|

市场调查报告书

商品编码

1892648

智慧物流平台市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Smart Logistics Platforms Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

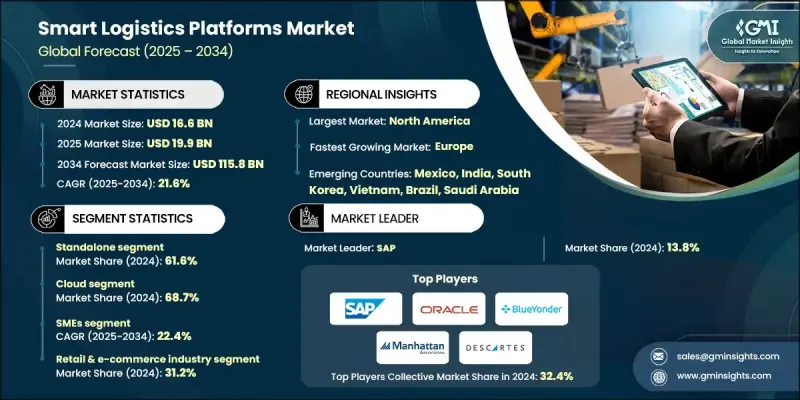

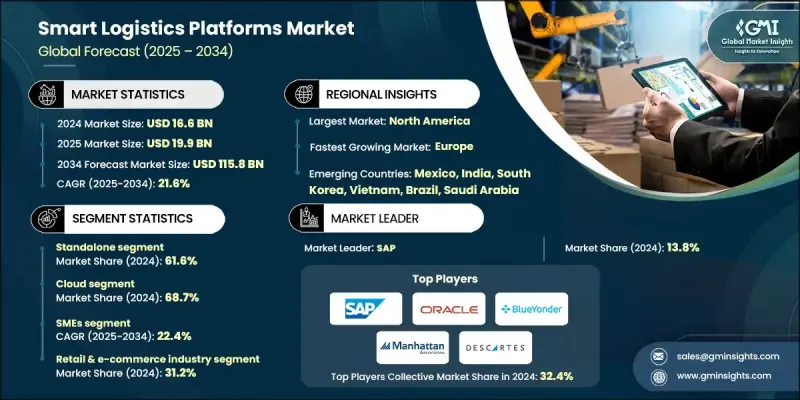

2024 年全球智慧物流平台市场价值为 166 亿美元,预计到 2034 年将以 21.6% 的复合年增长率成长至 1,158 亿美元。

全球贸易的扩张推动了对先进物流解决方案的需求,包括车队管理、即时追踪、路线优化、库存控制和仓库管理。企业正越来越多地采用这些平台来简化营运、提高效率并增强复杂供应链的透明度。企业可以选择整合解决方案(在单一平台上提供多种功能)或独立解决方案(专注于根据营运需求量身定制的特定任务)。人工智慧和机器学习透过优化路线、改善预测分析、加强安全性和防范网路威胁,进一步加速了市场成长。由于对全球出口的大量投资,北美和欧洲预计将继续保持领先地位,而亚太地区在出口导向经济体扩张的推动下,正崛起为成长最快的市场。中国、美国和德国在全球贸易中占据主导地位,因此对能够有效管理国际供应链的创新物流解决方案有着强劲的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 166亿美元 |

| 预测值 | 1158亿美元 |

| 复合年增长率 | 21.6% |

2024年,独立式物流解决方案占了61.6%的市占率。其受欢迎的原因在于部署速度更快、初始成本更低,并且无需完全系统整合即可处理特定的物流功能,例如路线优化、车队监控和仓库视觉化。这些解决方案可客製化、易于实施,是需要快速获得明确结果的企业的理想选择。

到2024年,云端部署领域将占据68.7%的市场。云端平台因其即时追踪、可扩展营运和人工智慧驱动的分析功能而广受欢迎。它们能够实现合作伙伴之间的无缝协作,增强供应链的透明度,并使物流供应商能够在无需庞大本地基础设施的情况下有效应对需求波动。

2024年,美国智慧物流平台市场规模达69亿美元。高昂的物流成本占国民生产总值的8-10%以上,推动了人工智慧平台的普及,这些平台可以优化路线、减少资源浪费并提高营运效率。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 电子商务成长与全通路履约需求

- 供应链可视性和韧性的必要性

- 劳动力短缺与自动化应用

- 云端采用和数位转型势在必行

- 产业陷阱与挑战

- 高昂的初始实施成本和总体拥有成本 (TCO) 问题

- 资料安全和隐私合规负担

- 市场机会

- 自主物流与人机混合网络

- 用于营运辅助的生成式人工智慧

- 最后一公里配送创新

- 内陆及最不发达国家(LDC)物流数位化

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 技术路线图与演进

- 技术采纳生命週期分析

- 价格趋势

- 按地区

- 副产品

- 专利分析

- 网路安全与资料治理格局

- 客户痛点及工作流程优化分析

- 可视性差距和即时追踪挑战

- 人工流程和资料输入效率低下

- 承运能力限制和货运采购

- 最后一公里配送成本与顾客体验

- 库存准确性和仓库劳动生产力

- 个案研究和实施成功指标

- 最佳情况

- 数位转型经济学与总拥有成本分析

- 云端迁移成本效益分析

- SaaS 与永久授权总体拥有成本比较

- 实施成本和专业服务

- 变革管理与培训投资

- 网路安全架构与资料隐私框架

- 云端安全和多租户隔离

- 资料加密

- 身分与存取管理 (IAM)

- GDPR、CCPA 和跨境资料法规

- 供应炼网路威胁及攻击途径

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

- 供应商选择标准

- 供应链及合作伙伴生态系分析

第五章:市场估算与预测:依解法划分,2021-2034年

- 独立版

- 融合的

第六章:市场估算与预测:依部署模式划分,2021-2034年

- 现场

- 云

- 私有云端

- 公共云端

- 混合云端

- 杂交种

第七章:市场估算与预测:依企业规模划分,2021-2034年

- 中小企业

- 大型企业

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 零售与电子商务

- 製造业

- 第三方物流

- 食品和饮料

- 製药

- 其他的

第九章:市场估计与预测:依地区划分,2021-2034年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 新加坡

- 马来西亚

- 印尼

- 越南

- 泰国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 全球公司

- Manhattan Associates

- SAP

- Oracle

- Blue Yonder

- Uber Freight

- Kinaxis

- E2 open

- Infor

- Descartes Systems

- HighJump

- Magaya Supply Chain

- LogiNext Mile

- Alpega

- Honeywell

- 区域公司

- Project44

- FourKites

- CH Robinson Worldwide

- XPO Logistics

- JB Hunt Transport Services

- Transporeon

- Trimble Transportation

- Samsara

- 新兴公司

- Flexport

- Convoy

- Waymo Via

- Starship Technologies

- Waabi

- Nuro

- Loadsmart

The Global Smart Logistics Platforms Market was valued at USD 16.6 billion in 2024 and is estimated to grow at a CAGR of 21.6% to reach USD 115.8 billion by 2034.

The expansion of global trade is fueling the need for advanced logistics solutions, including fleet management, live tracking, route optimization, inventory control, and warehouse management. Companies are increasingly adopting these platforms to streamline operations, enhance efficiency, and improve visibility across complex supply chains. Businesses can choose between integrated solutions, which offer multiple functionalities within a single platform, and standalone solutions, which focus on specific tasks tailored to operational requirements. Artificial intelligence and machine learning are further accelerating market growth by optimizing routes, improving predictive analytics, strengthening security, and preventing cyber threats. North America and Europe are expected to remain leaders due to substantial investments in global exports, while the Asia-Pacific region is emerging as the fastest-growing market, driven by the expansion of export-oriented economies. China, followed by the U.S. and Germany, dominates global trade, creating strong demand for innovative logistics solutions to manage international supply chains effectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.6 Billion |

| Forecast Value | $115.8 Billion |

| CAGR | 21.6% |

The standalone segment held a 61.6% share in 2024. Its popularity is attributed to faster deployment, lower initial costs, and the ability to handle specific logistics functions such as route optimization, fleet monitoring, and warehouse visibility without full system integration. These solutions are customizable, easy to implement, and ideal for businesses requiring quick, focused results.

The cloud deployment segment held a 68.7% share in 2024. Cloud platforms are widely preferred for their real-time tracking, scalable operations, and AI-driven analytics. They enable seamless collaboration among partners, enhance supply chain visibility, and allow logistics providers to respond effectively to fluctuating demand without heavy on-premises infrastructure.

U.S. Smart Logistics Platforms Market reached USD 6.9 billion in 2024. High logistics costs, which account for more than 8-10% of the national GDP, have driven the adoption of AI-powered platforms that optimize routes, reduce resource waste, and improve operational efficiency.

Key players in the Smart Logistics Platforms Market include Blue Yonder, SAP, Oracle, Manhattan Associates, Descartes Systems, LogiNext Mile, Honeywell, Magaya Supply Chain, Alpega, and Infor. Companies in the Global Smart Logistics Platforms Market are focusing on AI and ML integration to enhance predictive analytics, optimize fleet management, and strengthen cybersecurity. Cloud-based platform development is prioritized to improve scalability, real-time collaboration, and global supply chain visibility. Strategic partnerships with logistics providers, manufacturers, and technology firms help expand market reach and foster innovation. Firms are investing in R&D to introduce customizable and modular solutions that meet diverse client needs. Market players are also emphasizing digital transformation, offering IoT-enabled platforms to track shipments, monitor inventory, and reduce operational inefficiencies.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Solution

- 2.2.3 Deployment model

- 2.2.4 Enterprise size

- 2.2.5 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 E-Commerce growth & omnichannel Fulfilment demands

- 3.2.1.2 Supply chain visibility & resilience imperatives

- 3.2.1.3 Labor shortages & automation adoption

- 3.2.1.4 Cloud adoption & digital transformation mandates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial implementation costs & TCO concerns

- 3.2.2.2 Data security & privacy compliance burden

- 3.2.3 Market opportunities

- 3.2.3.1 Autonomous logistics & hybrid human-robot networks

- 3.2.3.2 Generative AI for operational assistance

- 3.2.3.3 Last-mile delivery innovation

- 3.2.3.4 Landlocked & least developed country (LDC) logistics digitization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology roadmaps & evolution

- 3.7.4 Technology adoption lifecycle analysis

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Patent analysis

- 3.10 Cybersecurity & data governance landscape

- 3.11 Customer pain points & workflow optimization analysis

- 3.11.1 Visibility gap & real-time tracking challenges

- 3.11.2 Manual processes & data entry inefficiencies

- 3.11.3 Carrier capacity constraints & freight procurement

- 3.11.4 Last-Mile delivery cost & customer experience

- 3.11.5 Inventory accuracy & warehouse labor productivity

- 3.12 Case studies & implementation success metrics

- 3.13 Best case scenarios

- 3.14 Digital transformation economics & TCO analysis

- 3.14.1 Cloud migration cost-benefit analysis

- 3.14.2 SaaS vs perpetual license TCO comparison

- 3.14.3 Implementation costs & professional services

- 3.14.4 Change management & training investments

- 3.15 Cybersecurity architecture & data privacy framework

- 3.15.1 Cloud security & multi-tenant isolation

- 3.15.2 Data Encryption

- 3.15.3 Identity & access management (IAM)

- 3.15.4 GDPR, CCPA & cross-border data regulations

- 3.15.5 Supply chain cyber threats & attack vectors

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Vendor selection criteria

- 4.8 Supply chain & partner ecosystem analysis

Chapter 5 Market Estimates & Forecast, By Solution, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Standalone

- 5.3 Integrated

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

- 6.3.1 Private Cloud

- 6.3.2 Public Cloud

- 6.3.3 Hybrid Cloud

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large Enterprises

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Retail & E-commerce

- 8.3 Manufacturing

- 8.4 Third party logistics

- 8.5 Food & Beverage

- 8.6 Pharmaceuticals

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Singapore

- 9.4.7 Malaysia

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.4.10 Thailand

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 Manhattan Associates

- 10.1.2 SAP

- 10.1.3 Oracle

- 10.1.4 Blue Yonder

- 10.1.5 Uber Freight

- 10.1.6 Kinaxis

- 10.1.7. E2 open

- 10.1.8 Infor

- 10.1.9 Descartes Systems

- 10.1.10 HighJump

- 10.1.11 Magaya Supply Chain

- 10.1.12 LogiNext Mile

- 10.1.13 Alpega

- 10.1.14 Honeywell

- 10.2 Regional companies

- 10.2.1 Project44

- 10.2.2 FourKites

- 10.2.3 C.H. Robinson Worldwide

- 10.2.4 XPO Logistics

- 10.2.5 J.B. Hunt Transport Services

- 10.2.6 Transporeon

- 10.2.7 Trimble Transportation

- 10.2.8 Samsara

- 10.3 Emerging companies

- 10.3.1 Flexport

- 10.3.2 Convoy

- 10.3.3 Waymo Via

- 10.3.4 Starship Technologies

- 10.3.5 Waabi

- 10.3.6 Nuro

- 10.3.7 Loadsmart