|

市场调查报告书

商品编码

1273501

超轻互联网设备市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Ultra-Portable Internet Devices Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,超轻型互联网设备市场预计将以 7.05% 的复合年增长率增长。

随着移动性的提高,越来越多的终端用户正在更换传统的 PC 和相关小工具。 低成本解决方案的可用性,加上对计算、娱乐和通信设备的需求,被认为正在推动这些小工具的市场渗透。

主要亮点

- 随着 IoT 设备的引入增加,超轻型互联网设备市场预计会增长。 智能家居设备的推出正在推动便携式互联网设备的发展。 物联网和连接设备的销售增长将受到设备成本下降和标准化支持的新应用和商业模式的推动。 根据Ericsson的移动报告,预计到 2022 年将有 290 亿台联网设备,其中 180 亿台将连接到物联网。

- 不断变化的更好路由器标准是推动便携式互联网设备需求的因素之一。 在过去十年中,便携式互联网设备稳步增长,以响应电气和电子工程师协会制定的不断发展的标准。 这些标准不断更新以提高网络吞吐量,例如最大速度和传输容量。 超轻型移动设备非常便携,可以访问基于云的内容。 因此,出现了轻巧、先进且对消费者友好的计算机小工具,以促进市场的增长。

- 根据世界广告研究所 (WARC) 使用移动行业组织 GSMA 的统计数据进行的一项调查,到 2025 年,预计将有超过 13 亿人通过智能手机和 PC 访问互联网。 此外,估计有 6900 万人仅通过 PC 访问互联网。 根据 WARC,目前约有 20 亿人通过智能手机上网,占全球 3.9 手机用户的 51%。 预计这将阻碍市场增长。

- 全球金融危机和由此引发的欧元区危机暴露了许多国家/地区严重的宏观经济脆弱性。 这个问题涉及一系列与公共部门过度负债无关的宏观经济失衡。 几个国家的房价、贷款和工资都出现了波动。 这些内部失衡往往与经常账户赤字扩大、出口业绩下降以及成本和价格竞争力持续下降并存。 与此同时,政策制定者尚未建立足够的金融安全网。 此外,缺乏结构性改革导致这些经济体中的大多数严重缺乏灵活性,阻碍了有效的资源配置。 这些会对客户的购买力产生负面影响,并影响所研究的市场。

- 最近,在家工作已成为一种常态。 大规模向远程工作转变的速度导致个人设备的使用,例如手机、笔记本电脑、平板电脑和台式机。 我们还观察到员工使用个人互联网连接访问公司网络。 根据欧盟统计局的数据,疫情期间能够在家办公的欧洲员工比例大幅上升,法国达到 29.4%,德国达到 22.8%,西班牙达到 15.1%,意大利达到 13.6%。

超轻型互联网设备的市场趋势

对便携式小工具和更好的互联网连接的需求不断增长

- 根据国际电信联盟的数据,全球带宽使用量从 2020 年的 719 Tbit/s 增加到 2021 年的 932 Tbit/s。 增幅为 30%,与上一年呈类似上升趋势。 亚太地区国际带宽使用总量超过400Tbit/s,是欧洲(204Tbit/s)和美洲(180Tbit/s)最高的两倍。

- Verizon 预计 5G 带宽将增长,最新频段将在已启动的 46 个市场中为 1 亿人提供服务。 到 2022 年和 2023 年,覆盖范围预计将扩大到超过 1.75 亿人。 到 2024 年剩余的 C 波段退役时,预计将有超过 2.5 亿人在 C 波段频谱上使用 Verizon 的 5G 连接。 5G 连接的低延迟将推动市场。 延迟是数据从一台设备上传并到达目标所需的时间。 在 4G 网络上,用户看到的平均延迟约为 50 毫秒,而使用 5G 技术时则降至 1 毫秒。

- 2022 年 12 月,为了改善该国偏远地区的互联网连接,英国政府测试了 Elon Musk 的 Starlink,它使用卫星向地球传输宽带信号。 据政府称,最近的测试表明,Starlink 卫星将在许多地区提供高达每秒 200 兆位的互联网速度,是英国超过 50 Mbps 的平均宽带速度的四倍。 政府继续评估系统的功能,以及各种供应商的解决方案和服务。

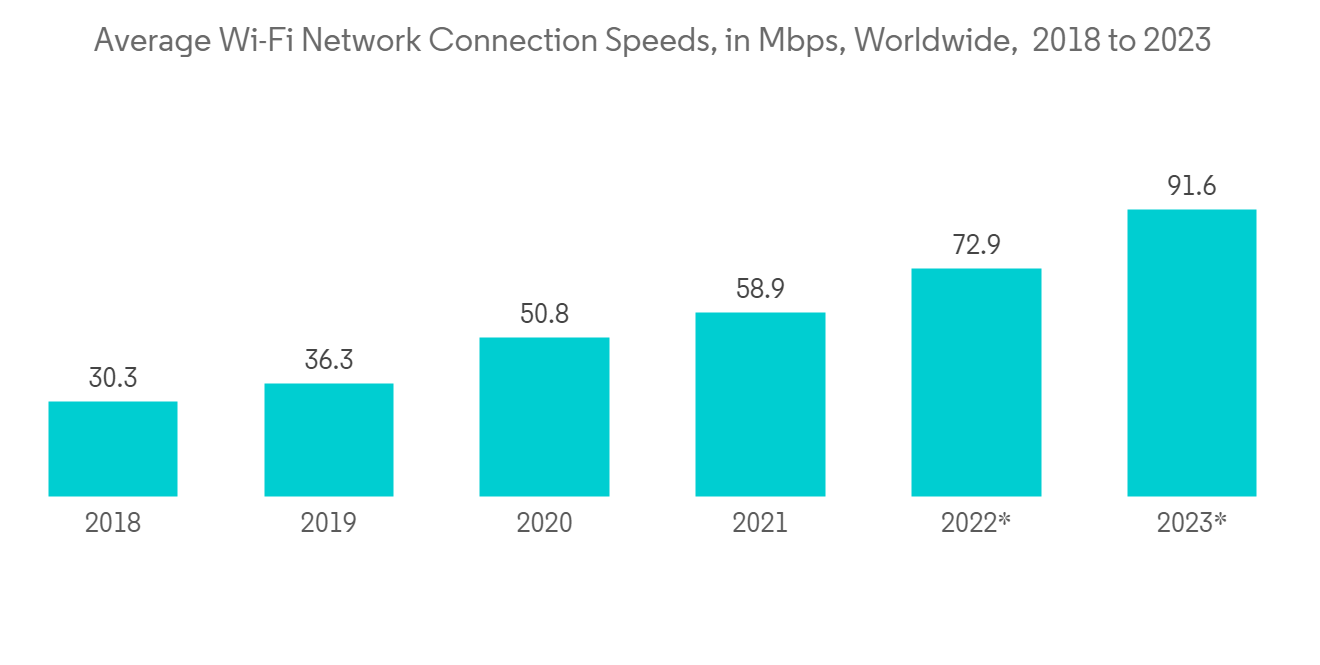

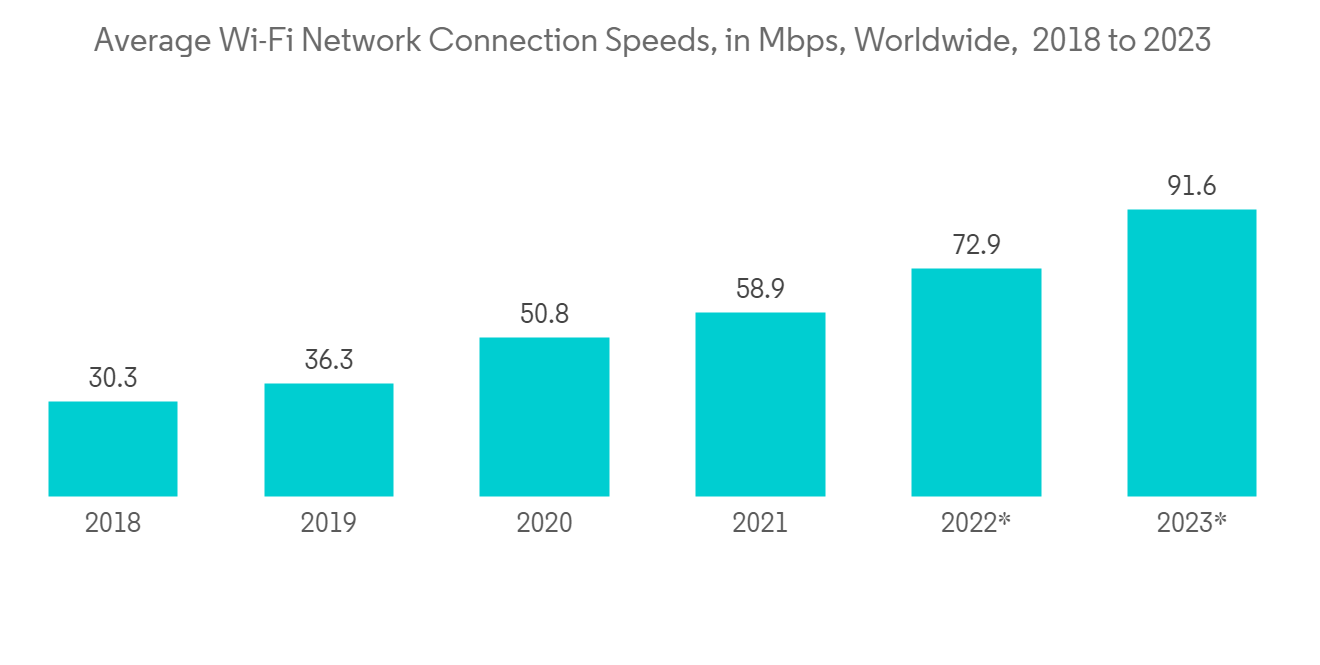

- 根据 Cisco Systems 的数据,从 2020 年到 2023 年,固定宽带互联网速度预计将增加近 50Mbps,最终达到 110.4Mbps。 2018年至2023年整个期间,年均增速有望达到20%。 2020 年的平均速度为 50.8 Mbps,比 2019 年提高了近 40%。 到2021年,预计将达到58.9Mbps,比2020年增长16%。

- 对智能手机、笔记本电脑、平板电脑和可穿戴设备等便携式电子产品的需求不断增长,推动了该行业的发展。 这些设备提供了更大的便利性、便携性和连接性,使它们成为许多人日常生活中不可或缺的一部分。 此外,技术的进步导致了更复杂和易于使用的设备的发展,增加了对便携式电子设备的需求。 此外,云计算和电子商务等在线服务的兴起增加了移动设备的使用,使用户可以随时随地访问这些服务。

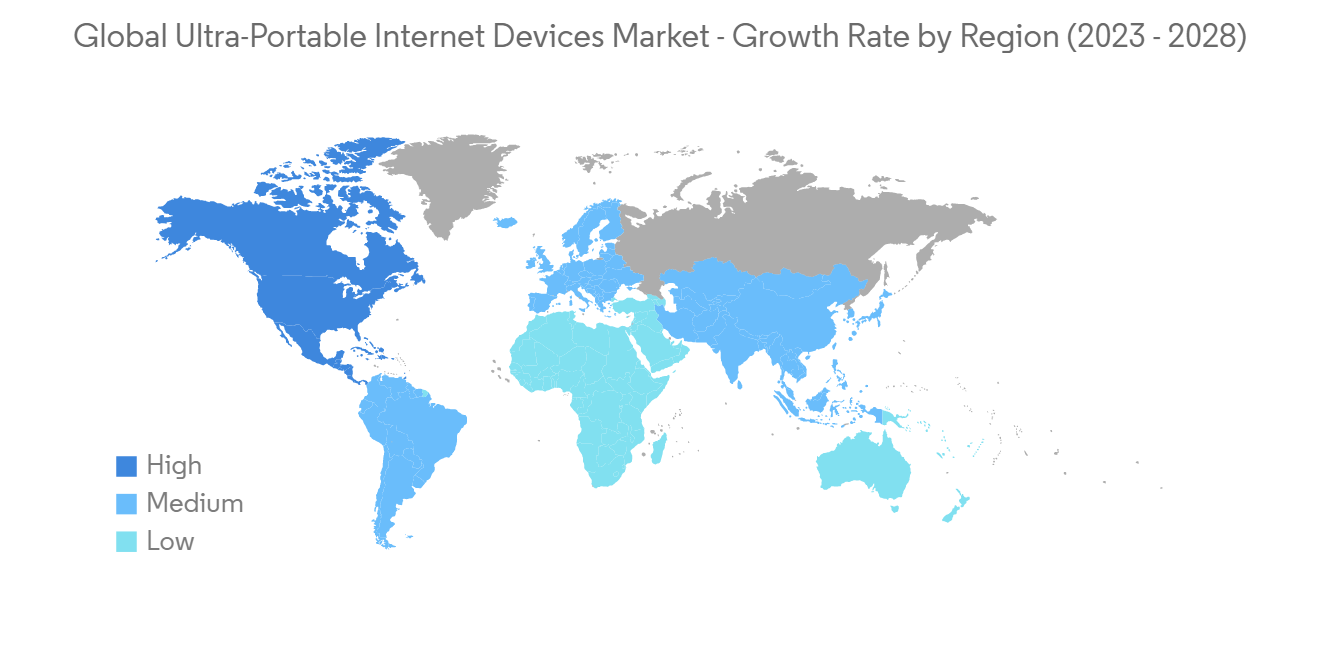

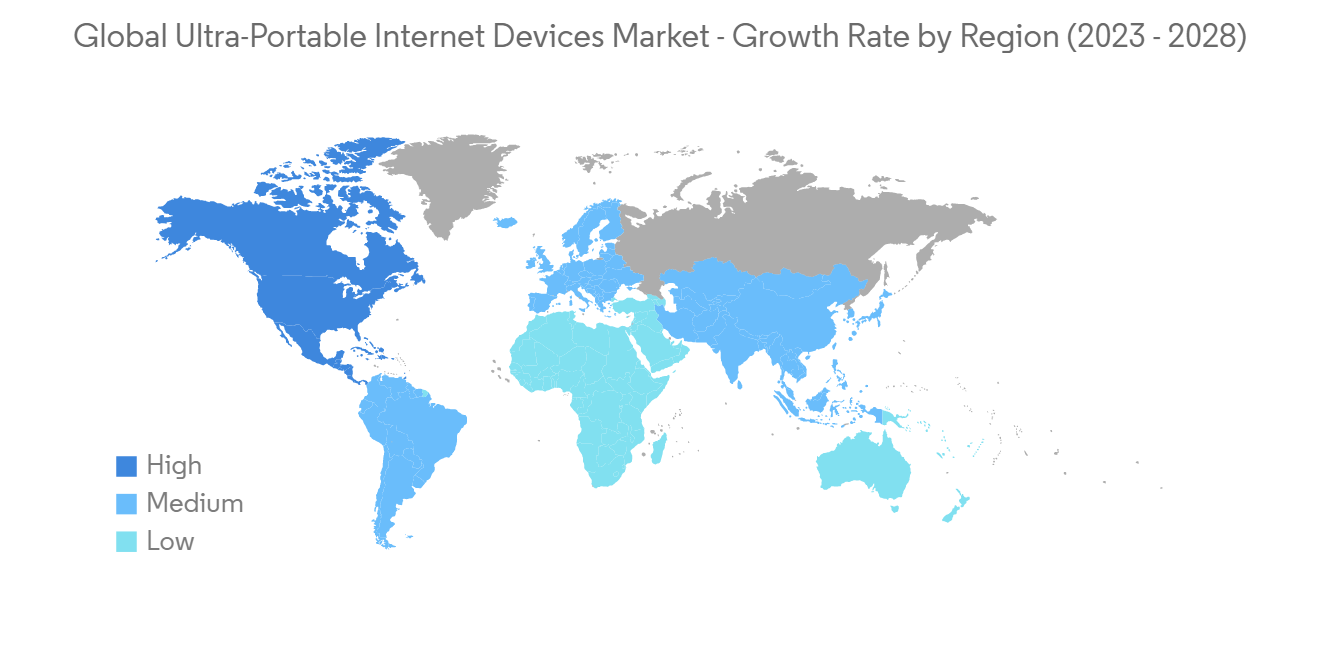

亚太地区增长最快

- 根据印度财政部政府发布的《2021-22 年印度经济调查》,该国互联网用户数量将在 2021 年超过 8.3 亿,并在六年内达到 5.3 亿2015. 不止于人。 印度的无线互联网数据总使用量从 2018 年的约 4,200 PB 激增了七倍多,到 2021 年达到 32,397 PB。 庞大的互联网基础将通过开发新产品来获得市场份额,从而为所研究的市场创造增长机会。

- 此外,政府将其教育系统数字化的举措正在推动超小型互联网小工具行业的发展。 例如,印度政府启动了“Kaushal Bharat,Kushal Bharat”项目。 根据该倡议,政府的目标是到 2022 年培训 4 亿人并让他们就业。 这些新举措包括 Pradhan Mantri Kaushal Vikas Yojana (PMKVY)、2015 年国家技能发展和创业战略、技能贷款计划和国家技能发展任务。 预计政府的此类努力将推动对教育系统计算机化的需求,从而在预测期内创造对超轻型互联网设备的需求。

- 此外,中国的超轻型互联网设备市场正在推出新产品。 例如,全球物联网模块供应商Quectel Wireless Solutions最近与China Mobile和Dianyi合作,在第25届GTI研讨会上展示了基于Quectel 5G模块RG500Q的5G USB dongle。 这款新推出的 5G 设备符合 3GPP Release 15 规范,支持 5G 独立 (SA) 和非独立 (NSA) 两种工作模式,是工业物联网、智慧城市、智能家居、培训教育和智能物流等领域的理想选择. 专为您的应用而设计。

- 该地区正在对 5G 的部署进行大量投资。 例如,澳大利亚政府已投入 1430 万美元的赠款,支持各种整合 5G 技术的公司。 到 2025 年,新加坡政府还投资了 250 亿新元(181 亿美元)的研发资金,以推进支持数字化利益最大化的变革性技术。 这可能会在预测期内提振对 5G 超轻型互联网设备的需求。

- 在现代教育机构中,无线连接已变得与笔和纸一样重要。 可靠、快速、安全和方便的互联网使教师能够访问促进更有效学习和发展的资源。 它还允许无限制地访问信息,从而提高学生的教育效果。 这些因素进一步增加了教育机构对无线路由器的需求,以建设支持互联网的校园,学生和教师可以通过互联网访问大量信息。

超轻型互联网设备行业概览

超轻型互联网设备市场的竞争格局因主要国际参与者的存在而分散。 在全球市场上运营的主要公司包括Apple Inc.、Microsoft Corporation、Intel Corporation、Samsung Electronics Corporation。 许多公司都在大力投资研发 (R&D) 以推出新类别的产品。 该领域的最新进展包括:

- 2022 年 11 月,Ericsson的物联网 (IoT) 部门与 Thales 合作推出了 IoT Access,这是一项提供来自预选服务提供商的非捆绑通用 eSIM 的服务。Larator 设备连接已启动。 企业现在第一次可以在设备激活期间轻鬆快速地选择一个或多个服务提供商。 这种新的商业模式将使公司能够显着缩短其物联网投资的上市时间。

- 2022 年 3 月,Vodafone Idea 宣布推出 Vi MiFi,这是一款袖珍型 4G 路由器,支持高达 150Mbps 的速度,最多可连接 10 台支持 WiFi 的设备。 它有一个 2700mAh 的电池,一次充电可以持续长达 5 小时。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第 4 章市场洞察

- 市场概览

- 产业吸引力 - 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 评估 COVID-19 对市场的影响

- 市场驱动因素

- 对便携式小工具的需求增加,互联网连接得到改善

- 市场製约因素

- 智能手机、Wi-Fi 路由器和集线器等替代设备的利用率很高

第 5 章市场细分

- 通过使用

- 个人使用

- 商业

- 按地区

- 北美

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美

第 6 章衝突信息

- 公司简介

- D-Link Corporation

- Google LLC

- TP-Link Technologies Co. Limited

- Huawei Technologies Co. Limited

- Xiaomi Inc.

- Netgear Inc.

第七章投资分析

第 8 章协作机器人市场的未来

The ultra-portable internet devices market is expected to register a CAGR of 7.05% over the forecasted period. With the growing mobility trend, an increasing number of end users are replacing traditional PCs and associated gadgets. The availability of low-cost solutions, combined with the desire for computers, entertainment, and communication devices, is likely to boost the market penetration of these gadgets.

Key Highlights

- The ultra-portable internet device market is anticipated to grow with the growing adoption of IoT devices. The adoption of smart home devices has been aiding the development of portable internet devices. The growth in the sale of IoT and connected devices is driven by emerging applications and business models supported by falling device costs and standardization. According to Ericsson's mobility report, out of the projected 29 billion connected devices by 2022, 18 billion were expected to be related to IoT.

- The constantly changing criteria for better routers is one of the elements driving the demand for portable internet devices. Throughout the last decade, portable internet devices have grown steadily, keeping up with developments in standards set by the Institute of Electrical and Electronics Engineers. These specifications are continually updated to improve network throughput in terms of maximum speeds and transmission capacities. Ultra-portable mobile devices provide greater portability and access to cloud-based content. As a result, low-weight, advanced, consumer-friendly computer gadgets have emerged, boosting the market's growth.

- According to a survey conducted by the World Advertising Research Center (WARC) utilizing statistics from the mobile trade association GSMA, it is expected that over 1.3 billion people will access the internet via smartphone and PC by 2025. Furthermore, 69 million people are predicted to access the internet solely through a PC. According to WARC, approximately 2 billion individuals currently access the internet through smartphones, accounting for 51% of the global base of 3.9 mobile users. This is expected to hinder the market's growth.

- Severe macroeconomic vulnerabilities were exposed to the public in many countries due to the global financial crisis and the accompanying euro area crisis. The issues covered various macroeconomic imbalances unrelated to the public sector's excessive debt. House prices, loans, and wages all grew wildly in several nations. These internal imbalances frequently coexisted with escalating current account deficits, declining export performance, and continuous cost and pricing competitiveness declines. At the same time, policymakers did not create enough fiscal safety nets. In addition, a lack of structural changes left most of these economies with severe rigidities preventing efficient resource allocation. These will show a negative effect on the customer purchase power, affecting the market studied.

- Working from home has become standard these days. The speed of the shift to large-scale remote work has resulted in the use of personal devices, including mobile phones, laptops, tablets, and desktops. Employees are also observed using personal internet connections to access the corporate network. According to Eurostat, during the pandemic, a considerable increase was observed in the proportion of employed people in Europe who could work from home, reaching 29.4%in France, 22.8% in Germany, 15.1% in Spain, and 13.6% in Italy.

Ultra Portable Internet Devices Market Trends

Increasing Demand for Portable Gadgets and Improved Internet Connectivity

- According to the International Telecommunication Union, global bandwidth use increased from 719 Tbit/s in 2020 to 932 Tbit/s in 2021. This represents a 30% gain and follows a rise similar to the one from the previous year. The Asia-Pacific region has the greatest regional total for the use of international bandwidth at over 400 Tbit/s, which is twice as high as that of Europe (204 Tbit/s) or the Americas (180 Tbit/s).

- Verizon expects to have incremental 5G bandwidth via the latest spectrum available to 100 million people in the starting 46 markets. Over 2022 and 2023, coverage is likely to increase to more than 175 million people. By 2024, when the remaining C-Band is cleared, greater than 250 million people are expected to access Verizon's 5G connection on the C-Band spectrum. Low latency in 5G connection drives the market as latency is when it clutches for data from one device to be uploaded and reaches its target. With 4G networks, the user looks at an average latency of around 50 ms, dropping to 1 ms with 5G technology.

- In December 2022, to improve internet connectivity in distant areas of the country, the UK government tested Elon Musk's Starlink, which employs satellites to beam a broadband signal to Earth. According to the government, the recent test showed that Starlink satellites could give internet rates of up to 200 megabits per second in many regions, four times faster than the UK average broadband speed of over 50 Mbps. The government continued to evaluate the system's capability and other solutions and services from various vendors.

- According to Cisco Systems, from 2020 to 2023, fixed broadband internet speeds are predicted to improve by nearly 50 Mbps, finally reaching 110.4 Mbps. During the entire period from 2018 to 2023, the compound annual growth rate is expected to reach 20%. The average speed in 2020 was 50.8 Mbps, representing a nearly 40% increase over 2019. It was predicted to rise by 16% from 2020 to 58.9 Mbps in 2021.

