|

市场调查报告书

商品编码

1913436

太阳能市场机会、成长要素、产业趋势分析及2026年至2035年预测Solar Photovoltaic (PV) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

全球太阳能光电(PV)市场预计到 2025 年将达到 3,235 亿美元,到 2035 年将达到 6,945 亿美元,年复合成长率为 8.1%。

太阳能发电系统在农业和商业活动中的日益普及推动了市场需求,屋顶光电系统和农光互补系统在优化土地利用的同时,也提供了经济高效的能源解决方案。这种双用途模式不仅能发电,还能带来经济效益,促进了多个产业的应用。企业对太阳能光电製造业的投资增加和产能扩张正在推动该产业的发展。土地资源的充足、安装成本的下降以及光伏组件效率和设计的改进,正在推动太阳能光伏的大规模部署。与传统能源来源相比,太阳能的成本竞争力也促进了其进一步普及。此外,全球对区域太阳能光电生产的资金投入和策略性投资,以及能够提升电网连接性、能源转换效率和运作稳定性的新一代太阳能逆变器,都在增强市场动态,并推动太阳能在公共产业、商业和工业领域的应用。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 3235亿美元 |

| 预测金额 | 6945亿美元 |

| 复合年增长率 | 8.1% |

受偏远地区电力需求成长的推动,预计2026年至2035年间,离网太阳能发电市场将以13%的复合年增长率成长。农村电气化计画的扩展、电池储能技术的进步、太阳能组件成本的下降以及政府补贴等因素,都在加速离网太阳能发电的普及。此外,智慧型能源管理系统在优化电力使用方面的应用,也促进了离网地区的成长。

到2025年,地面光伏发电市场份额将达到57.8%,这得益于农业光伏一体化(AgriVolt)模式的推广和高效土地利用策略的实施。光伏发电工程与农业的结合提高了资源利用效率,从而推动了该行业的成长。

预计到2035年,欧洲光电市场规模将达到1,345亿美元,主要得益于企业为实现可再生能源目标而进行的大力投资、智慧电网解决方案的普及以及储能能力的提升。此外,审批流程的简化和电网韧性的增强也进一步促进了光电发电在各种应用领域的大规模併网。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 产业生态系统

- 监管环境

- 产业影响因素

- 司机

- 产业潜在风险与挑战

- 成长潜力分析

- 成本结构分析

- 价格趋势分析

- 连结性别

- 按地区

- 波特五力分析

- PESTEL 分析

第四章 竞争情势

- 介绍

- 按地区分類的公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东

- 非洲

- 拉丁美洲

- 战略仪錶板

- 策略倡议

- 创新与科技趋势

第五章 依连结方式分類的市场规模及预测(2023-2035年)

- 併网

- 离网

6. 依安装方式分類的市场规模及预测,2023-2035年

- 地面安装

- 屋顶安装类型

7. 依最终用途分類的市场规模及预测(2023-2035年)

