|

市场调查报告书

商品编码

1829979

全球热传导流体市场(按产品类型、温度、最终用途产业和地区划分)- 预测至 2030 年Heat Transfer Fluids Market by Product Type, Temperature, Application, End-Use Industry, and Region - Global Forecast to 2030 |

||||||

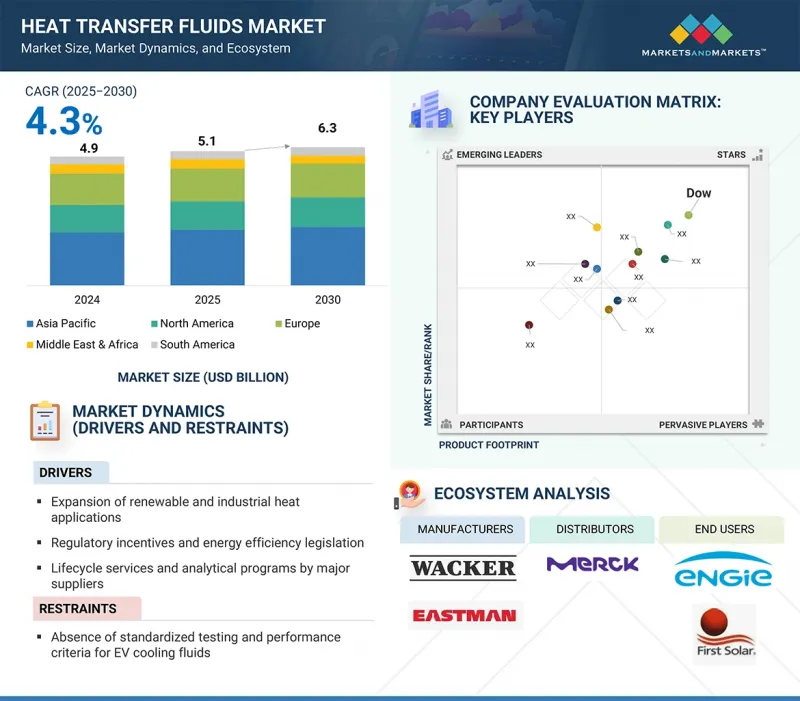

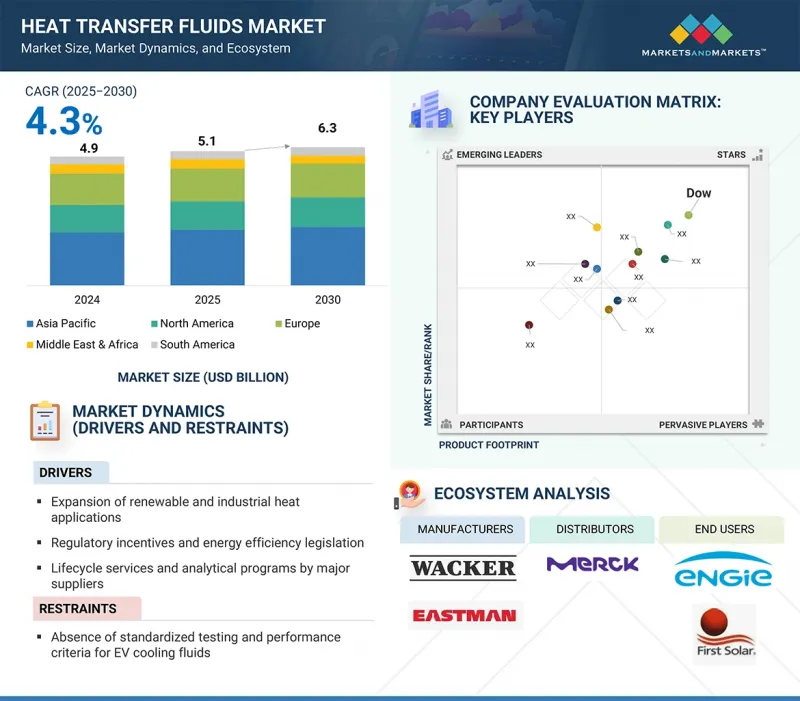

热传导流体市场预计将从 2025 年的 51 亿美元成长到 2030 年的 63 亿美元,预测期内的复合年增长率为 4.3%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2024 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 目标单位 | 价值(十亿/百万美元)和数量(千吨) |

| 部分 | 按产品类型、温度、最终用途行业和地区 |

| 目标区域 | 亚太地区、北美、欧洲、中东和非洲、南美 |

热传导流体市场的成长受到多个关键因素的驱动,包括快速工业化、对能源效率日益增长的需求以及主要终端应用产业的扩张。随着工业流程日益复杂化和多样化,尤其是在新兴经济体,对有效的温度控管解决方案的需求至关重要。化学、石化、汽车、食品饮料、製药和暖通空调 (HVAC) 等行业严重依赖导热流体来维持最佳工作温度并确保高效的製程。由于导热流体对于降低能耗和提高热系统的整体性能至关重要,因此对节能和效率的日益重视进一步推动了市场的发展。