- The rising demand for portable electronics such as smartphones, laptops, tablets, and wearable gadgets propels the industry forward. These devices provide more convenience, portability, and connectivity, making them crucial to many people's everyday lives. Furthermore, technological improvements have led to the development of more sophisticated and user-friendly devices, which has increased the demand for portable electronics. The rise of online services such as cloud computing and e-commerce has also led to the increased use of mobile devices, which allow users to access these services at any time and from any location.

Asia-Pacific to Witness the Fastest Growth

- According to the Economic Survey of India 2021-22 published by the Ministry of Finance, Government of India, the country's internet user base crossed 830 million in 2021, growing by over 530 million in the six years since 2015. India's total volume of wireless internet data usage surged over 7x to 32,397 petabytes in 2021 from around 4,200 petabytes in 2018. A huge internet base would create an opportunity for the market studied to grow by developing new products to capture the market share.

- Furthermore, the government's drive to digitize their country's education system is functioning as a spur for the ultra-portable internet gadget industry. For example, the Indian government launched the 'Kaushal Bharat, Kushal Bharat' project. With this effort, the government has set a goal of training 400 million persons by 2022 so that they can find work. These new initiatives include the Pradhan Mantri Kaushal Vikas Yojana (PMKVY), the National Strategy for Skill Development and Entrepreneurship 2015, the Skill Loan Scheme, and the National Skill Development Mission. Such government initiatives necessitate a computerized education system, which will generate a demand for ultra-portable internet devices over the forecast period.

- Moreover, the market for ultra-portable internet devices in China is witnessing new product launches. For instance, Quectel Wireless Solutions, a global supplier of IoT modules, recently partnered with China Mobile and Dianyi to demonstrate a 5G USB dongle based on Quectel 5G module RG500Q at the 25th GTI Workshop. Compliant with 3GPP Release 15 specifications and capable of both 5G standalone (SA) and non-standalone (NSA) modes of operation, the newly launched 5G device is designed for industrial IoT, smart city, smart home, training and education, and intelligent logistics applications.

- The region is witnessing huge investments in 5G implementation. For instance, the Australian government invested USD 14.3 million in grants to support various enterprises integrating 5G technologies. Also, the Singaporean government invested SGD 25 billion (USD18.1 billion) in R&D funding until 2025 to drive transformative technologies supporting efforts to maximize the benefits of digitalization. This may drive the demand for 5G ultra-portable internet devices over the forecasted period.

- In addition, in modern educational institutions, wireless connectivity is becoming as essential as pen and paper. Reliable, fast, secure, and convenient internet allows teachers to access resources that promote more effective learning and development. Moreover, it also provides students unlimited access to information to enrich their education. Such factors further boost the demand for wireless routers in education institutions to create internet-enabled campuses that allow students and teachers to access a great amount of information over the internet.

Ultra Portable Internet Devices Industry Overview

The competitive landscape of the ultra-portable internet devices market is fragmented due to the presence of major international key players. Some of the key companies operating in the global market include Apple Inc., Microsoft Corporation, Intel Corporation, and Samsung Electronics Corporation. Various companies invest heavily in research and development (R&D) to launch a new category of products. Some of the recent developments in this field are:

- In November 2022, in collaboration with Thales, Ericsson's Internet of Things (IoT) division launched IoT Accelerator Device Connect, a service that offers generic eSIMs unbundled from pre-selected service providers. For the first time, organizations may easily and rapidly select one or more service providers during device activation. This new business model significantly reduces organizations' time to market for IoT investments.

- In March 2022, Vodafone Idea announced the release of Vi MiFi, a pocket-size 4G router that supports speeds of up to 150 Mbps and allows users to connect up to ten WiFi-enabled devices. The company claims it has a 2700 mAh battery that may last up to 5 hours on a single charge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Increasing demand for Portable Gadgets and Improved Internet Connectivity

- 4.5 Market Restraints

- 4.5.1 High availability of alternate devices such as Smartphones, Wi-Fi routers, hubs etc.

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Personal Use

- 5.1.2 Commercial Use

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE INTELLIGENCE

- 6.1 Company Profiles

- 6.1.1 D-Link Corporation

- 6.1.2 Google LLC

- 6.1.3 TP-Link Technologies Co. Limited

- 6.1.4 Huawei Technologies Co. Limited

- 6.1.5 Xiaomi Inc.

- 6.1.6 Netgear Inc.