|

市场调查报告书

商品编码

1775081

智慧建筑的新创企业(2025年前半期) - M&A和投资:澳洲的新创企业牵引角色StartUps in Smart Buildings H1 2025 - M&A & Investments | Australasian Startups Gaining Traction |

||||||

本报告是评估2025年上半年智慧建筑与房地产科技领域新创企业的权威新资源。

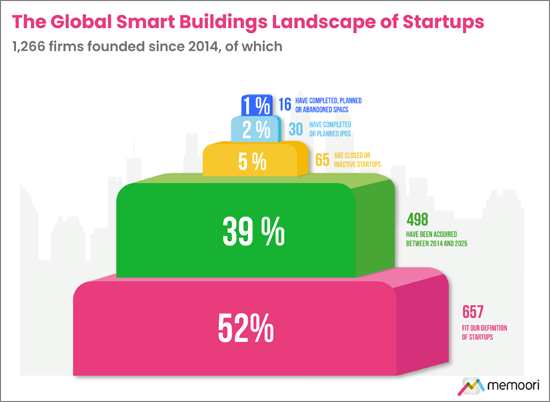

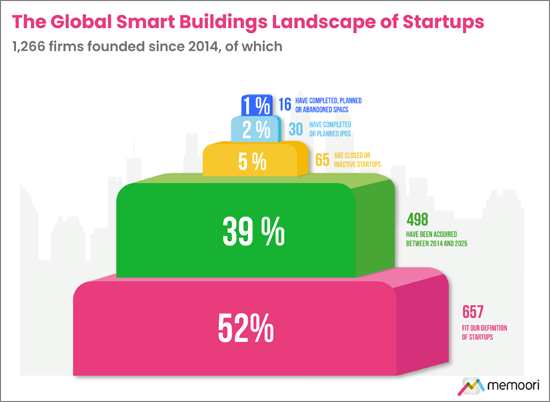

本研究涵盖了全球智慧建筑领域自2014年以来成立的1,266家处于管理和营运阶段的新创公司。其中,自2014年以来,已有498家公司(占39%)被收购。

这是对商业房地产生命週期中处于营运和维护阶段的新创公司和扩张型企业进行的第七次全面评估。报告重点关注过去六个月的风险投资、併购和策略投资。

本研究包含一个电子表格,列出了2025年上半年初创企业的收购和投资情况,以及两个包含高解析度图表的简报。

这份新创企业报告告诉我们什么?

- 2024年,智慧建筑新创企业的投资额为75亿美元。 2025年上半年,共追踪126轮融资,总金额达31亿美元。

- 与去年同期相比,融资轮次下降了13%,至145轮,显示2025年该技术领域的投资意愿有所下降。

- 2025年上半年,共进行了42初创企业收购,较去年同期成长超过60%。

本报告中的资讯是基于对智慧建筑市场的严谨分析,并基于我们先前在以下领域的研究:电网互动式建筑、暖通空调优化、人工智慧、物联网、视讯监控以及门禁控制。

我们对新创公司的定义是 "成立于2014年之前、专注于商业或工业建筑市场的私人控股公司,通常由风险投资或私募股权投资,而非作为子公司或被大型公司收购。"

本报告包含 80张投影片和 34张图表,揭示了所有关键事实并得出结论,帮助您了解新创公司如何塑造房地产科技的未来。

本报告深入研究了澳洲最令人兴奋的新创企业,其中包括 15 家:Bitpool、PlaceOS 和 Willow。这是我们 1 月发布的专注于亚洲新创企业的报告的后续。

本报告提供了有关新创公司如何透过收购、合作和联盟扩展业务的宝贵资讯。

谁该购买本报告?

