|

市场调查报告书

商品编码

1913302

结构性黏着剂市场机会、成长要素、产业趋势分析及2026年至2035年预测Structural Adhesive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

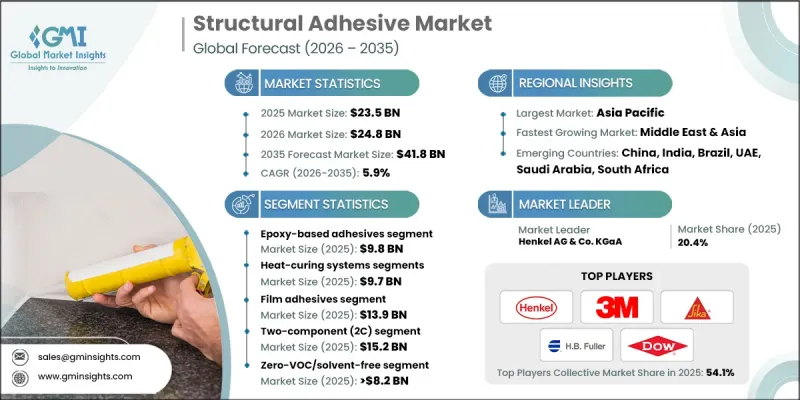

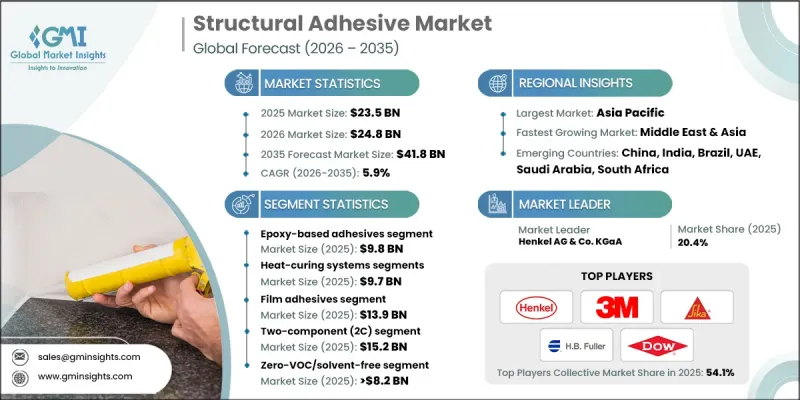

全球结构性黏着剂市场预计到 2025 年将达到 235 亿美元,到 2035 年将达到 418 亿美元,年复合成长率为 5.9%。

由于结构性黏着剂在汽车、航太、电子、船舶、风力发电和建筑等各行业的应用日益广泛,其市场正经历显着成长。在需要均匀应力分布和轻量化组件的应用中,这些黏合剂正逐步取代焊接和机械紧固件。电动车产量的激增以及复合材料在飞机製造中的应用加速了这一转变。此外,法规结构正引导市场转向环保化学配方,例如水性、低VOC和零VOC配方,以符合永续性和合规性标准。大规模汽车生产推动了市场成长,增加了素车、玻璃安装和电池组装等领域对结构性黏着剂的需求。同时,严格的环境法规也推动了无溶剂和低排放替代品的趋势。这些因素迫使製造商开发和创新配方,以在满足合规性要求的同时,实现高性能和高效率。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 235亿美元 |

| 预测金额 | 418亿美元 |

| 复合年增长率 | 5.9% |

预计到2025年,环氧树脂黏合剂市场规模将达到98亿美元。环氧树脂结构性黏着剂因其优异的拉伸强度和剪切强度,以及耐化学性和耐热性而备受青睐。这些特性使其成为电动车电池组、航太复合材料和素车组装等关键应用的理想选择。增韧环氧树脂黏合剂广泛应用于增强和黏合领域,而高模量系统则有助于承受风力发电应用中的长跨度循环负荷。丙烯酸结构性黏着剂在各工业领域的应用也日益广泛。

预计到2025年,热固性系统市场规模将达到97亿美元,这主要得益于对严苛运作系统需求的成长,例如航太复合材料和需要烘箱烘烤的汽车车体应用。这些系统由于其低交联密度和优异的耐久性,非常适合长寿命应用。然而,双组分室温固化环氧树脂和聚氨酯(PU)因其柔软性、易于现场和生产线组装以及无需人工安装等优点而备受关注。这些系统兼具性能和便利性,日益广泛应用于工业和建筑计划。

预计到2025年,美国结构性黏着剂市场规模将达到50亿美元,主要驱动力来自航太领域的强劲成长以及汽车产业对电动车日益增长的接受度。美国的製造能力发挥主导作用,而加拿大则透过航太和建筑应用做出贡献。墨西哥汽车产量的成长也促进了区域市场的成长。不断变化的监管环境正在推动低VOC和零VOC化学品的发展,进而推动结构玻璃和特殊黏合剂应用领域的创新。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 汽车和航太领域的减重

