|

市场调查报告书

商品编码

1332474

分析设备市场规模和份额分析-增长趋势和预测(2023-2028)Analytical Instrumentation Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

分析仪器市场规模预计将从 2023 年的 494.7 亿美元增长到 2028 年的 662.7 亿美元,预测期内(2023-2028 年)复合年增长率为 6.02%。

对产品质量的日益关注、研发投入的增加以及严格的政府法规是推动分析仪器市场增长的主要因素。 客户意识的提高(尤其是在新兴地区)以及跨学科分析仪器的需求预计将促进市场增长。 有关药品安全的严格监管、对食品质量的日益关注、原油和页岩气产量的增加以及质谱仪的技术进步将推动市场增长。

主要亮点

- 生物製药行业在研究市场的发展中也发挥着重要作用。 随着对药品质量生产的日益关注,生物加工行业也逐渐成为研究市场的重要投资者。

- 2022 年 1 月,富士胶片宣布为其北卡罗来纳州工厂新增 89,000 平方英尺的实验室空间。 该设施将包括分析仪器、高通量生物加工设备和自动化技术,以支持过程表征计划。 此次扩张将使 Fujifilm Geosynth Biotechnologies 能够进一步协助合作伙伴指导临床工艺开发,从而创建更强大的商业流程。

- 最终用户行业的自动化刺激了所研究市场的发展。 为电动汽车、手机、能源系统和其他系统开发电池的公司依靠分析仪器来增加存储容量和输出,创造更高效、更清洁和更安全的能源。 公司使用电子显微镜技术来了解原子级结构,并使用光谱工具来发现材料中导致缺陷和低效率的关键变化。

- 元素分析光谱仪广泛应用于环境、石化、食品安全、冶金、地球化学、临床/毒理学研究等领域。 这些产品广泛应用于中国、印度和拉丁美洲等市场,以支持遵守日益严格的国际环境和消费者安全法规。 安捷伦科技(Agilent Technologies)、赛默飞世尔科技(Thermo Fisher Scientific) 和岛津製作所(Shimadzu Corporation) 是接受调查的主要供应商之一,它们越来越多地投资于市场开发和市场拓展。

- 但是,分析设备的高成本限制了市场的增长。 除了设备成本外,其他各种成本,如员工劳动力成本、维护成本和实验室成本也限制了市场的增长。 此外,不断增加的特性和功能、技术进步和创新系统正在推高分析设备的成本。 例如,高效液相色谱 (HPLC) 的成本在 12,000 美元至 50,000 美元之间。 一个 90L 的色谱柱和装柱站的成本约为 200,000 美元。

- 新冠肺炎 (COVID-19) 疫情的爆发在所研究的市场中创造了巨大的需求。 在 COVID-19 疫情期间,对加速研究的需求显着增加,公众期望科学界取得前所未有的进展。

分析仪器市场趋势

生命科学领域预计将占据较大市场份额

- 生命科学在分析仪器行业中所占份额最大,占整个行业的四分之一。 生命科学包括超过十三个不同的技术领域,并涵盖使用分析工具的各种应用,特别是光谱学、原子光谱学和分子光谱学。 它为通用仪器应用和利基研究系统提供了巨大的增长机会。

- 对下一代测序 (NGS) 的需求持续强劲,影响着测序领域并推动了对核酸样品製备领域的强劲需求。 随着基因组技术已经超越基础研究并进入生物医学领域,这种增长在公共和私营部门都很显着。

