|

市场调查报告书

商品编码

1635358

亚太地区正排量帮浦:市场占有率分析、产业趋势、成长预测(2025-2030)APAC Positive Displacement Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

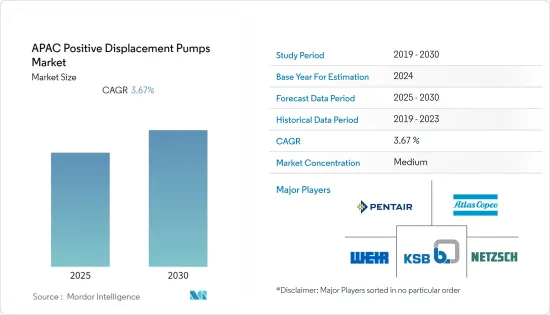

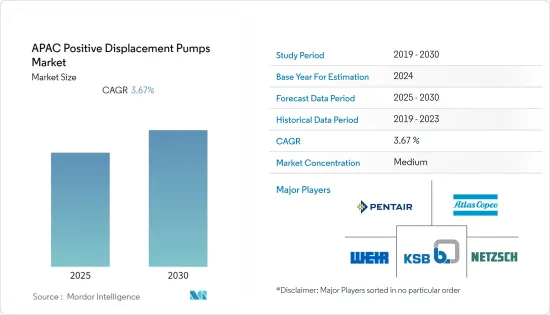

亚太地区正排量帮浦市场预计在预测期内复合年增长率为 3.67%

主要亮点

- 正排量帮浦透过在密封件和阀门的帮助下反覆封闭固定体积的液体并将其机械地移动通过系统来传输液体。帮浦透过吸入管吸入一定量的液体,并在高压下将其输送到排出管。

- 亚太地区各国政府针对市政和工业部门的污水处理制定了严格的法规和措施。企业必须在其设施内安装水处理设备,以克服水资源短缺的挑战。因此,污水处理可望为未来容积泵市场提供充足的商机。

- 由于其终端用户行业的不断扩大以及其作为全球最大汽车行业的地位,预计中国将在亚太地区占据较大的市场占有率。此外,中国的发电市场正在以相当快的速度成长,以满足不断增长的人口的需求。

- 此外,印度计划在 2030 年将 40% 的能源来自可再生能源。为了实现此类能源製造目标,製造商在政府的支持下正在该行业进行大量投资,预计这将在预测期内推动市场成长。

- COVID-19 大流行对世界各地的石油、天然气和发电活动产生了重大影响。这进一步导致计划建设活动延误和供应链中断。因此,对容积泵的需求也受到影响。但随着经济恢復正常,各产业全面恢復运转,市场对泵浦的需求增加。

亚太地区容积泵市场趋势

废弃物和污水产业预计将录得强劲成长

- 大多数用水的人类和工业活动都会产生污水。随着整体用水需求的增加,该地区污水产生量和整体污染负荷持续增加。因此,地方政府针对市政和工业部门的污水处理推出了严格的政策和措施。

- 世界上大约三分之二的人口生活在一年中至少有一个月缺水的地区。大约 50% 面临这种程度的水资源短缺的人生活在印度和中国。因此,人类和工业部门用水产生的污水处理需求预计会增加,以提高用水效率并满足用水需求。

- 此外,2021年11月,中国宣布了新的污水回用指南,到2025年将必须以回用标准处理的污水比例提高到25%。这进一步证明了中国雄心勃勃,不再扩大处理能力,而是更重视处理后废水的品质。作为这项努力的一部分,中国计划在未来五年内建造和升级8万公里的污水收集管道。

- 根据生态环境部统计,2020年我国污水排放557亿立方米,其中26%来自工业。

- 根据国家统计局的数据,2015年至2020年,中国在城市污水系统的投资为816亿美元。这项投资包括废水管道、新处理设施、雨水和废水流系统、污泥减量、再生水和早期降雨处理的建设和维护。此外,截至2020年1月,中国有10,113座水处理厂为95%的城市和30%的农村地区处理污水。

中国占有很大份额

- 中国是世界上最大的电力生产国之一。该国的能源需求预计将增加,从而导致能源产量增加。例如,中国宣布将于2020年建成世界第二大太阳能发电厂。位于中国西北部青海省的太阳能电站容量为220万千瓦,是世界上最重要的发电厂之一,仅次于印度2,245万千瓦的巴德拉太阳能电站。这座巨型发电厂预计将成为中央政府在西部创建可再生能源超级电网提案的一部分。

- 根据能源公司BP预测,2020年中国将占全球初级能源消耗的26%。该公司也估计,到2040年,中国仍可能保持领先地位,在全球能源消耗中占很大比例。 2020年12月,习近平主席承诺,2030年,中国将把非石化燃料占初级能源消耗的比重从20%提高到25%左右。

- 根据国家统计局数据,儘管炼油厂12月减少原油运作2.1%以弥补产品库存紧张,但2021年中国原油吞吐量与前一年同期比较增4.6%至1,413万日圆。

- 根据OEC World统计,2020年中国往復式容积泵出口额为6.87亿美元,成为全球第三大往復式容积泵出口国。中国进口往復式容积泵浦9.75亿美元,成为全球第一大进口国。

亚太地区容积泵产业概况

亚太地区正排量帮浦市场的公司之间的竞争日益激烈。许多公司已进入该市场,包括阿特拉斯科普柯和威尔集团 PLC。然而,随着技术创新的进步,许多公司正在透过赢得新契约和开发新市场来增加其市场份额。

- 2021 年 6 月 - 关键任务流量创造和工业解决方案的全球供应商英格索兰公司 (Ingersoll Rand Inc.) 宣布以 4.315 亿欧元收购容积泵製造商 seepex GmbH。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 污水管理日益受到关注

- 市场问题

- 高成本

第六章 市场细分

- 按类型

- 隔膜

- 活塞

- 齿轮

- 长袍

- 渐进空洞

- 拧紧

- 叶片

- 佩里斯塔

- 按最终用户产业

- 石油和天然气

- 化学

- 饮食

- 废弃物/污水

- 製药

- 电力

- 其他的

- 按国家/地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Atlas Copco

- The Weir Group PLC

- KSB SE & Co. KGaA

- NETZSCH Holding

- Pentair PLC

- SPX Flow Inc.

- Sulzer AG

- Xylem Inc.

- GRUNDFOS

- TSURUMI MANUFACTURING CO.,LTD.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 91536

The APAC Positive Displacement Pumps Market is expected to register a CAGR of 3.67% during the forecast period.

Key Highlights

- A positive displacement pump moves a fluid by repeatedly enclosing a fixed volume with the aid of seals or valves and moving it mechanically through the system. The pump intakes a fixed amount of liquid from the intake pipe and transfers it to a discharge pipe at high pressure.

- Governments in the Asia-Pacific region have introduced stringent policies and regulations regarding wastewater treatment in the municipal and industrial sectors. Operators must deploy water treatment units in their facilities to overcome water scarcity challenges. Therefore, wastewater treatment is expected to create ample opportunities for the positive displacement pumps market in the future.

- China is expected to hold a significant market share in the Asia-Pacific region due to its expanding end-user industry and position as the world's largest automotive industry. Additionally, China's power generation market is increasing at a significant pace to meet the demand of the increasing population.

- Further, India is planning to derive 40% of its energy from renewable sources by 2030, which is at 15% currently. To achieve these energy manufacturing goals, manufacturers, with the government's help, are making significant investments in the industry, which is anticipated to propel market growth over the forecast period.

- The COVID-19 pandemic has considerably impacted the oil and gas and power generation activities worldwide. This further resulted in delays in project construction activities and supply chain disruptions. As a result, the demand for positive displacement pumps was also impacted. However, the economies returning to normalcy and all industries moving back to their full operations increased the demand for these pumps in the market.

APAC Positive Displacement Pumps Market Trends

Waste and Wastewater Industry is Expected to Register Significant Growth

- Most of the human and industrial activities that use water produce wastewater. As the overall water demand grows, the quantity of wastewater produced and its overall pollution load are continuously increasing in the region. As a result, regional governments have introduced strict policies and regulations regarding wastewater treatment for both the municipal and industrial sectors.

- Around two-thirds of the world's population live in areas that experience water scarcity for at least one month a year. Around 50% of the people facing this level of water scarcity live in India and China. Therefore, the demand for wastewater treatment, produced as a result of human and industrial sector water usage, is expected to grow to improve the efficiency of water usage and meet the water demands.

- Moreover, in November 2021, China published new guidelines for wastewater reuse, raising the proportion of sewage that must be treated to reuse standards to 25% by 2025. This further proves the country's ambition to transition from capacity expansion to a greater emphasis on treated effluent quality. As part of the effort, China aims to construct and upgrade 80,000km of wastewater collection pipelines over the next five years.

- As per the China Ministry of Ecology and Environment, China discharged 55.7 billion cubic meters of wastewater in 2020, 26% of which originated from industrial sources.

- According to the China National Bureau of Statistics, China invested USD 81.6 billion in its municipal wastewater system from 2015 to 2020. The investment included sewage pipeline construction and maintenance, new treatment facilities, rainwater-sewage diversion systems, sludge mitigation, reclaimed water, and initial rainfall treatment. Moreover, as of January 2020, China's 10,113 water treatment plants treat wastewater for 95% of municipalities and 30% of rural areas.

China to Hold a Significant Share

- China is one of the largest producer of electricity globally. The country's energy demand is expected to increase, resulting in energy production growth. For instance, China unveiled the world's second-largest solar power plant in 2020. With a capacity of 2.2 GW, this solar park in Qinghai Province in China's northwest is among the world's most significant plants, second only to the 2.245 GW-capacity Bhadla solar park in India. The giant power station is anticipated to be one of the proposals central government's proposals to create a renewable energy super grid in the western part.

- According to the energy company BP, in 2020, China accounted for 26% of global primary energy consumption. The firm also estimated that, by 2040, China may still be at the top of the list and account for a significant share of global energy consumption. President Xi Jinping pledged in December 2020 that China could boost the share of non-fossil fuels in primary energy consumption to around 25% by 2030 from a previous commitment of 20%.

- According to the National Bureau of Statistics, China's crude throughput rose 4.6% yearly to 14.13 million in 2021 despite refineries cutting crude runs by 2.1% in December to offset product inventory pressure.

- According to OEC World, in 2020, China exported USD 687 million in reciprocating positive displacement pumps, making it the 3rd largest exporter of reciprocating positive displacement pumps worldwide. China imported USD 975 million in reciprocating positive displacement pumps, becoming the world's 1st largest importer of the same.

APAC Positive Displacement Pumps Industry Overview

The Asia-Pacific positive displacement pumps market is witnessing a rise in competitiveness among companies. The market consists of various players, including Atlas Copco and The Weir Group PLC, among others. However, with the growing technological innovations, many companies are increasing their market presence by securing new contracts and tapping new markets.

- June 2021 - Ingersoll Rand Inc., a global provider of mission-critical flow creation and industrial solutions, has announced the acquisition of a positive displacement pump manufacturer, seepex GmbH, for EUR 431.5 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Focus on Wastewater Management

- 5.2 Market Challenges

- 5.2.1 High Cost

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Diaphragm

- 6.1.2 Piston

- 6.1.3 Gear

- 6.1.4 Lobe

- 6.1.5 Progressive Cavity

- 6.1.6 Screw

- 6.1.7 Vane

- 6.1.8 Peristaltic

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemicals

- 6.2.3 Food & Beverage

- 6.2.4 Waste & Wastewater

- 6.2.5 Pharmaceutical

- 6.2.6 Power

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

- 6.3.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atlas Copco

- 7.1.2 The Weir Group PLC

- 7.1.3 KSB SE & Co. KGaA

- 7.1.4 NETZSCH Holding

- 7.1.5 Pentair PLC

- 7.1.6 SPX Flow Inc.

- 7.1.7 Sulzer AG

- 7.1.8 Xylem Inc.

- 7.1.9 GRUNDFOS

- 7.1.10 TSURUMI MANUFACTURING CO.,LTD.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219