|

市场调查报告书

商品编码

1644485

亚太现场服务管理:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia Pacific Field Service Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

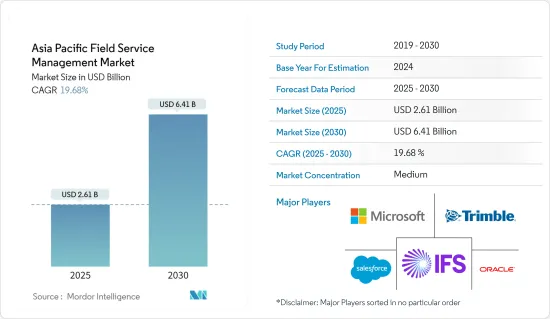

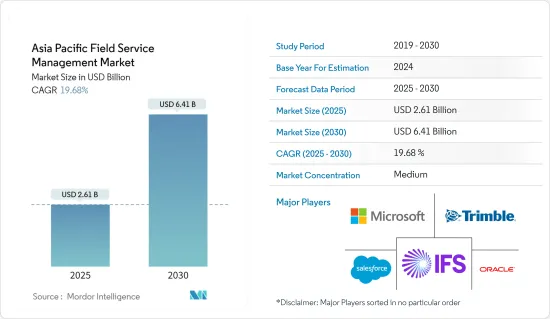

亚太地区现场服务管理市场规模预计在 2025 年为 26.1 亿美元,预计到 2030 年将达到 64.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 19.68%。

过去几年,由于对省时省钱的解决方案的需求不断增长,现场服务管理行业发展迅速。现场服务组织已经意识到采用数位技术可以在弥补各种技术人员短缺方面发挥关键作用,并正在广泛采用各种现场服务管理解决方案。

关键亮点

- 虽然现场服务在全球范围内呈上升趋势,但亚太地区却主导打破了美国在该领域的主导地位。这一快速成长趋势的推动力是该地区新兴市场(如中国和印度)大量中小型企业 (SME) 的存在。根据经合组织的资料,2021年亚洲中小企业数量预计为1.861亿家,高于2020年的1.8231亿家。中小企业总数的增加预计将显着促进亚太地区现场服务管理市场的发展。

- 中小企业数量不断增加,竞争同步加剧。这反过来会推动各种新技术和创新技术的采用,例如工作发票、计费和调度、服务交付等各种业务流程的自动化。降低营运成本和提高生产力的压力也越来越大。混合劳动模式和物联网等新技术的出现也在推动市场成长。

- 亚太地区现场服务管理市场历来因终端用户越来越多地采用即时协作系统而见证了显着的成长。预计这将在预测期内推动市场成长。此外,持续的新冠疫情也显着促进了市场成长。

- 对于现场服务组织来说,处理零件和物流一直是最重要的业务挑战之一。在亚太地区,SuiteCommerce 是与 NetSuite 预先整合的可扩展业务解决方案,其中包括用于订单管理、客户关係管理和我的帐户的增强型客户中心解决方案。现场服务公司倾向于主要使用该软体透过其网站销售产品,直接面向企业和直接面向消费者。

- COVID-19 对大型和小型企业都产生了重大影响。由于世界各国实施封锁,製造业、汽车业、纺织业、运输和物流业、旅游和酒店业以及消费品等关键产业被迫关闭。此外,随着经济适应这些偏远地区的新经营方式,COVID-19 再次证明了企业需要超越传统的现场服务业务,并制定策略透过使用智慧技术来提高弹性。

亚太地区现场服务管理市场趋势

印度加速采用现场服务管理解决方案

- 印度是现场服务管理解决方案、云端和人工智慧的主要市场之一。中小企业对人工智慧和云端运算的采用越来越多,以及所有终端用户对人工智慧技术的投资不断增加,是推动市场成长的一些关键因素。

- 由于中小企业的持续投资,该地区有望显着成长。中小型企业正在投入巨额资金,以最大限度地全面采用云端基础的、技术先进的现场服务管理解决方案。此外,印度市场也提供了巨大的成长机会。

- 例如,根据印度中小微型企业部的数据,截至 2022 年 3 月,印度有超过 790 万家 MSMEs(微型、小型和中型企业)。鑑于对可扩展 IT 解决方案和系统的依赖,中小微型企业和政府希望将敏感资讯和流程转移到云端是可以理解的。

