|

市场调查报告书

商品编码

1913387

资料中心建置市场机会、成长要素、产业趋势分析及2026年至2035年预测Data Center Construction Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

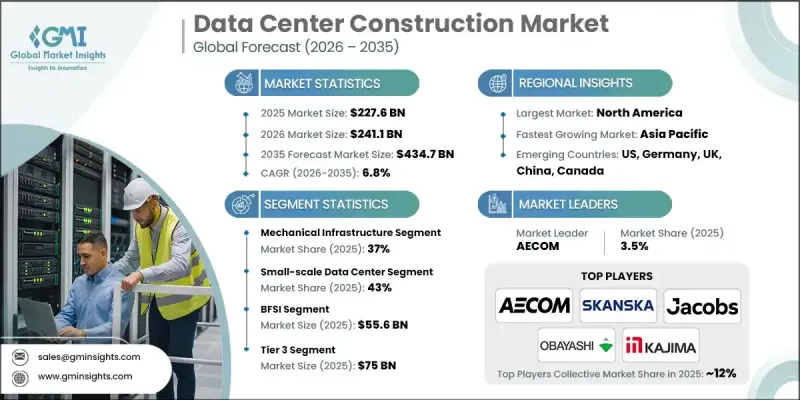

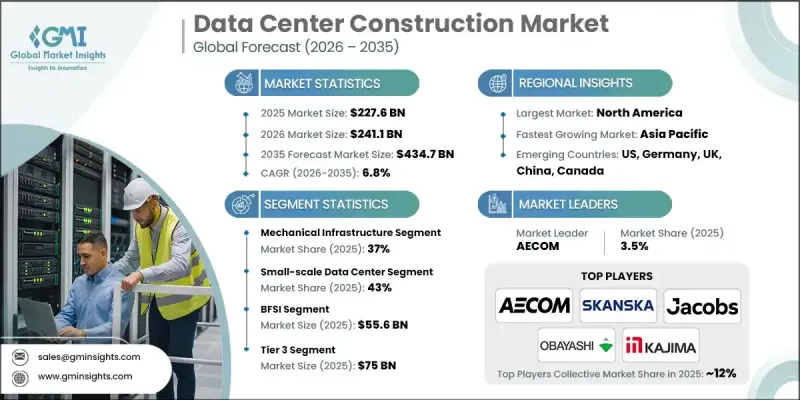

全球资料中心建设市场预计到 2025 年将达到 2,276 亿美元,到 2035 年将达到 4,347 亿美元,年复合成长率为 6.8%。

全球企业加速采用云端服务交付模式是推动市场成长的主要动力。各组织机构正稳步将工作负载从本地基础设施迁移到云端,促使云端服务供应商透过建造庞大的园区和区域设施来大幅提升容量。这种持续的需求推动了扩充性、标准化建设模式的不断发展,这些模式支援快速部署和长期弹性。同时,高阶运算工作负载日益增长的影响正在重塑设施需求,推动了对更高功率密度、先进冷却解决方案和加固型电气系统的需求。由数位化平台和企业转型驱动的全球数据产生量不断增长,进一步推动了对可靠处理和储存容量的需求。此外,企业对共用基础设施模式的日益依赖也推动了建设活动,因为企业越来越倾向于灵活的租赁安排,以降低资本密集度和营运负担。这些趋势共同推动了全球市场对现代化、高效且面向未来的资料中心设施的持续投资。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 2276亿美元 |

| 预测金额 | 4347亿美元 |

| 复合年增长率 | 6.8% |

预计到2025年,小规模资料中心市占率将达到43%,并在2026年至2035年间以5%的复合年增长率成长。这些设施通常运作在低功耗范围内,旨在支援区域营运、分散式运算需求和本地处理。随着企业越来越重视反应速度和资料接近性,它们在分散式数位基础设施中的作用也在不断扩大。

2025年,银行、金融服务和保险(BFSI)产业的市场规模预计将达到556亿美元。金融机构需要高度安全、合规且具弹性的基础设施,这推动了符合严格营运标准的设施的可持续建设。监管要求和数据主权方面的考量正在推动该行业采用地域分散式发展策略。

美国资料中心建设市场预计到2025年将达到595亿美元。大规模技术供应商的集中、先进的研究生态系统以及持续的基础设施现代化,都为强劲的投资活动提供了支撑。美国在全球资料中心营运能力中占据重要份额,预计到2030年将持续成长。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 系统平台提供者

