|

市场调查报告书

商品编码

1871110

自癒地板材料市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Self-healing Flooring Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

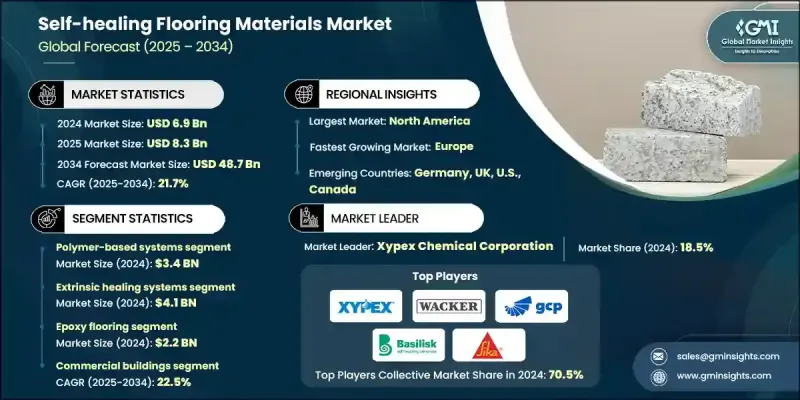

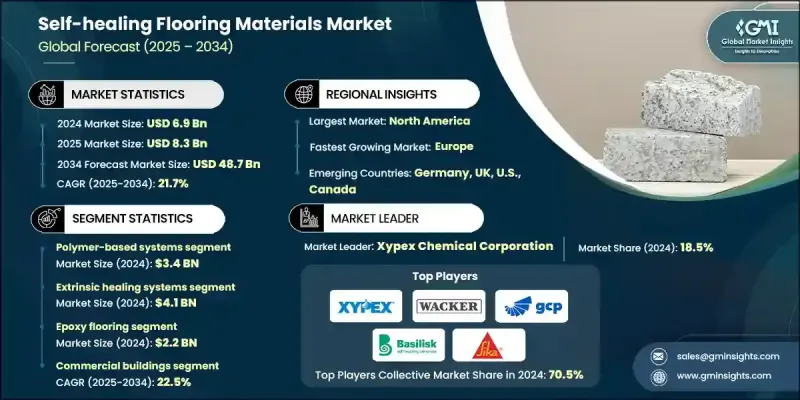

2024 年全球自癒地板材料市场价值为 69 亿美元,预计到 2034 年将以 21.7% 的复合年增长率成长至 487 亿美元。

市场扩张的驱动力来自商业、医疗保健和工业领域对耐用、低维护地板日益增长的需求。自修復地板因其能降低维修成本并最大限度地减少高人流量环境下的停机时间而备受青睐。先进材料技术在建筑和工业应用中广受认可,极大地促进了市场发展。环氧树脂、聚氨酯、混凝土、乙烯基、橡胶复合材料和智慧模组化地砖等地板类型均发挥作用,其市场接受度和价格溢价是影响因素。研究表明,自修復聚合物在受损后能够恢復其大部分机械强度,使其成为耐磨且易受衝击表面的理想选择。除了永续优势外,这些材料还有助于减少材料浪费和碳排放,进而提升环保性能。近期创新已将抗菌性能和热稳定性等其他功能整合到地板系统中。玻璃态聚合物和超分子聚合物因其在温和条件下能够反覆自修復并保持强度,正成为领先的材料。这些进步满足了对耐用性和卫生表面要求极高的应用需求,尤其是在医疗保健和食品加工设施中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 69亿美元 |

| 预测值 | 487亿美元 |

| 复合年增长率 | 21.7% |

2024 年,聚合物基系统细分市场占据 50% 的市场份额,预计到 2034 年将以 21.2% 的复合年增长率成长。这些系统利用环氧树脂、聚氨酯和先进聚合物混合物等材料,透过固有的分子设计或嵌入式微胶囊来实现自修復机制。

2024年,外源性修復系统市场规模达41亿美元。这些系统依赖微胶囊或血管网路技术,将修復因子储存在独立的储存库中,并在损伤发生时自动释放。基于微胶囊的外源性修復系统具有商业可行性,且性能稳定可靠。

受先进建筑标准、升级医疗基础设施和工业设施发展等因素的推动,北美自修復地板材料市场预计在2024年将占据41.5%的市场份额。美国是最大的单一市场,这得益于其严格的建筑规范和性能要求,这些因素有利于先进材料的应用。自修復地板在医院和临床设施的应用主要得益于其良好的卫生控制、无缝表面和较低的维护需求。

自修復地板材料市场的主要参与者包括Green-Basilisk BV、太平洋西北国家实验室(PNNL)、西卡集团、Sensicon Ventures Ltd、圣戈班、Xypex Chemical Corporation、Oscrete Construction Products、Corbion、Fescon Oy、HEGGEL GmbH、瓦克化学股份公司、Polycoat Products、Corbion、Fescon Oy、HEGGEL GmbH、瓦克化学股份公司、Polycoat Products、SMBMUR GmbH、SMBAwmbH、瓦克化学股份公司、Polycoat Products、SMBA固定 GmbH、CmbiniiUR。自修復地板市场的企业致力于开发先进的聚合物混合物,整合多功能特性,并拓展基于微胶囊的修復技术。与建筑公司、医疗保健机构和工业设施开发商的合作有助于提高市场渗透率。研发投入推动了抗菌、耐热和环保地板系统的创新。製造商强调成本效益高的解决方案和永续发展概念,以吸引具有环保意识的买家。数位行销、教育宣传活动和试点安装突显了产品优势,从而促进了产品的普及。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 降低基础设施维护成本