本报告包含的资讯对于全球范围内参与管理、营运或投资智慧建筑公司的任何人都具有价值。 对于有意投资或收购新创企业的人来说,本报告尤其有用。

提及的公司(包括但不限于):

|

|

目录

第1章 Start-Ups的世界智慧建筑的形势

第2章 创业投资和私人股权的资金筹措

- 2025年上半年值得关注的10家智慧建筑新创投资

- 楼宇物联网外部融资

- 智慧建筑导向IoT平台

- 建筑物能源管理的外部资金

- 能源管理软体

- HVAC最佳化软体

- 建筑物的永续性与碳管理

- 能源效率和再生能源服务

- 电网互动的外部资金

- 需求响应与虚拟发电厂

- 楼宇内储能和电动车充电

- 房地产科技外部融资

- 资产管理与维护

- 工作场所管理与租户体验

- 资料中心技术

- 外部实体安全融资

- 视讯监控与视讯分析

- 大规模通知、关键事件管理和公共安全资讯管理 (PSIM)

第3章 智慧建筑的现有企业新创企业和合作

- ABB

- Honeywell

- Johnson Controls

- Schneider Electric

- Siemens

- Carrier

- JLL

- Allegion

第4章 新创企业的合併和收购

- 2025 年上半年值得关注的 10 家智慧建筑新创公司收购案

- 物联网与数位孪生新创公司收购案

- 楼宇物联网平台

- 楼宇能源管理与电网互动新创公司收购

- 能源管理与电网互动

- 能源效率与再生能源服务

- 房地产科技新创公司收购

- 实体安全新创公司收购

- 视讯监控与分析

第5章 发展人员削减和关门的Start-Ups

第6章 澳洲的新创企业发展动能强劲

- Allume

- Bitpool

- Bueno

- CIM

- CriticalArc

- Exergenics

- FMClarity

- NUBE IO

- PlaceOS

- Skedda

- Tether

- Unleash

- Uptick

- Willow

- XY Sense

This Report is the New H1 2025 Definitive Resource for Evaluating Startups in the Smart Building & PropTech Space

This research identifies 1,266 startups founded since 2014 in the management and operations phase of the global smart commercial buildings space. In total 498 firms have been acquired since 2014, 39% of the total landscape. 65 are closed or inactive startups, 5% of the total.

It is our 7th comprehensive evaluation of startups and scaleups in the operations and maintenance phase of the lifecycle of commercial real estate. It highlights venture capital funding, M&A, and strategic investments over the last 6 months.

The research includes a spreadsheet listing all startup acquisitions and investments in the first half of 2025, AND 2 presentation files with high-resolution charts.

What does this Startups Report tell You?

- In 2024, $7.5 billion was invested in the smart building startup space. In the first half of 2025, we have tracked 126 funding rounds valued at $3.1 billion.

- Compared to the same period last year, this is a 13% decrease on 145 rounds, which suggests a reduced appetite for investing in this tech sector in 2025.

- There were 42 acquisitions of startups in the first half of 2025, over a 60% increase compared to the same period last year.

The information in this report is based on a rigorous analysis of the smart building market and builds on our previous research into Grid-Interactive Buildings, HVAC Optimization, Artificial Intelligence, the Internet of Things, Video Surveillance, and Access Control.

Our definition of a startup is "a private company formed no earlier than 2014 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company, and is generally financed by venture capital or private equity funding."

Within its 80 Slides and 34 Charts, The Report Sieves out all the Key Facts and Draws Conclusions, so you can Understand how StartUp Companies are Shaping the Future of PropTech.

We take a detailed look at Australasian startups gaining traction, with 15 firms including Bitpool, PlaceOS and Willow selected for this report. This is the follow-up to our report published in January, which covered Asian startups.

This report provides valuable information into how startup companies are developing their businesses through Acquisitions, Partnerships, and Alliances.

Who Should Buy This Report?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in smart building companies around the world. In particular, those wishing to invest in or acquire startups will find it particularly useful. Want to know more?

