|

市场调查报告书

商品编码

1807080

全球製药契约製造市场(至 2030 年):按服务(药物开发、製药(原料药、FDF - 肠外给药、片剂、胶囊)、生技药品(原料药、FDF)、包装和标籤、填充完成)和分子(小型、大型(ADC、CGT))Pharmaceutical Contract Manufacturing Market by Service (Drug Development, Pharmaceutical (API, FDF - Parenteral, Tablet, Capsule), Biologics (API, FDF), Packaging & Labelling, Fill-finish), Molecule (Small, Large (ADC, CGT)) - Global Forecast to 2030 |

||||||

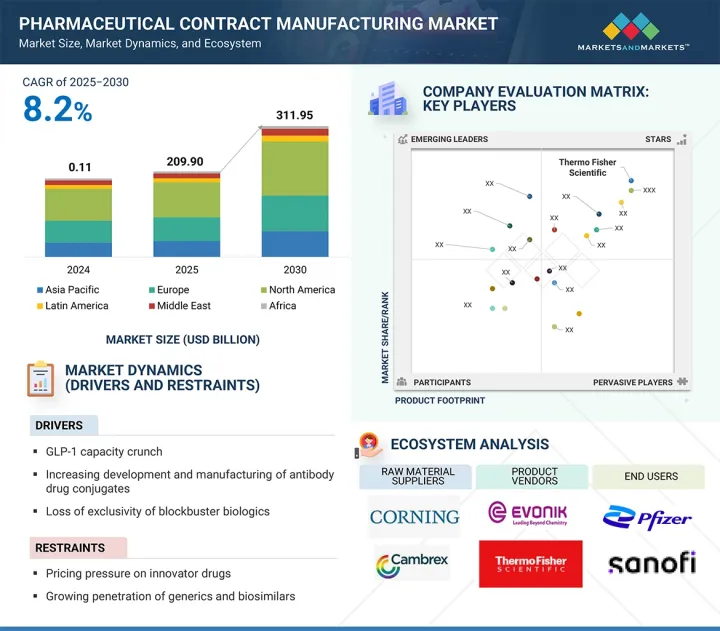

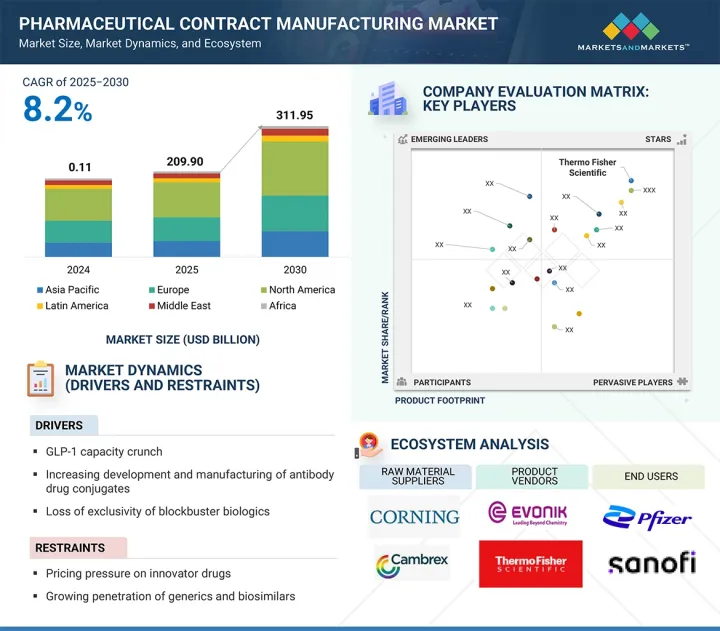

全球医药契约製造市场预计将从 2025 年的 2,099 亿美元成长到 2030 年的 3,119.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.2%。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 金额(美元) |

| 部分 | 服务、分子、最终用户、地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

医药契约製造市场的扩张主要受以下因素驱动:GLP-1製造和开发外包、ADC(抗体药物复合体)核准和项目,以及重磅生技药品独占权的丧失。然而,製药公司内部生产能力的扩张以及美国和欧洲的定价压力预计将抑制市场成长。

按服务划分,生技药品FDF 製造服务领域将在 2024 年实现最高复合年增长率

预计生技药品FDF製造服务将在2025年至2030年的预测期内呈现最快的成长速度。强劲的成长前景主要源自于对生技药品需求的激增,其中包括单株抗体、重组蛋白、细胞和基因疗法以及疫苗等复杂且高附加价值的产品。与传统疗法相比,标靶药物疗法疗效更高、副作用更小,因此人们日益关注该疗法,这进一步推动了对专业製造能力的需求。

此外,研发活动的增加,尤其是在细胞和基因治疗领域,也对市场扩张做出了重大贡献。在这些尖端治疗领域中,候选药物数量不断增加,这需要高度专业化的製造流程,促使製药公司与拥有必要专业知识、基础设施和合规能力的CDMO合作。预计这一趋势将推动对CDMO先进生技药品生产技术、产能扩张和品质系统的投资增加。因此,预计FDF製造服务产业将在未来几年实现显着成长,并在製药外包领域发挥越来越重要的作用。