- 医疗保健感染控制要求

- 工业停机时间最小化需求

- 产业陷阱与挑战

- 高昂的初始投资和催化剂成本

- 安装复杂性和承包商培训

- 温度和环境活化屏障

- 市场机会

- 疫情后医疗设施扩建

- 政府基础建设现代化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 材料类型

- 自癒机制

- 地板类型

- 最终用途

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依材料类型划分,2021-2034年

- 主要趋势

- 基于聚合物的体系

- 环氧树脂

- 聚氨酯

- 丙烯酸和甲基丙烯酸酯

- 聚脲

- 聚二甲基硅氧烷(PDMS)

- 水泥基/混凝土基体系

- 波特兰水泥基体

- 地聚合物系统

- 纤维增强型

- 混合/复合系统

- 聚合物-混凝土复合材料

- 纤维增强聚合物(FRP)

- 多层系统

- 生物基/永续材料

- 植物基聚合物体系

- 再生材料整合

- 可生物降解成分

- 其他的

第六章:市场估算与预测:依自癒机制划分,2021-2034年

- 主要趋势

- 外源性癒合系统

- 基于微胶囊的癒合剂

- 基于血管网络的系统

- 胶囊细菌/酵素系统

- 中空光纤集成

- 外部水库系统

- 内在癒合系统

- 动态共价网络

- 超分子交互作用

- 形状记忆聚合物

- 金属-配体配位

- 氢键体系

- 温度响应系统

- 自组装机制

- 其他的

第七章:市场估算与预测:依地板类型划分,2021-2034年

- 主要趋势

- 环氧树脂地板

- 聚氨酯地板

- 乙烯基地板

- 豪华乙烯基瓷砖

- 乙烯基复合磁砖

- 混凝土楼板

- 橡胶/复合地板

- 智慧模组化磁砖

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 住宅大楼

- 商业建筑

- 办公大楼

- 零售设施

- 教育机构

- 饭店及娱乐

- 运动与休閒

- 资料中心

- 医疗保健与製药

- 医院手术室

- 无菌处理区

- 实验室设施

- 製药生产

- 工业建筑

- 化学加工厂

- 汽车组装

- 电子製造

- 航太设施

- 其他

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Xypex Chemical Corporation

- Green-Basilisk BV

- Sika Group

- Oscrete Construction Products

- Fescon Oy

- Wacker Chemie AG

- Polycoat Products

- Saint Gobain

- Corbion

- Giatec Scientific Inc.

- HEGGEL GmbH

- SCHOMBURG GmbH

- Minicrete

- Sensicon Ventures Ltd

- Pacific Northwest National Laboratory (PNNL)

The Global Self-healing Flooring Materials Market was valued at USD 6.9 Billion in 2024 and is estimated to grow at a CAGR of 21.7% to reach USD 48.7 Billion by 2034.

The market expansion is driven by rising demand for durable, low-maintenance flooring across commercial, healthcare, and industrial sectors. Self-healing flooring is gaining traction as it reduces repair costs and minimizes downtime in high-traffic environments. Advanced materials technologies are becoming widely accepted in construction and industrial applications, contributing significantly to the market. Flooring types such as epoxy, polyurethane, concrete, vinyl, rubber composites, and smart modular tiles all play a role, influenced by adoption rates and price premiums. Research demonstrates that self-healing polymers can recover a substantial portion of their mechanical strength after damage, making them ideal for abrasive and impact-prone surfaces. In addition to sustainability benefits, these materials help reduce material waste and carbon emissions, enhancing environmental appeal. Recent innovations have integrated additional functionalities into flooring systems, such as antimicrobial properties and thermal stability. Vitrimers and supramolecular polymers are emerging as leading materials due to their ability to repeatedly self-heal under mild conditions while retaining strength. These advancements cater to demanding applications requiring both durability and hygienic surfaces, particularly in healthcare and food processing facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.9 Billion |

| Forecast Value | $48.7 Billion |

| CAGR | 21.7% |

The polymer-based systems segment held a 50% share in 2024 with a projected CAGR of 21.2% through 2034. These systems leverage materials like epoxy, polyurethane, and advanced polymer blends, incorporating self-healing mechanisms either through intrinsic molecular design or embedded microcapsules.

The extrinsic healing systems segment accounted for USD 4.1 Billion in 2024. These systems rely on microcapsule or vascular network technologies, storing healing agents in discrete reservoirs and releasing them automatically when damage occurs. Microcapsule-based extrinsic systems are commercially viable, with predictable and reliable performance characteristics.

