|

市场调查报告书

商品编码

1876530

认知增强蘑菇萃取物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Cognitive Enhancement Mushroom Extract Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

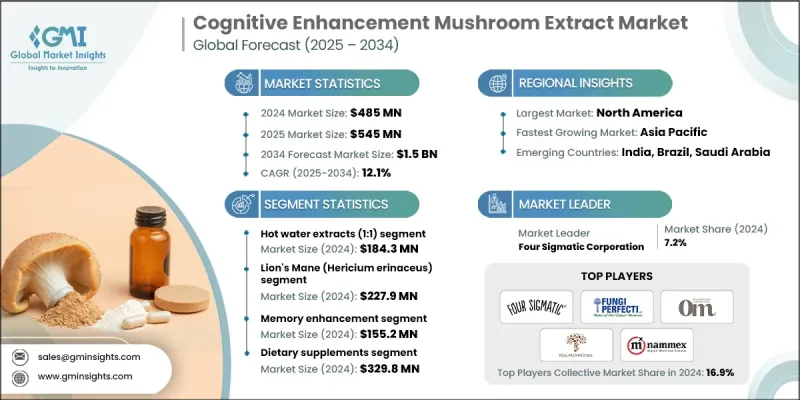

2024 年全球认知增强蘑菇萃取物市场价值为 4.85 亿美元,预计到 2034 年将以 12.1% 的复合年增长率增长至 15 亿美元。

由于天然益智药的日益普及、生物骇客运动的蓬勃发展以及人们对整体健康产品的偏好不断增强,市场正经历着快速增长。消费者越来越青睐能够提升专注力、记忆力、脑力和长期大脑健康的成分,这为以蘑菇为基础的认知增强剂创造了巨大的市场机会。随着越来越多的人采用天然方法来提升认知能力,记忆力改善和注意力提升等应用占据了市场主导地位。老年族群对神经保护功效的需求日益增长,而含有适应原蘑菇配方的压力和情绪支持产品也越来越受欢迎。专注于提升能量和脑力耐力的细分市场持续扩张,尤其是在专业人士和高绩效消费者群体中。市场的下一阶段正朝着个人化方向发展,智慧益智药将根据个人的基因和认知特征进行客製化。透过穿戴式装置、数位健康平台和个人化订阅服务收集的数据正被用于优化配方,从而创建自适应的、数据驱动的补充剂方案,以改善用户体验并增强用户与品牌的长期互动。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.85亿美元 |

| 预测值 | 15亿美元 |

| 复合年增长率 | 12.1% |

2034年,双重萃取(水+醇)技术市场规模将达到4.245亿美元,复合年增长率(CAGR)为12.5%。此技术的优点在于能够同时保留亲水性和亲脂性成分,确保β-葡聚醣和三萜类化合物等活性成分的存在,进而增强产品的效力和功效。随着消费者对萃取品质和生物利用度的关注度不断提高,双重萃取技术正成为旨在提升思维清晰度和抗压性的高端配方产品的首选。

2024年,记忆力增强类产品的市场价值达到1.552亿美元,并持续占据主导地位。越来越多的学生和职场人士开始使用功能性蘑菇来提升认知功能、学习能力和神经健康。将健脑补充剂融入日常健康生活方式的趋势日益增长,推动了对这些天然配方产品的持续需求,也进一步巩固了它们在整体认知健康方面的重要作用。

2024年,北美认知增强蘑菇萃取物市场规模达2.182亿美元。美国在这一市场中占据主导地位,这得益于其强大的健康品牌网络、活跃的线上零售以及消费者对增强记忆力、专注力和压力管理能力的天然成分日益增长的需求。消费者教育水平的提高和分销网络的不断发展,使得功能性蘑菇产品更容易获得,进一步巩固了该地区在该行业的领先地位。

全球认知增强蘑菇萃取物市场的主要活跃企业包括:Gaia Herbs Inc.、Four Sigmatic Corporation、Nammex(北美药用蘑菇提取物公司)、Life Extension Foundation、Doctor's Best Inc.、Garden of Life LLC、NOW Health Group Inc.(NOW Foods)、Om Mushroom Superfood、Amazing Inc.、Mushroom Wisdom Inc.、Jarrow Formulas Inc.、Swanson Health Products、Nature's Way Brands LLC、Himalaya Herbal Healthcare、Organic India USA LLC、New Chapter Inc. 和 Fungi Perfecti LLC(Host Defense Brand)。认知增强蘑菇萃取物市场的企业正透过创新、品牌合作以及拓展个人化营养领域来巩固其市场地位。领先企业正投资于先进的萃取技术,以提高产品的纯度、效力和生物利用度。许多公司正在推出由人工智慧驱动的健康资料支援的个人化促智配方,使消费者能够根据特定的认知需求客製化补充剂。与健康平台、电商管道和医疗从业者的策略合作正在提升品牌知名度和消费者覆盖率。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲 (MEA)

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依蘑菇种类

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依萃取物形式,2021-2034年

- 主要趋势

- 热水萃取液(1:1)

- 双重萃取(水+酒精)

- 标准化浓缩液(8:1,10:1)

- 液体培养菌丝体

- 超临界二氧化碳

第六章:市场估计与预测:依蘑菇品种划分,2021-2034年

- 主要趋势

- 猴头菇(猴头菇)

- 灵芝(Ganoderma lucidum)

- 冬虫夏草(冬虫夏草/蛹虫草)

- 多物种混合物

- 白桦茸(斜生白桦茸)

- 土耳其尾(Trametes versicolor)

第七章:市场估计与预测:依认知应用领域划分,2021-2034年

- 主要趋势

- 记忆增强

- 专注力与集中力

- 神经保护

- 情绪与压力管理

- 精神能量和耐力

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 膳食补充剂

- 功能性食品和饮料

- 临床/医学营养

- 传统药品产品

- 化妆品及个人护理

第九章:市场估算与预测:依配销通路划分,2021-2034年

- 主要趋势

- 线上零售/电子商务

- 专业保健品商店

- 超市/大型超市

- 医疗保健从业人员

- 传统医药店

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十一章:公司简介

- Amazing Grass (Amazing Nutrition LLC)

- Doctor's Best Inc.

- Four Sigmatic Corporation

- Fungi Perfecti, LLC (Host Defense Brand)

- Gaia Herbs Inc.

- Garden of Life LLC

- Himalaya Herbal Healthcare

- Jarrow Formulas Inc.

- Life Extension Foundation

- Mushroom Wisdom Inc.

- Nammex(北美药用蘑菇萃取物)

- Nature's Way Brands LLC

- New Chapter Inc

- NOW Health Group Inc. (NOW Foods)

- Om Mushroom Superfood

- Organic India USA LLC

- Planetary Herbals

- Real Mushrooms Inc.

- Source Naturals Inc.

- Swanson Health Products

The Global Cognitive Enhancement Mushroom Extract Market was valued at USD 485 million in 2024 and is estimated to grow at a CAGR of 12.1% to reach USD 1.5 billion by 2034.

The market is witnessing rapid growth due to the rising popularity of natural nootropics, the expanding biohacking movement, and the growing preference for holistic wellness products. Consumers are increasingly drawn to functional ingredients that promote focus, memory, mental energy, and long-term brain health, creating substantial opportunities for mushroom-based cognitive enhancers. Applications such as memory improvement and concentration enhancement dominate the market, as more individuals adopt natural solutions to boost cognitive performance. Demand for neuroprotective benefits is increasing among aging populations, while stress and mood support products are gaining popularity with adaptogenic mushroom formulations. The segment focused on energy and mental stamina continues to expand, particularly among professionals and high-performance consumers. The next phase of the market is shifting toward personalization, where intelligent nootropics are being customized based on individual genetic and cognitive profiles. Data collected through wearables, digital wellness platforms, and personalized subscriptions are being utilized to refine formulations, creating adaptive, data-driven supplement programs that improve user experience and long-term engagement with brands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $485 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 12.1% |

The Dual extraction (water + alcohol) methods segment will reach USD 424.5 million by 2034, growing at a CAGR of 12.5%. This technique's advantage lies in preserving both hydrophilic and lipophilic components, ensuring the presence of active compounds such as beta-glucans and triterpenoids for enhanced potency and efficacy. As consumer awareness increases regarding extraction quality and bioavailability, dual extraction methods are becoming a preferred choice in premium formulations aimed at improving mental clarity and stress resilience.

The memory enhancement category was valued at USD 155.2 million in 2024 and continues to dominate as students and professionals increasingly turn to functional mushrooms to support cognitive function, learning capacity, and neural health. The growing trend of incorporating brain-boosting supplements into daily wellness routines is fueling consistent demand for these natural formulations, reinforcing their role in overall cognitive well-being.

