|

市场调查报告书

商品编码

1830051

全球资料中心 CDU 市场按类型、冷却类型、最终用户和地区划分,预测至 2032 年Data Center Coolant Distribution Units Market by Type (In-Row, In-Rack, FDU), Cooling Type (Direct to Chip Cooling, Immersion Cooling), End User (Colocation Providers, Enterprises, Hyperscale), and Region Global Forecast to 2032 |

||||||

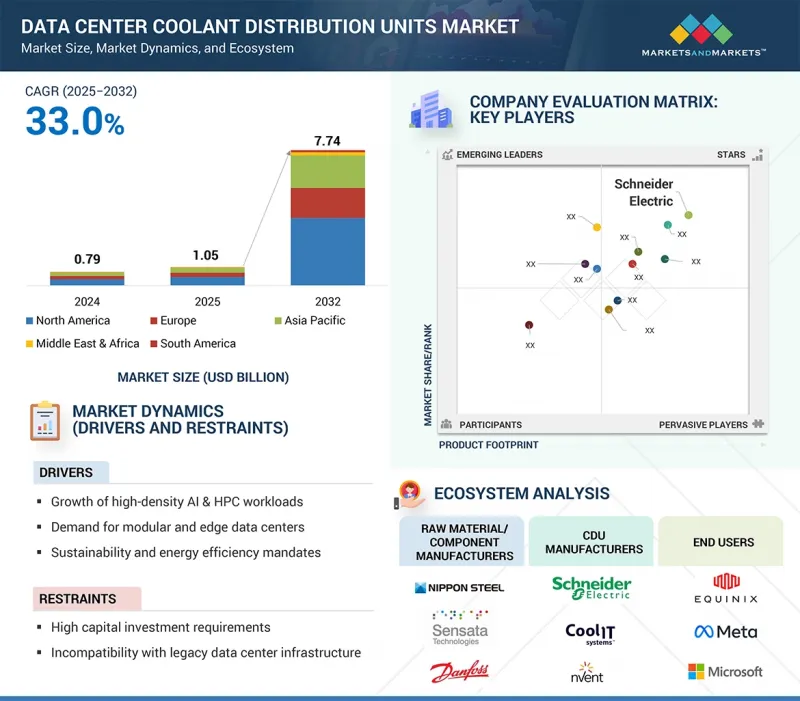

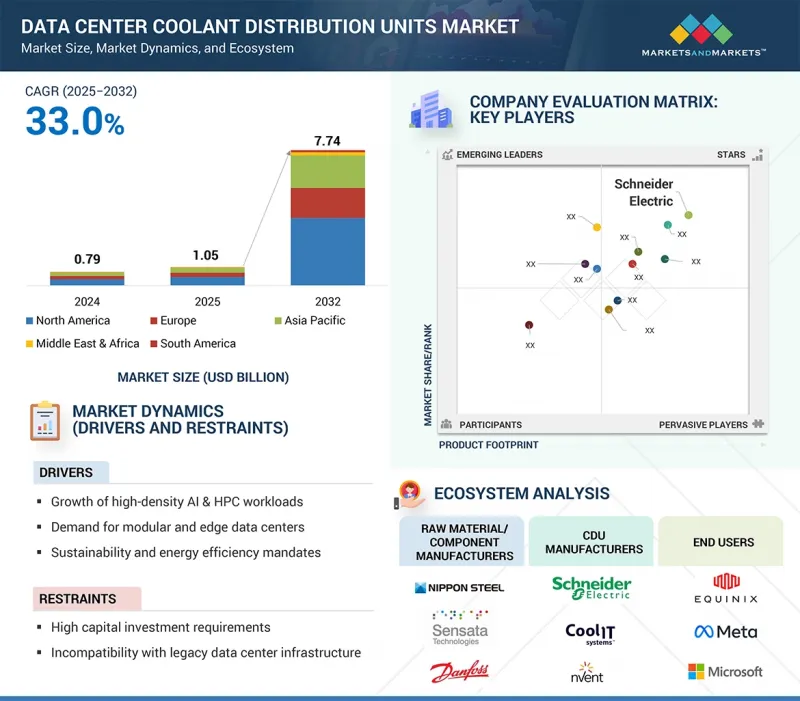

全球资料中心 CDU 市场预计将从 2025 年的 10.5 亿美元成长到 2032 年的 77.4 亿美元,预测期内的复合年增长率为 33.0%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 单元 | 100万美元 |

| 部分 | 类型、冷却类型、製程、冷却能力、资料中心类型、最终用户、地区 |

| 目标区域 | 亚太地区、欧洲、北美、中东和非洲、南美 |

作为液冷系统的关键组件,冷分配单元 (CDU) 将设施级冷却基础设施与 IT 设备连接起来,以高效地从源头散热。它们有助于实现精准冷却、提高机架密度并优化能源利用,使其成为下一代资料中心的首选解决方案,从而推动了全球 CDU 市场在超大规模、主机託管、企业和边缘资料中心的快速成长。

“预测期内,FDU 部分将实现最高的复合年增长率。”

预计在预测期内,落地式配电单元 (FDU) 市场将以最快的复合年增长率成长,这得益于超大规模资料中心和企业资料中心高密度机架的部署日益增多。 FDU 具有高製冷能力、扩充性以及支援大型 IT 负载的能力,使其成为运行人工智慧、高效能运算 (HPC) 和云端密集型工作负载的设施的理想选择。 FDU 的设计旨在与设施级冷冻水系统紧密连接,从而实现精确可靠的散热。北美、欧洲和亚太地区对资料中心的大量投资,以及向节能永续製冷解决方案的转变,正在推动 FDU 的普及。

“在预测期内,直接晶片冷却部分将实现最高的复合年增长率。”

