|

市场调查报告书

商品编码

1683518

北美正排量帮浦:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)NA Positive Displacement Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

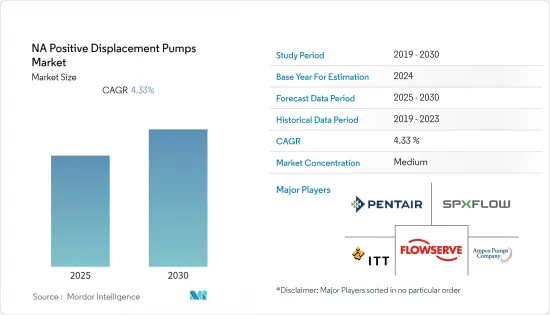

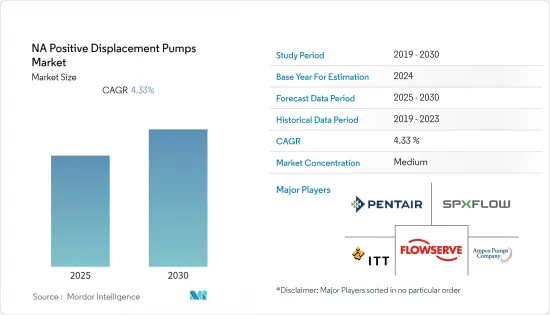

预计预测期内北美正排量帮浦市场的复合年增长率为 4.33%。

主要亮点

- 由于天然气产量的增加,对石油和天然气、化学品和发电等终端用户行业的投资增加将对研究市场产生重大影响。该地区的国家,包括美国和加拿大,拥有丰富的石油蕴藏量并正在寻求开发油砂资源。

- 美国页岩气的蓬勃发展和稳定的油价正在推动正排量泵在化学、石油和天然气行业的使用。此外,这些应用通常会面临恶劣的条件,从而降低生产力,迫使石油和天然气公司用先进技术取代现有设备。

- 此外,美国能源生产持续快速成长。例如,美国主要石油生产商之一埃克森美孚已宣布计划扩大在西德克萨斯州二迭纪盆地的生产活动,最早在2024年实现100万桶油当量的产量。

- 德克萨斯州的朱庇特管道和金德摩根的罗阿诺克扩建计划等管道建设计划计划于 2021年终完工。这些计划预计将在未来几年推动美国对系统中正排量泵的巨大需求。

- 此外,美国也率先开展了各种太阳能计划,并继续成为新可再生能源技术的强国。美国能源部能源资讯署 (EIA) 估计,到 2020 年,美国电力部门的净容量将达到约 1.07兆瓦,并预计未来将大幅增加,到 2050 年将达到约 1.7兆瓦。

北美正排量帮浦市场趋势

食品饮料产业预计将大幅成长

- 在过去的几十年里,食品饮料行业经历了从小型企业到中型企业再到大型企业的广泛变化。食品加工的工业化催生了许多使用正排量帮浦的应用。正排量泵使在大气条件下无法实现的过程成为可能。此外,它在处理氧气敏感和热敏感材料时还具有显着的优势。

- 此外,正排量帮浦在食品生产中具有许多优势,包括平稳、无脉衝泵送和卫生性能。大转子腔和防气蚀端口使其非常适合广泛的应用,包括高黏度流体和含有大颗粒的流体。

- 有些型号的设计具有特别严格的内部公差,这是透过使用特殊的防咬合内部合金来实现的。它们具有低滑移性能,可提高泵浦效率、改善卫生和生产性能以及设备寿命。

- 2022 年 6 月,NETZSCH Pumps North America, LLC 宣布推出 NOTOS Sanitary 2NSH 双螺旋泵浦。 NOTOS 卫生级 2NSH 双螺旋泵可在低压和高压下运行,在不影响品质的情况下保持产品的完整性和天然特性。该帮浦符合 FDA 要求,符合 3-A 卫生标准,可快速拆卸进行维护。

- 此外,多年来,食品和饮料加工公司一直致力于提高工厂效率,减少停机时间,并避免因人为错误造成的危险事故,增加了对工厂自动化的需求。工业中自动化程度的不断提高是采用正排量帮浦的主要驱动力。

预计美国将占较大市场占有率

- 美国是北美最大的容积泵市场。随着国内製造和加工行业(包括石油和天然气、化学品、食品和饮料)以及大型用水和污水管理和发电行业的广泛发展,对正排量泵的需求在过去几年中不断增长。