此外,太阳能和风能等再生能源来源的普及也对用于能源储存和传输的先进热传导流体提出了更高的要求。热传导流体配方的技术创新,使其具有更好的热稳定性、更低的维护成本和更高的安全性,也支持了市场的扩张。此外,严格的环境法规和向永续工业实践的转变,正在推动高性能、环保导热介质的使用,从而进一步扩大市场。这些因素共同作用,在各个领域催生了强劲的需求,并刺激了整体市场的成长。

合成流体凭藉其卓越的性能特征,成为传热流体市场中规模第二大且成长最快的细分市场,非常适合要求严苛的工业应用。与矿物油和乙二醇基流体不同,合成流体具有卓越的热稳定性,能够在高温和低温下高效运作且不分解。这一特性使其成为对热能需求严苛的产业的理想选择,例如化学加工、製药和高温製造。此外,合成流体具有卓越的传热效率和低挥发性,从而提高了系统的安全性和耐用性。合成流体还具有更强的抗氧化和抗结垢性能,可降低维护成本并延长传热系统的使用寿命。此外,合成流体通常符合更严格的环境和安全标准,使其成为严格监管地区的首选。虽然合成油的成本往往高于矿物油,但其长期性能优势和营运效率值得投资,并占据了主导市场份额。

中温热传导流体占据热传导流体产业第二大市场份额,在性能、成本和多功能性方面实现了最佳平衡,适用于广泛的工业应用。这些导热油通常在150°C至400°C之间工作,广泛应用于需要稳定加热和冷却但无需高温或低温流体那样强耐受性的行业,例如化学加工、塑胶、石油和天然气以及食品和饮料製造。其稳定的热性能和低劣化性使其比高温合成流体更具成本效益,除了製冷和低温运输应用之外,其应用范围也比低温流体更广泛。在聚合物和树脂生产、精炼和一般製造等领域,中温导热油至关重要,因为它们能够确保精确的温度控制、降低能耗并提高製程效率。此外,新兴国家日益增长的工业化进程以及对节能安全的温度控管解决方案的需求正在推动对这些导热油的需求。它们在连续和批量过程中的多功能性,以及易于维护和更换週期,使中温流体成为全球传热流体市场中第二大市场份额。

随着全球製造业在化学品、聚合物、药品、加工食品和金属需求不断增长的推动下迅速扩张,工业加工成为热传导流体(HTF) 市场成长最快的领域。这些产业需要在蒸馏、聚合、结晶、精炼和反应器加热等製程中进行精确的温度控管,而 HTF 能够确保效率、安全性和产品一致性。工业加工发展在亚太、中东和拉丁美洲的新兴经济体尤其强劲,这些地区的快速工业化、都市化和基础设施建设正在推动对化工厂、炼油厂和製造设施的大规模投资。此外,更严格的能源效率法规和永续性目标正在推动各行各业从传统的加热方式转向先进的 HTF,从而减少能源损失、延长设备寿命并提高运作可靠性。持续的技术进步,包括环保且更耐用的 HTF 的开发,正在进一步推动其在工业领域的应用。工业加工对 HTF 的用量远远超过其他应用,例如暖通空调 (HVAC) 和汽车。终端使用产业的不断扩大、监管支援和技术改进使得工业加工成为全球传热流体成长最快的应用领域。

暖通空调 (HTF) 产业是热流体 (HTF) 的一个快速成长的终端使用领域,这得益于全球对住宅、商业和工业领域节能供暖和製冷解决方案日益增长的需求。快速的都市化、人口增长和生活水准的提高正在推动对空调、冷气和供暖系统的需求,特别是在亚太、中东和拉丁美洲的发展中地区。同时,北美和欧洲的成熟市场正在升级 HVAC 系统,以满足更严格的能源效率和环境标准,从而推动采用可提供更好热性能同时减少能源损失的先进 HTF。此外,低温运输物流、资料中心和绿色建筑的成长正在推动对在中低温下可靠运作的乙二醇和合成基 HTF 的需求。随着对永续性的日益关注,製造商也推出了专为 HVAC 应用设计的环保、无毒 HTF,进一步加速了它们的应用。与其他产业相比,由于持续的系统升级、气候变迁、对空调的依赖性不断增加以及推广节能建筑技术的政策,HVAC 具有较高的成长潜力,使 HVAC 成为传热介质市场中成长最快的终端使用产业。

本报告研究了全球热传导流体市场,按产品类型、温度、最终用途行业和地理趋势对其进行细分,并提供了参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 生成式人工智慧效果