预计直接晶片冷却领域在预测期内将以最高的复合年增长率成长,这得益于其能够直接从 AI 工作负载、HPC 和高级云端运算设定中使用的高效能处理器和 GPU 中散热。直接晶片冷却解决方案在源头温度控管方面的效率超过了传统的空气冷却,支援更高的机架密度和整体系统性能。这一领域的成长主要得益于 AI 驱动的资料中心、大规模 HPC 部署和企业数位转型计画的兴起。超大规模和主机代管供应商正在北美、欧洲和亚太等地区大力投资液体冷却基础设施,进一步推动了该技术的采用。直接晶片冷却技术符合全球永续性和能源效率目标。 DTC 冷却不仅可以降低功耗,还可以提高运作可靠性,使其成为下一代资料中心最受欢迎的冷却技术之一。

超大规模资料中心将在预测期内实现最高的复合年增长率。

受人工智慧、高效能运算 (HPC) 和巨量资料应用的快速扩张以及全球云端服务提供商的大规模投资推动,超大规模资料中心市场预计将在预测期内实现最高的复合年增长率。超大规模资料中心的机架密度和电力需求都很高,传统的风冷方法已无法满足需求。因此,超大规模营运商越来越多地采用冷分散式机组 (CDU) 来实现高效的液体冷却、优化能源利用,并确保数千台伺服器的可靠热温度控管。随着营运商致力于在实现永续性目标的同时扩大规模,北美、欧洲和亚太等地区的采用正在加速。冷分散式机组 (CDU) 正成为下一代超大规模资料中心的关键技术,有效支援提高热效率并降低营运成本。

“预测期内,北美将占据最大的市场份额。”

预计北美将在预测期内占据资料中心冷分配单元 (CDU) 市场的最大份额,这主要得益于其成熟的超大规模、主机託管和企业资料中心生态系统。美国是云端运算和人工智慧驱动基础设施领域的领先国家之一,也是Google、微软、亚马逊和 Meta 等主要液冷公司的所在地。这些公司正在大力投资液冷技术的开发和应用,以满足对机架密度和能源效率要求更高的应用需求。

本报告分析了全球资料中心 CDU 市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 资料中心CDU市场中的诱人机会

- 资料中心冷却单元 (CDU) 市场(按冷却类型)

- 资料中心 CDU 市场(依最终用途划分)

- 北美资料中心 CDU 市场(按技术和国家划分)

- 资料中心 CDU 市场主要国家

第五章 市场概况

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

第六章 产业趋势

- 波特五力分析

- 主要相关利益者和采购标准

- 价值链分析

- 原物料供应商

- 零件製造商

- 系统组装商/CDU製造商

- OEM/系统整合商

- 最终用途

- 生态系分析

- 技术分析

- 主要技术

- 邻近技术

- 互补技术

- 案例研究分析

- 专利分析

- 定价分析

- 各地区资料中心浸入式冷却液平均售价趋势(2024年)

- 主要企业资料中心CDU平均售价趋势(2024年)

- 资料中心 CDU 平均售价趋势(按类型划分)(2024 年)

- 监管格局

- 大型会议和活动(2025年)

- 影响客户业务的趋势/中断

- 全球宏观经济展望

- 投资金筹措场景

- 2025年美国关税的影响

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 美国

- 欧洲

- 亚太地区

- 对终端产业的影响

- 人工智慧/生成式人工智慧的影响

- 介绍

- 人工智慧基础设施热负载快速增加

- 人工智慧增强型 CDU 智慧和控制

- 预测性维护和故障检测

- CDU 设计与模拟中的生成式 AI

- DCIM整合与智慧冷却编配

- CDU 市场机会与 AI 需求一致

第 7 章:资料中心 CDU 市场(按类型)

- 介绍

- 低基民盟

- 机架内 CDU

- 设施分配单位

8. 资料中心冷却单元 (CDU) 市场(按冷却类型)

- 介绍

- Direct to Chip Cooling

- 浸入式冷却

9. 资料中心CDU市场(依最终用途)

- 介绍

- 主机代管服务提供者

- 企业

- 超大规模资料中心

第 10 章:资料中心 CDU 市场(按流程)

- 介绍

- Liquid to Liquid CDU

- Liquid to Air CDU

第 11 章:资料中心 CDU 市场(按冷却能力)

- 介绍

- 小型基民盟

- 中型基民盟

- 大型基民盟

第 12 章:资料中心 CDU 市场(依资料中心类型)

- 介绍

- 中小型资料中心

- 大型资料中心

第 13 章:资料中心 CDU 市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 亚太地区

- 中国

- 韩国

- 日本

- 印度

- 马来西亚

- 新加坡

- 澳洲

- 其他亚太地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 南美洲其他地区

第十四章竞争格局

- 介绍

- 主要参与企业的策略/优势

- 收益分析

- 市占率分析(2024年)

- 市占率分析

- 主要市场公司排名(2024年)

- 品牌/产品比较

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

- 公司估值及财务指标

第十五章 公司简介

- 主要企业

- DCX LIQUID COOLING SYSTEMS

- NVENT

- SCHNEIDER ELECTRIC

- VERTIV GROUP CORP.

- DELTA ELECTRONICS, INC.

- NIDEC CORPORATION

- KAORI HEAT TREATMENT CO., LTD.

- SHENZHEN ENVICOOL TECHNOLOGY CO., LTD

- BOYD.

- COOLCENTRIC

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- LIQUIDSTACK HOLDING BV

- SHANGHAI VENTTECH REFRIGERATION EQUIPMENT CO., LTD.

- CHILLDYNE, INC.

- COOLIT SYSTEMS.

- MUNTERS GROUP AB

- TRANE TECHNOLOGIES PLC

- SUPER MICRO COMPUTER, INC

- LENOVO

- STULZ GMBH

- RITTAL GMBH & CO. KG

- LITE-ON TECHNOLOGY CORPORATION

- FLAKTGROUP

- NAUTILUS DATA TECHNOLOGIES

- 其他公司

- NORTEK AIR SOLUTIONS, LLC.

- JETCOOL TECHNOLOGIES INC

- ENVIRONMENTAL AIR SYSTEMS

- LENNOX

- EXCOOL LTD.

- AIREDALE INTERNATIONAL AIR CONDITIONING LTD.

- ATTOM TECHNOLOGY

- LNEYA THERMO REFRIGERATION CO., LTD.

- CANATEC PTE LTD.

第16章:相邻市场与相关市场

- 介绍

- 限制

- 资料中心 CDU 市场的互连市场

- 资料中心冷却市场:全球预测(2030 年左右)

- 市场定义

- 市场概况

- 浸入式冷却市场:全球预测(CDU 2031)

- 市场定义

- 市场概况

第十七章 附录

The global data center coolant distribution units market is projected to grow from USD 1.05 billion in 2025 to USD 7.74 billion by 2032, at a CAGR of 33.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) |

| Segments | Type, Cooling Type, Process, Capacity, Data Center Type, End User, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

Coolant distribution units act as an important component in liquid cooling systems, connecting the facility-level cooling infrastructure with the IT equipment to efficiently remove heat at the source. They support the delivery of precision cooling, higher rack densities, and optimized energy use. This makes them a preferred solution in next-generation data centers. Consequently, this fuels the rapid growth of the global coolant distribution units market in hyperscale, colocation, enterprise, and edge facilities.

"FDU segment to register highest CAGR during forecast period"

The Floor-Mounted Distribution Unit (FDU) segment is expected to grow at the fastest CAGR during the forecast period due to increasing deployments of high-density racks in hyperscale and enterprise data centers. FDUs offer high cooling capacity, scalability, and the ability to support large IT loads, making them ideal for facilities that perform AI, HPC, and cloud-intensive workloads. They are designed to connect closely with facility-level chilled water systems, which makes them well-suited for precise and reliable heat removal. Large investments in data centers across North America, Europe, and Asia-Pacific, combined with a shift toward energy-efficient and sustainable cooling solutions, have driven the adoption of FDUs.

"Direct to Chip Cooling segment to record highest CAGR during forecast period"

The Direct to Chip Cooling segment is projected to grow at the highest CAGR during the forecast period, driven by its ability to remove heat directly from high-performance processors and GPUs used in AI workloads, HPC, and advanced cloud computing setups. The efficiency of direct to chip cooling solutions surpasses traditional air cooling for thermal management at the source, supporting higher-density racks and overall system performance. The growth of this segment is largely due to the rise of AI-powered data centers, large-scale HPC deployments, and digital transformation initiatives by enterprises. Regions such as North America, Europe, and Asia-Pacific are further boosting adoption, with hyperscale and colocation providers investing heavily in liquid-cooling infrastructure. Direct to chip cooling technologies align with global sustainability and energy-efficiency goals. Besides reducing power consumption, DTC cooling improves operational reliability, making it one of the most in-demand cooling technologies in next-generation data centers.

Hyperscale data centers to record highest CAGR during forecast period"

The Hyperscale Data Center segment is expected to grow at the highest CAGR during the forecast period, driven by rapid expansion in AI, HPC, big data applications, and significant investments from global cloud providers. Traditional air-cooling methods are proving inadequate as hyperscale data centers operate with high rack densities and power demands. Therefore, hyperscale operators are adopting more coolant distribution units to enable efficient liquid cooling, optimize energy use, and ensure reliable heat management for thousands of servers. Regions such as North America, Europe, and Asia-Pacific are leading the way in adoption, as operators aim to scale up while meeting sustainability goals. Coolant distribution units are becoming a crucial technology for next-generation hyperscale data centers, effectively supporting improved thermal efficiency and lowering operating costs.

"North America to account for maximum market share during forecast period"

North America is expected to hold the largest share of the data center coolant distribution units market during the forecast period, primarily due to the well-established ecosystem of hyperscale, colocation, and enterprise data centers. The US is one of the top countries for cloud adoption and AI-driven infrastructure and hosts some of the major liquid-cooling companies, such as Google, Microsoft, Amazon, and Meta, which heavily invest in developing and adopting liquid-cooling technologies for applications requiring higher rack densities and energy efficiency. Additionally, the strong regulatory focus on sustainability and carbon reduction, along with the availability of advanced cooling technologies and robust infrastructure, further strengthen North America's position in this market. Favorable investment trends, rapid digitalization of sectors, and early adoption of next-generation liquid-cooling technology ensure that North America will continue to dominate the data center coolant distribution units market throughout the forecast period.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level- 30%, Director Level- 40%, and Others - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 35%, South America - 5%, and Middle East & Africa - 5%

Schneider Electric (France), Vertiv Group Corp. (US), Delta Electronics, Inc. (Taiwan), nVent (US), and DCX Liquid Cooling Systems (Poland) are some of the major players in the data center coolant distribution units market. These companies have adopted strategies such as product launches, acquisitions, collaborations, and expansion to grow their market share and revenue.

Research Coverage

The report defines, segments, and estimates the size of the data center coolant distribution units market based on type, cooling type, end user, and region. It strategically profiles key players and thoroughly analyzes their market share and core competencies. It also monitors and examines competitive developments, such as new product development, collaborations, partnerships, acquisitions, and expansions that they undertake in the market.

Reasons to Buy the Report

The report is intended to help both market leaders and new entrants by providing close estimates of revenue figures for the data center coolant distribution units and their segments. It aims to assist stakeholders in understanding the market's competitive landscape, gaining insights to strengthen their business positions, and developing effective go-to-market strategies. Additionally, it enables stakeholders to understand market trends and provides information on key drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of critical drivers (Growth of high-density AI & HPC workloads), restraints (High capital investments), opportunities (AI-based cooling control and predictive optimization), and challenges (precision control and flow management complexity) influencing the growth of the data center coolant distribution units.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the data center coolant distribution units.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the data center coolant distribution units across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the data center coolant distribution units.