按分子划分,小分子将在 2024 年占据市场主导地位

小分子领域,包括高效小分子、寡核苷酸和合成胜肽以及放射性药物,预计将在2024年占据最大的市场份额。高效小分子,尤其是在肿瘤学领域,需要专门的密闭设备和专业知识,这推动了对拥有先进设施的CDMO的需求。寡核苷酸和合成胜肽因其在精准医疗和标靶治疗中的作用而发展势头强劲,提供了新的外包机会。

随着核子医学的扩展,放射性药物及其诊断和治疗应用正受到越来越多的关注。其他小分子在从心血管疾病到感染疾病等众多治疗领域仍扮演着重要角色。其稳定性、口服生物生物有效性和经济高效的大规模生产使小分子对创新药和学名药管道都具有吸引力。慢性病的日益流行,加上合成化学和连续生产领域的持续创新,正在巩固其市场地位。在这些子类别中拥有专业知识的CDMO可以利用製药公司对速度、灵活性和成本效益的强劲需求,确保小分子仍然是CDMO产业成长的核心驱动力。

按地区划分,北美占比最大

2024 年,北美占据了市场主导地位,得益于其强大的法规结构、先进的製造基础设施和高度集中的主要 CDMO。该地区受益于成熟的製药业、广泛的研发能力以及大型製药企业的强大影响力,这些公司将开发和製造外包以优化成本并加快上市速度。支持性监管机构,尤其是美国FDA,透过明确的指导方针和加速核准来促进创新,鼓励对先进製造技术(如连续製造和高效 API 製造)的投资。北美在生技药品和先进疗法的製造方面也处于主导地位,并得到专门的细胞和基因疗法 CDMO 设施的支持。策略联盟、併购进一步加强了该地区的服务组合和能力。该地区强大的创业投资生态系统和产学研合作促进了创新,而其对品质、合规性和扩充性的重视吸引了来自世界各地的客户。

本报告调查了全球医药契约製造市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、各个细分市场、地区/主要国家的详细分析、竞争格局和主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 定价分析

- 价值链分析

- 供应链分析

- 生态系分析

- 投资金筹措场景

- 技术分析

- 专利分析

- 2025-2026年重要会议和活动

- 监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 最终用户未满足的需求

- 简化新药申请 (ANDA)核准

- 人工智慧/生成式人工智慧对医药契约製造市场的影响

- 2025年美国关税对医药契约製造市场的影响

第六章 医药契约製造市场(按服务)

- 製药製造服务

- 製药 API 製造服务

- 製药FDF製造服务

- 药物开发服务

- 生技药品製造服务

- 生技药品API製造服务

- 生技药品FDF製造服务

- 包装和标籤服务

- 灌装和精加工服务

- 其他的

7. 医药契约製造市场(依分子)

- 低分子

- 高效小分子

- 寡核苷酸和合成胜肽

- 放射性药物分子

- 其他的

- 聚合物

- 单株抗体

- 细胞和基因治疗

- 抗体药物复合体

- 疫苗

- 治疗性胜肽和蛋白质

- 其他的

第 8 章:医药契约製造市场(按最终用户划分)

- 大型製药公司

- 中小型製药企业

- 学名药公司

- 其他的

9. 医药契约製造市场(按地区)

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

- 欧洲

- 宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 瑞士

- 波兰

- 西班牙

- 其他的

- 亚太地区

- 宏观经济展望

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 其他的

- 拉丁美洲

- 宏观经济展望

- 巴西

- 墨西哥

- 其他的

- 中东

- 宏观经济展望

- 海湾合作委员会国家

- 其他的

- 非洲

- 宏观经济展望

第十章 竞争格局

- 主要参与企业的策略/优势

- 收益占有率分析

- 市场占有率分析

- 估值和财务指标

- 品牌/服务比较

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小型企业

- 竞争场景

第十一章 公司简介

- 主要企业

- THERMO FISHER SCIENTIFIC INC.

- LONZA

- CATALENT, INC.

- WUXI APPTEC

- WUXI BIOLOGICS

- SAMSUNG BIOLOGICS

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- EVONIK

- FUJIFILM HOLDINGS CORPORATION

- ABBVIE INC.

- SIEGFRIED HOLDING AG

- MERCK KGAA

- ALMAC GROUP

- CHARLES RIVER LABORATORIES

- ASYMCHEM INC.

- VETTER

- ALCAMI CORPORATION

- EUROFINS SCIENTIFIC

- 其他公司

- PIRAMAL PHARMA SOLUTIONS

- SYNGENE INTERNATIONAL LIMITED

- CAMBREX CORPORATION

- JUBILANT PHARMANOVA LIMITED

- YUHAN CORPORATION

- PIERRE FABRE LABORATORIES

- PFIZER CENTREONE

- DELPHARM

- FRONTAGE LABS

- SHARP SERVICES, LLC

- GRAND RIVER ASEPTIC MANUFACTURING

- RECIPHARM AB

- PCI PHARMA SERVICES

- CURIA GLOBAL, INC.

