|

市场调查报告书

商品编码

1406116

白车身:市场占有率分析、产业趋势与统计、2024-2029 年成长预测Automotive Body-in-White - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

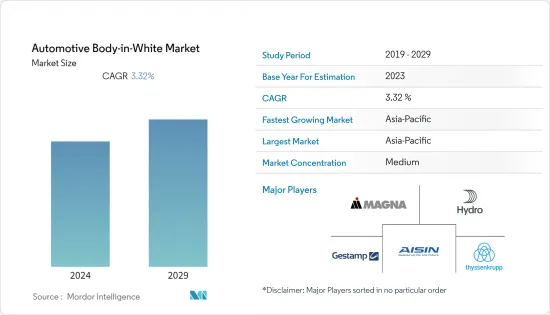

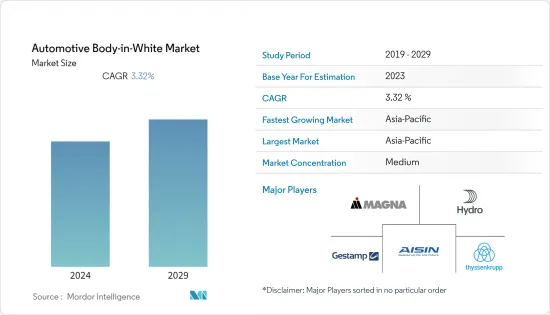

汽车白车身市场规模预计为991.2亿美元。

预计五年内将达到 1,167 亿美元,预测期内复合年增长率为 3.32%。

主要亮点

- 从长远来看,严格的环境和排放法规以及汽车中越来越多地采用轻量材料以提高燃油效率预计将在预测期内推动市场需求。

- 过去十年固体雷射光源的发展为白车身组装提供了新的焊接解决方案。特别是,提高电力效率(降低成本)以及将光纤与长工作距离相结合(工具弹性)的能力提供了新的可能性。

- 例如,柯马在2023年4月透露,已为海看汽车技术的车架线提供高度智慧型的焊接解决方案。此解决方案可确保新能源汽车的多车型生产、高JPH(每小时作业数)并切实减少生产损失。用于海灿杭州生产工厂。可在4个不同平台之间任意迁移,并与现有生产平台完全相容,批量生产循环效率60 JPH的纯电动车A06和SUV Z03。该解决方案是对柯马开放式框架技术的改进,可实现灵活、精确的白车身结构和虚拟试运行。

- 此外,对新合金和高效製造技术的持续研究和开发,以及对生产过程中自动化和机器人的投资增加,将为市场参与者提供新的机会。除此之外,白车身是每辆车的必备结构。因此,汽车产业的开拓也有望刺激全球白色家电市场的成长。

- 例如,NDR Auto Component Limited 在 2023 年 6 月强调了座椅金属零件和装饰件(装饰罩)的重要性。该公司的研发团队目前正在研究这些领域的多个产品系列。该公司的金属零件团队生产小客车座椅框架、小客车白车身(BIW)零件和两轮车零件。

- 预计亚太地区在预测期内成长最快,其次是欧洲和北美。由于印度和中国等国家采取的政府倡议,促进製造业发展并促进该市场的成长,预计亚太地区将呈现乐观成长。

汽车白车身市场趋势

对轻型车的需求不断增长推动汽车白色家电市场

- 在白车身市场,铝、镁合金、纤维增强塑料(FRP)等轻量材料的开发正在取得进展,使得生产用于轻型车的白车身产品成为可能。影响轻量材料技术的其他因素是客户主导的要求,例如造型、美观、NVH(噪音、振动、声振粗糙度)方面的降低和舒适度。

- 省油车需求增加的主要动力是实施更严格的排放气体和安全法规。因此,为了遵守更严格的废气和燃油效率法规,一些汽车製造商专注于减轻车辆的整体重量并提高燃油效率,而另一些汽车製造商则结成联盟和合作伙伴关係以稳定自己的市场地位。

