|

市场调查报告书

商品编码

1915210

全球车队远端资讯处理市场按车辆类型、软体包类型、供应商类型、解决方案类型和地区划分-预测至2032年Fleet Telematics Market by Vehicle Type (LCV, HCV), Package Type (Entry Level, Mid Tier, Advanced), Vendor Type (OEMs, Aftermarket), Solution Type (Embedded, Portable, Smartphone/Cellular), and Region - Global Forecast to 2032 |

||||||

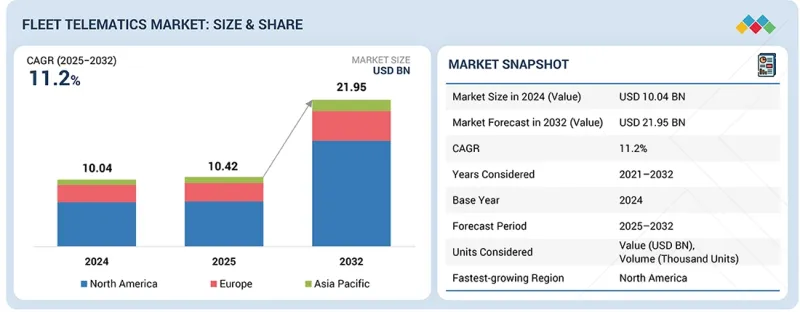

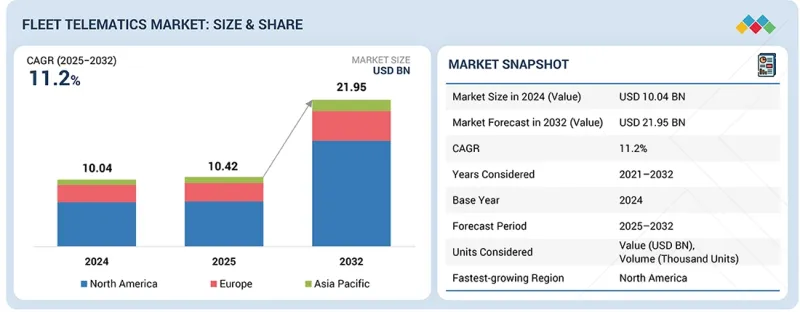

全球车队远端资讯处理市场预计将从2025年的104.2亿美元成长到2032年的219.5亿美元,复合年增长率(CAGR)为11.2%。随着车队公司寻求更深入的营运智能,包括即时零件健康分析、道路循环分析、多资产可视性和自动化合规工作流程,商用车远端资讯处理软体套件的应用正在稳步发展。智慧型手机/蜂窝远端资讯处理因其无需安装的特性,在小规模和外包车队中持续占据显着份额。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 单元 | 百万/十亿美元 |

| 部分 | 封装类型、解决方案类型、车辆类型、供应商类型 |

| 目标区域 | 亚太地区、欧洲、北美 |

同时,行动装置在租赁、租借和专业领域仍然至关重要,因为这些领域的资产经常在不同业者之间转移。不同车型的采用模式也存在差异:例如,轻型商用车车队优先考虑配送效率、单次运输利用率和工作流程数位化,而重型商用车车队则需要压力循环监控、维护间隔优化和货物状况可视化。

“预计在预测期内,售后市场细分领域将在车队远端资讯处理市场中占据主导地位。”

根据供应商类型,售后市场预计将引领车队远端资讯处理市场。这是因为大多数车队营运的车辆年份、品牌和规格各不相同,而售后市场系统可以透过改装设备和OEM数据整合将它们全部连接起来。与绑定到特定品牌的OEM入口网站不同,售后市场平台提供广泛的兼容性、强大的分析功能、高级报告和频繁的空中升级。它们还为车队提供单一的标准化介面,从而减少了管理多个OEM系统的需求。在包括印度等新兴市场在内的许多地区,现有车辆中OEM整合远端资讯处理系统的采用率仍然很低,这使得售后市场解决方案成为老旧车辆数位化的唯一可行途径。互通性挑战和OEM标准的分散进一步推动了对售后市场聚合器的需求,这些聚合器可以将来自不同汽车平臺的资料整合到单一仪表板中。

售后市场主要企业正在迅速整合原厂嵌入式数据。例如,Geotab 整合了来自众多汽车製造商的原厂车载资讯服务数据,包括福特、通用汽车(OnStar)、梅赛德斯-奔驰、沃尔沃汽车、Stellantis 旗下品牌、宝马集团、雷诺和大众集团。这使得车队能够在单一平台上整合和管理原厂及售后市场的车载资讯服务数据。

“预计在预测期内,高端细分市场将实现最高的增长率。”

根据软体包类型,预计在预测期内,高级解决方案将在车队远端资讯处理市场中实现最高成长率。这些远端资讯处理解决方案提供远距离诊断、预测性维护、碰撞检测、合规性监控以及即时视讯和事件分析等增值功能,所有这些都有助于车队降低成本并提高营运效率。对安全性、燃油效率和法规遵循的日益增长的需求,正促使营运商采用能够实现驾驶员培训、预防性维护工作流程和持续合规性管理的系统。随着车队向软体定义和以数据为中心的营运模式转型,他们需要由高级解决方案提供的不间断、高品质的资料流。

本报告研究了全球车队远端资讯处理市场,深入分析了关键驱动因素和限制因素、产品开发和创新以及竞争格局。

目录

第一章 引言

第二章执行摘要

第三章 主要发现

- 车队远端资讯处理市场企业面临的诱人机会

- 按供应商类型分類的车队远端资讯处理市场

- 按车辆类型分類的车队远端资讯处理市场

- 按套餐类型分類的车队远端资讯处理市场

- 按解决方案类型分類的车队远端资讯处理市场

- 按地区分類的车队远端资讯处理市场

第四章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 市场动态对车队远端资讯处理市场的影响

- 未满足的需求和閒置频段

- 车队远端资讯处理市场尚未满足的需求

- 閒置频段机会

- 相互关联的市场与跨产业机会

- 互联市场

- 跨职能机会

- 一级/二级/三级公司的策略性倡议

第五章 产业趋势

- 总体经济指标

- GDP趋势与预测

- 全球商用车产业趋势

- 全球车队产业趋势

- 影响客户业务的趋势与干扰因素

- 定价分析

- 主要企业车队远端资讯处理套餐的平均售价

- 按套餐类型分類的车队远端资讯处理平均售价趋势

- 各地区平均销售价格趋势

- 生态系分析

- 供应链分析

- 案例研究分析

- 投资和资金筹措方案

- 贸易分析

- 导入场景

- 出口方案

- 重大会议和活动(2026-2027)

