|

市场调查报告书

商品编码

1892911

现场服务管理市场机会、成长驱动因素、产业趋势分析及预测(2026-2035年)Field Service Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

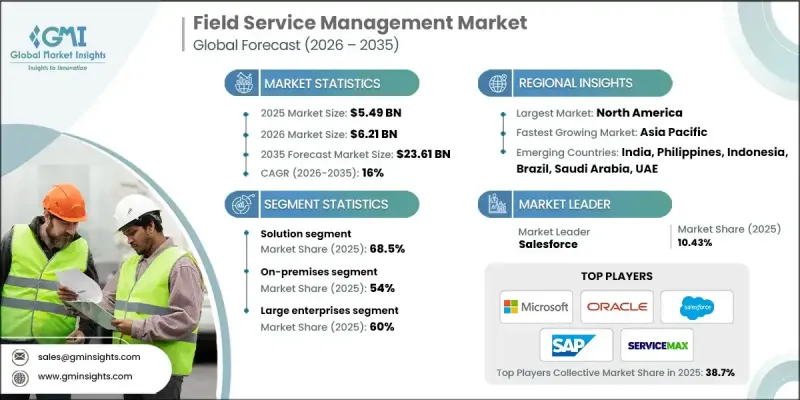

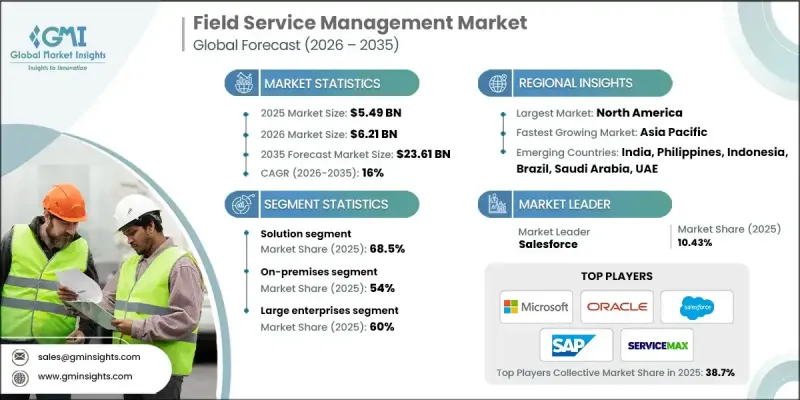

2025 年全球现场服务管理市场价值为 54.9 亿美元,预计到 2035 年将以 16% 的复合年增长率增长至 236.1 亿美元。

数位化优先营运、智慧劳动力自动化和互联资产网路的快速普及正在重塑市场格局。现代现场服务管理 (FSM) 平台融合了行动劳动力管理应用、人工智慧驱动的调度引擎、物联网赋能的资产诊断以及云端原生服务编排。这些功能使企业能够最大限度地减少停机时间、提高技术人员效率、提高首次修復率并增强客户满意度。公用事业、电信、医疗保健、製造业、暖通空调以及石油天然气等行业正在积极采用 FSM,以满足日益严格的服务期望、遵守安全法规并实现分散式现场营运的现代化。从人工纸本工作转向预测性维护、数位化工作流程和自动化调度,正在推动 FSM 的广泛应用。 FSM 供应商、物联网供应商、ERP 公司和云端超大规模云端服务商之间的合作关係,建构了无缝现场营运、扩增实境支援、即时监控和低程式码客製化的整合生态系统,从而提高了企业服务管理的效率和可扩展性。

| 市场范围 | |

|---|---|

| 起始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 54.9亿美元 |

| 预测值 | 236.1亿美元 |

| 复合年增长率 | 16% |

到了2025年,解决方案细分市场占据68.5%的市场份额,预计到2035年将以15.5%的复合年增长率成长。企业越来越依赖综合性的现场服务管理(FSM)平台来进行排班、工单管理、资产追踪和技术人员绩效监控。人工智慧、物联网、GPS和自动化工具的整合使企业能够消除低效环节、优化一次性修復率并高效扩展营运规模。公用事业、电信、医疗保健、能源和製造业等各行各业的组织都优先考虑统一的数位化解决方案,而不是分散或手动流程,这推动了FSM解决方案的持续成长。

