|

市场调查报告书

商品编码

1913411

动物饲料蛋白原料市场机会、成长要素、产业趋势分析及预测(2026年至2035年)Animal Feed Protein Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

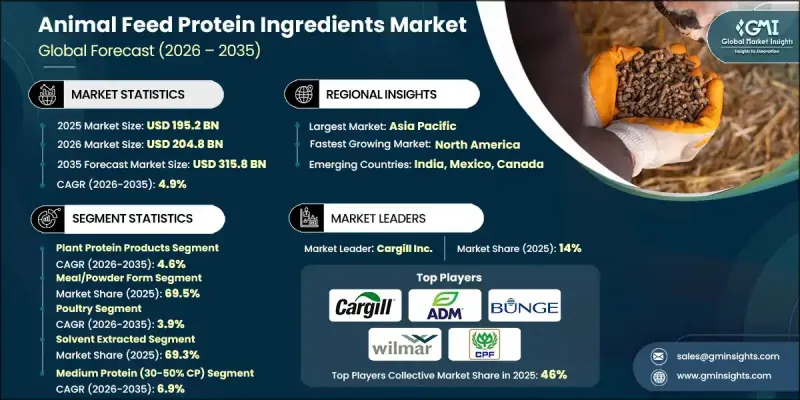

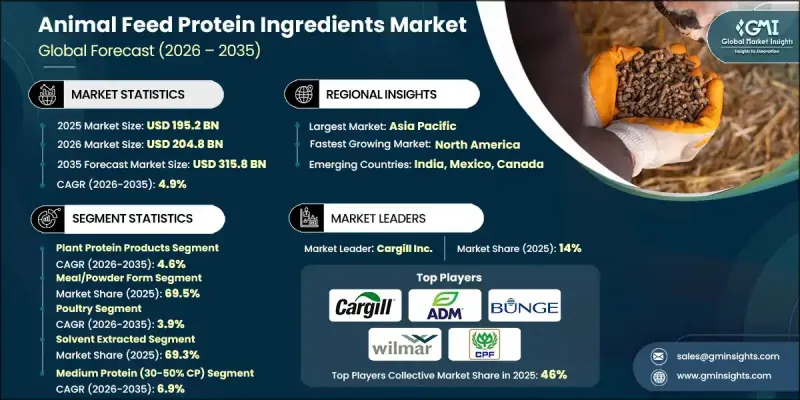

全球动物饲料蛋白原料市场预计到 2025 年将达到 1,952 亿美元,到 2035 年将达到 3,158 亿美元,年复合成长率为 4.9%。

该市场成长的驱动力在于肉类、乳製品和水产品生产中对饲料效率、动物健康和优质蛋白质含量的需求不断增长。动物饲料蛋白原料,包括植物性蛋白质、昆虫蛋白质和功能性添加剂,能够提高消化率和营养吸收率,进而提升生产力并促进永续性。全球环境法规和对低碳生产方式的追求正推动该产业走向更永续的实践。各地区的趋势有所不同:亚太地区透过畜牧业和水产养殖业的扩张推动成长;欧洲专注于可追溯性和永续性;北美则强调针对动物性能和健康的专业配方饲料。采用循环经济原则和一体化生产模式以优化资源和减少废弃物的企业,将获得长期竞争优势。随着人们对创新且来源可靠的蛋白质解决方案的兴趣日益浓厚,该市场仍在不断发展。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 1952亿美元 |

| 预测金额 | 3158亿美元 |

| 复合年增长率 | 4.9% |

预计到 2025 年,植物蛋白产品市占率将达到 71.2%,到 2035 年将以 4.6% 的复合年增长率成长。源自大豆、菜籽和其他作物的植物蛋白是一种经济高效且永续性的选择,可为畜牧业和水产养殖业提供均衡的氨基酸,符合全球资源效率和环境责任的目标。

按物理形态划分,预计到2025年,粉状和粉状饲料将占69.5%的市场份额,并在2026年至2035年间以4.7%的复合年增长率增长。这些形态因其用途广泛、易于添加到配方饲料中、营养成分分布均匀以及与自动化饲餵系统相容而备受青睐。颗粒和挤压成型等干燥形态的饲料因其控制释放、更高的饲料转化率以及减少集约化畜牧和水产养殖中的废弃物而日益受到关注。

欧洲动物饲料蛋白原料市场预计到2025年将达到339亿美元,并在整个预测期内保持强劲成长。严格的品质标准和负责任的采购法规正在推动满足环境和营养目标的蛋白质混合物的创新。德国凭藉其先进的畜牧业和前瞻性的饲料政策,是该市场的重要贡献者。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 全球肉类和乳製品消费量不断增长

- 水产养殖业的扩张

- 宠物饲养率不断提高,对优质宠物食品的需求也日益增长。

- 产业潜在风险与挑战

- 原物料价格波动

- 环境与永续性议题

- 市场机会

- 昆虫蛋白质市场的崛起

- 微生物和发酵蛋白的生长

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 专利状态

- 贸易统计(HS编码)

(註:贸易统计数据仅涵盖主要国家。)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续努力

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 考虑到碳足迹

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 企业矩阵分析

- 主要市场公司的竞争分析

- 竞争定位矩阵

- 重大进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 业务拓展计划

第五章 依产品类型分類的市场估算与预测,2022-2035年

- 植物性蛋白质产品

- 油籽粕

- 大豆浓缩蛋白/分离蛋白

- 豆类蛋白(豌豆、羽扇豆、蚕豆)

- 玉米蛋白(麵筋粉、麵筋饲料)

- 小麦蛋白产品

- 马铃薯蛋白

- 其他植物蛋白(苜蓿、米)

- 动物性蛋白质产品(ABP)

- 肉骨粉

- 肉粉

- 血粉

- 羽毛粉

- 禽肉粉

- 乳蛋白质(酪蛋白、乳蛋白质、乳清蛋白)

- 海洋蛋白质产品

- 鱼粉(白鱼粉、红鱼粉)

- 鱼蛋白浓缩物

- 鱼裂解液

- 贝类蛋白(虾、蟹、贝类)

- 软体动物性蛋白质(鱿鱼、蛤蜊)

- 微生物和发酵衍生的蛋白质

- 干燥发酵生物质

- 酵母蛋白(初级培养物、啤酒酵母、托鲁拉酵母)

- 酵母培养物

- 藻类蛋白

- 昆虫蛋白

- 黑家蝇幼虫

- 蟋蟀餐

- 麵包谷虫粉

- 其他的

6. 依实物形式分類的市场估算与预测,2022-2035 年

- 餐粉/粉状

- 蛋糕状

- 颗粒/挤出成型

- 液态/浓缩态

- 捣碎

第七章 畜牧业市场估算与预测(2022-2035年)

- 家禽

- 肉鸡

- 产蛋鸡

- 土耳其

- 其他(鸭子、鹅)

- 猪

- 起动机

- 製片人

- 为了增肥

- 母猪

- 牛(反刍动物)

- 牛

- 牛

- 牛/小牛肉

- 其他(水牛、野牛)

- 水产养殖

- 鲑鱼

- 鳟鱼

- 虾

- 鲤鱼

- 吴郭鱼

- 鲶鱼(斑点叉尾鰰、黄鲶鱼)

- 海鱼(鲈鱼、比目鱼、鲶鱼、鲱鱼、鳗鱼)

- 其他(海龟、螃蟹、软体动物)

- 宠物食品

- 狗

- 猫

- 鸟类

- 观赏鱼

- 小型哺乳动物

- 马

- 其他牲畜(绵羊、山羊、兔子)

第八章 依製造/加工方法分類的市场估算与预测,2022-2035年

- 渲染产品

- 溶剂萃取方法

- 机械萃取/压榨机

- 发酵衍生的

- 水解

- 浓缩/分离

9. 按蛋白质含量分類的市场估算与预测,2022-2035年

- 高蛋白(粗蛋白含量超过50%)

- 中等蛋白质含量(30-50% 粗蛋白质)

- 低至中等蛋白质含量(20-30%粗蛋白质)

第十章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

第十一章 公司简介

- Cargill Inc.

- Archer Daniels Midland Company(ADM)

- Bunge Limited

- Wilmar International Limited

- Charoen Pokphand Foods PCL

- Evonik Industries AG

- DSM-Firmenich

- Nutreco NV

- TASA(Tecnologica de Alimentos SA)

- Copeinca(Cooke Aquaculture)

- De Heus Animal Nutrition

- Alltech Inc.

- Protix BV

- InnovaFeed

- Calysta Inc.

The Global Animal Feed Protein Ingredients Market was valued at USD 195.2 billion in 2025 and is estimated to grow at a CAGR of 4.9% to reach USD 315.8 billion by 2035.

The market is fueled by rising demand for feed efficiency, animal health, and high-quality protein content in meat, dairy, and seafood production. Animal feed protein ingredients, including plant proteins, insect proteins, and functional additives, enhance digestibility and nutrient absorption, supporting both productivity and sustainability. Global environmental regulations and the push for low-carbon production methods are shaping the industry toward more sustainable practices. Regional dynamics vary, with Asia-Pacific driving growth due to expanding livestock and aquaculture sectors, Europe focusing on traceability and sustainability, and North America emphasizing specialty blends for animal performance and health. Companies adopting circular economy principles and integrated production models to optimize resources and reduce waste are positioned for long-term competitive advantage. The market is evolving with increasing interest in innovative, responsibly sourced protein solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $195.2 Billion |

| Forecast Value | $315.8 Billion |

| CAGR | 4.9% |

The plant protein products segment held 71.2% share in 2025 and is expected to grow at a CAGR of 4.6% through 2035. Plant-based proteins, sourced from soy, canola, and other crops, remain cost-effective and sustainable options for supplying balanced amino acids to livestock and aquaculture, aligning with global goals for resource efficiency and environmental responsibility.

By physical form, the meal and powder segment held a 69.5% share in 2025 and is forecast to grow at a CAGR of 4.7% during 2026-2035. These forms are preferred for their versatility, ease of blending into compound feeds, uniform nutrient distribution, and compatibility with automated feeding systems. Dry forms such as pellets and extrudates are gaining attention for controlled nutrient release, improved feed efficiency, and reduced wastage in intensive farming and aquaculture applications.

Europe Animal Feed Protein Ingredients Market accounted for USD 33.9 billion in 2025 and is expected to show strong growth throughout the forecast period. Stringent quality standards and responsible sourcing regulations are driving innovation in protein blends that meet environmental and nutritional goals. Germany contributes significantly due to its advanced livestock industry and progressive feed policies.

Key players operating in the Animal Feed Protein Ingredients Market include Cargill Inc., Archer Daniels Midland Company (ADM), Bunge Limited, Wilmar International Limited, Charoen Pokphand Foods PCL, Evonik Industries AG, DSM-Firmenich, Nutreco N.V., TASA (Tecnologica de Alimentos S.A.), Copeinca (Cooke Aquaculture), De Heus Animal Nutrition, Alltech Inc., Protix B.V., InnovaFeed, and Calysta Inc. Companies in the Animal Feed Protein Ingredients Market are adopting strategies to strengthen their presence and competitive positioning. They are investing in R&D to develop innovative protein blends and functional additives that improve animal performance while supporting sustainability. Expansion into emerging markets with growing livestock and aquaculture industries is a priority. Firms are enhancing processing technologies and product quality to meet regulatory standards and consumer demands. Collaborations, mergers, and acquisitions are being used to consolidate supply chains and access new distribution channels.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Physical form

- 2.2.4 Livestock

- 2.2.5 Production/processing method

- 2.2.6 Protein content

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing global meat & dairy consumption

- 3.2.1.2 Expansion of aquaculture industry

- 3.2.1.3 Rising pet ownership & premium pet food demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatile raw material prices

- 3.2.2.2 Environmental & sustainability concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Insect protein market emergence

- 3.2.3.2 Microbial & fermentation protein growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant protein products

- 5.2.1 Oilseed meals

- 5.2.2 Soy protein concentrate & isolate

- 5.2.3 Pulse proteins (pea, lupin, fava bean)

- 5.2.4 Corn protein (gluten meal, gluten feed)

- 5.2.5 Wheat protein products

- 5.2.6 Potato protein

- 5.2.7 Other plant proteins (alfalfa, rice)

- 5.3 Animal protein products (ABP)

- 5.3.1 Meat & bone meal

- 5.3.2 Meat meal

- 5.3.3 Blood meal

- 5.3.4 Feather meal

- 5.3.5 Poultry meal

- 5.3.6 Dairy proteins (casein, milk protein, lactalbumin)

- 5.4 Marine protein products

- 5.4.1 Fishmeal (white fish, dark fish)

- 5.4.2 Fish protein concentrate

- 5.4.3 Fish solubles

- 5.4.4 Crustacean proteins (shrimp, crab, shellfish)

- 5.4.5 Mollusk proteins (squid, clam)

- 5.5 Microbial & fermentation proteins

- 5.5.1 Dried fermentation biomass

- 5.5.2 Yeast proteins (primary, brewers, torula)

- 5.5.3 Yeast culture

- 5.5.4 Algae proteins

- 5.6 Insect proteins

- 5.6.1 Black soldier fly larvae

- 5.6.2 Cricket meal

- 5.6.3 Mealworm meal

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Physical Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Meal/Powder Form

- 6.3 Cake Form

- 6.4 Pellet/Extruded Form

- 6.5 Liquid/Condensed Form

- 6.6 Mash Form

Chapter 7 Market Estimates and Forecast, By Livestock, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Poultry

- 7.2.1 Broiler

- 7.2.2 Layer

- 7.2.3 Turkey

- 7.2.4 Others (duck, geese)

- 7.3 Swine

- 7.3.1 Starter

- 7.3.2 Grower

- 7.3.3 Finisher

- 7.3.4 Sow

- 7.4 Cattle (ruminants)

- 7.4.1 Dairy cattle

- 7.4.2 Beef cattle

- 7.4.3 Calf/veal

- 7.4.4 Others (buffalo, bison)

- 7.5 Aquaculture

- 7.5.1 Salmon

- 7.5.2 Trout

- 7.5.3 Shrimp

- 7.5.4 Carp

- 7.5.5 Tilapia

- 7.5.6 Catfish (channel, yellow)

- 7.5.7 Marine fish (seabass, pomfret, snakehead, herring, eel)

- 7.5.8 Others (turtle, crab, mollusks)

- 7.6 Petfood

- 7.6.1 Dogs

- 7.6.2 Cats

- 7.6.3 Birds

- 7.6.4 Fish (ornamental)

- 7.6.5 Small mammals

- 7.7 Equine

- 7.8 Other livestock (sheep, goats, rabbits)

Chapter 8 Market Estimates and Forecast, By Production/Processing Method, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Rendered Products

- 8.3 Solvent Extracted

- 8.4 Mechanically Extracted/Expeller Pressed

- 8.5 Fermentation-Derived

- 8.6 Hydrolyzed

- 8.7 Concentrated/Isolated

Chapter 9 Market Estimates and Forecast, By Protein Content, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 High Protein (>50% Crude Protein)

- 9.3 Medium Protein (30-50% CP)

- 9.4 Low-Medium Protein (20-30% CP)

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Cargill Inc.

- 11.2 Archer Daniels Midland Company (ADM)

- 11.3 Bunge Limited

- 11.4 Wilmar International Limited

- 11.5 Charoen Pokphand Foods PCL

- 11.6 Evonik Industries AG

- 11.7 DSM-Firmenich

- 11.8 Nutreco N.V.

- 11.9 TASA (Tecnologica de Alimentos S.A.)

- 11.10 Copeinca (Cooke Aquaculture)

- 11.11 De Heus Animal Nutrition

- 11.12 Alltech Inc.

- 11.13 Protix B.V.

- 11.14 InnovaFeed

- 11.15 Calysta Inc.