|

市场调查报告书

商品编码

1801768

全球光达模拟市场按自主程度、方法、雷射波长、光达类型、车辆类型、应用和地区划分 - 预测至 2032 年LiDAR Simulation Market by LiDAR Type, Method, Laser Wavelength, Vehicle Type, Level of Autonomy, Application, and Region - Global Forecast to 2032 |

||||||

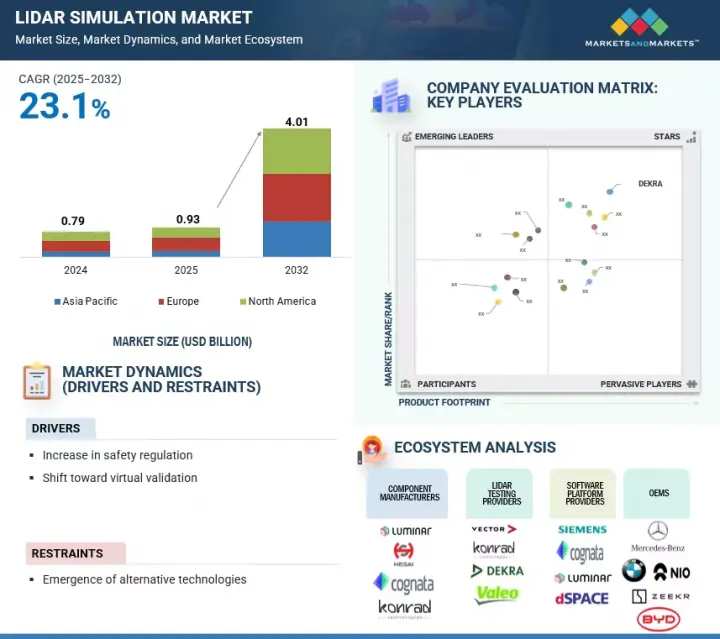

全球光达模拟市场预计将从 2025 年的 9.3 亿美元成长到 2032 年的 40.1 亿美元,预测期内复合年增长率为 23.1%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 对价单位 | 金额(百万美元) |

| 部分 | 按自主等级、按方法、按雷射波长、按雷射雷达类型、按车辆类型、按应用、按地区 |

| 目标区域 | 亚太地区、欧洲、北美 |

随着 LiDAR 感测器越来越多地整合到 ADAS(高级驾驶辅助系统)和自动驾驶汽车中,从而提升了安全性和感知能力,LiDAR 模拟市场正在经历快速成长。全球严格的安全法规推动了这一成长。例如,欧盟的《通用安全法规 2》(GSR2)强制要求 LiDAR 支援的自动紧急煞车 (AEB) 等功能,这促使原始设备製造商 (OEM) 开始大规模模拟和检验LiDAR 系统。

此外,光达技术的进步使得先进的模拟模型得以广泛应用。电动车的兴起进一步推动了对逼真且扩充性的光达模拟的需求,以支援复杂的感测器融合和机会导航。凭藉固态雷射雷达的高产能和极具竞争力的价格,亚太地区(尤其是中国)正在为新参与企业创造市场机会。

按自动驾驶等级划分,预计 2/2.5 级自动驾驶技术将在整个预测期内占据最大份额,这得益于全球范围内车辆越来越多地采用该技术。在监管机构的批准支持下,2 级乘用车的部分自动驾驶技术在美国、欧洲、中国、印度、日本和其他亚洲市场等地区正日益受到认可。这些车辆配备了主动式车距维持定速系统辅助等功能,正在成为许多车型的标配。预计到 2025 年,全球整体渗透率将达到 2,800 万至 3,000 万辆,因此,广泛的测试对于确保安全性和合规性至关重要。欧洲新车安全评鑑协会 (Euro NCAP) 2025 等标准尤其强调大众市场车辆的感测器可靠性。 2/2.5 级系统的成熟度和低复杂性使其开发风险低于更复杂且探索较少的 3 级和 4 级系统,因此需要在测试基础设施方面投入大量资金。 2.5 级系统的广泛应用巩固了其市场地位,但相对有限的自动驾驶水平限制了突破性创新的机会。

本报告研究了全球光达模拟市场,并提供了按自主级别、方法、雷射波长、光达类型、车辆类型、应用和地区分類的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 人工智慧/生成式人工智慧的影响

- 影响客户业务的趋势/中断

- 供应链分析

- 生态系分析

- 投资金筹措场景

- 专利分析

- 案例研究分析

- 技术分析

- 监管状况

- 2025-2026年主要会议和活动

- 主要相关人员和采购标准

- LiDAR测试对软体定义汽车的影响

- 汽车光达与V2X技术集成

- LiDAR OTA(无线)测试的最低可行性要求

- 绩效矩阵与关键绩效指标洞察

6. LiDAR 模拟市场(依自主等级)

- 介绍

- 2/2.5级

- 3级

- 4/5级

- 业界专家的见解

第七章 LiDAR 模拟市场(依方法)

