服务和多用途配件的需求激增。

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- 成本分解分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 引擎和液压系统的进步

- 远端资讯处理、物联网和操作员辅助技术

- 附件技术创新

- 研发投资模式

- 新兴技术

- 电动、混合动力和自动驾驶

- 预测性维护和远端诊断

- 当前的技术趋势

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 专利分析

- 永续性和环境影响分析

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

- 市场采用统计数据

- 设备销售和租赁渗透率

- 技术特性采用

- 区域市场占有率和客户指标

- 设备利用率和更换週期

- 客户行为与决策分析

- 购买与租赁决策因素

- 按最终用途细分的设备选择标准

- 品牌忠诚度模式与转换行为

- 售后市场收入来源

- 零件和服务收入潜力

- 保固和延长服务

- 翻新和再製机会

- 附件和配件市场动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按设备,2021-2034

- 主要趋势

- 小型挖土机

- 紧凑型轮式装载机

- 滑移装载机

- 小型履带式装载机

- 反铲装载机

- 其他的

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 载入中

- 挖掘

- 物料处理

- 起重和吊装

- 其他的

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 建造

- 农业

- 矿业

- 公用工程

- 其他的

第 8 章:市场估计与预测:按营运能力,2021-2034 年

- 主要趋势

- 5吨以下

- 6至8吨

- 8吨以上

第九章:市场估计与预测:依发电量,2021-2034

- 主要趋势

- 低于100 HP

- 101-200马力

- 201-400马力

- 超过400马力

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多边环境协定

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球参与者

- Bobcat Company

- Caterpillar

- Deere & Company

- Hitachi Construction Machinery

- JCB

- Komatsu

- Kubota

- SANY Heavy Industry

- Sumitomo

- Terex

- Volvo Construction Equipment

- XCMG

- Yanmar

- 区域参与者

- Doosan Infracore

- Hyundai Construction Equipment

- King Machinery

- Kobelco Construction Machinery

- Manitou

- Mecalac

- Wacker Neuson

- Zoomlion Heavy Industry Science & Technology

- 新兴玩家

- ASV

- Avant Tecno

- Boxer Equipment

- Ditch Witch

- Elematic

- Eurocomach

- Multione

- Rhinox

- Toro Company

- Vermeer

The Global Compact Construction Equipment Market was valued at USD 43.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 69.1 billion by 2034.

The surge in urban development projects, smart city initiatives, and expanding residential construction is reshaping market growth. Compact equipment has become vital for contractors seeking to boost jobsite efficiency, cut labor dependency, and reduce operational costs through fuel-efficient engines and embedded telematics. The rising shift toward cleaner energy and emission reduction is pushing the demand for electric and hybrid models, including compact loaders, mini excavators, and telehandlers. Technologies such as machine learning-based predictive maintenance, virtualization, and telematics are enabling real-time insights that reduce downtime and enhance machine longevity. With increasing demand for smarter, low-emission equipment, investment in fleet intelligence and compact automation continues to gain momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.5 Billion |

| Forecast Value | $69.1 Billion |

| CAGR | 5.2% |

The rising adoption of compact track loaders, mini excavators, and backhoe loaders is fueled by large-scale infrastructure expansion, clean energy deployment, and agricultural upgrades. Electrified machines, IoT-based fleet systems, and semi-autonomous equipment remain key areas of innovation and capital deployment. In developed regions such as North America and Europe, market consolidation is supported by continued investments in road upgrades, homebuilding, and sustainability-driven construction practices.

The mini excavators segment held a 38% share in 2024 and is expected to grow at a 5.5% CAGR through 2034. Their dominance stems from their versatility, ease of transport, and cost-effectiveness. Compact in design but powerful in operation, mini excavators are widely utilized in urban development, landscaping, public utilities, and small to mid-size residential and commercial construction. Their adaptability to different attachments increases their utility across a wide range of job-site applications, making them highly valuable to contractors and rental businesses alike.

The excavation segment held a 35% share in 2024 and is forecast to grow at a CAGR of 4.8% from 2025 to 2034. Excavation remains a critical part of modern construction activities, including foundation digging, trenching, roadwork, and utility installations. Compact excavators offer the accuracy and versatility required in space-constrained environments and densely populated cities. Their ability to switch between multiple attachments enables cost savings and increased efficiency, making them indispensable to a wide variety of projects.

US Compact Construction Equipment Market held an 85% share and generated USD 14.5 billion in 2024. Growth in this region is powered by large-scale infrastructure redevelopment, transportation investments, and housing demand. Federal and local initiatives focused on smart construction, along with growing preferences for electric and autonomous machines, are transforming equipment use across the country. Labor shortages and increasingly strict emission rules are also driving contractors and municipalities to deploy smarter, more efficient compact machines across construction and utility sectors.

