|

市场调查报告书

商品编码

1819103

全球资料中心浸入式冷却液市场(至 2032 年)按技术(单相 vs. 双相)、资料中心类型(超大规模、AI/ML、加密货币挖矿)、类型(矿物油、氟碳基液体、合成液体)和地区划分Data Center Immersion Cooling Fluids Market by Technology (Single-Phase, Two-Phase), Data Center Type (Hyperscale, AI/ML, Cryptocurrency Mining), Type (Mineral Oil, Fluorocarbon-based Fluids, Synthetic Fluids), and Region - Global Forecast to 2032 |

||||||

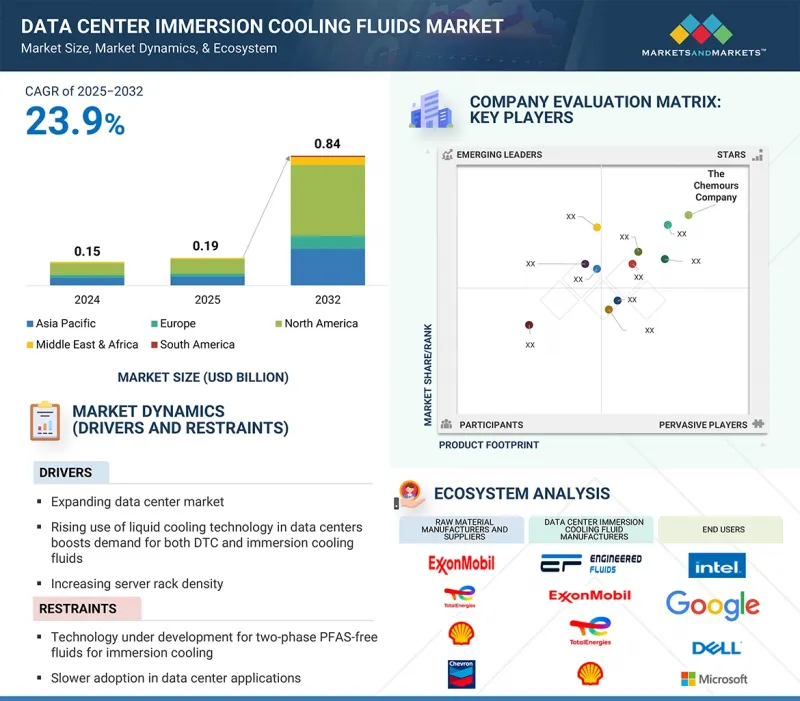

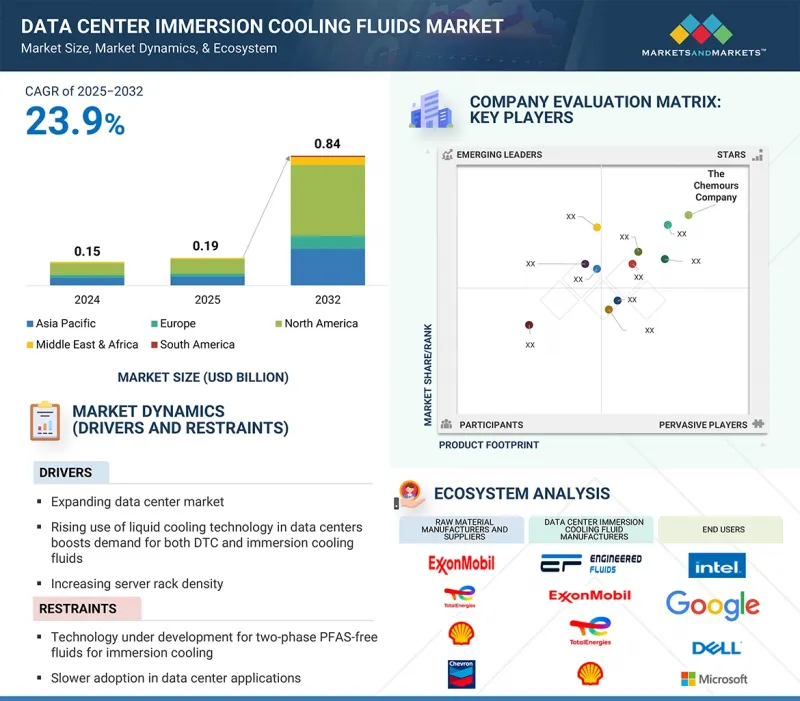

全球资料中心浸入式冷却液市场预计将从 2025 年的 1.9 亿美元成长到 2032 年的 8.4 亿美元,预测期内的复合年增长率为 23.9%。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 单元 | 金额(美元) |

| 部分 | 技术、类型、资料中心类型、地区 |

| 目标区域 | 亚太地区、欧洲、北美、中东和非洲、南美 |

云端运算、高效能运算 (HPC) 和商业资料中心对有效温度控管解决方案的需求正在推动市场成长。快速数位化和数据密集型应用的兴起,推动了对可扩展、可靠且高效的散热系统的需求不断增长。

