|

市场调查报告书

商品编码

1892829

復健护理市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Post-acute Care Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

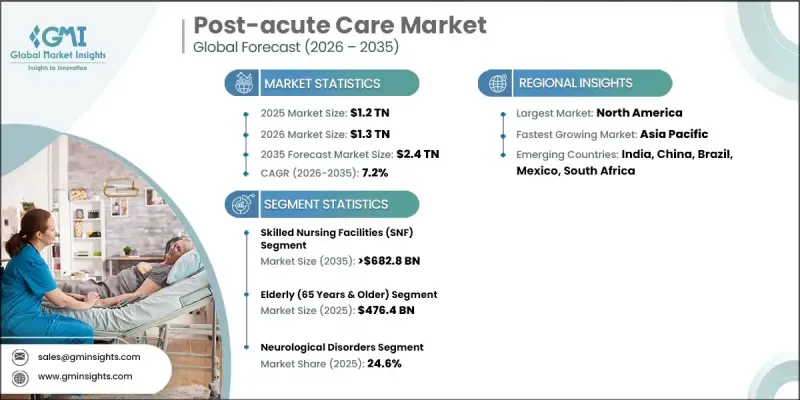

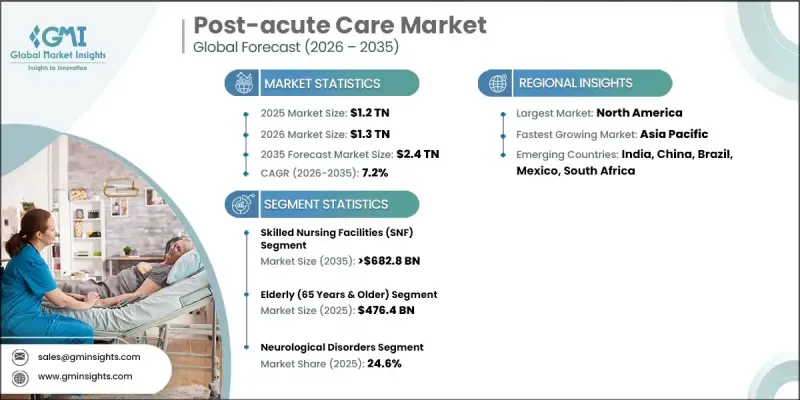

2025 年全球復健护理市场价值 1.2 兆美元,预计到 2035 年将以 7.2% 的复合年增长率增长至 2.4 兆美元。

居家和社区復健服务的日益普及、復健技术的不断创新以及慢性病和老年相关疾病盛行率的不断上升,共同推动了復健市场的成长。全球人口结构的变化也促进了需求的持续成长,2022年,65岁以上人口占全球总人口的10%。这些因素增加了患者出院后长期復健护理的需求,推动了家庭医疗保健服务、专业护理机构和住院復健机构的使用。此外,医疗保健系统寻求经济高效的復健途径,以改善治疗效果并减少再入院率,也进一步支撑了市场的发展。随着患者期望的不断变化,復健后护理机构正成为更广泛的医疗保健服务体系中不可或缺的一部分,为不同患者群体提供长期復健、行动能力改善和慢性病管理方面的支持。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 1.2兆美元 |

| 预测值 | 2.4兆美元 |

| 复合年增长率 | 7.2% |

数位健康解决方案的采用正在改变復健后护理的模式。远距復健平台、穿戴式监测设备、人工智慧支援的復健分析以及自动化治疗系统等技术,能够实现对患者的持续监测和个人化治疗方案的发展。这些进步有助于更早进行干预,并提高復原效率。由于成本优势和更高的患者满意度,居家和社区护理模式越来越受欢迎,这促使医疗机构扩大居家治疗、远端监测和专业护理课程的覆盖范围。这种转变正逐步将復健后照护重新定位为更分散化、以病人为中心的照护模式。

预计到2025年,专业护理机构将占市场份额的31.5%。这些机构的需求主要源于患者出院后需要持续的临床监管、结构化的復健服务以及全面的復健支持。缩短住院时间的压力持续推高了转诊至专业护理机构的患者数量。

2025年,65岁及以上人口创造了4,764亿美元的经济产值,预计到2035年将以7.1%的复合年增长率成长。寿命延长以及行动不便和慢性病的盛行率上升,推动了对復健、监测和长期恢復服务的持续需求。

2025年美国復健护理市场规模达4,906亿美元,2026年至2035年将以6.4%的复合年增长率成长。向基于价值的照护模式的转变,不断加强復健护理机构在改善治疗效果和确保医疗保健系统内护理连续性方面的作用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 产业影响因素

- 成长驱动因素

- 慢性病和合併症盛行率上升

- 转向以价值为导向的医疗模式,以及降低医院再入院率的压力

- 患者越来越倾向于选择居家和社区护理

- 远距医疗和远距患者监测技术的进步

- 产业陷阱与挑战

- 报销的不确定性与政策/监管变化

- 不同医疗机构和服务提供者之间的照护协调存在碎片化问题。

- 来自专业护理机构和门诊中心的竞争

- 市场机会

- 远距医疗和远距监测服务的扩展

- 居家医院和家庭急性照护计画的成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 技术格局

- 当前技术趋势

- 新兴技术

- 报销方案

- 消费者洞察

- 未来市场趋势

- 概述及优势

- 復健护理中的价值导向护理模式

- 復健护理-投资展望

- 创业场景

- 波特的分析

- PESTEL 分析

- 差距分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 竞争定位矩阵

- 主要市场参与者的竞争分析

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新服务上线

- 扩张计划

第五章:市场估算与预测:依服务类型划分,2022-2035年

- 专业护理机构(SNF)

- 家庭健康机构(HHA)

- 长期照护医院(LTCH)

- 安宁疗护

- 住院復健机构(IRF)

- 其他服务

第六章:市场估计与预测:依年龄组别划分,2022-2035年

- 老年人(65岁以上)

- 成人(45-64岁)

- 其他年龄组

第七章:市场估计与预测:依条件划分,2022-2035年

- 神经系统疾病

- 脑损伤

- 截肢

- 脊髓损伤

- 伤口管理

- 其他条件

第八章:市场估算与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Alden Network

- Amedisys

- Athena Health Care Systems

- Bella Vista Health Center

- Benchmark Senior Living

- Brookdale Senior Living

- CareCentrix

- Covenant Care

- Encompass Health

- Evernorth Health

- Genesis Healthcare

- Select Medical

- SYMPHONY CARE NETWORK

- Vineyard Post Acute

- VITAS Healthcare

The Global Post-acute Care Market was valued at USD 1.2 trillion in 2025 and estimated to grow at a CAGR of 7.2% to reach USD 2.4 trillion by 2035.

The growth is supported by the rising preference for home-based and community-centered recovery services, continued innovation in rehabilitation technologies, and the growing prevalence of chronic and age-related health conditions. Global demographic shifts are also contributing to sustained demand, as the share of individuals aged 65 years and older reached 10% of the global population in 2022. These factors are increasing the need for extended recovery care following hospital discharge, driving utilization of home healthcare services, skilled nursing facilities, and inpatient rehabilitation settings. The market is further supported by healthcare systems seeking cost-effective recovery pathways that improve outcomes while reducing hospital readmissions. As patient expectations evolve, post-acute care providers are becoming an essential component of the broader care continuum, supporting long-term recovery, mobility improvement, and chronic condition management across diverse patient populations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.2 Trillion |

| Forecast Value | $2.4 Trillion |

| CAGR | 7.2% |

The adoption of digital health solutions is transforming post-acute care delivery. Technologies such as remote rehabilitation platforms, wearable monitoring devices, AI-supported recovery analytics, and automated therapy systems enable continuous patient oversight and personalized treatment planning. These advancements support earlier intervention and improved recovery efficiency. Home- and community-based care models are increasingly favored due to cost advantages and higher patient satisfaction, encouraging providers to expand in-home therapy, remote monitoring, and skilled nursing programs. This shift is gradually repositioning post-acute care toward a more decentralized, patient-centered delivery model.