- 例如,2022年9月,开发电动作业车及其电池和动力来源的Atris Motor Vehicles与全球顶级汽车钢材製造商安赛乐米塔尔建立了合作伙伴关係。安赛乐米塔尔的 S-in Motion 皮卡车模型、驾驶室和货箱设计将有助于设计 XT,这是一款面向农民、建设业工人和车队所有者的全电动皮卡车。安赛乐米塔尔开发了 S-in-Motion,这是一系列轻钢解决方案,旨在为製造商製造更轻、更安全、更生态的车辆。 Atris 利用安赛乐米塔尔的白车身 CAD 工程资讯来改善 XT 的续航里程,同时减轻重量和成本。

- 2023 年 3 月,兰博基尼公布了该公司首款高性能电动车(HPEV) 超级跑车 LB744 的关键细节。这款令人难以置信的车辆作为世界上第一辆高性能电动车 (HPEV) 取得了开创性的成就。它采用插电式混合配置,巧妙地将轻质高功率锂离子电池放置在底盘中央的传动通道内。与先前的 V12 引擎相比,这种创新方法不仅可以减少排放气体,还可以提高性能。革命性的 L545 引擎容量为 6.5 升,是兰博基尼有史以来生产的最轻、最强大的 12 缸引擎。总重量仅218公斤,比Aventador轻了17公斤。

- 2023 年 8 月,为庆祝成立 60 週年,保时捷推出了一款特别版 911,旨在最大限度地提高驾驶乐趣。保时捷 911 S/T 限量生产 1,963 辆,提供轻量化设计和纯粹、纯粹的驾驶体验。 911 GT3 RS 的高转速 518bhp 引擎首次透过手排变速箱和轻型离合器传递到道路上。

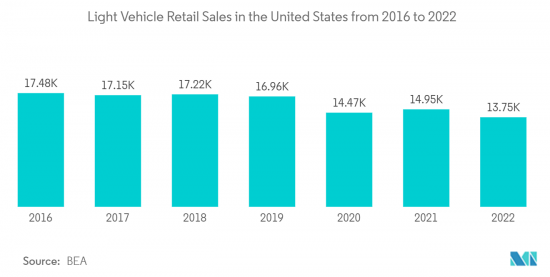

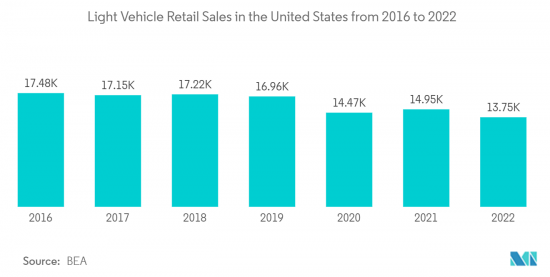

- 此外,美国汽车业预计到 2022 年将销售约 1,375 万辆轻型汽车。该统计数据包括零售的约 290 万辆小客车和近 1,090 万辆轻型卡车。

- 因此,随着製造商专注于引入创新技术和製造流程以从竞争对手中脱颖而出,汽车白车身市场预计将在预测期内显着成长。

预计亚太地区在预测期内成长最快

- 预计亚太地区将在预测期内做出重大贡献。汽车产量的增长以及政府对鼓励电动车的政策和倡议的日益重视倡议会在预测期内提振白车身市场。印度和中国等主要国家的崛起预计将补充亚太地区的市场开拓。

- 例如,2023年上半年,印度电动车零售超过70万辆。根据Vahan统计,截至2023年6月的整体销售量为721,971辆,是EV India 2022年销售量的73%。各国政府正在透过投资基础设施和为首次购买电动车的人提供补贴,鼓励从传统燃油汽车过渡到绿色燃油汽车。