按类型划分,预计氟碳基流体在预测期内将占据第二大市场份额。

氟碳流体凭藉其优异的介电性能、热稳定性和高效的传热能力,预计将在预测期内占据第二大市场份额,尤其是在高密度和高效能运算系统中。这类流体尤其适用于需要精确均匀冷却的场合,例如需要热负荷管理的超大规模和高效能运算 (HPC) 资料中心。然而,氟碳流体的高成本,且有环境限制,例如与替代矿物油基流体相比,其全球暖化潜势值更高,这限制了其大规模应用。

“从技术角度来看,预计双相冷却将在预测期内占据第二大市场份额。”

虽然两相繫统提供了增强的温度控管和电源效率,但大规模部署需要大量的初始投资和重大的基础设施维修。两相冷却系统在高密度、关键任务运算资料中心提供卓越的冷却性能,以实现最佳能源效率,同时处理人工智慧和高效能运算等应用产生的高热负荷。

本报告调查了全球资料中心浸入式冷却市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、各个细分市场、地区/主要国家的详细分析、竞争格局和主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

第六章 产业趋势

- 世界宏观经济展望

- 资料中心浸入式冷却的演变

- 伙伴关係

- 供应链分析

- 生态系分析

- 波特五力分析

- 主要相关利益者和采购标准

- 定价分析

- 监管状况

- 资料中心标准组织

- 大型会议及活动

- 专利分析

- 技术分析

- 案例研究分析

- 贸易分析

- 影响客户业务的趋势/中断

- 投资金筹措场景

- 生成式人工智慧对资料中心浸入式冷却液市场的影响

- 2025年美国关税对资料中心浸入式冷却液市场的影响

7. 资料中心浸入式冷却液市场(按类型)

- 矿物油

- 氟碳流体

- 合成液体

- 其他的

8. 资料中心浸入式冷却液市场(依资料中心类型)

- 超大规模资料中心

- 人工智慧/机器学习资料中心

- 加密货币挖矿资料中心

- 其他的

9. 资料中心浸入式冷却液市场(依技术)

- 单相冷却

- 两相冷却

第 10 章资料中心浸入式冷却液市场(按地区)

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 西班牙

- 俄罗斯

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 其他的

- 南美洲

第十一章 竞争格局

- 主要参与企业的策略/优势

- 收益分析

- 市占率分析

- 品牌/产品比较

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小型企业

- 估值和财务指标

- 竞争场景

第十二章:公司简介

- 主要企业

- THE CHEMOURS COMPANY

- FUCHS SE

- SUBMER

- THE LUBRIZOL CORPORATION

- INVENTEC PERFORMANCE CHEMICALS

- CASTROL LIMITED

- SHELL PLC

- GREEN REVOLUTION COOLING

- ENGINEERED FLUIDS

- CARGILL, INCORPORATED

- VALVOLINE GLOBAL OPERATIONS

- ENEOS CORPORATION

- TOTALENERGIES

- DYNALENE, INC.

- DCX LIQUID COOLING SYSTEMS

- HONEYWELL INTERNATIONAL INC.

- EXXON MOBIL CORPORATION

- DOW INC.

- PETRONAS LUBRICANTS INTERNATIONAL

- OLEON NV

- 其他公司

- SANMING HEXAFLUO CHEMICALS CO., LTD.

- GUANGDONG GIANT FLUORINE ENERGY SAVING TECHNOLOGY CO., LTD.

- ZHEJIANG NOAH FLUOROCHEMICAL CO., LTD

- FLUOREZ TECHNOLOGY INC.

- SHENZHEN HUAYI BROTHER TECHNOLOGY CO., LTD.

- AMER TECHNOLOGY CO., LTD.

第十三章:相邻市场与相关市场

第十四章 附录

The global data center immersion cooling fluids market is projected to grow from USD 0.19 billion in 2025 to USD 0.84 billion by 2032, at a CAGR of 23.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Technology, Type, Data Center Type, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

The growing need for effective thermal management solutions in cloud computing, high-performance computing, and business data center sectors is propelling the market's growth. The rapid digitization and development of data-intensive applications contribute to the growing demand for scalable, reliable, and effective heat dissipation systems.

"Fluorocarbon-based fluids are estimated to account for the second-largest share, by type, during the forecast period".

Fluorocarbon fluids are expected to hold the second-largest market share in the data center immersion cooling fluids market during the forecast period, due to their better dielectric characteristics, thermal stability, and efficient heat transfer capabilities, particularly in high-density, high-performance computing systems. Such fluids are specifically used when precise and homogeneous cooling is required, such as in hyperscale and HPC data centers, where thermal load management is involved. However, their relatively higher cost and environmental limitations limit their mass usage, such as a greater global warming potential than alternatives like mineral oil-based fluids.