- Competitive Assessment: Comprehensive analysis of market shares, growth strategies, and product offerings of leading companies such as DCX Liquid Cooling Systems (Poland), nVent (US), NIDEC CORPORATION (Japan), Schneider Electric (France), Vertiv Group Corp (US), KAORI HEAT TREATMENT CO., LTD. (Taiwan), Shenzhen Envicool Technology Co., Ltd. (China), Boyd (US), Delta Electronics Inc. (Taiwan), Coolcentric (US), Hewlett Packard Enterprise Development LP (US), LiquidStack Holding B.V. (US), Shanghai Venttech Refrigeration Equipment Co., Ltd. (China), Chilldyne Inc. (US), COOLIT SYSTEMS (Canada), Trane (Ireland), Munters Group AB (Sweden), Lenovo (China), Super Micro Computer Inc. (US), STULZ GMBH (Germany), Rittal GmbH & Co. KG (Germany), LITE-ON Technology Corporation (Taiwan), FlaktGroup (Germany), and Nautilus Data Technologies (US) in the data center coolant distribution units.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 CALCULATION FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DATA CENTER COOLANT DISTRIBUTION UNITS MARKET

- 4.2 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE

- 4.3 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE

- 4.4 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TECHNOLOGY AND COUNTRY

- 4.5 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Growth of high-density AI & HPC workloads

- 5.1.1.2 Demand for modular and edge data centers

- 5.1.1.3 Sustainability and energy efficiency mandates

- 5.1.2 RESTRAINTS

- 5.1.2.1 High capital investment

- 5.1.2.2 Incompatibility with legacy data center infrastructure

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Integration with waste heat recovery systems

- 5.1.3.2 Innovation in nanofluids and next-generation coolants

- 5.1.3.3 AI-based cooling control and predictive optimization

- 5.1.4 CHALLENGES

- 5.1.4.1 Precision control and flow management complexity

- 5.1.4.2 Integration with diverse cooling architectures

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF BUYERS

- 6.1.4 BARGAINING POWER OF SUPPLIERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 COMPONENT MANUFACTURERS

- 6.3.3 SYSTEM ASSEMBLERS/COOLANT DISTRIBUTION UNITS MANUFACTURERS

- 6.3.4 OEMS/SYSTEM INTEGRATORS

- 6.3.5 END USE

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGY

- 6.5.1.1 Direct-to-Chip Liquid Cooling (D2C)

- 6.5.1.2 Two-Phase Liquid Cooling

- 6.5.2 ADJACENT TECHNOLOGY

- 6.5.2.1 Immersion Cooling Systems

- 6.5.2.2 Rear Door Heat Exchangers (RDHx)

- 6.5.3 COMPLEMENTARY TECHNOLOGY

- 6.5.3.1 Advanced Thermal Interface Materials

- 6.5.3.2 Thermal Interface Materials (TIMs)

- 6.5.1 KEY TECHNOLOGY

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 IMPACT OF COOLANT DISTRIBUTION DESIGN ON SERVER-LEVEL THERMAL MANAGEMENT IN DATA CENTERS

- 6.6.1.1 Objective

- 6.6.1.2 Solution Statement

- 6.6.2 COMMISSIONING OF LIQUID-TO-AIR COOLANT DISTRIBUTION UNITS FOR DIRECT-TO-CHIP DATA CENTER COOLING

- 6.6.2.1 Objective

- 6.6.2.2 Solution Statement

- 6.6.1 IMPACT OF COOLANT DISTRIBUTION DESIGN ON SERVER-LEVEL THERMAL MANAGEMENT IN DATA CENTERS

- 6.7 PATENT ANALYSIS

- 6.7.1 METHODOLOGY

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY REGION, 2024

- 6.8.2 AVERAGE SELLING PRICE TREND OF DATA CENTER COOLANT DISTRIBUTION UNITS, BY KEY PLAYER, 2024

- 6.8.3 AVERAGE SELLING PRICE TREND OF DATA CENTER COOLANT DISTRIBUTION UNITS, BY TYPE, 2024

- 6.9 REGULATORY LANDSCAPE

- 6.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES & EVENTS IN 2025

- 6.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.12 GLOBAL MACROECONOMIC OUTLOOK

- 6.12.1 GDP

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 IMPACT OF 2025 US TARIFF

- 6.14.1 INTRODUCTION

- 6.15 KEY TARIFF RATES

- 6.16 PRICE IMPACT ANALYSIS

- 6.17 IMPACT ON COUNTRY/REGION

- 6.17.1 US

- 6.17.2 EUROPE

- 6.17.3 ASIA PACIFIC

- 6.18 IMPACT ON END-USE INDUSTRIES

- 6.19 IMPACT OF AI/GEN AI

- 6.19.1 INTRODUCTION

- 6.19.2 SURGE IN THERMAL LOAD FROM AI INFRASTRUCTURE

- 6.19.3 AI-ENHANCED COOLANT DISTRIBUTION UNITS INTELLIGENCE AND CONTROL

- 6.19.4 PREDICTIVE MAINTENANCE AND FAULT DETECTION

- 6.19.5 GENERATIVE AI IN COOLANT DISTRIBUTION UNITS DESIGN AND SIMULATION

- 6.19.6 DCIM INTEGRATION AND SMART COOLING ORCHESTRATION

- 6.19.7 COOLANT DISTRIBUTION UNITS MARKET OPPORTUNITY ALIGNED WITH AI DEMAND

7 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 IN-ROW COOLANT DISTRIBUTION UNITS

- 7.2.1 SPACE-SAVING COOLING SOLUTION WITH TARGETED EFFICIENCY TO SUPPORT HIGH-DENSITY DATA CENTER GROWTH

- 7.3 IN-RACK COOLANT DISTRIBUTION UNITS

- 7.3.1 RACK-INTEGRATED COOLING FOR PRECISION FLOW CONTROL IN HIGH-DENSITY DATA CENTERS

- 7.4 FACILITY DISTRIBUTION UNITS

- 7.4.1 HIGH-CAPACITY COOLING INFRASTRUCTURE FOR FACILITY-WIDE LIQUID-COOLED DATA CENTERS

8 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE

- 8.1 INTRODUCTION

- 8.2 DIRECT TO CHIP COOLING

- 8.2.1 COMPACT COOLING ARCHITECTURE ACCELERATES INTEGRATION IN HIGH-DENSITY RACKS

- 8.3 IMMERSION COOLING

- 8.3.1 IMMERSION COOLING ARCHITECTURE ACCELERATING DEPLOYMENT IN HIGH-DENSITY COMPUTE ENVIRONMENTS

9 DATA CENTER COOLANT DISTRIBUTION MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 COLOCATION PROVIDERS

- 9.2.1 ENABLING FLEXIBLE COOLING FOR MULTI-TENANT HIGH-DENSITY ENVIRONMENTS

- 9.3 ENTERPRISES

- 9.3.1 HYBRID COOLING TRANSITIONS ACCELERATING ADOPTION

- 9.4 HYPERSCALE DATA CENTERS

- 9.4.1 IMMERSION AND DIRECT-TO-CHIP ARCHITECTURES ACCELERATING DEMAND

10 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY PROCESS

- 10.1 INTRODUCTION

- 10.2 LIQUID-TO-LIQUID COOLANT DISTRIBUTION UNITS

- 10.2.1 RISING ADOPTION OF IMMERSION AND DIRECT LIQUID COOLING TECHNOLOGIES

- 10.3 LIQUID-TO-AIR COOLANT DISTRIBUTION UNITS

- 10.3.1 INCREASING NEED FOR FLEXIBLE AND MODULAR COOLING IN EDGE COMPUTING AND COLOCATION FACILITIES

11 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY CAPACITY

- 11.1 INTRODUCTION

- 11.2 SMALL-SCALE COOLANT DISTRIBUTION UNITS

- 11.2.1 RISE OF EDGE COMPUTING AND IOT EXPANSION DRIVE MARKET

- 11.3 MEDIUM-SCALE COOLANT DISTRIBUTION UNITS

- 11.3.1 RISING ADOPTION OF HYBRID IT AND CLOUD-FIRST STRATEGIES

- 11.4 LARGE-SCALE COOLANT DISTRIBUTION UNITS

- 11.4.1 INCREASING DEMAND FOR AI PROCESSING, CLOUD EXPANSION, AND HPC WORKLOADS REQUIRING EXTREME COOLING CAPACITY

12 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY DATA CENTER TYPE

- 12.1 INTRODUCTION

- 12.2 SMALL & MID-SIZED DATA CENTERS

- 12.2.1 INCREASING ADOPTION OF EDGE DATA CENTERS, CLOUD SERVICES BY SMES, AND RISING DEPLOYMENT OF MODULAR DATA CENTERS

- 12.3 LARGE DATA CENTERS

- 12.3.1 GROWTH OF HYPERSCALE CLOUD PROVIDERS, AI-DRIVEN WORKLOADS, AND 5G NETWORK EXPANSIONS DRIVES THE MARKET GROWTH

13 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 AI infrastructure and sustainability mandates driving growth

- 13.2.2 CANADA

- 13.2.2.1 Sustainability policies and modern data center design to drive market

- 13.2.3 MEXICO

- 13.2.3.1 Rising infrastructure demands and policy initiatives propelling market

- 13.2.1 US

- 13.3 ASIA PACIFIC

- 13.3.1 CHINA

- 13.3.1.1 Policy pressure and infrastructure demands driving market

- 13.3.2 SOUTH KOREA

- 13.3.2.1 Digital infrastructure growth and green policies to propel market

- 13.3.3 JAPAN

- 13.3.3.1 Urban constraints and high-power server demand

- 13.3.4 INDIA

- 13.3.4.1 Power constraints and digital growth accelerating market

- 13.3.5 MALAYSIA

- 13.3.5.1 Digital economy growth and government initiatives

- 13.3.6 SINGAPORE

- 13.3.6.1 Strategic policy and land constraints accelerating coolant distribution unit adoption

- 13.3.7 AUSTRALIA

- 13.3.7.1 Overcoming energy and climate challenges to drive market

- 13.3.8 REST OF ASIA PACIFIC

- 13.3.1 CHINA

- 13.4 EUROPE

- 13.4.1 GERMANY

- 13.4.1.1 Strict regulations and high energy costs accelerate adoption

- 13.4.2 UK

- 13.4.2.1 Digital infrastructure growth and green policies to propel market

- 13.4.3 FRANCE

- 13.4.3.1 Thermal regulation policies and low-carbon infrastructure regulations driving market

- 13.4.4 ITALY

- 13.4.4.1 Smart energy policies and development of new data centers to drive market

- 13.4.5 SPAIN

- 13.4.5.1 Digital expansion and climate goals driving demand

- 13.4.6 REST OF EUROPE

- 13.4.1 GERMANY

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.5.1.1 Saudi Arabia

- 13.5.1.1.1 Mega projects and digital transformation fueling growth

- 13.5.1.2 Rest of GCC countries

- 13.5.1.1 Saudi Arabia

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Data center expansions accelerating growth

- 13.5.3 REST OF MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.6 SOUTH AMERICA

- 13.6.1 BRAZIL

- 13.6.1.1 Data center growth and green innovation driving market

- 13.6.2 REST OF SOUTH AMERICA

- 13.6.1 BRAZIL

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS

- 14.3.1 REVENUE ANALYSIS OF KEY PLAYERS

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.4.1 MARKET SHARE ANALYSIS

- 14.4.2 RANKING OF KEY MARKET PLAYERS, 2024

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Type footprint

- 14.6.5.4 Application footprint

- 14.6.5.5 Process footprint

- 14.6.5.6 Capacity footprint

- 14.6.5.7 Data center type footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMES

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPETITIVE SCENARIO

- 14.8.1 PRODUCT LAUNCHES

- 14.8.2 DEALS

- 14.8.3 EXPANSIONS

- 14.9 COMPANY VALUATION AND FINANCIAL METRICS

15 COMPANY PROFILES

- 15.1 MAJOR PLAYERS

- 15.1.1 DCX LIQUID COOLING SYSTEMS

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 MnM view

- 15.1.1.3.1 Right to win

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses and competitive threats

- 15.1.2 NVENT

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Expansions

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 SCHNEIDER ELECTRIC

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.3.2 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 VERTIV GROUP CORP.