- 介绍

- 测试方法

- 模拟方法

- 业界专家的见解

第 8 章 LiDAR 模拟市场(按雷射波长)

- 介绍

- 短波红外频谱

- 长波红外频谱

- 业界专家的见解

第九章 光达模拟市场(按光达类型)

- 介绍

- 机械骑士

- 固态雷射雷达

- 业界专家的见解

第 10 章 LiDAR 模拟市场(依车辆类型)

- 介绍

- 搭乘用车

- 商用车

- 业界专家的见解

第 11 章 LiDAR 模拟市场(按应用)

- 介绍

- 智慧停车辅助

- 夜视

- 交通壅塞辅助

- 路径规划和本地化

- 其他的

- 业界专家的见解

第十二章 LiDAR 模拟市场(按地区)

- 介绍

- 亚太地区

- 宏观经济展望

- 中国

- 印度

- 日本

- 韩国

- 欧洲

- 宏观经济展望

- 德国

- 法国

- 义大利

- 英国

- 西班牙

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

第十三章竞争格局

- 概述

- 主要参与企业的策略/优势

- 市场占有率分析

- 收益分析

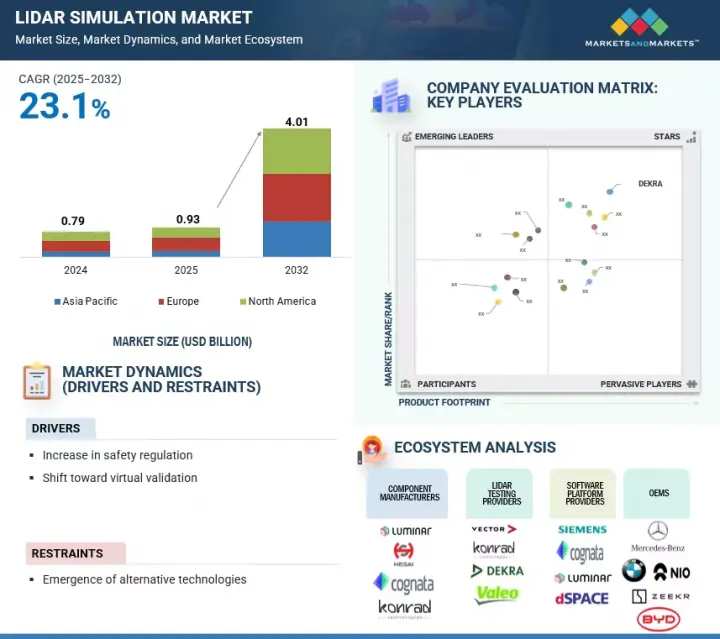

- 公司估值矩阵:2024 年关键参与企业

- 企业评估

- 财务指标

- 品牌比较

- 竞争场景

第十四章建议

- 预测期内,亚太地区将成为成长最快的市场

- 预计固态光达领域将在预测期内实现显着成长

- 预测期内模拟领域将占据主要份额

- 结论

第十五章 公司简介

- 主要参与企业

- AVL

- DEKRA

- VALEO

- ROBOSENSE

- LUMINAR TECHNOLOGIES, INC.

- VECTOR INFORMATIK GMBH

- APPLIED INTUITION, INC.

- COGNATA

- DSPACE

- IPG AUTOMOTIVE GMBH

- HESAI TECHNOLOGY

- 其他公司

- XENOMATIX

- CEPTON, INC.

- INNOVIZ TECHNOLOGIES LTD.

- QUANERGY SOLUTIONS, INC.

- IBEO AUTOMOTIVE SYSTEM GMBH

- DORLECO

- ANYVERSE SL

- SIEMENS

- ANYSIS INC.

- SICK AG

第十六章 附录

The global LiDAR simulation market is projected to reach USD 4.01 billion by 2032, growing from USD 0.93 billion in 2025 at a CAGR of 23.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) |

| Segments | LiDAR Type, Vehicle Type, Level of Autonomy, Method, Laser Wavelength, Application, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

The LiDAR simulation market is rapidly growing, driven by the increasing integration of LiDAR sensors in advanced driver-assistance systems (ADASs) and autonomous vehicles to enhance safety and perception capabilities. This growth is propelled by stringent global safety regulations. An example is the EU's General Safety Regulation 2 (GSR2), which mandates features like LiDAR-enabled automatic emergency braking (AEB), pushing OEMs toward extensive simulation and validation of LiDAR systems.

Additionally, technological advancements in LiDAR have enabled a wider adoption of sophisticated simulation models. Also, the rise in electric vehicles further boosts the demand for realistic and scalable LiDAR simulations to support complex sensor fusion and autonomous navigation. With its higher production capacity and competitive pricing for solid-state LiDARs, Asia Pacific, specifically China, is expanding market accessibility for new players and creating opportunities.

