|

市场调查报告书

商品编码

1876531

汽车数位孪生硬体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Automotive Digital Twin Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

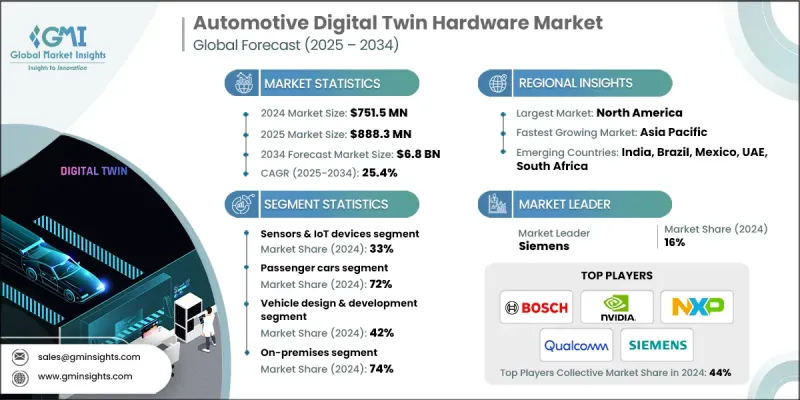

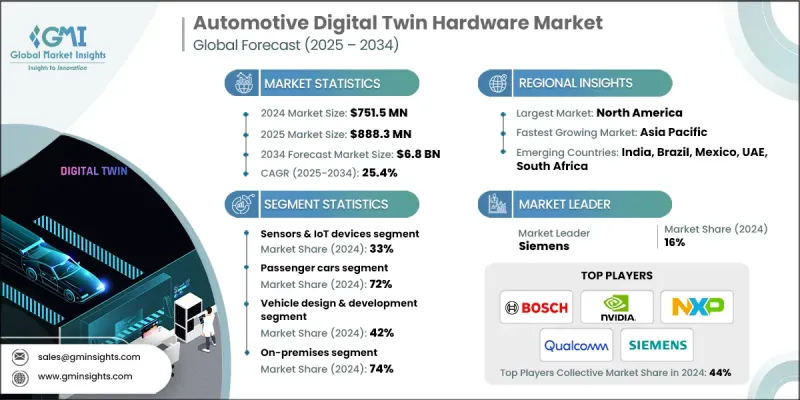

2024 年全球汽车数位孪生硬体市场价值为 7.515 亿美元,预计到 2034 年将以 25.4% 的复合年增长率增长至 68 亿美元。

随着汽车原始设备製造商 (OEM) 和一级供应商采用包括高效能运算 (HPC) 单元、感测器、GPU 和边缘伺服器在内的先进系统,对数位孪生硬体的需求正在加速增长。这些硬体组件能够在虚拟环境中模拟真实车辆的行为,使製造商能够分析生产结果、简化组装流程并提高资源利用率。数位孪生平台也能让工程师在将组装工作流程部署到生产线之前,对其进行虚拟测试和验证,从而提高工作效率。物联网/工业物联网 (IoT/IIoT)、人工智慧和工业 4.0 技术的日益普及正在改变汽车製造业,推动了对强大的数位孪生硬体解决方案的需求。随着车辆发展成为能够产生海量感测器资料的软体定义系统,数位孪生硬体能够促进即时资料处理、预测分析和营运优化。随着工业 4.0 计画强调自动化、精准化和预测性维护,物联网感测器、边缘运算设备和工业控制器在汽车工厂中的整合不断增长,从而对能够模拟和处理即时工厂资料的强大运算基础设施产生了强劲的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.515亿美元 |

| 预测值 | 68亿美元 |

| 复合年增长率 | 25.4% |

2024年,感测器和物联网设备细分市场占据33%的市场份额,预计2025年至2034年将以25.5%的复合年增长率成长。该细分市场在采集温度、振动和压力等即时指标方面发挥着至关重要的作用,从而能够模拟汽车资产的物理性能。随着自动驾驶技术的日益普及,包括光达、雷达和微机电系统(MEMS)组件在内的先进感测器的应用正在加速,从而支持更强大的预测建模和故障诊断能力。

