|

市场调查报告书

商品编码

1885915

锂离子电池回收市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Lithium-Ion Battery Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

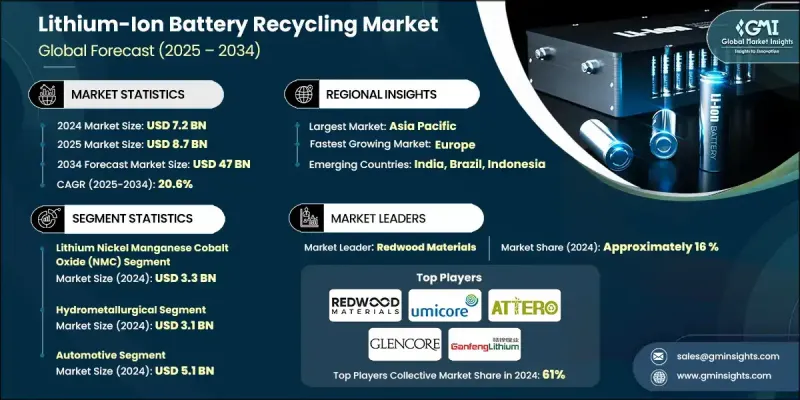

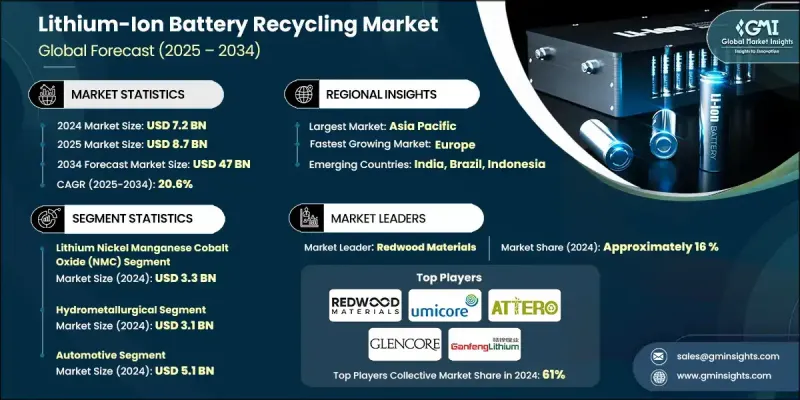

2024 年全球锂离子电池回收市场价值为 72 亿美元,预计到 2034 年将以 20.6% 的复合年增长率成长至 470 亿美元。

该产业已迅速从专业的环保服务转型为全球清洁能源供应链的核心环节。过去几年,湿式冶金製程因其能够比传统冶炼更精确地回收锂、钴、镍等高价值金属而成为首选方案。更新的监管框架进一步推动了这一转变,其中包括奖励金属回收效率高的回收商的全球新规,从而鼓励更广泛地采用水基精炼技术。此外,作为金属提取中间体的黑料的生产和贸易也呈现强劲成长势头。小型回收商越来越多地参与这一领域,向大型湿式冶金精炼厂供应黑料。随着电动车、储能项目和製造业废弃物产生的电池废弃物数量不断增长,预计该市场将在预测期内加速扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 72亿美元 |

| 预测值 | 470亿美元 |

| 复合年增长率 | 20.6% |

2024年,湿式冶金市场规模达31亿美元,预计2034年将以20.9%的复合年增长率成长,达到全球市场份额的36.1%。湿式冶金的优点在于其更高的回收效率、更低的排放以及超过90%的关键金属回收率。生产商正在扩大水基精炼设施的规模,以满足日益增长的可持续发展需求并增强其金属回收能力。

2024年,汽车产业市场规模达51亿美元,预计2025年至2034年将以20.5%的复合年增长率成长,占全球市场份额的71.2%。大多数可回收的锂离子电池来自电动车及相关製造活动。随着全球电动车产量的不断增长,废弃电池和缺陷电池的数量持续增加,使得汽车产业成为回收供应链和产业长期成长的关键贡献者。

2024年,美国锂离子电池回收市场规模预计将达12.1亿美元。该国市场成长得益于大规模回收项目,这些项目得到了政策激励、资金支持以及国内电池製造业扩张的推动。联邦和州政府的支持正在加速主要生产设施附近回收中心的建设,从而加强锂、镍和钴等关键金属的回收利用。

活跃于锂离子电池回收市场的主要公司包括Redwood Materials、赣锋锂业、优美科、嘉能可和Attero Recycling。这些公司正在实施多种策略以巩固市场地位并扩大竞争优势。许多公司正大力投资湿式冶金产能,以提高回收率并减少对环境的影响,同时也透过自动化和先进的分离技术对现有设施进行现代化改造。各公司正与电动车製造商和电池生产商签订长期供应协议,以确保稳定的废料来源。与政府机构的策略合作有助于为大规模回收项目争取资金和监管支持。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基准估算和计算

- 基准年计算

- 市场估算的关键趋势

- 初步研究和验证

- 原始资料

- 预测模型

- 研究假设和局限性

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(註:仅提供重点国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依化学品类别划分,2025-2034年

- 主要趋势

- 锂镍锰钴氧化物(NMC)

- 磷酸铁锂(LFP)

- 钴酸锂(LCO)

- 其他的

第六章:市场估算与预测:依製程划分,2025-2034年

- 主要趋势

- 火法冶金

- 湿式冶金

- 物理/机械

第七章:市场估计与预测:依来源划分,2025-2034年

- 主要趋势

- 汽车

- 商用车辆(电动巴士、货车)