"The level 2/2.5 segment is projected to account for the largest share during the forecast period."

By level of autonomy, the level 2/2.5 segment is projected to account for the largest share of the market during the forecast period due to the increase in the installation of this technology in vehicles worldwide. Partial automation in passenger vehicles at level 2 is increasingly embraced, supported by legal approvals across regions, including the US, Europe, China, India, Japan, and other Asian markets. Equipped with features such as adaptive cruise control and lane-keeping assist integrated with LiDAR technology, these vehicles are becoming standard on many models. With an anticipated global fleet of 28 to 30 million units by 2025, extensive testing is critical to ensure safety and regulatory compliance, particularly with standards like Euro NCAP 2025 emphasizing sensor reliability for mass-market vehicles. The established maturity and low complexity of level 2/2.5 systems, compared to the more complex and less explored levels 3 and 4, have lowered development risks and attracted substantial investment in testing infrastructure. While the widespread adoption of level 2.5 strengthens its market position, its relatively limited autonomy level constrains opportunities for groundbreaking innovation.

- FIGURE 1 DIFFERENT LEVELS OF AUTONOMY OFFERED BY SAE

Source: Secondary Research, SAE, and MarketsandMarkets Analysis

"The commercial vehicles segment is projected to be the fastest-growing market during the forecast period."

The demand for LiDAR simulation in commercial vehicles (CVs) is growing faster due to the increasing adoption of autonomous technologies in logistics and freight transport. LiDAR enhances safety and efficiency by enabling precise object detection and mapping over long distances. The commercial vehicles sector is witnessing rapid advancements in autonomous driving, focusing on LiDAR-enabled level 3 and level 4 technologies. For example, Daimler Trucks (Germany) has planned to launch SAE Level 4 autonomous trucks by 2027, on its fifth-generation Freightliner (US) Cascadia model in partnership with Torc Robotics (US). The truck will have redundant safety systems and integrated computing and sensor kits.

Additionally, the rise in e-commerce and last-mile delivery demands robust LiDAR systems, accelerating investment in testing infrastructure. The push for automation is significant, but high costs (e.g., LiDAR units still above USD 400) and supply chain disruptions could slow deployment in cost-sensitive commercial vehicle markets like India or Africa. The e-commerce boom supports growth, but economic shifts or alternative technologies (e.g., radar fusion) could challenge LiDAR's dominance, suggesting a niche-driven surge rather than a universal trend.

"Asia Pacific is projected to be the fastest-growing market during the forecast period."

Asia Pacific is projected to be the fastest-growing market, owing to the rising prominence of premium vehicles in the region. China is the most significant player in the LiDAR simulation market. Leading players in China include BYD, Zeekr, XPeng, and NIO. These players offer electric vehicle LiDAR combined with camera and radar to increase China's autonomy level. For example, BYD aims to pivot from its current "God's Eye" level 2+ system to level 3 capability via over-the-air updates.

Additionally, hybrid solid-state LiDAR technology in China is being increasingly adopted in vehicles like the Zeekr Qianli Haohan H9. The vehicle features a multi-LiDAR setup (5 units). These hybrid solid-state LiDARs are popular due to their low cost and high performance. South Korea, too, has been rapidly adopting level 3 autonomy supported by government regulations, allowing models like the Genesis G90 to be used since 2022 and aiming for level 4 commercialization by 2027. OEMs like Hyundai and Kia lead this deployment, supported by pilot zones and policies targeting 50% autonomous vehicles by 2035. Japan, an early adopter of models like the Honda Legend Hybrid since 2021, also has a market presence for level 3 autonomy.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMS: 20%, LiDAR Simulation Companies: 80%

- By Designation: Directors: 20%, C-Level Executives: 50%, Others: 30%

- By Region: Asia Pacific: 50%, North America: 20%, and Europe: 30%

The LiDAR simulation market is dominated by major players, including Dekra (Germany), AVL (Austria), Valeo (France), RoboSense (China), Luminar Technologies (US), Vector Informak GmbH (Germany), Applied Intuition (US), Cognata (Israel), dSpace GmbH (Germany), and IPG Automotive GmbH (Germany). These companies are expanding their portfolios to strengthen their LiDAR simulation market position.

Research Coverage:

The report covers the LiDAR simulation market by LiDAR Type (Mechanical LiDAR and Solid-state LiDAR), Vehicle Type (Passenger Cars and Commercial Vehicles), Level of Autonomy (Level 2/2.5, Level 3, and Level 4/5), Method (Testing Method and Simulation Method), Laser Wavelength (Short Infrared Spectrum and Long Wave Infrared Spectrum), Application (Intelligent Park Assist, Night Vision, Traffic Jam Assist, Road Mapping & Localization, and Others), and Region (North America, Asia Pacific, and Europe). The report also covers the competitive landscape and company profiles of significant LiDAR simulation market players. The study further includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the LiDAR simulation market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights, enabling them to position their businesses better and plan suitable go-to-market strategies.