- 硬体供应商

- 支付合作伙伴

- 利基专家

- 最终用途

- 成本结构

- 利润率

- 每个阶段的附加价值

- 影响供应链的因素

- 颠覆者

- 供应商情况

- 影响因素

- 司机

- 云端运算的快速发展

- 人工智慧、机器学习和高效能运算的兴起

- 数据生成和数位服务的激增

- 转向託管和外包资料中心

- 产业潜在风险与挑战

- 电力供应状况和电网限制

- 建筑和设备成本不断上涨

- 关键设备的采购前置作业时间过长

- 市场机会

- 扩展人工智慧赋能的高密度资料中心基础设施

- 采用模组化和预製构件施工模式

- 整合现场发电和储能解决方案

- 在电力资源丰富的次市场和新兴市场开发资料中心

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- CCPA/CPRA(加州消费者隐私法案/加州隐私权法案)

- NERC CIP(北美电力可靠性委员会 - 关键基础设施保护)

- 欧洲

- GDPR(一般资料保护规则)

- 2018年资料保护法(英国)

- 欧盟能源效率指令

- 气候中和资料中心协议

- 国家网路安全局指令

- 亚太地区

- 2023年数位个人资料保护法(印度)

- 韩国个人资讯保护法

- 1979 年通讯(拦截与访问)法(澳洲)

- 国内资料在地化与网路安全相关法规

- 拉丁美洲

- LGPD(Lei Geral de Protecao de Dados - 巴西)

- 阿根廷国家个人资料保护监管机构条例

- 墨西哥《关于保护私人企业所持有个人资料的联邦法律》

- 中东和非洲

- PDPL(个人资料保护法 - 阿联酋、沙乌地阿拉伯)

- 网路犯罪对策法

- 电子交易法(南非共和国)

- 北美洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 定价分析

- 副产品

- 按地区

- 成本細項分析

- 供应商成本结构

- 成本构成实施

- 持续营运成本

- 间接客户成本

- 专利分析

- 经营模式分析

- 比较资本投资销售模式与管理服务模式

- 收入来源

- 混合商业结构

- 案例研究

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 未来前景与机会

- 电力供应状况、电网限制及其对能源战略的影响

- 人工智慧赋能的高密度基础设施设计要求

- 模组化、预製化和可扩展的部署模式

第四章 竞争情势

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 企业扩张计画和资金筹措

第五章 资料中心市场估算与预测,2022-2035年

- 小规模资料中心

- 中型资料中心

- 大型资料中心

6. 2022-2035年基础设施市场估算与预测

- 电力基础设施

- 不断电系统(UPS)

- 电源分配单元(PDU)

- 紧急发电机

- 其他的

- 机械和设备

- 冷却系统

- HVAC

- 电脑房空调机组(CRAC机组)

- 风扇阵列

- 空气流量测量阻尼器

- DOAS

- 精密空调(PAC)机组

- 采用EC马达的表面安装式静压箱风扇

- 月有效用户(MAU)

- ERV

- 冷冻水系统

- 阻尼器

- 冷凝器风扇

- 通风系统

- 直接通膨(DX)系统

- 其他的

- 电脑房空调机组(CRAC机组)

- 架子

- 管道工程

- 架空地板

- 其他的

- 网路基础设施

- 其他的

7. 依最终用途分類的市场估计与预测,2022-2035 年

- BFSI

- 活力

- 政府

- 卫生保健

- 製造业

- 资讯科技/通讯

- 媒体与娱乐

- 零售

- 其他的

第八章 2022-2035年各层级市场估算与预测

- 一级

- 二级

- 三级

- 第四级

第九章 2022-2035年各地区市场估算与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 比荷卢经济联盟

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 泰国

- 印尼

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十章:公司简介

- Global leaders

- AECOM

- Jacobs

- Fluor

- Bechtel

- Skanska

- Samsung C&T

- Larsen &Toubro(L&T)

- Kajima

- Obayashi

- Balfour Beatty

- Turner Construction Company

- Mace

- NTT Facilities

- DSCO

- 本地公司

- Holder Construction

- Mortenson

- JE Dunn Construction

- Whiting-Turner Contracting Company

- HITT Contracting

- Clayco

- Hensel Phelps

- DPR Construction

- ISG plc

- 新兴企业

- AirTrunk

- Vantage Data Centers

- ODATA(Ascenty/ODATA)

- GreenSquareDC

- STO Building

The Global Data Center Construction Market was valued at USD 227.6 billion in 2025 and is estimated to grow at a CAGR of 6.8% to reach USD 434.7 billion by 2035.