到2025年,本地部署市场份额将达到54%,预计到2035年将以15.1%的复合年增长率成长。国防、医疗保健、公用事业、石油天然气和製造业等管理敏感营运资料、关键资产和关键现场资讯的产业更倾向于部署本地现场服务管理(FSM)系统。这些系统能够提供对伺服器的完全控制、可自订的安全协定以及符合合规要求的治理。本地部署解决方案还能确保在低连线环境下不间断地存取现场资料,同时最大限度地降低与第三方云端漏洞相关的风险。

美国现场服务管理市场占据85%的市场份额,预计2025年将达到18.1亿美元。美国市场的成长主要得益于企业采用数位化平台来简化营运、缩短服务回应时间并提升客户体验。 IT、电信、医疗保健和製造等行业的公司都在利用现场服务管理(FSM)工具来优化劳动力、即时追踪技术人员并实现服务流程自动化。物联网设备和预测性维护解决方案的普及进一步加速了对先进现场服务管理系统的需求。

目录

第一章:方法论

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 设备复杂性增加,需要先进的现场服务解决方案。

- 预测性维护在各工业领域的应用日益普及。

- 对更快的服务解决速度和 SLA 合规性的需求激增。

- 公用事业、电信和製造业的数位转型措施不断增加。交通运输解决方案

- 售后服务模式和长期维护合约的兴起。

- 产业陷阱与挑战

- 现有CRM或ERP系统的复杂性

- 熟练技术人员不足

- 市场机会

- 人工智慧副驾驶和生成式人工智慧在现场自动化领域的应用激增。

- 物联网连接资产安装量的增加推动了预测性服务的发展机会。

- 远端和自主维护工具的兴起,包括无人机和扩增实境支援。

- 新兴市场对经济高效的云端FSM解决方案的需求日益增长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 美国:HIPAA(健康保险流通与责任法案)影响联邦密克罗尼西亚联邦对医疗保健服务就诊中受保护健康资讯的处理。

- 加拿大:PIPEDA(个人资讯保护和电子文件法)规范了联邦供应机构供应商对国家个人资料的处理。

- 欧洲

- 德国:BSI IT 安全法案 / BSI 指南,针对关键基础设施和软体供应商的国家网路安全规则。

- 英国:英国《一般资料保护规范》(GDPR) 和 2018 年《资料保护法》规范了英国脱欧后在英国营运的 FSM 供应商的资料使用和传输。

- 法国:GDPR(欧盟)/CNIL 指南(资料保护和地理定位)。

- 义大利:Testo Unico sulla Sicurezza sul Lavoro(职业安全法)

- 亚太地区

- 中国:网路安全法(网路产品/关键资讯基础设施)

- 印度:《数位个人资料保护法》(2023 年)(及《资讯科技法》条款)

- 日本:《个人资讯保护法》(APPI)

- 澳洲:澳洲安全工作规范(工作场所和技术人员安全)

- 拉丁美洲

- 巴西:LGPD(Lei Geral de Protecao de Dados/通用资料保护法)

- 墨西哥:LFPDPPP(私人持有个人资料保护联邦法)

- 阿根廷:省级电动计程车法规(布宜诺斯艾利斯)

- MEA

- 阿联酋:联邦法令第45号/个人资料保护法(PDPL)(以及杜拜国际金融中心/阿布达比全球市场资料规则)

- 沙乌地阿拉伯:国家网路安全局/SASO 标准和工作场所安全规则

- 南非:《个人资讯保护法》(POPIA)

- 北美洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利分析

- 永续性和环境影响分析

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 未来展望与机会

- 技术路线图和演进时间表

- 新兴应用机会

- 投资需求及资金来源

- 风险评估与缓解策略

- 针对市场参与者的策略建议

- 用例

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估算与预测:依组件划分,2022-2035年

- 解决方案

- 移动现场执行

- 服务合约管理

- 保固管理

- 劳动力管理

- 客户管理

- 库存管理

- 其他的

- 服务

- 执行

- 培训与支援

- 咨询顾问

第六章:市场估算与预测:依部署模式划分,2022-2035年

- 现场

- 云

第七章:市场估计与预测:依产业垂直领域划分,2022-2035年

- 能源与公用事业

- 资讯科技和电信

- 製造业

- 卫生保健

- 金融服务业

- 运输与物流

- 零售与电子商务

- 其他的

第八章:市场估算与预测:依企业规模划分,2022-2035年

- 中小企业

- 大型企业

第九章:市场估算与预测:依应用领域划分,2022-2035年

- 工单管理

- 合约管理

- 移动劳动力管理

- 资产管理

- 车队监控

- 其他的

第十章:市场估计与预测:依地区划分,2022-2035年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 菲律宾

