|

市场调查报告书

商品编码

1871239

汽车冲压机自动化市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Stamping Press Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

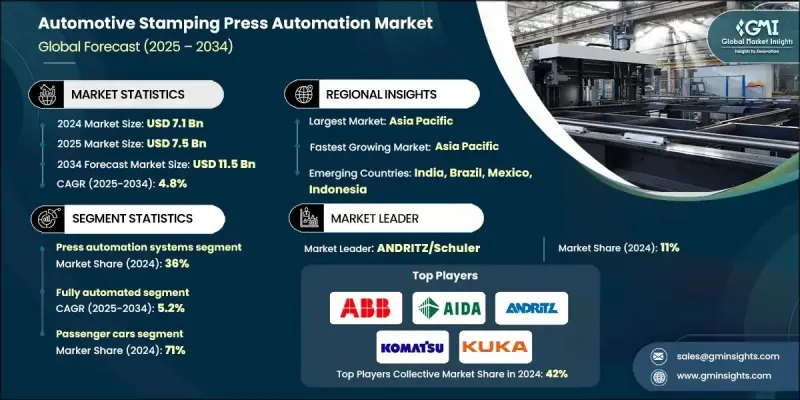

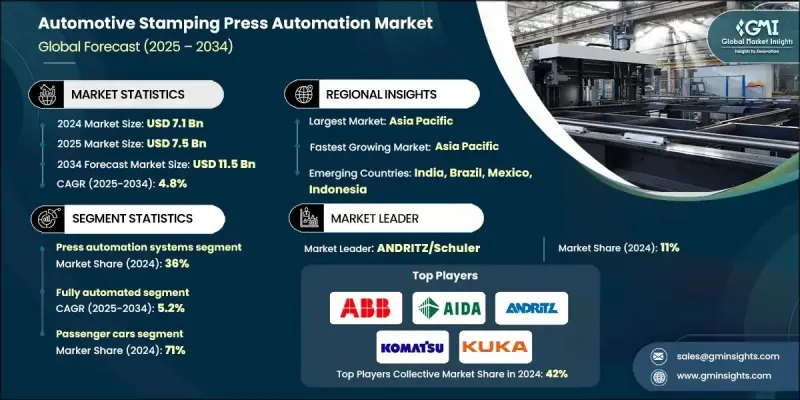

2024 年全球汽车冲压机自动化市场价值为 71 亿美元,预计到 2034 年将以 4.8% 的复合年增长率成长至 115 亿美元。

冲压市场在汽车製造业中扮演着至关重要的角色,因为它专注于金属汽车零件的自动化成型、加工和组装。机器人、CNC工具机和自动化控制系统的日益普及,正在提升汽车製造流程的生产精度、速度和重复性。电动车领域的快速扩张也正在重塑冲压自动化,因为电动车的生产需要轻量化且结构复杂的零件。製造商正加大对先进自动化技术的投资,以支援高强度钢、铝和复合材料的加工。包括物联网、智慧感测器和预测性维护在内的工业4.0技术的集成,进一步改变了这个产业。这些创新透过实现即时监控、自动化品质检查和预测性设备维护,优化了生产效率。这种整合减少了停机时间,提高了能源效率,并确保了汽车零件生产的高产量和高精度。随着自动化对于维持全球竞争力变得越来越重要,乘用车、商用车和电动车製造领域对先进冲压系统的需求持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 71亿美元 |

| 预测值 | 115亿美元 |

| 复合年增长率 | 4.8% |

到2024年,冲压自动化系统市占率将达到36%。此细分市场的成长主要得益于伺服驱动冲压技术的应用,与传统液压机相比,伺服冲压机具有更高的精度、灵活性和能源效率。伺服冲压机使操作人员能够即时微调成型参数,减少材料浪费,并有效加工各种材料,例如铝合金和高强度钢。其在电动车零件生产中的日益广泛的应用,凸显了其在精密製造环境中的价值。

预计从2025年到2034年,全自动化冲压领域将以5.2%的复合年增长率成长。该领域整合了高速冲压机、机器人搬运系统和智慧过程控制解决方案,可实现连续不间断生产。透过最大限度地减少人工干预,这些系统提高了产量、产品一致性和操作安全性,同时缩短了生产週期并降低了生产成本。如今,全自动化冲压生产线对于实现精益生产目标以及在大型汽车生产设施中保持统一的品质标准至关重要。

