|

市场调查报告书

商品编码

1885808

电动车固态电池市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Solid-State Battery for Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

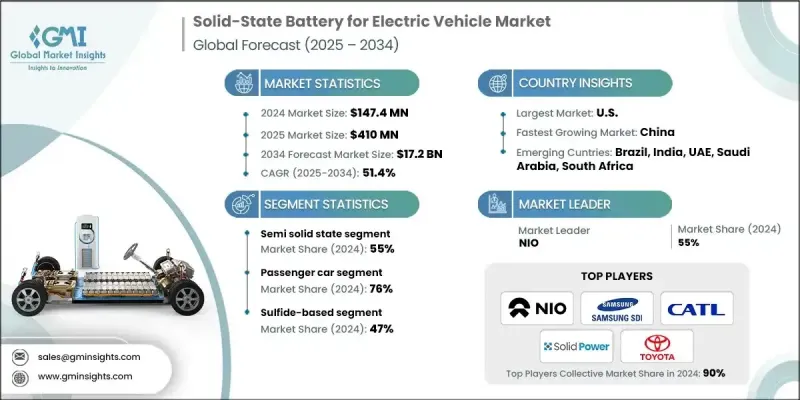

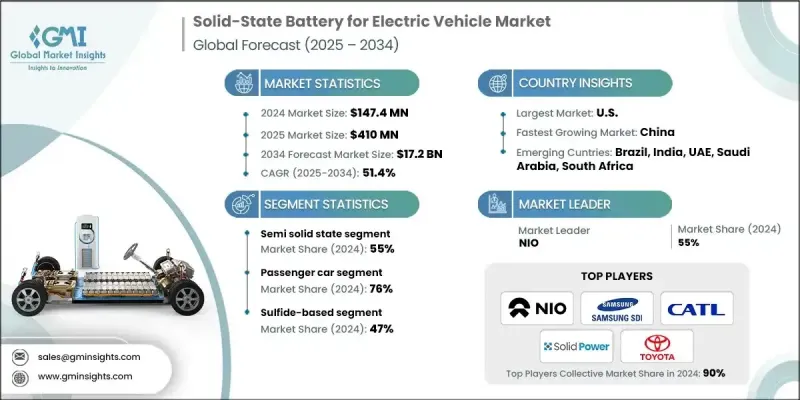

2024 年全球电动车固态电池市场价值为 1.474 亿美元,预计到 2034 年将以 51.4% 的复合年增长率增长至 172 亿美元。

对热失控、火灾隐患以及传统液态电解质锂离子电池固有限制的担忧,正促使汽车製造商探索更安全、更稳定的电池化学系统。固态电池无需易燃电解质,具有卓越的热稳定性,并能在极端温度下可靠运作。随着各国政府收紧电池安全法规,製造商也更加重视风险规避,市场对坚固耐用、抗碰撞的电池组的需求激增。汽车製造商正大力投资先进电池技术,以在不增加车辆重量的情况下延长续航里程。固态电池具有更高的能量密度、更薄的电池结构和更快的充电速度,推动了试点生产线的建设和战略供应合作。轻量化、长续航里程电动车的需求正在加速其商业化进程,而美国、欧洲、中国、日本和韩国等国的政府也正投入数十亿美元用于研发和生产,为新创公司和成熟製造商提供激励措施,从而降低风险。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.474亿美元 |

| 预测值 | 172亿美元 |

| 复合年增长率 | 51.4% |

2024年,半固态电池市占率达到55%,预计2025年至2034年将以50%的复合年增长率成长。半固态电池融合了传统液态电解质锂离子电池和全固态电池的优点,在提升安全性和能量密度的同时,仍能与现有製造流程相容。这种技术降低了生产成本,缩短了研发週期,使汽车製造商能够更快地推出新一代电池,加速中高阶电动车的普及应用。

2024年,乘用车市占率占比达76%,预计2025年至2034年将以51%的复合年增长率成长。消费者越来越期望电动车能够提供更长的续航里程,而无需频繁充电。固态电池能够使单次充电续航里程超过700至1000公里,从而缓解里程焦虑,并促进消费者对配备这些先进电池系统的紧凑型、中型和高端电动车的接受度。

美国电动车固态电池市场占86%的份额,预计2024年市场规模将达到4,970万美元。政府的各项倡议,例如工业研究法案(IRA)和美国能源部高级研究计画署(ARPA-E),正在推动电动车普及和电池创新的投资,支持固态电池的大规模研发和生产。这些项目正在助力电动车技术向更安全、更高性能方向快速转型。