- 如此巨大的增长预计将为分析仪器解决方案带来巨大需求,因为它们可以帮助製药公司遵守严格的药品安全法规。

- 该市场呈现出多项战略发展,例如新产品开发、合併和合作伙伴关係,表明该细分市场越来越多地采用分析工具。

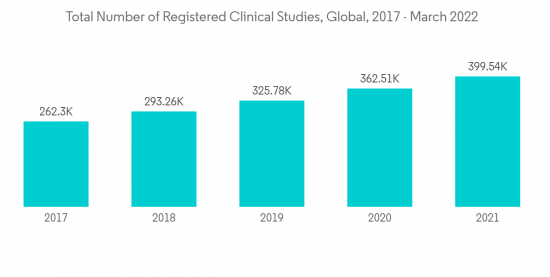

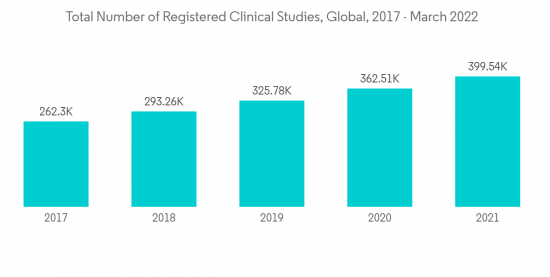

- 药物发现和临床研究需要各种复杂的诊断设备、分析设备、先进的医疗设备、检测设备和许多其他专业产品。 由于加速研究的需求不断增长以及社会对科学界前所未有的进步的期望,COVID-19 大流行给市场带来了巨大的需求。

- 因此,随着临床研究和药物发现活动的增加,生命科学行业对分析仪器的需求预计也会增长。

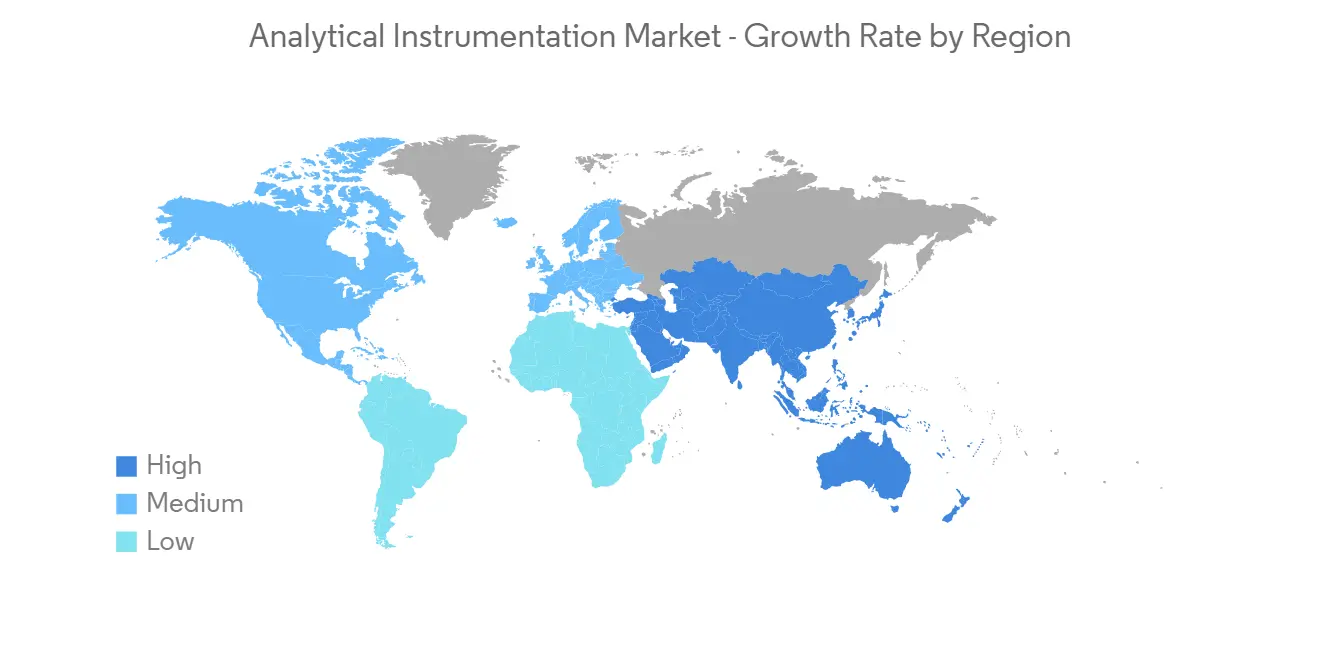

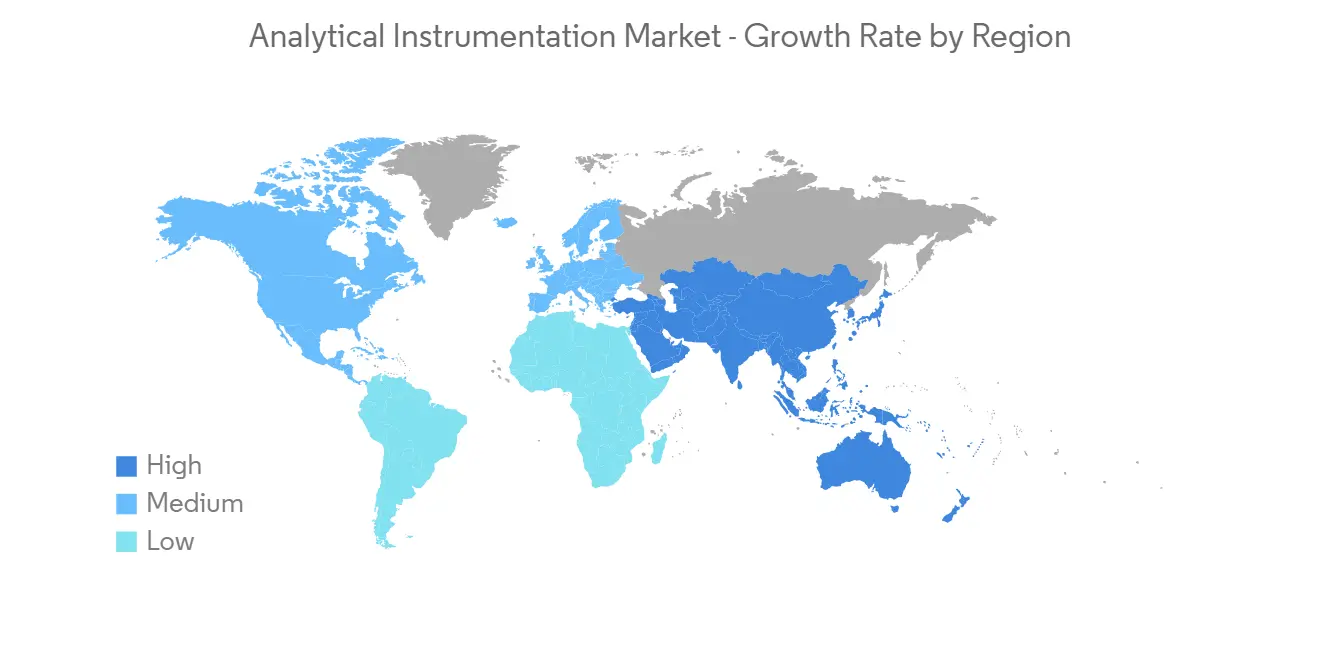

预计市场将高速增长的亚太地区

- 亚太地区对分析仪器的需求正在显着增长。 具体来说,这些产品用于解决气候变化、人口老龄化、粮食生产和新能源问题。 分析设备供应商也通过本地分销和直销来响应市场需求。 中美之间的贸易争端还导致多家公司将部分生产和供应链转移到中国境外,以避免业务运营受到干扰。

- 生命科学是中国政府在分析设备方面取得显着增长的领域之一。 “十三五”期间,我国生命科学产业实现中高速增长。 中国政府宣布下一个五年计划将包括在未来20年内向精准医疗行业投资约90亿美元。 此外,尚无特定的抗病毒治疗方法被证明对 COVID-19 有效。 中国使用抗病毒药物、不同药物和中药的组合。 然而,目前的疗法主要基于过去的经验,显示出治疗流感和其他病毒感染的临床疗效。