2024年,美国汽车冲压机自动化市场规模预计将达到10.9亿美元。美国市场的成长主要得益于对国内製造业的重新重视以及对先进自动化技术的应用。汽车製造商正加大对新一代冲压系统的投资,以提高乘用车和商用车生产的灵活性、生产效率和品质。製造业回流以及对供应链韧性的重视,持续推动该地区对自动化解决方案的需求。

全球汽车冲压机自动化市场的主要企业包括ABB、小松工业、库卡、发那科、爱达工程、AMADA、世义机械、美国比勒公司、安德里茨/舒勒以及优傲机器人。为了巩固自身地位,汽车冲压机自动化产业的领导者正采取以技术创新、合作和产能扩张为核心的策略。各公司正在开发整合人工智慧和物联网的智慧伺服驱动系统,以实现预测性维护、改善能源控制和增强製程优化。与汽车製造商和机器人公司的策略联盟正在帮助企业将自动化解决方案推广到整个生产设施。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预报

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 电动车和轻量化材料的日益普及

- 工业4.0与智慧工厂技术的融合

- 新兴市场汽车产量不断成长

- 对高品质、性能稳定的金属部件的需求

- 产业陷阱与挑战

- 先进自动化的高额资本投入

- 多材料冲压製程整合的复杂性

- 市场机会

- 扩大电动车和轻型汽车项目

- 采用人工智慧驱动的预测性维护和流程优化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 碳足迹评估

- 循环经济一体化

- 电子垃圾管理要求

- 绿色製造倡议

- 用例和应用

- 最佳情况

- 投资环境

- 冲压自动化领域的资本支出趋势

- 私募股权和创投活动

- 合併、收购和策略伙伴关係

- 投资报酬率与投资回收期分析

- 市场采纳趋势

- 各类车辆的自动化普及率

- 依自动化程度分類的采用情况:半自动化与全自动

- 物联网和人工智慧技术的融合

- 采用障碍和促进因素

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依产品划分,2021-2034年

- 主要趋势

- 印刷自动化系统

- 机器人物料搬运

- 製程控制与监控

- 整合与服务

第六章:市场估算与预测:依自动化程度划分,2021-2034年

- 主要趋势

- 半自动

- 全自动

- 智慧/互联

第七章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车辆(HCV)

第八章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 白车身(BIW)

- 动力系统

- 安全/结构

- 其他

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- ABB

- AIDA Engineering

- AMADA

- ANDRITZ/Schuler

- Bihler of America

- FANUC

- Komatsu Industries

- KUKA

- SEYI Machinery

- Universal Robots

- 区域玩家

- Acro Metal Stamping

- American Axle & Manufacturing

- ArtiFlex Manufacturing

- Challenge Manufacturing

- 新兴参与者/颠覆者

- AmeriStar

- Arcade Metal Stamping

- Automation Tool & Die (ATD)

- Eagle Press & Equipment

The Global Automotive Stamping Press Automation Market was valued at USD 7.1 Billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 11.5 Billion by 2034.

The market holds a crucial role in automotive manufacturing, as it focuses on the automated forming, shaping, and assembly of metal vehicle components. The growing use of robotics, CNC machinery, and automated control systems is enhancing production precision, speed, and repeatability across vehicle manufacturing processes. The rapid expansion of the electric vehicle segment is also reshaping stamping automation, as EV production requires lightweight and complex structural parts. Manufacturers are increasingly investing in advanced automation to support the processing of high-strength steel, aluminum, and composite materials. The integration of Industry 4.0 technologies including IoT, smart sensors, and predictive maintenance has further transformed the sector. These innovations optimize production efficiency by enabling real-time monitoring, automated quality checks, and predictive equipment maintenance. This integration reduces downtime, improves energy efficiency, and ensures high throughput and accuracy in automotive component production. With automation increasingly essential to maintain global competitiveness, demand for advanced stamping systems continues to rise across passenger, commercial, and electric vehicle manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 4.8% |

The press automation systems segment accounted for a 36% share in 2024. This segment is primarily driven by the adoption of servo-driven press technology, which offers superior accuracy, flexibility, and energy efficiency compared to traditional hydraulic presses. Servo presses enable operators to fine-tune forming parameters in real time, reduce material waste, and efficiently process diverse materials such as aluminum alloys and high-strength steel. Their growing use in the production of electric vehicle components underscores their value in precision manufacturing environments.

The fully automated segment is expected to grow at a CAGR of 5.2% from 2025 to 2034. This category integrates high-speed presses, robotic handling systems, and intelligent process control solutions that enable continuous, uninterrupted production. By minimizing manual intervention, these systems enhance throughput, product consistency, and operational safety while reducing cycle times and production costs. Fully automated stamping lines are now central to achieving lean manufacturing objectives and maintaining uniform quality standards across large-scale automotive production facilities.

United States Automotive Stamping Press Automation Market generated USD 1.09 Billion in 2024. Growth in the U.S. market is being driven by a renewed focus on domestic manufacturing and the adoption of advanced automation technologies. Automotive producers are increasingly investing in next-generation stamping systems to improve flexibility, productivity, and quality across both passenger and commercial vehicle production. The reshoring of manufacturing operations and the focus on supply chain resilience continue to strengthen demand for automated solutions in the region.

Key companies operating in the Global Automotive Stamping Press Automation Market include ABB, Komatsu Industries, KUKA, FANUC, AIDA Engineering, AMADA, SEYI Machinery, Bihler of America, ANDRITZ/Schuler, and Universal Robots. To reinforce their position, leading players in the automotive stamping press automation industry are adopting strategies centered on technological innovation, partnerships, and capacity expansion. Companies are developing intelligent servo-driven systems that integrate AI and IoT for predictive maintenance, improved energy control, and enhanced process optimization. Strategic alliances with automakers and robotics firms are helping expand automation solutions across production facilities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Automation Level

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of EVs and lightweight materials

- 3.2.1.2 Integration of Industry 4.0 and smart factory technologies

- 3.2.1.3 Rising vehicle production in emerging markets

- 3.2.1.4 Demand for high-quality, consistent metal components

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment for advanced automation

- 3.2.2.2 Complexity in integrating multi-material stamping processes

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of EV and lightweight vehicle programs

- 3.2.3.2 Adoption of AI-driven predictive maintenance and process optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability & environmental aspects

- 3.11.1 Carbon Footprint Assessment

- 3.11.2 Circular Economy Integration

- 3.11.3 E-Waste Management Requirements

- 3.11.4 Green Manufacturing Initiatives

- 3.12 Use cases and applications

- 3.13 Best-case scenario

- 3.14 Investment landscape

- 3.14.1 Capital expenditure trends in stamping automation

- 3.14.2 Private equity and venture funding activity

- 3.14.3 Mergers, acquisitions, and strategic partnerships

- 3.14.4 Return on investment and payback period analysis

- 3.15 Market adoption trends

- 3.15.1 Rate of automation adoption across vehicle types

- 3.15.2 Adoption by automation level: semi-automated vs fully automated

- 3.15.3 Integration of IoT and AI technologies

- 3.15.4 Adoption barriers and enablers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Press Automation systems

- 5.3 Robotic Material Handling

- 5.4 Process Control & Monitoring

- 5.5 Integration & services

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Semi-Automated

- 6.3 Fully Automated

- 6.4 Smart/Connected

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial Vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Body-in-White (BIW)

- 8.3 Powertrain

- 8.4 Safety/Structural

- 8.5 Other

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 ABB

- 10.1.2 AIDA Engineering

- 10.1.3 AMADA

- 10.1.4 ANDRITZ/Schuler

- 10.1.5 Bihler of America

- 10.1.6 FANUC

- 10.1.7 Komatsu Industries

- 10.1.8 KUKA

- 10.1.9 SEYI Machinery

- 10.1.10 Universal Robots

- 10.2 Regional Players

- 10.2.1 Acro Metal Stamping

- 10.2.2 American Axle & Manufacturing

- 10.2.3 ArtiFlex Manufacturing

- 10.2.4 Challenge Manufacturing

- 10.3 Emerging Players / Disruptors

- 10.3.1 AmeriStar

- 10.3.2 Arcade Metal Stamping

- 10.3.3 Automation Tool & Die (ATD)

- 10.3.4 Eagle Press & Equipment