|

市场调查报告书

商品编码

1883941

全球物流和运输市场按收入、货运方式、地区、业务场景和应用案例划分-预测至2035年Logistics & Transportation Market by Revenue (Transportation, Inventory, Warehousing, Administrative), Freight Transportation by Mode (Road, Rail, Marine, Air), Region (Europe, US, China, India), Business Scenarios & Use Cases- Global Forecast to 2035 |

|||||||

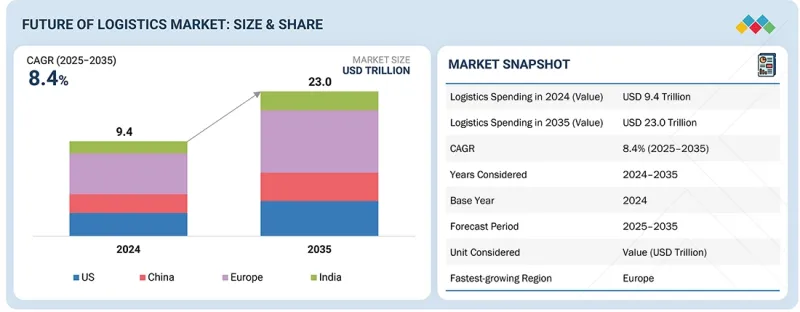

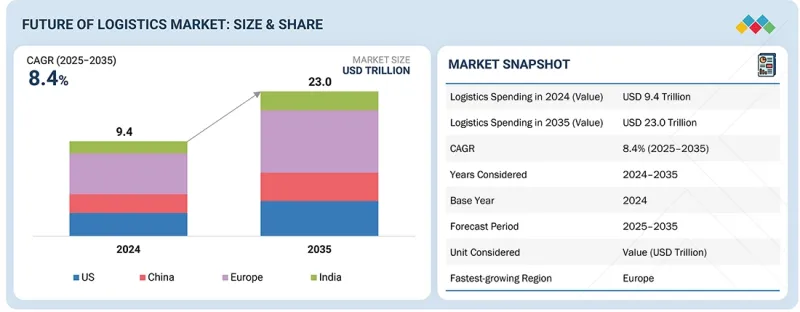

全球物流支出预计将从 2024 年的 9.4 兆美元成长到 2035 年的 23 兆美元,复合年增长率为 8.4%。

| 调查范围 | |

|---|---|

| 调查期 | 2024-2035 |

| 基准年 | 2024 |

| 预测期 | 2025-2035 |

| 单元 | 兆美元 |

| 部分 | 收入、货运方式、地区、业务场景、用例 |

| 目标区域 | 北美、欧洲、中国、印度 |

物流运输市场的成长主要受技术创新、全球贸易扩张和消费者期望变化的驱动。人工智慧、物联网和自动化技术的日益普及,使企业能够提高路线效率、减少库存,并满足消费者对更快、更可靠交付的需求。供应链营运的数位化,包括仓库自动化、智慧追踪和进阶分析,正在提升市场各环节的透明度和成本效益。

预计到2024年,全球物流总支出将达到9.4兆美元,其中城市物流支出将达到1.2兆美元(占总额的12.5%)。城市物流专注于在城市环境中高效运输货物,随着企业和政府应对都市化、交通拥堵和消费者期望变化等挑战,城市物流已在物流预算中占据相当大的比例。

随着数位平台、人工智慧和协作生态系统中新用例的出现,几个关键趋势正在塑造该产业的未来。

物流运输市场正经历一场变革,其驱动力是旨在优化效率、支持扩充性并实现永续性目标的创新商业模式。其中一个特别突出的趋势是第五方物流 (5PL) 供应商的崛起。这些供应商管理和最佳化整个供应链网络,并作为第三方物流 (3PL) 和第四方物流 (4PL) 服务的全面协调者。综合办法有望推动市场显着扩张。该趋势旨在应对日益复杂的全球物流,并将协调和整合置于竞争策略的核心地位。

人工智慧驱动的路线优化是另一个关键业务应用场景。利用机器学习和即时数据动态优化运输和配送路线,可以最大限度地提高资源利用率并降低营运成本。采用人工智慧路线规划的企业可以将每次配送成本降低高达 30%,这充分证明了投资人工智慧技术在车队管理、编队行驶和高效路线规划方面的商业价值。其他新兴趋势包括碳抵销物流平台、仓储共用平台、类似 Uber 的货运模式以及众包最后一公里配送,所有这些都在推动产业的创新和成长。