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 全球参与者

- Salesforce

- Microsoft

- SAP

- Oracle

- IFS

- ServiceMax (PCT)

- Trimble

- Accruent

- 区域玩家

- Zinier

- KloudGin

- Zuper

- FieldAware

- Praxedo

- simPRO

- OverIT

- ProntoForms

- 新兴参与者

- FieldEZ Technologies

- Jobber

- Housecall

- ServicePower

The Global Field Service Management Market was valued at USD 5.49 billion in 2025 and is estimated to grow at a CAGR of 16% to reach USD 23.61 billion by 2035.

The market is reshaped by the rapid adoption of digital-first operations, intelligent workforce automation, and connected asset networks. Modern FSM platforms now combine mobile workforce management apps, AI-driven scheduling engines, IoT-enabled asset diagnostics, and cloud-native service orchestration. These capabilities enable companies to minimize downtime, boost technician efficiency, improve first-time fix rates, and elevate customer satisfaction. Sectors such as utilities, telecom, healthcare, manufacturing, HVAC, and oil & gas are embracing FSM to meet stricter service expectations, comply with safety regulations, and modernize decentralized field operations. The shift away from manual paperwork toward predictive maintenance, digital workflows, and automated dispatching is driving strong adoption. Collaborative partnerships between FSM providers, IoT vendors, ERP firms, and cloud hyperscalers create integrated ecosystems for seamless field operations, augmented reality support, real-time monitoring, and low-code customization, making enterprise service management more efficient and scalable.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.49 Billion |

| Forecast Value | $23.61 Billion |

| CAGR | 16% |

The solution segment held 68.5% share in 2025 and is expected to grow at a CAGR of 15.5% through 2035. Businesses increasingly rely on comprehensive FSM platforms for scheduling, work order management, asset tracking, and technician performance monitoring. Integration of AI, IoT, GPS, and automation tools enables companies to eliminate inefficiencies, optimize first-time fixes, and scale operations efficiently. Organizations across utilities, telecom, healthcare, energy, and manufacturing prioritize unified digital solutions over fragmented or manual processes, fueling sustained growth in FSM solutions adoption.

The on-premises segment held a 54% share in 2025 and is projected to grow at a CAGR of 15.1% through 2035. Industries that manage sensitive operational data, critical assets, and mission-critical field information, such as defense, healthcare, utilities, oil & gas, and manufacturing, prefer on-premises FSM deployments. These systems offer complete control over servers, customizable security protocols, and compliance-aligned governance. On-premises solutions also ensure uninterrupted access to field data in low-connectivity environments while minimizing risks associated with third-party cloud vulnerabilities.

US Field Service Management Market held an 85% share, generating USD 1.81 billion in 2025. Growth in the US market is fueled by enterprises adopting digital platforms to streamline operations, reduce service response times, and enhance customer experiences. Companies across IT, telecom, healthcare, and manufacturing leverage FSM tools for workforce optimization, real-time technician tracking, and automated service processes. The expansion of IoT devices and predictive maintenance solutions further accelerates the need for advanced field service management systems.

Major companies operating in the Global Field Service Management Market include Salesforce, SAP, Microsoft, Oracle, IFS, Jobber, Zinier, ServiceMax, Trimble, and Housecall. To strengthen their foothold in the Field Service Management Market, companies are investing in advanced digital solutions that integrate AI, IoT, and cloud capabilities to optimize field operations. They are expanding platform functionalities to include predictive maintenance, augmented reality support, and real-time analytics to improve technician productivity and first-time fix rates. Strategic partnerships with IoT manufacturers, ERP providers, and cloud service vendors enable the creation of interoperable ecosystems for seamless workflow automation. Firms are also focusing on on-premises deployments for data-sensitive clients and offering flexible subscription-based models to attract SMEs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Enterprise Size

- 2.2.4 Deployment Mode

- 2.2.5 Industry Vertical

- 2.2.6 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in equipment complexity requiring advanced field service solutions.

- 3.2.1.2 Rise in predictive maintenance adoption across industrial sectors.

- 3.2.1.3 Surge in demand for faster service resolution and SLA compliance.