"Two-phase cooling is estimated to account for the second-largest share, by technology, during the forecast period".

Two-phase cooling is projected to hold the second-largest market share in the data center immersion cooling fluids market in the forecast period, mainly because, while it delivers enhanced thermal management and power efficiency, mass adoption is hampered by significant initial capital investment and extensive infrastructural changes that have to be made for its adoption. Two-phase systems deliver enhanced cooling in high-density, mission-critical computing data centers to allow data centers to manage the high heat loads that applications like artificial intelligence and high-performance computing produce while achieving optimal energy efficiency.

"Cryptocurrency mining data centers are estimated to account for the second-largest share, by data center type, during the forecast period".

Cryptocurrency mining data centers are estimated to occupy the second-largest share in the data center market by type during the forecast period. This is primarily due to their niche role in enabling computational and power requirements for large-scale crypto mining operations. The cryptocurrency usage and investment boom has driven demand for more scalable, energy-efficient, and sophisticated mining hardware, propelling purpose-built data centers into the forefront of mining viability and profitability. Purpose-built data centers leverage the latest cooling and power technologies and economies of scale costs to enable high-volume mining economically, a necessity as solo mining becomes impractical amid growing hash rates and hardware costs.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level- 30%, Director Level- 40%, and Others - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 35%, South America - 5%, and Middle East & Africa - 5%

Chemours Company (US), FUCHS SE (Germany), The Lubrizol Corporation (US), Submer (Spain), and Inventec Performance Chemicals (France) are some of the major players operating in the data center immersion cooling fluids market. These players have adopted strategies such as acquisitions, expansions, partnerships, and agreements to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the data center immersion cooling fluids market based on technology, type, data center type, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles data center immersion cooling fluids manufacturers and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes competitive developments, such as expansions, partnerships, and new product launches, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the data center immersion cooling fluids market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape, gain insights to improve the position of their businesses, and develop suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Expanding Data Center Market, Increasing penetration of liquid cooling technology in the data center market, further driving demand for both DTC as well as immersion cooling fluids and Increasing server rack density), restraints (Technology under development for two-phase PFAS free fluids for immersion cooling and Slower adoption in the data center applications), opportunities (Growing installation of AI based Mega Data Center, Growing demand for energy efficient cooling solutions, Sustainability Trend - Increasing pressure on data center owners/ operators to reduce carbon footprint and Increasing demand for environment friendly fluid technology, such as PFAS free and bio-based fluids), and challenges (Competition from DTC liquid cooling technology and Maintenance Challenges and Cost Burden in Immersion Cooling for Data Centers) influencing the growth of the data center immersion cooling fluids market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the data center immersion cooling fluids market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the data center immersion cooling fluids market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the industrial market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players such as The Chemours Company (US), FUCHS SE (Germany), Submer (Spain), The Lubrizol Corporation (US), Inventec Performance Chemicals (France), Castrol Limited (UK), Shell plc (UK), Green Revolution Cooling (US), Engineered Fluids (US), Cargill, Incorporated (US), Valvoline Global Operations (US), ENEOS Corporation (Japan), TotalEnergies (France), Dynalene, Inc. (US), DCX Liquid Cooling Systems (Poland), Honeywell International Inc. (US), Exxon Mobil Corporation (US), Dow Inc. (US), PETRONAS Lubricants International (Malaysia), Oleon NV (Belgium), Chevron Corporation (US) and others in the data center immersion cooling fluids market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 CALCULATION FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DATA CENTER IMMERSION COOLING FLUIDS MARKET

- 4.2 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY DATA CENTER TYPE

- 4.3 NORTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY AND COUNTRY

- 4.4 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding data center market

- 5.2.1.2 Rising use of liquid cooling technology in data centers boosts demand for DTC and immersion cooling fluids

- 5.2.1.3 Increasing server rack density

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technology under development for two-phase PFAS-free fluids for immersion cooling

- 5.2.2.2 Slower adoption in data center applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing installation of AI-based mega data centers

- 5.2.3.2 Growing demand for energy-efficient cooling solutions

- 5.2.3.3 Data center owners and operators face growing pressure to lower carbon footprint

- 5.2.3.4 Increasing demand for environment-friendly fluid technology, such as PFAS-free and bio-based fluids

- 5.2.4 CHALLENGES

- 5.2.4.1 Competition from DTC liquid cooling technology

- 5.2.4.2 Maintenance challenges and cost burden in immersion cooling for data centers