- 该地区拥有众多国家,从先进技术中心到新兴经济体。 新加坡、韩国、台湾和澳大利亚等国家已经在製药、生物技术、半导体和采矿等行业的世界舞台上发挥着重要作用。 这些国家的增长得益于大量外国投资和融入全球供应链的理想地点。 许多人预计该地区国家很快就能与中国、日本和其他国际参与者竞争。

- 由于对测试和研发活动的投资不断增加,印度等国家也跻身分析仪器行业的新兴市场之列。 不断扩大的最终用户行业意识的提高也推动了对该市场的投资。 因此,进入世纪之交以来,中国的分析设备市场经历了快速增长。 然而,在过去几年中,变化的速度已放缓至低个位数,利润率继续萎缩。 儘管私营公司的收入仍在增长,但来自政府机构和私营部门的采购压力正在损害私营公司的利润。

- 根据印度分析仪器协会 (IAIA) 的数据,印度目前约占全球分析仪器市场的 2-3%。 然而,印度规模很小,尤其是在液相色谱仪和质谱仪等高端仪器的製造方面。

- IAIA 对由于政府缺乏对该国分析仪器行业的支持而导致利润率下降和增长率放缓表示担忧,并建议政府机构提出紧急干预建议。

分析行业概述

分析仪器市场分散,存在大量初级和中小型供应商,具体情况取决于地点。 虽然市场上的主要供应商已经获得了更详细的产品组合併满足不同客户的需求,但较小的供应商在利基领域开展业务,提供定制和客户特定订单。 主要参与者包括安捷伦科技公司、马尔文帕纳科有限公司(思百吉公司)、珀金埃尔默公司、赛默飞世尔科技公司和岛津公司。

- 2022 年 2 月 - Sartorius AG 宣布收购 Novasep 的色谱部门。 收购的产品组合包括用于寡核甘酸、□和胰岛素等小型生物製剂的色谱系统,以及用于连续生物製剂生产的创新系统。

- 2022 年 1 月 - 布鲁克公司宣布收购 Prolab Instruments GmbH,这是一家专门从事低流量、高精度液相色谱技术和系统的瑞士技术公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章研究方法

第 3 章执行摘要

第 4 章市场洞察

- 市场概览

- 工业价值链分析

- 行业吸引力 - 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场动态

- 市场驱动因素

- 精准医疗的发展

- 市场製约因素

- 初始成本高

第六章 COVID-19 对行业的影响评估

第七章市场细分

- 产品类型

- 色谱法

- 分子分析光谱

- 元素分析光谱

- 质谱分析

- 分析显微镜

- 其他产品类型

- 最终用户

- 生命科学

- 化学/石油化学

- 石油和天然气

- 材料科学

- 食品检验

- 供水和污水处理

- 其他最终用户

- 地区

- 北美

- 欧洲

- 亚太地区

- 世界其他地区

第8章竞争态势

- 供应商排名分析

- Chromatography

- Mass Spectroscopy Market

- Molecular Analysis Spectrometers

- Elemental Analysis Spectrometers

- 企业檔案

- Agilent Technologies Inc.

- Bruker Corporation

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corporation

- Malvern Panalytical Ltd(Spectris company)

- Mettler Toledo International Inc.

- Waters Corp.

- Bio-Rad Laboratories Inc.

第9章 投资分析

第10章 市场展望

The Analytical Instrumentation Market size is expected to grow from USD 49.47 billion in 2023 to USD 66.27 billion by 2028, at a CAGR of 6.02% during the forecast period (2023-2028).

The increasing concern for product quality, increasing investments in R&D, and stringent government regulations are the major factors driving the analytical instrumentation market growth. Increasing customer awareness, especially in emerging regions, and the need for analytical instruments across multiple sectors are expected to expand the market growth. Stringent regulations on drug safety, increasing focus on the quality of food products, expansion of crude and shale gas production, and technological advancements in mass spectrometers would aid the market growth.

Key Highlights

- The biopharmaceutical industry also plays a significant role in developing the studied market. With a rising emphasis on pharmaceutical quality production, the bioprocessing sector is also emerging as a substantial investor in the market studied.