- SIMTRA BIOPHARMA SOLUTIONS

- PORTON

- MABPLEX INTERNATIONAL CO. LTD.

- CELLARES

第十二章 附录

The global pharmaceutical contract manufacturing market is projected to reach USD 311.95 billion by 2030 from an estimated USD 209.90 billion in 2025, at a CAGR of 8.2% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Service, Molecule, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa |

The expansion of the pharmaceutical contract manufacturing market has been predominantly fueled by outsourcing for GLP-1 manufacturing & development, ADC approvals and programs, and loss of exclusivity for blockbuster biologics. However, expansion of in-house capacities by pharmaceutical companies and pricing pressure in the US and Europe are expected to restrict market growth.

The biologics FDF manufacturing services segment reported the highest CAGR in 2024.

Based on biologics manufacturing service, the pharmaceutical contract manufacturing market is segmented into biologics API manufacturing services and biologics FDF Manufacturing Services. Among these, biologics FDF manufacturing services are projected to experience the fastest growth rate during the forecast period from 2025 to 2030. This strong growth outlook is primarily driven by the surging demand for biologics, which include complex and high-value products such as monoclonal antibodies, recombinant proteins, cell and gene therapies, and vaccines. The rising focus on targeted pharmacological therapies, which offer greater efficacy and reduced side effects compared to traditional treatments, is further boosting demand for specialized manufacturing capabilities. In addition, the increasing volume of research and development activities, particularly in cell and gene therapy, contributes significantly to market expansion. A growing number of pipeline candidates in these advanced therapeutic areas requires highly specialized manufacturing processes, encouraging pharmaceutical companies to partner with CDMOs possessing the necessary expertise, infrastructure, and regulatory compliance. This trend is expected to result in higher investment in advanced biologics production technologies, capacity expansion, and quality systems within CDMOs. Consequently, the FDF manufacturing services segment is well-positioned to achieve substantial growth and play an increasingly critical role in the pharmaceutical outsourcing landscape over the coming years.

The small molecules segment dominated the pharmaceutical contract manufacturing market in 2024.

The pharmaceutical contract manufacturing market is segmented by molecules into small molecules & large molecules. In 2024, small molecules, encompassing high-potency small molecules, oligonucleotides and synthetic peptides, radiopharmaceuticals, and other small molecules, hold the largest share of the pharmaceutical CDMO market by molecule segment. High-potency small molecules, particularly oncology, require specialized containment and expertise, driving demand for CDMOs with advanced facilities. Oligonucleotides and synthetic peptides have gained momentum due to their role in precision medicine and targeted therapies, offering new outsourcing opportunities. Radiopharmaceuticals, with applications in diagnostics and treatment, are seeing increased interest as nuclear medicine expands. The other small molecules category remains vital for numerous therapeutic areas, from cardiovascular to infectious diseases. Small molecules are favored for their stability, oral bioavailability, and cost-efficient mass production, making them attractive for both innovative and generic drug pipelines. The growing prevalence of chronic conditions, coupled with ongoing innovation in synthetic chemistry and continuous manufacturing, strengthens their market position. CDMOs with specialized expertise across these subcategories can leverage strong demand from pharmaceutical companies seeking speed, flexibility, and cost efficiency, ensuring that small molecules continue to be a core driver of the CDMO industry's growth.

North America accounted for the largest share in the global pharmaceutical contract manufacturing market from 2025 to 2030.

North America dominated the pharmaceutical CDMO market in 2024, driven by its strong regulatory framework, advanced manufacturing infrastructure, and high concentration of leading CDMO players. The region benefits from a well-established pharmaceutical industry, extensive R&D capabilities, and a strong presence of big pharmaceutical companies outsourcing development and manufacturing to optimize costs and speed to market. Supportive regulatory agencies, particularly the US FDA, promote innovation through clear guidelines and expedited approvals, encouraging investment in advanced manufacturing technologies such as continuous processing and high-potency API production. North America also leads in biologics and advanced therapies manufacturing, supported by specialized CDMO facilities catering to cell and gene therapies. Strategic collaborations, mergers, and acquisitions further enhance service portfolios and capacity. The region's robust venture capital ecosystem and academic-industry partnerships foster innovation, while its focus on quality, compliance, and scalability attracts global clients.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 70% and Demand Side- 30%

- By Designation: Managers- 45%, CXO and Directors- 30%, and Executives- 25%

- By Region: North America- 30%, Europe- 30%, Asia Pacific- 30%, Latin America- 5%, and the Middle East & Africa- 5%

Key Companies

Key players in the pharmaceutical contract manufacturing market include Thermo Fisher Scientific Inc. (US), Lonza (Switzerland), WuXi AppTec (China), WuXi Biologics (China), AbbVie Inc. (US), Catalent, Inc. (Novo Holdings) (US), Samsung Biologics (South Korea), Evonik (Germany), FUJIFILM Holding Corporation (Japan), Siegfried Holding AG (Switzerland), and Boehringer Ingelheim International GmbH (Germany). Other notable companies are Merck KGaA (Germany), Almac Group (UK), Charles River Laboratories (US), Asymchem Inc. (China), Vetter (Germany), and Alcami Corporation (US).

