|

市场调查报告书

商品编码

1929001

静态随机存取记忆体(SRAM)市场机会、成长要素、产业趋势分析及2026年至2035年预测Static Random-Access Memory (SRAM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

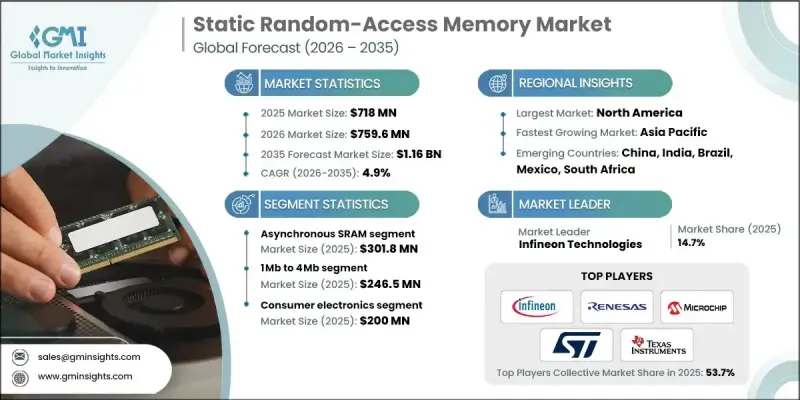

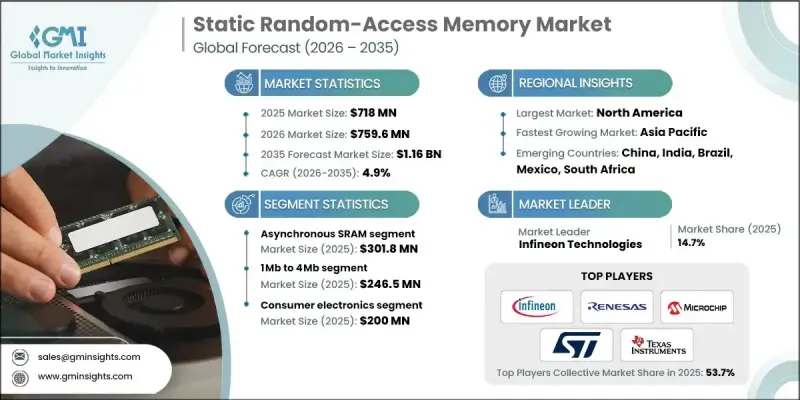

全球静态随机存取记忆体 (SRAM) 市场预计到 2025 年将达到 7.18 亿美元,到 2035 年将达到 11.6 亿美元,年复合成长率为 4.9%。

由于先进电子系统对高速、低延迟和高可靠性的储存解决方案的需求不断增长,市场正在扩张。 SRAM 在下一代半导体设计中的整合度不断提高,以及其在运算、网路和汽车电子领域的应用日益广泛,正在推动其长期成长。半导体製造技术的不断进步,也为 SRAM 产品更高的密度和效率提供了支援。对数据密集型数位基础设施的投资不断增长,也加速了 SRAM 的应用,因为 SRAM 在确保快速数据存取和处理方面发挥关键作用。随着现代应用不断产生和处理大量数据,快速稳定的片上记忆体变得日益重要。静态随机存取记忆体 (SRAM) 是一种挥发性半导体记忆体,仅在通电时才保存数据,与其他类型的记忆体相比,其存取速度更快。这些效能优势满足了系统设计人员对速度、可靠性和低功耗的需求。

| 市场覆盖范围 | |

|---|---|

| 开始年份 | 2025 |

| 预测年份 | 2026-2035 |

| 起始值 | 7.18亿美元 |

| 预测金额 | 11.6亿美元 |

| 复合年增长率 | 4.9% |

预计到2025年,非同步SRAM市场规模将达到3.018亿美元。该市场凭藉其稳定的运作、简化的介面设计以及与多种电子架构的兼容性,保持着强劲的市场地位。其久经考验的可靠性和易于整合性也使其在多种系统设计中广泛应用。