- 由于几家主要企业正在进行大量投资并与其他参与者推出合资企业以满足不断增长的需求,预计市场在预测期内将保持高度竞争。

- 例如,2022年7月,蒂森克虏伯股份公司宣布扩大在中国的汽车车身业务。该公司将投资800万欧元(940万美元)在江苏省昆山市设立蒂森克虏伯汽车装备(苏州)有限公司,该工厂预计于2022年12月开始营运。该工厂将是一座白车身工厂,将为中国汽车製造商製造模具和设备。

- 由于上述趋势和发展,亚太市场预计在预测期内将以健康的速度成长。

汽车白车身产业概况

随着区域和全球产业巨头的出现,汽车白车身市场正在经历适度的整合。主要参与者包括 Magna International Inc.、Norsk Hydro ASA、Gestamp Automation SA、Aisin Seiki 和 ThyssenKrupp AG。

这些公司拥有强大的全球和区域分销网络,并正在策略性地扩大其在该市场的产品供应。这些公司正在积极寻求合作、签约、达成协议以巩固自己的地位。

例如,继 2022 年 12 月与 Norsk Hydro ASA (Hydro) 建立技术合作伙伴关係后,Mercedes-Benz于 2023 年 5 月宣布了其低碳技术计画的倡议成果。这种创新材料在梅廷根专业铸造成专为白车身设计的先进结构部件。它用于各种车辆(包括 EQS、EQE、S 级、E 级、GLC 和 C 级)的避震塔等安全关键元件。此外,EQE 型号还采用低二氧化碳铝製纵向构件。

2022 年 11 月,柯马为新款阿尔法罗密欧 Tonale 推出了多功能白色车身 (BIW) 製造解决方案。这种增强的生产设置包含 20 条生产线,使製造商能够灵活地以最多四种不同变体的随机组合组装中型 Tonale 模型,同时保持最佳吞吐量。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 日益增长的减重需求正在推动汽车车体市场的发展

- 市场抑制因素

- 製造白车身结构的材料成本急剧上升预计将限制市场成长

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 车型

- 小客车

- 商用车

- 推进类型

- 内燃机

- 电动车

- 材料类型

- 铝

- 钢

- 复合材料

- 其他材料

- 材料连接技术

- 焊接

- 咬合

- 雷射硬焊

- 加盟

- 其他材料连接技术

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Magna International Inc.

- Norsk Hydro ASA

- Gestamp Automocion SA

- Aisin Seiki Co. Limited

- Thyssenkrupp AG

- ABB Corporation

- TECOSIM Group

- Tata Steel Limited

- Dura Automotive Systems

- Tower International

- CIE Automotive

- Benteler International

- Kuka AG

第七章 市场机会及未来趋势

The automotive body-in-white market size is estimated at USD 99.12 billion. It is expected to reach USD 116.70 billion over the period of five years, registering a CAGR of 3.32% during the forecast period.

Key Highlights

- Over the long term, stringent environmental regulations and emission norms, along with the rising adoption of lightweight materials in vehicles to achieve fuel efficiency, are expected to propel the market demand during the forecast period.

- The development of solid-state laser sources in the past decade has offered new welding solutions for BIW assembly. In particular, improved electrical efficiency (cost reductions) and the capability to combine optic fibers and long working distances (tool flexibility) offer new possibilities.

- For instance, in April 2023, Comau revealed that it had provided a highly intelligent welding solution for Hycan Automotive Technology Co., Ltd.'s frame line. It guarantees multi-model production of new energy cars, high JPH (Jobs per Hour), and a tangible decrease in production losses. It is used at the Hycan Hangzhou production facility. It can transition between four distinct platforms at random, is completely compatible with existing production platforms, and is mass-producing pure electric A06 automobile and SUV Z03 at 60 JPH cycle efficiency. The solution is built on a modified version of Comau's Opengate frame technology, which allows for flexible high-precision body-in-white construction and virtual commissioning.