- The report will help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

- The report will help stakeholders understand the current and future pricing trends of the LiDAR simulation market.

The report provides insight into the following pointers:

- Analysis of key drivers (Increase in safety regulation and shift toward virtual validation), key restraint (Emergence of alternative technologies), key opportunity (Cost reduction and scalability of testing infrastructure and development of advanced simulation and validation tool), and key challenge (Upfront cost of LiDAR)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the LiDAR simulation market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the LiDAR simulation market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players, namely Dekra (Germany), AVL (Austria), Valeo (France), RoboSense (China), Luminar Technologies (US), Vector Informak GmbH (Germany), Applied Intuition (US), Cognata (Israel), dSpace GmbH (Germany), and IPG Automotive GmbH (Germany), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LIDAR SIMULATION MARKET

- 4.2 LIDAR SIMULATION MARKET, BY LIDAR TYPE

- 4.3 LIDAR SIMULATION MARKET, BY VEHICLE TYPE

- 4.4 LIDAR SIMULATION MARKET, BY LEVEL OF AUTONOMY

- 4.5 LIDAR SIMULATION MARKET, BY METHOD

- 4.6 LIDAR SIMULATION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent safety regulations

- 5.2.1.2 Shift toward virtual validation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Emergence of alternative techniques

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Cost reduction and scalability of testing infrastructure

- 5.2.3.2 Development of advanced simulation and validation tools

- 5.2.4 CHALLENGES

- 5.2.4.1 Upfront cost of LiDAR

- 5.2.1 DRIVERS

- 5.3 IMPACT OF AI/GEN AI

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT & FUNDING SCENARIO

- 5.7.1 FUNDING SCENARIO, 2021-2025

- 5.8 PATENT ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ADVANCED DATA ANNOTATION TO CREATE ROBUST ENVIRONMENT FOR VIRTUAL VALIDATION

- 5.9.2 APPLIED INTUITION'S SENSOR SIM PLATFORM INTEGRATION INTO VOLVO CARS

- 5.9.3 INTEGRATING HIGH-PERFORMANCE LIDAR SENSORS WITH ADVANCED SIMULATION AND AUTOMATED TESTING PLATFORMS

- 5.9.4 IMPLEMENTING MATERIAL-AWARE LIDAR SIMULATION FRAMEWORK THAT DISTINGUISHES BETWEEN MULTIPLE MATERIAL CLASSES AND SUBCLASSES

- 5.9.5 HESAI ENABLED AUTOMOTIVE OEMS TO VIRTUALLY TEST LIDAR SENSORS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Sensor fusion algorithms

- 5.10.1.2 Solid-state LiDAR

- 5.10.1.3 Frequency-modulated continuous wave (FMCW) LiDAR

- 5.10.1.4 4D LiDAR

- 5.10.2 COMPLIMENTARY TECHNOLOGIES

- 5.10.2.1 Automated testing & manufacturing software

- 5.10.2.2 Hardware-in-the-Loop (HIL) test benches

- 5.10.2.3 Hybrid radar

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Radar and camera systems

- 5.10.3.2 3D simulation platforms

- 5.10.3.3 Silicon CMOS Readout Integrated Circuits (ROICs)

- 5.10.1 KEY TECHNOLOGIES

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES AND THEIR TESTING PARAMETERS FOR NEW CAR MODELS

- 5.11.2 REGULATIONS AND LEGISLATION FOR AUTONOMOUS VEHICLES

- 5.11.3 REGULATIONS ON USAGE OF AUTONOMOUS VEHICLES, BY KEY COUNTRY

- 5.11.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 IMPACT OF LIDAR TESTING ON SOFTWARE-DEFINED VEHICLES

- 5.15 INTEGRATION OF AUTOMOTIVE LIDAR WITH V2X TECHNOLOGIES

- 5.16 MINIMUM VIABILITY REQUIREMENTS OF LIDAR OTA (OVER-THE-AIR) TESTING

- 5.17 INSIGHTS INTO PERFORMANCE MATRIX AND KPI

6 LIDAR SIMULATION MARKET, BY LEVEL OF AUTONOMY

- 6.1 INTRODUCTION

- 6.2 LEVEL 2/2.5

- 6.2.1 INCREASE IN DEMAND FOR ACTIVE SAFETY SYSTEMS TO DRIVE GROWTH

- 6.3 LEVEL 3

- 6.3.1 RISING DEMAND FOR HIGH DEGREE OF AUTOMATION TO DRIVE MARKET

- 6.4 LEVEL 4/5

- 6.4.1 LEVEL 4/5 AUTONOMY GRANTS FULL AUTOMATION TO VEHICLES

- 6.5 INSIGHTS FROM INDUSTRY EXPERTS

7 LIDAR SIMULATION MARKET, BY METHOD

- 7.1 INTRODUCTION

- 7.2 TESTING METHOD

- 7.2.1 DEMAND FOR OPTICAL BENCH TESTING TO DRIVE MARKET

- 7.2.2 ENVIRONMENTAL CHAMBER TESTING

- 7.2.3 EMC/EMI TESTING

- 7.2.4 SAFETY TESTING (LASER CLASSIFICATION)

