|

市场调查报告书

商品编码

1564672

锂离子电池用硅负极 - 专利形势的分析(2024年)Silicon Anode for Li-ion Batteries - Patent Landscape Analysis 2024 |

|||||||

人们认识到硅基负极在锂离子电池中的潜力,因此进行了大量投资,将该技术推向市场。

锂离子电池中的硅基负极具有优异的电化学性能,包括更高的能量密度、更大的重量和体积容量、合适的热力学锂化电位和更高的平均电压。

如今,在锂离子电池中使用硅基阳极正在成为现实,数十亿美元流入硅阳极新创公司(IDTechEx,2021)和锂离子电池硅阳极材料市场。 (IDTechEx,2024)。多家材料製造商宣布商业化生产用于锂离子电池的硅活性材料,包括Advano、Sila Nanotechnology、Elkem、Group14、NanoGraf、OneD Materials 和Nexeon。同样,Amprius、Sionic Energy(以前称为NOHMS)、Farasis Energy、Enovix、StoreDot、三星、松下、PPES(丰田和松下的合资企业) 、包括Murata和Enevate/EnerTech在内的多家电池製造商已经宣布硅负极锂离子电池的商业化应用。 特斯拉于 2019 年收购了电池製造商 Maxwell Technologies,并于 2021 年收购了电池新创公司 SiLion。同年,PPES与Nexeon宣布建立合作伙伴关係,重点开发硅负极,StoreDot与EVE Energy b>并与Group14 Technologies 签订战略框架协议,以加速StoreDot 电动车XFC 锂硅电池的商业化。此外,戴姆勒、保时捷、通用汽车等汽车原始设备製造商正在认识到硅阳极的潜力,并正在投资硅阳极公司或与硅阳极公司合作。

本报告对锂离子电池硅负极产业进行了调查和分析,提供了有关技术和智慧财产权(IP)的专利状况以及主要公司的策略的资讯。

报告涵盖的公司(部分)

LG Chem/LG Energy Solution,Panasonic/Sanyo,Samsung,Murata Manufacturing/Sony,Toyota,ATL(Amperex Technology),COSMX/COSLIGHT,Guoxuan High Tech Power Energy/Gotion,CATL(Contemporary Amperex Technology Ltd),Global Graphene,SVOLT/Fengchao Energy Technology,General Motors,NEC,SK Group,Enevate,Resonac(Showa Denko/Hitachi Chemical),Shanshan Energy Technology,Mitsubishi Chemical,BYD,EVE Energy,Bosch/SEEO,A123 Systems(Wanxiang group),Sunwoda,Nissan,Tafel New Energy Technology/Zenergy,BTR New Energy Material,Amprius/Berzelius,Nexeon,Mitsui Mining & Smelting,Envision/AESC,Tinci Materials Technology,TDK,Hitachi 、JEVE(天津 EV Energy),Huawei,Hyundai/Kia,WeLion New Energy Technology,Wacker Chemie,BAK Battery,Hitachi Maxell,GS Yuasa,Mitsui Chemicals,Tianmu Energy Anode Material,CALB(China Aviation Lithium Battery),Yinlong Energy,Furukawa,Toshiba,Kaijin New Energy Technology,Smoothway Electronic Materials,Kunlunchem,Chery Automobile,Fujifilm,MU Ionic Solutions,Ube Corporation,Shin Etsu Chemical,Sumitomo Electric Industries,MGL New Materials,Sound Group,Zeon,FAW(China First Automobile Works),BMW,Umicore,Sekisui Chemical,Capchem Group,Novolyte Technologies,其他

