|

市场调查报告书

商品编码

1844381

固定式离岸风能市场机会、成长动力、产业趋势分析及2025-2034年预测Fixed Offshore Wind Energy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

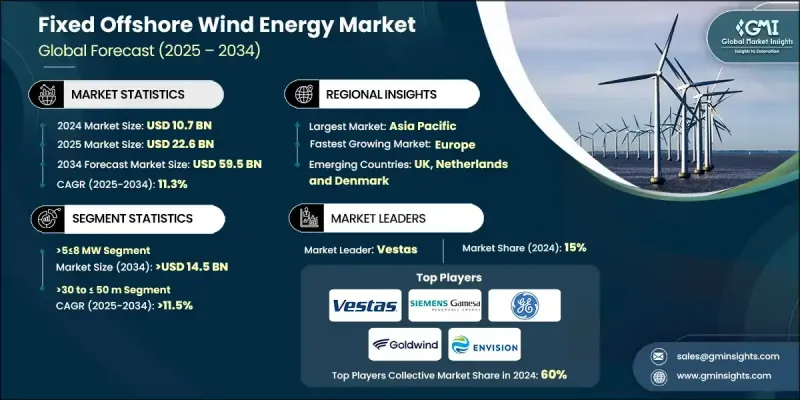

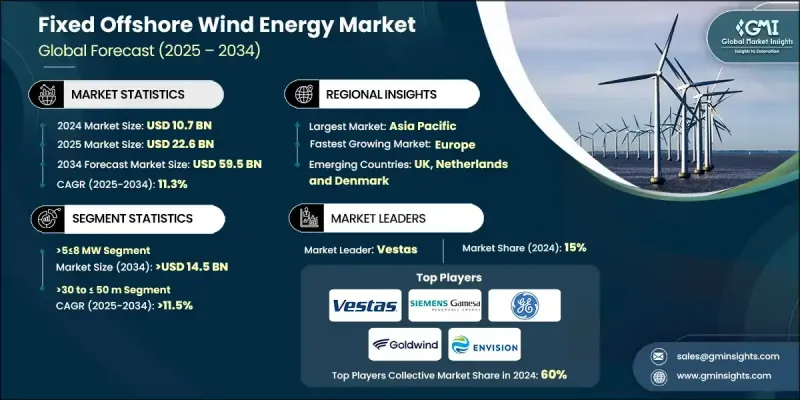

2024 年全球固定式离岸风能市场价值为 107 亿美元,预计到 2034 年将以 11.3% 的复合年增长率成长至 595 亿美元。

这一增长主要得益于政府的支持性倡议、沿海地区能源需求的不断增长以及对减少碳排放的日益重视。多个地区的政策制定者正在推出再生能源强制规定、财政激励措施和拍卖框架,以加速离岸风电的发展。由于人口稠密的沿海地区需要清洁高效的能源,强劲且稳定的离岸风电资源使这项技术成为切实可行的选择。这些项目也能减少输电损耗,提高向城市和工业区的电力传输效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 107亿美元 |

| 预测值 | 595亿美元 |

| 复合年增长率 | 11.3% |

更高容量的涡轮机在提升营运产量方面发挥着重要作用,新技术则提升了可靠性和性能,并降低了维护成本。基础结构、叶片设计和施工技术的创新正在优化安装进度并降低资本支出。此外,主要市场参与者正在加大研发投入,以扩大生产规模,同时确保长期成本竞争力。旨在改善电网整合和最大限度提高产能利用率的策略性进步,正在为固定式离岸风电领域的持续成长奠定基础。

预计到2034年,2兆瓦及以下风电市场规模将达到80亿美元,这得益于其在岛屿、浅海沿岸地区以及电网基础设施有限的低需求地区等小型项目中的适应性。这些风力涡轮机非常适合无法建造大型离岸风电场的市场。发展中国家对混合能源系统的兴趣日益浓厚,以及相关激励措施的出台,将进一步推动该领域的成长。

预计30公尺以上至50公尺以下的市场规模将达到270亿美元,这得益于技术进步,使得在更深的水域部署成为可能。沿海风电计画正在深水区迅速扩张,以提高发电能力。此外,政府为推广浮动平台和更深的离岸风电计画提供的补贴正在重塑产业格局,在先前被认为不适合建造固定结构的海域释放出新的机会。