- 此外,印度拥有庞大的工业基础,这意味着 FSM 市场基础广泛。由于该国地理区域发达且基本客群庞大,预计其现场服务管理市场将稳定成长。全国技术用户数量的稳定成长进一步推动了现场服务管理市场的成长。

- 在新冠肺炎疫情爆发前,现场服务管理高峰会在印度举行,高峰会涵盖的主题包括满足现场服务接触点日益复杂的需求所需的技能、技术和变革管理策略,物联网在现场服务管理中的未来,解决第三方劳动力管理和第三方计费中的关键挑战,提高首次修復率以实现更高的客户满意度和利润。

大公司占有较大的市场占有率

- 亚太地区大型企业对现场服务管理解决方案的采用相对比中小企业更为先进。大型企业的承受能力和规模经济允许更大规模地部署客户管理、保固管理、库存管理、计费和工单管理解决方案。

- 在当今的现场服务管理软体中,客户关係管理已成为企业的首要任务之一,因为它可以提高组织的品牌知名度并有助于留住客户。本公司广泛注重为客户提供快速且流畅的体验,从而对该地区现场服务管理市场的需求和要求产生正面影响。

- 各行各业的公司都在踏上各种数位转型之旅并投资于客户参与解决方案。企业也明显脱离了 CRM 等传统平台。因此,企业计划的这种转变可能会在预测期内为市场上的製造商和供应商提供更好的前景。

- 此外,该地区的主要供应商正致力于建立策略联盟,以扩大其地理覆盖范围。 2022 年 8 月,微软(斯里兰卡科伦坡)与领先的开放原始码整合供应商 WSO2 宣布了一项战略协议,将部署云端原生解决方案,透过 Microsoft Azure 向全球地区安全地交付 API、应用程式和数位身分。该协议还意味着整合供应商将使用 Microsoft Azure 作为其主要云端平台。

- 此外,由于数位转型,大型企业正在采用云端整合合约管理解决方案。它可以让您更好地控制,允许在一个方便的地方创建、协商、签署、核准、追踪和更新公共和私营部门的合约。

- 除了大型企业采用现场服务管理软体的好处之外,亚太成熟经济体工业领域的崛起也为现场服务管理软体整合带来了新的机会。例如,根据亚洲开发银行的数据,2021年,孟加拉工业部门的增加价值与前一年同期比较10.3%。

亚太地区现场服务管理产业概览

亚太地区现场服务管理市场竞争激烈,有大量全球和区域参与企业。这些公司采取的关键策略包括併购、产品创新和业务扩张。主导市场的主要企业是 Salesforce.Com Inc.、Microsoft Corporation、IFS AB、Trimble Inc 和 Oracle Corporation。

- 2021 年 8 月 - Mize Inc.,一家服务零件和合约管理的领导者,包括库存、定价和基于物联网的预防性维修监控解决方案,与 Syncron 合併。合併后的公司将使用 Syncron 名称,专注于提供连网服务体验并加速以服务为中心的新经营模式。此外,两家公司都致力于对创新进行大量投资并扩大全球覆盖范围,包括亚洲市场。

- 2021 年 7 月-以资产为中心的现场服务管理公司 ServiceMax 宣布已签署最终协议,收购行动现场营运管理解决方案供应商 LiquidFrameworks。此次收购旨在扩大 ServiceMax 针对工业、环境和石油天然气服务的现场服务管理解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估新冠肺炎对市场的影响

- FSM 的关键使用案例分析(AR/VR 远端协助、专注于客户维繫和服务的预测性维护、逐步转向后端自动化)

第五章 市场动态

- 市场驱动因素

- 客户对更快回应时间的需求使得 FMS 公司可以投资新技术。

- 更加重视最大限度地提高工作效率

- 市场问题

- 实施/整合问题和授权成本(成本和投资报酬率挑战)

第六章 市场细分

- 依实施类型

- 本地

- 云

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户

- Allied FM(硬体:建筑和空调,软体:园林绿化和清洁)

- 资讯科技和电讯

- 医疗保健和生命科学

- 能源和公共产业

- 石油和天然气

- 製造业

- 其他最终使用者(运输、房地产等)

- 按国家

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Field Aware US, Inc.

- Oracle Corporation(OFSC)

- IFS AB

- ServiceMax Inc.

- ServicePower, Inc.

- Coresystems(SAP SE)

- Microsoft Corporation(Dynamics 365 for Field Service)

- Accruent LLC(Fortive Corp)

- Mize, Inc.

- Salesforce.com, Inc.(Field Service Cloud)

- Zinier, Inc.

- Trimble Inc.

- The simPRO Group Pty Limited

- Kirona Solutions Limited(Advanced)

第八章投资分析

第九章:未来展望

The Asia Pacific Field Service Management Market size is estimated at USD 2.61 billion in 2025, and is expected to reach USD 6.41 billion by 2030, at a CAGR of 19.68% during the forecast period (2025-2030).

The field service management industry has been seeing rapid growth over the last few years, lifted by the growing demand for time and cost-effective solutions. The Field service organizations realize that adopting digital technology can play a very significant role in terms of closing the gap for various technician workforce shortages, and so they are widely adopting various field service management solutions.

Key Highlights

- Field service is on an upward trajectory globally, and one region leading the charge to challenge the overall US dominance of the sector is the Asia-Pacific. The reason behind this rapid growth trend is attributed to the fact that the region's emerging markets (such as China and India) are home to a wide range of small and medium-sized enterprises (SMEs). As per the data from OECD, the estimated number of small and medium-sized enterprises (SMEs) in Asia in 2021 was 186.1 million, whereas, in the year 2020, it was 182.31 million. This rise in the total number of SMEs will significantly boost the market for field service management in the Asia Pacific region.

- The continuous increase in the number of these enterprises leads to a sympathetic growth in the competition. This, in turn, fuels the introduction of various new innovative technology, such as automation for various business processes like job invoicing, billing and scheduling, and service delivery. There is also a rising demand to reduce operating costs and increase productivity. The emergence of new technologies such as mixed labor models and IoT are also promoting the growth of the market.

- The market for Asia Pacific field service management has historically been subjected to significant growth owing to the rising adoption of real-time collaboration systems at the end-user segments. This is anticipated to foster the growth of the market during the forecast period. Moreover, the ongoing COVID-19 pandemic has resulted in a significant boost in market growth.

- One of the top business challenges for the organizations related to field service, was dealing with parts and logistics. In the Asia-Pacific region, SuiteCommerce is a demanding scalable business solution pre-integrated into NetSuite, involving order management, customers, and an enhanced customer center solution for My Account. The Field service companies primarily tend to use this software to sell their products via the website, both direct to business and direct to consumer.

- The COVID-19 had significantly impact on both large corporations and SMEs. Key industries include manufacturing, automotive, textile, transportation and logistics, tourism and hospitality, and consumer goods have been forced to close due to global country-level lockdowns. Furthermore, as the economy adjusts to this new, remote manner of conducting business, COVID-19 reaffirmed the necessity for enterprises to think beyond their conventional field service operations and create strategies to be resilient through the use of intelligent technologies.

APAC Field Service Management Market Trends

Adoption of Field Service Management Solutions in India is Increasing at a High Pace

- India is one of the crucial markets for field service management solutions, cloud, and AI. The rising AI and cloud adoption among SMEs and the growing investments by all the end-users in AI technology are some of the significant factors enhancing the market's growth.

- The region is anticipated to witness massive growth, owing to the ongoing investments by small and medium organizations. SMEs are investing a huge sum of money to maximize the overall adoption of cloud-based and technologically advanced solutions for field service management. Moreover, the country India offers significant growth opportunities in the market.

- For instance, as of March 2022, as per the Ministry of Micro, Small & Medium Enterprises, India has over 7.9 million MSMEs (micro, small and medium enterprises). Given that the MSMEs and government are relying on scalable IT solutions and systems, it is quite understandable that they would like to shift their sensitive information and processes to the cloud.

- Moreover, the FSM market has a wide scope in India, primarily due to large-scale industrialization. The country is anticipated to exhibit steady growth in the field service management market with advanced geographic zones and a high client base. The steady rise in the overall number of technology users in the country further propels the growth of the field service management market.

- Before COVID-19, Field Service Management Summit occurted in India, which covered the topics such as skills, technology, and change management strategies required to fulfill the rising complexity of the field service touchpoint, the future of IoT for field services management, addressing the key challenges in third-party workforce management and third billing, enhancing first-time fix rates to achieve higher customer satisfaction, profits, etc.

Large Enterprises to Hold Significant Market Share

- The growing adoption of field service management solutions in large enterprises is relatively greater than SMEs in the Asia Pacific region. The affordability and the large scale of economies of the Large organizations enable them to deploy customer management, warranty management, inventory management, and billing and work order management solutions on a greater scale.