Research Coverage

This research report categorizes the pharmaceutical contract manufacturing market, by service {drug development services, pharmaceutical manufacturing services [pharmaceutical API manufacturing services, pharmaceutical FDF manufacturing services (parenteral, tablet, capsule, oral liquid, semi-solid, other formulations), biologics manufacturing services (biologics API manufacturing services, biologics FDF manufacturing services)], packaging & labelling services, fill-finish services, other services}, molecule [small molecules (high-potency small molecules, oligonucleotide & synthetic peptides, radiopharmaceutical, and other molecules) large molecules (mAbs, CGT, ADC, vaccines, therapeutic peptides & proteins, and other large molecules)], end user (big pharmaceutical companies, small & mid-sized pharmaceutical companies, generic pharmaceutical companies, other end users), and by region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the pharmaceutical contract manufacturing market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, key strategies, collaborations, partnerships, and agreements. New launches, collaborations, acquisitions, and recent developments associated with the pharmaceutical contract manufacturing market.

Reasons to buy this report

The report will help market leaders and new entrants by providing them with closest approximations of the revenue numbers for the overall pharmaceutical contract manufacturing market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better positioning their businesses and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (GLP-1 capacity crunch, increasing development and manufacturing of antibody drug conjugates, loss of exclusivity of blockbuster biologics, increasing complexity of injectable drug formats) restraints (pricing pressure on innovator drugs, growing penetration of generics and biosimilars, strict regulatory compliance, risk in advanced therapies pipeline), opportunities (Rising demand for cell and gene therapies, growing inclination toward one-stop-shop model, market expansion in emerging countries, booming radiopharmaceutical and nuclear medicine segment), and challenges (global trade instability and insourcing) influencing the growth of pharmaceutical contract development and manufacturing market.

- Service Development/Innovation: Thorough investigation of recently launched services available in the pharmaceutical contract manufacturing market.

- Market Development: Utilizing analysis of regional market trends, the study offers comprehensive knowledge on profitable markets.

- Market Diversification: Comprehensive information on new services, underdeveloped areas, present developments, and pharmaceutical contract manufacturing sector investments is what market diversification is based on.

- Competitive Assessment: A comprehensive evaluation of the market shares, growth strategies, and service offerings of prominent companies such as Thermo Fisher Scientific Inc. (US), Catalent, Inc. (US), Lonza (Switzerland), AbbVie Inc. (US), WuXi AppTec (China), and others in the pharmaceutical contract development and manufacturing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key objectives of secondary research

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.2.1.1 Company revenue analysis (Bottom-up approach)

- 2.2.1.2 MnM repository analysis

- 2.2.1.3 Primary interviews

- 2.2.2 INSIGHTS FROM PRIMARY EXPERTS

- 2.2.3 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.3 GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 STRATEGIC IMPERATIVES FOR KEY STAKEHOLDERS

- 3.1.1 PHARMACEUTICAL CONTRACT MANUFACTURERS

- 3.1.1.1 Capacity lock in for GLP-1 and biologics opportunities

- 3.1.1.2 Sterile fill-finish services

- 3.1.1.3 OSD differentiation and dual site sourcing

- 3.1.2 PHARMACEUTICAL COMPANIES

- 3.1.2.1 Own vs. outsourcing critical steps

- 3.1.2.2 Dual-source, multi-site supply resilience

- 3.1.3 STARTUPS AND INNOVATIVE BIOTECH FIRMS

- 3.1.3.1 Gene-to-IND platform

- 3.1.3.2 Clinical supply risk management

- 3.1.1 PHARMACEUTICAL CONTRACT MANUFACTURERS

4 PREMIUM INSIGHTS

- 4.1 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET OVERVIEW

- 4.2 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE AND COUNTRY, 2025

- 4.3 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE

- 4.4 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER

- 4.5 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.6 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 GLP-1 capacity crunch

- 5.2.1.2 Increasing development and manufacturing of antibody drug conjugates

- 5.2.1.3 Loss of exclusivity of blockbuster biologics

- 5.2.1.4 Increasing complexity of injectable drug formats

- 5.2.2 RESTRAINTS

- 5.2.2.1 Pricing pressure on innovator drugs

- 5.2.2.2 Growing penetration of generics and biosimilars

- 5.2.2.3 Strict regulatory compliance

- 5.2.2.4 Risk in advanced therapies pipeline

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for cell and gene therapies

- 5.2.3.2 Growing inclination toward one-stop-shop model

- 5.2.3.3 Market expansion in emerging countries

- 5.2.3.4 Booming radiopharmaceutical and nuclear medicine segment

- 5.2.4 CHALLENGES

- 5.2.4.1 Global trade instability and insourcing

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING ANALYSIS, BY SERVICE

- 5.4.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.4.3 COMPARISON OF CDMO PRICING MODELS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 MANUFACTURING SITE, EXPANSION, AND CAPEX TREND OF KEY CDMOS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Single-use bioprocessing systems