2024年,美国固定式离岸风电市场规模达18亿美元。作为离岸风电发展中心,美国持续实施激励计划和专案专属框架,例如租赁和许可计划,以促进主要沿海地区的离岸风电部署。能源巨头正透过对东海岸地区的资本投资做出长期承诺,显示该地区离岸风电产业发展势头强劲。

全球固定式离岸风电市场领导者包括Southwire公司、Impsa、Iberdrola、Enessere、Equinor、西门子歌美飒可再生能源、Vattenfall、金风科技、住友电工、耐克森、通用电气、GE Vernova、中国长江三峡能源公司、RWESE能源、JLS、可再生能源集团、电缆、再生能源集团和古塔斯系统。为了巩固其在固定式离岸风电市场的地位,各企业正专注于建立长期合资企业、扩大製造能力和本地化供应链以改善成本结构。许多企业正在投资大型海上枢纽,并与政府和区域公用事业公司建立策略合作伙伴关係,以确保长期合约。多样化风机组合、改进模组化设计以及整合智慧监控技术也已成为其策略的核心。这些企业更加重视风扇效率、基础类型和数位资产管理方面的创新,从而能够提高能源产量和营运效率,最终增强其在离岸风电部署方面的全球竞争力。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 2021-2034年价格趋势分析

- 按涡轮额定功率

- 按地区

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

- 战略仪表板

- 策略倡议

- 公司标竿分析

- 创新与技术格局

第五章:市场规模及预测:以涡轮机额定功率,2021 - 2034

- 主要趋势

- ≤2兆瓦

- >2≤5兆瓦

- >5≤8兆瓦

- >8≤10兆瓦

- >10≤12兆瓦

- > 12 兆瓦

第六章:市场规模及预测:按轴,2021 - 2034

- 主要趋势

- 水平的

- 逆风

- 顺风

- 垂直的

第七章:市场规模及预测:依组件划分,2021 - 2034

- 主要趋势

- 刀片

- 塔楼

- 其他的

第八章:市场规模及预测:依深度,2021 - 2034

- 主要趋势

- >0 ≤ 30 米

- >30 ≤ 50 米

- > 50米

第九章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 西班牙

- 英国

- 法国

- 义大利

- 瑞典

- 波兰

- 丹麦

- 葡萄牙

- 荷兰

- 爱尔兰

- 比利时

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 越南

- 菲律宾

- 台湾

第十章:公司简介

- China Three Gorges

- Enessere

- Equinor

- Furukawa Electric

- General Electric

- GE Vernova

- Goldwind

- Impsa

- Iberdrola

- JERA

- Ls Cable & System

- Nexans

- Prysmian Group

- RWE Renewables

- SSE Renewables

- Sumitomo Electric Industries

- Southwire Company

- Siemens Gamesa Renewable Energy

- Vestas

- Vattenfall

The Global Fixed Offshore Wind Energy Market was valued at USD 10.7 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 59.5 billion by 2034.

The growth is primarily driven by a combination of supportive government initiatives, rising energy demand in coastal zones, and heightened focus on cutting carbon emissions. Policymakers across several regions are rolling out renewable energy mandates, financial incentives, and auction frameworks to accelerate offshore wind development. With densely populated coastal regions requiring clean and efficient energy sources, the availability of strong and consistent offshore wind resources continues to make this technology a practical choice. These projects also reduce transmission losses and improve electricity delivery efficiency to urban and industrial zones.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.7 Billion |

| Forecast Value | $59.5 Billion |

| CAGR | 11.3% |

Higher-capacity turbines are playing a major role in pushing operational output, with newer technologies enhancing reliability, performance, and lowering maintenance costs. Innovations in foundation structures, blade design, and construction techniques are optimizing installation timelines and reducing capital expenditure. Moreover, major market players are channeling investments into R&D to scale up production while ensuring long-term cost competitiveness. Strategic advancements, aimed at improving grid integration and maximizing capacity utilization, are laying the foundation for sustained growth in the fixed offshore wind energy space.