电动车固态电池市场的主要参与者包括蔚来汽车、LG能源解决方案、Solid Power、比亚迪、宁德时代、丰田、国腾高科、Enovix、三星SDI和日产汽车。这些企业正透过投资先进研发来提升电池的能量密度、耐用性和安全性,从而巩固其市场地位。他们与汽车製造商和材料供应商建立策略合作关係,建立试点生产线,并扩大产能以满足不断增长的市场需求。地域扩张、确保关键原材料供应以及利用政府激励措施也是其核心策略。此外,各企业也致力于透过创新设计、更快的充电解决方案和紧凑的架构来提升电池性能,从而在快速发展的电动车电池领域巩固其竞争优势。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 高能量密度固体电解质的突破

- 全球对更安全的电动车电池技术的需求不断增长

- 原始OEM和政府在试验生产线上投入大量资金

- 转向续航里程更长、充电速度更快的电动车

- 策略伙伴关係与材料创新

- 产业陷阱与挑战

- 製造成本高,加工流程复杂。

- 超级工厂的可扩展性和良率问题

- 供应链成熟度有限

- 快速充电过程中的耐用性问题

- 市场机会

- 全球电动车渗透率不断提高。

- 锂金属和硅负极设计的进展

- 高端高性能电动车商业化

- 回收和循环经济路径

- 市场挑战

- 技术验证和现场测试要求

- 竞争激烈的下一代技术

- 原始设备製造商规避风险和保守的采纳时间表

- 标准化和互通性问题

- 单醣生产业熟练劳动力短缺

- 成长驱动因素

- 成长潜力分析

- 主要市场趋势和颠覆性因素

- 未来市场趋势

- 监管环境

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 目前技术

- 先进的阳极和阴极材料

- 用于热控制的热管理系统

- 高能量密度电池

- 可扩展的製造工艺

- 新兴技术

- 人工智慧赋能的电池设计与製造

- 自形成阳极技术

- 双电源和多化学架构

- 数位孪生与智慧製造

- 目前技术

- 专利分析

- 生产统计

- 生产中心

- 消费中心

- 进出口

- 价格趋势

- 按地区

- 透过推进

- 定价分析与价值链经济学

- 按材料细分市场分類的 SSB 定价趋势

- 成本结构细分

- 区域价格敏感性

- 成本細項分析

- 材料成本

- 製造和加工成本

- 品质控制和测试成本

- 包装和运输成本

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 全球贸易与进出口分析

- 按区域导入相依性

- 贸易法规和关税的影响

- 产品生命週期分析

- 预期循环寿命

- 日历寿命和劣化模式

- 性能保持时间

- 生命週期末期效能阈值

- 关键产业缺口及公司因应策略

- 技术差距

- 製造和可扩展性差距

- 供应链缺口

- 标准化和互通性差距

- 市场接受度差距

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依材料划分,2021-2034年

- 主要趋势

- 聚合物基

- 硫化物基

- 氧化物基

- 其他的

第六章:市场估算与预测:以推进方式划分,2021-2034年

- 主要趋势

- 纯电动车

- 插电式混合动力汽车

- 戊型肝炎病毒

第七章:市场估算与预测:依应用阶段划分,2021-2034年

- 主要趋势

- 原型/研发

- 试点规模部署

- 商业生产

第八章:市场估算与预测:依技术划分,2021-2034年

- 主要趋势

- 半固态

- 固态

第九章:市场估价与预测:依车辆类型划分,2021-2034年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车辆

- 轻型

- 中型

- 重负

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 新加坡

- 越南

- 泰国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球参与者

- BYD Company Limited

- CATL

- Factorial Energy

- Ganfeng Lithium

- General Motors

- Ilika plc

- LG Energy

- Panasonic Corporation

- PolyPlus Battery Company

- QuantumScape Corporation

- SAFT

- Samsung SDI

- SK Innovation

- Solid Power

- Toyota Motor Corporation

- Volkswagen Group

- 区域玩家

- Blue Solutions

- CALB

- EVE Energy

- Farasis Energy

- Gotion High-Tech

- Hyundai Motor Group

- Narada Power Source

- Nissan Motor

- ProLogium Technology

- Sakuu Corporation

- Sunwoda Electronic

- Svolt Energy Technology

- WeLion New Energy Technology

- 新兴参与者

- 阶乘能量

- 伊利卡公司

- 伊诺蝙蝠

- PolyPlus电池公司

- 佐久公司

- 威利昂新能源技术

The Global Solid-State Battery for Electric Vehicle Market was valued at USD 147.4 million in 2024 and is estimated to grow at a CAGR of 51.4% to reach USD 17.2 billion by 2034.