- 住宅

- 商业和工业

- 公共产业

第八章 2023-2035年各地区市场规模及预测

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 奥地利

- 挪威

- 丹麦

- 芬兰

- 法国

- 义大利

- 瑞士

- 西班牙

- 瑞典

- 英国

- 荷兰

- 波兰

- 比利时

- 爱尔兰

- 波罗的海国家

- 葡萄牙

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 马来西亚

- 新加坡

- 泰国

- 菲律宾

- 越南

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 约旦

- 阿曼

- 科威特

- 土耳其

- 非洲

- 南非

- 埃及

- 阿尔及利亚

- 奈及利亚

- 摩洛哥

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 秘鲁

第九章:公司简介

- Asun Trackers

- Canadian Solar

- CsunSolarTech

- Emmvee Solar

- First Solar

- GCL-SI

- Jinko Solar

- JA Solar Technology

- LONGi

- Q CELLS

- LG Electronics

- Motech Industries

- Renesola

- REC Solar Holdings

- Risen Energy

- Solar Frontier KK

- SunPower Corporation

- Solaria Corporation

- Shunfeng International Clean Energy

- Shenzhen Shine Solar

- Su-vastika Solar

- Trina Solar

- Vikram Solar

- Yingli Solar

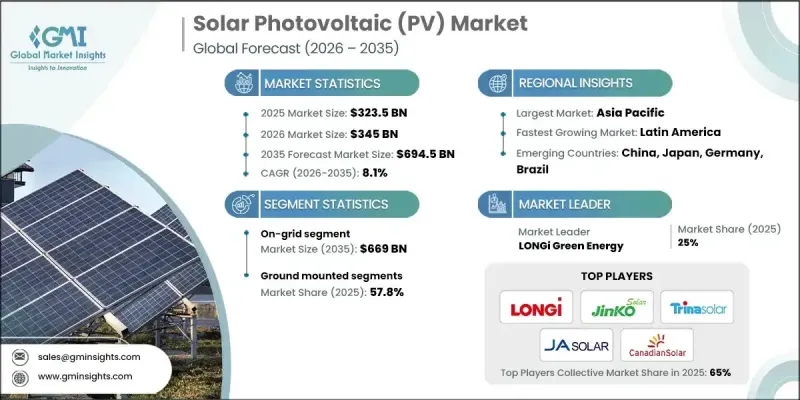

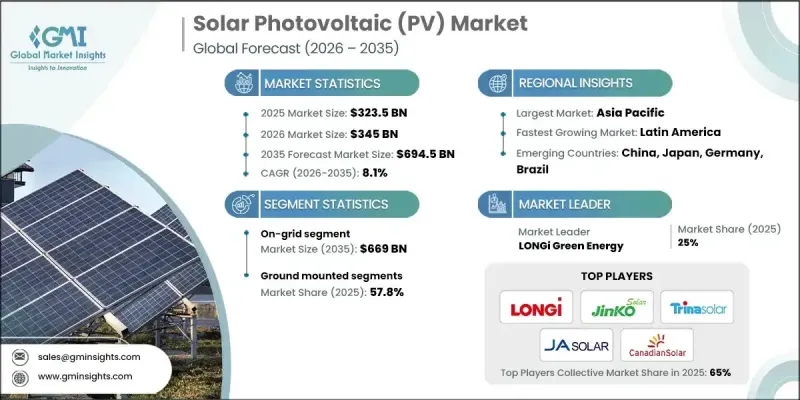

The Global Solar Photovoltaic (PV) Market was valued at USD 323.5 billion in 2025 and is estimated to grow at a CAGR of 8.1% to reach USD 694.5 billion by 2035.

Rising integration of solar PV systems in agricultural and commercial operations is driving demand, as rooftop installations and agrivoltaic systems optimize land use while providing cost-effective energy solutions. This dual-use approach not only generates electricity but also delivers economic benefits, encouraging adoption across multiple sectors. Growing corporate investments and capacity expansion initiatives in solar PV manufacturing are fueling industry development. Favorable land availability, declining installation costs, and improvements in panel efficiency and design are promoting utility-scale solar deployments. The cost competitiveness of solar power versus traditional sources further supports widespread adoption. Additionally, global funding and strategic investments in local solar production, along with next-generation solar inverters that enhance grid integration, energy conversion efficiency, and operational stability, strengthen market dynamics and enabling applications across utility, commercial, and industrial segments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $323.5 Billion |

| Forecast Value | $694.5 Billion |

| CAGR | 8.1% |

The off-grid solar PV segment is anticipated to grow at a CAGR of 13% from 2026 to 2035, driven by increasing electricity demand in remote areas. Expansion of rural electrification initiatives, advancements in battery storage technology, decreasing solar component costs, and supportive government subsidies are accelerating adoption. Integration of smart energy management systems is also optimizing power usage, supporting growth in off-grid communities.

The ground-mounted solar PV segment accounted for 57.8% share in 2025, benefiting from agrivoltaic adoption and efficient land utilization strategies. Combining solar projects with agriculture enhances resource efficiency, driving sector growth.

