|

市场调查报告书

商品编码

1892682

往復式柱塞泵市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Reciprocating Plunger Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

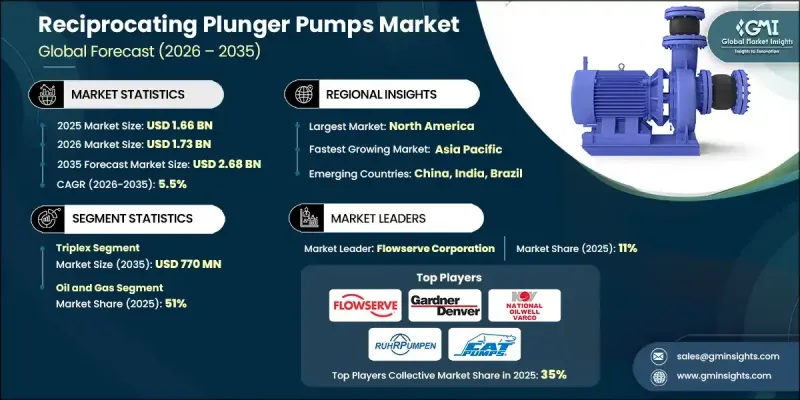

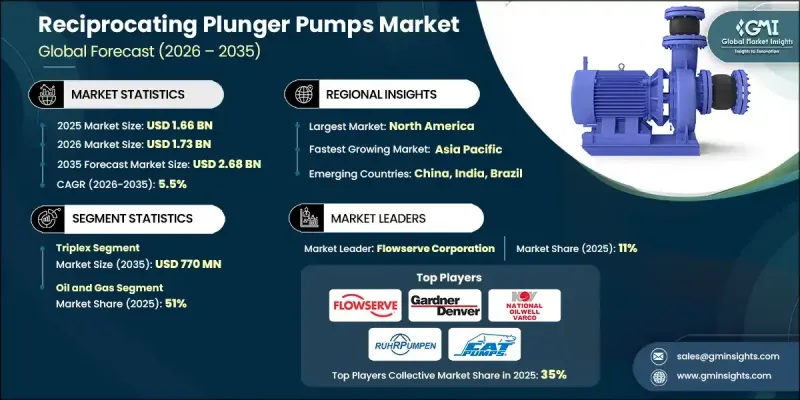

2025 年全球往復柱塞泵市场价值为 16.6 亿美元,预计到 2035 年将以 5.5% 的复合年增长率增长至 26.8 亿美元。

成长的驱动力源自于对能够在严苛环境下运作的设备的需求,在这些环境中,流体输送必须精准、稳定且可靠。往復泵因其能够保持恆定压力并可处理粘稠、磨蚀性或难处理的流体而持续受到信赖。其卓越的性能可靠性使其成为水处理、化学、石油天然气等产业不可或缺的工具。当需要长期保持运作稳定性和可重复的精确度时,企业便会依赖此类帮浦。市场正日益转向旨在减少停机时间和降低维护需求的工程设计,促使製造商考虑节能配置和数位化升级。随着企业寻求在泵浦的整个生命週期内提高生产效率和降低成本,以即时监控和预测性维护为中心的新技术正蓬勃发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 16.6亿美元 |

| 预测值 | 26.8亿美元 |

| 复合年增长率 | 5.5% |

预计到2035年,三缸泵浦市场规模将达到7.7亿美元。这种配置之所以能保持领先地位,是因为它在输出功率、机械稳定性和运作效率方面实现了可靠的平衡。三缸泵浦采用三个柱塞,能够产生脉动极小的均匀流量,这对于各种高需求工业应用至关重要。与多柱塞泵相比,三缸泵结构更简单,有助于最大限度地减少维护需求并降低拥有成本,因此对于注重可靠性和简化操作的行业来说极具吸引力。

预计到2025年,石油和天然气市场将占据51%的市场。该行业高度依赖往復式柱塞泵,因为这类泵能够应对钻井、压裂以及其他重要的上游和中游作业中所需的高压力条件。该领域的专案通常在对设备耐用、精准且使用寿命长的要求极高的环境中运行,这凸显了专为高强度工作环境设计的泵浦的重要性。