- 5.9.1.2 Continuous manufacturing

- 5.9.1.3 Advanced formulation technologies

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 High-performance liquid chromatography

- 5.9.2.2 Mass spectrometry

- 5.9.2.3 Next-generation sequencing

- 5.9.2.4 Automation and robotics

- 5.9.2.5 Process analytical technology

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 3D printing

- 5.9.3.2 Artificial intelligence and machine learning

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY SCENARIO

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 BARGAINING POWER OF SUPPLIERS

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 THREAT OF NEW ENTRANTS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 UNMET NEEDS OF END USERS

- 5.15.1 CAPACITY AND TIMELY ACCESS

- 5.15.2 COST EFFICIENCY AND FLEXIBILITY

- 5.15.3 END-TO-END INTEGRATED SERVICES

- 5.15.4 ADVANCED MODALITY EXPERTISE

- 5.15.5 QUALITY AND REGULATORY CONSISTENCY

- 5.16 ABBREVIATED NEW DRUG APPLICATION (ANDA) APPROVALS

- 5.17 IMPACT OF AI/GEN AI ON PHARMACEUTICAL CONTRACT MANUFACTURING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI/GEN AI

- 5.17.3 AI USE CASES

- 5.17.4 KEY COMPANIES IMPLEMENTING AI/GEN AI

- 5.18 IMPACT OF 2025 US TARIFFS ON PHARMACEUTICAL CONTRACT MANUFACTURING MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.4.3.1 India

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE

- 6.1 INTRODUCTION

- 6.2 PHARMACEUTICAL MANUFACTURING SERVICES

- 6.2.1 PHARMACEUTICAL API MANUFACTURING SERVICES

- 6.2.1.1 Rising cases of patent expiry to fuel market

- 6.2.2 PHARMACEUTICAL FDF MANUFACTURING SERVICES

- 6.2.2.1 Parenteral manufacturing services

- 6.2.2.1.1 Increasing demand for specialized manufacturing capabilities to support growth

- 6.2.2.2 Tablet manufacturing services

- 6.2.2.2.1 Growing domestic production capacity in emerging markets to boost market

- 6.2.2.3 Capsule manufacturing services

- 6.2.2.3.1 Rising adoption in pharmaceutical, nutraceutical, and cosmetic applications to stimulate growth

- 6.2.2.4 Oral liquid manufacturing services

- 6.2.2.4.1 Growing preference for oral liquids over powders to fuel market

- 6.2.2.5 Semi-solid manufacturing services

- 6.2.2.5.1 Rising prevalence of skin infections and burns to foster growth

- 6.2.2.6 Other FDF manufacturing services

- 6.2.2.1 Parenteral manufacturing services

- 6.2.1 PHARMACEUTICAL API MANUFACTURING SERVICES

- 6.3 DRUG DEVELOPMENT SERVICES

- 6.3.1 INCREASING COST OF DRUG DISCOVERY AND DEVELOPMENT TO EXPEDITE GROWTH

- 6.4 BIOLOGICS MANUFACTURING SERVICES

- 6.4.1 BIOLOGICS API MANUFACTURING SERVICES

- 6.4.1.1 Rising investments in single-use production capacities to bolster growth

- 6.4.2 BIOLOGICS FDF MANUFACTURING SERVICES

- 6.4.2.1 Growing demand for generic medicines and biologics to fuel market

- 6.4.1 BIOLOGICS API MANUFACTURING SERVICES

- 6.5 PACKAGING & LABELING SERVICES

- 6.5.1 INCREASING COMPLEXITY AND STRINGENCY OF REGULATORY REQUIREMENTS FOR DRUG SAFETY AND EFFICACY TO FAVOR GROWTH

- 6.6 FILL-FINISH SERVICES

- 6.6.1 SURGE IN DEMAND FOR BIOLOGICS AND COMPLEX INJECTABLE THERAPIES TO BOOST MARKET

- 6.7 OTHER SERVICES

7 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE

- 7.1 INTRODUCTION

- 7.2 SMALL MOLECULES

- 7.2.1 HIGH-POTENCY SMALL MOLECULES

- 7.2.1.1 Increasing adoption of high-potency small molecules for treating oncology, rare diseases, and other diseases to aid growth

- 7.2.2 OLIGONUCLEOTIDE & SYNTHETIC PEPTIDES

- 7.2.2.1 Growing focus on next-gen therapies to drive market

- 7.2.3 RADIOPHARMACEUTICAL MOLECULES

- 7.2.3.1 Advances in isotope production, radiolabeling chemistry, and theranostic approaches to boost market

- 7.2.4 OTHER SMALL MOLECULES

- 7.2.1 HIGH-POTENCY SMALL MOLECULES

- 7.3 LARGE MOLECULES

- 7.3.1 MONOCLONAL ANTIBODIES

- 7.3.1.1 Rising use of mAbs in managing cancer, autoimmune disorders, and osteoporosis to spur growth