- 2020年11月,全球容积帮浦製造商Wilo SE宣布将在美国威斯康辛州开设新厂,预计将提振该地区的容积帮浦市场。

- 此外,核能和可再生能源在美国也呈现崛起趋势。太阳能正在获得大量投资,这就是我们看到太阳能净发电量增加的原因。该地区依靠水电等可再生能源进行大规模发电,这将推动该地区的研究市场。

- 美国也是一些标誌性的发电工程的所在地。华盛顿州哥伦比亚河上的大古力水坝是该州最大的水力发电发电工程之一,可满足该州约三分之二的电力需求。

- 此外,通用电气再生能源公司也与美国政府签订了两份水电合约。一处是诺斯菲尔德山抽水蓄能发电厂,另一处是太平洋天然气电力公司的卡里布一号水力发电厂。

北美正排量帮浦产业概况

北美正排量帮浦市场相当分散,有数家地区性和全球性参与者。主要企业包括 Ampco Pumps Company Inc.、Flowserve Corporation 和 ITT Inc. 该市场的主要企业正在推出创新的新产品并建立伙伴关係和联盟以获得竞争优势。

- 2022 年 3 月 - 阿特拉斯·科普柯同意收购 LEWA GmbH 及其子公司以及 Geveke BV 及其子公司。 LEWA 是隔膜计量泵、製程泵和容积泵的领先製造商。

- 2021 年 5 月 - CDI Energy Products 宣布开发并推出针对离心帮浦和正排量泵浦应用的专有先进热塑性聚合物复合材料。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 产业影响分析

第五章 市场动态

- 市场驱动因素

- 扩大 MEMS 技术的应用

- 该地区对水处理设施的需求不断增加

- 市场挑战

- 高成本、相容性问题

第六章 市场细分

- 按容积泵类型

- 隔膜

- 活塞

- 齿轮

- 长袍

- 渐进腔

- 拧紧

- 叶片

- 蠕动

- 按最终用户产业

- 石油和天然气

- 化学

- 饮食

- 用水和污水

- 药品

- 力量

- 其他的

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Ampco Pumps Company Inc.

- Flowserve Corporation

- ITT Inc.

- Pentair PLC

- SPX Flow Inc.

- Xylem Inc.

- Liquidyne Process Technologies, Inc.

- Springer Pumps, LLC.

- Titan Manufacturing, Inc.

- Dickow Pump Co.

- Centec LLC

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 91325

The NA Positive Displacement Pumps Market is expected to register a CAGR of 4.33% during the forecast period.

Key Highlights

- The increasing investments in the end-user industries, such as oil and gas, chemical, and power generation, significantly impact the studied market due to the increasing natural gas production. Countries in the region, such as the United States and Canada, have abundant oil reserves and try to utilize their oil sands resources.

- The boom of shale gas in the United States and the stabilizing oil prices are driving the usage of positive displacement pumps in the chemical and oil and gas industries. Additionally, these applications are often exposed to harsher conditions, resulting in low productivity, driving the oil and gas companies to replace existing equipment with advanced technologies.

- Moreover, energy production in the United States continues to expand rapidly. For instance, ExxonMobil, one of the major oil producers in the country, announced its plans to increase the production activity in the Permian Basin of West Texas by producing around 1 million bpd oil equivalent as early as 2024.

- Pipeline construction projects such as Jupiter Pipeline in Texas and Roanoke Expansion Project by Kinder Morgan are some of the projects destined to be completed by the end of 2021. These projects are also expected to create a considerable demand for positive displacement pumps, as a part of systems, in the United States over the next few years.

- Further, the United States also pioneered various solar energy projects and remained a powerhouse in new renewable energy technologies. The US Department of Energy's Energy Information Administration (EIA) estimated that the net capacity of the electric power sector in the country was estimated to be around 1.07 terawatts in 2020 and was expected to increase significantly in the future to reach approximately 1.7 terawatts by 2050.

North America Positive Displacement Pumps Market Trends

Food & Beverage Segment is Expected to Witness Significant Growth

- In recent decades the food and beverage industry witnessed widespread changes from small to middle and large firms. The industrialization of food processing created several applications that use positive displacement pumps. It enables processes that can not otherwise be performed under atmospheric conditions. Furthermore, it offers a great advantage in processing oxygen and heat-sensitive materials.