Europe Solar Photovoltaic (PV) Market is projected to reach USD 134.5 billion by 2035, fueled by strong corporate investment in renewable energy targets, adoption of smart grid solutions, and enhanced energy storage capabilities. Streamlined permitting processes and improved grid resilience are further enabling large-scale integration of solar power across diverse applications.

Leading players operating in the Global Solar Photovoltaic (PV) Market include LONGi, First Solar, JA Solar Technology, Canadian Solar, Emmvee Solar, Jinko Solar, Q CELLS, Vikram Solar, LG Electronics, Trina Solar, Renesola, Motech Industries, SunPower Corporation, Solaria Corporation, Shunfeng International Clean Energy, CSunSolarTech, Solar Frontier, Risen Energy, Asun Trackers, Shenzhen Shine Solar, Su-vastika Solar, REC Solar Holdings, and GCL-SI. Companies in the Global Solar Photovoltaic (PV) Market are strengthening their presence by investing in advanced manufacturing technologies and improving panel efficiency and durability. Strategic collaborations with energy developers and government programs allow companies to expand regional footprints and accelerate project deployment. Firms are also focusing on R&D for next-generation inverters and smart grid-compatible solutions, optimizing system performance and reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2023 - 2035

- 2.2 Business trends

- 2.3 Connectivity trends

- 2.4 Mounting trends

- 2.5 End use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Price trend analysis

- 3.6.1 By connectivity

- 3.6.2 By region

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East

- 4.2.5 Africa

- 4.2.6 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Connectivity, 2023 - 2035 (USD Billion & MW)

- 5.1 Key trends

- 5.2 On grid

- 5.3 Off grid

Chapter 6 Market Size and Forecast, By Mounting, 2023 - 2035 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Ground mounted

- 6.3 Roof top

Chapter 7 Market Size and Forecast, By End Use, 2023 - 2035 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

- 7.4 Utility

Chapter 8 Market Size and Forecast, By Region, 2023 - 2035 (USD Billion & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Austria

- 8.3.2 Norway

- 8.3.3 Denmark

- 8.3.4 Finland

- 8.3.5 France

- 8.3.6 Italy

- 8.3.7 Switzerland

- 8.3.8 Spain

- 8.3.9 Sweden

- 8.3.10 UK

- 8.3.11 Netherlands

- 8.3.12 Poland

- 8.3.13 Belgium

- 8.3.14 Ireland

- 8.3.15 Baltics

- 8.3.16 Portugal

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.4.6 Malaysia

- 8.4.7 Singapore

- 8.4.8 Thailand

- 8.4.9 Philippines

- 8.4.10 Vietnam

- 8.5 Middle East

- 8.5.1 Israel

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

- 8.5.4 Jordan

- 8.5.5 Oman

- 8.5.6 Kuwait

- 8.5.7 Turkey

- 8.6 Africa

- 8.6.1 South Africa

- 8.6.2 Egypt

- 8.6.3 Algeria

- 8.6.4 Nigeria

- 8.6.5 Morocco

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Argentina

- 8.7.3 Chile

- 8.7.4 Peru

Chapter 9 Company Profiles

- 9.1 Asun Trackers

- 9.2 Canadian Solar

- 9.3 CsunSolarTech

- 9.4 Emmvee Solar

- 9.5 First Solar

- 9.6 GCL-SI

- 9.7 Jinko Solar

- 9.8 JA Solar Technology

- 9.9 LONGi

- 9.10 Q CELLS

- 9.11 LG Electronics

- 9.12 Motech Industries

- 9.13 Renesola

- 9.14 REC Solar Holdings

- 9.15 Risen Energy

- 9.16 Solar Frontier KK

- 9.17 SunPower Corporation

- 9.18 Solaria Corporation

- 9.19 Shunfeng International Clean Energy

- 9.20 Shenzhen Shine Solar

- 9.21 Su-vastika Solar

- 9.22 Trina Solar

- 9.23 Vikram Solar

- 9.24 Yingli Solar