目录

简介

- 报告的背景和目的

- 调查范围

- Excel 资料库

- 知识产权基础知识,以便更好地理解本报告

- 电池领域的挑战

- 硅负极的主要优缺点

- 硅负极锂离子电池存在的主要问题及改良措施

摘要整理

专利形势概要

主要趋势与IP企业

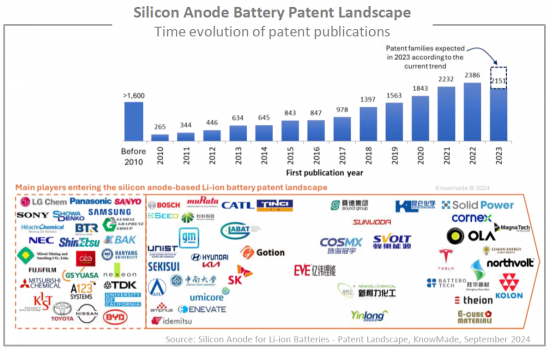

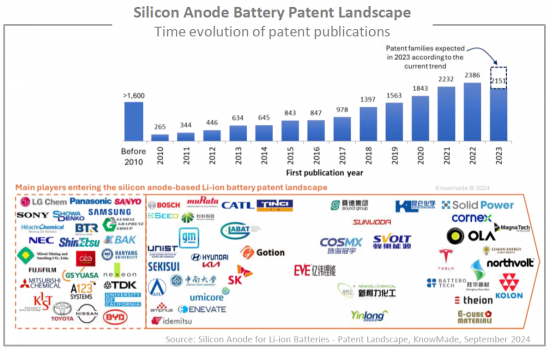

- 专利公布和主要专利申请人的时间变化

- 专利公开趋势:依国家划分

- 主要专利权人:依专利族数量分类

- 主要专利申请人:依公司分类、原籍国

- 涉足专利领域的主要新创公司和纯粹参与者

- 主要知识产权公司的时间表

- 2021 年后的智慧财产权公司与新进者

- 主要智慧财产权公司:依供应链细分(负极材料、负极、电池)

- 专利目前的法律状态(已授权、待审、已过期)

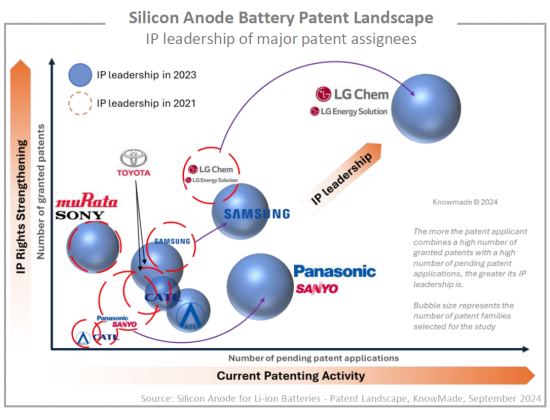

- 主要受託人的智慧财产权领导力以及 2021 年以来的演变

- 主要公司专利的地理范围

- 主要申请人的智慧财产权策略(国内策略与全球策略)

- 主要知识产权公司和新进入者

主要企业的近几年的专利活动

- Samsung,LG Chem/LG Energy Solution,Panasonic/Sanyo,ATL,COSMX,Nexeon,Enevate,Ionobell,Enwires

Start-Ups和pure企业的考察

- 绘製了硅负极电池专利格局中超过 290 家新创公司和纯粹参与者的地图

- 中国新创公司与纯粹参与者

- 韩国新创公司和纯企业

- 日本新创公司和纯企业

- 北美的新创公司和纯粹的参与者

- 欧洲新创公司与纯粹参与者

- 其他(台湾、以色列、印度、新加坡、澳洲等)

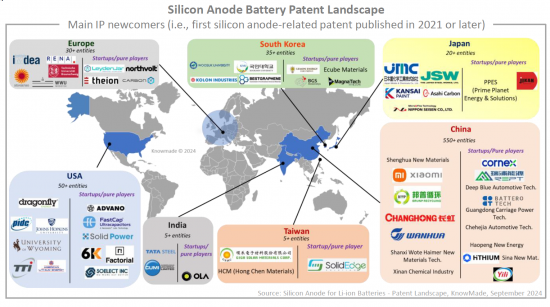

2021年以后的IP新加入企业的考察

- 绘製了自 2021 年以来已发布首个与硅负极电池相关专利的 650 多个智慧财产权新进者的地图

- 中国知识产权新进者

- 韩国 IP 新进者

- 日本IP新进入者

- 美国知识产权新进者

- 欧洲知识产权新进入者

- 其他(台湾、加拿大、印度等)

附录

Knowmade的简报

Who are the key players and newcomers in the global IP race for the promising silicon anode-based Li-ion batteries?

KEY FEATURES:

- PDF >100 slides

- Excel file >18,200 patent families

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Main patent assignees and IP newcomers in the different segments of the supply chain.

- Key players' IP position and the relative strength of their patent portfolio.

- Patents categorized by categorized by supply chain segments (materials, anode, battery cell, other battery components).

- Recent patenting activities of key players.

- Focus on startups, pure players, and IP newcomers.

- Excel database containing all patents analyzed in the report, including patent segmentations and hyperlinks to an updated online database.

The recognized potential of the silicon-based anode for Li-ion batteries has led to significant investments in bringing this technology to market

Silicon-based anodes in Li-ion batteries offer superior electrochemical performance, including higher energy density, greater gravimetric and volumetric capacity, suitable thermodynamic lithiation potentials, and higher average voltage.

Today, the use of silicon-based anodes in Li-ion batteries is becoming a reality, with billions od dollars flowing into silicon anode start-ups (IDTechEx, 2021) and a market for silicon anode material for Li-ion batteries projected to reach $24 billion by 2034 (IDTechEx, 2024) . Several material manufacturers, such as Advano, Sila Nanotechnology, Elkem, Group14, NanoGraf, OneD Materials, and Nexeon, have announced the commercial production of silicon active materials for Li-ion batteries. Likewise, several battery manufacturers have announced the commercial availability of silicon anode Li-ion cells, including Amprius, Sionic Energy (formerly NOHMS), Farasis Energy, Enovix, StoreDot, Samsung, Panasonic, PPES (a joint venture between Toyota and Panasonic), Murata, and Enevate/EnerTech. In the automotive sector, there have been significant strategic acquisitions and partnerships. Tesla acquired battery manufacturer Maxwell Technologies in 2019 and battery start-up SiLion in 2021. That same year, PPES and Nexeon announced a partnership focused on silicon anode development, and StoreDot entered into a strategic framework agreement with EVE Energy, while partnering with Group14 Technologies to accelerate commercialization of StoreDot's XFC lithium-silicon cells for electric vehicles. Additionally, automotive OEMs such as Daimler, Porsche, and GM have recognized the potential of silicon anodes and have invested in and partnered with silicon anode companies.

In this highly competitive and dynamic environment, it is increasingly crucial to have a strong understanding of the patent landscape and the strategies of key players in technology and intellectual property (IP) . To meet this need, Knowmade is releasing a new Silicon Anode Batteries Patent Landscape report, which aims to clarify the current positions of IP players, analyze their IP strategies, and reveal where industry leaders, newcomers, and start-ups are focusing their R&D efforts.

A dynamic IP landscape

IP competition analysis should reflect the vision of players with a strategy to enter and develop their business in the silicon anode Li-ion battery market. In this report, Knowmade's analysts provide a comprehensive overview of the competitive IP landscape and latest technological developments in this field. The report covers IP dynamics and key trends in terms of patents applications, patent assignees, filing countries, and patented technologies. It also identifies the IP leaders, most active patent applicants, and new entrants in the IP landscape. The report also sheds light on under-the-radar companies and new players in this field.

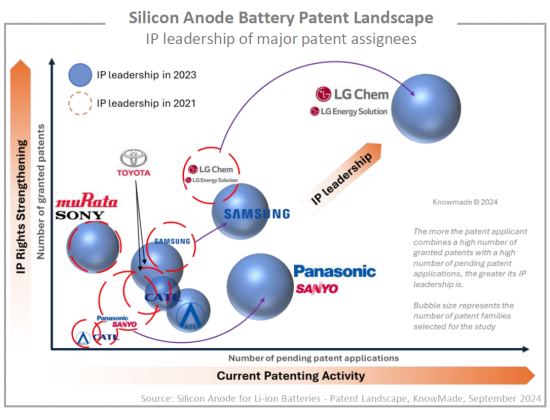

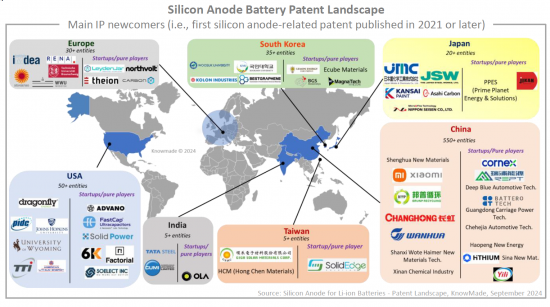

Evolution of leading players' positions and entry of new patent applicants

LG Chem/LGES is leading the silicon anode battery patent landscape, with strong IP competition from Samsung, Murata, Panasonic/Sanyo, and Toyota. Additionally, we have identified over 290 start-ups and pure players involved in the patent landscape, and more than 650 new entrants who filed their first silicon anode-related patents in 2021 or later, most of whom are Chinese entities. In dedicated sections of the report, we focus on the IP portfolios held by key players, start-ups, and newcomers from various countries.

Useful Excel patent database

This report also includes an extensive Excel database with all patents analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and affiliation segments (anode material, anode, battery cell, other battery cell components).

Companies mentioned in the report (non-exhaustive)

LG Chem/LG Energy Solution, Panasonic/Sanyo, Samsung, Murata Manufacturing/Sony, Toyota, ATL (Amperex Technology), COSMX / COSLIGHT, Guoxuan High Tech Power Energy / Gotion, CATL (Contemporary Amperex Technology Ltd), Global Graphene, SVOLT / Fengchao Energy Technology, General Motors, NEC, SK Group, Enevate, Resonac (Showa Denko / Hitachi Chemical), Shanshan Energy Technology, Mitsubishi Chemical, BYD, EVE Energy, Bosch/SEEO, A123 Systems (Wanxiang group), Sunwoda, Nissan, Tafel New Energy Technology / Zenergy, BTR New Energy Material, Amprius / Berzelius, Nexeon, Mitsui Mining & Smelting, Envision / AESC, Tinci Materials Technology, TDK, Hitachi , JEVE (Tianjin EV Energy), Huawei, Hyundai/Kia, WeLion New Energy Technology, Wacker Chemie, BAK Battery, Hitachi Maxell, GS Yuasa, Mitsui Chemicals, Tianmu Energy Anode Material, CALB (China Aviation Lithium Battery), Yinlong Energy, Furukawa, Toshiba, Kaijin New Energy Technology, Smoothway Electronic Materials, Kunlunchem, Chery Automobile, Fujifilm, MU Ionic Solutions, Ube Corporation, Shin Etsu Chemical, Sumitomo Electric Industries, MGL New Materials, Sound Group, Zeon, FAW (China First Automobile Works), BMW, Umicore, Sekisui Chemical, Capchem Group, Novolyte Technologies, and more.

TABLE OF CONTENTS

INTRODUCTION

- Context & objectives of the report

- Scope of the report

- Excel database

- Basic knowledge of IP to better understand this report

- Challenges in battery field

- Main advantages and drawbacks of silicon anode

- Main challenges and improvement solutions for silicon anode lithium-ion battery

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

Main trends and IP players

- Time evolution of patent publications and main patent applicants

- Time evolution of patent publications by country

- Main patent assignees according to the number of their patent families

- Main patent assignees by companies' typology and originating countries

- Main start-ups and pure players involved in the patent landscape

- Timeline of main IP players

- Historical IP players and new entrants since 2021

- Main IP players by supply chain segments (anode material, anode, battery cell)

- Current legal status of patents (granted, pending, dead)

- IP leadership of main assignees and evolution from 2021

- Geographical coverage of main players' patents

- IP strategy of main patent applicants (domestic strategy vs. global strategy)

- Key IP players and newcomers

Recent patenting activity of key players

- Samsung, LG Chem/LG Energy Solution, Panasonic/Sanyo, ATL, COSMX, Nexeon, Enevate, Ionobell, Enwires

Focus on start-ups and pure players

- Mapping of 290+ startups and pure players involved in the silicon anode battery patent landscape

- Chinese startups and pure players

- South Korean startups and pure players

- Japanese startups and pure players

- North American startups and pure players

- European startups and pure players

- Others (Taiwanese, Israeli, Indian, Singaporean, Australian, etc.)

Focus on IP newcomers since 2021

- Mapping of 650+ IP newcomers that published their first patent related silicon anode batteries in 2021 or later.

- Chinese IP newcomers

- South Korean IP newcomers

- Japanese IP newcomers

- American IP newcomers

- European IP newcomers

- Others (Taiwanese, Canadian, Indian, etc.)

ANNEX

- Methodology for patent search, selection and analysis

- Terminology