2024年,乘用车市占率达72%,预计2025年至2034年间将以25.7%的复合年增长率成长。这一主导地位归功于系统互联性的提升、电气化趋势以及驾驶辅助系统的进步。汽车製造商正在部署GPU、物联网感测器和边缘运算系统,以进行即时车辆仿真,从而提高设计精度和生产效率。向软体定义汽车的转型日益增强,也进一步凸显了对数位孪生技术的需求,这些技术能够支援预测性维护、虚拟验证和空中软体更新。

预计到2024年,北美汽车数位孪生硬体市场将占据34%的份额。该地区的成长主要得益于互联、自动驾驶和电动车技术的广泛应用。汽车原始设备製造商(OEM)和零件供应商正大力投资于GPU加速运算、低延迟边缘硬体和物联网感测器网络,以实现数位化工厂环境和即时模拟。人工智慧加速处理器和模组化硬体系统的快速发展,进一步提升了整个区域汽车生态系统的设计精度、营运效率和生产可靠性。

全球汽车数位孪生硬体市场的主要参与者包括博世、大陆集团、通用电气、IBM、Molex、英伟达、恩智浦半导体、PTC、高通和西门子。这些领先企业正致力于透过多项策略措施拓展其全球业务。他们大力投资研发,开发可扩展的高效能运算平台,并整合人工智慧驱动的模拟工具,以提供即时分析和预测性洞察。与汽车製造商和技术供应商的策略合作与伙伴关係,帮助他们共同开发客製化的数位孪生解决方案,以优化生产和设计。此外,各公司也着重提升製造能力和区域分销网络,以强化其供应链。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 高效能运算 (HPC) 和 GPU 硬体的集成

- 边缘运算和物联网/工业物联网设备的采用

- 人工智慧和机器学习硬体的进步

- 自动驾驶和连网汽车研发的扩展

- 工业4.0和智慧製造的采用

- 产业陷阱与挑战

- 高昂的硬体和基础设施成本

- 异质系统间的资料互通性

- 市场机会

- AI加速仿真硬体

- 边缘运算和云端运算基础设施的集成

- 电动车和电池系统中数位孪生硬体的扩展

- 采用 5G 和超低延迟网络

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 联邦监管环境

- 国际标准(ISO、SAE)

- 网路安全要求

- 安全和合规标准

- 资料隐私法规

- 环境标准

- 区域监管差异

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 人工智慧集成

- 合成资料和模拟

- 量子计算应用

- 先进的安全技术

- 边缘运算演进

- 5G及未来连接

- 永续性技术

- 价格趋势分析

- 总拥有成本 (TCO) 分析

- 硬体购置成本

- 实施和整合成本

- 营运和维护成本

- 培训和支援费用

- 专利分析

- 依技术领域分析专利组合

- 专利申请趋势与创新活动

- 竞争性专利情报

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 客户旅程图

- 意识和发现阶段

- 评估和甄选阶段

- 实施和整合阶段

- 运行和优化阶段

- 投资报酬率(ROI)框架

- 投资报酬率计算方法

- 投资回收期分析

- 净现值(NPV)模型

- 风险调整后收益

- 投资和融资分析

- 创投趋势

- 策略性企业投资

- 政府资助计划

- 併购活动和估值

- IPO市场动态

- 私募股权参与

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 感测器和物联网设备

- 边缘运算设备

- 连接和网路硬体

- 执行器和控制系统

- 高效能运算/仿真硬体

第六章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

- 电动车(EV)