- 决策流程

- 买方相关利益者和采购评估标准

- 采购过程中的关键相关利益者

- 采购标准

- 招募障碍和内部挑战

- 市场盈利

- 潜在收入

- 成本动态

- 利润机会:按申请

- 监理环境与合规性

- 监管机构、政府机构和其他组织

- 业界标准

- 对永续性的承诺

- 向电动和混合动力车队过渡

- 即时废气和能量监测

- 绿色物流与智慧城市系统集成

- 利用资料驱动的洞察力优化燃油经济性

- 专利分析

- 生成式人工智慧对车队远端资讯处理市场的影响

- 预测性和生成性维护建模

- 智慧路线和行为优化

- 车队洞察与自动化报告

- 数位双胞胎仿真能力

- 主要新技术

- 边缘运算

- 5G连接

- 数位双胞胎

- 人工智慧驱动的视讯远端资讯处理

- 巨量资料分析

- 互补技术

- V2X通信

- 云端运算平台

- 用于舰队训练的AR/VR介面

- 智慧城市基础设施一体化

- 生物识别车辆通行系统

- 技术/产品蓝图

- 短期 | 基础建设与早期商业化(2025-2027 年)

- 中期规划 | 扩张与标准化(2028-2030 年)

- 长期 |大规模商业化与颠覆性变革(2031-2035 年及以后)

- 车辆远端资讯处理技术对主要企业成本节约的影响

- 主要企业的成本削减分析

- 车队远端资讯处理解决方案成本分析

- 车队远端资讯处理资料方案洞察(按原始设备製造商划分)

- 商用车远端资讯处理架构考量

- 从以硬体为中心转向软体定义架构

- 分层模组化系统设计

- 用于资料处理的边缘云端协作

- 与车辆网域控制器和ADAS系统的整合

- 网路安全与功能安全设计

- 车队远端资讯处理市场生态系统:未来应用

- 自动驾驶车队营运和远端驾驶

- 预测性和生成性维护平台

- 动态保险/基于使用量的经营模式

- 一体化智慧物流与供应链网络

- 绿色车队管理与碳排放智能

第六章 按套餐类型分類的车队远端资讯处理市场

- 入门级

- 中檔

- 先进的

- 主要发现

7. 按解决方案类型分類的车队远端资讯处理市场

- 内建

- 可携式的

- 智慧型手机/行动电话

- 主要发现

8. 按车辆类型分類的车队远端资讯处理市场

- 轻型商用车

- 大型商用车辆

- 主要发现

9. 按供应商类型分類的车队远端资讯处理市场

- OEM

- 售后市场

- 主要发现

第十章:按地区分類的车队远端资讯处理市场

- 北美洲

- 美国

- 加拿大

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 欧洲

- 法国

- 德国

- 义大利

- 西班牙

- 英国

第十一章 竞争格局

- 概述

- 主要参与企业的策略/优势

- 市占率分析(2025 年)

- 对排名前五的上市/公众公司的收入分析

- 公司估值和财务指标

- 品牌/产品对比

- 企业评估矩阵:主要企业(2025 年)

- 公司评估矩阵:Start-Ups/中小企业(2025 年)

- 竞争场景

第十二章:公司简介

- 主要企业

- GEOTAB INC.

- VERIZON

- TRIMBLE INC.

- SAMSARA INC.

- POWERFLEET

- TELETRAC NAVMAN US LTD

- MASTERNAUT LIMITED

- TOMTOM INTERNATIONAL BV

- OMNITRACS

- MICROLISE LIMITED

- PTC

- AZUGA, A BRIDGESTONE COMPANY

- 其他公司

- OCTO GROUP SPA

- ZONAR SYSTEMS, INC.

- SPIREON

- LYTX, INC.

- MOTIVE TECHNOLOGIES, INC.

- VOLKSWAGEN GROUP

- MAHINDRA&MAHINDRA LTD.

- SUN-TECH INTERNATIONAL GROUP LIMITED

- CALAMP

- RAM TRACKING

- LINXUP

- ITRIANGLE

- NOREGON

第十三章调查方法

第十四章附录

The fleet telematics market is projected to grow from USD 10.42 billion in 2025 to USD 21.95 billion by 2032 at a CAGR of 11.2%. The adoption of telematics packages for commercial vehicles is moving steadily toward advanced tiers as fleets seek deeper operational intelligence, including real-time component health insights, load cycle analytics, multi-asset visibility, and automated compliance workflows. Smartphone/cellular telematics continues to gain a significant share among small and subcontracted fleets due to its zero installation model.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Package type, Solution Type, Vehicle Type, Vendor Type (OEMS, Aftermarket) |

| Regions covered | Asia Pacific, Europe, and North America |

At the same time, portable devices remain essential for rental, leasing, and vocational segments where assets regularly shift between operators. Adoption patterns are also diverging by vehicle class. For example, LCV fleets are prioritizing delivery performance, trip level utilization, and workflow digitization, whereas HCV fleets demand stress cycle monitoring, maintenance interval optimization, and cargo condition visibility.

"The aftermarket segment is projected to dominate the fleet telematics market during the forecast period."