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.1.1 GDP

- 6.1.2 RESEARCH AND DEVELOPMENT (R&D) EXPENDITURE

- 6.2 EVOLUTION OF IMMERSION COOLING FOR DATA CENTERS

- 6.3 PARTNERSHIPS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PORTER'S FIVE FORCES ANALYSIS

- 6.6.1 BARGAINING POWER OF SUPPLIERS

- 6.6.2 BARGAINING POWER OF BUYERS

- 6.6.3 THREAT OF NEW ENTRANTS

- 6.6.4 THREAT OF SUBSTITUTES

- 6.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.7.2 BUYING CRITERIA

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY REGION, 2024

- 6.8.2 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY KEY PLAYER, 2024

- 6.8.3 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY TECHNOLOGY, 2024

- 6.9 REGULATORY LANDSCAPE

- 6.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 ORGANIZATIONS PROVIDING STANDARDS FOR DATA CENTERS

- 6.10.1 INTRODUCTION

- 6.10.2 AMERICAN NATIONAL STANDARDS INSTITUTE

- 6.10.3 AMERICAN SOCIETY OF HEATING, REFRIGERATING AND AIR-CONDITIONING ENGINEERS

- 6.10.4 INSTITUTE FOR ENERGY AND TRANSPORT

- 6.10.5 DISTRIBUTED MANAGEMENT TASK FORCE

- 6.10.6 TELECOMMUNICATION INDUSTRY ASSOCIATION

- 6.10.7 NATIONAL ELECTRICAL MANUFACTURERS ASSOCIATION

- 6.10.8 CANADIAN STANDARDS ASSOCIATION GROUP

- 6.10.9 UNDERWRITERS LABORATORY

- 6.10.10 UNITED STATES DEPARTMENT OF ENERGY

- 6.10.11 UNITED STATES ENVIRONMENTAL PROTECTION AGENCY

- 6.10.12 STATEMENT ON STANDARDS FOR ATTESTATION ENGAGEMENTS NO. 16

- 6.10.13 INTERNATIONAL STANDARDS COMPLIANCE

- 6.11 KEY CONFERENCES AND EVENTS

- 6.12 PATENT ANALYSIS

- 6.12.1 METHODOLOGY

- 6.13 TECHNOLOGY ANALYSIS

- 6.13.1 KEY TECHNOLOGIES

- 6.13.1.1 Immersion cooling tank and enclosure design

- 6.13.1.2 Thermal interface optimization and hardware configuration

- 6.13.2 ADJACENT TECHNOLOGIES

- 6.13.2.1 Data center infrastructure management

- 6.13.2.2 Immersion-compatible hardware design

- 6.13.1 KEY TECHNOLOGIES

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 DOWNUNDER GEOSOLUTIONS ADOPTS IMMERSION COOLING TECHNOLOGY BY GREEN REVOLUTION COOLING

- 6.14.2 GREEN REVOLUTION COOLING AND TEXAS ADVANCED COMPUTING CENTER COLLABORATE TO ENHANCE SUPERCOMPUTER PERFORMANCE

- 6.15 TRADE ANALYSIS

- 6.15.1 IMPORT SCENARIO (HS CODE 2710)

- 6.15.2 EXPORT SCENARIO (HS CODE 2710)

- 6.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.17 INVESTMENT AND FUNDING SCENARIO

- 6.18 IMPACT OF GENERATIVE AI ON DATA CENTER IMMERSION COOLING FLUIDS MARKET

- 6.19 IMPACT OF 2025 US TARIFF ON DATA CENTER IMMERSION COOLING FLUIDS MARKET

- 6.19.1 KEY TARIFF RATES

- 6.19.2 PRICE IMPACT ANALYSIS

- 6.19.3 IMPACT ON COUNTRY/REGION

- 6.19.3.1 US

- 6.19.3.2 Europe

- 6.19.3.3 Asia Pacific

- 6.19.4 IMPACT ON APPLICATIONS (DATA CENTER TYPES)

- 6.19.4.1 Hyperscale data centers

- 6.19.4.2 AI/ML data centers

- 6.19.4.3 Cryptocurrency mining data centers

- 6.19.4.4 Others (Edge data centers and colocation data centers)

7 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MINERAL OIL

- 7.2.1 EASY AVAILABILITY AND LOW PRICE TO FUEL DEMAND

- 7.3 FLUOROCARBON-BASED FLUIDS

- 7.3.1 ASIA PACIFIC TO BE LARGEST MARKET FOR FLUOROCARBON-BASED FLUIDS

- 7.4 SYNTHETIC FLUIDS

- 7.4.1 LOW CORROSION PROPERTY TO FUEL DEMAND

- 7.5 OTHER TYPES

8 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY DATA CENTER TYPE

- 8.1 INTRODUCTION

- 8.2 HYPERSCALE DATA CENTERS

- 8.2.1 HIGH POWER DENSITY AND HEAT GENERATION TO DRIVE MARKET

- 8.3 AI/ML DATA CENTERS

- 8.3.1 SURGING AI/ML & HPC WORKLOADS TO DRIVE DEMAND FOR IMMERSION COOLING FLUIDS

- 8.4 CRYPTOCURRENCY MINING DATA CENTERS

- 8.4.1 ENERGY EFFICIENCY, EQUIPMENT LONGEVITY, AND SPATIAL OPTIMIZATION TO PROPEL MARKET

- 8.5 OTHER DATA CENTERS

9 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 SINGLE-PHASE COOLING

- 9.2.1 LOW MAINTENANCE AND COST-EFFECTIVENESS TO DRIVE MARKET

- 9.3 TWO-PHASE COOLING

- 9.3.1 RISING NEED FOR EFFICIENT, HIGH-PERFORMANCE COOLING IN HIGH-DENSITY SERVER ENVIRONMENTS TO DRIVE MARKET

10 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Supportive policy frameworks promoting green and energy-efficient infrastructure to drive market