North America Cognitive Enhancement Mushroom Extract Market generated USD 218.2 million in 2024. The United States played a central role in this dominance due to the strong presence of established wellness brands, high levels of online retail activity, and a growing inclination toward natural ingredients that enhance memory, focus, and stress management. Increasing consumer education and evolving distribution networks have made functional mushroom products more accessible, strengthening the region's leadership in the industry.

Key companies active in the Global Cognitive Enhancement Mushroom Extract Market include Gaia Herbs Inc., Four Sigmatic Corporation, Nammex (North American Medicinal Mushroom Extracts), Life Extension Foundation, Doctor's Best Inc., Garden of Life LLC, NOW Health Group Inc. (NOW Foods), Om Mushroom Superfood, Amazing Grass (Amazing Nutrition LLC), Planetary Herbals, Real Mushrooms Inc., Source Naturals Inc., Mushroom Wisdom Inc., Jarrow Formulas Inc., Swanson Health Products, Nature's Way Brands LLC, Himalaya Herbal Healthcare, Organic India USA LLC, New Chapter Inc., and Fungi Perfecti LLC (Host Defense Brand). Companies in the Cognitive Enhancement Mushroom Extract Market are strengthening their market position through innovation, brand partnerships, and expansion into personalized nutrition. Leading players are investing in advanced extraction technologies to improve product purity, potency, and bioavailability. Many are introducing personalized nootropic formulations supported by AI-driven health data, allowing consumers to tailor supplements to specific cognitive needs. Strategic collaborations with wellness platforms, e-commerce channels, and health practitioners are enhancing brand visibility and consumer reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Extract form

- 2.2.3 Mushroom species

- 2.2.4 Cognitive application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa (MEA)

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By mushroom species

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Extract Form, 2021-2034 (USD Million & Tons)

- 5.1 Key trends

- 5.2 Hot water extracts (1:1)

- 5.3 Dual extraction (water + alcohol)

- 5.4 Standardized concentrated (8:1, 10:1)

- 5.5 Liquid culture mycelium

- 5.6 Supercritical CO2

Chapter 6 Market Estimates and Forecast, By Mushroom Species, 2021-2034 (USD Million & Tons)

- 6.1 Key trends

- 6.2 Lion's mane (hericium erinaceus)

- 6.3 Reishi (ganoderma lucidum)

- 6.4 Cordyceps (sinensis/militaris)

- 6.5 Multi-species blends

- 6.6 Chaga (inonotus obliquus)

- 6.7 Turkey tail (trametes versicolor)

Chapter 7 Market Estimates and Forecast, By Cognitive Application, 2021-2034 (USD Million & Tons)

- 7.1 Key trends

- 7.2 Memory enhancement

- 7.3 Focus & concentration

- 7.4 Neuroprotection

- 7.5 Mood & stress management

- 7.6 Mental energy & stamina

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million & Tons)

- 8.1 Key trends

- 8.2 Dietary supplements

- 8.3 Functional foods & beverages

- 8.4 Clinical/medical nutrition

- 8.5 Traditional medicine products

- 8.6 Cosmetics & personal care

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million & Tons)

- 9.1 Key trends

- 9.2 Online retail/e-commerce

- 9.3 Specialty health stores

- 9.4 Supermarkets/hypermarkets

- 9.5 Healthcare practitioners

- 9.6 Traditional medicine outlets

Chapter 10 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Amazing Grass (Amazing Nutrition LLC)

- 11.2 Doctor's Best Inc.

- 11.3 Four Sigmatic Corporation

- 11.4 Fungi Perfecti, LLC (Host Defense Brand)

- 11.5 Gaia Herbs Inc.

- 11.6 Garden of Life LLC

- 11.7 Himalaya Herbal Healthcare

- 11.8 Jarrow Formulas Inc.

- 11.9 Life Extension Foundation

- 11.10 Mushroom Wisdom Inc.

- 11.11 Nammex (North American Medicinal Mushroom Extracts)

- 11.12 Nature's Way Brands LLC

- 11.13 New Chapter Inc

- 11.14 NOW Health Group Inc. (NOW Foods)

- 11.15 Om Mushroom Superfood

- 11.16 Organic India USA LLC

- 11.17 Planetary Herbals

- 11.18 Real Mushrooms Inc.

- 11.19 Source Naturals Inc.

- 11.20 Swanson Health Products

![PMS 和经期保健品市场 - 按产品(组合、单一 [维生素、矿物质])、消费群体(经前症候群、围绝经期)、配方(片剂和胶囊、粉末)、配销通路、全球预测( 2024 年- 2032 年)](/sample/img/cover/42/default_cover_gmi.png)