By vendor type, the aftermarket segment is projected to lead the fleet telematics market, as most fleets operate vehicles of different ages, brands, and configurations, and aftermarket systems can connect all of them through retrofit devices or OEM data integrations. Unlike OEM portals tied to specific brands, aftermarket platforms offer broader compatibility, stronger analytics, richer reporting, and frequent over-the-air feature updates. They also give fleets a single, standardized interface, reducing the need to manage multiple OEM systems. In many regions, including India and other emerging markets, OEM-installed telematics adoption in the existing vehicle base is still low, making aftermarket solutions the only practical way to digitize older or legacy vehicles. Interoperability challenges and fragmented OEM standards further propel the demand for aftermarket aggregators that can combine data from different vehicle platforms into one dashboard.

Aftermarket leaders are rapidly integrating OEM-embedded data. For instance, Geotab integrates OEM telematics data from a wide range of vehicle manufacturers, including Ford, General Motors (OnStar), Mercedes-Benz, Volvo Cars, Stellantis brands, BMW Group, Renault, and the Volkswagen Group, enabling fleets to consolidate factory-installed and retrofit telematics data on a single platform for unified management.

"The advanced segment is projected to grow at the highest rate during the forecast period."

By package type, the advanced segment is projected to grow at the highest rate in the fleet telematics market during the forecast period. These telematics deliver high-value capabilities, such as remote diagnostics, predictive maintenance, crash detection, compliance monitoring, and real-time video and event analytics, all of which help fleets reduce costs and improve operational performance. Rising safety, fuel, and regulatory demands are pushing operators to adopt systems that enable driver coaching, proactive maintenance workflows, and continuous compliance management. As fleets transition toward software-defined and data-centric operations, they require uninterrupted, high-quality data streams that advanced solutions are built to provide. Increasing operational complexity across mixed and high utilization fleets further accelerates the demand for platforms that consolidate diagnostics, sensor data, driver behavior insights, and maintenance information into a single management view. As a result, many players are undertaking strategies to capture this demand. For example, Samsara's 2025 AI Safety Suite demonstrated crash rate reductions of nearly 75% using automated video analysis and real-time driver coaching. Likewise, Daimler Truck's global Truck Data Center (TDC) enabled factory-level remote diagnostics and OTA updates as standard on new models. Similarly, ZF's TX-CONNECT platform integrated predictive maintenance and advanced sensor data across trucks and trailers. Many other players are undertaking similar developments for long-term advantages, such as low operating costs, strong safety performance, reduced downtime, and better regulatory alignment.

"Asia Pacific is projected to grow at a significant rate during the forecast period."

Asia Pacific is projected to be the fastest-growing regional market during the forecast period. The growth of the region can be attributed to China's advanced connectivity infrastructure, strong 4G/5G penetration, and nationwide digital transport systems. Government mandates for safety, hazardous goods tracking, and Beidou-based positioning continue to drive the adoption of telematics across trucks, buses, and LCVs, while leading logistics operators, such as JD Logistics, SF Express, and Alibaba Cainiao, depend on advanced routing, cold chain, and real-time freight-visibility tools. Rapid expansion of autonomous driving pilots, ADAS integration, and OEM-connected platforms is pushing the demand for higher-value telematics packages.

Chinese OEMs, including Foton, Dongfeng, SAIC, and BYD, are standardizing embedded connectivity in new commercial vehicles, accelerating market penetration. In September 2025, the Chinese government announced that China had established a complete industrial chain system for key intelligent connected vehicle technologies, covering smart cockpits, autonomous driving, cloud connectivity, and vehicle control. China's long-term auto roadmap targets over 80% penetration of new energy and connected vehicles by 2040. It expects to reinforce continued growth for connected and telematics-enabled commercial fleets.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 32%, Tier 1 - 48%, and Tier 2 - 20%

- By Designation: CXOs - 31%, Managers - 53%, and Executives - 16%

- By Region: North America - 43%, Asia Pacific - 24%, Europe - 33%

The fleet telematics market is dominated by major players, such as Geotab Inc. (Canada), Verizon (US), Trimble Inc. (US), Samsara Inc. (US), and Powerfleet (US). These companies have adopted a mix of organic and inorganic growth strategies, such as product launches, strategic partnerships, joint ventures, mergers & acquisitions, and expansion of production facilities, to strengthen their international footprint and capture a larger market share. Through these strategies, they have expanded across regions by offering differentiated telematics portfolios tailored to specific fleet segments, including advanced safety and compliance modules, multi-asset visibility solutions, industry-specific workflows, and integrated platforms that connect vehicles, trailers, and operational systems into a unified ecosystem.

Research Coverage

This research report categorizes the fleet telematics market by Vehicle Type (Light Commercial Vehicle, Heavy Commercial Vehicle), Package Type (Entry Level, Mid Tier, Advanced), Vendor Type (OEMs, Aftermarket), Solution Type (Embedded, Portable, Smartphone/Cellular), and Region. It covers the competitive landscape and profiles of the major players of the fleet telematics market. Further, the study includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall fleet telematics market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insight into the following pointers:

- Analysis of key drivers (Increasing demand for intelligent fleet operations; focus on fuel efficiency and reducing vehicle downtime, technology-driven transformation in fleet management) restraints (Connectivity limitations in remote areas and developing markets, integration complexity with legacy fleet systems and multi-brand vehicles), opportunities (Convergence of V2X communication and autonomous mobility; digital transformation through AI and smart infrastructure, expanding opportunities in logistics and transportation, cross-platform integration and API-driven ecosystems), and challenges (Escalating cost of ownership (TCO), challenges in user adoption, lack of standardization)

- Product Development/Innovation: Detailed insights into upcoming technologies and research & development activities in the fleet telematics market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the fleet telematics market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players, such as Geotab Inc. (Canada), Verizon (US), Trimble Inc. (US), Samsara Inc. (US), and Powerfleet (US), in the fleet telematics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING FLEET TELEMATICS MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLEET TELEMATICS MARKET

- 3.2 FLEET TELEMATICS MARKET, BY VENDOR TYPE

- 3.3 FLEET TELEMATICS MARKET, BY VEHICLE TYPE

- 3.4 FLEET TELEMATICS MARKET, BY PACKAGE TYPE

- 3.5 FLEET TELEMATICS MARKET, BY SOLUTION TYPE

- 3.6 FLEET TELEMATICS MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing demand for intelligent fleet operations