The skilled nursing facilities segment accounted for a 31.5% share in 2025. Demand for these facilities is driven by the need for continuous clinical supervision, structured rehabilitation services, and comprehensive recovery support following hospital stays. Pressure to reduce inpatient length of stay continues to strengthen referral volumes to skilled nursing providers.

The population aged 65 years and older generated USD 476.4 billion in 2025 and is expected to grow at a CAGR of 7.1% through 2035. Increasing longevity and higher rates of mobility limitations and chronic conditions are driving sustained demand for rehabilitation, monitoring, and long-term recovery services.

U.S. Post-acute Care Market generated USD 490.6 billion in 2025 and will grow at a CAGR of 6.4% from 2026 to 2035. The shift toward value-based care models continues to strengthen the role of post-acute providers in improving outcomes and ensuring care continuity across healthcare systems.

Key companies operating in the Global Post-acute Care Market include Encompass Health, Brookdale Senior Living, Amedisys, Genesis Healthcare, Select Medical, CareCentrix, Evernorth Health, Benchmark Senior Living, Athena Health Care Systems, Covenant Care, Alden Network, VITAS Healthcare, Vineyard Post Acute, Bella Vista Health Center, and SYMPHONY CARE NETWORK. Companies in the Post-acute Care Market adopt multiple strategies to reinforce their market position and expand service reach. Providers invest in home-based care models and remote monitoring technologies to align with patient preferences and cost-efficiency goals. Strategic expansion through partnerships and acquisitions helps broaden geographic coverage and service portfolios. Emphasis on clinical quality, outcomes measurement, and value-based care alignment strengthens relationships with hospitals and payers. Workforce development initiatives support skilled staffing across nursing and rehabilitation services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Service trends

- 2.2.3 Age group trends

- 2.2.4 Condition trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases and comorbidities

- 3.2.1.2 Shift to value-based care and pressure to reduce hospital readmissions

- 3.2.1.3 Increasing patient preference for home- and community-based care

- 3.2.1.4 Advances in telehealth and remote patient monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Reimbursement uncertainty and policy/regulatory changes

- 3.2.2.2 Fragmented care coordination across providers and settings

- 3.2.2.3 Competition from skilled nursing facilities and outpatient centers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of telehealth and remote monitoring services

- 3.2.3.2 Growth of hospital-at-home and home-based acute care programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Consumer insights

- 3.8 Future market trends

- 3.9 Overview and benefits

- 3.10 Value-based care model in post-acute care

- 3.11 Post-acute care - Investment outlook

- 3.12 Start-up scenario

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive positioning matrix

- 4.4 Competitive analysis of major market players

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New service launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Skilled nursing facilities (SNF)

- 5.3 Home health agencies (HHA)

- 5.4 Long-term care hospitals (LTCHs)

- 5.5 Hospice care

- 5.6 Inpatient rehabilitation facilities (IRF)

- 5.7 Other services

Chapter 6 Market Estimates and Forecast, By Age Group, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Elderly (65 years & older)

- 6.3 Adult (45-64 years)

- 6.4 Other age groups

Chapter 7 Market Estimates and Forecast, By Condition, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Neurological disorders

- 7.3 Brain injury

- 7.4 Amputations

- 7.5 Spinal cord injury

- 7.6 Wound management

- 7.7 Other conditions

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alden Network

- 9.2 Amedisys

- 9.3 Athena Health Care Systems

- 9.4 Bella Vista Health Center

- 9.5 Benchmark Senior Living

- 9.6 Brookdale Senior Living

- 9.7 CareCentrix

- 9.8 Covenant Care

- 9.9 Encompass Health

- 9.10 Evernorth Health

- 9.11 Genesis Healthcare

- 9.12 Select Medical

- 9.13 SYMPHONY CARE NETWORK

- 9.14 Vineyard Post Acute

- 9.15 VITAS Healthcare