预计到 2035 年,16Mb 及以上 SRAM 市场将以 6.3% 的复合年增长率成长,达到 1.947 亿美元。该市场的成长是由对片上储存容量日益增长的需求所驱动的,以实现更快的数据处理并减少对外部储存组件的依赖。

预计到 2025 年,北美静态随机存取记忆体 (SRAM) 市占率将达到 31.2%。该地区的成长得益于强大的半导体製造能力、先进的技术基础设施以及对专注于记忆体技术创新的研发活动的持续投资。

目录

第一章调查方法和范围

第二章执行摘要

第三章业界考察

- 生态系分析

- 供应商情况

- 利润率

- 成本结构

- 每个阶段的附加价值

- 影响价值链的因素

- 中断

- 产业影响因素

- 司机

- 扩展人工智慧和机器学习应用

- 边缘运算和物联网设备的激增

- 处理器对高效能快取的需求不断增长

- 半导体技术和节点小型化的进步

- 汽车和5G基础设施电子产业的成长

- 产业潜在风险与挑战

- 高昂的製造成本和规模限制

- 半导体供应链波动性和原料供应情况

- 市场机会

- SRAM在人工智慧加速器和高效能运算中的应用日益广泛

- 在先进的SoC设计中扩展嵌入式SRAM集成

- 司机

- 成长潜力分析

- 监管环境

- 波特分析

- PESTEL 分析

- 科技与创新趋势

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 副产品

- 定价策略

- 新兴经营模式

- 合规要求

- 永续性措施

- 消费者心理分析

- 专利和智慧财产权分析

- 地缘政治和贸易趋势

第四章 竞争情势

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 市场集中度分析

- 按地区

- 主要企业的竞争标竿分析

- 财务绩效比较

- 收入

- 利润率

- 研究与开发

- 产品系列比较

- 产品线丰富

- 科技

- 创新

- 按地区分類的企业发展比较

- 全球扩张分析

- 服务网路覆盖范围

- 按地区分類的市场渗透率

- 竞争定位矩阵

- 领导企业

- 受让人

- 追踪者

- 小众玩家

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年主要发展动态

- 併购

- 伙伴关係与合作

- 技术进步

- 扩张与投资策略

- 永续发展倡议

- 数位转型计划

- 新兴/Start-Ups竞赛的趋势

第五章 按类型分類的市场估算与预测,2022-2035年

- 异步SRAM

- 同步SRAM

- 其他的

第六章 依记忆容量分類的市场估算与预测,2022-2035年

- 1MB 或更少

- 1Mb~4Mb

- 4Mb~16Mb

- 16Mb 或以上

7. 2022-2035年按最终用途产业分類的市场估算与预测

- 资讯科技/通讯

- 家用电子电器

- 车

- 航太/国防

- 工业的

- 卫生保健

- 其他的

第八章 2022-2035年各地区市场估算与预测

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第九章:公司简介

- Alliance Memory, Inc.

- Analog Devices, Inc.

- GSI Technology Inc.

- Infineon Technologies

- Integrated Silicon Solution Inc.(ISSI)

- Microchip Technology Inc.

- NXP Semiconductors

- ON Semiconductor

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- STMicroelectronics NV

- Texas Instruments

- Toshiba Corporation

- Winbond Electronics Corporation

The Global Static Random-Access Memory Market was valued at USD 718 million in 2025 and is estimated to grow at a CAGR of 4.9% to reach USD 1.16 billion by 2035.

Market expansion is driven by rising demand for memory solutions that deliver high speed, minimal latency, and reliable performance across advanced electronic systems. Increasing integration of SRAM in next-generation semiconductor designs and the broadening scope of applications across computing, networking, and automotive electronics are reinforcing long-term growth. Ongoing improvements in semiconductor fabrication technologies are supporting higher density and improved efficiency in SRAM products. Growing investment in data-intensive digital infrastructure is also accelerating adoption, as SRAM plays a critical role in ensuring fast data access and processing. As modern applications continue to generate and process larger volumes of data, the importance of fast and stable on-chip memory is increasing. Static random-access memory is defined as a volatile semiconductor memory that retains stored data as long as power is supplied and enables faster access speeds compared to alternative memory types. These performance advantages are sustaining demand as system designers prioritize speed, reliability, and low power consumption.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $718 Million |

| Forecast Value | $1.16 Billion |

| CAGR | 4.9% |

The asynchronous SRAM segment generated USD 301.8 million in 2025. This segment maintains a strong position due to its stable operation, simplified interface design, and compatibility with a wide range of electronic architectures. Its proven reliability and ease of integration continue to support widespread use across multiple system designs.