- 4.2.1.2 Focus on fuel efficiency and reducing vehicle downtime

- 4.2.1.3 Technology-driven transformation in fleet management

- 4.2.1.4 Need for strengthening compliance and safety standards

- 4.2.2 RESTRAINTS

- 4.2.2.1 Connectivity limitations in remote areas and developing markets

- 4.2.2.2 Integration complexity with legacy fleet systems and multi-brand vehicles

- 4.2.2.3 Data security and user trust issues

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Convergence of V2X communication and autonomous mobility

- 4.2.3.2 Digital transformation through AI and smart infrastructure

- 4.2.3.3 Expanding opportunities in logistics and transportation

- 4.2.3.4 Cross-platform integration and API-driven ecosystems

- 4.2.4 CHALLENGES

- 4.2.4.1 Escalating TCO (total cost of ownership)

- 4.2.4.2 User adoption challenges

- 4.2.4.3 Lack of standardization

- 4.2.5 IMPACT OF MARKET DYNAMICS ON FLEET TELEMATICS MARKET

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN FLEET TELEMATICS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/-2/-3 PLAYERS

- 4.5.1 STRATEGIC MOVES BY TIER-1/-2/-3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 MACROECONOMICS INDICATORS

- 5.1.1 INTRODUCTION

- 5.1.2 GDP TRENDS AND FORECAST

- 5.1.3 TRENDS IN GLOBAL COMMERCIAL VEHICLE INDUSTRY

- 5.1.4 TRENDS IN GLOBAL FLEET INDUSTRY

- 5.2 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE OF FLEET TELEMATICS PACKAGE TYPES, BY KEY PLAYER

- 5.3.2 AVERAGE SELLING PRICE TREND OF FLEET TELEMATICS, BY PACKAGE TYPE

- 5.3.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 UNLOCKING FLEET ELECTRIFICATION POTENTIAL THROUGH DATA-DRIVEN EV SUITABILITY ANALYSIS

- 5.6.2 SCHLUMBERGER ADOPTED POWERFLEET'S MIX TO IMPROVE OPERATIONAL EFFICIENCY

- 5.6.3 OMV PETROM IMPLEMENTED POWERFLEET'S MIX TO IMPROVE FLEET EFFICIENCY AND PRODUCTIVITY

- 5.6.4 ATWELL ADOPTED GEOTAB'S FLEET MANAGEMENT PLATFORM TO ENHANCE FLEET SAFETY AND IMPROVE VEHICLE UTILIZATION

- 5.7 INVESTMENT & FUNDING SCENARIO

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- 5.8.2 EXPORT SCENARIO

- 5.9 KEY CONFERENCES & EVENTS, 2026-2027

- 5.10 DECISION-MAKING PROCESS

- 5.11 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 5.13 MARKET PROFITABILITY

- 5.13.1 REVENUE POTENTIAL

- 5.13.2 COST DYNAMICS

- 5.13.3 MARGIN OPPORTUNITIES, BY APPLICATION

- 5.14 REGULATORY LANDSCAPE AND COMPLIANCE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 INDUSTRY STANDARDS

- 5.15 SUSTAINABILITY INITIATIVES

- 5.15.1 TRANSITION TOWARD ELECTRIFIED AND HYBRID FLEETS

- 5.15.2 REAL-TIME EMISSION AND ENERGY MONITORING

- 5.15.3 INTEGRATION WITH GREEN LOGISTICS AND SMART CITY SYSTEMS

- 5.15.4 FUEL EFFICIENCY OPTIMIZATION THROUGH DATA-DRIVEN INSIGHTS

- 5.16 PATENT ANALYSIS

- 5.17 IMPACT OF GENERATIVE AI ON FLEET TELEMATICS MARKET

- 5.17.1 PREDICTIVE AND GENERATIVE MAINTENANCE MODELING

- 5.17.2 INTELLIGENT ROUTE AND BEHAVIOR OPTIMIZATION

- 5.17.3 AUTOMATED FLEET INSIGHTS AND REPORTING

- 5.17.4 DIGITAL TWIN AND SIMULATION CAPABILITIES

- 5.18 KEY EMERGING TECHNOLOGIES

- 5.18.1 EDGE COMPUTING

- 5.18.2 5G CONNECTIVITY

- 5.18.3 DIGITAL TWINS

- 5.18.4 AI-DRIVEN VIDEO TELEMATICS

- 5.18.5 BIG DATA ANALYTICS

- 5.19 COMPLEMENTARY TECHNOLOGIES

- 5.19.1 V2X COMMUNICATION (VEHICLE-TO-EVERYTHING)

- 5.19.2 CLOUD COMPUTING PLATFORMS

- 5.19.3 AR/VR INTERFACES FOR FLEET TRAINING

- 5.19.4 SMART CITY INFRASTRUCTURE INTEGRATION

- 5.19.5 BIOMETRIC VEHICLE ACCESS SYSTEM

- 5.20 TECHNOLOGY/PRODUCT ROADMAP

- 5.20.1 SHORT TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 5.20.2 MID TERM (2028-2030) | EXPANSION & STANDARDIZATION

- 5.20.3 LONG TERM (2031-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 5.21 IMPACT OF VEHICLE TELEMATICS ON COST SAVINGS OF KEY PLAYERS

- 5.21.1 COST SAVING ANALYSIS FOR KEY PLAYERS

- 5.21.1.1 Webfleet

- 5.21.1.2 Geotab Inc.