Concerns over thermal runaway, fire hazards, and the inherent limitations of conventional liquid-electrolyte lithium-ion batteries are pushing automakers to explore safer, more stable battery chemistries. Solid-state batteries eliminate flammable electrolytes, offer superior thermal stability, and perform reliably under extreme temperatures. With governments tightening battery safety regulations and manufacturers focusing on risk mitigation, the demand for robust, crash-resistant battery packs is surging. Automakers are investing heavily in advanced battery technologies to extend driving range without adding extra weight to vehicles. Solid-state batteries provide higher energy density, thinner cell structures, and faster charging, driving pilot production lines and strategic supply partnerships. The push toward lightweight, long-range EVs is accelerating commercialization, while governments in the US, Europe, China, Japan, and South Korea are investing billions in research, development, and production, providing incentives that reduce risks for startups and established manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $147.4 Million |

| Forecast Value | $17.2 Billion |

| CAGR | 51.4% |

The semi-solid-state segment held a 55% share in 2024 and is projected to grow at a 50% CAGR from 2025 to 2034. Semi-solid-state batteries bridge conventional liquid-electrolyte lithium-ion cells with fully solid-state designs, enhancing safety and energy density while remaining compatible with current manufacturing infrastructure. This approach reduces production costs, shortens timelines, and allows automakers to introduce next-generation battery performance faster, accelerating adoption in mid-range and premium EVs.

The passenger cars segment held a 76% share in 2024 and is expected to grow at a CAGR of 51% from 2025 to 2034. Customers increasingly expect EVs to deliver extended ranges without frequent charging. Solid-state batteries enable ranges exceeding 700 to 1,000 km per charge, alleviating range anxiety and boosting consumer adoption of compact, mid-size, and premium EVs equipped with these advanced battery systems.

US Solid-State Battery for Electric Vehicle Market held an 86% share, generating USD 49.7 million in 2024. Government initiatives like the IRA and ARPA-E are driving investment in electric vehicle adoption and battery innovation, supporting large-scale research, development, and manufacturing of solid-state batteries. These programs are enabling a swift transition to safer, higher-performance EV battery technologies.

Key players in the Solid-State Battery for Electric Vehicle Market include NIO, LG Energy Solution, Solid Power, BYD, CATL, Toyota, Gotion High-Tech, Enovix, Samsung SDI, and Nissan. Companies in the Solid-State Battery for Electric Vehicle Market are strengthening their position by investing in advanced R&D to enhance energy density, durability, and safety. They are forming strategic collaborations with automakers and material suppliers, establishing pilot production lines, and scaling manufacturing capacity to meet growing demand. Geographic expansion, securing critical raw materials, and leveraging government incentives are also central strategies. Additionally, firms focus on improving battery performance through innovative designs, faster charging solutions, and compact architectures to solidify their competitive advantage in the rapidly evolving EV battery landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material

- 2.2.3 Propulsion

- 2.2.4 Vehicle

- 2.2.5 Application Stage

- 2.2.6 Technology

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Breakthroughs in high-energy-density solid electrolytes

- 3.2.1.2 Rising global demand for safer EV battery technologies

- 3.2.1.3 Heavy OEM & government investments in pilot lines

- 3.2.1.4 Shift toward long-range EVs with ultra-fast charging

- 3.2.1.5 Strategic partnerships & material innovations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs & complex processing

- 3.2.2.2 Scalability & yield issues in gigafactories

- 3.2.2.3 Limited supply chain maturity

- 3.2.2.4 Durability issues during fast charging

- 3.2.3 Market opportunities

- 3.2.3.1 Growing global EV penetration

- 3.2.3.2 Advances in lithium-metal & silicon-anode design

- 3.2.3.3 Premium & performance EV commercialization

- 3.2.3.4 Recycling & circular economy pathways

- 3.2.4 Market Challenges

- 3.2.4.1 Technology validation & field testing requirements

- 3.2.4.2 Competing next-generation technologies

- 3.2.4.3 Oem risk aversion & conservative adoption timelines

- 3.2.4.4 Standardization & interoperability issues

- 3.2.4.5 Skilled workforce shortage for ssb manufacturing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current Technologies

