|

市场调查报告书

商品编码

1885891

发酵衍生蛋白市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Fermentation-Derived Proteins Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

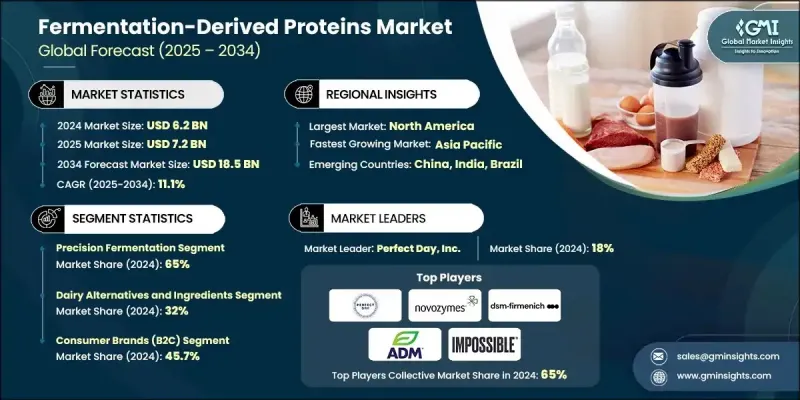

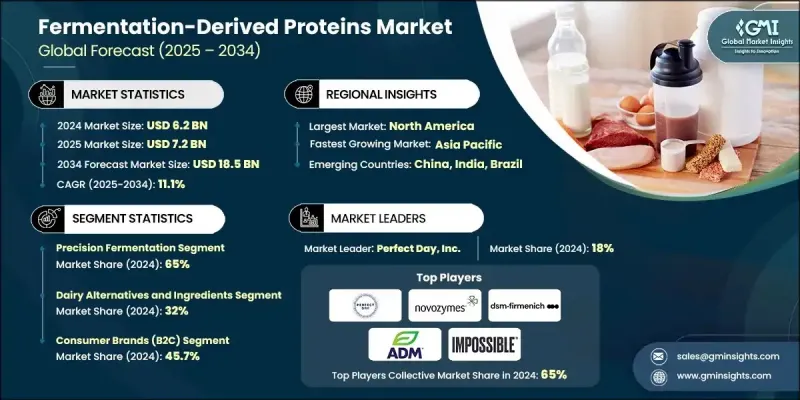

2024 年全球发酵衍生蛋白质市场价值为 62 亿美元,预计到 2034 年将以 11.1% 的复合年增长率增长至 185 亿美元。

随着气候压力加剧,食品业加速摆脱传统畜牧业,整个蛋白质格局正日益向发酵系统转型。随着企业扩大生产规模,生产出能够复製乳製品、肉类和蛋类蛋白特性的替代品,发酵技术的商业应用迅速扩展。投资流入巩固了Quorn、Impossible Foods和Perfect Day等领先创新者的市场地位,而包括ADM和DSM-Firmenich在内的全球主要食品集团也深化了合作,以提高产业整合度。包括减少温室气体排放和提高土地利用效率在内的永续性议题推动了这项转型,2021年后发表的研究不断证明,与传统畜牧系统相比,发酵蛋白具有环境优势。公众对抗生素使用和人畜共患病风险的讨论,进一步激发了人们对发酵技术的兴趣,将其视为气候和粮食安全政策规划中的一项战略组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 62亿美元 |

| 预测值 | 185亿美元 |

| 复合年增长率 | 11.1% |

到了2024年,精准发酵领域占据65%的市场份额,预计到2034年将以10.9%的复合年增长率成长。企业依靠精准发酵、生物质发酵和传统发酵平台来开发高功能性蛋白质,这些蛋白质能够提供必要的起泡、凝胶和熔化特性。这些成分被寻求清洁标籤配方、改善质地、感官性能和营养价值的消费品公司所采用。

2024年,乳製品替代品和配料应用领域占据32%的市场份额,预计到2034年将以8.6%的复合年增长率成长。发酵衍生的配料在饮料、烘焙食品、肉类替代品和乳製品替代品等品类中,其性能可与动物性蛋白质媲美甚至超越动物性蛋白质。品牌将这些蛋白质融入产品中,以改善口感、增强乳化效果、简化成分錶并满足监管标准,尤其是在酱料、冷冻甜点和即饮配方等产品中。

