|

市场调查报告书

商品编码

1636448

北美电动车电池负极:市场占有率分析、产业趋势、成长预测(2025-2030)North America Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

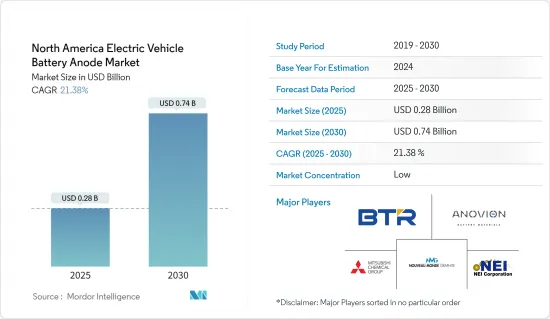

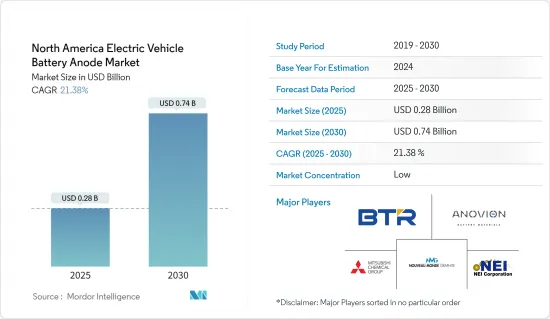

预计2025年北美电动车电池负极市场规模为2.8亿美元,2030年预计将达7.4亿美元,预测期内(2025-2030年)复合年增长率为21.38%。

主要亮点

- 电动车的普及、政府的支持措施以及锂离子电池价格的下降将支持预测期内的市场成长。

- 相反,由于国内电池组件产量有限,市场可能面临挑战。

- 然而,负极材料和高效电解质的持续研究和进展为市场扩张提供了一个有希望的机会。

- 随着汽车产业需求的增加,美国很可能透过扩大负极材料的使用来引领市场。

北美电动车电池负极市场趋势

锂离子电池类型预计将占据较大份额

- 从历史上看,锂离子电池为从行动电话到个人电脑的家用电子电器提供动力。然而,它们的作用已经扩大,并已成为北美混合动力汽车和全电动汽车 (EV) 的首选动力源。这种变化主要是由于电动车的环境效益,它不排放二氧化碳和氮氧化物等温室气体。

- 在北美,锂离子电池由于其良好的容量重量比而比其他类型的电池更受欢迎。锂离子电池的卓越性能、长寿命和降低成本进一步推动了其采用。高能量密度和长循环寿命使锂离子电池成为电动车製造商的最佳选择。随着北美国家扩大电动车产量,对适合锂离子技术的先进製造设备的需求不断增加,推动了对电池负极材料的需求。

- 锂离子电池在北美市场占据主导地位的关键因素是价格下降。过去十年,技术进步、规模经济和复杂的製造流程显着降低了锂离子电池的成本。

- 2023年,锂离子电池组价格将与前一年同期比较%至139美元/kWh。随着电池价格下降,电动车将变得更加便宜,从而导致电动车的采用率和市场占有率增加。需求的激增推动了包括负极在内的电池组件消费量的增加,并推动了提高电池性能的技术进步。

- 展望未来,由于该地区将重点增加阳极材料和阴极材料等锂离子电池製造组件的产量,预计锂离子电池阳极市场将在预测期内成长。

- 例如,2024年4月,澳洲Sicona Battery Technologies公司计划在美国东南部建立硅碳负极材料初始生产设施。硅碳负极越来越多地用于电动车 (EV) 电池的生产。传统的锂离子电池通常使用石墨负极,但硅碳负极具有多种优势,特别是在能量密度方面。该公司计划在2030年将美国的产量扩大到每年26,500吨。

- 因此,由于电动车中锂离子电池的使用量增加和价格下降,预计锂离子电池阳极细分市场在预测期内将大幅成长。

预计美国将主导市场

- 近年来,在电动车普及和对尖端电池技术需求不断增加的推动下,美国电动车电池负极市场迅速扩大。

- 随着美国电动车销量的飙升,电池製造商正在加大对国内生产的投资,从而增加了对电动车电池负极的需求。根据国际能源总署(IEA)的报告,2023年美国电动车销量将达139万辆,较2022年的99万辆大幅成长。

- 在政府的大力支持下,电池製造商正在美国建造新的电动车(EV)工厂。这种扩张将显着增加对电动车生产所用材料的需求,特别是电池和阳极。例如,2024年1月,美国能源局拨款1.31亿美元用于推进电动车电池和充电系统研发的计划。

- 展望未来,随着电动车越来越普及,在国家电池技术研发努力的推动下,电池阳极市场可望成长。特别是,创新的硅碳复合阳极比传统石墨阳极具有更高的能量密度,对于扩大电动车的续航里程至关重要。Panasonic和 LG Energy Solution 等领先公司以及 Sila Nanotechnologies 等新兴企业正在投入资源进行研发,以提高负极的效能和稳定性。

- 此外,Nouveau Monde Graphite 在为加拿大魁北克快速成长的锂离子电池和燃料电池市场开发碳中性电池阳极材料方面发挥先锋作用。

- 鑑于电动车普及率和技术进步的轨迹,美国将在预测期内引领市场。

北美电动车电池负极产业概况

北美电动车电池负极市场处于减半状态。市场主要企业包括(排名不分先后)BTR新材料集团、三菱化学集团公司、Anovion LLC、Nouveau Monde Graphite Inc和NEI Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 政府对电池製造的措施和投资

- 电池原物料成本下降

- 抑制因素

- 国内电池零件製造的限制

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子

- 铅酸

- 其他的

- 材料

- 锂

- 石墨

- 硅

- 其他的

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

贝特瑞新材料集团

- Anovion LLC

- Mitsubishi Chemical Group Corporation

- Nouveau Monde Graphite Inc

- NEI Corporation

- Targray Industries Inc.