The above 16Mb SRAM segment is projected to grow at a CAGR of 6.3% and is expected to reach USD 194.7 million by 2035. Growth in this segment is being supported by increasing requirements for higher on-chip memory capacity to enable faster data handling and reduced dependence on external memory components.

North America Static Random-Access Memory (SRAM) Market accounted for 31.2% share in 2025. Regional growth is supported by strong semiconductor manufacturing capabilities, advanced technological infrastructure, and sustained investment in research and development activities focused on memory innovation.

Key companies operating in the Global Static Random-Access Memory Market include Samsung Electronics Co., Ltd., Texas Instruments, Renesas Electronics Corporation, Microchip Technology Inc., Infineon Technologies, NXP Semiconductors, STMicroelectronics NV, Toshiba Corporation, Winbond Electronics Corporation, Alliance Memory, Inc., GSI Technology Inc., ON Semiconductor, Integrated Silicon Solution Inc., and Analog Devices, Inc. Companies in the Static Random-Access Memory (SRAM) Market are strengthening their position through continuous innovation, capacity expansion, and technology optimization. Many players are investing in advanced process nodes to improve speed, reduce power consumption, and increase memory density. Expanding product portfolios to address diverse performance and capacity requirements is a key strategy. Firms are also focusing on long-term supply agreements with system manufacturers to secure consistent demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Type Trends

- 2.2.3 Memory Size Trends

- 2.2.4 End Use Industry Trends

- 2.2.5 Regional Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of AI and Machine Learning Applications

- 3.2.1.2 Proliferation of Edge Computing and IoT Devices

- 3.2.1.3 Increasing Demand for High-Performance Cache Memory in Processors

- 3.2.1.4 Advancements in Semiconductor Technology and Node Scaling

- 3.2.1.5 Growth in Automotive and 5G Infrastructure Electronics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Manufacturing Costs and Scaling Limitations

- 3.2.2.2 Volatility in Semiconductor Supply Chain and Raw Material Availability

- 3.2.3 Market opportunities

- 3.2.3.1 Rising Adoption of SRAM in AI Accelerators and High-Performance Computing

- 3.2.3.2 Growing Integration of Embedded SRAM in Advanced SoC Designs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing Strategies

- 3.10 Emerging Business Models

- 3.11 Compliance Requirements

- 3.12 Sustainability Measures

- 3.13 Consumer Sentiment Analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit Margin

- 4.3.1.3 R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1 Product Range Breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global Footprint Analysis

- 4.3.3.2 Service Network Coverage

- 4.3.3.3 Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 1.1.1 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Asynchronous SRAM

- 5.3 Synchronous SRAM

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Memory Size, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Up to 1Mb

- 6.3 1Mb to 4Mb

- 6.4 4Mb to 16Mb

- 6.5 Above 16 Mb

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 IT & telecom

- 7.3 Consumer electronics

- 7.4 Automotive

- 7.5 Aerospace & defense

- 7.6 Industrial

- 7.7 Healthcare

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alliance Memory, Inc.

- 9.2 Analog Devices, Inc.

- 9.3 GSI Technology Inc.

- 9.4 Infineon Technologies

- 9.5 Integrated Silicon Solution Inc. (ISSI)

- 9.6 Microchip Technology Inc.

- 9.7 NXP Semiconductors

- 9.8 ON Semiconductor

- 9.9 Renesas Electronics Corporation

- 9.10 Samsung Electronics Co., Ltd.

- 9.11 STMicroelectronics NV

- 9.12 Texas Instruments

- 9.13 Toshiba Corporation

- 9.14 Winbond Electronics Corporation