- 7.2.5 LIDAR OTA TESTING

- 7.3 SIMULATION METHOD

- 7.3.1 SIMULATION METHOD IS PIVOTAL IN VALIDATING AND OPTIMIZING SENSOR PERFORMANCE ACROSS COMPLEX DRIVING SCENARIOS

- 7.3.2 LIDAR SENSOR MODELING

- 7.3.3 VIRTUAL ENVIRONMENT CREATION

- 7.3.4 WEATHER AND LIGHTNING SIMULATION

- 7.3.5 HARDWARE-IN-THE-LOOP (HIL) AND SOFTWARE-IN-THE-LOOP (SIL) TESTING

- 7.4 INSIGHTS FROM INDUSTRY EXPERTS

8 LIDAR SIMULATION MARKET, BY LASER WAVELENGTH

- 8.1 INTRODUCTION

- 8.2 SHORT WAVE INFRARED SPECTRUM

- 8.2.1 ABILITY OF SHORT WAVE INFRARED LIDAR TO ENHANCE DETECTION IN CHALLENGING WEATHER CONDITIONS TO BOOST ITS POPULARITY

- 8.3 LONG WAVE INFRARED SPECTRUM

- 8.3.1 ABILITY OF LONG WAVE INFRARED LIDAR TO PRODUCE HIGH-QUALITY IMAGES TO BOOST DEMAND

- 8.4 INSIGHTS FROM INDUSTRY EXPERTS

9 LIDAR SIMULATION MARKET, BY LIDAR TYPE

- 9.1 INTRODUCTION

- 9.2 MECHANICAL LIDAR

- 9.2.1 FOCUS ON INCREASING VEHICLE SAFETY TO DRIVE MARKET

- 9.3 SOLID-STATE LIDAR

- 9.3.1 COST BENEFITS OF SOLID-STATE LIDAR TO DRIVE MARKET

- 9.4 INSIGHTS FROM INDUSTRY EXPERTS

10 LIDAR SIMULATION MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CARS

- 10.2.1 DEMAND FOR PERSONAL CARS AND ELECTRIC PASSENGER CARS EQUIPPED WITH ADVANCED SAFETY FEATURES TO DRIVE MARKET

- 10.3 COMMERCIAL VEHICLES

- 10.3.1 INCREASE IN AUTONOMOUS FLEET AND DEMAND FOR SAFETY FEATURES TO FUEL MARKET GROWTH

- 10.4 INSIGHTS FROM INDUSTRY EXPERTS

11 LIDAR SIMULATION MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 INTELLIGENT PARKING ASSIST

- 11.3 NIGHT VISION

- 11.4 TRAFFIC JAM ASSIST

- 11.5 ROAD MAPPING AND LOCALIZATION

- 11.6 OTHERS

- 11.7 INSIGHTS FROM INDUSTRY EXPERTS

12 LIDAR SIMULATION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 Rapid, large-scale deployment of level 3 and 4 autonomous vehicles to drive market

- 12.2.3 INDIA

- 12.2.3.1 Focus on enforcing vehicle safety standards to boost demand

- 12.2.4 JAPAN

- 12.2.4.1 Emphasis on automation under strict safety certification criteria to boost growth

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Steady growth toward high levels of vehicle autonomy to boost market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 GERMANY

- 12.3.2.1 Country's commitment toward integrating LiDAR into its premium and electric vehicle segments to drive demand

- 12.3.3 FRANCE

- 12.3.3.1 Country's focus on levels 3 and 4 automation to spur growth

- 12.3.4 ITALY

- 12.3.4.1 Emphasis on testing and deploying levels 3 and 4 autonomous vehicles to boost market

- 12.3.5 UK

- 12.3.5.1 Rapid upward trend in vehicle autonomy to boost growth

- 12.3.6 SPAIN

- 12.3.6.1 Introduction of legal frameworks to enable high levels of autonomy to drive market

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Focus on maintaining competitiveness in autonomous driving technologies to boost growth

- 12.4.3 CANADA

- 12.4.3.1 Steady rise in vehicle autonomy to drive demand for LiDAR simulation

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6 COMPANY VALUATION

- 13.7 FINANCIAL METRICS

- 13.8 BRAND COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 RECOMMENDATIONS

- 14.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- 14.2 SOLID-STATE LIDAR SEGMENT TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- 14.3 SIMULATION SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE DURING FORECAST PERIOD

- 14.4 CONCLUSION

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 AVL

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches & developments

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Expansions

- 15.1.1.3.4 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 DEKRA

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Expansions

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 VALEO

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 ROBOSENSE

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 MnM view

- 15.1.4.3.1 Key strengths

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses and competitive threats

- 15.1.5 LUMINAR TECHNOLOGIES, INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches & developments

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 VECTOR INFORMATIK GMBH

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.6.3 Recent developments

- 15.1.7 APPLIED INTUITION, INC.