- 7.3.2 CELL & GENE THERAPIES

- 7.3.2.1 Emerging treatments for previously untreatable genetic and rare diseases to boost market

- 7.3.3 ANTIBODY DRUG CONJUGATES

- 7.3.3.1 Growing need for precision medicines to fuel market

- 7.3.4 VACCINES

- 7.3.4.1 Growing threat of infectious disease outbreaks to drive market

- 7.3.5 THERAPEUTIC PEPTIDES & PROTEINS

- 7.3.5.1 Increasing research in genomics to support growth

- 7.3.6 OTHER LARGE MOLECULES

- 7.3.1 MONOCLONAL ANTIBODIES

8 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 BIG PHARMACEUTICAL COMPANIES

- 8.2.1 PRICING PRESSURE IN PHARMACEUTICAL INDUSTRY TO CONTRIBUTE TO GROWTH

- 8.3 SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES

- 8.3.1 NEED TO SAVE IN-HOUSE DRUG MANUFACTURING COST TO FOSTER GROWTH

- 8.4 GENERIC PHARMACEUTICAL COMPANIES

- 8.4.1 FAVORABLE GOVERNMENT SUPPORT FOR ADOPTION OF GENERIC DRUGS TO PROPEL MARKET

- 8.5 OTHER END USERS

9 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 High clinical trial and drug discovery activities to foster growth

- 9.2.3 CANADA

- 9.2.3.1 Favorable government support and increased focus on R&D activities to sustain growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Free drug-pricing policy and high pharmaceutical investments to speed up growth

- 9.3.3 UK

- 9.3.3.1 Favorable R&D funding scenario to augment growth

- 9.3.4 FRANCE

- 9.3.4.1 Booming life science research and growing generics market to drive market

- 9.3.5 ITALY

- 9.3.5.1 Rising commercial drug development and increasing life science R&D to favor growth

- 9.3.6 SWITZERLAND

- 9.3.6.1 Rapid growth as global pharmaceutical manufacturing hub to drive market

- 9.3.7 POLAND

- 9.3.7.1 Universal health coverage and advanced government-supported medical infrastructure to encourage growth

- 9.3.8 SPAIN

- 9.3.8.1 Growing pharmaceutical R&D expenditure and increasing outsourcing of trial phases to boost market

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Made in China 2025 initiative and high government drug development investments to aid growth

- 9.4.3 JAPAN

- 9.4.3.1 High geriatric population and advanced pharmaceutical research to augment growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Increased biotech investments and developed pharma sector to propel market

- 9.4.5 INDIA

- 9.4.5.1 Favorable industrial environment and lower labor costs to drive market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Strategic geographical location and stringent regulatory environment to foster growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Rapid patient enrolment and increased focus on advanced clinical trials to expedite growth

- 9.5.3 MEXICO

- 9.5.3.1 Surge in pharmaceutical goods export to promote growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Kingdom of Saudi Arabia (KSA)

- 9.6.2.1.1 Increasing healthcare expenditure to aid growth

- 9.6.2.2 UAE

- 9.6.2.2.1 Strategic government healthcare initiatives and broader economic diversification plans to drive market

- 9.6.2.3 Rest of GCC countries

- 9.6.2.1 Kingdom of Saudi Arabia (KSA)

- 9.6.3 REST OF MIDDLE EAST

- 9.7 AFRICA

- 9.7.1 RISING PREVALENCE OF CHRONIC DISEASES TO FACILITATE GROWTH

- 9.7.2 MACROECONOMIC OUTLOOK OF AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE SHARE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/SERVICE COMPARISON

- 10.6.1 THERMO FISHER SCIENTIFIC INC.

- 10.6.2 LONZA

- 10.6.3 WUXI BIOLOGICS AND WUXI APPTEC

- 10.6.4 CATALENT, INC.

- 10.6.5 SAMSUNG BIOLOGICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Service footprint

- 10.7.5.4 Molecule footprint

- 10.8 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 SERVICE LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 THERMO FISHER SCIENTIFIC INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Service launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 LONZA

- 11.1.2.1 Business overview

- 11.1.2.2 Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 CATALENT, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Service launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 WUXI APPTEC

- 11.1.4.1 Business overview

- 11.1.4.2 Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.3.2 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 WUXI BIOLOGICS

- 11.1.5.1 Business overview

- 11.1.5.2 Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Service launches

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.3.4 Other developments

- 11.1.6 SAMSUNG BIOLOGICS

- 11.1.6.1 Business overview

- 11.1.6.2 Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Service launches

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.7 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 11.1.7.1 Business overview

- 11.1.7.2 Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.7.3.3 Other developments

- 11.1.8 EVONIK

- 11.1.8.1 Business overview

- 11.1.8.2 Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Expansions

- 11.1.9 FUJIFILM HOLDINGS CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Expansions

- 11.1.10 ABBVIE INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.10.3.2 Expansions

- 11.1.11 SIEGFRIED HOLDING AG

- 11.1.11.1 Business overview

- 11.1.11.2 Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.11.3.2 Expansions

- 11.1.12 MERCK KGAA

- 11.1.12.1 Business overview

- 11.1.12.2 Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.12.3.2 Expansions

- 11.1.13 ALMAC GROUP

- 11.1.13.1 Business overview

- 11.1.13.2 Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.13.3.2 Expansions

- 11.1.14 CHARLES RIVER LABORATORIES

- 11.1.14.1 Business overview

- 11.1.14.2 Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.14.3.2 Expansions

- 11.1.15 ASYMCHEM INC.