第六章 产业趋势

- 介绍

- 影响客户业务的趋势/中断

- 供应链分析

- 定价分析

- 投资状况及资金筹措情景

- 生态系分析

- 技术分析

- 专利分析

- 贸易分析

- 2025-2026年主要会议和活动

- 关税和监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 宏观经济展望

- 案例研究分析

- 2025年美国关税的影响-热传导流体市场

热传导流体市场(依产品类型)

- 介绍

- 矿物油

- 合成液体

- 乙二醇基液体

- 其他的

热传导流体市场(按温度)

- 介绍

- 低温

- 中等温度

- 高温

- 极高的温度

热传导流体市场(依最终用途产业)

- 介绍

- 化工/石化

- 石油和天然气

- 车

- 可再生能源

- 製药

- 食品/饮料

- 空调设备

- 其他终端用途产业

热传导流体市场(按地区)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 义大利

- 法国

- 英国

- 西班牙

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 阿根廷

- 巴西

- 其他的

第十一章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 市占率分析

- 收益分析

- 品牌/产品比较分析

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 估值和财务指标

- 竞争场景

第十二章:公司简介

- 主要参与企业

- DOW

- EASTMAN CHEMICAL COMPANY

- EXXON MOBIL CORPORATION

- CHEVRON CORPORATION

- HUNTSMAN CORPORATION

- SHELL PLC

- LANXESS

- CLARIANT

- WACKER CHEMIE AG

- INDIAN OIL CORPORATION LTD.

- SCHULTZ CANADA CHEMICALS LTD.

- 其他公司

- PARATHERM

- ARKEMA

- BASF SE

- DALIAN RICHFORTUNE CHEMICALS CO., LTD.

- BRITISH PETROLEUM

- DUPONT TATE & LYLE BIOPRODUCTS COMPANY LLC

- DYNALENE

- HINDUSTAN PETROLEUM CORPORATION LIMITED

- GLOBAL HEAT TRANSFER LTD.

- ISEL

- PARAS LUBRICANTS LTD.

- PETRO-CANADA LUBRICANTS, INC.

- PHILLIPS 66 COMPANY

- RADCO INDUSTRIES, INC.

- SCHAEFFER MANUFACTURING CO.

第十三章 附录

The heat transfer fluids market is projected to grow from USD 5.1 billion in 2025 to USD 6.3 billion by 2030, registering a CAGR of 4.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2024 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion/Million) and Volume (Kiloton) |

| Segments | Product Type, Temperature, Application, End-use Industry, And Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The growth of the heat transfer fluids market is driven by several key factors, including rapid industrialization, rising energy efficiency needs, and the expansion of major end-use industries. As industrial processes become more advanced and widespread, especially in emerging economies, the requirement for effective thermal management solutions becomes crucial. Industries such as chemical, petrochemical, automotive, food and beverage, pharmaceuticals, and HVAC heavily rely on heat transfer fluids to maintain optimal operating temperatures and ensure efficient processes. The increasing emphasis on energy conservation and efficiency further propels the market, as heat transfer fluids are essential in reducing energy consumption and improving overall thermal system performance.

Additionally, the adoption of renewable energy sources like solar and wind power demands advanced heat transfer fluids for energy storage and transfer. Technological innovations in heat transfer fluid formulations-offering better thermal stability, lower maintenance, and higher safety-also support market expansion. Furthermore, strict environmental regulations and the shift toward sustainable industrial practices promote the use of high-performance, eco-friendly heat transfer fluids, expanding the market further. These combined factors create strong demand across various sectors, fueling overall market growth.

"Synthetic fluids, by product type, to be fastest-growing segment in terms of value during forecast period"

Synthetic fluids represent the fastest-growing and second-largest segment in the heat transfer fluids market due to their superior performance features, making them highly suitable for demanding industrial uses. Unlike mineral oils and glycol-based fluids, synthetic options provide exceptional thermal stability, enabling efficient operation at both high and low temperatures without breaking down. This quality makes them ideal for industries with strict thermal needs, such as chemical processing, pharmaceuticals, and high-temperature manufacturing. Additionally, synthetic fluids offer excellent heat transfer efficiency and lower volatility, improving system safety and durability. Their advanced formulas also resist oxidation and fouling better, which helps lower maintenance costs and extends the lifespan of heat transfer systems. Moreover, synthetic fluids often comply with stricter environmental and safety standards, making them a preferred choice in regions with rigorous regulations. Although they tend to be more costly than mineral oils, their long-term performance advantages and operational efficiency justify the investment, securing their prominent market share.