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches & developments

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Other developments

- 15.1.8 COGNATA

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.3.2 Other developments

- 15.1.9 DSPACE

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches & developments

- 15.1.9.3.2 Deals

- 15.1.9.3.3 Other developments

- 15.1.10 IPG AUTOMOTIVE GMBH

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches & developments

- 15.1.10.3.2 Deals

- 15.1.10.3.3 Expansions

- 15.1.11 HESAI TECHNOLOGY

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches & developments

- 15.1.1 AVL

- 15.2 OTHER KEY PLAYERS

- 15.2.1 XENOMATIX

- 15.2.2 CEPTON, INC.

- 15.2.3 INNOVIZ TECHNOLOGIES LTD.

- 15.2.4 QUANERGY SOLUTIONS, INC.

- 15.2.5 IBEO AUTOMOTIVE SYSTEM GMBH

- 15.2.6 DORLECO

- 15.2.7 ANYVERSE SL

- 15.2.8 SIEMENS

- 15.2.9 ANYSIS INC.

- 15.2.10 SICK AG

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.4.1 LIDAR SIMULATION MARKET, BY LEVEL OF AUTONOMY & LIDAR TYPE

- 16.4.2 LIDAR SIMULATION MARKET, BY VEHICLE TYPE (ICE AND ELECTRIC), AT REGIONAL LEVEL

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 CURRENCY EXCHANGE RATES, 2020-2024

- TABLE 3 KEY SAFETY REGULATIONS SHAPING AUTOMOTIVE INDUSTRY

- TABLE 4 ADVANCEMENTS IN AUTOMOTIVE LIDAR SIMULATION TOOLS

- TABLE 5 FUNDING DATA, 2021-2025

- TABLE 6 KEY PATENTS, 2023-2025

- TABLE 7 COMPARISON BETWEEN FMCW AND TOF LIDARS

- TABLE 8 TESTING PARAMETERS FOR NEW CAR MODELS, BY REGULATORY BODY

- TABLE 9 REGULATIONS AND LEGISLATION FOR AUTONOMOUS VEHICLES

- TABLE 10 REGULATIONS ON USAGE OF AUTONOMOUS VEHICLES, BY KEY COUNTRY

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY METHOD (%)

- TABLE 16 KEY BUYING CRITERIA FOR LIDAR, BY METHOD

- TABLE 17 LIDAR SIMULATION MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 18 LIDAR SIMULATION MARKET, BY LEVEL OF AUTONOMY, 2025-2032 (USD MILLION)

- TABLE 19 LEVEL 2/2.5: LIDAR SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 20 LEVEL 2/2.5: LIDAR SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 21 LEVEL 3: LIDAR SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 22 LEVEL 3: LIDAR SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 23 LEVEL 4/5: LIDAR SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 24 LEVEL 4/5: LIDAR SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 25 LIDAR SIMULATION MARKET, BY METHOD, 2021-2024 (USD MILLION)

- TABLE 26 LIDAR SIMULATION MARKET, BY METHOD, 2025-2032 (USD MILLION)

- TABLE 27 AUTOMOTIVE LIDAR MARKET: TESTING METHODS

- TABLE 28 TESTING METHOD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 TESTING METHOD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 30 AUTOMOTIVE LIDAR MARKET: SIMULATION METHODS

- TABLE 31 PROVIDERS OF SIMULATION PLATFORMS

- TABLE 32 SIMULATION METHOD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 SIMULATION METHOD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 34 COMPARISON BETWEEN 905 NM AND 1550 NM LIDAR

- TABLE 35 KEY PLAYERS OFFERING SHORT WAVE INFRARED SPECTRUM AND LONG WAVE INFRARED SPECTRUM LIDAR SYSTEMS

- TABLE 36 LIDAR SIMULATION MARKET, BY LASER WAVELENGTH, 2021-2024 (USD MILLION)

- TABLE 37 LIDAR SIMULATION MARKET, BY LASER WAVELENGTH, 2025-2032 (USD MILLION)