- 10.2.2 INDIA

- 10.2.2.1 Significant deployment of data centers to increase demand for cooling fluids

- 10.2.3 JAPAN

- 10.2.3.1 Growing government initiatives and rising sustainability demands to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Government investments and technological advancements to fuel demand

- 10.2.5 AUSTRALIA

- 10.2.5.1 Extreme climate and cooling challenges to boost demand

- 10.2.6 MALAYSIA

- 10.2.6.1 Government incentives and digital initiatives to boost demand

- 10.2.7 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Technological innovations to drive market

- 10.3.2 CANADA

- 10.3.2.1 Increasing power density and high-performance computing to drive market

- 10.3.3 MEXICO

- 10.3.3.1 Expansion of e-commerce to support market growth

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Strong industrial and automotive sector to drive market

- 10.4.2 UK

- 10.4.2.1 Increasing demand for data storage and processing capabilities to drive market

- 10.4.3 FRANCE

- 10.4.3.1 Technological advancements and industry initiatives to propel market

- 10.4.4 NETHERLANDS

- 10.4.4.1 Regulatory and technological dynamics to boost demand

- 10.4.5 SPAIN

- 10.4.5.1 Sustainability incentives to fuel adoption

- 10.4.6 RUSSIA

- 10.4.6.1 Cryptocurrency mining and data sovereignty demands to accelerate immersion cooling adoption

- 10.4.7 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Transformation in digital infrastructure to support market growth

- 10.5.1.2 UAE

- 10.5.1.2.1 Hyperscale expansion and energy efficiency targets to support market growth

- 10.5.1.3 Rest of GCC Countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.3.1 REVENUE ANALYSIS OF TOP 5 PLAYERS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Technology footprint

- 11.6.5.4 Type footprint

- 11.6.5.5 Data center type footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT/SOLUTION LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 THE CHEMOURS COMPANY

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 FUCHS SE

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 SUBMER

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.3.3 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 THE LUBRIZOL CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 INVENTEC PERFORMANCE CHEMICALS

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 CASTROL LIMITED

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 SHELL PLC

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 GREEN REVOLUTION COOLING

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 ENGINEERED FLUIDS

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 CARGILL, INCORPORATED

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 VALVOLINE GLOBAL OPERATIONS

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.12 ENEOS CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 TOTALENERGIES

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.14 DYNALENE, INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 DCX LIQUID COOLING SYSTEMS

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.16 HONEYWELL INTERNATIONAL INC.

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches

- 12.1.17 EXXON MOBIL CORPORATION

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions/Services offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Product launches

- 12.1.17.3.2 Deals

- 12.1.18 DOW INC.

- 12.1.18.1 Business overview

- 12.1.18.2 Products/Solutions/Services offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Product launches

- 12.1.19 PETRONAS LUBRICANTS INTERNATIONAL

- 12.1.19.1 Business overview

- 12.1.19.2 Products/Solutions/Services offered

- 12.1.20 OLEON NV

- 12.1.20.1 Business overview

- 12.1.20.2 Products/Solutions/Services offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Product launches

- 12.1.1 THE CHEMOURS COMPANY

- 12.2 OTHER PLAYERS

- 12.2.1 SANMING HEXAFLUO CHEMICALS CO., LTD.

- 12.2.2 GUANGDONG GIANT FLUORINE ENERGY SAVING TECHNOLOGY CO., LTD.

- 12.2.3 ZHEJIANG NOAH FLUOROCHEMICAL CO., LTD

- 12.2.4 FLUOREZ TECHNOLOGY INC.

- 12.2.5 SHENZHEN HUAYI BROTHER TECHNOLOGY CO., LTD.