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 DELTA ELECTRONICS, INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strengths

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses and competitive threats

- 15.1.6 NIDEC CORPORATION

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.6.3 Recent developments

- 15.1.7 KAORI HEAT TREATMENT CO., LTD.

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.8 SHENZHEN ENVICOOL TECHNOLOGY CO., LTD

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.9 BOYD.

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.10 COOLCENTRIC

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.11 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.12 LIQUIDSTACK HOLDING B.V.

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches

- 15.1.12.3.2 Expansions

- 15.1.13 SHANGHAI VENTTECH REFRIGERATION EQUIPMENT CO., LTD.

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.14 CHILLDYNE, INC.

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.15 COOLIT SYSTEMS.

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches

- 15.1.15.3.2 Deals

- 15.1.15.3.3 Expansions

- 15.1.16 MUNTERS GROUP AB

- 15.1.16.1 Business overview

- 15.1.16.2 Products offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Deals

- 15.1.17 TRANE TECHNOLOGIES PLC

- 15.1.17.1 Business overview

- 15.1.17.2 Products offered

- 15.1.17.3 Recent developments

- 15.1.17.3.1 Product launches

- 15.1.18 SUPER MICRO COMPUTER, INC

- 15.1.18.1 Business overview

- 15.1.18.2 Products offered

- 15.1.19 LENOVO

- 15.1.19.1 Business overview

- 15.1.19.2 Products offered

- 15.1.19.3 Recent developments

- 15.1.19.3.1 Deals

- 15.1.20 STULZ GMBH

- 15.1.20.1 Business overview

- 15.1.20.2 Products offered

- 15.1.20.3 Recent developments

- 15.1.20.3.1 Product launches

- 15.1.20.3.2 Expansions

- 15.1.21 RITTAL GMBH & CO. KG

- 15.1.21.1 Business overview

- 15.1.21.2 Products offered

- 15.1.21.3 Recent developments

- 15.1.21.3.1 Product launches

- 15.1.22 LITE-ON TECHNOLOGY CORPORATION

- 15.1.22.1 Business overview

- 15.1.22.2 Products offered

- 15.1.22.3 Recent developments

- 15.1.22.3.1 Product launches

- 15.1.23 FLAKTGROUP

- 15.1.23.1 Business overview

- 15.1.23.2 Products offered

- 15.1.23.3 Recent developments

- 15.1.23.3.1 Product launches

- 15.1.24 NAUTILUS DATA TECHNOLOGIES

- 15.1.24.1 Business overview

- 15.1.24.2 Products offered

- 15.1.24.3 Recent developments

- 15.1.24.3.1 Product launches

- 15.1.1 DCX LIQUID COOLING SYSTEMS

- 15.2 OTHER PLAYERS

- 15.2.1 NORTEK AIR SOLUTIONS, LLC.

- 15.2.2 JETCOOL TECHNOLOGIES INC

- 15.2.3 ENVIRONMENTAL AIR SYSTEMS

- 15.2.4 LENNOX

- 15.2.5 EXCOOL LTD.

- 15.2.6 AIREDALE INTERNATIONAL AIR CONDITIONING LTD.

- 15.2.7 ATTOM TECHNOLOGY

- 15.2.8 LNEYA THERMO REFRIGERATION CO., LTD.

- 15.2.9 CANATEC PTE LTD.

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 LIMITATIONS

- 16.3 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET INTERCONNECTED MARKET

- 16.4 DATA CENTER COOLING MARKET: GLOBAL FORECAST TO 2030

- 16.4.1 MARKET DEFINITION

- 16.4.2 MARKET OVERVIEW

- 16.4.2.1 Solution

- 16.4.2.2 Services

- 16.5 IMMERSION COOLING MARKET: GLOBAL FORECAST TO 2031

- 16.5.1 MARKET DEFINITION

- 16.5.2 MARKET OVERVIEW

- 16.5.2.1 Single-phase immersion cooling

- 16.5.2.2 Two-phase immersion cooling

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET SNAPSHOT, 2025 VS. 2032

- TABLE 2 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 5 TABLE 2: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: ECOSYSTEM

- TABLE 6 MAJOR PATENTS RELATED TO DATA CENTER COOLANT DISTRIBUTION UNITS, 2014-2024

- TABLE 7 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY REGION, 2024 (USD/LITER)

- TABLE 8 AVERAGE SELLING PRICE TREND OF DATA CENTER COOLANT DISTRIBUTION UNITS, BY COMPANY, 2024 (USD THOUSAND)

- TABLE 9 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY TECHNOLOGY, 2024 (USD/LITER)

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET PRODUCTS MARKET: KEY CONFERENCES & EVENTS

- TABLE 14 GLOBAL GDP PER CAPITA, 2014-2024 (USD)

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR DATA CENTER COOLANT DISTRIBUTION MARKET

- TABLE 17 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 18 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 19 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 20 IN-ROW COOLANT DISTRIBUTION UNITS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 21 IN-ROW COOLANT DISTRIBUTION UNITS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 22 IN-RACK COOLANT DISTRIBUTION UNITS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 23 IN-RACK COOLANT DISTRIBUTION UNITS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 24 FACILITY DISTRIBUTION UNITS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 FACILITY DISTRIBUTION UNITS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 26 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 27 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2025-2032 (USD MILLION)

- TABLE 28 DIRECT TO CHIP COOLING: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 DIRECT TO CHIP COOLING: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 30 IMMERSION COOLING: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 IMMERSION COOLING: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 32 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 33 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 34 COLOCATION PROVIDERS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 COLOCATION PROVIDERS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 36 ENTERPRISES: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 ENTERPRISES: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 38 HYPERSCALE DATA CENTERS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 HYPERSCALE DATA CENTERS: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 40 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 42 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 44 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 46 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 47 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2025-2032 (USD MILLION)

- TABLE 48 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END-USE, 2021-2024 (USD MILLION)

- TABLE 49 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END-USE, 2025-2032 (USD MILLION)

- TABLE 50 US: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 51 US: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 52 CANADA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 CANADA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 54 MEXICO: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 55 MEXICO: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 56 ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 57 ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 58 ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 60 ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 61 ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2025-2032 (USD MILLION)

- TABLE 62 ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 63 ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 64 CHINA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 CHINA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 66 SOUTH KOREA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 SOUTH KOREA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 68 JAPAN: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 JAPAN: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 70 INDIA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 71 INDIA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 72 MALAYSIA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 73 MALAYSIA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 74 SINGAPORE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 SINGAPORE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 76 AUSTRALIA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 77 AUSTRALIA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 79 REST OF ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 80 EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 82 EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 83 EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 84 EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 85 EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2025-2032 (USD MILLION)

- TABLE 86 EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 87 EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 88 GERMANY: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 89 GERMANY: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 90 UK: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 91 UK: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 92 FRANCE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 FRANCE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 94 ITALY: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 95 ITALY: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 96 SPAIN: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 97 SPAIN: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 98 REST OF EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 99 REST OF EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2025-2032 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 108 SAUDI ARABIA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 109 SAUDI ARABIA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 110 REST OF GCC COUNTRIES: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 111 REST OF GCC COUNTRIES: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 112 SOUTH AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 113 SOUTH AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 114 REST OF MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 115 REST OF MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 116 SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 118 SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 119 SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 120 SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2021-2024 (USD MILLION)

- TABLE 121 SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY COOLING TYPE, 2025-2032 (USD MILLION)

- TABLE 122 SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 123 SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY END USE, 2025-2032 (USD MILLION)

- TABLE 124 BRAZIL: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 125 BRAZIL: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 126 REST OF SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 127 REST OF SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 128 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025)

- TABLE 129 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 130 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: REGION FOOTPRINT

- TABLE 131 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: TYPE FOOTPRINT

- TABLE 132 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: BY APPLICATION

- TABLE 133 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: PROCESS FOOTPRINT

- TABLE 134 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: CAPACITY FOOTPRINT

- TABLE 135 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: DATA CENTER TYPE FOOTPRINT

- TABLE 136 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 137 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 138 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: PRODUCT LAUNCHES, JANUARY 2020- JULY 2025

- TABLE 139 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: DEALS, JANUARY 2020- JULY 2025

- TABLE 140 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 141 DCX LIQUID COOLING SYSTEMS: COMPANY OVERVIEW

- TABLE 142 DCX LIQUID COOLING SYSTEMS: PRODUCTS OFFERED

- TABLE 143 NVENT: COMPANY OVERVIEW

- TABLE 144 NVENT: PRODUCTS OFFERED

- TABLE 145 NVENT: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 146 NVENT: DEALS, JANUARY 2020-JULY 2025

- TABLE 147 NVENT: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 148 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 149 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- TABLE 150 SCHNEIDER ELECTRIC: DEALS, JANUARY 2020-JULY 2025

- TABLE 151 SCHNEIDER ELECTRIC: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 152 VERTIV GROUP CORP.: PRODUCTS OFFERED

- TABLE 153 VERTIV GROUP CORP.: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 154 VERTIV GROUP CORP.: DEALS, JANUARY 2020-JULY 2025

- TABLE 155 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 156 DELTA ELECTRONICS, INC.: PRODUCTS OFFERED

- TABLE 157 NIDEC CORPORATION: COMPANY OVERVIEW

- TABLE 158 NIDEC CORPORATION: PRODUCTS OFFERED

- TABLE 159 NIDEC CORPORATION: EXPANSION

- TABLE 160 KAORI HEAT TREATMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 161 KAORI HEAT TREATMENT CO., LTD.: PRODUCTS OFFERED

- TABLE 162 SHENZHEN ENVICOOL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 163 SHENZHEN ENVICOOL TECHNOLOGY CO., LTD: PRODUCTS OFFERED

- TABLE 164 SHENZHEN ENVICOOL TECHNOLOGY CO., LTD: DEALS, JANUARY 2020-JULY 2025

- TABLE 165 BOYD.: COMPANY OVERVIEW

- TABLE 166 BOYD.: PRODUCTS OFFERED

- TABLE 167 BOYD.: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 168 COOLCENTRIC: COMPANY OVERVIEW

- TABLE 169 COOLCENTRIC: PRODUCTS OFFERED

- TABLE 170 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY OVERVIEW

- TABLE 171 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: PRODUCTS OFFERED

- TABLE 172 LIQUIDSTACK HOLDING B.V.: COMPANY OVERVIEW

- TABLE 173 LIQUIDSTACK HOLDING B.V.: PRODUCTS OFFERED

- TABLE 174 LIQUIDSTACK HOLDING B.V.: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 175 LIQUIDSTACK HOLDING B.V.: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 176 SHANGHAI VENTTECH REFRIGERATION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 177 SHANGHAI VENTTECH REFRIGERATION EQUIPMENT CO., LTD.: PRODUCTS OFFERED

- TABLE 178 CHILLDYNE, INC.: COMPANY OVERVIEW

- TABLE 179 CHILLDYNE, INC.: PRODUCTS OFFERED

- TABLE 180 COOLIT SYSTEMS.: COMPANY OVERVIEW

- TABLE 181 COOLIT SYSTEMS.: PRODUCTS OFFERED

- TABLE 182 COOLIT SYSTEMS.: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 183 COOLIT SYSTEMS.: DEALS, JANUARY 2020-JULY 2025

- TABLE 184 COOLIT SYSTEMS.: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 185 MUNTERS GROUP AB: COMPANY OVERVIEW

- TABLE 186 MUNTERS GROUP AB: PRODUCTS OFFERED

- TABLE 187 MUNTERS GROUP AB: DEALS, JANUARY 2020-JULY 2025

- TABLE 188 MUNTERS GROUP AB: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 189 TRANE TECHNOLOGIES PLC: COMPANY OVERVIEW