- Nexeon Lid.

- LG Chem Ltd

- Tokai Carbon Co., Ltd.

- Nippon Carbon Co., Ltd.

- 市场排名分析

- 其他主要企业名单

第七章 市场机会及未来趋势

- 增加其他电池化学物质的研究和开发

The North America Electric Vehicle Battery Anode Market size is estimated at USD 0.28 billion in 2025, and is expected to reach USD 0.74 billion by 2030, at a CAGR of 21.38% during the forecast period (2025-2030).

Key Highlights

- In the forecast period, the market is poised for growth, driven by the rising adoption of electric vehicles, supportive government initiatives, and declining prices of lithium-ion batteries.

- Conversely, the market may face challenges due to the limited domestic manufacturing of battery components.

- However, ongoing research and advancements in anode materials and efficient electrolytes present promising opportunities for market expansion.

- With increasing demand from the automotive sector, the United States is set to lead the market, bolstered by its growing application of anode materials.

North America Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery Type is Expected to Have a Major Share

- Historically, lithium-ion batteries powered consumer electronics, from mobile phones to personal computers. However, their role has expanded, becoming the preferred power source for hybrid and fully electric vehicles (EVs) in North America. This shift is primarily attributed to the environmental benefits of EVs, which produce no CO2, nitrogen oxides, or other greenhouse gases.

- In North America, lithium-ion batteries are outpacing other battery types in popularity due to their favorable capacity-to-weight ratio. Their adoption is further fueled by superior performance, extended shelf life, and declining costs. With high energy density and long cycle life, lithium-ion batteries have become the go-to choice for EV manufacturers. As countries in North America ramp up EV production, there's a growing demand for advanced manufacturing equipment tailored to lithium-ion technology, thereby driving the demand for battery anode material.

- A significant driver of lithium-ion batteries' market dominance in North America is their decreasing prices. Over the last decade, technological advancements, economies of scale, and refined manufacturing processes have led to a significant drop in lithium-ion battery costs.

- In 2023, the price of lithium-ion battery packs decreased by 14% compared to the previous year to USD139/kWh. As battery prices drop, EVs become more affordable, leading to increased adoption and a larger market share for electric vehicles. This surge in demand will drive higher consumption of battery components, including the anode, and encourage technological advancements to improve battery performance.

- In the future, due to the region's heightened emphasis on boosting the production of lithium-ion battery manufacturing components, such as anode and cathode materials, the market for lithium-ion battery anodes is projected to grow during the forecast period.

- For instance, in April 2024, Sicona Battery Technologies, based in Australia, is set to establish its inaugural production facility for silicon-carbon anode materials in the Southeastern United States. Silicon-carbon anodes are increasingly being used in the manufacturing of electric vehicle (EV) batteries. Traditional lithium-ion batteries typically use graphite anodes, but silicon-carbon anodes offer several advantages, particularly in terms of energy density. By 2030, the company plans to expand its U.S. production to a total output of 26,500 tons annually.

- Thus, owing to the increasing use of lithium-ion batteries in electric vehicles and decreasing prices, the lithium-ion battery anode segment is expected to grow significantly in the forecast period.

United States of America is Expected to Dominate the Market

- In recent years, the United States EV battery anode market has rapidly expanded, fueled by the rising adoption of electric vehicles and the demand for cutting-edge battery technologies.

- As electric vehicle sales surge in the United States, battery manufacturers are increasingly investing in domestic production, thereby driving up demand for EV battery anodes. The International Energy Agency reported that U.S. EV car sales reached 1.39 million units in 2023, a notable rise from 0.99 million in 2022.

- With strong government support, battery manufacturers are setting up new plants for electric vehicles (EVs) in the United States. This expansion is set to significantly elevate the demand for materials, especially battery anodes, used in EV production. For example, in January 2024, the U.S. Department of Energy allocated USD 131 million to projects aimed at advancing research and development in EV batteries and charging systems.

- Looking ahead, as EV adoption continues to rise, the battery anode market is poised for growth, bolstered by the nation's R&D efforts in battery technology. Notably, the innovative silicon-carbon composite anodes, which promise higher energy density than traditional graphite anodes, are pivotal for extending the EV range. Major players like Panasonic and LG Energy Solution, alongside newcomers like Sila Nanotechnologies, are pouring resources into R&D to boost anode performance and stability.

- Moreover, Nouveau Monde Graphite is pioneering the development of a carbon-neutral battery anode material in Quebec, Canada, targeting the burgeoning lithium-ion and fuel cell markets.

- Given the trajectory of EV adoption and technological advancements, the U.S. is poised to lead the market during the forecast period.

North America Electric Vehicle Battery Anode Industry Overview

The North America electric vehicle battery anode market is semi-fragmented. Some of the major players in the market (in no particular order) include BTR New Material Group Co., Ltd., Mitsubishi Chemical Group Corporation, Anovion LLC, Nouveau Monde Graphite Inc, and NEI Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Limited Domestic Manufacturing of Battery Components

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Lithium

- 5.2.2 Graphite

- 5.2.3 Silicon

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1

BTR New Material Group Co., Ltd

- 6.3.2 Anovion LLC

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Nouveau Monde Graphite Inc

- 6.3.5 NEI Corporation

- 6.3.6 Targray Industries Inc.

- 6.3.7 Nexeon Lid.

- 6.3.8 LG Chem Ltd

- 6.3.9 Tokai Carbon Co., Ltd.

- 6.3.10 Nippon Carbon Co., Ltd.

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Chemistries