- Among the current field service management software, customer management has become one of the key priorities for the companies as it allows the organizations' brand recognition and assists in retaining customers. Enterprises are widely focusing on offering a fast and smooth experience to the customer, which has positively impacted the demand and requirement for the field service management market in the region.

- Enterprises across various industries are seeing various digital transformations and investing in customer engagement solutions. Also, a change from the traditional platforms, like CRM, is notably evident across enterprises. Therefore, such a shift among the enterprise projects may provide more excellent prospects to the manufacturers and vendors in the market over the forecasted time period.

- Moreover, key vendors in this region concentrate on strategic alliances to increase their geographical reach. In August 2022, Microsoft (COLOMBO, Sri Lanka) and WSO2, a key open-source integration vendor, announced a strategic agreement to roll out cloud-native solutions for securely delivering APIs, applications, and digital identities to areas all over the world via Microsoft Azure. Due to the agreement, the integration vendor will also use Microsoft Azure as its primary cloud platform.

- Additionally, as a result of digital transformation, Larger enterprises are adopting cloud-integrated contract management solutions. Better management is made possible by it, and businesses in both the public and private sectors are able to write, negotiate, sign, approve, track, and renew contracts in one convenient spot.

- Alongside the advantages of deploying field service management software for large enterprises, the rising industrial sector in the maturing economies of the APAC region opens up new opportunities for the integration of field service management software. For example, according to the Asian Development Bank, in 2021, the value added in the industry sector in Bangladesh registered a growth rate of 10.3% year-on-year.

APAC Field Service Management Industry Overview

The market for Asia Pacific Field Service Management studied is moderately competitive, which is due to the presence of considerable number of global and regional players. The primary strategies adopted by these firms involve mergers and acquisitions, product innovations, and expansions. The key players dominating the market are Salesforce.Com Inc., Microsoft Corporation, IFS AB, Trimble Inc, and Oracle Corporation.

- August 2021 - A leader in service parts and contracts management, including inventory, pricing, and IoT-based preventive repair monitoring solutions, Mize Inc. combined with Syncron. The combined company will, in the future, utilize the Syncron name and will focus on delivering connected service experiences and accelerating new service-centric business models. Moreover, the companies are focusing on investing significantly in innovation and expanding their global coverage, including Asian markets.

- July 2021 - ServiceMax, a firm dealing with asset-centric field service management, declared that it has entered into a definitive agreement to obtain LiquidFrameworks, a provider of mobile field operations management solutions. The acquisition aims to advance ServiceMax's field service management solutions for industrial, environmental, and oil and gas services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definiton

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Analysis of the Major FSM Use-cases (Emergence of AR/VR for Remote Assistanc, Focus on Predictive Maintenance for Customer Retention and Service, Gradual Transition Toward Back-end Automation)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Customer Demand for Quicker Response Time enabling FMS Companies to Invest in New Technologies

- 5.1.2 Growing Emphasis on Maximizing Work Efficiency

- 5.2 Market Challenges

- 5.2.1 Implementation/Integration Issues and Licensing Costs (Cost and ROI challenges)

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End-User

- 6.3.1 Allied FM (Hard - Building and HVAC and Soft - Landscaping and Cleaning)

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare and Lifesciences

- 6.3.4 Energy and Utilities

- 6.3.5 Oil and Gas

- 6.3.6 Manufacturing

- 6.3.7 Other End-Users (Transportation, Real Estate, etc.)

- 6.4 By Country

- 6.4.1 India

- 6.4.2 China

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Field Aware US, Inc.

- 7.1.2 Oracle Corporation (OFSC)

- 7.1.3 IFS AB

- 7.1.4 ServiceMax Inc.

- 7.1.5 ServicePower, Inc.

- 7.1.6 Coresystems (SAP SE)

- 7.1.7 Microsoft Corporation (Dynamics 365 for Field Service)

- 7.1.8 Accruent LLC (Fortive Corp)

- 7.1.9 Mize, Inc.

- 7.1.10 Salesforce.com, Inc. (Field Service Cloud)

- 7.1.11 Zinier, Inc.

- 7.1.12 Trimble Inc.

- 7.1.13 The simPRO Group Pty Limited

- 7.1.14 Kirona Solutions Limited (Advanced)