- 5.21.2 COST ANALYSIS OF FLEET TELEMATICS SOLUTIONS

- 5.21.1 COST SAVING ANALYSIS FOR KEY PLAYERS

- 5.22 INSIGHTS INTO FLEET TELEMATICS DATA PLANS, BY OEM

- 5.23 INSIGHTS INTO COMMERCIAL VEHICLE TELEMATICS ARCHITECTURE

- 5.23.1 SHIFT FROM HARDWARE-CENTRIC TO SOFTWARE-DEFINED ARCHITECTURE

- 5.23.2 LAYERED AND MODULAR SYSTEM DESIGN

- 5.23.3 EDGE-CLOUD COLLABORATION FOR DATA PROCESSING

- 5.23.4 INTEGRATION WITH VEHICLE DOMAIN CONTROLLERS AND ADAS SYSTEMS

- 5.23.5 CYBERSECURITY AND FUNCTIONAL SAFETY EMBEDDED BY DESIGN

- 5.24 FLEET TELEMATICS MARKET ECOSYSTEM: FUTURE APPLICATIONS

- 5.24.1 AUTONOMOUS FLEET OPERATIONS AND REMOTE DRIVING

- 5.24.2 PREDICTIVE AND GENERATIVE MAINTENANCE PLATFORMS

- 5.24.3 DYNAMIC INSURANCE AND USAGE-BASED BUSINESS MODELS

- 5.24.4 INTEGRATED SMART LOGISTICS AND SUPPLY CHAIN NETWORKS

- 5.24.5 GREEN FLEET MANAGEMENT AND CARBON INTELLIGENCE

6 FLEET TELEMATICS MARKET, BY PACKAGE TYPE

- 6.1 INTRODUCTION

- 6.2 ENTRY LEVEL

- 6.2.1 INCREASING ADOPTION OF TELEMATICS BY SMALL AND MEDIUM-SIZED FLEETS TO PROPEL GROWTH

- 6.3 MID TIER

- 6.3.1 RISING DEMAND FOR ADVANCED ANALYTICS, PREDICTIVE MAINTENANCE, AND ABILITY TO EXPAND FLEETS TO BOOST MARKET

- 6.4 ADVANCED

- 6.4.1 NEED FOR CUSTOMIZABLE SOLUTIONS FOR COMPLEX FLEET MANAGEMENT CHALLENGES TO FUEL SEGMENT GROWTH

- 6.5 KEY PRIMARY INSIGHTS

7 FLEET TELEMATICS MARKET, BY SOLUTION TYPE

- 7.1 INTRODUCTION

- 7.2 EMBEDDED

- 7.2.1 NEED FOR INTEGRATION OF ADVANCED FEATURES OF EMBEDDED SYSTEMS WITH DEEP VEHICLE INSIGHTS TO FUEL GROWTH

- 7.3 PORTABLE 125 7.3.1 EASE OF TRANSFER BETWEEN VEHICLES AND LOW UPFRONT COSTS TO DRIVE DEMAND FOR PORTABLE TELEMATICS SOLUTIONS

- 7.4 SMARTPHONE/CELLULAR

- 7.4.1 SMARTPHONES/CELLULAR NETWORKS PROVIDE ADVANCED MANAGEMENT FEATURES TO FLEET TELEMATICS

- 7.5 KEY PRIMARY INSIGHTS

8 FLEET TELEMATICS MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.2 LIGHT COMMERCIAL VEHICLE

- 8.2.1 SURGE IN E-COMMERCE AND FOCUS ON ROUTE OPTIMIZATION TO FUEL SEGMENT GROWTH

- 8.3 HEAVY COMMERCIAL VEHICLE

- 8.3.1 DEMAND FOR EFFECTIVE FUEL MANAGEMENT SYSTEM AND REAL-TIME DRIVER MONITORING TO DRIVE MARKET

- 8.4 KEY PRIMARY INSIGHTS

9 FLEET TELEMATICS MARKET, BY VENDOR TYPE

- 9.1 INTRODUCTION

- 9.2 OEMS

- 9.2.1 NEED FOR TIGHT INTEGRATION AND PER-VEHICLE SPECIALIZATION TO FUEL GROWTH

- 9.3 AFTERMARKET

- 9.3.1 GROWING DEMAND FOR CUSTOMIZABLE AND SCALABLE TELEMATICS SOLUTIONS TO DRIVE GROWTH

- 9.4 KEY PRIMARY INSIGHTS

10 FLEET TELEMATICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Technological advancements in AI-powered fleet management solutions to propel growth

- 10.2.2 CANADA

- 10.2.2.1 Rising demand for efficient fuel management prompts businesses to invest in telematics

- 10.2.1 US

- 10.3 ASIA PACIFIC

- 10.3.1 CHINA

- 10.3.1.1 Presence of vast commercial fleets to drive market

- 10.3.2 INDIA

- 10.3.2.1 Rising e-commerce sector to boost growth

- 10.3.3 JAPAN

- 10.3.3.1 Focus on technological innovations in automotive sector to boost market

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Emphasis on improving fuel economy and operational efficiency to spur growth

- 10.3.1 CHINA

- 10.4 EUROPE

- 10.4.1 FRANCE

- 10.4.1.1 Surge in adoption of vehicle-tracking and fuel management systems to drive market growth

- 10.4.2 GERMANY

- 10.4.2.1 Presence of leading OEMs to drive market

- 10.4.3 ITALY

- 10.4.3.1 Demand for cost-optimized fleet and fuel management solutions to boost adoption of telematics solutions

- 10.4.4 SPAIN

- 10.4.4.1 Growing focus on driver-behavior monitoring and route optimization to drive market

- 10.4.5 UK

- 10.4.5.1 Need for integration of telematics with new technologies and efficient fuel management solutions to propel growth

- 10.4.1 FRANCE

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS, 2025

- 11.4 REVENUE ANALYSIS OF TOP FIVE LISTED/PUBLIC PLAYERS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Solution type footprint

- 11.7.5.4 Vehicle type footprint

- 11.7.5.5 Vendor type footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 11.8.5.1 Detailed list of startups/SMEs

- 11.8.5.2 Competitive benchmarking of startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

- 11.9.2 DEALS

- 11.9.3 EXPANSION

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GEOTAB INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches & developments

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 VERIZON

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches & developments

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 TRIMBLE INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches & developments

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 SAMSARA INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches & developments

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansion

- 12.1.4.3.4 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 POWERFLEET

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches & developments

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansion

- 12.1.5.3.4 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 TELETRAC NAVMAN US LTD

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches & developments

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 MASTERNAUT LIMITED

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches & developments

- 12.1.7.3.2 Deals

- 12.1.8 TOMTOM INTERNATIONAL BV

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches & developments

- 12.1.8.3.2 Deals

- 12.1.9 OMNITRACS

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches & developments

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Other developments

- 12.1.10 MICROLISE LIMITED

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches & developments

- 12.1.10.3.2 Deals

- 12.1.11 PTC

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches & developments

- 12.1.11.3.2 Deals

- 12.1.12 AZUGA, A BRIDGESTONE COMPANY

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches & developments

- 12.1.1 GEOTAB INC.

