|

市场调查报告书

商品编码

1910908

拉丁美洲资料中心建置:市场占有率分析、产业趋势与统计、成长预测(2026-2031 年)Latin America Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

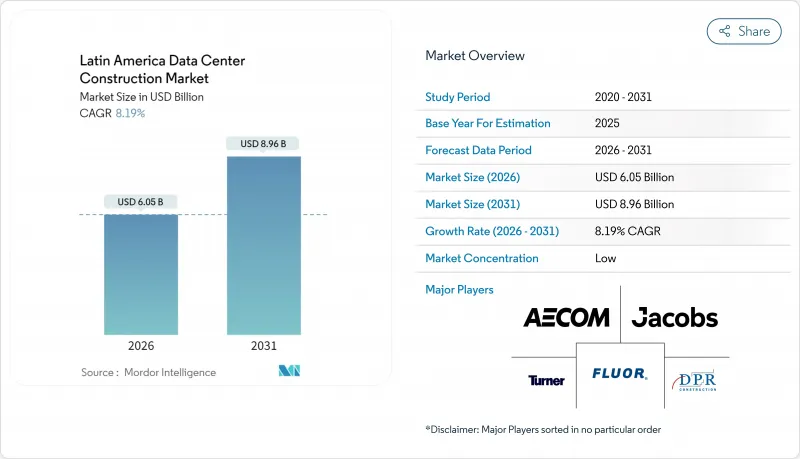

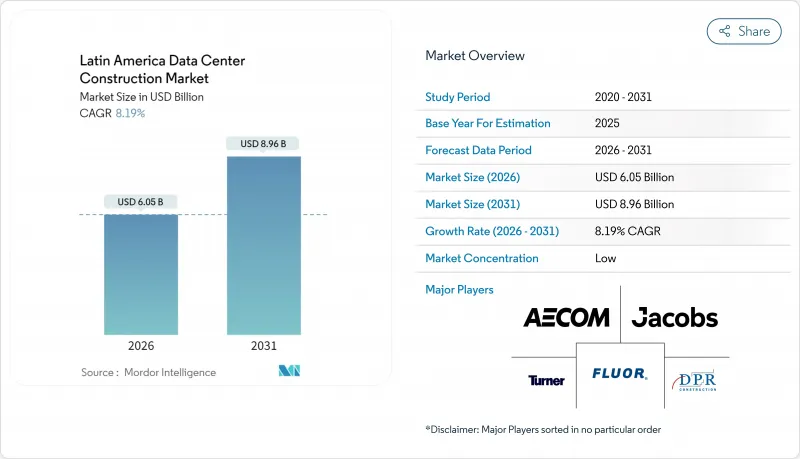

预计拉丁美洲资料中心建设市场将从 2025 年的 55.9 亿美元成长到 2026 年的 60.5 亿美元,到 2031 年达到 89.6 亿美元,2026 年至 2031 年的复合年增长率为 8.19%。

强劲的投资趋势主要受政府主导的云端运算政策、美国云端巨头超大规模园区扩张以及人工智慧工作负载对专业化、高密度设施的需求成长所驱动。巴西将引领区域投资,预计到2024年将占总投资的40%,而墨西哥的克雷塔罗走廊则因其接近性美国市场以及州政府的激励措施而吸引新的资本。受热带气候带来的高冷却需求驱动,机械设备在2024年将占总投资的38%。同时, IT基础设施将实现最快成长,到2030年将以8.52%的复合年增长率成长。到2024年,三级设施将占据62%的市场份额,但随着超大规模资料中心业者对稳定运行时间的需求不断增长,四级计划正以8.90%的复合运作稳步推进。供应链瓶颈和电网限制将延长计划週期,但智利正在进行的放鬆管制以及巴西、智利和哥伦比亚丰富的可再生能源机会为良好的投资前景提供了支持。

拉丁美洲数据中心建设市场趋势与洞察

加速云端运算、人工智慧和巨量资料工作负载

人工智慧应用所需的功率密度是传统运算的三到五倍,迫使营运商重新设计散热架构和电气布线拓扑结构。微软在巴西投资27亿美元,Scala公司斥资500亿美元打造“人工智慧之城”,都体现了新需求的规模。液冷技术正在加速普及,本地生产的Delta系统降低了ODATA站点的能耗。区域政策制定者正将人工智慧基础设施定位为提升数位竞争力的支柱,推动加快审批流程并提供有针对性的税收优惠。承包商报告称,高密度机电一体化(MEP)封装的竞标激增,母线槽、泵浦和板式热交换器的供应商也在扩大其区域生产规模。

美国云端运算巨头建置超大规模园区

亚马逊网路服务 (AWS)、微软 Azure 和谷歌云端计画到 2030 年在拉丁美洲投资超过 100 亿美元。位于圣保罗、克雷塔罗和波哥大的千兆瓦级园区将需要冗余的 400kV 电源、先进的消防系统和预製配电室,这将使试运行时间缩短至 12 至 18 个月。仅区域光纤联盟 V.tal 就已拨款 10 亿美元,用于在巴西提供超大规模资料中心所需的机房。这种客製化建设模式有利于那些擅长整合设计和施工的工程总承包 (EPC) 公司,随着主要城市的电力供应日益紧张,需求正向二线都会区蔓延。

电网瓶颈和电价飙涨

在墨西哥,长达18个月的公用设施接入等待时间迫使开发商购买柴油发电设备,导致计划资本支出增加高达25%,并推高营运成本。阿根廷的宏观经济波动加剧了价格风险,而圣保罗州局部电网拥塞则促使开发商将目光转向坎皮纳斯和阿雷格里港。人工智慧工作负载的增加提高了电力密度,使原本为商业办公负载设计的电网不堪负荷。为了确保价格可预测,公用事业公司越来越多地签署15年期的可再生能源购电协议(PPA),但中小企业缺乏签订此类协议的财力,从而减缓了中端市场对再生能源的接受度。

细分市场分析

至2025年,机械设备将占拉丁美洲资料中心建设市场规模的37.35%。巴西、秘鲁和哥伦比亚炎热潮湿的环境要求配备强大的冷水循环系统、蒸发冷却系统和客製化的封闭系统。电力设施内的配电盘、开关设备和UPS阵列对于满足银行和电信产业的运作要求至关重要。一般建筑领域的主要支出用于建造坚固的壳体结构,包括抗震改造和抗飓风外墙,以保护关键任务机房。

IT基础设施是成长最快的类别,复合年增长率 (CAGR) 达到 8.16%,这主要得益于对 AI 推理优化伺服器、NVMe 储存阵列和 400Gbps 网路架构日益增长的需求。超大规模客户正在将高密度机架作为标准配置,而高密度机架需要直接冷却歧管,从而推动了对不銹钢管道和冗余冷却泵的需求。咨询、试运行和设施管理等服务透过确保合规性和优化 PUE 值来增加价值。由于拉丁美洲证券交易所加强了碳排放揭露标准,能源效率咨询在拉丁美洲数据中心建设市场中的份额正在上升。

截至2025年,Tier III级资料中心将占拉丁美洲资料中心建置市场的61.10%,其可用性高达99.982%,且资本支出可控。银行、保险公司和公共云端选择此级别资料中心来运行能够容忍较短维护视窗的关键业务工作负载,而内容传递网路和区域边缘节点则通常采用Tier II级资料中心,以控製成本并接近性使用者。

预计到2031年,Tier IV级资料中心的建设将以8.55%的复合年增长率成长,这主要得益于超大规模资料中心业者和金融科技平台为满足99.995%的服务水准保证而做出的努力。多条独立的配电通道、高可靠性的冷却设备以及可同时维护的发电机组会使资本预算增加高达60%,但客户为了满足与运作相关的收入条款,愿意承担这部分额外成本。建造者在设计阶段早期就与认证机构接洽,从而避免了新进入者在后期维修时面临的高昂成本。

拉丁美洲资料中心建设市场按基础设施(电力基础设施、机械基础设施及其他)、等级标准(Tier I 和 II、Tier III 及其他)、最终用户(银行和金融服务、保险、IT 和电信及其他)、资料中心类型(託管、超大规模及其他)和地区(巴西、墨西哥及其他)进行细分。预测数据以美元计价。

其他福利

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速云端运算、人工智慧和巨量资料工作负载

- 美国云端运算巨头扩建超大规模园区

- 由于5G的推广,二线都会区对边缘资料中心的需求不断增长。

- 主权云端和资料居住监管

- 可再生能源购电协议(PPA)的供应状况

- 采用模组化和预製建筑

- 市场限制

- 电网瓶颈和电价飙涨

- 三级/四级认证机电技术人员短缺

- 水资源压力抑制了液体冷却技术的应用。

- 环境许可审批流程漫长,并遭到当地居民的反对。

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 拉丁美洲资料中心建置关键统计数据

- 拉丁美洲资料中心总装置容量(兆瓦),2023 年和 2024 年

- 2025-2030年拉丁美洲在建IT总装置容量(兆瓦)

- 拉丁美洲资料中心建设的平均资本支出(Capex)和营运支出(Opex)

- 拉丁美洲顶尖公司正在加大对资料中心基础设施的投资

第五章 市场规模与成长预测

- 透过基础设施

- 透过电力基础设施

- 配电解决方案

- 配电单元

- 开关设备

- 其他电力基础设施

- 备用电源解决方案

- UPS

- 发电机

- 配电解决方案

- 透过机械基础设施

- 冷却系统

- 液冷法

- 空气冷却法

- 机架和机柜

- 其他机械和设备

- 冷却系统

- 透过IT基础设施

- 伺服器

- 贮存

- 其他IT基础设施

- 一般建筑

- 服务

- 设计咨询

- 一体化

- 支援与维护

- 透过电力基础设施

- 按层级标准

- 一级和二级

- 三级

- 四级

- 按最终用户行业划分

- 银行、金融服务和保险

- 资讯科技/通讯

- 政府和国防机构

- 卫生保健

- 其他的

- 依资料中心类型

- 託管资料中心

- 超大规模/自建资料中心

- 其他(适用于企业/边缘运算/模组化)

- 按地区

- 巴西

- 智利

- 阿根廷

- 其他拉丁美洲

第六章 竞争情势

- 市占率分析

- 公司简介

- AECOM

- Turner Construction Company

- DPR Construction

- Jacobs Solutions Inc.

- Fluor Corporation

- Skanska AB(Latin America)

- Ferrovial SA

- Grupo ACS(Dragados)

- ACCIONA Construccion

- Andrade Gutierrez Engenharia

- Camargo Correa Infra

- Novonor(Odebrecht Engenharia)

- Queiroz Galvao SA

- Techint EandC

- Sacyr Ingenieria e Infraestructuras

- Mota-Engil LATAM

- Constructora Norberto Odebrecht LatAm

- Grupo Carso Infraestructura

- COSAPI Ingenieria y Construccion

- Constructora Colpatria

- Grupo Marhnos

- Constructora Sudamericana

- Ghella SpA

- Besix Watpac

第七章 市场机会与未来展望

The Latin America Data Center Construction market is expected to grow from USD 5.59 billion in 2025 to USD 6.05 billion in 2026 and is forecast to reach USD 8.96 billion by 2031 at 8.19% CAGR over 2026-2031.

Robust investment momentum stems from sovereign-cloud mandates, hyperscale campus build-outs by United States cloud majors, and mounting artificial-intelligence workloads that require specialized, high-density facilities. Brazil leads regional spending with 40% of total 2024 investments, while Mexico's Queretaro corridor attracts fresh capital thanks to proximity to U.S. demand and state incentives. Mechanical infrastructure dominated 2024 spending at 38% because tropical heat loads elevate cooling requirements, yet IT infrastructure posts the quickest gains at an 8.52% CAGR through 2030. Tier III sites prevailed with 62% share in 2024, but Tier IV projects advance at an 8.90% CAGR as hyperscalers insist on fault-tolerant uptime. Supply-chain bottlenecks and grid constraints lengthen project cycles; however, sweeping deregulation in Chile and abundant renewable-energy opportunities across Brazil, Chile, and Colombia sustain a positive investment outlook.

Latin America Data Center Construction Market Trends and Insights

Accelerating cloud, AI and big-data workloads

Artificial-intelligence applications now demand three to five times the power density of legacy computing, compelling operators to redesign thermal architectures and electrical topologies. Microsoft's USD 2.7 billion Brazil investment and Scala's USD 50 billion AI City illustrate the scale of new requirements. Liquid-cooling adoption accelerates, with locally manufactured Delta Cube systems reducing energy usage in ODATA sites. Regional policy makers regard AI infrastructure as a pillar of digital competitiveness, prompting expedited permits and targeted tax breaks. Contractors report surging bids for high-density MEP packages, and suppliers of busway, pumps, and plate-heat exchangers scale up regional production footprints.

Hyperscale campus build-outs by U.S. cloud majors

Amazon Web Services, Microsoft Azure, and Google Cloud collectively earmark more than USD 10 billion for Latin America by 2030. Multi-gigawatt campuses in Sao Paulo, Queretaro, and Bogota require redundant 400 kV utility feeds, advanced fire suppression, and prefabricated power rooms that cut commissioning cycles to 12-18 months. Regional fiber conglomerate V.tal alone budgets USD 1 billion to deliver hyperscale-ready shells in Brazil. The build-to-suit model favors EPC firms proficient in integrated design-build, and demand spills into secondary metros as power availability tightens in first-tier cities.

Grid-power bottlenecks and surging electricity tariffs

Mexico struggles with 18-month utility-interconnection queues, pushing developers to procure diesel generation that adds up to 25% to project CAPEX and inflates operating expenses. Argentina's macro-economic volatility amplifies tariff risk, while localized transmission congestion in Sao Paulo forces developers toward Campinas and Porto Alegre. AI workloads multiply power density, stressing grids originally designed for commercial office loads. Operators increasingly sign 15-year renewable PPAs to secure predictable pricing, but smaller enterprises lack the balance-sheet to pursue such deals, slowing adoption in mid-market segments.

Other drivers and restraints analyzed in the detailed report include:

- 5G-driven edge-DC demand in secondary LATAM metros

- Sovereign-cloud and data-residency regulations

- Scarcity of Tier-III/IV-certified MEP labor

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mechanical infrastructure contributed 37.35% to the Latin America Data Center Construction market size in 2025, as hot-humid conditions across Brazil, Peru, and Colombia require robust chilled-water loops, evaporative cooling, and custom containment systems. Power distribution units, switchgear, and UPS arrays within electrical infrastructure stay essential for banking and telecom uptime mandates. General construction captures resilient shell-and-core outlays, including seismic bracing and hurricane-rated envelopes that safeguard mission-critical halls.

IT infrastructure is the fastest-growing category with an 8.16% CAGR, driven by servers optimized for AI inference, NVMe storage arrays, and 400 Gbps networking fabric. Hyperscale clients standardize on high-density racks requiring direct-to-chip liquid manifolds, which boosts demand for stainless-steel piping and redundant coolant pumps. Services such as consulting, commissioning, and facility management add value by ensuring regulation compliance and PUE optimization. The Latin America Data Center Construction market share within energy-efficiency consulting rises as carbon disclosure norms tighten in stock exchanges across the region.

Tier III sites held 61.10% of the Latin America Data Center Construction market share in 2025, balancing 99.982% availability against manageable capex. Banks, insurers, and public clouds select this level for core workloads that tolerate brief maintenance windows. Conversely, content-delivery networks and regional edge nodes often deploy Tier II to limit cost while placing nodes closer to users.

Tier IV construction will grow 8.55% CAGR through 2031 on the back of hyperscalers and fintech platforms seeking 99.995% service-level commitments. Multiple independent distribution paths, fault-tolerant chillers, and concurrently maintainable generators inflate capital budgets by up to 60%, yet clients accept the premium to satisfy uptime-linked revenue clauses. Builders partner with certification bodies early in design to avoid late-stage retrofit costs that have plagued first-time entrants.

The Latin America Data Center Construction Market is Segmented by Infrastructure (Electrical Infrastructure, Mechanical Infrastructure, and More), Tier Standard (Tier I and II, Tier III, and More), End User (Banking Financial Services & Insurance, IT & Telecommunications, and More), Data Center Type (Colocation, Hyperscale, and More), and Geography (Brazil, Mexico, and More). Forecasts are in USD.

List of Companies Covered in this Report:

- AECOM

- Turner Construction Company

- DPR Construction

- Jacobs Solutions Inc.

- Fluor Corporation

- Skanska AB (Latin America)

- Ferrovial S.A.

- Grupo ACS (Dragados)

- ACCIONA Construccion

- Andrade Gutierrez Engenharia

- Camargo Correa Infra

- Novonor (Odebrecht Engenharia)

- Queiroz Galvao S.A.

- Techint EandC

- Sacyr Ingenieria e Infraestructuras

- Mota-Engil LATAM

- Constructora Norberto Odebrecht LatAm

- Grupo Carso Infraestructura

- COSAPI Ingenieria y Construccion

- Constructora Colpatria

- Grupo Marhnos

- Constructora Sudamericana

- Ghella S.p.A.

- Besix Watpac

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating cloud, AI and big-data workloads

- 4.2.2 Hyperscale campus build-outs by US cloud majors

- 4.2.3 5G-driven edge-DC demand in secondary LATAM metros

- 4.2.4 Sovereign-cloud and data-residency regulations

- 4.2.5 Power-purchase-agreement (PPA) availability for renewables

- 4.2.6 Modular and prefabricated construction adoption

- 4.3 Market Restraints

- 4.3.1 Grid-power bottlenecks and surging electricity tariffs

- 4.3.2 Scarcity of Tier-III/IV-certified MEP labour

- 4.3.3 Water-stress curbing liquid-cooling deployments

- 4.3.4 Lengthy environmental licensing and community opposition

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Key Latin America Data Center Construction Statistics

- 4.8.1 Data Centers Total Installed Capacity (MW) in the Latin America, 2023 and 2024

- 4.8.2 Total IT Load Under Construction in the Latin America, MW, 2025 - 2030

- 4.8.3 Average Capex and Opex for the Latin America Data Center Construction

- 4.8.4 Top Capex Spenders on Data Center Infrastructure in Latin America

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Infrastructure

- 5.1.1 By Electrical Infrastructure

- 5.1.1.1 Power Distribution Solutions

- 5.1.1.1.1 Power Distribution Unit

- 5.1.1.1.2 Switchgears

- 5.1.1.1.3 Others Electrical Infrastructure

- 5.1.1.2 Power Backup Solutions

- 5.1.1.2.1 UPS

- 5.1.1.2.2 Generators

- 5.1.1.1 Power Distribution Solutions

- 5.1.2 By Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.2.1.1 Liquid-based Cooling

- 5.1.2.1.2 Air-based Cooling

- 5.1.2.2 Racks and Cabinets

- 5.1.2.3 Other Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.3 By IT Infrastructure

- 5.1.3.1 Servers

- 5.1.3.2 Storage

- 5.1.3.3 Other IT Infrastructure

- 5.1.4 General Construction

- 5.1.5 Services

- 5.1.5.1 Design and Consulting

- 5.1.5.2 Integration

- 5.1.5.3 Support and Maintenance

- 5.1.1 By Electrical Infrastructure

- 5.2 By Tier Standard

- 5.2.1 Tier I and II

- 5.2.2 Tier III

- 5.2.3 Tier IV

- 5.3 By End-User Industry

- 5.3.1 Banking, Financial Services and Insurance

- 5.3.2 IT and Telecommunications

- 5.3.3 Government and Defense

- 5.3.4 Healthcare

- 5.3.5 Other End Users

- 5.4 By Data Center Type

- 5.4.1 Colocation Data Centers

- 5.4.2 Hyperscale / Self-built Data Centers

- 5.4.3 Others (Enterprise / Edge / Modular)

- 5.5 By Geography

- 5.5.1 Brazil

- 5.5.2 Chile

- 5.5.3 Argentina

- 5.5.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.2.1 AECOM

- 6.2.2 Turner Construction Company

- 6.2.3 DPR Construction

- 6.2.4 Jacobs Solutions Inc.

- 6.2.5 Fluor Corporation

- 6.2.6 Skanska AB (Latin America)

- 6.2.7 Ferrovial S.A.

- 6.2.8 Grupo ACS (Dragados)

- 6.2.9 ACCIONA Construccion

- 6.2.10 Andrade Gutierrez Engenharia

- 6.2.11 Camargo Correa Infra

- 6.2.12 Novonor (Odebrecht Engenharia)

- 6.2.13 Queiroz Galvao S.A.

- 6.2.14 Techint EandC

- 6.2.15 Sacyr Ingenieria e Infraestructuras

- 6.2.16 Mota-Engil LATAM

- 6.2.17 Constructora Norberto Odebrecht LatAm

- 6.2.18 Grupo Carso Infraestructura

- 6.2.19 COSAPI Ingenieria y Construccion

- 6.2.20 Constructora Colpatria

- 6.2.21 Grupo Marhnos

- 6.2.22 Constructora Sudamericana

- 6.2.23 Ghella S.p.A.

- 6.2.24 Besix Watpac

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment