|

市场调查报告书

商品编码

1272676

Alpha烯烃市场 - 增长、趋势和预测 (2023-2028)Alpha Olefins Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,全球Alpha烯烃市场预计将以超过 5% 的复合年增长率增长。

主要亮点

- COVID-19 对 2020 年的市场产生了负面影响。 但市场将在2022年达到疫情前水平,有望继续稳步增长。

- 推动市场发展的主要因素是造纸和纸浆行业不断增长的需求。 另一方面,由于聚乙烯的不可生物降解性,严格的环境法规阻碍了α-烯烃市场的增长。

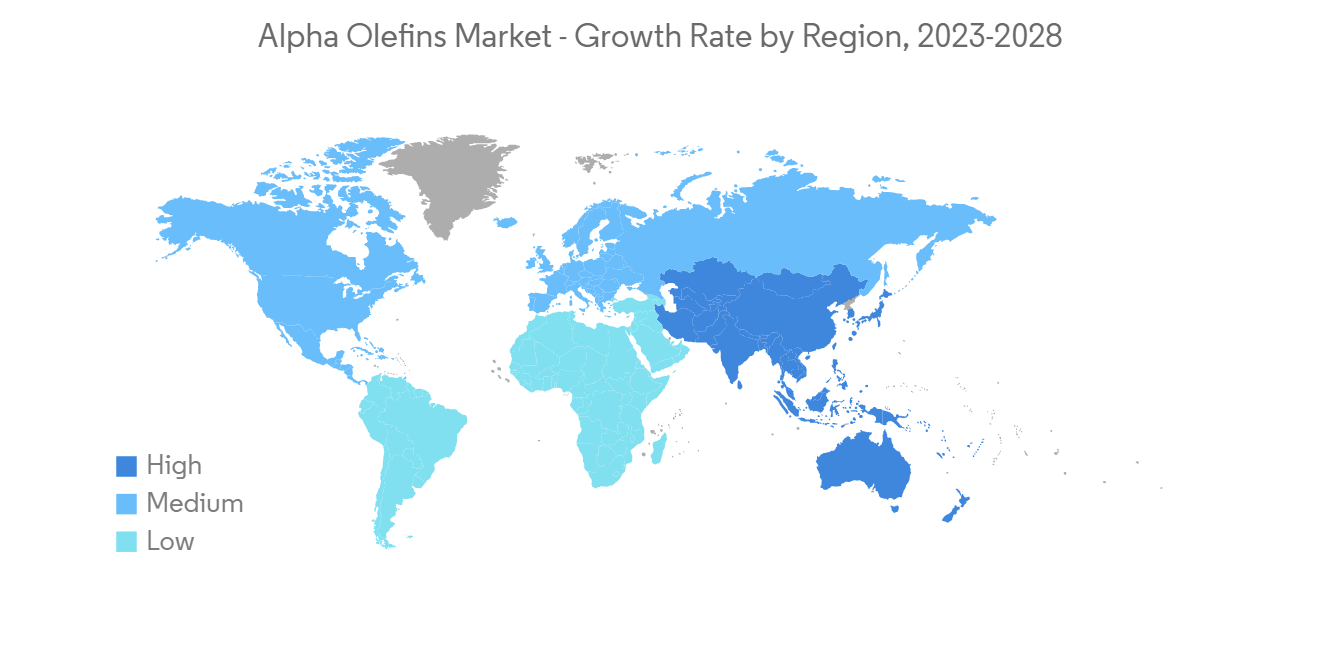

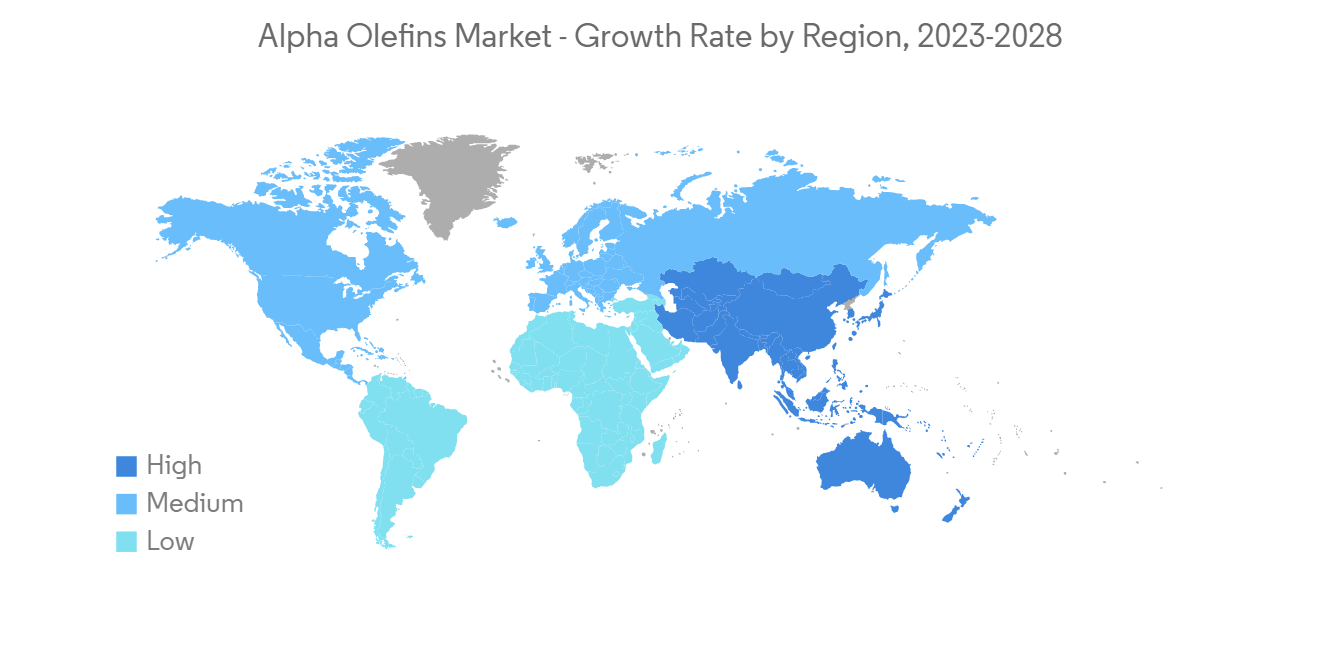

- 此外,用于开发各种来源的Alpha-烯烃的研发投资不断增加,预计将在未来几年成为市场机遇。 亚太地区主导着全球市场,中国、印度和日本等国家的消费量最大。