- TABLE 190 TRANE TECHNOLOGIES PLC: PRODUCTS OFFERED

- TABLE 191 TRANE TECHNOLOGIES PLC: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 192 SUPER MICRO COMPUTER, INC.: COMPANY OVERVIEW

- TABLE 193 SUPER MICRO COMPUTER, INC.: PRODUCTS OFFERED

- TABLE 194 LENOVO: COMPANY OVERVIEW

- TABLE 195 LENOVO: PRODUCTS OFFERED

- TABLE 196 LENOVO: DEALS, JANUARY 2020-JULY 2025

- TABLE 197 STULZ GMBH: COMPANY OVERVIEW

- TABLE 198 STULZ GMBH: PRODUCTS OFFERED

- TABLE 199 STULZ GMBH: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 200 STULZ GMBH: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 201 RITTAL GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 202 RITTAL GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 203 RITTAL GMBH & CO. KG: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 204 LITE-ON TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 205 LITE-ON TECHNOLOGY CORPORATION: PRODUCTS OFFERED

- TABLE 206 LITE-ON TECHNOLOGY CORPORATION: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 207 FLAKTGROUP: COMPANY OVERVIEW

- TABLE 208 FLAKTGROUP: PRODUCTS OFFERED

- TABLE 209 FLAKTGROUP: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 210 NAUTILUS DATA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 211 NAUTILUS DATA TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 212 NAUTILUS DATA TECHNOLOGIES: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 213 NORTEK AIR SOLUTIONS, LLC.: COMPANY OVERVIEW

- TABLE 214 JETCOOL TECHNOLOGIES INC: COMPANY OVERVIEW

- TABLE 215 ENVIRONMENTAL AIR SYSTEMS: COMPANY OVERVIEW

- TABLE 216 LENNOX: COMPANY OVERVIEW

- TABLE 217 EXCOOL LTD.: COMPANY OVERVIEW

- TABLE 218 AIREDALE INTERNATIONAL AIR CONDITIONING LTD.: COMPANY OVERVIEW

- TABLE 219 ATTOM TECHNOLOGY: COMPANY OVERVIEW

- TABLE 220 LNEYA THERMO REFRIGERATION CO., LTD.: COMPANY OVERVIEW

- TABLE 221 CANATEC PTE LTD.: COMPANY OVERVIEW

- TABLE 222 DATA CENTER COOLING MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 223 DATA CENTER COOLING MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 224 IMMERSION COOLING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 225 IMMERSION COOLING MARKET, BY TYPE, 2023-2031 (USD MILLION)

List of Figures

- FIGURE 1 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR DATA CENTER COOLANT DISTRIBUTION UNITS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF DATA CENTER COOLANT DISTRIBUTION UNITS MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF DATA CENTER COOLANT DISTRIBUTION UNITS MARKET (2/2)

- FIGURE 8 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: DATA TRIANGULATION

- FIGURE 9 FACILITY DISTRIBUTION UNITS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 RISING ADOPTION OF LIQUID COOLING TECHNOLOGIES IN DATA CENTERS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 12 DIRECT TO CHIP COOLING SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 13 HYPERSCALE DATA CENTERS TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 IN-ROW CDU SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 15 SINGAPORE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD (2025-2032)

- FIGURE 16 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 20 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: ECOSYSTEM

- FIGURE 22 MAJOR PATENTS RELATED TO DATA CENTER COOLANT DISTRIBUTION UNITS, 2014-2024

- FIGURE 23 AVERAGE SELLING PRICE TREND OF DATA CENTER IMMERSION COOLING FLUIDS, BY REGION, 2024 (USD/LITER)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF DATA CENTER COOLANT DISTRIBUTION UNITS, BY KEY PLAYER, 2024 (USD THOUSAND)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF DATA CENTER COOLANT DISTRIBUTION UNITS, BY TYPE, 2024 (USD THOUSAND)

- FIGURE 26 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET-TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET-INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 IN-ROW CDU SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 29 DIRECT TO CHIP COOLING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 30 HYPERSCALE DATA CENTERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 32 NORTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET SNAPSHOT

- FIGURE 34 EUROPE: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET SNAPSHOT

- FIGURE 35 MIDDLE EAST & AFRICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET SNAPSHOT

- FIGURE 36 SOUTH AMERICA: DATA CENTER COOLANT DISTRIBUTION UNITS MARKET SNAPSHOT

- FIGURE 37 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 38 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET SHARE ANALYSIS, 2024

- FIGURE 39 RANKING OF KEY PLAYERS IN COOLANT DISTRIBUTION UNIT

- FIGURE 40 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 41 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: COMPANY FOOTPRINT

- FIGURE 43 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: EV/EBITDA

- FIGURE 45 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: ENTERPRISE VALUE (USD BILLION)

- FIGURE 46 DATA CENTER COOLANT DISTRIBUTION UNITS MARKET: YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 47 NVENT: COMPANY SNAPSHOT

- FIGURE 48 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 49 VERTIV GROUP CORP.: COMPANY SNAPSHOT

- FIGURE 50 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 51 NIDEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 KAORI HEAT TREATMENT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 53 SHENZHEN ENVICOOL TECHNOLOGY CO., LTD: COMPANY SNAPSHOT

- FIGURE 54 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP: COMPANY SNAPSHOT

- FIGURE 55 MUNTERS GROUP AB: COMPANY SNAPSHOT

- FIGURE 56 TRANE TECHNOLOGIES PLC: COMPANY SNAPSHOT

- FIGURE 57 SUPER MICRO COMPUTER, INC.: COMPANY SNAPSHOT

- FIGURE 58 LENOVO: COMPANY SNAPSHOT

- FIGURE 59 LITE-ON TECHNOLOGY CORPORATION: COMPANY SNAPSHOT