Market growth is driven by the accelerating adoption of cloud-based delivery models across enterprises worldwide. Organizations are steadily shifting workloads away from in-house infrastructure, prompting cloud service providers to invest heavily in new capacity through large campuses and regional facilities. This sustained demand is encouraging the continuous development of scalable, standardized construction models that support rapid deployment and long-term resilience. At the same time, the rising influence of advanced computing workloads is reshaping facility requirements, increasing the need for higher power density, sophisticated cooling solutions, and reinforced electrical systems. Growth in global data creation from digital platforms and enterprise transformation is further elevating the requirement for reliable processing and storage capacity. Construction activity is also supported by increasing reliance on shared infrastructure models, as businesses favor flexible leasing arrangements to reduce capital intensity and operational burden. Together, these trends are driving steady investment in modern, efficient, and future-ready data center facilities across global markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $227.6 Billion |

| Forecast Value | $434.7 Billion |

| CAGR | 6.8% |

The small-scale data center segment accounted for 43% share in 2025 and is expected to grow at a CAGR of 5% between 2026 and 2035. These facilities typically operate within lower power capacity ranges and are designed to support regional operations, distributed computing needs, and localized processing. Their role within decentralized digital infrastructure continues to grow as organizations prioritize responsiveness and data proximity.

The BFSI segment generated USD 55.6 billion in 2025. Financial institutions require highly secure, compliant, and resilient infrastructure, driving sustained construction of facilities that meet stringent operational standards. Regulatory requirements and data sovereignty considerations support the adoption of geographically distributed development strategies within this segment.

U.S. Data Center Construction Market reached USD 59.5 billion in 2025. Strong investment activity is supported by the concentration of large technology providers, advanced research ecosystems, and ongoing infrastructure modernization. The country represents a significant share of global operational capacity, with continued expansion expected through 2030.

Key companies active in the Global Data Center Construction Market include Skanska, Turner & Townsend, AECOM, Jacobs Engineering, DPR Construction, NTT Facilities, Obayashi, Kaijima, Mace, and DSCO. Companies operating in the Global Data Center Construction Market are reinforcing their market position through strategic specialization, technological integration, and global expansion. Many firms are investing in expertise related to high-density and energy-efficient facility design to meet evolving workload requirements. Strategic partnerships with cloud providers and colocation operators help secure long-term project pipelines. Companies are also focusing on modular construction techniques to reduce build timelines and improve scalability. Geographic diversification allows firms to capture demand across emerging and established markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022-2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Data center

- 2.2.3 Infrastructure

- 2.2.4 End use

- 2.2.5 Tier

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 System & platform providers

- 3.1.1.2 Hardware suppliers

- 3.1.1.3 Payment partners

- 3.1.1.4 Niche specialists

- 3.1.1.5 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid growth in cloud computing

- 3.2.1.2 Proliferation of AI, machine learning, and high-performance computing

- 3.2.1.3 Explosion in data generation and digital services

- 3.2.1.4 Shift toward colocation and outsourced data centers

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Power availability and grid constraints

- 3.2.2.2 Rising construction and equipment costs

- 3.2.2.3 Long lead times for critical equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of ai-ready and high-density data center infrastructure

- 3.2.3.2 Adoption of modular and prefabricated construction models

- 3.2.3.3 Integration of on-site power generation and energy storage solutions

- 3.2.3.4 Development of data centers in power-rich secondary and emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory Landscape

- 3.4.1 North America

- 3.4.1.1 CCPA / CPRA (California Consumer Privacy Act / California Privacy Rights Act)

- 3.4.1.2 NERC CIP (North American Electric Reliability Corporation - Critical Infrastructure Protection)

- 3.4.2 Europe

- 3.4.2.1 GDPR (General Data Protection Regulation)

- 3.4.2.2 Data Protection Act 2018 (UK)

- 3.4.2.3 EU Energy Efficiency Directive

- 3.4.2.4 Climate Neutral Data Centre Pact

- 3.4.2.5 National Cybersecurity Agency Directives

- 3.4.3 Asia Pacific

- 3.4.3.1 Digital Personal Data Protection Act 2023 (India)

- 3.4.3.2 PIPA (Personal Information Protection Act, South Korea)

- 3.4.3.3 Telecommunications (Interception and Access) Act 1979 (Australia)