- 12.2.6 AMER TECHNOLOGY CO., LTD.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 INTERCONNECTED MARKETS

- 13.3.1 IMMERSION COOLING FLUIDS MARKET

- 13.3.1.1 Market definition

- 13.3.1.2 Market overview

- 13.3.1.3 Immersion cooling fluids market, by technology

- 13.3.1.3.1 Single-phase cooling

- 13.3.1.3.1.1 Cost-effective method requiring limited maintenance

- 13.3.1.3.2 Two-phase cooling

- 13.3.1.3.2.1 More complex and expensive immersion cooling system

- 13.3.1.3.1 Single-phase cooling

- 13.3.1 IMMERSION COOLING FLUIDS MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 DATA CENTER IMMERSION COOLING FLUIDS MARKET SNAPSHOT, 2025 VS. 2032

- TABLE 2 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2021-2023 (%)

- TABLE 3 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2021-2023 (%)

- TABLE 4 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2021-2023 (%)

- TABLE 5 FOREIGN DIRECT INVESTMENT, BY COUNTRY/REGION, 2022 VS. 2023 (USD BILLION)

- TABLE 6 PARTNERS OF MAJOR IMMERSION COOLING SOLUTION PROVIDERS

- TABLE 7 ROLE OF COMPANIES IN DATA CENTER IMMERSION COOLING FLUIDS ECOSYSTEM

- TABLE 8 DATA CENTER IMMERSION COOLING FLUIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 10 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 11 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY REGION, 2024 (USD/LITER)

- TABLE 12 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY COMPANY, 2024 (USD/LITER)

- TABLE 13 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY TECHNOLOGY, 2024 (USD/LITER)

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 STANDARDS RELATED TO DATA CENTER IMMERSION COOLING FLUIDS

- TABLE 18 DATA CENTER IMMERSION COOLING FLUIDS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 DATA CENTER IMMERSION COOLING FLUIDS MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 20 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 21 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 22 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 23 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 24 MINERAL OIL: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 25 MINERAL OIL: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 26 MINERAL OIL: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (THOUSAND LITERS)

- TABLE 27 MINERAL OIL: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (THOUSAND LITERS)

- TABLE 28 FLUOROCARBON-BASED FLUIDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 29 FLUOROCARBON-BASED FLUIDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 30 FLUOROCARBON-BASED FLUIDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (THOUSAND LITERS)

- TABLE 31 FLUOROCARBON-BASED FLUIDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2023-2030 (THOUSAND LITERS)

- TABLE 32 SYNTHETIC FLUIDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 33 SYNTHETIC FLUIDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 34 SYNTHETIC FLUIDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (THOUSAND LITERS)

- TABLE 35 SYNTHETIC FLUIDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (THOUSAND LITERS)

- TABLE 36 OTHER TYPES: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 37 OTHER TYPES: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 38 OTHER TYPES: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (THOUSAND LITERS)

- TABLE 39 OTHER TYPES: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (THOUSAND LITERS)

- TABLE 40 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY DATA CENTER TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 41 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY DATA CENTER TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 42 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND LITERS)

- TABLE 43 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2025-2032 (THOUSAND LITERS)

- TABLE 44 SINGLE-PHASE COOLING: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (THOUSAND LITERS)

- TABLE 45 SINGLE-PHASE COOLING: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (THOUSAND LITERS)

- TABLE 46 TWO-PHASE COOLING: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (THOUSAND LITERS)

- TABLE 47 TWO-PHASE COOLING: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (THOUSAND LITERS)

- TABLE 48 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (THOUSAND LITERS)

- TABLE 49 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (THOUSAND LITERS)

- TABLE 50 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 51 DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

- TABLE 52 ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 53 ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 54 ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 55 ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 56 ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND LITERS)

- TABLE 57 ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2025-2032 (THOUSAND LITERS)

- TABLE 58 CHINA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 59 CHINA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 60 CHINA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 61 CHINA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 62 INDIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 63 INDIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 64 INDIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 65 INDIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 66 JAPAN: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 67 JAPAN: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 68 JAPAN: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 69 JAPAN: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 70 SOUTH KOREA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 71 SOUTH KOREA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 72 SOUTH KOREA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 73 SOUTH KOREA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 74 AUSTRALIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 75 AUSTRALIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 76 AUSTRALIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 77 AUSTRALIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 78 MALAYSIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 79 MALAYSIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 80 MALAYSIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 81 MALAYSIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 82 REST OF ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 83 REST OF ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 84 REST OF ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 85 REST OF ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 86 NORTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 87 NORTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 88 NORTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 89 NORTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 90 NORTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND LITERS)

- TABLE 91 NORTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2025-2032 (THOUSAND LITERS)

- TABLE 92 US: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 93 US: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 94 US: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 95 US: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 96 CANADA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 97 CANADA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 98 CANADA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 99 CANADA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 100 MEXICO: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 101 MEXICO: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 102 MEXICO: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 103 MEXICO: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 104 EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 105 EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 106 EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 107 EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 108 EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND LITERS)

- TABLE 109 EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2025-2032 (THOUSAND LITERS)

- TABLE 110 GERMANY: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 111 GERMANY: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 112 GERMANY: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 113 GERMANY: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 114 UK: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 115 UK: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 116 UK: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 117 UK: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 118 FRANCE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 119 FRANCE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 120 FRANCE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 121 FRANCE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 122 NETHERLANDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 123 NETHERLANDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 124 NETHERLANDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 125 NETHERLANDS: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 126 SPAIN: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 127 SPAIN: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 128 SPAIN: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 129 SPAIN: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 130 RUSSIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 131 RUSSIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 132 RUSSIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 133 RUSSIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 134 REST OF EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 135 REST OF EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 136 REST OF EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 137 REST OF EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 138 MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 139 MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 140 MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 141 MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 142 MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND LITERS)