- 不断增加的建筑和基础设施计划

- 技术进步

- 产业潜在风险与挑战

- 较长的固化时间

- 与拉炼相比,高成本

- 市场机会

- 电动车(EV)的扩张

- 3D列印与积层製造

- 维修/保养用途

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 透过技术平台

- 未来市场趋势

- 专利状态

- 贸易统计(HS编码)(註:仅提供主要国家的贸易统计)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 考虑到碳足迹

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章 依技术平台分類的市场估算与预测,2022-2035年

- 环氧树脂黏合剂

- 聚氨酯(PU)黏合剂

- 丙烯酸黏合剂

- 氰基丙烯酸黏合剂

- 硅胶黏合剂

- 其他技术

第六章 依固化机制分類的市场估算与预测,2022-2035年

- 热固化系统

- 高温固化(150 ℃以上)

- 中温固化(120-150 ℃)

- 低温固化(70-120 ℃)

- 室温固化系统

- 湿固化系统

- 紫外线/辐射固化系统

- 双重固化系统

第七章 按类型分類的市场估计与预测,2022-2035年

- 薄膜黏合剂

- 贴上式黏合剂

- 液态、低黏度黏合剂

第八章 按组件系统分類的市场估算与预测,2022-2035年

- 单一成分(1C)系统

- 双组分(2C)系统

9. 按挥发性有机化合物 (VOC) 含量分類的市场估算和预测,2022-2035 年

- 低VOC黏合剂(低于50克/公升)

- 零VOC/无溶剂黏合剂

- 水性黏合剂

- 生物基/可再生成分

第十章 依应用领域分類的市场估计与预测,2022-2035年

- 金属与金属的黏合

- 复合材料黏合

- 复合材料黏合

- 塑胶黏合剂

- 木材/加工木材黏合剂

- 混凝土和砌体粘结

- 玻璃黏合剂

- 其他的

第十一章 依最终用途产业分類的市场估计与预测,2022-2035年

- 车

- 航空航太太空产业

- 风力发电

- 船舶/造船

- 建筑和基础设施

- 电学

- 用水和污水

- 其他的

第十二章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第十三章:公司简介

- 3M Company

- Arkema SA

- Ashland Global Holdings Inc.

- Bostik(Arkema)

- Cemedine Co., Ltd.

- Dow Inc.

- Dymax Corporation

- Henkel AG &Co. KGaA

- HB Fuller Company

- Huntsman Corporation

- Kangda New Materials

- Kisling AG

- Master Bond Inc.

- Panacol-Elosol GmbH

- Parson Adhesives

- PPG Industries

- Sika AG

- ThreeBond Holdings Co., Ltd.

- Toagosei Co., Ltd.

- Weiss Chemie+Technik GmbH &Co. KG

The Global Structural Adhesive Market was valued at USD 23.5 billion in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 41.8 billion by 2035.

Structural adhesives are experiencing significant growth as multiple industries, including automotive, aerospace, electronics, marine, wind energy, and construction, increasingly adopt them. These adhesives are gradually replacing welding and mechanical fasteners in applications that require evenly distributed stresses and lightweight assemblies. The surge in electric vehicle production and the integration of composite materials in aircraft have accelerated this transition. Additionally, regulatory frameworks are steering the market toward environmentally friendly chemistries, such as water-based, low-VOC, and zero-VOC formulations, aligning with sustainability and compliance standards. Market growth is driven by large-scale vehicle production, creating high demand for structural adhesives in body-in-white, glazing, and battery assembly, alongside stringent environmental regulations encouraging solvent-free and low-emission alternatives. These factors compel manufacturers to innovate and develop formulations that meet compliance while delivering high performance and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $23.5 Billion |

| Forecast Value | $41.8 Billion |

| CAGR | 5.9% |

The epoxy-based adhesives segment generated USD 9.8 billion in 2025. Epoxy structural adhesives are highly valued for their exceptional tensile and shear strength, as well as chemical and thermal resistance. These properties make them ideal for critical applications, including electric vehicle battery packs, aerospace composites, and body-in-white assemblies. Toughened epoxy adhesives are widely used for reinforcement and bonding applications, while high-modulus systems in wind energy applications help withstand cyclic loads across long spans. The acrylic structural adhesives segment is also witnessing growing adoption across various industries.

The heat-curing systems segment was valued at USD 9.7 billion in 2025 and is seeing rising demand in challenging operating environments, such as aerospace composites and automotive body-in-white applications that require oven baking. These systems offer lower cross-link density and high durability, making them suitable for long-lasting applications. However, two-component, room-temperature curing epoxies and polyurethanes (PUs) are gaining traction due to their flexibility, ease of field and line assembly, and elimination of labor-intensive installations. These systems are increasingly used in industrial and construction projects, providing a balance between performance and convenience.