- 3.4.3.4 National Data Localization and Cybersecurity Laws

- 3.4.4 Latin America

- 3.4.4.1 LGPD (Lei Geral de Protecao de Dados - Brazil)

- 3.4.4.2 National Directorate for Personal Data Protection Regulations (Argentina)

- 3.4.4.3 Federal Law on the Protection of Personal Data Held by Private Parties (Mexico)

- 3.4.5 Middle East & Africa

- 3.4.5.1 PDPL (Personal Data Protection Law - UAE, Saudi Arabia)

- 3.4.5.2 Anti-Cyber Crime Laws

- 3.4.5.3 Electronic Communications and Transactions Act (South Africa)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Cost breakdown analysis

- 3.9.1 Vendor cost structure

- 3.9.2 Implementation of cost components

- 3.9.3 Ongoing operational costs

- 3.9.4 Indirect customer costs

- 3.10 Patent analysis

- 3.11 Business model analysis

- 3.11.1 Capex sale vs managed services models

- 3.11.2 Revenue streams

- 3.11.3 Hybrid commercial structures

- 3.12 Case studies

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

- 3.14 Future outlook and opportunities

- 3.15 Power Availability, Grid Constraints & Energy Strategy Impact

- 3.16 AI-Ready & High-Density Infrastructure Design Requirements

- 3.17 Modular, Prefabricated & Scalable Deployment Models

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Data Center, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Small-scale data center

- 5.3 Medium data center

- 5.4 Large data center

Chapter 6 Market Estimates & Forecast, By Infrastructure, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Electrical infrastructure

- 6.2.1 UPS

- 6.2.2 Power distribution units (PDUs)

- 6.2.3 Backup generators

- 6.2.4 Others

- 6.3 Mechanical infrastructure

- 6.3.1 Cooling systems

- 6.3.2 Hvac

- 6.3.2.1 Computer room air conditioning (CRAC) units

- 6.3.2.1.1 Fan arrays

- 6.3.2.1.2 Air flow measurement damper

- 6.3.2.1.3 DOAS

- 6.3.2.2 Precision air conditioning (PAC) units

- 6.3.2.2.1 Face mounted plenum fan with EC motor

- 6.3.2.2.2 MAU

- 6.3.2.2.3 ERV

- 6.3.2.3 Chilled water systems

- 6.3.2.3.1 Dampers

- 6.3.2.3.2 Condenser fans

- 6.3.2.4 Ventilation systems

- 6.3.2.5 Direct expansion (DX) systems

- 6.3.2.6 Others

- 6.3.2.1 Computer room air conditioning (CRAC) units

- 6.3.3 Racks

- 6.3.4 Ductwork

- 6.3.5 Raised flooring

- 6.3.6 Others

- 6.4 Networking infrastructure

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Energy

- 7.4 Government

- 7.5 Healthcare

- 7.6 Manufacturing

- 7.7 IT & telecom

- 7.8 Media & entertainment

- 7.9 Retail

- 7.10 Others

Chapter 8 Market Estimates & Forecast, By Tier, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Tier 1

- 8.3 Tier 2

- 8.4 Tier 3

- 8.5 Tier 4

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Thailand

- 9.4.7 Indonesia

- 9.4.8 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Chile

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global leaders

- 10.1.1 AECOM

- 10.1.2 Jacobs

- 10.1.3 Fluor

- 10.1.4 Bechtel

- 10.1.5 Skanska

- 10.1.6 Samsung C&T

- 10.1.7 Larsen & Toubro (L&T)

- 10.1.8 Kajima

- 10.1.9 Obayashi

- 10.1.10 Balfour Beatty

- 10.1.11 Turner Construction Company

- 10.1.12 Mace

- 10.1.13 NTT Facilities

- 10.1.14 DSCO

- 10.2 Regional players

- 10.2.1 Holder Construction

- 10.2.2 Mortenson

- 10.2.3 JE Dunn Construction

- 10.2.4 Whiting-Turner Contracting Company

- 10.2.5 HITT Contracting

- 10.2.6 Clayco

- 10.2.7 Hensel Phelps

- 10.2.8 DPR Construction

- 10.2.9 ISG plc

- 10.3 Emerging players

- 10.3.1 AirTrunk

- 10.3.2 Vantage Data Centers

- 10.3.3 ODATA (Ascenty / ODATA)

- 10.3.4 GreenSquareDC

- 10.3.5 STO Building