|

市场调查报告书

商品编码

1632082

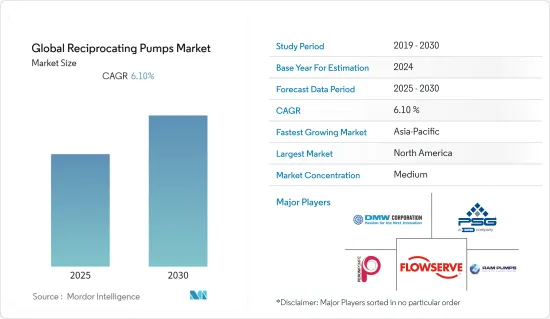

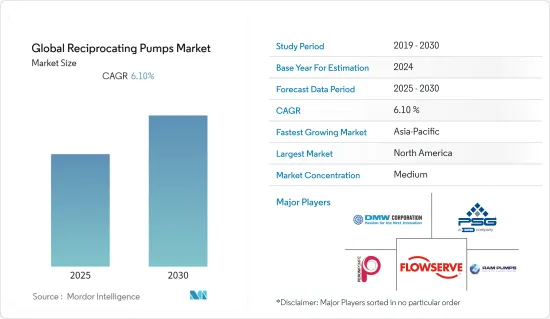

全球往復泵市场占有率分析、产业趋势与统计、成长预测(2025-2030)Global Reciprocating Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计全球往復泵市场在预测期间内复合年增长率为 6.1%

主要亮点

- 往復泵是一种将机械能转换为液压能的液压机械。这些帮浦使用在汽缸内前后移动的活塞。此外,这些泵浦长期以来主要用于高压、小容量应用。

- 在污水处理行业中,当需要低扬程泵送大量污水或污泥时,会使用往復泵。各地区污水处理投资的增加预计将推动往復泵的需求。例如,根据欧盟统计局的数据,2021 年,污水处理占政府和非营利部门总支出的 23%,废弃物管理占 28%。

- 同样,美国政府于 2021 年 11 月宣布新增 5.5 亿美元支出,其中 5,500 万美元专门用于污水、饮用水和雨水基础设施。

- 然而,流体流动不均匀、初始成本高以及高磨损导致的维护成本增加等挑战阻碍了所研究市场的成长。

- COVID-19 大流行的爆发对所研究的市场产生了重大影响,因为它扰乱了关键最终用户行业的活动。例如,在美国,OSHA 发布了几项有关工人安全的指南,限制在任何时间在某些场所使用劳动力。然而,随着情况恢復正常,预计市场在预测期内将呈现疫情前的成长水准。

往復泵市场趋势

石油和天然气产业占主要市场占有率

- 石油和天然气开采是一种高压应用,需要吸力来提升流体并将其压入各个室进行进一步处理。柱塞泵适用于高压环境中的应用,因此是这些情况下最常用的泵浦。

- 多年来,石油和天然气行业经历了显着增长。世界大部分地区对石油产品的需求不断增加,导致对石油开采和运输现代化的投资增加,从而推动了对往復泵的需求,而往復泵广泛用于石油开采和运输过程。

- 沙乌地阿美表示,2021年其平均碳氢化合物产量为每天1,230万桶油当量,其中包括每天920万桶原油。鑑于需求成长,该公司计划在 2027 年将原油最大可持续产能 (MSC) 提高至 1,300 万桶/日 (mmbpd)。

- 这些趋势鼓励供应商开发满足石油和天然气产业多样化需求的创新产品。例如,DDL 是世界上少数专门生产蒸气/气体动力往復泵的製造商之一。这些泵浦主要用于精製和石化厂的重型业务。

亚太地区实现显着成长

- 由于快速的工业化和都市化,亚太地区对往復泵的需求不断增加。例如,亚银预测,到2030年,亚洲约55%的人口将实现城市化。此外,根据中华人民共和国国务院的预测,到2021年,中国常住人口都市化将达64.72%。

- 印度政府在 2021 年预算中拨款 1.41 兆印度卢比用于污水处理和固态废弃物管理。污水处理基础设施投资的增加预计将推动对用于低水头泵送大量废水的往復泵的需求。

- 由于往復泵在高压环境下运行,因此也广泛应用于采矿领域。此外,往復泵非常适合采矿作业,因为它们能够以固定速度产生固定量的流体排气量,从而无论压力如何,都可以提供恆定的流量。

- 澳洲、中国和印度等国家采矿业规模的不断扩大进一步推动了研究市场的成长。例如,根据澳洲矿业冶金研究所(AusIMM)的统计,澳洲采矿业占该国出口的75%,年均采矿收益达500亿美元。

往復泵产业概况

全球往復泵市场竞争温和。由于市场上有多个参与企业,供应商正在专注于开发创新解决方案,以在市场中脱颖而出。现有参与企业正专注于併购,以减少竞争并进一步增强其市场地位。该市场的主要企业包括 DMW Corporation、PSG Dover、Flowserve Corporation 和 Ram Pumps Ltd。

- 2022年5月-杰瑞在OTC2022上推出了最新的JR7,000QP柱塞泵和创新压裂解决方案:Apollo涡轮压裂泵、Power2Go 33MW移动燃气涡轮发电机组和电动压裂。

- 2021 年 6 月 - Celeros Flow Technology 推出新的标准化系列往復泵,提供更高的速度和简化的设计。最新的升级允许客户查看预先配置的图纸并快速从泵浦选项中进行选择。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 扩大石油和天然气领域的业务

- 往復泵技术的进步

- 市场限制因素

- 安装和维护成本高

第六章 市场细分

- 按类型

- 活塞

- 柱塞

- 隔膜

- 依技术

- 100m3/h以下

- 100~300m3/h

- 300~800m3/h

- 800立方公尺/小时以上

- 按最终用户

- 石油和天然气

- 水/污水

- 矿业

- 化学

- 饮食

- 纸浆/造纸製造

- 其他的

- 按地区

- 北美洲

- 亚太地区

- 欧洲

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- DMW Corporation

- PSG Dover

- Peroni Pompe SPA

- Flowserve Corporation

- Ram Pumps Ltd.

- Celeros Flow Technology

- Cat Pumps

- TEIKOKU MACHINERY WORKS, LTD

- URACA GmbH & Co. KG

- Wasp Pumps Pvt. Ltd.

第八章投资分析

第九章 市场未来展望

The Global Reciprocating Pumps Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- A reciprocating pump at its core is a hydraulic machine that converts mechanical energy into hydraulic energy. These pumps use a piston moving back and forth in a cylinder. Additionally, these pumps have been in use for a long time, primarily for high-pressure and low-volume applications.

- In the wastewater treatment industry, reciprocating pumps are used where it is required to deal with a large quantity of sewage and sludges to be pumped against low heads. The increasing investment in wastewater treatment across various regions is expected to drive the demand for reciprocating pumps. For instance, according to Eurostat, wastewater treatment and waste management accounted for 23% and 28% of total expenditure in the general government and non-profit sector in 2021.

- Similarly, in November 2021, the United States Government announced USD 550 million in new spending, of which USD 55 million was allocated to fund the development of wastewater, drinking water, and stormwater infrastructure.

- However, factors such as non-uniform flow of liquid, high initial cost, and increased maintenance cost due to higher degree of wear and tear are challenging the growth of the studied market.

- The outbreak of the COVID-19 pandemic had a significant impact on the studied market owing to the destruction of activities across the major end-user industries. For instance, in the United States, several guidelines regarding the safety of the workers were issued by OSHA that restricted the use of manpower at any specific site at a single time. However, with the conditions returning towards normalcy, the market is expected to witness pre-pandemic level growth during the forecast period.

Reciprocating Pumps Market Trends

Oil & Gas Sector to Hold Significant Market Share

- As oil and gas extraction are high-pressure applications, they require suction to lift fluids and push them into different chambers for further processing. Plunger pumps are most popular to be used in this situation, as they are well suited for applications in high-pressure environments.

- Over the years, the oil & gas industry has witnessed significant growth. Owing to the increasing demand for petroleum-based products across the majority of the world, increased investment to modernize oil extraction and transportation has been observed, which is driving the demand for reciprocating pumps as they are widely used in oil extraction and transportation processes.

- According to Aramco, in 2021, the company's average hydrocarbon production was 12.3 million barrels of oil equivalent per day, including 9.2 mmbpd of crude oil. Considering the growing demand, the company plans to raise crude oil Maximum Sustainable Capacity (MSC) to 13 million barrels per day (mmbpd) by 2027.

- Such trends encourage the vendors to develop innovative products to fulfill various requirements of the oil & gas industry. For instance, DDL is among the few companies worldwide that specialize in manufacturing steam/gas-driven reciprocating pumps. These pumps are used predominantly in arduous duties within oil refineries and petrochemical plants.

Asia Pacific to Witness Significant Growth

- The demand for reciprocating pumps has been increasing in the Asia Pacific region owing to rapid industrialization and urbanization. For instance, according to the forecasts of ADB, about 55% of the population in Asia will be urban by 2030. Furthermore, in China, the urbanization rate of permanent residents reached 64.72% in 2021, according to the State Council of the People's Republic of China.

- In its budget for 2021, the Indian government allocated INR 1,41,000 crore for wastewater treatment and solid waste management. Increasing investment in the wastewater treatment infrastructure is expected to drive the demand for reciprocating pumps as they're used for pumping large quantities of sewage against the low head.

- Reciprocating pumps are also widely used in the mining sector because they operate in high-pressure environments. Furthermore, the ability of reciprocating pumps to produce a fixed volume of fluid displacement at a given speed to provide a constant flow, regardless of pressure, makes them ideal for mining operations.

- The increasing size of the mining sector across countries such as Australia, China, and India further supports the studied market's growth. For instance, according to the Australasian Institute of Mining and Metallurgy (AusIMM), the Australian mining industry amounts to 75% of the country's exports, and the average annual earning of the Australian mining industry amounts to USD 50 billion.

Reciprocating Pumps Industry Overview

The Global Reciprocating Pumps market is moderately competitive. Owing to the presence of several players in the market, the vendors focus on developing innovative solutions to achieve market differentiation. Established players are focusing more on mergers & acquisitions to reduce competition and further strengthen their market presence. Major players in the market include DMW Corporation, PSG Dover, Flowserve Corporation, and Ram Pumps Ltd.

- May 2022 - Jereh unveiled its latest JR7000QP Plunger Pump and its innovative fracturing solutions of Apollo Turbine Frac Pumper, Power2Go 33MW Mobile Gas Turbine Genset, and Electric Frac at the OTC 2022.

- June 2021 - Celeros Flow Technology launched a new, standardized range of reciprocating pumps to improve the speed and bring simplicity to design. The latest upgrades will allow the customers to view preconfigured drawings and quickly select from the pump options.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Deployment in Oil & Gas Sector

- 5.1.2 Advancement in Reciprocating Pump Technology

- 5.2 Market Restraints

- 5.2.1 High Installation and Maintenance Cost Associated

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Piston

- 6.1.2 Plunger

- 6.1.3 Diaphragm

- 6.2 By Mechnism

- 6.2.1 Up to 100 m3/h

- 6.2.2 100-300 m3/h

- 6.2.3 300-800 m3/h

- 6.2.4 Above 800 m3/h

- 6.3 By End-User

- 6.3.1 Oil & Gas

- 6.3.2 Water & Waste Water

- 6.3.3 Mining

- 6.3.4 Chemical

- 6.3.5 Food & Beverages

- 6.3.6 Pulp & Paper

- 6.3.7 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Asia Pacific

- 6.4.3 Europe

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DMW Corporation

- 7.1.2 PSG Dover

- 7.1.3 Peroni Pompe SPA

- 7.1.4 Flowserve Corporation

- 7.1.5 Ram Pumps Ltd.

- 7.1.6 Celeros Flow Technology

- 7.1.7 Cat Pumps

- 7.1.8 TEIKOKU MACHINERY WORKS, LTD

- 7.1.9 URACA GmbH & Co. KG

- 7.1.10 Wasp Pumps Pvt. Ltd.