"Medium temperature to be second-largest segment in heat transfer fluids market in terms of value during forecast period"

Medium-temperature heat transfer fluids hold the second-largest market share in the heat transfer fluids industry because they provide an optimal balance between performance, cost, and versatility, making them suitable for a wide range of industrial operations. These fluids, usually functioning between 150°C and 400°C, are widely used in industries such as chemical processing, plastics, oil and gas, and food and beverage manufacturing, where consistent heating and cooling are needed but the extreme resistance of high-temperature or cryogenic fluids is not required. Their ability to deliver stable thermal performance without rapid degradation makes them highly cost-effective compared to high-temperature synthetics, while offering broader applicability than low-temperature fluids outside refrigeration and cold chain applications. In sectors like polymer and resin production, refining, and general manufacturing, medium-temperature HTFs ensure precise temperature control, reduce energy consumption, and improve process efficiency, making them essential. Moreover, the increasing industrialization in emerging economies and the need for energy-efficient and safer thermal management solutions are boosting demand for these fluids. Their versatility in both continuous and batch processes and easier maintenance and replacement cycles helps ensure that medium-temperature fluids remain the second most used category in the global heat transfer fluids market.

"Industrial processing to be fastest-growing application segment of heat transfer fluids in terms of value during forecast period"

Industrial processing is the fastest-growing segment in the heat transfer fluids (HTFs) market because global manufacturing is expanding quickly, driven by increasing demand for chemicals, polymers, pharmaceuticals, processed food, and metals. These industries need precise thermal management in processes like distillation, polymerization, crystallization, refining, and reactor heating, where HTFs ensure efficiency, safety, and product consistency. Growth in industrial processing is especially strong in emerging economies across Asia-Pacific, the Middle East, and Latin America, where rapid industrialization, urbanization, and infrastructure development are fueling significant investments in chemical plants, refineries, and manufacturing facilities. Additionally, stricter energy efficiency regulations and sustainability goals are encouraging industries to switch from traditional heating methods to advanced HTFs that reduce energy loss, extend equipment lifespan, and enhance operational reliability. Ongoing technological progress, including the development of eco-friendly and longer-lasting HTFs, further promotes adoption in industrial settings. Compared to other applications like HVAC or automotive, industrial processing uses larger volumes of HTFs but and This combination of expanding end-use industries, regulatory backing, and technological improvements makes industrial processing the fastest-growing application area for heat transfer fluids globally.

"HVAC to be fastest-growing end-use industry segment of heat transfer fluids market in terms of value during forecast period"

The HVAC industry is rapidly becoming the fastest-growing end-use sector for heat transfer fluids (HTFs) due to the increasing global demand for energy-efficient cooling and heating solutions in homes, businesses, and industry. Rapid urbanization, population growth, and higher living standards are boosting the need for air conditioning, refrigeration, and heating systems, especially in developing regions across Asia-Pacific, the Middle East, and Latin America. Meanwhile, mature markets in North America and Europe are increasingly upgrading HVAC systems to meet stricter energy efficiency and environmental standards, which boosts the adoption of advanced HTFs that offer better thermal performance with less energy loss. Additionally, the growth of cold chain logistics, data centers, and green buildings is raising demand for glycol-based and synthetic HTFs that can operate reliably across low- and medium-temperature ranges. With a greater focus on sustainability, manufacturers are also launching eco-friendly and non-toxic HTFs designed specifically for HVAC applications, further speeding up their adoption. Compared to other sectors, HVAC has high growth potential driven by ongoing system upgrades, climate change, increasing reliance on cooling, and policies promoting energy-efficient building tech. These factors make HVAC the fastest-growing end-use industry in the heat transfer fluids market.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations in the heat transfer fluids market. Additionally, information was gathered through secondary research to assess and validate the market size of different segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East & Africa - 10%, South America - 5%.

The heat transfer fluids market comprises Dow (US), Eastman Chemical Company (US), ExxonMobil (US), Chevron Corporation (US), Huntsman Corporation (US), Shell PLC (UK), Lanxess (Germany), Clariant (Switzerland), Wacker Chemie AG (Germany), Indian Oil Corporation Ltd. (India), and Schultz Canada Chemicals Ltd. (Canada). The study provides an in-depth competitive analysis of key players in the Heat transfer fluids market, including their company profiles, recent developments, and main market strategies.

Research Coverage

This report segments the heat transfer fluids market based on product type, temperature, application, end-use industry, and region, and provides estimates for the overall market value across different regions. A detailed analysis of key industry players has been conducted to offer insights into their business overviews, products and services, key strategies, and expansions related to the heat transfer fluids market.

Key benefits of buying report

This research report focuses on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the Heat transfer fluids market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers: (Increasing expansion in renewable and industrial heat applications), restraints (Absence of standardized testing and performance criteria for EV cooling fluids), opportunities (Customized, application-specific formulations in HTF industry), and challenges (Balancing performance with environmental compliance).

- Market Penetration: Comprehensive information on the heat transfer fluids offered by top players in the heat transfer fluids market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, partnerships, agreements, joint ventures, collaborations, announcements, awards, and market expansion.

- Market Development: The report provides comprehensive information about lucrative emerging markets and analyzes the heat transfer fluids market across regions.