- 11.1.15.1 Business overview

- 11.1.15.2 Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.15.3.2 Expansions

- 11.1.16 VETTER

- 11.1.16.1 Business overview

- 11.1.16.2 Services offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Service launches

- 11.1.16.3.2 Deals

- 11.1.16.3.3 Expansions

- 11.1.17 ALCAMI CORPORATION

- 11.1.17.1 Business overview

- 11.1.17.2 Services offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Deals

- 11.1.17.3.2 Expansions

- 11.1.18 EUROFINS SCIENTIFIC

- 11.1.18.1 Business overview

- 11.1.18.2 Services offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Expansions

- 11.1.1 THERMO FISHER SCIENTIFIC INC.

- 11.2 OTHER PLAYERS

- 11.2.1 PIRAMAL PHARMA SOLUTIONS

- 11.2.2 SYNGENE INTERNATIONAL LIMITED

- 11.2.3 CAMBREX CORPORATION

- 11.2.4 JUBILANT PHARMANOVA LIMITED

- 11.2.5 YUHAN CORPORATION

- 11.2.6 PIERRE FABRE LABORATORIES

- 11.2.7 PFIZER CENTREONE

- 11.2.8 DELPHARM

- 11.2.9 FRONTAGE LABS

- 11.2.10 SHARP SERVICES, LLC

- 11.2.11 GRAND RIVER ASEPTIC MANUFACTURING

- 11.2.12 RECIPHARM AB

- 11.2.13 PCI PHARMA SERVICES

- 11.2.14 CURIA GLOBAL, INC.

- 11.2.15 SIMTRA BIOPHARMA SOLUTIONS

- 11.2.16 PORTON

- 11.2.17 MABPLEX INTERNATIONAL CO. LTD.

- 11.2.18 CELLARES

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 IMPACT ANALYSIS OF SUPPLY-SIDE AND DEMAND-SIDE FACTORS

- TABLE 3 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: RISK ANALYSIS

- TABLE 4 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 5 GLP-1 PIPELINE, EXPECTED LAUNCH BY 2030

- TABLE 6 ADC PIPELINE, EXPECTED LAUNCH BY 2030

- TABLE 7 IMPENDING AND ONGOING PATENT EXPIRIES OF BLOCKBUSTER BIOLOGICS, 2023-2035

- TABLE 8 LIST OF RECENTLY APPROVED INJECTABLES, 2022-2024

- TABLE 9 CELL & GENE THERAPY-SPECIFIC CDMO EXPANSIONS, 2023-2025

- TABLE 10 CELL & GENE THERAPY PIPELINE, EXPECTED LAUNCH BY 2030

- TABLE 11 INDICATIVE PRICING ANALYSIS, BY SERVICE

- TABLE 12 INDICATIVE PRICING ANALYSIS, BY REGION

- TABLE 13 PRICING MODELS FOR CDMO SERVICES

- TABLE 14 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: ROLE OF COMPANIES IN SUPPLY CHAIN

- TABLE 15 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 16 MANUFACTURING SITES OF KEY CDMOS

- TABLE 17 LIST OF SITE EXPANSIONS FOR KEY CDMOS, 2023-2025

- TABLE 18 CAPEX FOR SELECTED PUBLICLY LISTED KEY CDMOS, 2021-2024 (USD MILLION)

- TABLE 19 NUMBER OF PATENTS FILED IN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2014-2024

- TABLE 20 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 21 REGULATORY SCENARIO, BY COUNTRY

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF PHARMACEUTICAL CONTRACT MANUFACTURING SERVICES (%)

- TABLE 30 BUYING CRITERIA FOR PHARMACEUTICAL CONTRACT MANUFACTURING, BY END USER

- TABLE 31 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 32 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 33 PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 34 PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 35 NORTH AMERICA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 36 EUROPE: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 37 ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 38 LATIN AMERICA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 39 MIDDLE EAST: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 40 GCC COUNTRIES: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 41 PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030(USD BILLION)

- TABLE 42 NORTH AMERICA: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 43 EUROPE: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 44 ASIA PACIFIC: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 45 LATIN AMERICA: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 46 MIDDLE EAST: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030(USD BILLION)

- TABLE 47 GCC COUNTRIES: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 48 PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030(USD BILLION)

- TABLE 49 PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030(USD BILLION)