- Moreover, ongoing R&D on new alloys and efficient manufacturing techniques and increasing investments in automation and robots in the production process are likely to offer new opportunities for players in the market. Apart from this, the body in white is an integral structure for all automobiles. Hence, the development of the automobile sector will also add to the growth of the global body-in-white market.

- For instance, in June 2023, NDR Auto Component Limited emphasized the importance of metal components and cosmetic components (trim cover) in the seat. The company's R&D team is now working on numerous product portfolios in these areas. Its metal components team is working on the creation of passenger vehicle seat frames, passenger car body-in-white (B-I-W) parts, and two-wheeler components.

- The Asia-Pacific region is anticipated to have significant growth, followed by Europe and North America during the forecast period. Asia-Pacific is expected to witness optimistic growth due to the government initiatives adopted in countries like India and China, promoting manufacturing and contributing to the growth of this market.

Automotive Body-in-White Market Trends

Growing Demand for Light-weight Vehicles to Drive the Automotive Body-in-White Market

- The body-in-white market is seeing advancements in lightweight material developments such as aluminum, magnesium alloy, and fiber-reinforced plastics (FRP), which are enabling the production of the body in white for lighter vehicles. The other influencing factors for lightweight materials technology are customer-driven requirements like styling, aesthetic appearance, reduced NVH (noise, vibration, harshness) aspects, and comfort.

- The primary driving force behind the rising demand for fuel-efficient vehicles is the implementation of stringent emission and safety regulations. Accordingly, to comply with stricter emissions and fuel economy standards, while some automobile manufacturers are focusing on reducing the overall weight of the car and enhancing fuel efficiency, others are entering into collaborations, partnerships, etc., to stabilize their position in the market.

- For instance, in September 2022, Atlis Motor Vehicles, which is developing an electric work vehicle as well as the batteries and motors that will power it, struck a cooperation partnership with ArcelorMittal, the world's top producer of automotive steels. ArcelorMittal's S-in motion pickup truck model, as well as cab and box designs, will be used by Atlis to assist in driving the design of the XT, a purpose-built, totally electric pickup truck meant to serve people and fleet owners working in agriculture and construction. ArcelorMittal created S-in-Motion, a series of lightweight steel solutions for manufacturers looking to construct lighter, safer, and more ecologically friendly automobiles. Atlis will use ArcelorMittal's body in white CAD engineering information to cut weight and cost while improving the range of its XT.

- In March 2023, Lamborghini unveiled key details about the LB744, marking the company's inaugural high-performance electrified vehicle (HPEV) supercar. This extraordinary automobile represents a pioneering achievement as the world's first high-performance electrified vehicle (HPEV). It features a plug-in hybrid configuration, with a lightweight, high-power lithium-ion battery ingeniously positioned within the transmission tunnel at the center of the chassis. This innovative approach is designed to not only reduce emissions but also enhance performance when compared to its predecessor, the V12. The groundbreaking L545 engine boasts a 6.5-liter capacity, making it Lamborghini's lightest and most potent 12-cylinder engine to date. In total, it weighs a mere 218 kilograms, which is 17 kilograms lighter than the Aventador unit.

- In August 2023, Porsche introduced a special edition 911 designed for maximum driving enjoyment on its 60th anniversary. Produced in a limited run of 1,963 cars, the Porsche 911 S/T offers a lightweight design and a pure, undiluted driving experience. For the first time, the 911 GT3 RS's 518 hp, high-revving engine is delivered to the road via a manual transmission and lightweight clutch.

- Further, the car sector in the United States will sell around 13.75 million light vehicle units in 2022. This statistic comprises around 2.9 million passenger automobiles and a little under 10.9 million light trucks sold at retail.

- Therefore, with manufacturers focusing on adopting innovative technologies and manufacturing processes to stand unique from their competitors, the automotive body-in-white market is expected to accumulate notable growth during the forecast period.

Asia-Pacific Region Likely to Exhibit Fastest Growth During the Forecast Period

- The Asia-Pacific region is expected to contribute significantly over the forecast period. Growing automotive production and increasing government focus on designing policies and initiatives encouraging electric vehicles are likely to boost the body-in-white market during the forecast period. The rising prominence of major countries like India and China is anticipated to supplement the development of the market in the Asia-Pacific region.

- For instance, in the first half of 2023, retail sales of electric vehicles in India surpassed 700,000 units. According to Vahan statistics, overall sales as of June 2023 were 721,971 units, which is already 73% of India EV Inc.'s record sales in the Year 2022. The government is investing in the development of infrastructure and incentivizing first electric vehicle buyers with subsidies to encourage people to shift from conventional fuel vehicles to green fuel vehicles.

- With several key players investing heavily and entering joint ventures with other players to cater to the growing demand, the market is likely to remain highly competitive during the forecast period.

- For instance, in July 2022, Thyssenkrupp AG announced an expansion of its automobile body business in China. It spent EUR 8 million (USD 9.4 million) in Kunshan, Jiangsu Province, to establish thyssenkrupp Automotive Equipment (Suzhou) Co., Ltd. This facility is scheduled to begin operations in December 2022. It will be a body-in-white factory that will manufacture dies and equipment for Chinese automakers.

- With the aforementioned trends and developments, it is expected that the market in the Asia-Pacific region will grow at a healthy rate during the forecast period.

Automotive Body-in-White Industry Overview

The automotive body-in-white market exhibits a moderate level of consolidation, owing to the presence of both regional and global industry giants. Key players include Magna International Inc., Norsk Hydro ASA, Gestamp Automocion SA, Aisin Seiki, and Thyssenkrupp AG.

These firms boast robust global and regional distribution networks and are strategically engaged in expanding their product offerings within this market. They actively seek collaborations, enter contracts, and forge agreements to fortify their positions.

For instance, in May 2023, Mercedes-Benz, following its technical collaboration with Norsk Hydro ASA (Hydro) in December 2022, unveiled the initial outcomes of its low-carbon technology initiative. This innovative material is expertly cast into advanced structural components designed for body-in-white applications at Mettingen. It finds application in safety-critical elements, such as shock towers, for a range of vehicles, including EQS, EQE, S-Class, E-Class, GLC, and C-Class models. Moreover, the EQE model will feature low-CO2 aluminum longitudinal members.

In November 2022, Comau introduced a versatile Body-In-White (BIW) manufacturing solution for the all-new Alfa Romeo Tonale. This enhanced production setup incorporates 20 lines, enabling the manufacturer to flexibly assemble its mid-size Tonale model in a randomized combination of up to four distinct variants while maintaining optimal throughput.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand for Lightweight Vehicles to Drive the Automotive Body-in-White Market

- 4.2 Market Restraints

- 4.2.1 High Cost of Materials to Manufacture BIW Structures is Expected to Limit Market Growth.

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Value in USD)

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 IC Engines

- 5.2.2 Electric Vehicles

- 5.3 Material Type

- 5.3.1 Aluminum

- 5.3.2 Steel

- 5.3.3 Composites

- 5.3.4 Other Material Types

- 5.4 Material Joining Technique

- 5.4.1 Welding

- 5.4.2 Clinching

- 5.4.3 Laser Brazing

- 5.4.4 Bonding

- 5.4.5 Other Material Joining Techniques

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles *

- 6.2.1 Magna International Inc.

- 6.2.2 Norsk Hydro ASA

- 6.2.3 Gestamp Automocion SA

- 6.2.4 Aisin Seiki Co. Limited

- 6.2.5 Thyssenkrupp AG

- 6.2.6 ABB Corporation

- 6.2.7 TECOSIM Group

- 6.2.8 Tata Steel Limited

- 6.2.9 Dura Automotive Systems

- 6.2.10 Tower International

- 6.2.11 CIE Automotive

- 6.2.12 Benteler International

- 6.2.13 Kuka AG