- Market Capacity: Production capacities of companies manufacturing heat transfer fluids are provided wherever available, along with upcoming capacities for the heat transfer fluids market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the Heat transfer fluids market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HEAT TRANSFER FLUIDS MARKET

- 4.2 HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE

- 4.3 HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE

- 4.4 HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY

- 4.5 HEAT TRANSFER FLUIDS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expansion in renewable and industrial heat applications

- 5.2.1.2 Regulatory incentives and energy efficiency legislation

- 5.2.1.3 Lifecycle services and analytical programs by major suppliers

- 5.2.1.4 Rising adoption of immersion cooling in EVs and electronics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Absence of standardized testing and performance criteria for EV cooling fluids

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Customized, application-specific formulations

- 5.2.3.2 Technological innovation in immersion and direct cooling

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing performance with environmental compliance

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT OF GENERATIVE AI ON HEAT TRANSFER FLUIDS MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.4.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2021-2024

- 6.4.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT TYPE, 2021-2024

- 6.5 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 PATENTS GRANTED WORLDWIDE, 2014-2024

- 6.8.3 PATENT PUBLICATION TRENDS

- 6.8.4 INSIGHTS

- 6.8.5 LEGAL STATUS OF PATENTS

- 6.8.6 JURISDICTION ANALYSIS

- 6.8.7 TOP APPLICANTS

- 6.8.8 LIST OF MAJOR PATENTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 841950)

- 6.9.2 EXPORT SCENARIO (HS CODE 841950)

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 TARIFF AND REGULATORY REGULATIONS RELATED TO HEAT TRANSFER FLUIDS MARKET

- 6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.3 REGULATIONS RELATED TO HEAT TRANSFER FLUIDS MARKET

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 ITC MAURYA ENHANCED HEAT PUMP EFFICIENCY WITH NANO-ENHANCED HEAT TRANSFER FLUIDS

- 6.15.2 ENHANCING SOLAR POWER PLANT EFFICIENCY THROUGH ADVANCED HEAT TRANSFER FLUID PERFORMANCE

- 6.15.3 EXTENDING THERMAL LIMITS AND RELIABILITY: VERSALIS' TRANSITION TO THERMINOL FOR HIGH-TEMPERATURE DISTILLATION

- 6.16 IMPACT OF 2025 US TARIFF - HEAT TRANSFER FLUIDS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 IMPACT ON END-USE INDUSTRIES

7 HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 MINERAL OILS

- 7.2.1 COST-EFFECTIVE COMPARED TO GLYCOL-BASED AND SYNTHETIC FLUIDS-KEY FACTOR DRIVING MARKET GROWTH

- 7.3 SYNTHETIC FLUIDS

- 7.3.1 ENVIRONMENTALLY FRIENDLY NATURE TO SUPPORT ADOPTION

- 7.4 GLYCOL-BASED FLUIDS

- 7.4.1 OFFER EXCELLENT CORROSION INHIBITION PROPERTIES-KEY FACTOR PROPELLING MARKET GROWTH

- 7.5 OTHER PRODUCT TYPES

- 7.5.1 NANOFLUIDS

- 7.5.2 IONIC LIQUIDS

- 7.5.3 BIO-BASED HTF

- 7.5.4 MOLTEN SALTS

8 HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE

- 8.1 INTRODUCTION

- 8.2 LOW TEMPERATURE

- 8.2.1 NEED TO ENHANCE EFFICIENCY IN COOLING & CRYOGENICS SYSTEMS TO DRIVE MARKET

- 8.3 MEDIUM TEMPERATURE

- 8.3.1 RISING INDUSTRIALIZATION AND URBANIZATION TO SUPPORT MARKET GROWTH

- 8.4 HIGH TEMPERATURE

- 8.4.1 VITAL ROLE IN ENERGY-INTENSIVE INDUSTRIES TO DRIVE MARKET

- 8.5 ULTRA-HIGH TEMPERATURE

- 8.5.1 USE IN HIGHLY SPECIALIZED APPLICATIONS TO DRIVE ADOPTION

9 HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 CHEMICAL & PETROCHEMICAL

- 9.2.1 IMPLEMENTATION IN CHEMICAL PLANTS OWING TO LOW VOLATILITY PROPERTIES TO PROPEL MARKET

- 9.3 OIL & GAS

- 9.3.1 ADOPTION IN OIL & GAS PLANTS TO REDUCE VIBRATIONS IN TRANSDUCERS, CABLES, AND CONTROL VALVES TO PROPEL MARKET

- 9.4 AUTOMOTIVE

- 9.4.1 USE IN AUTOMOBILE BATTERIES, COMPRESSORS, AND MOTORS FOR EFFICIENT HEAT TRANSFER TO PROPEL MARKET

- 9.5 RENEWABLE ENERGY

- 9.5.1 DEPLOYMENT IN CSP PLANTS DUE TO HIGH OXIDATION RESISTANCE AND THERMAL STABILITY TO PROPEL MARKET

- 9.6 PHARMACEUTICALS

- 9.6.1 IMPLEMENTATION OF FOOD-GRADE HEAT TRANSFER FLUIDS IN PHARMACEUTICAL APPLICATIONS TO PROPEL MARKET

- 9.7 FOOD & BEVERAGES

- 9.7.1 UTILIZATION OF HEAT TRANSFER FLUIDS AS SUBSTITUTE FOR STEAM IN FOOD PROCESSING PLANTS TO PROPEL MARKET

- 9.8 HVAC

- 9.8.1 CORROSION RESISTANCE AND LONG-TERM STABILITY OF HEAT TRANSFER FLUIDS TO INCREASE DEMAND FOR HVAC APPLICATIONS

- 9.9 OTHER END-USE INDUSTRIES

- 9.9.1 ELECTRICAL & ELECTRONICS

- 9.9.2 AEROSPACE

10 HEAT TRANSFER FLUIDS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Thriving chemical and automotive sectors to propel market

- 10.2.2 JAPAN

- 10.2.2.1 Automotive sector to drive demand

- 10.2.3 INDIA

- 10.2.3.1 Government initiatives for renewable energy to support market growth

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Thriving automotive & chemical industry to drive market

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Increasing demand for renewable energy to drive market

- 10.3.2 CANADA

- 10.3.2.1 Focus on renewable energy sector to drive demand

- 10.3.3 MEXICO

- 10.3.3.1 Thriving petrochemical and automotive manufacturing sectors to propel market

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Strong manufacturing sector to drive growth

- 10.4.2 ITALY

- 10.4.2.1 Established manufacturing and food & beverages sectors to drive market

- 10.4.3 FRANCE

- 10.4.3.1 Technological & sustainability initiatives to drive market

- 10.4.4 UK

- 10.4.4.1 Focus on renewable energy sector and commitment to circular economy to drive market

- 10.4.5 SPAIN

- 10.4.5.1 Government initiatives for renewable energy sector to drive demand

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 UAE

- 10.5.1.1.1 Government initiatives and strategic diversification to drive demand

- 10.5.1.2 Saudi Arabia

- 10.5.1.2.1 Government commitment to economic diversification to drive demand

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 UAE

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Burgeoning industrial sector, coupled with government schemes, to drive market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 ARGENTINA

- 10.6.1.1 Government initiatives to drive demand

- 10.6.2 BRAZIL

- 10.6.2.1 Diverse industrial landscape to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 ARGENTINA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.6 COMPANY EVALUATION MATRIX, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Product type footprint

- 11.6.5.2 End-use industry footprint

- 11.6.5.3 Region footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DOW

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 EASTMAN CHEMICAL COMPANY

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 EXXON MOBIL CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 CHEVRON CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 HUNTSMAN CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 SHELL PLC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 LANXESS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 CLARIANT

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.9 WACKER CHEMIE AG

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services/Solutions offered

- 12.1.10 INDIAN OIL CORPORATION LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.11 SCHULTZ CANADA CHEMICALS LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.1 DOW

- 12.2 OTHER PLAYERS

- 12.2.1 PARATHERM

- 12.2.2 ARKEMA

- 12.2.3 BASF SE

- 12.2.4 DALIAN RICHFORTUNE CHEMICALS CO., LTD.

- 12.2.5 BRITISH PETROLEUM

- 12.2.6 DUPONT TATE & LYLE BIOPRODUCTS COMPANY LLC

- 12.2.7 DYNALENE

- 12.2.8 HINDUSTAN PETROLEUM CORPORATION LIMITED

- 12.2.9 GLOBAL HEAT TRANSFER LTD.

- 12.2.10 ISEL

- 12.2.11 PARAS LUBRICANTS LTD.

- 12.2.12 PETRO-CANADA LUBRICANTS, INC.

- 12.2.13 PHILLIPS 66 COMPANY

- 12.2.14 RADCO INDUSTRIES, INC.

- 12.2.15 SCHAEFFER MANUFACTURING CO.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF HEAT TRANSFER FLUIDS, BY REGION, 2021-2024 (USD/KILOTON)

- TABLE 2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2021-2024 (USD/KILOTON)

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT TYPE, 2021-2024 (USD/KILOTON)

- TABLE 4 HEAT TRANSFER FLUIDS MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES IN HEAT TRANSFER FLUIDS MARKET

- TABLE 6 COMPLEMENTARY TECHNOLOGIES IN HEAT TRANSFER FLUIDS MARKET

- TABLE 7 ADJACENT TECHNOLOGIES IN HEAT TRANSFER FLUIDS MARKET

- TABLE 8 HEAT TRANSFER FLUIDS MARKET: TOTAL NUMBER OF PATENTS

- TABLE 9 HEAT TRANSFER FLUIDS MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 10 HEAT TRANSFER FLUIDS MARKET: LIST OF MAJOR PATENTS, 2018-2024

- TABLE 11 HEAT TRANSFER FLUIDS MARKET: LIST OF KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 12 TARIFF RATES ASSOCIATED WITH HEAT TRANSFER FLUIDS MARKET

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LIST OF REGULATIONS FOR HEAT TRANSFER FLUIDS MARKET

- TABLE 19 HEAT TRANSFER FLUIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 22 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 23 HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 24 HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 25 HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 26 HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 27 HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 28 HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 29 HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (KILOTON)

- TABLE 30 HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 31 HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 32 HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 33 HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 34 HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 35 HEAT TRANSFER FLUIDS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 HEAT TRANSFER FLUIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 HEAT TRANSFER FLUIDS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 38 HEAT TRANSFER FLUIDS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 39 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 42 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 43 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 44 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 46 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 47 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 48 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (KILOTON)

- TABLE 50 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 51 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 52 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 54 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 55 CHINA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 56 CHINA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 CHINA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 58 CHINA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 59 JAPAN: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 60 JAPAN: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 61 JAPAN: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 62 JAPAN: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 63 INDIA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 64 INDIA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 INDIA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 66 INDIA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 67 SOUTH KOREA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 68 SOUTH KOREA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 69 SOUTH KOREA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 70 SOUTH KOREA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 71 REST OF ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 72 REST OF ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 74 REST OF ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 75 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 78 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 79 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 82 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 83 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (KILOTON)

- TABLE 86 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 87 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 88 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 90 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 91 US: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 92 US: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 US: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 94 US: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 95 CANADA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 96 CANADA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 CANADA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 98 CANADA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 99 MEXICO: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 100 MEXICO: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 101 MEXICO: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 102 MEXICO: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 103 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 106 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 107 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 110 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 111 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (KILOTON)

- TABLE 114 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 115 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 118 EUROPE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 119 GERMANY: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 GERMANY: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 GERMANY: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 122 GERMANY: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 123 ITALY: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 ITALY: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 ITALY: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 126 ITALY: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 127 FRANCE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 128 FRANCE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 FRANCE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 130 FRANCE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 131 UK: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 UK: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 UK: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 134 UK: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 135 SPAIN: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 SPAIN: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 SPAIN: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 138 SPAIN: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 139 REST OF EUROPE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 140 REST OF EUROPE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 REST OF EUROPE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 142 REST OF EUROPE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 143 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 146 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 150 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (KILOTON)

- TABLE 154 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 158 MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 159 UAE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 160 UAE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 UAE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 162 UAE: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 163 SAUDI ARABIA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 SAUDI ARABIA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 SAUDI ARABIA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 166 SAUDI ARABIA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 167 REST OF GCC COUNTRIES: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 168 REST OF GCC COUNTRIES: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 REST OF GCC COUNTRIES: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 170 REST OF GCC COUNTRIES: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 171 SOUTH AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 SOUTH AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 174 SOUTH AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 175 REST OF MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 179 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 180 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 182 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 183 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 184 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 185 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 186 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 187 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (USD MILLION)

- TABLE 188 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (USD MILLION)

- TABLE 189 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2021-2024 (KILOTON)

- TABLE 190 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE, 2025-2030 (KILOTON)

- TABLE 191 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 192 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 194 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 195 ARGENTINA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 196 ARGENTINA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 ARGENTINA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 198 ARGENTINA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 199 BRAZIL: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 200 BRAZIL: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 201 BRAZIL: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 202 BRAZIL: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 203 REST OF SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 205 REST OF SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 206 REST OF SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 207 OVERVIEW OF STRATEGIES ADOPTED BY KEY HEAT TRANSFER FLUID MANUFACTURERS

- TABLE 208 HEAT TRANSFER FLUIDS MARKET: DEGREE OF COMPETITION

- TABLE 209 HEAT TRANSFER FLUIDS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 210 HEAT TRANSFER FLUIDS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 211 HEAT TRANSFER FLUIDS MARKET: REGION FOOTPRINT

- TABLE 212 HEAT TRANSFER FLUIDS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 213 HEAT TRANSFER FLUIDS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 214 HEAT TRANSFER FLUIDS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 215 HEAT TRANSFER FLUIDS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 216 HEAT TRANSFER FLUIDS MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 217 HEAT TRANSFER FLUIDS MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 218 DOW: COMPANY OVERVIEW

- TABLE 219 DOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 DOW: DEALS

- TABLE 221 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 222 EASTMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 EASTMAN CHEMICAL COMPANY: PRODUCT LAUNCHES

- TABLE 224 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 225 EASTMAN CHEMICAL COMPANY: EXPANSIONS

- TABLE 226 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 227 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 CHEVRON CORPORATION: COMPANY OVERVIEW

- TABLE 229 CHEVRON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 230 CHEVRON CORPORATION: DEALS

- TABLE 231 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- TABLE 232 HUNTSMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 SHELL PLC: COMPANY OVERVIEW

- TABLE 234 SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 SHELL PLC: DEALS

- TABLE 236 LANXESS: COMPANY OVERVIEW

- TABLE 237 LANXESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 CLARIANT: COMPANY OVERVIEW

- TABLE 239 CLARIANT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 240 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 241 WACKER CHEMIE AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 242 INDIAN OIL CORPORATION LTD.: COMPANY OVERVIEW

- TABLE 243 INDIAN OIL CORPORATION LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 244 SCHULTZ CANADA CHEMICALS LTD.: COMPANY OVERVIEW

- TABLE 245 SCHULTZ CANADA CHEMICALS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 PARATHERM: COMPANY OVERVIEW

- TABLE 247 ARKEMA: COMPANY OVERVIEW

- TABLE 248 BASF SE: COMPANY OVERVIEW

- TABLE 249 DALIAN RICHFORTUNE CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 250 BRITISH PETROLEUM: COMPANY OVERVIEW

- TABLE 251 DUPONT TATE & LYLE BIOPRODUCTS COMPANY LLC: COMPANY OVERVIEW

- TABLE 252 DYNALENE: COMPANY OVERVIEW

- TABLE 253 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 254 GLOBAL HEAT TRANSFER LTD.: COMPANY OVERVIEW

- TABLE 255 ISEL: COMPANY OVERVIEW

- TABLE 256 PARAS LUBRICANTS LTD.: COMPANY OVERVIEW

- TABLE 257 PETRO-CANADA LUBRICANTS, INC.: COMPANY OVERVIEW

- TABLE 258 PHILLIPS 66 COMPANY: COMPANY OVERVIEW

- TABLE 259 RADCO INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 260 SCHAEFFER MANUFACTURING CO.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HEAT TRANSFER FLUIDS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HEAT TRANSFER FLUIDS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 HEAT TRANSFER FLUIDS MARKET: DATA TRIANGULATION

- FIGURE 9 MINERAL OILS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 LOW-TEMPERATURE SEGMENT WILL DOMINATE MARKET DURING STUDY PERIOD

- FIGURE 11 CHEMICAL & PETROCHEMICAL INDUSTRY SEGMENT TO LEAD MARKET IN 2025

- FIGURE 12 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 EXPANSION IN RENEWABLE AND INDUSTRIAL HEAT APPLICATIONS TO DRIVE MARKET

- FIGURE 14 SYNTHETIC FLUIDS TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 LOW TEMPERATURE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 16 RENEWABLE ENERGY SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 HEAT TRANSFER FLUIDS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 USE OF GENERATIVE AI IN HEAT TRANSFER FLUIDS MARKET

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 HEAT TRANSFER FLUIDS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF HEAT TRANSFER FLUIDS, BY REGION, 2021-2024 (USD/KILOTON)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT TYPE, 2021-2024

- FIGURE 24 HEAT TRANSFER FLUIDS MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 25 HEAT TRANSFER FLUIDS MARKET: ECOSYSTEM

- FIGURE 26 NUMBER OF PATENTS GRANTED, 2015-2024

- FIGURE 27 HEAT TRANSFER FLUIDS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 28 PATENT ANALYSIS FOR HEAT TRANSFER FLUIDS, BY JURISDICTION, 2015-2024

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 30 IMPORT OF HS CODE 841950-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 31 EXPORT OF HS CODE 841950-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS: HEAT TRANSFER FLUIDS MARKET

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 35 MINERAL OILS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 LOW TEMPERATURE SEGMENT TO LEAD HEAT TRANSFER FLUIDS MARKET IN 2024

- FIGURE 37 CHEMICAL & PETROCHEMICALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC: HEAT TRANSFER FLUIDS MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: HEAT TRANSFER FLUIDS MARKET SNAPSHOT

- FIGURE 41 EUROPE: HEAT TRANSFER FLUIDS MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST AND AFRICA: HEAT TRANSFER FLUIDS MARKET SNAPSHOT

- FIGURE 43 SOUTH AMERICA: HEAT TRANSFER FLUIDS MARKET SNAPSHOT

- FIGURE 44 HEAT TRANSFER FLUIDS MARKET SHARE OF KEY PLAYERS, 2024

- FIGURE 45 HEAT TRANSFER FLUIDS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2021-2025 (USD BILLION)

- FIGURE 46 HEAT TRANSFER FLUIDS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 47 HEAT TRANSFER FLUIDS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 HEAT TRANSFER FLUIDS MARKET: COMPANY FOOTPRINT

- FIGURE 49 HEAT TRANSFER FLUIDS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 EV/EBITDA OF KEY VENDORS

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 52 DOW: COMPANY SNAPSHOT

- FIGURE 53 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 54 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 CHEVRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 58 LANXESS: COMPANY SNAPSHOT

- FIGURE 59 CLARIANT: COMPANY SNAPSHOT