U.S. Structural Adhesive Market reached USD 5 billion in 2025, owing to a strong aerospace sector and growing adoption of electric vehicles in the automotive industry. Manufacturing capabilities in the U.S. play a leading role, while Canada contributes through aerospace and construction applications. Mexico's growing automotive production also supports regional market expansion. The evolving regulatory landscape promotes low and zero-VOC chemistries, driving innovation in structural glazing and specialty adhesive applications.

Key players in the Global Structural Adhesive Market include 3M, Arkema S.A., Ashland Global Holdings Inc., Dow Inc., Bostik (Arkema), Dymax Corporation, Henkel AG & Co. KGaA, H.B. Fuller Company, Huntsman Corporation, Kangda New Materials, Kisling AG, Master Bond Inc., Panacol-Elosol GmbH, Parson Adhesives, PPG Industries, Sika AG, ThreeBond Holdings Co., Ltd., Toagosei Co., Ltd., and Weiss Chemie + Technik GmbH & Co. KG. Companies in the Global Structural Adhesive Market are implementing several strategies to strengthen their market presence and enhance competitiveness. Investments in research and development focus on creating high-performance, environmentally friendly formulations, including low- and zero-VOC adhesives. Strategic partnerships with automotive, aerospace, and electronics manufacturers facilitate product integration into large-scale production. Firms are expanding regional manufacturing capacities to serve emerging markets and enhance supply chain resilience. Emphasis on sustainability, regulatory compliance, and innovative product design helps companies differentiate their offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology platform

- 2.2.2 Curing mechanism

- 2.2.3 Form

- 2.2.4 Component system

- 2.2.5 VOC content

- 2.2.6 Application

- 2.2.7 End use industry

- 2.2.8 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Lightweighting in automotive & aerospace

- 3.2.1.2 Rising construction & infrastructure projects

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Long curing times

- 3.2.2.2 High cost compared to fasteners

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in electric vehicles (EVS)

- 3.2.3.2 3D printing & additive manufacturing

- 3.2.3.3 Repair & maintenance applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By technology platform

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Platform, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Epoxy-based adhesives

- 5.3 Polyurethane (PU) adhesives

- 5.4 Acrylic adhesives

- 5.5 Cyanoacrylate adhesives

- 5.6 Silicone adhesives

- 5.7 Other technologies

Chapter 6 Market Estimates and Forecast, By Curing Mechanism, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Heat-curing systems

- 6.2.1 High-temperature cure (>150°C)

- 6.2.2 Medium-temperature cure (120-150°C)

- 6.2.3 Low-temperature cure (70-120°C)

- 6.3 Room-temperature curing systems

- 6.4 Moisture-curing systems

- 6.5 UV & radiation-curing systems

- 6.6 Dual-cure systems

Chapter 7 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Film adhesives

- 7.3 Paste adhesives

- 7.4 Liquid & low-viscosity adhesives

Chapter 8 Market Estimates and Forecast, By Component System, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Single-component (1C) systems

- 8.3 Two-component (2C) systems

Chapter 9 Market Estimates and Forecast, By VOC Content, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Low-VOC adhesives (<50 g/L)

- 9.3 Zero-VOC/solvent-free adhesives

- 9.4 Water-based adhesives

- 9.5 Bio-based/renewable content

Chapter 10 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Metal-to-metal bonding

- 10.3 Composite bonding

- 10.4 Mixed-material bonding

- 10.5 Plastic bonding

- 10.6 Wood & engineered wood bonding

- 10.7 Concrete & masonry bonding

- 10.8 Glass bonding

- 10.9 Others

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 Automotive

- 11.3 Aviation & aerospace

- 11.4 Wind energy

- 11.5 Marine & shipbuilding

- 11.6 Construction & infrastructure

- 11.7 Electronics & electrical

- 11.8 Water & wastewater

- 11.9 Others

Chapter 12 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

- 12.6.4 Rest of Middle East and Africa

Chapter 13 Company Profiles

- 13.1 3M Company

- 13.2 Arkema S.A.

- 13.3 Ashland Global Holdings Inc.

- 13.4 Bostik (Arkema)

- 13.5 Cemedine Co., Ltd.

- 13.6 Dow Inc.

- 13.7 Dymax Corporation

- 13.8 Henkel AG & Co. KGaA

- 13.9 H.B. Fuller Company

- 13.10 Huntsman Corporation

- 13.11 Kangda New Materials

- 13.12 Kisling AG

- 13.13 Master Bond Inc.

- 13.14 Panacol-Elosol GmbH

- 13.15 Parson Adhesives

- 13.16 PPG Industries

- 13.17 Sika AG

- 13.18 ThreeBond Holdings Co., Ltd.

- 13.19 Toagosei Co., Ltd.

- 13.20 Weiss Chemie + Technik GmbH & Co. KG