Key manufacturers shaping the Global Compact Construction Equipment Market include Hitachi Construction Machinery, Volvo Construction Equipment, Deere & Company, Komatsu, Caterpillar, XCMG, Kubota, JCB, Yanmar, and SANY Heavy Industry. Companies in the Compact Construction Equipment Market are focusing on innovation, digital integration, and emission reduction to strengthen their market positions. Strategic priorities include expanding electric and hybrid product portfolios to meet evolving environmental regulations. Leading players are investing in advanced telematics and AI-based predictive analytics to improve equipment efficiency and lifecycle value. Partnerships with rental agencies and smart city developers are helping OEMs reach broader customer bases. Expansion into emerging markets and increased local manufacturing capacity are also critical strategies aimed at cost optimization and regional competitiveness.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment

- 2.2.3 Application

- 2.2.4 End Use

- 2.2.5 Operating Capacity

- 2.2.6 Power Output

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing urbanization and infrastructure projects

- 3.2.1.2 Rise in rental fleet adoption boosting cost-effective equipment utilization.

- 3.2.1.3 Surge in technological advancements such as telematics, automation, and AI.

- 3.2.1.4 Surging electrification of compact construction equipment.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Increasingly stringent emission regulations

- 3.2.2.2 Intense competition from larger equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Growing electrification trend with battery, hybrid, and hydrogen-powered equipment.

- 3.2.3.2 Rise in adoption of smart and autonomous compact construction solutions.

- 3.2.3.3 Surge in demand for aftermarket services and multi-purpose attachments.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 Cost breakdown analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.1.1 Engine & hydraulic system advances

- 3.8.1.2 Telematics, IOT & operator assistance technologies

- 3.8.1.3 Attachment technology innovation

- 3.8.1.4 R&D investment patterns

- 3.8.2 Emerging technologies

- 3.8.2.1 Electric, hybrid, and autonomous operations

- 3.8.2.2 Predictive maintenance & remote diagnostics

- 3.8.1 Current technological trends

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Patent analysis

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Market adoption statistics

- 3.13.1 Equipment sales & rental penetration

- 3.13.2 Technology feature adoption

- 3.13.3 Regional market share & customer metrics

- 3.13.4 Equipment utilization & replacement cycles

- 3.14 Customer Behavior & Decision-Making Analysis

- 3.14.1 Purchase vs. rental decision factors

- 3.14.2 Equipment selection criteria by End use segment

- 3.14.3 Brand loyalty patterns and switching behavior

- 3.15 Aftermarket Revenue Streams

- 3.15.1 Parts and service revenue potential

- 3.15.2 Warranty and extended service offerings

- 3.15.3 Refurbishment and remanufacturing opportunities

- 3.15.4 Attachment and accessory market dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Equipment, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.1.1 Mini excavators

- 5.1.2 Compact wheel loaders

- 5.1.3 Skid steer loaders

- 5.1.4 Compact track loaders

- 5.1.5 Backhoe loaders

- 5.1.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Loading

- 6.3 Excavation

- 6.4 Material handling

- 6.5 Lifting & hoisting

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Agriculture

- 7.4 Mining

- 7.5 Utility works

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Operating Capacity, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Below 5 Ton

- 8.3 6 to 8 Ton

- 8.4 Above 8 ton

Chapter 9 Market Estimates & Forecast, By Power Output, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Less than 100 HP

- 9.3 101-200 HP

- 9.4 201-400 HP

- 9.5 More than 400 HP

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Bobcat Company

- 11.1.2 Caterpillar

- 11.1.3 Deere & Company

- 11.1.4 Hitachi Construction Machinery

- 11.1.5 JCB

- 11.1.6 Komatsu

- 11.1.7 Kubota

- 11.1.8 SANY Heavy Industry

- 11.1.9 Sumitomo

- 11.1.10 Terex

- 11.1.11 Volvo Construction Equipment

- 11.1.12 XCMG

- 11.1.13 Yanmar

- 11.2 Regional Players

- 11.2.1 Doosan Infracore

- 11.2.2 Hyundai Construction Equipment

- 11.2.3 King Machinery

- 11.2.4 Kobelco Construction Machinery

- 11.2.5 Manitou

- 11.2.6 Mecalac

- 11.2.7 Wacker Neuson

- 11.2.8 Zoomlion Heavy Industry Science & Technology

- 11.3 Emerging Players

- 11.3.1 ASV

- 11.3.2 Avant Tecno

- 11.3.3 Boxer Equipment

- 11.3.4 Ditch Witch

- 11.3.5 Elematic

- 11.3.6 Eurocomach

- 11.3.7 Multione

- 11.3.8 Rhinox

- 11.3.9 Toro Company

- 11.3.10 Vermeer