|

市场调查报告书

商品编码

1913434

视讯点播市场机会、成长要素、产业趋势分析及2026年至2035年预测Video on Demand Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

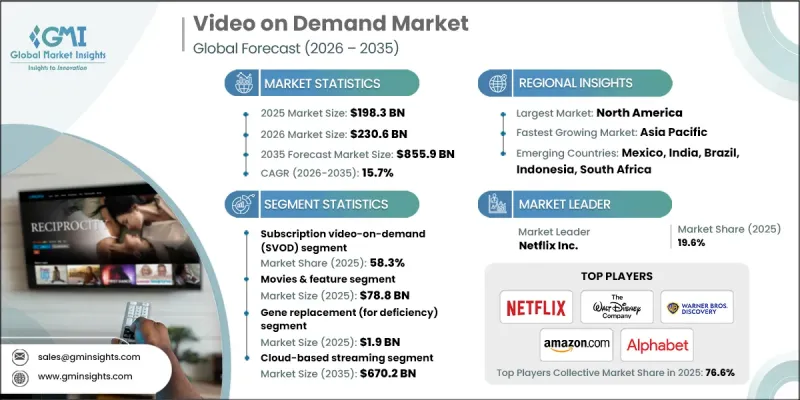

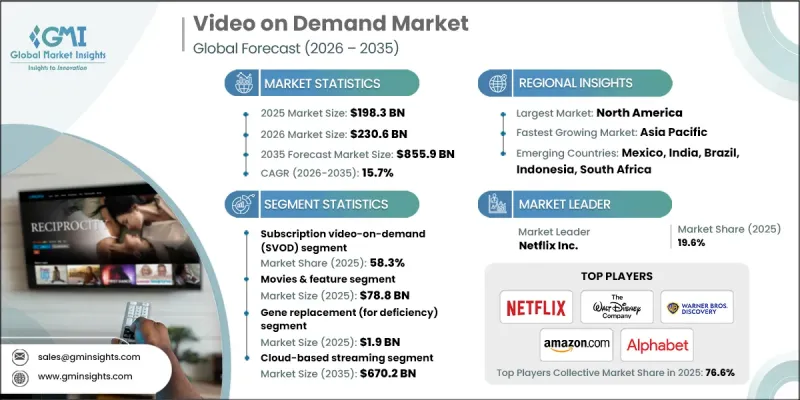

全球视讯点播市场预计到 2025 年将达到 1,983 亿美元,到 2035 年将达到 8,559 亿美元,年复合成长率为 15.7%。

这一增长得益于高速互联网连接的普及和基于云端的内容传送架构的日益广泛应用。消费者越来越倾向于灵活地获取娱乐内容,以适应他们的日程安排和生活方式,这显着提升了他们对行动观看和个人化观看体验的需求。串流品质、使用者介面和连网设备生态系统的持续改进,正在推动各个年龄层使用者群体的广泛接受。智慧电视、行动装置和多萤幕环境正在改变人们的内容消费习惯,使用户能够跨平台无缝存取影片内容。对网路基础设施和串流媒体技术的投资不断提升可靠性并改善观看品质。随着数位娱乐生态系统的日趋成熟,在不断变化的消费者期望和技术创新的推动下,随选视讯平台正成为全球媒体消费的中心。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 1983亿美元 |

| 预测金额 | 8559亿美元 |

| 复合年增长率 | 15.7% |

内容传递网路、自适应串流技术和跨装置相容性的持续进步不断增强着视讯点播生态系统。各平台正投入大量资源升级基础设施,以确保稳定的性能和高品质的播放。视讯点播服务使用户能够自由选择何时以及如何观看内容,并提供灵活的存取模式,包括跨多个装置的订阅模式和广告支援模式。

截至2025年,订阅式随选视讯市场占了58.3%的市占率。这种模式之所以能保持其主导地位,是因为它能够产生稳定的经常性收入,从而可以持续投资于独家内容和平台升级。已开发地区和新兴地区的高渗透率都表明,消费者对无限量点播娱乐内容有着强烈的偏好。

预计到 2025 年,电影和电影长片市场将创造 788 亿美元的收入,到 2035 年将达到 3,210 亿美元。对优质影片、原创作品和丰富内容库的需求持续推动着全球市场的参与度和平台差异化。