- 12.2 OTHER PLAYERS

- 12.2.1 OCTO GROUP SPA

- 12.2.2 ZONAR SYSTEMS, INC.

- 12.2.3 SPIREON

- 12.2.4 LYTX, INC.

- 12.2.5 MOTIVE TECHNOLOGIES, INC.

- 12.2.6 VOLKSWAGEN GROUP

- 12.2.7 MAHINDRA&MAHINDRA LTD.

- 12.2.8 SUN-TECH INTERNATIONAL GROUP LIMITED

- 12.2.9 CALAMP

- 12.2.10 RAM TRACKING

- 12.2.11 LINXUP

- 12.2.12 ITRIANGLE

- 12.2.13 NOREGON

13 RESEARCH METHODOLOGY

- 13.1 RESEARCH DATA

- 13.1.1 SECONDARY DATA

- 13.1.1.1 List of key secondary sources

- 13.1.1.2 Key data from secondary sources

- 13.1.2 PRIMARY DATA

- 13.1.2.1 Primary interview participants

- 13.1.2.2 Key industry insights and breakdown of primary interviews

- 13.1.2.3 List of primary interviewees

- 13.1.1 SECONDARY DATA

- 13.2 MARKET SIZE ESTIMATION

- 13.2.1 BOTTOM-UP APPROACH

- 13.2.2 TOP-DOWN APPROACH

- 13.3 DATA TRIANGULATION

- 13.4 FACTOR ANALYSIS

- 13.4.1 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- 13.5 RESEARCH ASSUMPTIONS

- 13.6 RESEARCH LIMITATIONS

- 13.7 RISK ASSESSMENT

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.3.1 FLEET TELEMATICS MARKET, BY VEHICLE TYPE, AT COUNTRY LEVEL

- 14.3.2 FLEET TELEMATICS MARKET, BY SOLUTION TYPE, AT COUNTRY LEVEL

- 14.3.3 COMPANY INFORMATION

- 14.3.3.1 Profiling of additional market players (up to 5)

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 FLEET TELEMATICS MARKET DEFINITION, BY PACKAGE TYPE

- TABLE 2 FLEET TELEMATICS MARKET DEFINITION, BY SOLUTION TYPE

- TABLE 3 FLEET TELEMATICS MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 4 FLEET TELEMATICS MARKET DEFINITION, BY VENDOR TYPE

- TABLE 5 USD EXCHANGE RATES, 2019-2024

- TABLE 6 KEY REGULATIONS AND COMPLIANCE RULES, BY COUNTRY/REGION

- TABLE 7 IMPACT OF MARKET DYNAMICS ON FLEET TELEMATICS MARKET

- TABLE 8 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 9 AVERAGE SELLING PRICE OF FLEET TELEMATICS PACKAGE TYPES, BY KEY PLAYER, 2025 (USD PER MONTH)

- TABLE 10 AVERAGE SELLING PRICE TREND OF FLEET TELEMATICS, BY PACKAGE TYPE, 2023-2025 (USD PER YEAR)

- TABLE 11 ENTRY LEVEL: AVERAGE SELLING PRICE TREND, BY REGION, 2023-2025 (USD PER YEAR)

- TABLE 12 MID TIER: AVERAGE SELLING PRICE TREND, BY REGION, 2023-2025 (USD PER YEAR)

- TABLE 13 ADVANCED: AVERAGE SELLING PRICE TREND, BY REGION, 2023-2025 (USD PER YEAR)

- TABLE 14 ROLE OF COMPANIES IN MARKET ECOSYSTEM

- TABLE 15 IMPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 16 EXPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 17 KEY CONFERENCES & EVENTS, 2026-2027

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- TABLE 19 KEY BUYING CRITERIA, BY PACKAGE TYPE

- TABLE 20 MARGIN OPPORTUNITIES, BY APPLICATION

- TABLE 21 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 REGULATIONS MANDATING TELEMATICS SERVICES

- TABLE 25 VEHICLE SAFETY STANDARDS, BY COUNTRY/REGION

- TABLE 26 LIST OF PATENTS PUBLISHED IN FLEET TELEMATICS MARKET

- TABLE 27 OEM-WISE TELEMATICS DATA PLANS

- TABLE 28 FLEET TELEMATICS MARKET, BY PACKAGE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 29 FLEET TELEMATICS MARKET, BY PACKAGE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 30 FLEET TELEMATICS MARKET, BY PACKAGE TYPE, 2021-2024 (USD MILLION)

- TABLE 31 FLEET TELEMATICS MARKET, BY PACKAGE TYPE, 2025-2032 (USD MILLION)

- TABLE 32 ENTRY LEVEL: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 33 ENTRY LEVEL: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 34 ENTRY LEVEL: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 ENTRY LEVEL: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 36 MID TIER: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 37 MID TIER: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 38 MID TIER: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 MID TIER: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 40 ADVANCED: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 41 ADVANCED: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 42 ADVANCED: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 ADVANCED: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 44 FLEET TELEMATICS MARKET, BY SOLUTION TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 45 FLEET TELEMATICS MARKET, BY SOLUTION TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 46 EMBEDDED: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 47 EMBEDDED: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 48 PORTABLE: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 49 PORTABLE: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 50 SMARTPHONE/CELLULAR: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 51 SMARTPHONE/CELLULAR: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 52 FLEET TELEMATICS MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 53 FLEET TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 54 LIGHT COMMERCIAL VEHICLE: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 55 LIGHT COMMERCIAL VEHICLE: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 56 HEAVY COMMERCIAL VEHICLE: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 57 HEAVY COMMERCIAL VEHICLE: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 58 FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 59 FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 60 OEMS: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 61 OEMS: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 62 AFTERMARKET: FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 63 AFTERMARKET: FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 64 FLEET TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 65 FLEET TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 66 NORTH AMERICA: FLEET TELEMATICS MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 67 NORTH AMERICA: FLEET TELEMATICS MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 68 US: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 69 US: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 70 CANADA: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 71 CANADA: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 72 ASIA PACIFIC: FLEET TELEMATICS MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 73 ASIA PACIFIC: FLEET TELEMATICS MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 74 CHINA: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 75 CHINA: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 76 INDIA: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 77 INDIA: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 78 JAPAN: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 79 JAPAN: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 80 SOUTH KOREA: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 81 SOUTH KOREA: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 82 EUROPE: FLEET TELEMATICS MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 83 EUROPE: FLEET TELEMATICS MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 84 FRANCE: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 85 FRANCE: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 86 GERMANY: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 87 GERMANY: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 88 ITALY: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 89 ITALY: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 90 SPAIN: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 91 SPAIN: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 92 UK: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 93 UK: FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 94 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 95 MARKET SHARE ANALYSIS OF TOP FLEET TELEMATICS SERVICE PROVIDERS, 2025

- TABLE 96 FLEET TELEMATICS MARKET: REGION FOOTPRINT, 2025

- TABLE 97 FLEET TELEMATICS MARKET: SOLUTION TYPE FOOTPRINT, 2025

- TABLE 98 FLEET TELEMATICS MARKET: VEHICLE TYPE FOOTPRINT, 2025

- TABLE 99 FLEET TELEMATICS MARKET: VENDOR TYPE FOOTPRINT, 2025

- TABLE 100 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 101 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 102 FLEET TELEMATICS MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2021-DECEMBER 2025

- TABLE 103 FLEET TELEMATICS MARKET: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 104 FLEET TELEMATICS MARKET: EXPANSION, JANUARY 2021-DECEMBER 2025

- TABLE 105 GEOTAB INC.: COMPANY OVERVIEW

- TABLE 106 GEOTAB INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 107 GEOTAB INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 108 GEOTAB INC.: DEALS

- TABLE 109 GEOTAB INC.: EXPANSION

- TABLE 110 VERIZON: COMPANY OVERVIEW

- TABLE 111 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 VERIZON: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 113 VERIZON: DEALS

- TABLE 114 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 115 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 TRIMBLE INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 117 TRIMBLE INC.: DEALS

- TABLE 118 SAMSARA INC.: COMPANY OVERVIEW

- TABLE 119 SAMSARA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 SAMSARA INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 121 SAMSARA INC.: DEALS

- TABLE 122 SAMSARA INC.: EXPANSION

- TABLE 123 SAMSARA INC.: OTHER DEVELOPMENTS

- TABLE 124 POWERFLEET: COMPANY OVERVIEW

- TABLE 125 POWERFLEET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 POWERFLEET: MIX FLEET MANAGER PACKAGE DIFFERENCES

- TABLE 127 POWERFLEET: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 128 POWERFLEET: DEALS

- TABLE 129 POWERFLEET: EXPANSION

- TABLE 130 POWERFLEET: OTHER DEVELOPMENTS

- TABLE 131 TELETRAC NAVMAN US LTD: COMPANY OVERVIEW

- TABLE 132 TELETRAC NAVMAN US LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 TELETRAC NAVMAN US LTD.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 134 TELETRAC NAVMAN US LTD.: DEALS

- TABLE 135 TELETRAC NAVMAN US LTD.: OTHER DEVELOPMENTS

- TABLE 136 MASTERNAUT LIMITED: COMPANY OVERVIEW

- TABLE 137 MASTERNAUT LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 MASTERNAUT LIMITED: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 139 MASTERNAUT LIMITED: DEALS

- TABLE 140 TOMTOM INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 141 TOMTOM INTERNATIONAL BV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 TOMTOM INTERNATIONAL BV: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 143 TOMTOM INTERNATIONAL BV: DEALS

- TABLE 144 OMNITRACS: COMPANY OVERVIEW

- TABLE 145 OMNITRACS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 OMNITRACS: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 147 OMNITRACS: DEALS

- TABLE 148 OMNITRACS: OTHER DEVELOPMENTS

- TABLE 149 MICROLISE LIMITED: COMPANY OVERVIEW

- TABLE 150 MICROLISE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 MICROLISE LIMITED: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 152 MICROLISE LIMITED: DEALS

- TABLE 153 PTC: COMPANY OVERVIEW

- TABLE 154 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 PTC: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 156 PTC: DEALS

- TABLE 157 AZUGA, A BRIDGESTONE COMPANY: COMPANY OVERVIEW

- TABLE 158 AZUGA, A BRIDGESTONE COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 AZUGA, A BRIDGESTONE COMPANY: PRODUCT LAUNCHES & DEVELOPMENTS

List of Figures

- FIGURE 1 MARKET SCENARIO

- FIGURE 2 GLOBAL FLEET TELEMATICS MARKET, 2021-2032

- FIGURE 3 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN FLEET TELEMATICS MARKET, 2021-2025

- FIGURE 4 DISRUPTIONS INFLUENCING GROWTH OF FLEET TELEMATICS MARKET

- FIGURE 5 HIGH-GROWTH SEGMENTS IN FLEET TELEMATICS MARKET, 2025-2032

- FIGURE 6 NORTH AMERICA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 7 RISING FOCUS ON IMPROVING FLEET EFFICIENCY TO DRIVE MARKET

- FIGURE 8 OEMS SEGMENT TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 9 HEAVY COMMERCIAL VEHICLE SEGMENT TO LEAD MARKET BY 2032