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 车辆设计与开发

- 製造与生产优化

- 预测性维护

- 自动驾驶汽车测试

- 供应炼和车队管理

第八章:市场估算与预测:依部署模式划分,2021-2034年

- 主要趋势

- 云

- 现场

- 杂交种

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球参与者

- Siemens

- DSpace

- NVIDIA

- PTC

- IBM

- Bosch

- Intel

- NXP Semiconductors

- General Electric

- 区域玩家

- Keysight Technologies

- Altair Engineering

- ETAS

- Vector Informatik

- National Instruments

- Ansys

- Qualcomm

- Continental

- Molex

- 新兴参与者

- Threedy

- Neural Concept

- Applied Intuition

- Cognata

- Luminar Technologies

- Mobileye Global

The Global Automotive Digital Twin Hardware Market was valued at USD 751.5 million in 2024 and is estimated to grow at a CAGR of 25.4% to reach USD 6.8 billion by 2034.

The demand for digital twin hardware is accelerating as automotive OEMs and Tier-1 suppliers embrace advanced systems, including high-performance computing (HPC) units, sensors, GPUs, and edge servers. These hardware components replicate real-world vehicle behavior in virtual settings, allowing manufacturers to analyze production outcomes, streamline assembly processes, and improve resource utilization. Digital twin platforms also enhance workforce efficiency by enabling engineers to test and validate assembly workflows virtually before implementing them on production lines. The rising adoption of IoT/IIoT, artificial intelligence, and Industry 4.0 technologies is transforming automotive manufacturing, driving the need for robust digital twin hardware solutions. As vehicles evolve into software-defined systems that generate massive sensor data, digital twin hardware facilitates real-time data processing, predictive analytics, and operational optimization. With Industry 4.0 initiatives emphasizing automation, precision, and predictive maintenance, the integration of IoT sensors, edge computing devices, and industrial controllers within automotive plants continues to grow, creating strong demand for powerful computing infrastructure capable of simulating and processing real-time factory data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $751.5 Million |

| Forecast Value | $6.8 Billion |

| CAGR | 25.4% |

The sensors and IoT devices segment held a 33% share in 2024 and is anticipated to grow at a CAGR of 25.5% from 2025 to 2034. This segment plays a critical role in capturing real-time metrics such as temperature, vibration, and pressure to replicate the physical performance of automotive assets. With the increasing adoption of autonomous driving technologies, the use of advanced sensors including LiDAR, radar, and MEMS components is accelerating, supporting enhanced predictive modeling and fault diagnostics.

The passenger cars segment held 72% share in 2024 and will grow at a CAGR of 25.7% between 2025 and 2034. This dominance is attributed to greater system connectivity, electrification trends, and advancements in driver assistance systems. Automotive manufacturers are deploying GPUs, IoT-enabled sensors, and edge computing systems to conduct real-time vehicle simulations, improving both design precision and production efficiency. The growing shift toward software-defined vehicles is reinforcing the need for digital twin technologies that support predictive maintenance, virtual validation, and over-the-air software updates.

North America Automotive Digital Twin Hardware Market held 34% share in 2024. The region's growth is driven by the strong adoption of connected, autonomous, and electric vehicle technologies. Automotive OEMs and component suppliers are heavily investing in GPU-powered computing, low-latency edge hardware, and IoT sensor networks to enable digitalized factory environments and real-time simulation. The rapid development of AI-accelerated processors and modular hardware systems is further enhancing design accuracy, operational efficiency, and production reliability across the regional automotive ecosystem.

Key players active in the Global Automotive Digital Twin Hardware Market include Bosch, Continental, General Electric, IBM, Molex, NVIDIA, NXP Semiconductors, PTC, Qualcomm, and Siemens. Leading companies in the Global Automotive Digital Twin Hardware Market are focusing on several strategic initiatives to expand their global presence. They are investing heavily in R&D to develop scalable, high-performance computing platforms and integrating AI-driven simulation tools to deliver real-time analytics and predictive insights. Strategic collaborations and partnerships with automakers and technology providers are helping them co-develop customized digital twin solutions for production and design optimization. Companies are also emphasizing the expansion of manufacturing capabilities and regional distribution networks to strengthen their supply chains.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 Deployment Mode

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Integration of high-performance computing (HPC) and GPU hardware

- 3.2.1.2 Adoption of edge computing and IoT/IIoT devices

- 3.2.1.3 Advancements in AI and machine learning hardware

- 3.2.1.4 Expansion of autonomous and connected vehicle development

- 3.2.1.5 Industry 4.0 and smart manufacturing adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High hardware and infrastructure costs

- 3.2.2.2 Data interoperability across heterogeneous systems

- 3.2.3 Market opportunities

- 3.2.3.1 AI-accelerated simulation hardware

- 3.2.3.2 Integration of edge and cloud computing infrastructure

- 3.2.3.3 Expansion of digital twin hardware in EV and battery systems

- 3.2.3.4 Adoption of 5G and ultra-low latency networks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Federal regulatory environment

- 3.4.2 International standards (ISO, SAE)

- 3.4.3 Cybersecurity requirements

- 3.4.4 Safety and compliance standards

- 3.4.5 Data privacy regulations

- 3.4.6 Environmental standards

- 3.4.7 Regional regulatory variations

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Artificial intelligence integration

- 3.7.2 Synthetic data and simulation

- 3.7.3 Quantum computing applications

- 3.7.4 Advanced security technologies

- 3.7.5 Edge computing evolution

- 3.7.6 5G and beyond connectivity

- 3.7.7 Sustainability technologies

- 3.8 Price trend analysis

- 3.9 Total cost of ownership (TCO) analysis

- 3.9.1 Hardware acquisition costs

- 3.9.2 Implementation and integration costs

- 3.9.3 Operational and maintenance costs

- 3.9.4 Training and support costs

- 3.10 Patent analysis

- 3.10.1 Patent portfolio analysis by technology area

- 3.10.2 Patent filing trends and innovation activity

- 3.10.3 Competitive patent intelligence

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Customer journey mapping

- 3.13.1 Awareness and discovery phase

- 3.13.2 Evaluation and selection phase

- 3.13.3 Implementation and integration phase

- 3.13.4 Operation and optimization phase

- 3.14 Return on investment (ROI) framework

- 3.14.1 ROI calculation methodologies

- 3.14.2 Payback period analysis

- 3.14.3 Net present value (NPV) models

- 3.14.4 Risk-adjusted returns

- 3.15 Investment and funding analysis

- 3.15.1 Venture capital trends

- 3.15.2 Strategic corporate investment

- 3.15.3 Government funding programs

- 3.15.4 M&A activity and valuations

- 3.15.5 IPO market dynamics

- 3.15.6 Private equity involvement

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Sensors & IoT devices

- 5.3 Edge computing devices

- 5.4 Connectivity & networking hardware

- 5.5 Actuators & control systems

- 5.6 High-performance computing / simulation hardware

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

- 6.4 Electric vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Vehicle design & development

- 7.3 Manufacturing & production optimization

- 7.4 Predictive maintenance

- 7.5 Autonomous vehicle testing

- 7.6 Supply chain & fleet management

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Cloud

- 8.3 On-premises

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Siemens

- 10.1.2 DSpace

- 10.1.3 NVIDIA

- 10.1.4 PTC

- 10.1.5 IBM

- 10.1.6 Bosch

- 10.1.7 Intel

- 10.1.8 NXP Semiconductors

- 10.1.9 General Electric

- 10.2 Regional Players

- 10.2.1 Keysight Technologies

- 10.2.2 Altair Engineering

- 10.2.3 ETAS

- 10.2.4 Vector Informatik

- 10.2.5 National Instruments

- 10.2.6 Ansys

- 10.2.7 Qualcomm

- 10.2.8 Continental

- 10.2.9 Molex

- 10.3 Emerging Players

- 10.3.1 Threedy

- 10.3.2 Neural Concept

- 10.3.3 Applied Intuition

- 10.3.4 Cognata

- 10.3.5 Luminar Technologies

- 10.3.6 Mobileye Global