到2025年,北美随选视讯市场将占全球随选视讯市场总额的37.2%。强大的数位基础设施、有利的法规环境和高宽频普及率支撑了该地区的优势。成熟的内容生态系统以及消费者对个人化观看体验和OTT服务的偏好转变,将持续推动市场成长。

目录

第一章调查方法

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率分析

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 扩展高速宽频和5G基础设施

- 智慧型装置和联网电视的普及率不断提高

- 加大对原创和独家内容的投入

- 广告支援型串流模式(AVOD/混合模式)的成长

- 与通讯业者和设备製造商建立策略合作伙伴关係

- 产业潜在风险与挑战

- 高成本的内容取得和製作成本会影响盈利。

- 激烈的竞争会导致用户流失和价格压力。

- 市场机会

- 拓展新兴市场

- 广告支援型和混合型串流模式的成长

- 人工智慧驱动的个人化和内容推荐集成

- 拓展至直播及互动内容形式

- 司机

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特五力分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 新兴经营模式

- 合规要求

- 专利和智慧财产权分析

- 地缘政治和贸易趋势

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 主要企业的竞争标竿分析

- 财务绩效比较

- 收入

- 利润率

- 研究与开发

- 产品系列比较

- 产品线的广度

- 科技

- 创新

- 按地区比较存在状况

- 全球扩张分析

- 服务网路覆盖

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导企业

- 受让人

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 2022-2025 年主要发展动态

- 併购

- 合作伙伴关係和合资企业

- 技术进步

- 扩张与投资策略

- 数位转型计划

- 新兴/Start-Ups竞赛的趋势

第五章 依服务模式分類的市场估算与预测,2022-2035年

- 订阅视讯点播 (SVOD)

- 广告支援的视讯点播(AVOD)

- 交易型视讯点播 (TVOD)

- 按次付费观看(PPV)

- 混合视讯点播(VoD)模式

6. 按内容类型分類的市场估算与预测,2022-2035 年

- 电影和电影长片

- 电视剧

- 运动的

- 新闻和直播

- 儿童与教育内容

- 其他的

第七章 按设备分類的市场估算与预测,2022-2035年

- 智慧型手机和平板电脑

- 智慧电视

- 笔记型电脑和桌上型电脑

- OTT串流媒体设备

- 其他的

第八章 依实施类型分類的市场估算与预测,2022-2035年

- 基于云端的串流媒体

- 本地部署/託管串流媒体解决方案

- 混合内容传递网路

9. 依最终用途分類的市场估计与预测,2022-2035 年

- 个人消费者

- 企业和机构教育

第十章 2022-2035年各地区市场估计与预测

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十一章:公司简介

- Alibaba Group Holding Ltd.

- Alphabet Inc.

- Amazon.com, Inc.

- Apple Inc.

- Baidu, Inc.

- British Broadcasting Corporation(BBC)

- Comcast Corporation

- Fandango Media, LLC

- Fox Corporation

- ITV plc

- Netflix Inc.

- Paramount Global

- Roku, Inc.

- Sony Group Corporation

- Telefonica SA

- Tencent Holdings Ltd.

- The Walt Disney Company

- Vivendi SE

- Warner Bros. Discovery, Inc.

- Zee Entertainment Enterprises Ltd.

The Global Video on Demand Market was valued at USD 198.3 billion in 2025 and is estimated to grow at a CAGR of 15.7% to reach USD 855.9 billion by 2035.

The growth is driven by the widespread availability of high-speed internet connectivity and the growing adoption of cloud-based content delivery architectures. Consumers increasingly prefer flexible access to entertainment that fits their schedules and lifestyles, which has significantly increased demand for on-the-go and personalized viewing experiences. Continuous improvements in streaming quality, user interfaces, and connected device ecosystems have expanded adoption across all age groups. Smart televisions, mobile devices, and multi-screen environments are reshaping content consumption habits, allowing viewers to access video content seamlessly across platforms. Investments in network infrastructure and streaming technologies continue to strengthen reliability and viewing quality. As digital entertainment ecosystems mature, video on demand platforms are becoming central to global media consumption, supported by evolving consumer expectations and technological innovation.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $198.3 Billion |

| Forecast Value | $855.9 Billion |

| CAGR | 15.7% |

Ongoing advancements in content delivery networks, adaptive streaming technologies, and cross-device compatibility continue to reinforce the video-on-demand ecosystem. Platforms are dedicating significant resources to infrastructure upgrades to ensure consistent performance and high-quality playback. Video on demand services allow users to choose when and how they consume content, offering flexible access models that include subscription-based and advertising-supported options across multiple devices.