- TABLE 38 SHORT WAVE INFRARED SPECTRUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 SHORT WAVE INFRARED SPECTRUM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 40 LONG WAVE INFRARED SPECTRUM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 LONG WAVE INFRARED SPECTRUM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 42 MECHANICAL AND SOLID-STATE LIDAR OFFERINGS BY KEY PLAYERS

- TABLE 43 LIDAR SIMULATION MARKET, BY LIDAR TYPE, 2021-2024 (USD MILLION)

- TABLE 44 LIDAR SIMULATION MARKET, BY LIDAR TYPE, 2025-2032 (USD MILLION)

- TABLE 45 MECHANICAL LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 MECHANICAL LIDAR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 SOLID-STATE LIDAR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 SOLID-STATE LIDAR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 49 LIDAR SIMULATION MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 50 LIDAR SIMULATION MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 51 PASSENGER CARS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 PASSENGER CARS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 COMMERCIAL VEHICLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 COMMERCIAL VEHICLES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 COMPARISON BETWEEN LIDAR TESTING AND SIMULATION APPLICATIONS

- TABLE 56 LIDAR SIMULATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 LIDAR SIMULATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 58 ASIA PACIFIC: LIDAR TESTING AND SIMULATION PLAYERS, FACILITIES, AND TECHNOLOGIES

- TABLE 59 EUROPE: LIDAR TESTING AND SIMULATION PLAYERS, FACILITIES, AND TECHNOLOGIES

- TABLE 60 NORTH AMERICA: LIDAR TESTING AND SIMULATION PLAYERS, FACILITIES, AND TECHNOLOGIES

- TABLE 61 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN LIDAR SIMULATION MARKET

- TABLE 62 DEGREE OF COMPETITION, 2024

- TABLE 63 LIDAR SIMULATION MARKET: REGION FOOTPRINT

- TABLE 64 LIDAR SIMULATION MARKET: LIDAR TYPE FOOTPRINT

- TABLE 65 LIDAR SIMULATION MARKET: METHOD FOOTPRINT

- TABLE 66 LIDAR SIMULATION MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2024-JULY 2025

- TABLE 67 LIDAR SIMULATION MARKET: DEALS, JANUARY 2024-JULY 2025

- TABLE 68 LIDAR SIMULATION MARKET: EXPANSIONS, JANUARY 2024-JULY 2025

- TABLE 69 LIDAR SIMULATION MARKET: OTHER DEVELOPMENTS, JANUARY 2024-JULY 2025

- TABLE 70 ADVANCEMENTS IN SIMULATION PLATFORMS, BY KEY PLAYER, 2022-2024

- TABLE 71 AVL: COMPANY OVERVIEW

- TABLE 72 AVL: PRODUCTS OFFERED

- TABLE 73 AVL: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 74 AVL: DEALS

- TABLE 75 AVL: EXPANSIONS

- TABLE 76 AVL: OTHER DEVELOPMENTS

- TABLE 77 DEKRA: COMPANY OVERVIEW

- TABLE 78 DEKRA: PRODUCTS OFFERED

- TABLE 79 DEKRA: EXPANSIONS

- TABLE 80 DEKRA: OTHER DEVELOPMENTS

- TABLE 81 VALEO: COMPANY OVERVIEW

- TABLE 82 VALEO: PRODUCTS OFFERED

- TABLE 83 VALEO: DEALS

- TABLE 84 VALEO: OTHER DEVELOPMENTS

- TABLE 85 ROBOSENSE: COMPANY OVERVIEW

- TABLE 86 ROBOSENSE: PRODUCTS OFFERED

- TABLE 87 ROBOSENSE: DEALS

- TABLE 88 LUMINAR TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 89 LUMINAR TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 90 LUMINAR TECHNOLOGIES, INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 91 LUMINAR TECHNOLOGIES, INC.: DEALS

- TABLE 92 LUMINAR TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- TABLE 93 VECTOR INFORMATIK GMBH: COMPANY OVERVIEW

- TABLE 94 VECTOR INFORMATIK GMBH: PRODUCTS OFFERED

- TABLE 95 VECTOR INFORMATIK GMBH: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 96 VECTOR INFORMATIK GMBH: DEALS

- TABLE 97 VECTOR INFORMATIK GMBH: OTHER DEVELOPMENTS

- TABLE 98 APPLIED INTUITION, INC.: COMPANY OVERVIEW

- TABLE 99 APPLIED INTUITION, INC.: PRODUCTS OFFERED

- TABLE 100 APPLIED INTUITION, INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 101 APPLIED INTUITION, INC.: DEALS

- TABLE 102 APPLIED INTUITION, INC.: OTHER DEVELOPMENTS

- TABLE 103 COGNATA: COMPANY OVERVIEW

- TABLE 104 COGNATA: PRODUCTS OFFERED

- TABLE 105 COGNATA: DEALS

- TABLE 106 COGNATA: OTHER DEVELOPMENTS

- TABLE 107 DSPACE: COMPANY OVERVIEW

- TABLE 108 DSPACE: PRODUCTS OFFERED

- TABLE 109 DSPACE: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 110 DSPACE: DEALS