Companies Mentioned Include (BUT NOT LIMITED TO):

|

|

Table of Contents

1. The Global Smart Buildings Landscape of Startups

2. Venture Capital and Private Equity Funding

- 2.1. 10 Notable Startup Investments in Smart Buildings H1 2025

- 2.2. External Funding for IoT in Buildings

- IoT Platforms for Smart Buildings

- 2.3. External Funding for Building Energy Management

- Energy Management Software

- HVAC Optimization Software

- Sustainability & Carbon Management in Buildings

- Energy Efficiency & Renewable Energy Services

- 2.4. External Funding for Grid Interactivity

- Demand Response & Virtual Power Plant

- Energy Storage & EV Charging in Buildings

- 2.5. External Funding for PropTech

- Asset & Maintenance Management

- Workplace Management & Tenant Experience

- Technology for Data Centers

- 2.6. External Funding for Physical Security

- Video Surveillance & Video Analytics

- Mass Notification & Critical Incident Management & PSIM

3. Smart Building Incumbents Partner with Startups

- 3.1. ABB

- 3.2. Honeywell

- 3.3. Johnson Controls

- 3.4. Schneider Electric

- 3.5. Siemens

- 3.6. Carrier

- 3.7. JLL

- 3.8. Allegion

4. Mergers & Acquisitions of Emerging Players

- 4.1. 10 Notable Startup Acquisitions in Smart Buildings H1 2025

- 4.2. Acquisitions of IoT & Digital Twin Startups

- IoT Platforms for Buildings

- 4.3. Acquisitions of Building Energy Management & Grid Interactivity Startups

- Energy Management & Grid Interactivity

- Energy Efficiency & Renewable Energy Services

- 4.4. Acquisitions of PropTech Startups

- 4.5. Acquisitions of Physical Security Startups

- Video Surveillance & Analytics

5. Startups Reducing Headcount or Closed

6. Australasian Startups Gaining Traction

- Allume

- Bitpool

- Bueno

- CIM

- CriticalArc

- Exergenics

- FMClarity

- NUBE IO

- PlaceOS

- Skedda

- Tether

- Unleash

- Uptick

- Willow

- XY Sense

List of Charts and Figures

- The Global Smart Buildings Landscape of Startups: 1,266 Firms Founded since 2014

- Regional Distribution of 1,266 Startups Founded since 2014

- Startups VC and PE Funding: Number & Value of Funding Rounds 2015 to H1 2025

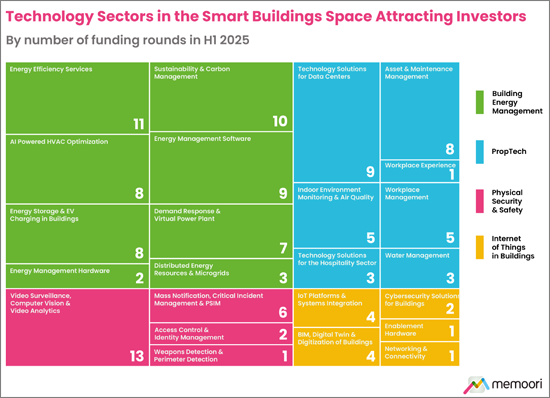

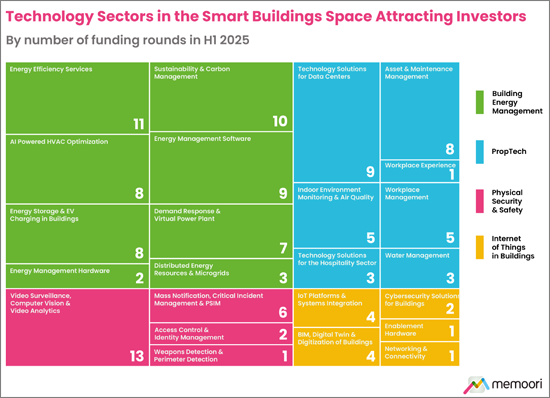

- Technology Sectors in the Smart Buildings Space Attracting Investors H1 2025

- Startup Acquisitions in the Smart Buildings Space 2014 to H1 2025

Appendix

- 1. Technology Categories for Startups in the Smart Buildings Landscape

- 2. Funding and Investments in Startups H1 2025

- 3. Mergers & Acquisitions of Startups H1 2025

- 4. Australasian Startups Gaining Traction H1 2025