α-烯烃市场趋势

表面活性剂用量增加

- 表面活性剂包含在各种洗涤剂中,但其中阴离子表面活性剂因其良好的发泡性能而受到特别重视。 许多阴离子表面活性剂用于洗涤剂中,但目前最常用的是十二烷基苯磺酸盐和乙氧基化十二烷基硫酸钠。

- Alpha-烯烃磺酸是阴离子表面活性剂,多年来一直有效地用于洗衣和个人护理产品,但逐渐被其他低成本产品所取代。

- Alpha-烯烃磺酸盐在清洁剂中的主要优势是它们能够在稀产品、硬水和低温下形成稳定的泡沫。 此外,它具有良好的去污力,可用于洗涤剂和化妆品,可快速生物降解,与皮肤具有良好的相容性,并且高度溶于水。 因此它适用于液体或粉末洗涤剂和个人卫生用品,尤其是洗碗机、洗衣粉、汽车清洁剂或沐浴露。

- 个人护理中最常用的Alpha-烯烃磺酸盐是 C14-16 烯烃磺酸钠,可用作洗涤剂、润湿剂和乳化剂。 如果配製得当,C14-16 烯烃磺酸钠可带来诸如粘度、消费者可接受的发泡曲线和快速闪光泡沫等优点,以形成一致的泡沫。

- 洗涤剂和肥皂中含有的表面活性剂会与水混合併粘附在衣物等洗涤表面上的污垢上。 这降低了表面张力并允许从表面去除污垢。

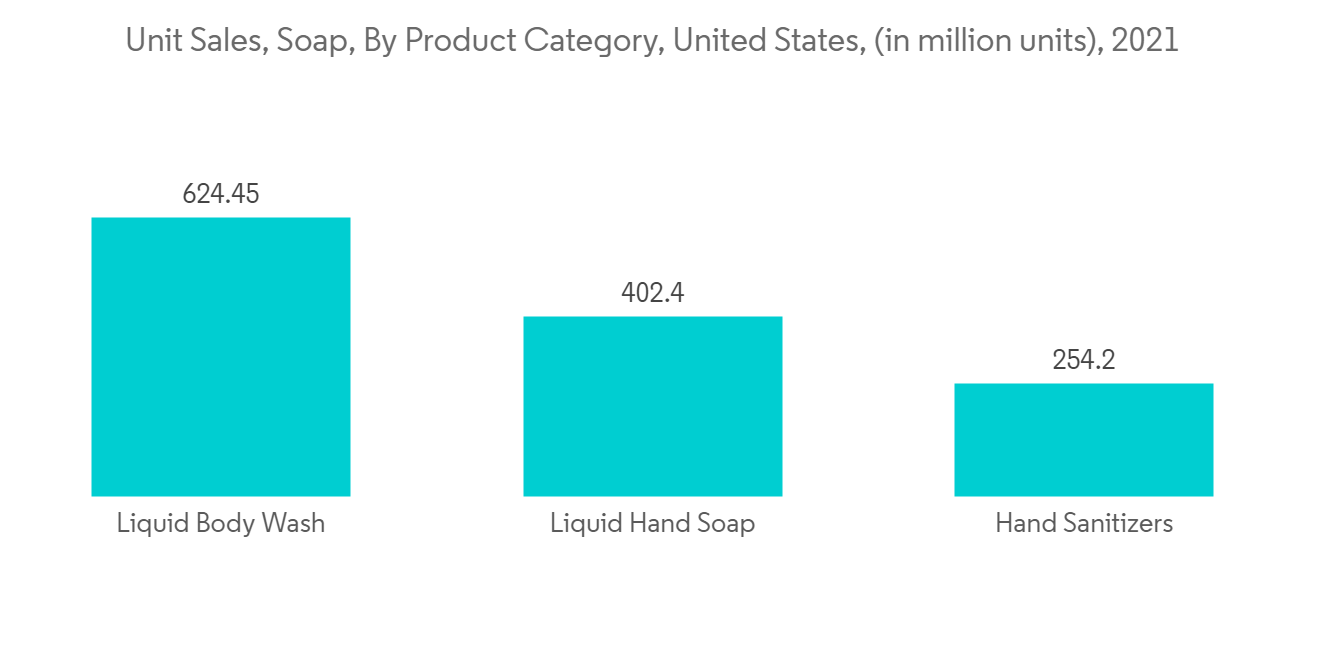

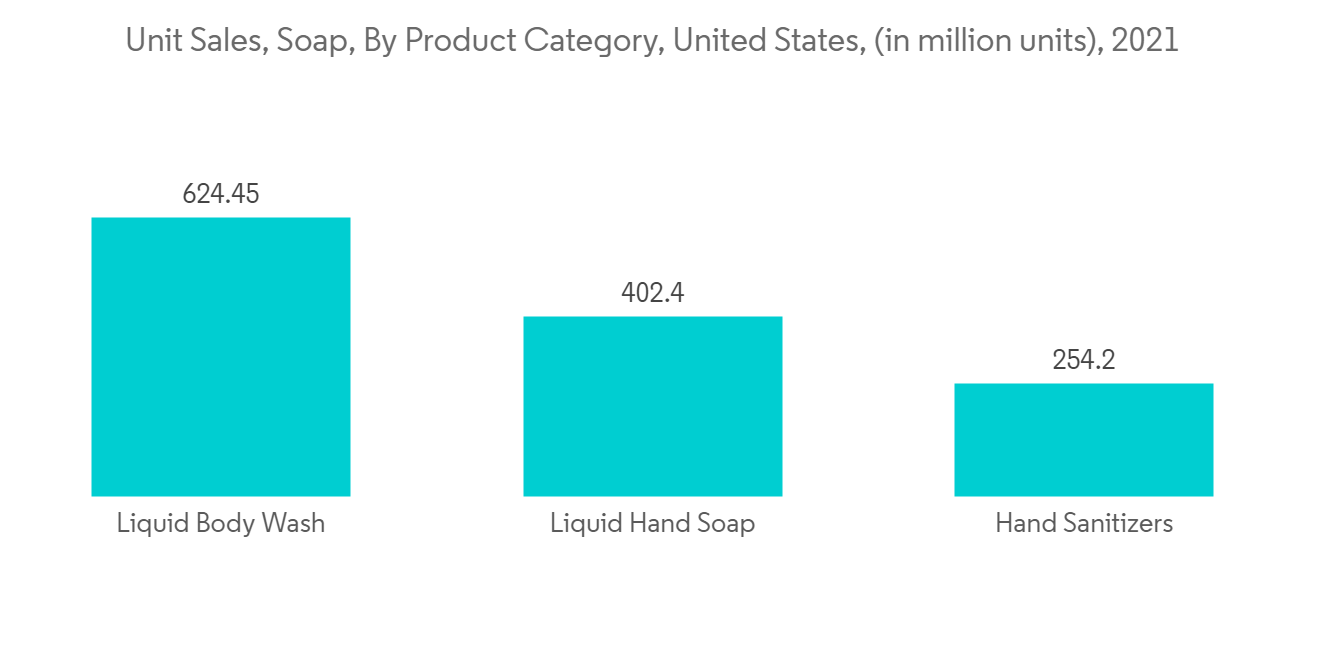

- 2021 年,沐浴露是美国销量最高的肥皂产品。 2021年,美国液体沐浴露品类的多渠道销量将达到约6.24亿件。 洗手液和洗手液紧随其后,2021年销量分别约为4.02亿和2.54亿支。 因此,预计市场在预测期内将稳步增长。 由于这些因素,预计市场将在预测期内增长。

亚太地区主导市场

- 预计亚太地区将成为Alpha-烯烃消费的主导市场。 中国、日本、韩国、印度和东南亚国家等国家对Alpha-烯烃的需求增加。 中国还是润滑油、油田化学品、增塑剂等产品的最大生产国,服务于全球市场。

- 在中国,由于 COVID-19 流行病导致卫生意识提高,肥皂和洗涤剂的消费量急剧增加。 预计这种消费将在未来几年推动对Alpha烯烃的需求。

- α 烯烃主要用于生产线性低密度聚乙烯 (LLDPE) 和高密度聚乙烯 (HDPE) 等聚乙烯,并用于从包装到管道的各种应用。

- 根据印度包装工业协会 (PIAI) 的数据,包装工业目前是印度第五大经济部门。 印度以每年 22-25% 的速度增长,已成为包装行业的首选中心。 预计这将增加对聚乙烯的需求,进而增加市场对Alpha-烯烃的需求。

- 此外,中国拥有世界上最大的纸浆和造纸工业之一。 中国是世界三大造纸国之一。 例如,2022年9月,中国转化纸和纸板产量将在1160万吨左右,预计将增加对Alpha-烯烃的需求。

- 因此,由于上述原因,亚太地区有望在预测期内主导所研究的市场。

α-烯烃行业概览

α 烯烃市场因其性质而部分整合。 市场参与者包括 Chevron Phillips Chemical Company LLC、INEOS、SABIC、Sasol、Shell plc。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第 1 章介绍

- 调查先决条件

- 本次调查的范围

第 2 章研究方法论

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 造纸和纸浆行业的需求不断扩大

- 其他司机

- 抑制因素

- 聚乙烯的不可生物降解特性

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 类型

- 1-己烯

- 1-辛烯

- 1-丁烯

- 其他类型

- 用法

- 润滑剂

- 油田化学品

- 增塑剂

- 聚烯烃共聚单体

- 表面活性剂

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 墨西哥

- 加拿大

- 其他北美地区

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第 6 章竞争格局

- 併购、合资企业、合作、合同

- 市场份额分析 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Evonik Industries AG

- Idemitsu Kosan Co., Ltd.

- INEOS

- Kemipex

- LANXESS

- Qatar Chemical Company Ltd

- Shell plc

- SABIC

- Sasol

第 7 章市场机会与未来趋势

- 增加研发投资以开发各种来源的alpha烯烃

简介目录

Product Code: 69487

The global alpha olefins market is projected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The major factor driving the market is the growing demand from the paper and pulp industries. On the flip side, stringent environmental regulations due to the non-biodegradable nature of polyethylene are hindering the growth of the alpha olefins market.

- Further, growing R&D Investments for the development of alpha olefins from various sources are expected to act as a market opportunity in the coming years. The Asia-Pacific region dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Alpha Olefins Market Trends

Increasing Usage in Surfactants Application

- Surfactants are present in a wide range of cleaning products, and one of the usual groups is anionic surfactants, which are particularly valued for their foaming ability. Many anionic surfactants are used in detergents, although the most commonly used today are the salts of dodecylbenzene sulfonic acid and ethoxylated sodium lauryl sulfate.

- Alpha olefin sulfonate is an anionic surfactant that has been used efficaciously for many years in laundry and personal care products but was gradually substituted by other low-cost products.

- The chief benefit of alpha olefin sulfonate in cleaning products is that it can form stable foams in diluted products, hard water, and at low temperatures. In addition, it has good cleaning properties, is useful in both detergents and cosmetics, has fast biodegradability, has good compatibility with the skin, and is highly soluble in water. Therefore, it is suitable for liquid or powder detergents and personal hygiene products, especially for dishwashers, laundry detergents, automotive cleaners, or bath gels.

- The most common alpha olefin sulfonate used in personal care is sodium C14-16 olefin sulfonate, which functions as a detergent, wetting agent, and emulsifier. When properly formulated, sodium C14-16 olefin sulfonate imparts viscosity, a consumer-acceptable foaming profile, and quick flash foam to produce a stable lather, among other benefits.

- The surfactants included in detergents and soaps mix with water and attach themselves to the dirt on clothes and other cleaning surfaces. This helps reduce surface tension and remove dirt from the concerned surface.

- In 2021, liquid body wash had the highest unit sales among soap products in the United States. In 2021, the liquid body wash category generated around 624 million units in multi-outlet sales in the United States. Also, it was followed by liquid hand soap and hand sanitizer, which sold about 402 million units and 254 million units, respectively, in 2021. This is expected to help the market grow steadily during the forecast period. Owing to all the abovementioned factors, the market is expected to grow during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to be the dominant market in alpha olefins consumption. In countries like China, Japan, South Korea, India, and Southeast Asian nations, the demand for alpha olefins is increasing. China is also the largest producer of lubricants, oil field chemicals, plasticizers, etc., catering to the market worldwide.

- The consumption of soap and detergent witnessed a sharp increase in the country, owing to the hygiene awareness due to the COVID-19 pandemic. This consumption is expected to propel the demand for alpha olefins in the coming years.

- Alpha olefins are mostly used to manufacture polyethylene, such as linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), which are used in various applications ranging from packaging to pipes.

- According to the Packaging Industry Association of India (PIAI), the packaging industry is currently the fifth-largest economic sector in India. It is growing at a rate of 22-25% per year, making India a preferred hub for the packaging industry. This is expected to increase the demand for polyethylene, in turn, increasing the demand for alpha olefins in the market.

- Further, China has one of the world's largest pulp and paper industries. China is one of the top three producers of paper in the world. For instance, in September 2022, China's processed paper and cardboard manufacturing volume was roughly 11.6 million metric tonnes, which is expected to increase the demand for alpha olefins.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market studied during the forecast period.

Alpha Olefins Industry Overview

The alpha-olefin market is partially consolidated in nature. Some of the major players in the market include Chevron Phillips Chemical Company LLC, INEOS, SABIC, Sasol, and Shell plc, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Paper and Pulp Industries

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Non-biodegradable Nature of Polyethylene

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 1-Hexene

- 5.1.2 1-Octene

- 5.1.3 1-Butene

- 5.1.4 Other Types

- 5.2 Appllication

- 5.2.1 Lubricants

- 5.2.2 Oil Field Chemicals

- 5.2.3 Plasticizers

- 5.2.4 Polyolefin Comonomers

- 5.2.5 Surfactants

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Merger and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chevron Phillips Chemical Company LLC

- 6.4.2 Exxon Mobil Corporation

- 6.4.3 Evonik Industries AG

- 6.4.4 Idemitsu Kosan Co., Ltd.

- 6.4.5 INEOS

- 6.4.6 Kemipex

- 6.4.7 LANXESS

- 6.4.8 Qatar Chemical Company Ltd

- 6.4.9 Shell plc

- 6.4.10 SABIC

- 6.4.11 Sasol

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing R&D Investments for the Development of Alpha Olefins from Various Sources

02-2729-4219

+886-2-2729-4219