中国在物流和运输市场占有主导地位。

中国货运市场的主要成长动力包括数位货运平台和基于人工智慧的路线优化技术的快速发展。这些技术透过即时运力匹配,显着提高了卡车运转率,减少了空服里程。政府主导的基础设施建设项目,例如公路和铁路的多模态以及高速公路的扩建,促进了高效的远距和跨境货运,将内陆製造商与全球门户连接起来。在都市区「绿色走廊」部署具有竞争力的纯电动和液化天然气动力卡车,正在加速永续货运的发展。大规模的低温运输投资也为此提供了支持,以满足不断增长的生鲜食品和药品需求。严格的托盘标准化目标和基于物联网的追踪系统正在推动货柜的广泛应用,提高营运效率,并促进合规性。电子商务的兴起进一步推动了都市区对当日达的需求,这需要配备先进技术的多元化车队来满足复杂的库存管理和快速履约的需求。

本报告对全球物流和运输市场进行了分析,提供了有关关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章执行摘要

第三章物流产业的关键趋势

- 电动卡车将主导全球货运

- 物流永续燃料的兴起

- 自主货运网络革命

- 分散式仓储发展势头强劲

- 无人机在最后一公里和紧急配送的应用

- 绿色货物转型

- 数位货运经纪业务的快速成长

第四章物流业的现况与未来

- 全球物流产业:目标区隔市场

- 全球物流支出(占GDP的百分比)及主要细分市场

- 第一部分:交通运输

- 第二部分:仓储和配送

- 第三部分:货运

- 第四部分:第三方/物流(3PL/4PL)

- 第五部分:数位化物流

- 第六部分:逆向物流

- 第七部分:专业物流

- 第 8 部分:加值物流服务

- 价值链的演变

第五章 城市物流的未来趋势与机会

第六章物流产业的关键驱动因素

- 驱动因素 1:机器人与自动化

- 驱动因素二:数位化

- 驱动因素3:近岸外包

- 驱动因素四:脱碳

- 驱动因素5:贸易前景与关税

- 驱动因素六:技术创新

第七章:新的业务场景和用例

- 第五方物流(5PL)供应商

- 人工智慧驱动的路线优化

- 货运版的 Uber

- 仓库共用平台

- 众包最后一公里配送

- 碳抵销物流平台

第八章结论

第九章附录

The global logistics spending is expected to reach USD 23.0 trillion in 2035, from USD 9.4 trillion in 2024, with a CAGR of 8.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Trillion) |

| Segments | Revenue, Freight Transportation by Mode, Region, Business Scenarios & Use Cases |

| Regions covered | North America, Europe, China, India |

The growth of the logistics and transportation market is being driven by a combination of technological innovation, rising global trade, and evolving consumer expectations. Increasing adoption of AI, IoT, and automation allows companies to streamline routes, reduce inventory, and meet demand for fast, reliable delivery. Digitization of supply chain operations-including warehouse automation, smart tracking, and advanced analytics-is enabling greater visibility and cost efficiency in every segment of the market.

In 2024, total logistics expenditure was estimated at USD 9.4 trillion, with urban logistics accounting for USD 1.2 trillion or 12.5% of this total. Urban logistics, which includes activities dedicated to efficiently moving goods within city environments, is already commanding a considerable share of logistics budgets as businesses and administrations address the challenges posed by urbanization, traffic congestion, and shifting consumer expectations.

Several pivotal trends are shaping the industry's future, with new use cases emerging across digital platforms, AI, and collaborative ecosystems.

The logistics & transportation market is undergoing a transformative shift, fueled by innovative business scenarios designed to optimize efficiency, support scalability, and meet sustainability goals. One prominent scenario is the rise of 5PL providers. They manage and optimize complete supply chain networks, acting as an overarching coordinator for 3PL and 4PL services. Their comprehensive approach, which leverages centralized control, is expected to drive significant market expansion. This scenario addresses the increasing complexity of global logistics, putting orchestration and integration at the forefront of competitive strategy.

AI-powered route optimization is another critical business scenario. Leveraging machine learning and real-time data, these solutions dynamically create optimal transport and delivery routes, maximizing resource utilization and reducing operational expenses. Organizations using AI-driven routing can achieve savings of up to 30% per delivery load, underlining the strong business case for investment in AI technology for fleet management, platooning, and efficient route planning. Several other emerging trends are also present, including carbon offset logistics platforms, warehouse sharing platforms, freight uberization, and crowdsourced last-mile delivery, all of which are driving innovation and growth in the sector.

China holds a leading position in the logistics & transportation market.

Key growth drivers for China's freight transportation market include rapid advancements in digital freight platforms and AI-based route optimization, which significantly increase truck utilization and reduce empty miles through real-time capacity matching. Government-backed infrastructure initiatives, such as road-rail multimodal integration and expressway network expansion, enable efficient long-haul and cross-border trucking, connecting inland manufacturers to global gateways. Competitive battery-electric and LNG truck deployments in urban "green corridors" accelerate sustainable freight, supported by large-scale cold-chain investments to handle rising demand for perishable goods and pharmaceuticals. Stringent pallet standardization targets and IoT-based tracking are driving container penetration, streamlined operations, and compliance. E-commerce proliferation further fuels the demand for same-day urban deliveries, necessitating diversified, technologically advanced fleets to meet complex inventory and quick-fulfillment expectations.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: Logistics & Transportation Players - 45%, OEMs - 10%, Logistics Platform Providers - 25%, Reverse & Specialized Players - 20%

- By Designation: C Level - 40%, Directors - 40%, Others - 20%

- By Region: Americas - 20%, Europe - 30%, Asia Pacific (China, India, ASEAN) - 30%

The logistics & transportation market is led by established players such as DHL Group (Germany), FedEx Express (US), Maersk (Denmark), JDL Group (US), ShipBob (US), WebExpress (Russia), Blackbuck (India), Streebo (US), IBM (US), and UPS (US), among others.

Key Benefits of Buying this Report:

The logistics & transportation market report will help market leaders and new entrants with information on business scenarios and use cases for logistics & transportation players. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, trends, and opportunities.

The report provides insights into the following points:

Analysis of Key Drivers (robotics and automation, digitalization across supply chain, nearshoring, decarbonization, and trade prospects and tariffs)

Product Development/Innovation: Detailed insights on development activities, as well as business scenarios for the logistics & transportation market

Market Development: Comprehensive information about lucrative markets; the report analyzes the logistics & transportation market across varied regions.

Market Diversification: Exhaustive information about business opportunities, revenue potential, untapped geographies, and investments in the logistics & transportation market

TABLE OF CONTENTS

1 INTRODUCTION

2 EXECUTIVE SUMMARY

- 2.1 KEY FINDINGS

- 2.2 GLOBAL LOGISTICS SPENDING (AS % OF GDP)

- 2.3 TRENDS LIKELY TO IMPACT LOGISTICS INDUSTRY BY 2035

- 2.4 SEGMENTS COVERED

- 2.5 FUTURE TRENDS AND IMPACT

- 2.6 FACTORS DRIVING LOGISTICS INDUSTRY

- 2.7 URBAN LOGISTICS SPENDING

- 2.8 NEW BUSINESS SCENARIOS AND USE CASES

3 KEY TRENDS IN LOGISTICS INDUSTRY

- 3.1 ELECTRIC TRUCKS TO DOMINATE FREIGHT MOVEMENT GLOBALLY

- 3.2 RISE OF SUSTAINABLE FUELS IN LOGISTICS

- 3.3 REVOLUTION OF AUTONOMOUS FREIGHT NETWORKS

- 3.4 DECENTRALIZED WAREHOUSING TO GAIN MOMENTUM

- 3.5 INTEGRATION OF DRONES IN LAST-MILE AND URGENT DELIVERIES

- 3.6 SHIFT TOWARD GREEN FREIGHT

- 3.7 RAPID GROWTH OF DIGITAL FREIGHT BROKERAGE

4 PRESENT AND FUTURE OF LOGISTICS INDUSTRY

- 4.1 GLOBAL LOGISTICS INDUSTRY: SEGMENTS COVERED

- 4.2 GLOBAL LOGISTICS SPENDING (AS % OF GDP) AND KEY SEGMENTS

- 4.2.1 SEGMENT 1: TRANSPORTATION

- 4.2.2 SEGMENT 2: WAREHOUSING AND DISTRIBUTION

- 4.2.3 SEGMENT 3: FREIGHT FORWARDING

- 4.2.4 SEGMENT 4: THIRD-PARTY AND FOURTH-PARTY LOGISTICS (3PL AND 4PL)

- 4.2.5 SEGMENT 5: DIGITAL LOGISTICS

- 4.2.6 SEGMENT 6: REVERSE LOGISTICS

- 4.2.7 SEGMENT 7: SPECIALIZED LOGISTICS

- 4.2.8 SEGMENT 8: VALUE-ADDED LOGISTICS SERVICES

- 4.3 VALUE CHAIN EVOLUTION

5 FUTURE TRENDS AND OPPORTUNITIES IN URBAN LOGISTICS

6 KEY DRIVERS OF LOGISTICS INDUSTRY

- 6.1 DRIVER 1: ROBOTICS AND AUTOMATION

- 6.2 DRIVER 2: DIGITALIZATION

- 6.3 DRIVER 3: NEARSHORING

- 6.4 DRIVER 4: DECARBONIZATION

- 6.5 DRIVER 5: TRADE PROSPECTS AND TARIFFS

- 6.6 DRIVER 6: TECHNOLOGICAL INNOVATIONS

7 NEW BUSINESS SCENARIOS AND USE CASES

- 7.1 FIFTH-PARTY LOGISTICS (5PL) PROVIDERS

- 7.2 AI-POWERED ROUTE OPTIMIZATION

- 7.3 UBERIZATION OF FREIGHT

- 7.4 WAREHOUSE-SHARING PLATFORMS

- 7.5 CROWD-SOURCED LAST-MILE DELIVERY

- 7.6 CARBON OFFSET LOGISTICS PLATFORMS