2024年北美发酵蛋白市场规模为23亿美元,预计2034年将达69亿美元。该地区受益于强大的研发基础设施、早期商业化途径、强劲的风险投资活动以及开放的分销网络,这些都加速了替代乳製品、鸡蛋和肉类产品的普及。

全球发酵蛋白市场的主要活跃企业包括:The Better Meat Co.、ADM(Archer Daniels Midland)、奇华顿(Givaudan)、杜邦(IFF)、Solar Foods Oy、Perfect Day, Inc.、TurtleTree Labs、Quorn Foods、Kerry Group、Standing Ovation、诺维信A/S)、帝斯曼-菲美意(DSM-Firmenich)、嘉吉(Cargill)、Calysta、Onego Bio、Impossible Foods Inc.、Nature's Fynd、Formo、EVERY Company 和 Corbion。这些企业正透过积极扩张产能、产品多元化以及与大型食品饮料生产商建立长期合作关係来巩固其竞争地位。许多企业正在开发专有发酵菌株,以提高产量、降低成本并创造差异化的功能性蛋白质。与原料供应商和消费品品牌进行策略合作,有助于加速配方推广,同时增强供应链的稳定性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对可持续、不含动物成分的蛋白质解决方案的需求日益增长

- 精准发酵和菌株工程技术的进展

- 与全球食品饮料企业建立策略伙伴关係

- 产业陷阱与挑战

- 高生产力和资本支出要求

- 监管不确定性和审批流程缓慢

- 市场机会

- 企业环境与ESG承诺的改善

- 新兴市场和应用中的未开发潜力

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按来源

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依发酵製程划分,2021-2034年

- 主要趋势

- 精准发酵

- 乳蛋白

- 鸡蛋蛋白

- 功能性和特殊性蛋白质

- 风味和香气蛋白/化合物

- 生物质发酵

- 真菌蛋白

- 酵母或细菌基生物质

- 利用气体或非常规原料製备单细胞蛋白

- 传统/混合发酵

- 发酵植物蛋白基质

- 利用动物或植物原料进行混合发酵

第六章:市场估算与预测:依应用领域划分,2021-2034年

- 主要趋势

- 乳製品替代品和配料

- 鸡蛋替代品和功能性鸡蛋成分

- 肉类和海鲜替代品

- 麵包店、糖果店和甜点店

- 饮料和营养产品

- 食品服务及工业原料

第七章:市场估计与预测:依配销通路划分,2021-2034年

- 主要趋势

- 消费品牌(B2C)

- 原料配方供应商(B2B)

- 合约研发生产组织(CDMO)

- 饲料和宠物食品製造商

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Perfect Day, Inc.

- The EVERY Company

- Impossible Foods Inc.

- Nature's Fynd

- The Better Meat Co.

- Solar Foods Oy

- TurtleTree Labs

- Formo

- Onego Bio

- Standing Ovation

- Quorn Foods

- Givaudan (including Naturals & Ingredients)

- Novozymes A/S

- ADM (Archer Daniels Midland)

- DSM-Firmenich

- Kerry Group

- Cargill

- Corbion

- DuPont (IFF)

- Calysta

The Global Fermentation-Derived Proteins Market was valued at USD 6.2 billion in 2024 and is estimated to grow at a CAGR of 11.1% to reach USD 18.5 billion by 2034.

The broader protein landscape is increasingly shifting toward fermentation-based systems as climate pressures intensify and the food sector accelerates its move away from conventional animal agriculture. Commercial adoption of fermentation technologies has expanded rapidly as companies scale production of alternatives that replicate the characteristics of dairy, meat, and egg proteins. Investment inflows have strengthened the market presence of leading innovators such as Quorn, Impossible Foods, and Perfect Day, while major global food groups-including ADM and DSM-Firmenich have deepened collaboration to improve industrial integration. Sustainability concerns, including greenhouse gas reduction and land-use efficiency, have supported the transition, as research published after 2021 consistently demonstrates the environmental advantages of fermentation-derived proteins compared to traditional livestock systems. Public conversations about antibiotic use and zoonotic risks have driven further interest in fermentation technologies as a strategic component in climate and food-security policy planning.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.2 Billion |

| Forecast Value | $18.5 Billion |

| CAGR | 11.1% |

The precision fermentation segment held a 65% share in 2024 and is estimated to grow at a CAGR of 10.9% through 2034. Companies rely on precision, biomass, and traditional fermentation platforms to develop highly functional proteins that provide essential foaming, gelling, and melting characteristics. These ingredients are adopted by consumer product firms seeking clean-label reformulations with improved texture, sensory performance, and nutritional value.

The dairy alternatives and ingredient applications segment accounted for a 32% share in 2024 and is expected to grow at an 8.6% CAGR toward 2034. Fermentation-derived ingredients can match or exceed the performance of animal-based proteins across categories such as beverages, baked goods, meat substitutes, and dairy alternatives. Brands integrate these proteins into products to enhance mouthfeel, strengthen emulsification, simplify ingredient lists, and meet regulatory standards, especially in items like sauces, frozen desserts, and ready-to-drink formulations.

North America Fermentation-Derived Proteins Market generated USD 2.3 billion in 2024 and is forecast to reach USD 6.9 billion by 2034. The region benefits from strong R&D infrastructure, early commercialization pathways, robust venture capital activity, and receptive distribution networks that accelerate adoption across alternative dairy, egg, and meat products.

Key companies active in the Global Fermentation-Derived Proteins Market include The Better Meat Co., ADM (Archer Daniels Midland), Givaudan, DuPont (IFF), Solar Foods Oy, Perfect Day, Inc., TurtleTree Labs, Quorn Foods, Kerry Group, Standing Ovation, Novozymes A/S, DSM-Firmenich, Cargill, Calysta, Onego Bio, Impossible Foods Inc., Nature's Fynd, Formo, EVERY Company, and Corbion. Companies in the Fermentation-Derived Proteins Market are strengthening their competitive position through aggressive capacity expansion, product diversification, and long-term partnerships with major food and beverage manufacturers. Many are developing proprietary fermentation strains to improve yield, reduce cost, and create differentiated functional proteins. Strategic collaborations with ingredient suppliers and CPG brands help accelerate formulation adoption while reinforcing supply chain stability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fermentation Process

- 2.2.3 Application

- 2.2.4 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for sustainable, animal-free protein solutions

- 3.2.1.2 Advances in precision fermentation and strain engineering

- 3.2.1.3 Strategic partnerships with global food and beverage players

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production and capital expenditure requirements

- 3.2.2.2 Regulatory uncertainty and slow approval pathways

- 3.2.3 Market opportunities

- 3.2.3.1 Rising corporate climate and ESG commitments

- 3.2.3.2 Untapped potential in emerging markets and applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Source

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Fermentation Process, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Precision fermentation

- 5.2.1 Dairy proteins

- 5.2.2 Egg proteins

- 5.2.3 Functional and specialty proteins

- 5.2.4 Flavor and aroma proteins/compounds

- 5.3 Biomass fermentation

- 5.3.1 Mycoprotein

- 5.3.2 Yeast- or bacterial-based biomass

- 5.3.3 Single-cell protein from gases or unconventional feedstocks

- 5.3.4 Traditional / mixed fermentation

- 5.3.5 Fermented plant-based protein matrices

- 5.3.6 Hybrid fermentation with animal or plant inputs

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dairy alternatives and ingredients

- 6.3 Egg alternatives and functional egg ingredients

- 6.4 Meat and seafood alternatives

- 6.5 Bakery, confectionery, and desserts

- 6.6 Beverages and nutrition products

- 6.7 Food service and industrial ingredients

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Consumer brands (B2C)

- 7.3 Ingredient and formulation suppliers (B2B)

- 7.4 Contract development and manufacturing organizations (CDMOs)

- 7.5 Feed and pet food manufacturers

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Perfect Day, Inc.

- 9.2 The EVERY Company

- 9.3 Impossible Foods Inc.

- 9.4 Nature’s Fynd

- 9.5 The Better Meat Co.

- 9.6 Solar Foods Oy

- 9.7 TurtleTree Labs

- 9.8 Formo

- 9.9 Onego Bio

- 9.10 Standing Ovation

- 9.11 Quorn Foods

- 9.12 Givaudan (including Naturals & Ingredients)

- 9.13 Novozymes A/S

- 9.14 ADM (Archer Daniels Midland)

- 9.15 DSM-Firmenich

- 9.16 Kerry Group

- 9.17 Cargill

- 9.18 Corbion

- 9.19 DuPont (IFF)

- 9.20 Calysta