The <= 2 MW segment is expected to reach USD 8 billion by 2034, supported by its adaptability in smaller-scale projects such as island installations, shallow coastal zones, and low-demand areas with limited grid infrastructure. These turbines are ideal for markets where full-scale offshore farms are not viable. Increased interest in hybrid energy systems and incentives across developing countries will add further momentum to this segment's growth trajectory.

The >30 to <=50 m segment is forecast to reach USD 27 billion, fueled by technological advancements that allow for deployment at greater water depths. Coastal wind projects are expanding rapidly in deeper waters to increase power generation capacity. Additionally, government-backed subsidies aimed at promoting floating platforms and deeper offshore turbine projects are reshaping the industry, unlocking opportunities in areas previously considered non-viable for fixed structures.

U.S. Fixed Offshore Wind Energy Market was valued at USD 1.8 billion in 2024. As a growing hub for offshore wind, the U.S. continues to implement incentive schemes and project-specific frameworks, such as leasing and permitting initiatives, that are bolstering deployment along key coastal regions. Energy giants are making long-term commitments through capital investments along the East Coast, signaling strong forward momentum in the regional industry.

Leading companies in the Global Fixed Offshore Wind Energy Market include Southwire Company, Impsa, Iberdrola, Enessere, Equinor, Siemens Gamesa Renewable Energy, Vattenfall, Goldwind, Sumitomo Electric Industries, Nexans, General Electric, GE Vernova, China Three Gorges, RWE Renewables, JERA, Prysmian Group, LS Cable & System, Furukawa Electric, SSE Renewables, and Vestas. To strengthen their position in the fixed offshore wind energy market, companies are focusing on long-term joint ventures, expanding manufacturing capabilities, and localizing supply chains to improve cost structures. Many are investing in large-scale offshore hubs and building strategic partnerships with governments and regional utilities to secure long-term contracts. Diversifying turbine portfolios, improving modular design, and integrating smart monitoring technologies have also become central to their strategy. Enhanced focus on innovation in turbine efficiency, foundation types, and digital asset management allows these firms to improve energy yield and operational efficiency, ultimately reinforcing their global competitiveness in offshore wind deployment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360-degree synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Turbine rating trends

- 2.4 Axis trends

- 2.5 Component trends

- 2.6 Depth trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Price trend analysis, 2021-2034

- 3.3.1 By turbine rating

- 3.3.2 By region

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Turbine rating, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 2 MW

- 5.3 >2≤ 5 MW

- 5.4 >5≤ 8 MW

- 5.5 >8≤10 MW

- 5.6 >10≤ 12 MW

- 5.7 > 12 MW

Chapter 6 Market Size and Forecast, By Axis, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Horizontal

- 6.2.1 Up-wind

- 6.2.2 Down-wind

- 6.3 Vertical

Chapter 7 Market Size and Forecast, By Component, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Blades

- 7.3 Towers

- 7.4 Others

Chapter 8 Market Size and Forecast, By Depth, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 >0 ≤ 30 m

- 8.3 >30 ≤ 50 m

- 8.4 > 50 m

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 Spain

- 9.3.3 UK

- 9.3.4 France

- 9.3.5 Italy

- 9.3.6 Sweden

- 9.3.7 Poland

- 9.3.8 Denmark

- 9.3.9 Portugal

- 9.3.10 Netherlands

- 9.3.11 Ireland

- 9.3.12 Belgium

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Australia

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.4.6 Vietnam

- 9.4.7 Philippines

- 9.4.8 Taiwan

Chapter 10 Company Profiles

- 10.1 China Three Gorges

- 10.2 Enessere

- 10.3 Equinor

- 10.4 Furukawa Electric

- 10.5 General Electric

- 10.6 GE Vernova

- 10.7 Goldwind

- 10.8 Impsa

- 10.9 Iberdrola

- 10.10 JERA

- 10.11 Ls Cable & System

- 10.12 Nexans

- 10.13 Prysmian Group

- 10.14 RWE Renewables

- 10.15 SSE Renewables

- 10.16 Sumitomo Electric Industries

- 10.17 Southwire Company

- 10.18 Siemens Gamesa Renewable Energy

- 10.19 Vestas

- 10.20 Vattenfall