- 非公路用电动车(建筑、矿业车队)

- 电池製造废弃物(大型工厂和次品)

- 乘用电动车(纯电动车和插电式混合动力车)

- 非汽车

- 电动工具及工业电子产品(无线电钻、UPS电源)

- 固定式储能係统(电网和住宅)

- 微型交通工具(电动滑板车、自行车、无人机)

- 消费性电子产品(智慧型手机、笔记型电脑、平板电脑)

第八章:市场估算与预测:依地区划分,2025-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- 3R Recycler

- ACE Green Recycling

- American Battery Technology Company

- Attero Recycling

- BatX Energies

- Cirba Solutions

- Ganfeng Lithium

- Glencore

- Li-Cycle Holdings Corporation

- Lohum Cleantech

- Neometals

- RecycLiCo Battery Material

- Redwood Materials

- SK TES

- Umicore

The Global Lithium-Ion Battery Recycling Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 20.6% to reach USD 47 billion by 2034.

The industry has rapidly shifted from a specialized environmental service to a central part of the clean energy supply chain worldwide. Over the past few years, hydrometallurgical processes have become the preferred option due to their ability to recover high-value metals such as lithium, cobalt, and nickel with far greater precision than conventional smelting. This transition is further supported by updated regulatory frameworks, including new global rules that reward recyclers achieving high metal recovery efficiencies, encouraging wider adoption of water-based refining technologies. The industry is also experiencing strong momentum in the production and trade of black mass, which serves as an intermediate material for further metal extraction. Smaller recyclers are increasingly participating in this segment by supplying black mass to larger hydrometallurgical refiners. With the growing volume of battery waste generated from electric mobility, energy storage projects, and manufacturing scrap, the market is positioned for accelerated expansion throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $47 Billion |

| CAGR | 20.6% |

The hydrometallurgical segment was valued at USD 3.1 billion in 2024 and is forecast to grow at a 20.9% CAGR through 2034, reaching 36.1% of the global market. The shift toward hydrometallurgy is driven by its higher recovery efficiency, lower emissions profile, and ability to reclaim more than 90% of critical metals. Producers are scaling up water-based refining facilities to align with rising sustainability expectations and strengthen their metal recovery capabilities.

The automotive segment was valued at USD 5.1 billion in 2024 and is projected to grow at a 20.5% CAGR from 2025 to 2034, accounting for a 71.2% share. Most recyclable lithium-ion batteries originate from electric vehicles and related manufacturing activities. As EV production expands globally, the availability of end-of-life and defective batteries continues to increase, making the automotive sector a key contributor to recycling supply streams and long-term industry growth.

U.S. Lithium-Ion Battery Recycling Market generated USD 1.21 billion in 2024. Growth in the country is supported by large-scale recycling projects backed by policy incentives, funding programs, and expanding domestic battery manufacturing. Federal and state-level support is accelerating the development of recycling hubs near major production facilities, reinforcing the recovery of essential metals such as lithium, nickel, and cobalt.

Major companies active in the Lithium-Ion Battery Recycling Market include Redwood Materials, Ganfeng Lithium, Umicore, Glencore, and Attero Recycling. Companies in the Lithium-Ion Battery Recycling Market are implementing multiple strategies to strengthen their presence and expand their competitive advantage. Many are investing heavily in hydrometallurgical capacity to improve recovery rates and reduce environmental impact, while also modernizing facilities with automation and advanced separation technologies. Firms are forging long-term supply agreements with EV manufacturers and battery producers to secure consistent waste streams. Strategic collaborations with government agencies help unlock funding and regulatory support for large-scale recycling initiatives.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Chemistry

- 2.2.3 Process

- 2.2.4 Source

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Chemistry, 2025 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Lithium Nickel Manganese Cobalt Oxide (NMC)

- 5.3 Lithium Iron Phosphate (LFP)

- 5.4 Lithium Cobalt Oxide (LCO)

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Process, 2025 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Pyrometallurgical

- 6.3 Hydrometallurgical

- 6.4 Physical/Mechanical

Chapter 7 Market Estimates and Forecast, By Source, 2025 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.2.1 Commercial vehicles (electric buses, vans)

- 7.2.2 Off-road electric vehicles (construction, mining fleets)

- 7.2.3 Battery manufacturing scrap (giga factories and rejects)

- 7.2.4 Passenger electric vehicles (BEVs and PHEVs)

- 7.3 Non-Automotive

- 7.3.1 Power tools and industrial electronics (cordless drills, UPS units)

- 7.3.2 Stationary energy storage systems (grid and residential)

- 7.3.3 Micromobility devices (e-scooters, bikes, drones)

- 7.3.4 Consumer electronics (smartphones, laptops, tablets)

Chapter 8 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 3R Recycler

- 9.2 ACE Green Recycling

- 9.3 American Battery Technology Company

- 9.4 Attero Recycling

- 9.5 BatX Energies

- 9.6 Cirba Solutions

- 9.7 Ganfeng Lithium

- 9.8 Glencore

- 9.9 Li-Cycle Holdings Corporation

- 9.10 Lohum Cleantech

- 9.11 Neometals

- 9.12 RecycLiCo Battery Material

- 9.13 Redwood Materials

- 9.14 SK TES

- 9.15 Umicore