- 3.2.1.4 Increase in digital transformation initiatives in utilities, telecom, and manufacturing. transportation solutions

- 3.2.1.5 Rise in after-sales service models and long-term maintenance contracts.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexities in the existing CRM or ERP systems

- 3.2.2.2 Insufficient skilled technicians

- 3.2.3 Market opportunities

- 3.2.3.1 Surge in adoption of AI copilots and generative AI for field automation.

- 3.2.3.2 Increase in IoT-connected asset installations driving predictive service opportunities.

- 3.2.3.3 Rise in remote and autonomous maintenance tools, including drones and AR support.

- 3.2.3.4 Growing demand for cost-effective cloud FSM solutions in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US: HIPAA (Health Insurance Portability & Accountability Act) impacts FSM handling of protected health information for healthcare service visits.

- 3.4.1.2 Canada: PIPEDA (Personal Information Protection and Electronic Documents Act) governs national personal data processing by FSM vendors.

- 3.4.2 Europe

- 3.4.2.1 Germany: BSI IT Security Act / BSI-Guidelines national cybersecurity rules for critical infrastructure and software vendors.

- 3.4.2.2 UK: UK GDPR & Data Protection Act 2018 governs data use and transfer post-Brexit for FSM providers operating in the UK

- 3.4.2.3 France: GDPR (EU) / CNIL guidance (data protection & geolocation).

- 3.4.2.4 Italy: Testo Unico sulla Sicurezza sul Lavoro (occupational safety law)

- 3.4.3 Asia Pacific

- 3.4.3.1 China: Cybersecurity Law (network products / critical information infrastructure)

- 3.4.3.2 India: DPDP Act / Digital Personal Data Protection Act (2023) (and IT Act provisions)

- 3.4.3.3 Japan: APPI (Act on the Protection of Personal Information)

- 3.4.3.4 Australia: Safe Work Australia codes (workplace & technician safety)

- 3.4.4 Latin America

- 3.4.4.1 Brazil: LGPD (Lei Geral de Protecao de Dados / General Data Protection Law)

- 3.4.4.2 Mexico: LFPDPPP (Federal Law on Protection of Personal Data Held by Private Parties)

- 3.4.4.3 Argentina: Provincial EV Taxi Regulations (Buenos Aires)

- 3.4.5 MEA

- 3.4.5.1 UAE: Federal Decree-Law No. 45 / Personal Data Protection Law (PDPL) (and DIFC/ADGM data rules)

- 3.4.5.2 Saudi Arabia: National Cybersecurity Authority / SASO standards and workplace safety rules

- 3.4.5.3 South Africa: POPIA (Protection of Personal Information Act)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental impact analysis

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Future outlook & opportunities

- 3.10.1 Technology roadmap & evolution timeline

- 3.10.2 Emerging application opportunities

- 3.10.3 Investment requirements & funding sources

- 3.10.4 Risk assessment & mitigation strategies

- 3.10.5 Strategic recommendations for market participants

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Mobile field execution

- 5.2.2 Service contract management

- 5.2.3 Warranty management

- 5.2.4 Workforce management

- 5.2.5 Customer management

- 5.2.6 Inventory management

- 5.2.7 Others

- 5.3 Services

- 5.3.1 Implementation

- 5.3.2 Training & support

- 5.3.3 Consulting & advisory

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Industry Vertical, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Energy & utilities

- 7.3 IT and Telecom

- 7.4 Manufacturing

- 7.5 Healthcare

- 7.6 BFSI

- 7.7 Transportation & logistics

- 7.8 Retail and E-commerce

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large Enterprises

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Work Order Management

- 9.3 Contract Management

- 9.4 Mobile Workforce Management

- 9.5 Asset Management

- 9.6 Fleet Monitoring

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Salesforce

- 11.1.2 Microsoft

- 11.1.3 SAP

- 11.1.4 Oracle

- 11.1.5 IFS

- 11.1.6 ServiceMax (PCT)

- 11.1.7 Trimble

- 11.1.8 Accruent

- 11.2 Regional Players

- 11.2.1 Zinier

- 11.2.2 KloudGin

- 11.2.3 Zuper

- 11.2.4 FieldAware

- 11.2.5 Praxedo

- 11.2.6 simPRO

- 11.2.7 OverIT

- 11.2.8 ProntoForms

- 11.3 Emerging Players

- 11.3.1 FieldEZ Technologies

- 11.3.2 Jobber

- 11.3.3 Housecall

- 11.3.4 ServicePower