- In January 2022, Fujifilm announced the addition of an additional 89,000 sq. ft of laboratory space at its North Carolina facility, which will feature analytical instrumentation, high throughput bioprocessing equipment, and automation technologies to support the process characterization program. This expansion will also allow Fujifilm Diosynth Biotechnologies to help its partners further in guiding clinical process development that can create more robust commercial processes.

- Automation across the end-user industries fueled the development in the market studied. Companies developing batteries for electric vehicles, mobile phones, energy systems, and other systems rely on analytical instruments to enhance storage potential and output, creating a more efficient, cleaner, and safer energy source. Companies use electron microscopy technologies to understand structures that level down at the atomic scale and spectroscopy tools to discover critical changes in materials that cause defects and inefficiency.

- Elemental analysis spectrometers are finding applications in environmental, petrochemical, food safety, metallurgical, geochemical, and clinical/toxicology research. These products are widely used in markets such as China, India, and Latin America, to support compliance with increasingly stringent international environmental and consumer safety regulations. Agilent Technologies Inc., Thermo Fisher Scientific, and Shimadzu Corporation, among others, are some significant vendors in the market studied, which are also increasingly investing in the market development and expansion of market scope.

- However, the high cost of analytical instruments restrains the growth of the studied market. Along with the cost of instruments, various other costs, such as staffing, maintenance, and laboratory expenses, are also restraining the market's growth. Moreover, the advancement in features and functionalities, technological advances, and innovative systems are adding to the cost of analytical instruments. For instance, high-performance liquid chromatography (HPLC) ranges from USD 12,000 to USD 50,000. The 90-L column and packing station costs about USD 200,000.

- The COVID-19 outbreak resulted in significant demand in the market studied. The need for accelerated research significantly increased during the COVID-19 epidemic, and the public expects unprecedented progress from the scientific community.

Analytical Instrumentation Market Trends

Life Sciences Segment Expected to Hold Significant Market Share

- Life sciences account for the largest analytical instrument industry share, representing a quarter of the entire industry. Life sciences comprise more than 13 individual technology segments, encompassing various applications using analytical tools such as spectrometry, atomic spectroscopy, and molecular spectroscopy, among others. It provides significant opportunities for the growth of both general instrument applications and niche research systems.

- Demand for Next Generation Sequencing (NGS) continues to flourish, impacting the sequencing segment and driving strong demand in the nucleic acid sample preparation segment. This growth was evident in the public and private sectors, as genomics technology went beyond basic research to reach the biomedical domain.

- Such tremendous growth is expected to create a significant demand for analytical instrumentation solutions, as it helps pharmaceutical companies comply with stringent regulations on drug safety.

- The market is witnessing several strategic developments, such as new product developments, mergers, and collaboration, that suggest an increase in the adoption of the analytical tool in the segment.

- Drug discovery and clinical research require various complex diagnostic instruments, analytical instruments, advanced medical devices, testing equipment, and many other specialized products. The COVID-19 pandemic resulted in significant demand in the market due to the growing need for accelerated research and public expectations of unprecedented progress from the scientific community.

- Hence, the demand for analytical instrumentation in the life sciences industry is expected to grow with increasing clinical research and drug discovery activities.

Asia-Pacific Region Expected to Witness High Market Growth

- The demand for analytical instrumentation is growing significantly in the Asia-Pacific region. Specifically, the area utilized these products to address climate change, an aging population, food production, and newer energy sources. Analytical instrumentation vendors have also responded to the market demand via distribution by local companies and direct sales. Also, due to the trade tensions between the US and China, multiple companies have shifted some of their production and supply chains to countries outside China to circumvent disruption in business operations.

- One sector that received significant growth for analytical instruments from the Chinese government is life sciences. Within the 13th Five-Year Plan period, the life sciences industry in China registered medium-to-high-speed growth. China's government announced that it would further include a commitment to invest around USD 9 billion over the next 20 years in the precision medicine industry in its next five-year plan. Moreover, there is no specific antiviral treatment that is proven to be effective for COVID-19. Combinations of antivirals, different drugs, and traditional Chinese medicine are used in China. However, current treatment options are mainly based on previous experience showing clinical benefits in treating influenza and other viral infections.

