|

市场调查报告书

商品编码

1273434

Polyamides市场 - 增长、趋势和预测 (2023-2028)Polyamides Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,Polyamides市场预计将以超过 4% 的复合年增长率增长。

主要亮点

- COVID-19 对 2020 年的市场产生了负面影响。 但市场将在2022年达到疫情前水平,有望继续稳步增长。

- 汽车和包装行业不断增长的需求预计将推动预测期内的市场增长。 另一方面,严格的政府法规和基于弹性体的替代品的竞争预计会阻碍市场增长。

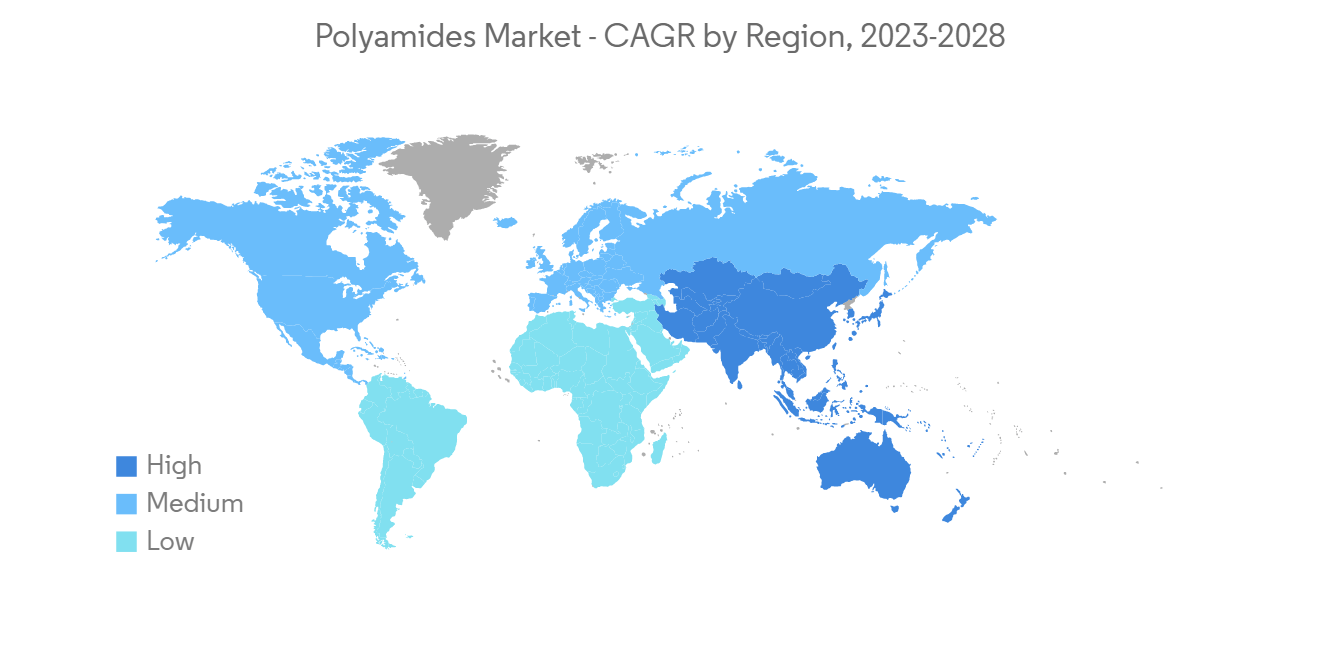

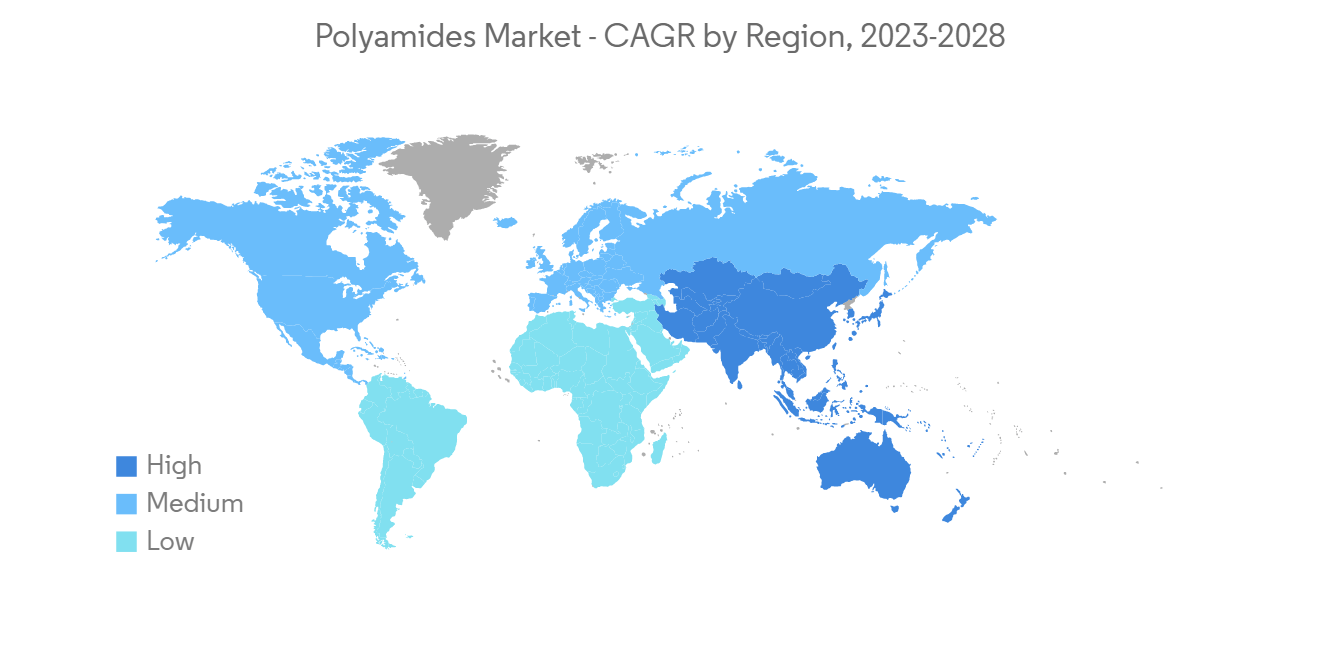

- 生物基Polyamides的日益普及有望在未来带来机遇。 亚太地区主导着全球市场,中国、印度和日本等国家的消费量最大。

Polyamides市场趋势

在汽车行业的应用拓展

- 塑料的使用使汽车更轻、更安全、更经济。 塑料用于製造内饰、结构元件、推进工程和技术部件。 Polyamides用于製造玻璃增强塑料结构件、进气歧管、发动机盖、摇臂阀盖、安全气囊容器以及许多其他汽车内外部件。

- 在汽车动力总成中,PA 6,4 比高分子量 PA 6,6 和 PA 6,6 具有更好的耐磨性能,因此製造商使用 PA 4,6 塑料链条张紧器导轨。我们正在推广。 它还可以提高安全性并减少噪音的产生。 PA 6、6 还用于汽车冷却系统,允许集成由铝或塑料製成的各种部件。 PA 6、6 也用于前照灯边框。

- 在印度,乘用车和商用车的销量大幅增长。 例如,2021-2022年国内乘用车销量将达到3,069,499辆,较2020-21年增长13%。

- 此外,该国生产的乘用车数量显着增加。 例如,根据印度汽车製造商协会(SIAM)发布的最新数据,2021-2022 年乘用车产量将达到 3,650,698 辆,较 2020-21 年增长 19%,推动市场增长。支持

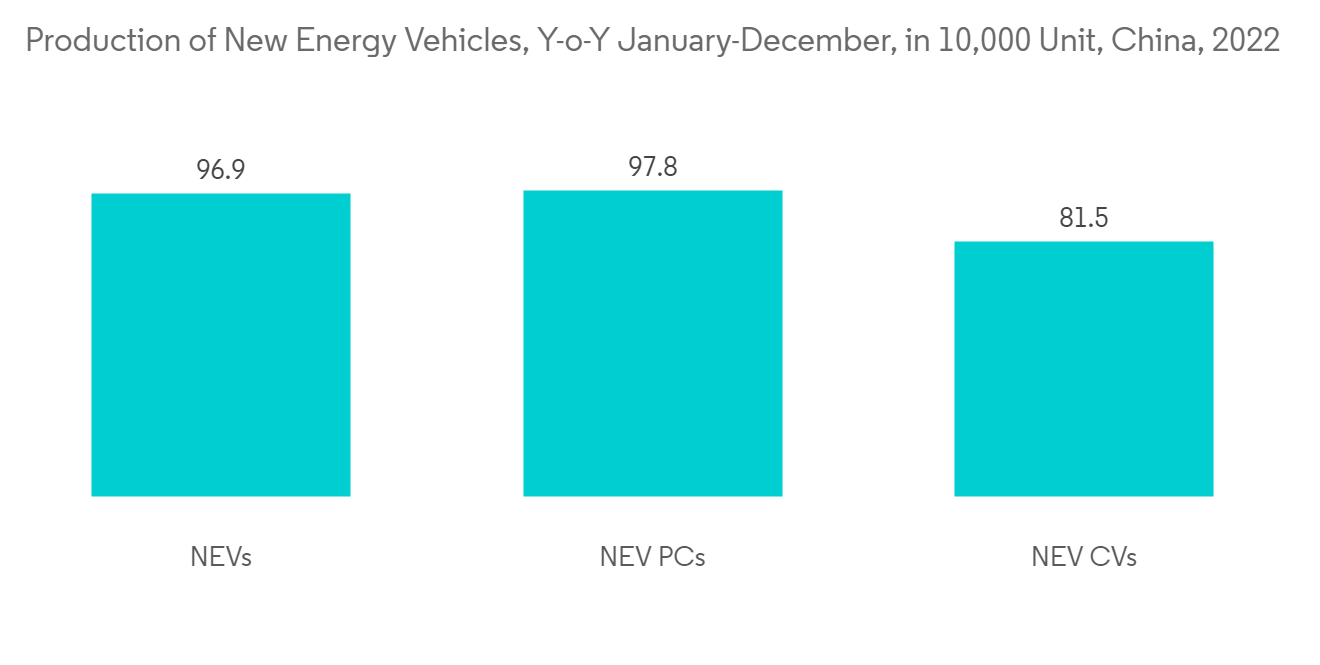

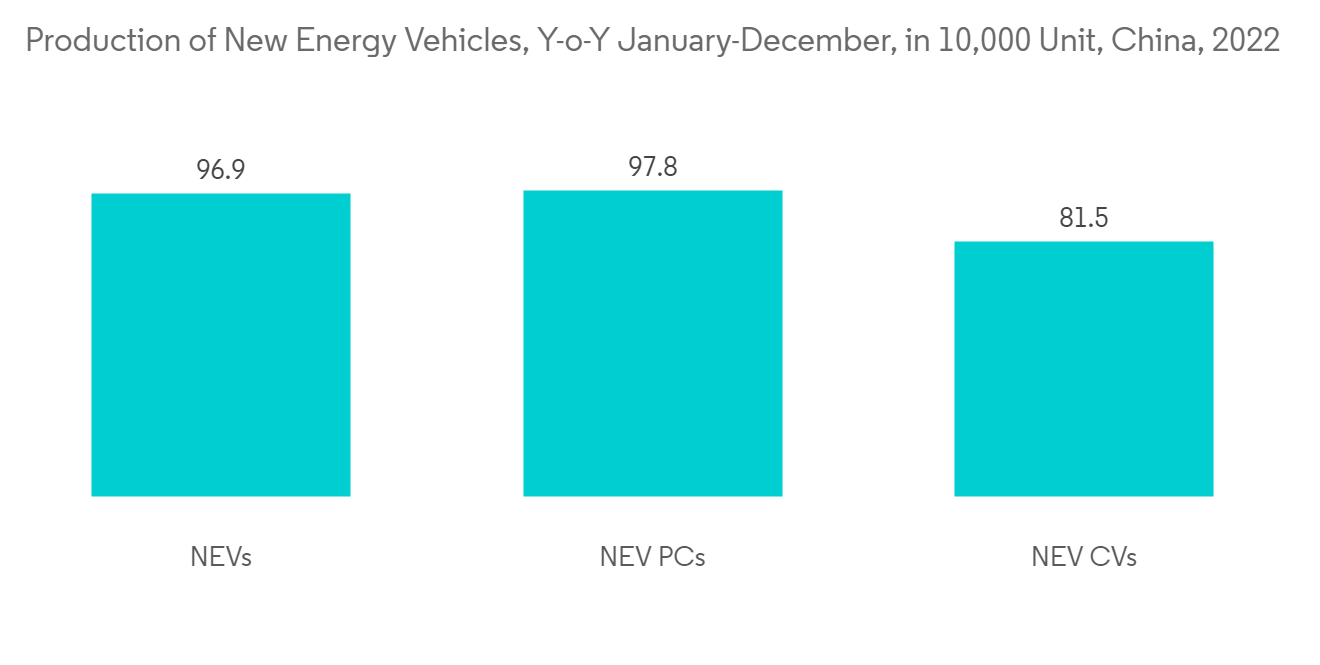

- 此外,中国汽车行业的扩张预计将有利于Polyamides的需求。 根据中国汽车工业协会 (CAAM) 的数据,2022 年 12 月,中国的新电动汽车 (NEV) 产量与去年同月相比增长了 96.9%。 预计这将增加该国对Polyamides的需求。

- 因此,由于汽车行业的扩张,在预测期内对Polyamides的需求将随之增加。

亚太地区主导市场

- 在过去几年中,亚太地区一直是最大的Polyamides市场。 亚太地区各国汽车、国防和电子行业的增长推动了市场研究。 汽车工业是Polyamides的最大消费者。 汽车行业对Polyamides的需求正以较高的速度增长。

- 人口的快速增长和可支配收入的增加是推动该地区汽车需求的两个主要原因。 根据国际汽车製造商协会(法国:OICA)的数据,中国是最大的汽车生产国。 2021 年仅中国就将生产 2,60,82,220 辆汽车。

- 此外,中国的国防部门也在不断发展,中国拥有世界上最大的国防预算。 中国政府提出2022年国防预算为2300亿美元,同比增长7.1%,极大地推动了市场增长。

- 此外,据日本电子和信息技术产业协会称,到 2021 年,日本整个电子行业的产值将增长近 10%,达到约 1000 亿美元,预测期间该地区对Polyamides的需求将增加期间。让

- 因此,由于上述原因,亚太地区预计将在预测期内主导所研究的市场。

Polyamides行业概况

Polyamides市场本质上是部分分散的。 市场上的主要参与者包括阿科玛、巴斯夫、杜邦、帝斯曼和可乐丽。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 汽车行业对Polyamides 6 和Polyamides 66 的需求不断扩大

- 在包装行业的广泛应用

- 约束因素

- 严格的政府法规

- 与基于弹性体的替代品的竞争

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于金额)

- 产品类型

- Polyamides 6,6

- Polyamides 6

- Polyamides 66

- 芳纶

- 其他产品类型

- 用法

- 吸湿性

- 耐化学性

- 耐热性

- 美丽

- 填色

- 最终用户行业

- 汽车

- 航空航天与国防

- 电气/电子

- 包装和储存

- 挤压

- 纺织品

- 其他最终用户行业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- Aquafil S.p.A

- Arkema

- Asahi Kasei Corporation

- Ascend Performance Materials

- BASF SE

- DuPont

- INVISTA

- DSM

- Kuraray Co. Ltd

- Lanxess

- NILIT

- Radici Partecipazioni SpA

- TORAY INDUSTRIES, INC.

第七章市场机会与未来趋势

- 生物基Polyamides越来越受欢迎

简介目录

Product Code: 46260

The polyamides market is projected to register a CAGR of more than 4% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The increasing demand from the automotive and packaging industry is expected to drive the growth of the market growth during the forecast period. On the other hand, stringent government regulations and competition from elastomer-based alternatives are expected to hinder the market's growth.

- The increasing popularity of bio-based polyamides is expected to be an opportunity in the future. The Asia-Pacific region dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Polyamides Market Trends

Growing Applications in the Automotive Industry

- The use of plastics makes vehicles lighter, safer, and more economical. Plastics are used for making interiors, structural elements, propulsion engineering, and technical parts. Polyamide is used in producing glass-reinforced plastics-based structural parts, air intake manifolds, engine covers, rocker valve covers, airbag containers, and various other interior and exterior automotive parts.

- For a car's powertrain, manufacturers are promoting plastic chain tensioner guides made of PA 4, 6 since PA 6, 4 offers better wear performance than high molecular weight PA 6, 6, and PA 6, 6. It also enhances safety and reduces noise generation. PA 6, 6 has found its way into automotive cooling systems, allowing the consolidation of various components that were once made of aluminum and plastics. PA 6, 6 is also used in headlamp bezels.

- India witnessed a significant increase in the sales of passenger vehicles and commercial vehicles. For instance, the domestic sales of passenger vehicles were 3,069,499 for 2021-2022, representing an increase of 13% compared to 2020-21.

- Furthermore, the country witnessed a significant increase in the production of passenger vehicles. For instance, according to the latest data published by the Society of Indian Automobile Manufacturers (SIAM), the production of passenger vehicles reached 3,650,698 for 2021-2022, representing an increase of 19% compared to FY 2020-21, supporting the market growth.

- Moreover, the expansion of the automotive segment in China is anticipated to benefit the demand for polyamides. According to the China Association of Automobile Manufacturing (CAAM), the country's production of new electric vehicles (NEVs) witnessed a year-on-year increase of 96.9% in December 2022. This, in turn, is expected to increase the demand for polyamides in the country.

- Thus, with expanding automotive industry, the demand for polyamides subsequently increases during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for the largest polyamide market in the past few years. The growing automotive industry, defense sector, electronics sector, etc., in various countries in the Asia-Pacific region, is driving the market studied. The automotive industry is the largest consumer of polyamides. The demand for polyamides from the automotive sector is increasing at a moderately high rate.

- Rapid population expansion and increased disposable income are two major reasons driving vehicle demand in the region. According to the International Organization of Motor Vehicle Manufacturers (French: Organisation Internationale des Constructeurs d'Automobiles) (OICA), China is the largest producer of automobiles. The country alone produced 2,60,82,220 units of vehicles in 2021.

- Moreover, China is witnessing growth in the defense sector, and the country has the largest defense spending in the world. The government of China has proposed a USD 230 billion defense budget for 2022, representing an increase of 7.1% year-on-year, supporting the market's growth significantly.

- Furthermore, according to Japan Electronics and Information Technology Industries Association, the overall production value of the Japan electronics sector increased by almost 10% to around USD 100 billion in 2021, increasing the demand for polyamides in the region during the forecast period.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market studied during the forecast period.

Polyamides Industry Overview

The polyamide market is partially fragmented in nature. Some of the major players in the market include Arkema, BASF SE, DuPont, DSM, and Kuraray Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Polyamide 6 and Polyamide 66 from the Automotive Industry

- 4.1.2 Wide-spread Applications in the Packaging Industry

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Competition from Elastomer-based Alternatives

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Polyamide 6,6

- 5.1.2 Polyamide 6

- 5.1.3 Polyamide 66

- 5.1.4 Kevlar

- 5.1.5 Other Product Types

- 5.2 Application

- 5.2.1 Moisture-Absorbent

- 5.2.2 Chemical-Resistant

- 5.2.3 Temperature-Resistant

- 5.2.4 Aesthetic

- 5.2.5 Colorable

- 5.3 End-User Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Electrical and Electronics

- 5.3.4 Packaging and Storage

- 5.3.5 Extrusion

- 5.3.6 Textile

- 5.3.7 Other End-User Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aquafil S.p.A

- 6.4.2 Arkema

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 Ascend Performance Materials

- 6.4.5 BASF SE

- 6.4.6 DuPont

- 6.4.7 INVISTA

- 6.4.8 DSM

- 6.4.9 Kuraray Co. Ltd

- 6.4.10 Lanxess

- 6.4.11 NILIT

- 6.4.12 Radici Partecipazioni SpA

- 6.4.13 TORAY INDUSTRIES, INC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity of Bio-based Polyamides

02-2729-4219

+886-2-2729-4219