- TABLE 143 MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2025-2032 (THOUSAND LITERS)

- TABLE 144 SAUDI ARABIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 145 SAUDI ARABIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 146 SAUDI ARABIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 147 SAUDI ARABIA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 148 UAE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 149 UAE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 150 UAE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 151 UAE: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 152 REST OF GCC COUNTRIES: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 153 REST OF GCC COUNTRIES: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 154 REST OF GCC COUNTRIES: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 155 REST OF GCC COUNTRIES: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 158 REST OF MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 159 REST OF MIDDLE EAST & AFRICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 160 SOUTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (THOUSAND LITERS)

- TABLE 161 SOUTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (THOUSAND LITERS)

- TABLE 162 SOUTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2022-2024 (USD THOUSAND)

- TABLE 163 SOUTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

- TABLE 164 SOUTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2022-2024 (THOUSAND LITERS)

- TABLE 165 SOUTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2025-2032 (THOUSAND LITERS)

- TABLE 166 DATA CENTER IMMERSION COOLING FLUIDS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 167 DATA CENTER IMMERSION COOLING FLUIDS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 168 DATA CENTER IMMERSION COOLING FLUIDS MARKET: REGION FOOTPRINT

- TABLE 169 DATA CENTER IMMERSION COOLING FLUIDS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 170 DATA CENTER IMMERSION COOLING FLUIDS MARKET: TYPE FOOTPRINT

- TABLE 171 DATA CENTER IMMERSION COOLING FLUIDS MARKET: DATA CENTER TYPE FOOTPRINT

- TABLE 172 DATA CENTER IMMERSION COOLING FLUIDS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 173 DATA CENTER IMMERSION COOLING FLUIDS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 174 DATA CENTER IMMERSION COOLING FLUIDS MARKET: PRODUCT/SOLUTION LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 175 DATA CENTER IMMERSION COOLING FLUIDS MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 176 THE CHEMOURS COMPANY: COMPANY OVERVIEW

- TABLE 177 THE CHEMOURS COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 THE CHEMOURS COMPANY: PRODUCT LAUNCHES

- TABLE 179 THE CHEMOURS COMPANY: DEALS

- TABLE 180 FUCHS SE: COMPANY OVERVIEW

- TABLE 181 FUCHS SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 SUBMER: COMPANY OVERVIEW

- TABLE 183 SUBMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 SUBMER: DEALS

- TABLE 185 SUBMER: EXPANSIONS

- TABLE 186 SUBMER: OTHER DEVELOPMENTS

- TABLE 187 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 188 THE LUBRIZOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 THE LUBRIZOL CORPORATION: DEALS

- TABLE 190 INVENTEC PERFORMANCE CHEMICALS: COMPANY OVERVIEW

- TABLE 191 INVENTEC PERFORMANCE CHEMICALS: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 192 CASTROL LIMITED: COMPANY OVERVIEW

- TABLE 193 CASTROL LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 CASTROL LIMITED: DEALS

- TABLE 195 SHELL PLC: COMPANY OVERVIEW

- TABLE 196 SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 SHELL PLC: PRODUCT LAUNCHES

- TABLE 198 SHELL PLC: DEALS

- TABLE 199 GREEN REVOLUTION COOLING: COMPANY OVERVIEW

- TABLE 200 GREEN REVOLUTION COOLING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 GREEN REVOLUTION COOLING: DEALS

- TABLE 202 ENGINEERED FLUIDS: COMPANY OVERVIEW

- TABLE 203 ENGINEERED FLUIDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 205 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 VALVOLINE GLOBAL OPERATIONS: COMPANY OVERVIEW

- TABLE 207 VALVOLINE GLOBAL OPERATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 ENEOS CORPORATION: COMPANY OVERVIEW

- TABLE 209 ENEOS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 TOTALENERGIES: COMPANY OVERVIEW

- TABLE 211 TOTALENERGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 TOTALENERGIES: DEALS

- TABLE 213 DYNALENE, INC.: COMPANY OVERVIEW

- TABLE 214 DYNALENE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 DCX LIQUID COOLING SYSTEMS: COMPANY OVERVIEW

- TABLE 216 DCX LIQUID COOLING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 218 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 220 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 221 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 EXXON MOBIL CORPORATION: PRODUCT LAUNCHES

- TABLE 223 EXXON MOBIL CORPORATION: DEALS

- TABLE 224 DOW INC.: COMPANY OVERVIEW

- TABLE 225 DOW INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 DOW INC.: PRODUCT LAUNCHES

- TABLE 227 PETRONAS LUBRICANTS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 228 PETRONAS LUBRICANTS INTERNATIONAL: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 229 OLEON NV: COMPANY OVERVIEW