- The region is home to several highly diverse countries ranging from advanced technological hubs to emerging economies. Countries like Singapore, South Korea, Taiwan, and Australia are already significant players on the world stage in industries like pharmaceuticals, biotechnology, semiconductors, and mining. The growth lifted in these countries due to substantial foreign investment and an ideal location to integrate into global supply chains. Many expect countries in the region to be competitive with China, Japan, and other international players shortly.

- Countries such as India have also been among the emerging markets in the analytical instrumentation industry owing to higher investment in testing and R&D activities. The growing awareness among the country's expanding end-user industries is also driving investment in the market studied. Therefore, the country's analytical instruments market witnessed exponential growth since the turn of the century. However, in the past 2-3 years, the pace of change slowed down to high single digits, and ever-thinning margins impacted the industry. Procurement pressures from government organizations and the private sector are taking a toll on the companies' bottom lines, though top lines are still growing.

- According to the Indian Analytical Instrument Association (IAIA), the country presently accounts for about 2-3% of the global analytical instrumentation market. However, India is at a very micro-scale in manufacturing, especially for high-end equipment, like liquid chromatography and mass spectrometry.

- Expressing concern over the declining margins and slow growth rate due to the lack of government support for the country's analytical instrument industry, IAIA suggested immediate intervention of the government organizations to support the much-needed boost to the analytical instrument manufacturing sector in the country.

Analytical Instrumentation Industry Overview

The analytical instruments market is fragmented and is home to numerous primary and smaller vendors depending on the location. The major vendors in the market garner more in-depth product portfolios, catering to different customer requirements, whereas smaller vendors operate in niche segments, providing customizations and customer-specific orders. Key players include Agilent Technologies Inc., Malvern Panalytical Ltd (Spectris Company), PerkinElmer Inc., Thermo Fisher Scientific, and Shimadzu Corporation.

- February 2022 - Sartorius AG announced the acquisition of Novasep's chromatography division. The portfolio acquired encompasses chromatography systems suited for smaller biomolecules, such as oligonucleotides, peptides, and insulin, and innovative systems for continuous biologics manufacturing.

- January 2022 - Bruker Corporation announced the acquisition of Prolab Instruments GmbH, a Swiss technology company specializing in low-flow, high-precision liquid chromatography technology and systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development of Precision Medicine

- 5.2 Market Restraint

- 5.2.1 High Initial Cost

6 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE INDUSTRY

7 MARKET SEGMENTATION

- 7.1 Product Type

- 7.1.1 Chromatography

- 7.1.2 Molecular Analysis Spectroscopy

- 7.1.3 Elemental Analysis Spectroscopy

- 7.1.4 Mass Spectroscopy

- 7.1.5 Analytical Microscopes

- 7.1.6 Other Product Types

- 7.2 End User

- 7.2.1 Life Sciences

- 7.2.2 Chemical and Petrochemical

- 7.2.3 Oil and Gas

- 7.2.4 Material Sciences

- 7.2.5 Food Testing

- 7.2.6 Water and Wastewater

- 7.2.7 Other End Users

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia-Pacific

- 7.3.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Vendor Ranking Analysis

- 8.1.1 Chromatography

- 8.1.2 Mass Spectroscopy Market

- 8.1.3 Molecular Analysis Spectrometers

- 8.1.4 Elemental Analysis Spectrometers

- 8.2 Company Profiles

- 8.2.1 Agilent Technologies Inc.

- 8.2.2 Bruker Corporation

- 8.2.3 PerkinElmer Inc.

- 8.2.4 Thermo Fisher Scientific Inc.

- 8.2.5 Shimadzu Corporation

- 8.2.6 Malvern Panalytical Ltd (Spectris company)

- 8.2.7 Mettler Toledo International Inc.

- 8.2.8 Waters Corp.

- 8.2.9 Bio-Rad Laboratories Inc.