- 3.9.1.1 Advanced anode and cathode materials

- 3.9.1.2 Thermal management systems for heat control

- 3.9.1.3 High-energy density cells

- 3.9.1.4 Scalable manufacturing processes

- 3.9.2 Emerging Technologies

- 3.9.2.1 AI-enabled battery design & manufacturing

- 3.9.2.2 Self-forming anode technologies

- 3.9.2.3 Dual-power & multi-chemistry architectures

- 3.9.2.4 Digital twin & smart manufacturing

- 3.9.1 Current Technologies

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Price trends

- 3.12.1 By region

- 3.12.2 By propulsion

- 3.13 Pricing analysis and value chain economics

- 3.13.1 SSB pricing trends by material segment

- 3.13.2 Cost structure breakdown

- 3.13.3 Regional price sensitivity

- 3.14 Cost breakdown analysis

- 3.14.1 Material costs

- 3.14.2 Manufacturing & processing costs

- 3.14.3 Quality control & testing costs

- 3.14.4 Packaging & transportation costs

- 3.15 Sustainability and environmental aspects

- 3.15.1 Sustainable practices

- 3.15.2 Waste reduction strategies

- 3.15.3 Energy efficiency in production

- 3.15.4 Eco-friendly initiatives

- 3.15.5 Carbon footprint considerations

- 3.16 Global trade and import/export analysis

- 3.16.1 Import dependencies by region

- 3.16.2 Trade regulations and tariff impact

- 3.17 Product lifecycle analysis

- 3.17.1 Expected cycle life

- 3.17.2 Calendar life & degradation patterns

- 3.17.3 Performance retention over time

- 3.17.4 End-of-life performance thresholds

- 3.18 Critical industry gaps & company response strategies

- 3.18.1 Technology gaps

- 3.18.2 Manufacturing & scalability gaps

- 3.18.3 Supply chain gaps

- 3.18.4 Standardization & interoperability gaps

- 3.18.5 Market adoption gaps

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Polymer-based

- 5.3 Sulfide-based

- 5.4 Oxide-based

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 PHEV

- 6.4 HEV

Chapter 7 Market Estimates & Forecast, By Application Stage, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Prototype / R&D

- 7.3 Pilot-scale deployment

- 7.4 Commercial production

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units, Fleet Size)

- 8.1 Key trends

- 8.2 Semi-solid state

- 8.3 Solid state

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 Hatchback

- 9.2.2 Sedan

- 9.2.3 SUV

- 9.3 Commercial vehicles

- 9.3.1 Light duty

- 9.3.2 Medium duty

- 9.3.3 Heavy duty

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Singapore

- 10.4.7 Vietnam

- 10.4.8 Thailand

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 BYD Company Limited

- 11.1.2 CATL

- 11.1.3 Factorial Energy

- 11.1.4 Ganfeng Lithium

- 11.1.5 General Motors

- 11.1.6 Ilika plc

- 11.1.7 LG Energy

- 11.1.8 Panasonic Corporation

- 11.1.9 PolyPlus Battery Company

- 11.1.10 QuantumScape Corporation

- 11.1.11 SAFT

- 11.1.12 Samsung SDI

- 11.1.13 SK Innovation

- 11.1.14 Solid Power

- 11.1.15 Toyota Motor Corporation

- 11.1.16 Volkswagen Group

- 11.2 Regional players

- 11.2.1.1 Blue Solutions

- 11.2.1.2 CALB

- 11.2.1.3 EVE Energy

- 11.2.1.4 Farasis Energy

- 11.2.1.5 Gotion High-Tech

- 11.2.1.6 Hyundai Motor Group

- 11.2.1.7 Narada Power Source

- 11.2.1.8 Nissan Motor

- 11.2.1.9 ProLogium Technology

- 11.2.1.10 Sakuu Corporation

- 11.2.1.11 Sunwoda Electronic

- 11.2.1.12 Svolt Energy Technology

- 11.2.1.13 WeLion New Energy Technology

- 11.3 Emerging Players

- 11.3.1 Factorial Energy

- 11.3.2 Ilika plc

- 11.3.3 InoBat

- 11.3.4 PolyPlus Battery Company

- 11.3.5 Sakuu Corporation

- 11.3.6 WeLion New Energy Technology