- TABLE 230 OLEON NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 OLEON NV: PRODUCT LAUNCHES

- TABLE 232 SANMING HEXAFLUO CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 233 GUANGDONG GIANT FLUORINE ENERGY SAVING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 234 ZHEJIANG NOAH FLUOROCHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 235 FLUOREZ TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 236 SHENZHEN HUAYI BROTHER TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 237 AMER TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 238 IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2019-2022 (USD THOUSAND)

- TABLE 239 IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2023-2030 (USD THOUSAND)

- TABLE 240 IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2019-2022 (THOUSAND LITERS)

- TABLE 241 IMMERSION COOLING FLUIDS MARKET, BY TECHNOLOGY, 2023-2030 (THOUSAND LITERS)

List of Figures

- FIGURE 1 DATA CENTER IMMERSION COOLING FLUIDS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DATA CENTER IMMERSION COOLING FLUIDS MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR DATA CENTER IMMERSION COOLING FLUIDS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF DATA CENTER IMMERSION COOLING FLUIDS MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF DATA CENTER IMMERSION COOLING FLUIDS MARKET (2/2)

- FIGURE 8 DATA CENTER IMMERSION COOLING FLUIDS MARKET: DATA TRIANGULATION

- FIGURE 9 SYNTHETIC FLUIDS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 AI/ML DATA CENTERS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 12 AI/ML DATA CENTERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 SINGLE-PHASE COOLING SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 SINGE-PHASE COOLING SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 15 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD (2025-2032)

- FIGURE 16 DATA CENTER IMMERSION COOLING FLUIDS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 COUNTRIES WITH HIGHEST NUMBER OF DATA CENTERS, 2022 VS. 2024

- FIGURE 18 PREFERRED COOLING TECHNOLOGIES

- FIGURE 19 POWER DENSITY BY DEVELOPMENT TYPE (KW PER RACK)

- FIGURE 20 LIQUID COOLING CRUCIAL FOR HIGH-DENSITY RACKS, WITH IMMERSION COOLING FAVORED FOR THERMAL MANAGEMENT ABOVE 150 KW PER RACK

- FIGURE 21 GLOBAL DATA CENTER POWER USAGE EFFECTIVENESS (PUE)

- FIGURE 22 EVOLUTION OF DATA CENTER COOLING AND IMMERSION COOLING

- FIGURE 23 DATA CENTER IMMERSION COOLING FLUIDS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 DATA CENTER IMMERSION COOLING FLUIDS MARKET: ECOSYSTEM MAPPING

- FIGURE 25 DATA CENTER IMMERSION COOLING FLUIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DATA CENTER TYPE

- FIGURE 27 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 28 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY REGION, 2024 (USD/LITER)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY KEY PLAYER, 2024 (USD/LITER)

- FIGURE 30 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY TECHNOLOGY, 2024 (USD/LITER)

- FIGURE 31 LIST OF MAJOR PATENTS RELATED TO DATA CENTER IMMERSION COOLING FLUIDS, 2014-2024

- FIGURE 32 IMPORT DATA RELATED TO HS CODE 2710-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 33 EXPORT DATA RELATED TO HS CODE 2710-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 34 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 35 SYNTHETIC FLUIDS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 36 CRYPTOCURRENCY MINING DATA CENTERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 SINGLE-PHASE COOLING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC: DATA CENTER IMMERSION COOLING FLUIDS MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: DATA CENTER IMMERSION COOLING FLUIDS MARKET SNAPSHOT

- FIGURE 41 EUROPE: DATA CENTER IMMERSION COOLING FLUIDS MARKET SNAPSHOT

- FIGURE 42 DATA CENTER IMMERSION COOLING FLUIDS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2024 (USD BILLION)

- FIGURE 43 DATA CENTER IMMERSION COOLING FLUIDS MARKET SHARE ANALYSIS, 2024

- FIGURE 44 DATA CENTER IMMERSION COOLING FLUIDS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 45 DATA CENTER IMMERSION COOLING FLUIDS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 DATA CENTER IMMERSION COOLING FLUIDS MARKET: COMPANY FOOTPRINT

- FIGURE 47 DATA CENTER IMMERSION COOLING FLUIDS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 DATA CENTER IMMERSION COOLING FLUIDS MARKET: EV/EBITDA

- FIGURE 49 DATA CENTER IMMERSION COOLING FLUIDS MARKET: ENTERPRISE VALUE (USD BILLION)

- FIGURE 50 DATA CENTER IMMERSION COOLING FLUIDS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 51 THE CHEMOURS COMPANY: COMPANY SNAPSHOT

- FIGURE 52 FUCHS SE: COMPANY SNAPSHOT

- FIGURE 53 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 54 ENEOS CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 TOTALENERGIES: COMPANY SNAPSHOT

- FIGURE 56 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 57 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 DOW INC.: COMPANY SNAPSHOT