- Moreover, positive displacement pumps offer many benefits in food production, including smooth, pulse-free pumping and hygienic performance. Large rotor fluid cavities and anti-cavitation ports make them ideal for a wide range of applications, including highly viscous fluids and fluids containing large particles.

- Some pump models are designed with particularly tight internal tolerances, facilitated through the use of special non-galling internal alloys. These offer low slip performance, increasing pumping efficiency and improving sanitary and production performance and unit longevity.

- In June 2022, NETZSCH Pumps North America, LLC, announced the introduction of the NOTOS Sanitary 2NSH Twin Screw Pump, which is ideal for meeting the food and beverage requirements industries. It can work at both low and high working pressures; the NOTOS Sanitary 2NSH Twin Screw Pump maintains product integrity and natural properties without any quality loss. The FDA-compliant pump meets 3-A Sanitary Standards and can be disassembled quickly for easy maintenance.

- Further, over the years, food and beverage processing companies made consistent efforts to increase plant efficiency, reduce downtime, and avoid hazardous accidents caused due to human error, thus leading to a rise in the demand for plant automation. The increasing adoption of automation in the industry is a major driver for implementing positive displacement pumps.

United States is Expected to Account for a Significant Market Share

- The United States is the largest market for positive displacement pumps in North America. The presence of a wide range of domestic manufacturing and processing industries, such as oil and gas, chemicals, and food and beverages, along with huge water and wastewater management and power generation sectors, has augmented the demand for positive displacement pumps over the past several years.

- In November 2020, Wilo SE, a global manufacturer of positive displacements, announced the opening of its new factory in Wisconsin, United States, which will boost the market for positive displacement pumps in the region.

- Moreover, nuclear and renewable energy sources are increasing in the United States. Solar energy is witnessing significant investments; thus, an increase in the solar net electricity generation can be observed. The region relies on renewable energy like hydropower for large-scale power generation, which will drive the studied market in the region.

- The United States is also home to some of the iconic hydropower projects. Grand Coulee Dam, built across the Columbia River in Washington, has been one of the best hydropower projects and generates around two-thirds of the electricity requirement for the state.

- Further, GE Renewable Energy signed an agreement with the US government for two hydropower contracts. One is for the Northfield Mountain pumped hydro storage station and the other for PG&E's Caribou One hydropower station.

North America Positive Displacement Pumps Industry Overview

The North America Positive Displacement Pumps Market is moderately fragmented with the presence of several regional and global companies. Some of the key players are Ampco Pumps Company Inc., Flowserve Corporation, ITT Inc., etc. Key players in this market are introducing new innovative products and forming partnerships and collaborations to gain competitive advantages.

- March 2022 - Atlas Copco agreed to acquire LEWA GmbH and subsidiaries and Geveke BV and subsidiaries. LEWA is a significant manufacturer of diaphragm metering, process, and positive displacement pumps.

- May 2021 - CDI Energy Products announced the development and launch of its newest proprietary thermoplastic polymer composite material aimed at applications in centrifugal and positive displacement pumps.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact Analysis of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Popularity of MEMS Technology

- 5.1.2 Increasing demand of water treatment facilities in the region

- 5.2 Market Challenges

- 5.2.1 High Cost and Compatibility Issues

6 MARKET SEGMENTATION

- 6.1 Type of Positive Displacement Pump

- 6.1.1 Diaphragm

- 6.1.2 Piston

- 6.1.3 Gear

- 6.1.4 Lobe

- 6.1.5 Progressive Cavity

- 6.1.6 Screw

- 6.1.7 Vane

- 6.1.8 Peristaltic

- 6.2 End-user Industries

- 6.2.1 Oil & Gas

- 6.2.2 Chemicals

- 6.2.3 Food & Beverage

- 6.2.4 Water & Wastewater

- 6.2.5 Pharmaceutical

- 6.2.6 Power

- 6.2.7 Others

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ampco Pumps Company Inc.

- 7.1.2 Flowserve Corporation

- 7.1.3 ITT Inc.

- 7.1.4 Pentair PLC

- 7.1.5 SPX Flow Inc.

- 7.1.6 Xylem Inc.

- 7.1.7 Liquidyne Process Technologies, Inc.

- 7.1.8 Springer Pumps, LLC.

- 7.1.9 Titan Manufacturing, Inc.

- 7.1.10 Dickow Pump Co.

- 7.1.11 Centec LLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219