The subscription-based video on demand segment accounted for 58.3% share in 2025. This model remains dominant due to its ability to generate stable recurring revenue, enabling continuous investment in exclusive programming and platform enhancements. High adoption levels across developed and emerging regions highlight strong consumer preference for unlimited, on-demand access to entertainment content.

The movies and feature films segment generated USD 78.8 billion in 2025 and is projected to reach USD 321 billion by 2035. Demand for premium releases, original productions, and extensive content libraries continues to drive engagement and platform differentiation across global markets.

North America Video on Demand Market held a 37.2% share of the global video on demand market in 2025. Strong digital infrastructure, favorable regulatory conditions, and high broadband penetration support regional dominance. Mature content ecosystems and shifting consumer preferences toward personalized viewing and over-the-top services continue to accelerate growth.

Key companies operating in the Global Video on Demand Market include Netflix Inc., Amazon.com, Inc., The Walt Disney Company, Alphabet Inc., Apple Inc., Tencent Holdings Ltd., Sony Group Corporation, Warner Bros. Discovery, Inc., Paramount Global, Comcast Corporation, Roku, Inc., Alibaba Group Holding Ltd., Fox Corporation, British Broadcasting Corporation, Vivendi SE, Telefonica S.A., ITV plc, Baidu, Inc., Fandango Media, LLC, and Zee Entertainment Enterprises Ltd. These companies compete through content investment, technology leadership, and global reach. Companies in the Global Video on Demand Market are strengthening their market position by prioritizing innovation, sustainability, and consumer convenience. Manufacturers are focusing on developing durable, ergonomic, and efficient products that address evolving household needs. Sustainability-driven strategies, including reduced material usage and recyclable components, are gaining importance.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Service model trends

- 2.2.3 Content type trends

- 2.2.4 Device trends

- 2.2.5 Deployment trends

- 2.2.6 End User trends

- 2.2.7 Regional trends

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expanding High-Speed Broadband and 5G Infrastructure

- 3.2.1.2 Rising Adoption of Smart Devices and Connected TVs

- 3.2.1.3 Increasing Investments in Original and Exclusive Content

- 3.2.1.4 Growth of Ad-Supported Streaming Models (AVOD/Hybrid Plans)

- 3.2.1.5 Strategic Partnerships with Telecom Operators and Device Manufacturers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Content Acquisition and Production Costs Impacting Profitability

- 3.2.2.2 Intense Competition Leading to Subscriber Churn and Pricing Pressure

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Growth of ad-supported and hybrid streaming models

- 3.2.3.3 Integration of AI-driven personalization and content recommendation

- 3.2.3.4 Expansion into live streaming and interactive content formats

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Patent and IP analysis

- 3.11 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Service Model, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Subscription Video on Demand (SVOD)

- 5.3 Advertising-Supported Video on Demand (AVOD)

- 5.4 Transactional Video on Demand (TVOD)

- 5.5 Pay-Per-View (PPV)

- 5.6 Hybrid VoD Models

Chapter 6 Market Estimates and Forecast, By Content Type, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Movies & feature films

- 6.3 TV series

- 6.4 Sports

- 6.5 News & live broadcasts

- 6.6 Kids & educational content

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Device, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Smartphones & tablets

- 7.3 Smart TVs

- 7.4 Laptops & desktops

- 7.5 OTT streaming devices

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Deployment, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Cloud-based streaming

- 8.3 On-premise/managed streaming solutions

- 8.4 Hybrid content delivery networks

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 Individual consumers

- 9.3 Enterprises & corporate learning

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alibaba Group Holding Ltd.

- 11.2 Alphabet Inc.

- 11.3 Amazon.com, Inc.

- 11.4 Apple Inc.

- 11.5 Baidu, Inc.

- 11.6 British Broadcasting Corporation (BBC)

- 11.7 Comcast Corporation

- 11.8 Fandango Media, LLC

- 11.9 Fox Corporation

- 11.10 ITV plc

- 11.11 Netflix Inc.

- 11.12 Paramount Global

- 11.13 Roku, Inc.

- 11.14 Sony Group Corporation

- 11.15 Telefonica S.A.

- 11.16 Tencent Holdings Ltd.

- 11.17 The Walt Disney Company

- 11.18 Vivendi SE

- 11.19 Warner Bros. Discovery, Inc.

- 11.20 Zee Entertainment Enterprises Ltd.