美国往復式柱塞泵市场占82%的市场份额,预计到2025年市场规模将达到4.1亿美元。北美凭藉其先进的工业基础和强大的油气产业,在全球产业中保持领先地位。该地区对用于水力压裂、钻井作业和注水应用的高压系统的持续需求,将继续支撑市场的稳定和长期成长。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 石油天然气和工业领域的高需求

- 日益重视水和废水管理

- 技术进步和自动化

- 产业陷阱与挑战

- 高昂的维护和营运成本

- 来自离心泵的竞争

- 机会

- 在亚太和中东地区扩张

- 在再生能源和特殊应用领域的应用

- 成长驱动因素

- 成长潜力分析

- 主要市场趋势和颠覆性因素

- 未来市场趋势

- 差距分析

- 风险及缓解分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按泵浦配置

- 监管环境

- 北美洲

- 欧洲

- 亚太

- 中东和非洲

- 拉丁美洲

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依泵浦配置划分,2022-2035年

- 三联泵浦

- 五联泵浦

- 七联泵

- 其他配置

第六章:市场估计与预测:依压力范围划分,2022-2035年

- 低压(<500 巴 / <7,250 磅/平方英吋)

- 中等压力(500-800 巴 / 7,250-11,600 磅/平方英吋)

- 高压(>800 巴 / >11,600 磅/平方英吋)

第七章:市场估算与预测:依流量容量划分,2022-2035年

- 低流量(<100 加仑/分钟 / <380 公升/分钟)

- 中流量(100-500 加仑/分钟 / 380-1,900 公升/分钟)

- 高流量(>500 加仑/分钟 / >1,900 公升/分钟)

第八章:市场估算与预测:依驱动类型划分,2022-2035年

- 电动马达驱动

- 柴油引擎驱动

- 燃气发动机驱动

- 液压驱动

- 其他驱动系统

第九章:市场估算与预测:依应用领域划分,2022-2035年

- 石油和天然气

- 化学加工

- 水和废水

- 发电

- 采矿与矿产

- 工业製造

第十章:市场估价与预测:依配销通路划分,2022-2035年

- 直销

- 间接销售

第十一章:市场估计与预测:按地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 土耳其

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Flowserve Corporation

- Gardner Denver (Ingersoll Rand)

- National Oilwell Varco (NOV)

- Ruhrpumpen

- Cat Pumps (Interpump Group)

- Weir Group (Weir Oil & Gas)

- Halliburton

- Schlumberger (Cameron)

- Hammelmann GmbH (Paul Hammelmann Maschinenfabrik)

- KAMAT GmbH & Co. KG

- URACA GmbH & Co. KG

- Kerr Pumps (Weir SPM)

- Ariel Corporation

- Pratissoli Pumps (Interpump Group)

- Wanner Engineering (Hydra-Cell)

The Global Reciprocating Plunger Pumps Market was valued at USD 1.66 billion in 2025 and is estimated to grow at a CAGR of 5.5% to reach USD 2.68 billion by 2035.

Growth is shaped by the need for equipment capable of operating in demanding environments where fluids must be moved with precision, consistency, and resilience. Reciprocating pumps continue to be trusted solutions because they maintain constant pressure and can work with thick, abrasive, or challenging fluids. Their performance reliability makes them essential in sectors such as water treatment, chemical processing, and the oil and gas industry. Businesses depend on this pump category when operational stability and repeatable accuracy are mandatory over extended periods. The market has increasingly shifted toward designs engineered to reduce operational downtime and lower maintenance requirements, prompting manufacturers to consider energy-efficient configurations and digital enhancements. New developments centered on real-time monitoring and predictive maintenance are gaining momentum as companies seek higher productivity and cost savings throughout the pump lifecycle.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.66 Billion |

| Forecast Value | $2.68 Billion |

| CAGR | 5.5% |

The triplex pump segment is projected to attain USD 770 million by 2035. This configuration maintains a leading position because it offers a dependable balance of output, mechanical stability, and operating efficiency. Featuring three plungers, these pumps generate a uniform flow with limited pulsation, which is crucial in various high-demand industrial operations. Their simplified layout compared to multi-plunger alternatives helps minimize maintenance needs and reduce ownership costs, making them appealing for industries prioritizing reliability and streamlined operation.

The oil & gas market held 51% share in 2025. This sector depends heavily on reciprocating plunger pumps due to their ability to manage extremely high-pressure conditions required in drilling, fracturing, and other essential upstream and midstream activities. Projects in this field typically operate in environments that demand durable, accurate, and long-lasting equipment, reinforcing the importance of pumps engineered for demanding workloads.

United States Reciprocating Plunger Pumps Market captured 82% share and generated USD 410 million in 2025. North America maintains a prominent position in the global industry due to its advanced industrial base and strong oil and gas sector. The region's ongoing requirement for high-pressure systems used in hydraulic fracturing, drilling operations, and water injection applications continues to support market stability and long-term uptake.

Leading companies in the Global Reciprocating Plunger Pumps Market include Ariel Corporation, Cat Pumps (Interpump Group), Flowserve Corporation, Gardner Denver (Ingersoll Rand), Halliburton, Hammelmann GmbH (Paul Hammelmann Maschinenfabrik), KAMAT GmbH & Co. KG, Kerr Pumps (Weir SPM), National Oilwell Varco (NOV), Pratissoli Pumps (Interpump Group), Ruhrpumpen, Schlumberger (Cameron), URACA GmbH & Co. KG, Wanner Engineering (Hydra-Cell), and Weir Group (Weir Oil & Gas). Companies active in the Reciprocating Plunger Pumps Market are enhancing their market position by investing in advanced pump engineering, incorporating digital monitoring features, and introducing designs aimed at reducing energy consumption. Many manufacturers are expanding their product lines to address higher-pressure demands while improving material durability to extend pump service life. Collaboration with end-use industries is becoming more common as firms work to tailor pump configurations to specific operating conditions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Pump configuration

- 2.2.3 Application

- 2.2.4 Pressure range

- 2.2.5 Flow rate capacity

- 2.2.6 Drive type

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High demand from oil & gas and industrial sectors

- 3.2.1.2 Growing focus on water and wastewater management

- 3.2.1.3 Technological advancements and automation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High maintenance and operational costs

- 3.2.2.2 Competition from centrifugal pumps

- 3.2.3 Opportunities

- 3.2.3.1 Expansion in Asia-Pacific and Middle East regions

- 3.2.3.2 Adoption in renewable energy and specialty applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Gap Analysis

- 3.7 Risk and mitigation Analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By pump configuration

- 3.10 Regulatory landscape

- 3.10.1 North America

- 3.10.2 Europe

- 3.10.3 Asia-Pacific

- 3.10.4 Middle East and Africa

- 3.10.5 Latin America

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Pump Configuration, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Triplex pumps

- 5.3 Quintuplex pumps

- 5.4 Septuplex pumps

- 5.5 Other configurations

Chapter 6 Market Estimates & Forecast, By Pressure Range, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low pressure (<500 bar / <7,250 psi)

- 6.3 Medium pressure (500-800 bar / 7,250-11,600 psi)

- 6.4 High pressure (>800 bar / >11,600 psi)

Chapter 7 Market Estimates & Forecast, By Flow Rate Capacity, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low flow (<100 gpm / <380 lpm)

- 7.3 Medium flow (100-500 gpm / 380-1,900 lpm)

- 7.4 High flow (>500 gpm / >1,900 lpm)

Chapter 8 Market Estimates & Forecast, By Drive Type, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Electric motor driven

- 8.3 Diesel engine driven

- 8.4 Gas engine driven

- 8.5 Hydraulic driven

- 8.6 Other drive systems

Chapter 9 Market Estimates & Forecast, By Application, 2022-2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Oil & gas

- 9.3 Chemical processing

- 9.4 Water & wastewater

- 9.5 Power generation

- 9.6 Mining & minerals

- 9.7 Industrial manufacturing

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Turkey

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Flowserve Corporation

- 12.2 Gardner Denver (Ingersoll Rand)

- 12.3 National Oilwell Varco (NOV)

- 12.4 Ruhrpumpen

- 12.5 Cat Pumps (Interpump Group)

- 12.6 Weir Group (Weir Oil & Gas)

- 12.7 Halliburton

- 12.8 Schlumberger (Cameron)

- 12.9 Hammelmann GmbH (Paul Hammelmann Maschinenfabrik)

- 12.10 KAMAT GmbH & Co. KG

- 12.11 URACA GmbH & Co. KG

- 12.12 Kerr Pumps (Weir SPM)

- 12.13 Ariel Corporation

- 12.14 Pratissoli Pumps (Interpump Group)

- 12.15 Wanner Engineering (Hydra-Cell)