- TABLE 111 DSPACE: OTHER DEVELOPMENTS

- TABLE 112 IPG AUTOMOTIVE GMBH: COMPANY OVERVIEW

- TABLE 113 IPG AUTOMOTIVE GMBH: PRODUCTS OFFERED

- TABLE 114 IPG AUTOMOTIVE GMBH: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 115 IPG AUTOMOTIVE GMBH: DEALS

- TABLE 116 IPG AUTOMOTIVE GMBH: EXPANSIONS

- TABLE 117 IPG AUTOMOTIVE GMBH: OTHER DEVELOPMENTS

- TABLE 118 HESAI TECHNOLOGY: COMPANY OVERVIEW

- TABLE 119 HESAI TECHNOLOGY: PRODUCTS OFFERED

- TABLE 120 HESAI TECHNOLOGY: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 121 XENOMATIX: COMPANY OVERVIEW

- TABLE 122 CEPTON, INC.: COMPANY OVERVIEW

- TABLE 123 INNOVIZ TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 124 QUANERGY SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 125 IBEO AUTOMOTIVE SYSTEM GMBH: COMPANY OVERVIEW

- TABLE 126 DORLECO: COMPANY OVERVIEW

- TABLE 127 ANYVERSE SL: COMPANY OVERVIEW

- TABLE 128 SIEMENS: COMPANY OVERVIEW

- TABLE 129 ANSYS INC.: COMPANY OVERVIEW

- TABLE 130 SICK AG: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 MARKET SIZE ESTIMATION: HYPOTHESIS BUILDING

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 LIDAR SIMULATION MARKET OVERVIEW

- FIGURE 7 EUROPE TO ACCOUNT FOR LARGEST SHARE BY 2032

- FIGURE 8 PASSENGER CARS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 RISING DEMAND FOR AUTONOMOUS VEHICLES (L2/2.5 AND L3) TO DRIVE MARKET GROWTH

- FIGURE 10 SOLID-STATE LIDAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 PASSENGER CARS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 LEVEL 2/2.5 SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 TESTING METHOD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 EUROPE TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 15 LIDAR SIMULATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 DIFFERENT LEVELS OF AUTONOMY OFFERED BY SAE

- FIGURE 17 COMPARISON BETWEEN CAMERA, RADAR, AND LIDAR

- FIGURE 18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 19 SUPPLY CHAIN ANALYSIS

- FIGURE 20 ECOSYSTEM ANALYSIS

- FIGURE 21 ECOSYSTEM MAP FOR LIDAR SIMULATION

- FIGURE 22 INVESTMENT SCENARIO, 2021-2025

- FIGURE 23 PATENTS APPLIED AND GRANTED, 2016-2025

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY METHOD

- FIGURE 25 KEY BUYING CRITERIA FOR LIDAR, BY METHOD

- FIGURE 26 LIDAR SIMULATION MARKET, BY LEVEL OF AUTONOMY, 2025 VS. 2032 (USD MILLION)

- FIGURE 27 LIDAR SIMULATION MARKET, BY METHOD, 2025 VS. 2032 (USD MILLION)

- FIGURE 28 COMPARISON BETWEEN LIDAR WAVELENGTHS

- FIGURE 29 LIDAR SIMULATION MARKET, BY LASER WAVELENGTH, 2025 VS. 2032 (USD MILLION)

- FIGURE 30 LIDAR SIMULATION MARKET, BY LIDAR TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 31 MECHANICAL LIDAR AND OTHER SENSORS IN FIFTH-GENERATION WAYMO DRIVER SYSTEM

- FIGURE 32 INNOVIZONE: SOLID-STATE LIDAR IN BMW I7

- FIGURE 33 LIDAR SIMULATION MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 34 LIDAR SIMULATION MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 35 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 36 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 37 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 38 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024 (USD TRILLION)

- FIGURE 39 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 40 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 41 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 42 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024 (USD TRILLION)

- FIGURE 43 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 44 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 45 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 46 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024 (USD TRILLION)

- FIGURE 47 MARKET SHARE ANALYSIS, 2024

- FIGURE 48 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 49 LIDAR SIMULATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 LIDAR SIMULATION MARKET: COMPANY FOOTPRINT

- FIGURE 51 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 52 FINANCIAL METRICS, 2025 (USD BILLION)

- FIGURE 53 BRAND COMPARISON

- FIGURE 54 VALEO: COMPANY SNAPSHOT

- FIGURE 55 ROBOSENSE: COMPANY SNAPSHOT

- FIGURE 56 LUMINAR TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 57 HESAI TECHNOLOGY: COMPANY SNAPSHOT