- FIGURE 10 ADVANCED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 EMBEDDED SEGMENT TO LEAD MARKET BY 2032

- FIGURE 12 NORTH AMERICA TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 13 WORKING OF VEHICLE TELEMATICS

- FIGURE 14 FLEET TELEMATICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 ADOPTION RATE OF TELEMATICS AND FLEET MANAGEMENT SOLUTIONS, 2025

- FIGURE 16 AVERAGE FLEET OPERATING EXPENSES, 2025 (USD)

- FIGURE 17 PRIVACY CONCERNS FROM CONSUMERS AND BUSINESSES

- FIGURE 18 SOLUTION ARCHITECTURE TO GET PREDICTIVE INSIGHTS USING VEHICLE TELEMATICS DATA

- FIGURE 19 GROWTH OF LOGISTICS INDUSTRY, 2016-2030

- FIGURE 20 COMMERCIAL VEHICLE SALES, BY COUNTRY, 2024 (MILLION UNITS)

- FIGURE 21 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF FLEET TELEMATICS, BY PACKAGE TYPE, 2023-2025 (USD PER YEAR)

- FIGURE 23 ENTRY LEVEL: AVERAGE SELLING PRICE, BY REGION, 2023-2025 (USD PER YEAR)

- FIGURE 24 MID TIER: AVERAGE SELLING PRICE TREND, BY REGION, 2023-2025 (USD PER YEAR)

- FIGURE 25 ADVANCED: AVERAGE SELLING PRICE TREND, BY REGION, 2023-2025 (USD PER YEAR)

- FIGURE 26 FLEET TELEMATICS MARKET ECOSYSTEM

- FIGURE 27 SUPPLY CHAIN ANALYSIS

- FIGURE 28 INVESTMENT & FUNDING SCENARIO, 2022-2025 (USD MILLION)

- FIGURE 29 IMPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- FIGURE 32 KEY BUYING CRITERIA, BY PACKAGE TYPE

- FIGURE 33 PATENTS APPLIED AND GRANTED, 2015-2025

- FIGURE 34 LEGAL STATUS OF PATENTS PUBLISHED, 2015-2025

- FIGURE 35 5G FEATURES OF FUTURE TELEMATICS

- FIGURE 36 IMPACT OF VEHICLE TELEMATICS ON COST SAVINGS OF WEBFLEET

- FIGURE 37 IMPACT OF VEHICLE TELEMATICS ON COST SAVINGS OF GEOTAB

- FIGURE 38 COST ANALYSIS OF FLEET TELEMATICS SOLUTIONS

- FIGURE 39 FLEET TELEMATICS MARKET, BY PACKAGE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 40 FLEET TELEMATICS MARKET, BY SOLUTION TYPE, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 41 FLEET TELEMATICS MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 42 IN-HAND NETWORKS' TELEMATICS SOLUTIONS FOR LIGHT COMMERCIAL VEHICLES

- FIGURE 43 TOTAL COST OF FLEET OPERATIONS AND BENEFITS OF FLEET MANAGEMENT SYSTEM

- FIGURE 44 FLEET TELEMATICS MARKET, BY VENDOR TYPE, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 45 BENEFITS OF OEM TELEMATICS SOLUTIONS

- FIGURE 46 FLEET TELEMATICS MARKET, BY REGION, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 47 NORTH AMERICA: FLEET TELEMATICS MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: FLEET TELEMATICS MARKET SNAPSHOT

- FIGURE 49 CHINA: FLEET TELEMATICS MARKET DEVELOPMENT

- FIGURE 50 EUROPE: FLEET TELEMATICS MARKET, BY COUNTRY, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 51 MARKET SHARE ANALYSIS OF TOP FLEET TELEMATICS SERVICE PROVIDERS, 2025

- FIGURE 52 REVENUE ANALYSIS OF TOP FIVE LISTED/PUBLIC PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 53 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 54 FINANCIAL METRICS, 2025

- FIGURE 55 BRAND/PRODUCT COMPARISON OF TOP FIVE PLAYERS

- FIGURE 56 FLEET TELEMATICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 57 FLEET TELEMATICS MARKET: COMPANY FOOTPRINT, 2025

- FIGURE 58 FLEET TELEMATICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

- FIGURE 59 EVOLUTION OF FLEET TRACKING THROUGH GEOTAB GO9

- FIGURE 60 GEOTAB INC.: STRONG OPPORTUNITY FOR ADOPTION OF IN-CAB AI COACHING

- FIGURE 61 VERIZON: COMPANY SNAPSHOT

- FIGURE 62 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 63 SAMSARA INC.: COMPANY SNAPSHOT

- FIGURE 64 POWERFLEET: COMPANY SNAPSHOT

- FIGURE 65 POWERFLEET: ENTERPRISE FLEET SOLUTIONS

- FIGURE 66 POWERFLEET: FLEET MANAGEMENT SOLUTIONS

- FIGURE 67 TELETRAC NAVMAN US LTD.: COMPANY SNAPSHOT

- FIGURE 68 MASTERNAUT LIMITED: COMPANY SNAPSHOT

- FIGURE 69 TOMTOM INTERNATIONAL BV: COMPANY SNAPSHOT

- FIGURE 70 OMNITRACS: COMPANY SNAPSHOT

- FIGURE 71 MICROLISE LIMITED: COMPANY SNAPSHOT

- FIGURE 72 PTC: COMPANY SNAPSHOT

- FIGURE 73 AZUGA, A BRIDGESTONE COMPANY: COMPANY SNAPSHOT

- FIGURE 74 RESEARCH DESIGN

- FIGURE 75 RESEARCH PROCESS FLOW

- FIGURE 76 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 77 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 78 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 79 FLEET TELEMATICS MARKET: BOTTOM-UP APPROACH

- FIGURE 80 FLEET TELEMATICS MARKET: TOP-DOWN APPROACH

- FIGURE 81 DATA TRIANGULATION

- FIGURE 82 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES