|

市场调查报告书

商品编码

1635397

拉丁美洲的正排量帮浦:市场占有率分析、产业趋势、统计和成长预测(2025-2030)Latin America Positive Displacement Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

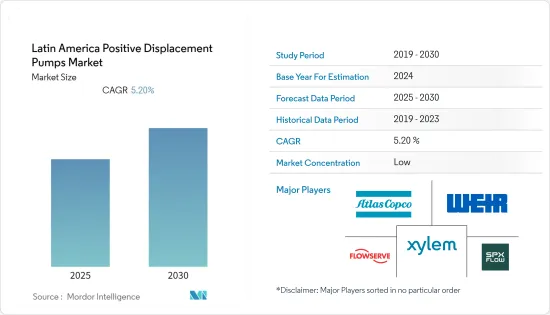

拉丁美洲正排量帮浦市场预计在预测期内复合年增长率为 5.2%。

主要亮点

- 拉丁美洲自然资源丰富。因此,采矿业对各国经济极为重要。石油和天然气行业是主要的最终用户,但发电、水和用水和污水、建筑、化学加工、食品和饮料、製药、金属和采矿等其他行业也推动了销售。

- COVID-19 疫情对拉丁美洲的石油、天然气和电力生产产生了重大影响。由于供应链中断和计划建设活动的延误,整个全部区域正排量帮浦的需求正在减少。预计正排量帮浦市场的帮浦销售可能会在 COVID-19 大流行结束后恢復。该地区工业化的进一步发展、建设计划数量的增加和采矿活动的活性化是推动拉丁美洲容积泵需求的主要因素。

- 工业部门产生的污水处理需求的增加和地下水位下降可能会推动未来对正排量帮浦的市场需求。正排量泵浦具有高黏度、固态吞吐量、效率和精确的重复性,所有这些都有助于市场成长。

- 此外,拉丁美洲等新兴地区的民用供水基础设施正在迅速发展,对正排量泵的需求正在增加。公共部门和工业部门对污水处理的需求都在显着增加,安装的泵浦组数量也在增加。海水淡化和零液体排放(ZLD)等技术预计将推动民用和工业领域的正排量泵市场。

拉丁美洲正排量帮浦市场趋势

石油和天然气产业推动正排量帮浦市场

- 作为最大的最终用户之一,石油和天然气行业正在推动正排量泵的销售。在 COVID-19 爆发导致该地区经济严重衰退后,国家法律体制和法规的改革对于泵浦销售的恢復至关重要。由于该地区重点开发油气资源和基础化学品的普遍需求,正排量帮浦製造商具有诱人的市场前景。

- 此外,容积泵广泛应用于委内瑞拉、巴西和墨西哥等国家的石油和天然气产业。这些泵浦用于探勘和精製目的。此外,页岩气探勘和液化天然气等石油和天然气行业的投资可能会推动拉丁美洲地区对正排量泵的需求。

- 此外,秘鲁和智利等拉丁美洲国家的采矿活动不断增加,增加了对正排量泵浦的需求,特别是对现有泵浦的维修和维护。智利和秘鲁似乎也有资本投资的机会。因此,这些因素预计将在整个预测期内推动市场成长。

- 儘管材料价格的供需趋势正在放缓,但石油和天然气行业预计在预测期内对正排量泵的需求庞大。这是由于世界各地对页岩气的持续投资。人们越来越重视安装小容量液化天然气终端,导致石油生产商投资减少,对正排量帮浦的需求增加。

巴西是拉美容积泵市场最具优势的国家

- 巴西是拉丁美洲正排量帮浦市场的主要收益国。这是因为企业数量增加导致饮用水量减少,地下水污染加剧。此外,由于一次性水量减少和地下水污染,正排量泵浦的使用不断增加,预计将进一步加速市场扩张。

- 根据世界综合贸易解决方案统计,在拉丁美洲,巴西的容积泵主要出口到玻利维亚、智利和巴拉圭。紧随其后的是美国、阿根廷和德国。主要目的国中,美国和德国的出货量成长最为显着,而其他主要国家的成长速度则较慢。

- 2020 年 6 月,Netch Pump & Systems(巴西)从 Exton美国子公司交付了第 100 万台泵浦。泵浦在我们位于德国 Waldkreiburg 的总部製造,是一款用于高密度固态的 Nemo 蛇形泵浦。这些零件在巴西内奇工厂设计和製造,然后对泵浦进行组装、测试并运往美国。

- 此外,根据 Indexbox 的数据,2020 年巴西容积泵和手动泵的国外进口量增加。期间进口急剧增加。成长最快的是2009年,当时进口量增加。预计2020年进口将达到峰值,短期内可望稳定成长。

拉丁美洲正排量泵产业概况

拉丁美洲正排量帮浦市场是一个高度分散的市场。该市场的主要企业包括福斯公司、阿特拉斯·科普柯和赛莱默公司。

- 2021 年 3 月 - Abel Pumps 被 IDEX Corporation 收购,该公司为采矿、船舶、电力、水和用水和污水以及其他一般行业等各种终端行业製造高度工程化的往復式正排量泵。

- 2021 年 1 月 - 阿特拉斯·科普柯可携式能源公司扩大了脱水泵产品线,推出了 30 多款新型重型、大容量泵。我们推出了一款新型活塞正排量泵,可以干运转而不会损坏内部零件。非常适合中等水量和深度的井点应用。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 石油和天然气产业的持续需求

- 一次性水位严重短缺和地下水污染推动市场

- 市场挑战

- 传统最终用户产业市场饱和

第六章 市场细分

- 按类型

- 往復泵

- 隔膜

- 活塞

- 柱塞

- 旋转泵

- 齿轮

- 长袍

- 拧紧

- 叶片

- 蠕动帮浦

- 渐进空洞

- 往復泵

- 按最终用户

- 石油和天然气

- 化学

- 饮食

- 用水和污水

- 製药

- 电力

- 其他的

- 按地区

- 巴西

- 哥伦比亚

- 墨西哥

第七章 竞争格局

- 公司简介

- Atlas Copco

- The Weir Group PLC

- Flowserve Corporation

- Xylem Inc.

- SPX FLOW, Inc

- Colfax

- IDEX

- Abel Pumps

- Dover Corporation

- Tsurumi Pump

- Pentair Plc

- Alfa Laval AB

第八章投资分析

第九章 未来市场展望

简介目录

Product Code: 91648

The Latin America Positive Displacement Pumps Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- Latin America has an abundance of natural resources. As a result, the extractive industry is critical to the economies of the countries. Although the oil and gas industry is the major end-user, sales are also driven by other industries including as power generation, water and wastewater, construction, chemical processes, food and beverage, pharmaceuticals, and metals and mining.

- The COVID-19 pandemic has had a significant effect on the production of oil, gas, and electricity in Latin America. Positive displacement pumps are in less demand throughout the region as a result of supply chain interruptions and delays in project construction activity. Also, It was expected that positive displacement pump market pump sales will likely resume after the end of COVID-19 pandemic. Further rising industrialization, increased construction projects, and increased mining activity in the region are the primary drivers boosting demand for positive displacement pumps in Latin America.

- The rising need to treat wastewater created by the industrial sector, along with declining groundwater levels, will drive market demand for positive displacement pumps in the future. Positive displacement pumps have high viscosity, solids handling capability, efficiency, and accurate repeatable measurement, all of which contribute to market growth.

- Additionally, The rapid development of civic water utility infrastructure in emerging regions such as Latin America has led to increased demand for positive displacement pumps. The demand for sewage treatment has increased massively in both public and industrial sectors with increased number of pumping units installed base. Technologies such as desalination and ZLD (zero-liquid discharge) is expected to boost the market for positive displacement pumps market in civic and industrial sectors.

Latin America Positive Displacement Pumps Market Trends

Oil and Gas Industry drives Positive Displacement Pumps Market

- As one of the largest end-user, the oil and gas industry drives positive displacement pump sales. Following a devastating drop in the region's economy as a result of the COVID-19 outbreak, reforms in each country's legal frameworks and regulations are critical to reviving pump sales. Positive displacement pump manufacturers have an appealing market outlook due to regional attention to the development of oil and gas resources as well as the general requirement for basic chemicals.

- Moreover, positive displacement pumps are widely used in the oil and gas industries of nations such as Venezuela, Brazil, and Mexico. These pumps are utilized for both exploratory and refining purposes. Furthermore, investments in the oil and gas sector, such as shale gas exploration and liquefied natural gas, are likely to drive demand for positive displacement pumps in Latin American regions.

- Further, mining activity in Latin American countries such as Peru and Chile has increased the demand for positive displacement pumps, particularly for the repair and maintenance of existing pumps. Chile and Peru are likely to present a combined opportunity for capital expenditure. As a result, these factors are likely to promote market growth throughout the forecast period.

- Despite the slowing trend in material price supply and demand, the oil and gas industry is likely to have enormous demand for positive displacement pumps over the projection period. This is due to ongoing investments in shale gas around the world. The increasing emphasis on establishing micro-liquefied natural gas terminals, which has resulted in reduced investment value for oil producers, has resulted in rising demand for positive displacement pumps.

Brazil is the Most Lucrative Country in the Latin America Positive Displacement Pump Market

- Brazil is the leading revenue-producing nation in the Latin American positive displacement pump market because of an increase in businesses that has decreased the amount of potable water and increased groundwater contamination. Additionally, the use of positive displacement pumps has expanded as a result of low disposable water levels and groundwater adulteration, which would accelerate market expansion even more.

- According to World Integrated Trade Solution, in Latin America, positive displacement pump exports from Brazil were primarily destined for Bolivia, Chile, and Paraguay. Following these countries are the United States, Argentina, and Germany. The US and Germany recorded the most noticeable rates of growth in terms of shipments among the major destination nations, while the other leaders experienced more modest rates of growth.

- Netzsch Pumps & Systems, Brazil, delivered its millionth pump from its subsidiary in Exton, USA, in June 2020. The pump was created at the company's headquarters in Waldkraiburg, Germany, and is a Nemo progressive cavity pump for high-density solids. The components were designed and constructed in the Netzsch facility in Brazil, and the pump was then assembled, tested, and transported to the United States.

- Additionally, according to Indexbox, Brazil saw a rise in foreign imports of positive displacement pumps and hand pumps in 2020. Imports increased dramatically during this time period. The rate of growth was fastest in 2009, when imports rose. Imports peaked in 2020 and are expected to grow steadily in the short term.

Latin America Positive Displacement Pumps Industry Overview

Latin America positive displacement pumps market is fairly fragmented market. Some of the key players in the market include Flowserve Corp., Atlas Copco, Xylem Inc., etc.

- March 2021 - Abel Pumps, a producer of highly engineered reciprocating positive displacement pumps for a range of end sectors, including mining, marine, power, water, wastewater, and other general industries, was acquired by IDEX Corporation.

- January 2021 - Atlas Copco Portable Energy has expanded its dewatering range with the introduction of over thirty new heavy-duty, high-capacity pumps. A novel piston positive displacement pump that may run dry without destroying internal components has been introduced. It is best suited for wellpoint applications with modest water volume and depth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study assumptions and market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness -Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Continuous Demand from the Oil & Gas Industry

- 5.1.2 Huge Scarcity in the Disposable Water Level and Groundwater Adulteration will Drive the Market

- 5.2 Market Challenges

- 5.2.1 Market Saturation in Conventional End-user Industries

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Reciprocating Pumps

- 6.1.1.1 Diaphragm

- 6.1.1.2 Piston

- 6.1.1.3 Plunger

- 6.1.2 Rotary Pumps

- 6.1.2.1 Gear

- 6.1.2.2 Lobe

- 6.1.2.3 Screw

- 6.1.2.4 Vane

- 6.1.2.5 Peristaltic

- 6.1.2.6 Progressive Cavity

- 6.1.1 Reciprocating Pumps

- 6.2 End-User

- 6.2.1 Oil & Gas

- 6.2.2 Chemicals

- 6.2.3 Food & Beverages

- 6.2.4 Water & Wastewater

- 6.2.5 Pharmaceuticals

- 6.2.6 Power

- 6.2.7 Others

- 6.3 Geography

- 6.3.1 Brazil

- 6.3.2 Colombia

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atlas Copco

- 7.1.2 The Weir Group PLC

- 7.1.3 Flowserve Corporation

- 7.1.4 Xylem Inc.

- 7.1.5 SPX FLOW, Inc

- 7.1.6 Colfax

- 7.1.7 IDEX

- 7.1.8 Abel Pumps

- 7.1.9 Dover Corporation

- 7.1.10 Tsurumi Pump

- 7.1.11 Pentair Plc

- 7.1.12 Alfa Laval AB

8 INVESTMENT ANALYSIS

9 FUTURE MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219