- TABLE 50 NORTH AMERICA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 51 EUROPE: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 52 ASIA PACIFIC: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 53 LATIN AMERICA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 54 MIDDLE EAST: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030(USD BILLION)

- TABLE 55 GCC COUNTRIES: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 56 PARENTERAL MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 57 NORTH AMERICA: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 58 EUROPE: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 59 ASIA PACIFIC: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 60 LATIN AMERICA: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 61 MIDDLE EAST: PARENTERAL MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 62 GCC COUNTRIES: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 63 TABLET MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 64 NORTH AMERICA: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 65 EUROPE: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 66 ASIA PACIFIC: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 67 LATIN AMERICA: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 68 MIDDLE EAST: TABLET MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 69 GCC COUNTRIES: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 70 CAPSULE MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 71 NORTH AMERICA: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 72 EUROPE: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 73 ASIA PACIFIC: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 74 LATIN AMERICA: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 75 MIDDLE EAST: CAPSULE MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 76 GCC COUNTRIES: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 77 ORAL LIQUID MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 78 NORTH AMERICA: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 79 EUROPE: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 80 ASIA PACIFIC: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 81 LATIN AMERICA: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 82 MIDDLE EAST: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 83 GCC COUNTRIES: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 84 SEMI-SOLID MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 85 NORTH AMERICA: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 86 EUROPE: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 87 ASIA PACIFIC: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 88 LATIN AMERICA: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 89 MIDDLE EAST: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 90 GCC COUNTRIES: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 91 OTHER FDF MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 92 NORTH AMERICA: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 93 EUROPE: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 94 ASIA PACIFIC: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 95 LATIN AMERICA: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 96 MIDDLE EAST: OTHER FDF MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 97 GCC COUNTRIES: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 98 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 99 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 100 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 101 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 102 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 103 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 104 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 105 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 106 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 107 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 108 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 109 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 110 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 111 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 112 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 113 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 114 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 115 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 116 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 117 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 118 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 119 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 120 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 121 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 122 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 123 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 124 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 125 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 126 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 127 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 128 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 129 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 130 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 131 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 132 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 133 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 134 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 135 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 136 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 137 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 138 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 139 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL- FINISH SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 140 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 141 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 142 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 143 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 144 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 145 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 146 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 147 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 148 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 149 PHARMACEUTICAL MANUFACTURING SERVICES MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 150 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 151 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 152 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 153 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 154 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 155 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 156 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 157 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 158 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 159 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 160 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 161 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 162 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 163 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 164 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 165 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 166 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 167 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 168 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 169 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 170 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 171 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 172 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 173 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 174 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 175 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 176 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 177 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 178 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 179 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 180 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 181 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 182 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 183 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 184 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 185 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 186 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 187 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 188 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 189 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 190 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 191 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 192 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 193 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 194 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 195 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 196 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 197 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 198 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 199 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 200 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 201 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 202 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 203 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 204 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 205 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 206 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 207 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 208 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 209 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 210 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 211 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 212 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 213 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 214 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 215 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 216 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 217 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 218 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 219 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 220 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 221 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 222 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 223 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 224 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 225 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 226 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 227 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 228 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 229 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 230 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 231 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 232 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 233 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 234 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 235 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 236 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 237 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 238 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 239 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 240 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 241 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 242 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 243 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 244 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 245 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 246 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 247 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 248 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 249 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 250 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 251 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 252 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 253 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 254 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 255 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 256 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 257 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 258 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 259 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 260 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 261 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 262 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 263 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 264 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 265 NORTH AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 266 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 267 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 268 NORTH AMERICA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 269 NORTH AMERICA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 270 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 271 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 272 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 273 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 274 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 275 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 276 US: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 277 US: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 278 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 279 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 280 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 281 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 282 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 283 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 284 CANADA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 285 CANADA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 286 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 287 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 288 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 289 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 290 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 291 EUROPE: KEY MACROECONOMIC INDICATORS

- TABLE 292 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 293 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 294 EUROPE: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 295 EUROPE: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 296 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 297 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 298 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 299 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 300 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 301 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 302 GERMANY: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 303 GERMANY: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 304 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 305 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 306 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 307 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 308 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 309 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 310 UK: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 311 UK: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 312 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 313 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 314 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 315 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 316 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 317 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 318 FRANCE: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 319 FRANCE: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 320 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 321 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 322 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 323 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 324 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 325 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 326 ITALY: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 327 ITALY: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 328 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 329 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 330 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 331 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 332 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 333 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 334 SWITZERLAND: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 335 SWITZERLAND: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 336 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 337 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 338 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 339 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 340 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 341 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 342 POLAND: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 343 POLAND: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 344 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 345 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 346 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 347 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 348 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 349 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 350 SPAIN: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 351 SPAIN: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 352 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 353 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 354 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 355 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 356 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 357 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 358 REST OF EUROPE: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 359 REST OF EUROPE: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 360 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 361 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 362 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 363 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 364 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 365 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 366 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 367 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 368 ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 369 ASIA PACIFIC: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 370 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 371 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 372 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 373 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 374 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)