North America Self-healing Flooring Materials Market captured 41.5% share in 2024, driven by demand for advanced construction standards, upgraded healthcare infrastructure, and industrial facility development. The United States is the largest single-country market due to strict building codes and performance requirements favoring advanced material adoption. Key factors supporting self-healing flooring in hospitals and clinical facilities include hygiene control, seamless surfaces, and lower maintenance needs.

Key players in the Self-healing Flooring Materials Market include Green-Basilisk BV, Pacific Northwest National Laboratory (PNNL), Sika Group, Sensicon Ventures Ltd, Saint Gobain, Xypex Chemical Corporation, Oscrete Construction Products, Corbion, Fescon Oy, HEGGEL GmbH, Wacker Chemie AG, Polycoat Products, SCHOMBURG GmbH, and Minicrete. Companies in the self-healing flooring market focus on developing advanced polymer blends, integrating multifunctional properties, and expanding microcapsule-based healing technologies. Partnerships with construction firms, healthcare providers, and industrial facility developers help enhance market penetration. Investment in R&D drives innovation in antimicrobial, thermal-resistant, and eco-friendly floor systems. Manufacturers emphasize cost-effective solutions and sustainability messaging to attract environmentally conscious buyers. Digital marketing, educational campaigns, and pilot installations highlight product advantages, boosting adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Self-Healing Mechanism

- 2.2.4 Flooring type

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure maintenance cost reduction

- 3.2.1.2 Healthcare infection control requirements

- 3.2.1.3 Industrial downtime minimization needs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment & catalyst costs

- 3.2.2.2 Installation complexity & contractor training

- 3.2.2.3 Temperature & environmental activation barriers

- 3.2.3 Market opportunities

- 3.2.3.1 Post-pandemic healthcare facility expansion

- 3.2.3.2 Government infrastructure modernization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Material Type

- 3.7.3 Self-Healing Mechanism

- 3.7.4 Flooring type

- 3.7.5 End Use

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polymer-based systems

- 5.2.1 Epoxy Resins

- 5.2.2 Polyurethane

- 5.2.3 Acrylic & methacrylate

- 5.2.4 Polyurea

- 5.2.5 Polydimethylsiloxane (PDMS)

- 5.3 Cementitious/concrete-based systems

- 5.3.1 Portland cement matrix

- 5.3.2 Geopolymer systems

- 5.3.3 Fiber-reinforced variants

- 5.4 Hybrid/composite systems

- 5.4.1 Polymer-concrete composites

- 5.4.2 Fiber-reinforced polymers (FRP)

- 5.4.3 Multi-layer systems

- 5.5 Bio-based/sustainable materials

- 5.5.1 Plant-based polymer systems

- 5.5.2 Recycled content integration

- 5.5.3 Biodegradable components

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Self-Healing Mechanism, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Extrinsic healing systems

- 6.2.1 Microcapsule-based healing agents

- 6.2.2 Vascular network-based systems

- 6.2.3 Encapsulated bacteria/enzyme system

- 6.2.4 Hollow fiber integration

- 6.2.5 External reservoir systems

- 6.3 Intrinsic healing systems

- 6.3.1 Dynamic covalent networks

- 6.3.2 Supramolecular interactions

- 6.3.3 Shape memory polymers

- 6.3.4 Metal-ligand coordination

- 6.3.5 Hydrogen bonding systems

- 6.3.6 Temperature-responsive systems

- 6.3.7 Self-assembly mechanisms

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Flooring Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Epoxy flooring

- 7.3 Polyurethane flooring

- 7.4 Vinyl flooring

- 7.4.1 Luxury vinyl tile

- 7.4.2 Vinyl composite tile

- 7.5 Concrete flooring

- 7.6 Rubber/composites flooring

- 7.7 Smart modular tiles

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential buildings

- 8.3 Commercial buildings

- 8.3.1 Office buildings

- 8.3.2 Retail facilities

- 8.3.3 Educational institutions

- 8.3.4 Hospitality & entertainment

- 8.3.5 Sports & recreation

- 8.3.6 Data centers

- 8.4 Healthcare & pharmaceuticals

- 8.4.1 Hospital operating rooms

- 8.4.2 Sterile processing areas

- 8.4.3 Laboratory facilities

- 8.4.4 Pharmaceutical manufacturing

- 8.5 Industrial buildings

- 8.5.1 Chemical processing plants

- 8.5.2 Automotive assembly

- 8.5.3 Electronics manufacturing

- 8.5.4 Aerospace facilities

- 8.6 Other

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Xypex Chemical Corporation

- 10.2 Green-Basilisk BV

- 10.3 Sika Group

- 10.4 Oscrete Construction Products

- 10.5 Fescon Oy

- 10.6 Wacker Chemie AG

- 10.7 Polycoat Products

- 10.8 Saint Gobain

- 10.9 Corbion

- 10.10 Giatec Scientific Inc.

- 10.11 HEGGEL GmbH

- 10.12 SCHOMBURG GmbH

- 10.13 Minicrete

- 10.14 Sensicon Ventures Ltd

- 10.15 Pacific Northwest National Laboratory (PNNL)